“We should change Bitcoin now in a contentious way to fix the security budget” is basically the same tinkering mentality that central bankers have.

It begins with an overconfident assumption that they know fees won’t be sufficient in the future and that a certain “fix” is going to generate more fees. But some “fixes” could even backfire and create less fees, or introduce bugs, or damage the incentive structure.

The Bitcoin fee market a couple decades out will primarily be a function of adoption or lack thereof. In a world of eight billion people, only a couple hundred million can do an on chain transaction per year, or a bit more with maximal batching. The number of people who could do a monthly transaction is 1/12th of that number. In order to be concerned that bitcoin fees will be too low to prevent censorship in the future, we have to start with the assumption that not many people use bitcoin decades out.

Fedwire has about 100x the gross volume that Bitcoin currently does, with a similar number of transactions. What will Bitcoin’s fee market be if volumes go up 5x or 10x, let alone 50x or 100x? Who wants to raise their hand with a confident model of what bitcoin volumes will be in 2040?

What will someone pay to send a ten million dollar equivalent on chain settlement internationally? $100 in fees per million dollar settlement transaction would be .01%. $300 to get it in a quicker block would be 0.03%. That type of environment can generate tens of billions of dollars of fees annually. The fees that people pay to ship millions of dollars of gold long distances, or to perform a real estate transaction worth millions of dollars, are extremely high. Even if bitcoin is a fraction of that, it would be high by today’s standards. And in a world of billions of people, if nobody wants to pay $100 to send a million dollar settlement bearer asset transaction, then that’s a world where not many people use bitcoin period.

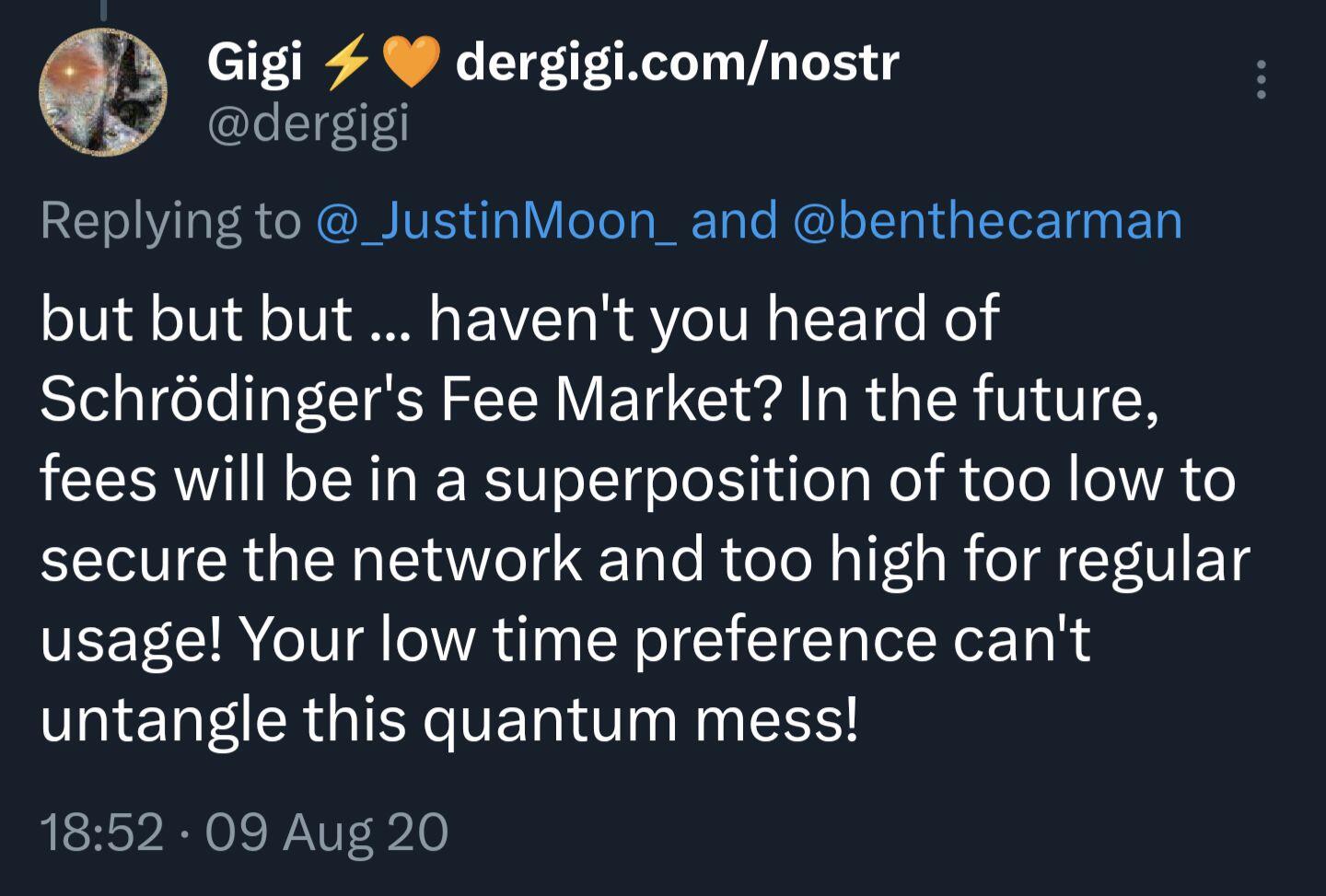

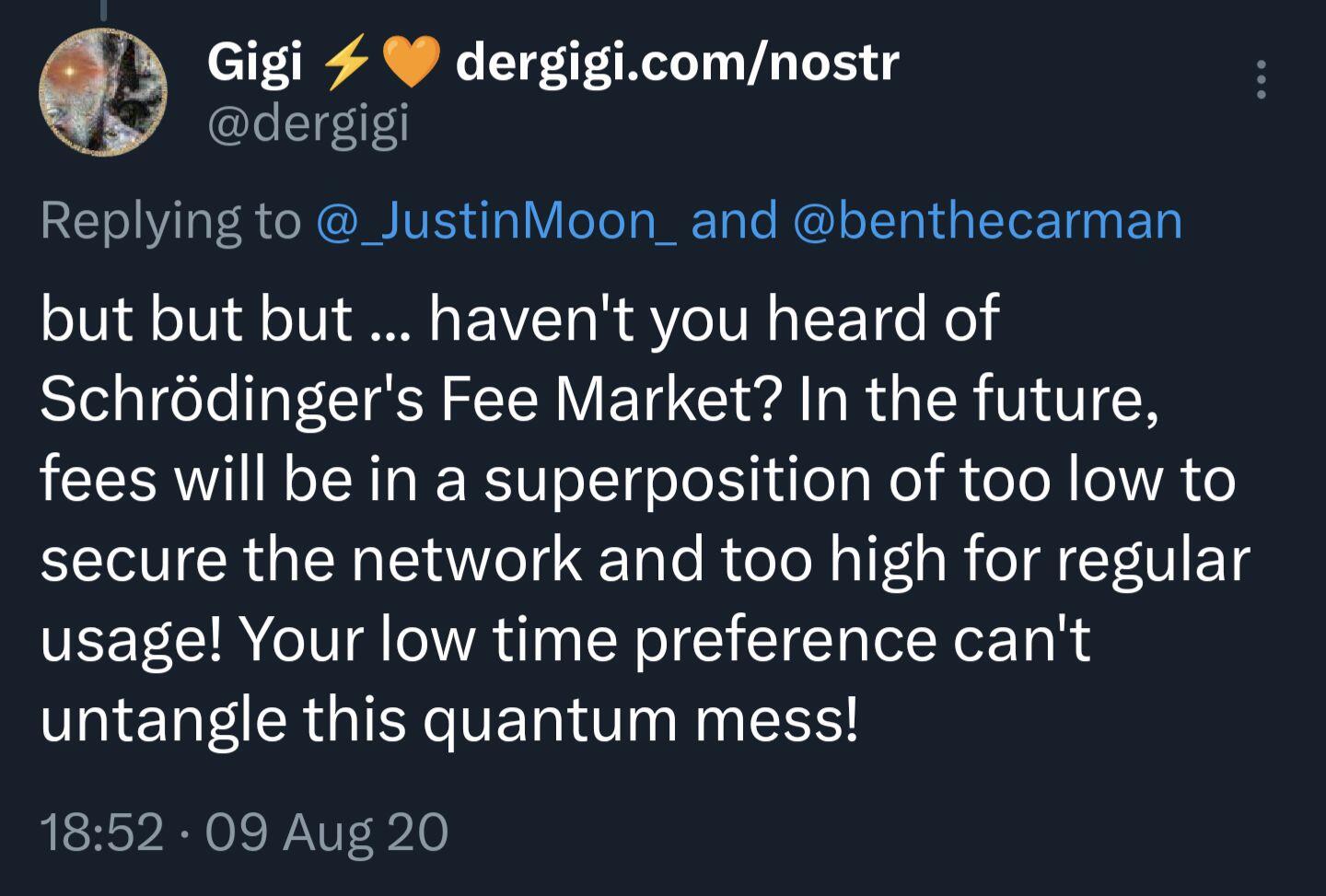

In some months the “security budget” concern trends. In other months, the “fees will be so high that only rich people can transact on chain” concern trends. These are so wildly contradictory and the fact that both are common concerns shows how little we know about the long term future.

I don’t think the fee market can be fixed by gimmicks. Either the network is desirable to use in a couple decades or it’s not. If 3 or 4 decades into bitcoin’s life it can’t generate significant settlement volumes, and gets easily censored due to low fees, then it’s just not a very desirable network at that point for one reason or another.

Some soft forks like covenants can be thoughtfully considered for scaling and fee density, and it’s good for smart developers to always be thinking about low risk improvements to the network that the node network and miners might have a high consensus positive view toward over time. But trying to rush VC-backed softforks, and using security budget FUD to push them, is pretty disingenuous imo.

Anyway, good morning.

Thread

Login to reply

Replies (52)

Schrödinger's fee market.

In reality, there is not fee market, but fee auction.

GM. 🔥☕️

Good morning lyn

I guess I just say to myself by 2040 a 100 dollar fee to transfer will be half the price of a coffee. It’s all relative. It’s not really a big deal.

Well articulated answer to some high time preference "Bitcoiners."

They seem to have bamboozled some good folks too.

all want blockspace so fees spikes 😿 so no one want blockspace a this price so budget problem 😿 please buy my shitcoin🙏

yeah exactly, my shitcoin where free blockspace for everyone is supported by military-grade super-quanticresistant-lastgen-computers that takes network up and you can vote by staking your ultra-soud trust-us-we-will-never-inflate money 😄🫡

I think a fair number of people boost every single post by @Lyn Alden but if you read them it is easy to see why.

View quoted note →

> But some “fixes” could even backfire and create less fees, or introduce bugs, or damage the incentive structure

> Some soft forks like covenants can be thoughtfully considered for scaling and fee density

Couldn't this be one of these cases? If covenants allow moving a lot of the transactional volume offchain wouldn't this compromise the incentive of a fee market to form in the first place?

yes, i think that is a problem with lightning when btc switches to pure fees based mining.

GM Lyn 🤗

This motivates me to keep using lightning ⚡

One of the things that makes the future unique, is that nobody knows... Lots of moving parts, better/faster computers, phones, chips, processors...

tick tock

next block

View quoted note →

Based af, Lyn

GM!

Great post. I will use this as a reference to refer people to when this topic comes up.

I'm not reading all that

but sorry that's happening to you or whatever

It either works or it doesn’t. Trying to fix it a every corner of the way is what we currently have with Central Banks! Well said Lyn!

Can one of these Central Bitcoiners accurately predict what transaction fees will be tomorrow, much less in 2040?

I’m not particularly smart, but I’m very good at finding smart people and listening to them.

Thanks lyn, your book, book suggestions, and monthly subscription are the best deals I spend money on.

To be fair, we do absolutely need to do fee smoothing to reduce spikes.

Do you mean some kind of futures market for fees?

Why and how?🤔

Maybe spikes are useful information that helps regulate user behavior.

How spikey or smooth will transaction fees be in 15 years, and what should we do about it today with any reasonable amount of conviction?

Yea I mean I don’t think they’ll be *that* spikey, but having the ability to eat a single huge-fee transaction without miners trying to reorg each other would be nice. I think there’s some designs with a “pot” of fee money that miners can contribute to or take from in exchange for bigger/smaller/easier/harder blocks that can eat such a spike and smooth it out a bit. Would also reduce weekly cycle impact on miner revenue.

Notably, such a design would still allow market forces to increase block rate/size during fee/block space demand increases, but even without miners turning off, which is cool.

You mean Lightning?

Adopt a low time preference. The end.

I read that study a while back that discussed how incentives could become unstable in a fee-only scenario, with extra block re-orgs. There have probably been more studies since then. My analysis and research at the time pointed to that there seem to be various fee-smoothing mechanisms that are somewhat straightforward and could be implemented, but it also seems like not an existential risk and something that could be implemented if it starts being a problem.

One of my opinions of the paper I read was that they didn’t sufficiently take into account economic incentives. Miners put serious capex into ASICS with long lifespans, and so even if block-by-block incentives can incentivize more re-orgs, the long term revenue comes from the reliability of the network. So it’s unclear that miners would cause enough block re-orgs to make the network stability shitty. But if that’s how it works out, there are fixes as you pointed out. Seems like something that can be done if it actually materializes as a problem one day, rather than something that needs to be done years or decades in advance of there *maybe* being a problem.

This. The sooner people realize #bitcoin is a better FedWire or international settlement mechanism (as opposed to money), the sooner people will realize the power of Bitcoin's immutability. That should not change.

View quoted note →

GM🌞

It's crucial to have a stalwart in the crypto space that understands the balance between fees and transaction volume. While fees are necessary to support the network, they should not discourage transactions excessively. It's encouraging to see the markets slowly realizing this, especially considering the inflationary pressures affecting traditional economies worldwide. Some governments are already ahead of the curve by mining and stockpiling digital assets.

The key point is that increasing transaction volume will take time, but eventually, we will reach a tipping point. It's important for Bitcoin to resist being politicized and used as a tool to advance specific agendas. However, we have already witnessed attempts to tax Bitcoin, citing energy usage, despite it being more energy-efficient than traditional systems. Those in power will fight to maintain control, but the resilience of Bitcoin will be continue to be evident.

Having a few like-minded people is my security budget.

View quoted note →

I have some objections to this analysis.

The "wildly contradictory" arguments that you point to are precisely the problem: Fees could be so high that only rich people can use L1 (plebs sure aren't going to spending $50 every transaction) while at the same time even these higher fees could represent a such a small fraction of total market cap that it doesn't keep things secure.

My understanding of the drivechain idea is that it's aiming to aggregate huge volumes of lows fees up to main chain. It's not clear that it would work exactly as planned, but it does represent a possible Goldilocks arrangements that doesn't fall back onto Saylor's silly "oh but rich people pay to transport art and pay real estate agents 3%" argument. I'm having trouble picturing high value investors needing to settle $10 million a few times a second.

Certainly, we're not relying on high value investors constantly making L1 transaction to keep Bitcoin running?

If Bitcoin where to obtain this sort of global store-of-value status such that trillions of dollars was changing hands every day, handling transactions off L1 would have become the norm. If I'm a rich folk settling $10 million in a single transaction, it's not the security of PoW that I'm most interested to pay for, it would be the handling of keys and this sort of thing that your average Walmart heiress isn't going to be confident with - so this will be handled by boutique Swiss bankers, who would devise their own ways to skimp paying the billions of on-chain fees.

The problem with putting the security assumption on high net worth investors is that they are the easiest to capture, they don't care about censorship resistance. If the blockchain is captured by a monopoly miner or a cabal of corporations, it need not cease to be a store of value, as long as these high net worth investors continue to believe it's a store of value.

Also, no need to pile on to this "VC-backed" ad hominem: Either it's a well-thought out idea (since 2015) or it's not

You are without a doubt by far my favorite mind in bitcoin 👏👏

Assuming a single future scenario within a complex adaptive system, & using that assumption to proclaim the only solution we will ever need, is either mistaken or disingenuous.

View quoted note → @Gigi@`MichaelMatulef`@`walker`

Reading this, I'm once again silently amazed at the genius of Bitcoin.

Money of the people, by the people, for the people.

Conflicting issues and competing interests are inherent to a diverse and global network. The fact that all of these conflicts must be resolved to a single consensus seems impossibly difficult, and yet Bitcoin forces us all to cooperate.

There can be only one language of value.

Every issue of consequence inescapably finds itself in lively debate in the public square, vying for hearts and minds. If the issue resonates, then it persuades those who have put in the effort to become node runners to cast their vote.

For those who do not run nodes, but have some coins, they cast their vote by selling the hard fork they think will lose.

It is amazing.

View quoted note →

Amazing!

This is the signal i need in the AM

It’s important to remember that there are multi-billion dollar mining companies who have a financial interest in changing the protocol in a way that benefits their economics, not necessarily the system as a whole. Now is a particularly challenging time for bitcoin miners with the hash price near all time lows.

It wouldn’t surprise me that public miners are astroturfing ideas to improve their revenues.

The security budget is a non issue imo. If it’s not profitable to mine, hashrate will drop and difficulty will adjust until it is.

It may make a lot of sense to revisit Satoshi's words on this -

Re: Bitcoin P2P e-cash paper

Good morning.

I'm not concerned about the security budget of bitcoin. I'm certain that the free market will find the right balance of security & usability.

手续费是比特币的货币属性,并非投资部分,一切取决于比特币作为货币应用而非投资品的推广。 View quoted note →

And between 2040 and soon, the fees will be entirely offset by the electricity producer.

The Texas anti-Bitcoin bill was likely the lever pulling of large gas-fired peak power producers, who saw their $9,000 /kw hour peak fees disappear as the grid has become more adaptive.

Proposed changes are an evil Trojan horse.

Run your own user node.

#Bitcoin Freedom.

An excellent heads up

Thank you Lyn!

Fees are SAFU (they really are).

Introducing potential existential risks on the base chain is a no go.

GM!

If you make a bip and Lyn ain't feeling it, I would put forward that...

YOU

ARE

SCREWED

Anti tinkering

Attack surface !!! Every tinker risks widening the attack surface in ways that can be bewildering.