At a family dinner, my cousin ranted about corporations evading taxes, calling it theft. I chuckled, realizing the irony. Governments often misuse funds, and taxes aren't their lifeline. It hit me: we need to detach money from state control. This epiphany shifted my focus towards advocating for financial independence and educating others on the importance of separating money from state power. What if we could redesign our financial system for true freedom? @Documenting ₿itcoin 📄

WBTM

WBTM

npub1japy...zrsl

#WhatBitcoinTaughtMe (WBTM) https://geyser.fund/project/whatbitcointaughtme

A lot of valuable info isn't on indexed webpages – it's in #podcasts and #videos, which aren’t easy to search. At #WBTM, we break down key ideas from brilliant thinkers and share the original sources, bringing you the best insights from our journey on #Bitcoin

New Logo! 🍊

#BitcoinIsWater #DontLike | #Zap Or #Share

NO FINANCIAL ADVICE, EDUCATIONAL CONTENT ONLY

Donations: https://coinos.io/WBTM

Available communication channels:

#Nostr (main source)

#Podcast

#Fountain https://fountain.fm/show/qY2p53f9v5BE3gsUwo4t

#Spotify https://open.spotify.com/show/4uBOOdKzF3GT7NFWPRDUP1

#YouTube https://www.youtube.com/@WBTM21

#BlueSky @wbtm.bsky.social

#X|Twitter @wbtm21

#Threads @wbtm.21

#Instagram @wbtm.21 (bitcoin Art)

#TelegramGroup (short Articles) https://t.me/wbtm21

#WhatsAppGroup (discussions) | Community (short Articles)

#LinkedInCompanyPage (medium-size Articles)

https://www.linkedin.com/company/wbtm/

Before: Thought volatility meant Bitcoin was too risky.

Insight: Learned volatility is part of price discovery, normal for new assets.

After: See Bitcoin's potential beyond short-term swings.

CTA: Have you? @Swan Bitcoin

"Bitcoin is digital gold" - Michael Dell, 2024. Shows big tech sees Bitcoin's value. Thoughts? Do you agree? @jimmysong https://video.twimg.com/amplify_video/1808268607576854531/pl/suB_bhG5x3l3gldp.m3u8?tag=16

Before: "I'm avoiding Bitcoin, it's not in my portfolio."

Insight: Found out Vanguard owns a chunk of MicroStrategy, which is basically a Bitcoin stash.

After: Realized I indirectly own Bitcoin through my investments.

Before, I believed only physical assets like gold were truly scarce. Then I learned about Bitcoin's fixed supply and time's unchangeable flow. Now, I see Bitcoin and time as the universe's only guaranteed scarce resources, changing how I value and use them. Have you considered how scarcity impacts your investments and daily choices? @preston

Title: Trump's Digital Stockpile Executive Order: Pros & Cons

1. Increases national digital asset reserves.

2. Boosts blockchain tech innovation.

3. Diversifies economic strategies.

4. Not limited to Bitcoin, includes 5 Reasons Satoshi's 1M Bitcoins Aren't a Network Treasury:

1. No evidence of intent.

2. Satoshi valued decentralization.

3. Moves market unpredictably.

4. Could undermine trust.

5. Contradicts Bitcoin's self-sufficiency ethos.

Bonus: It could be lost forever.

Which one stood out? @CARLA⚡️ digital assets.

Bonus: Could redefine digital currency use.

CTA: Which one stood out? @Sovreign

Believed Bitcoin was failproof. Realized no technology is. Now, I constantly question and learn, ensuring resilience. Have you questioned Bitcoin's robustness lately? @npub132er...zmdh

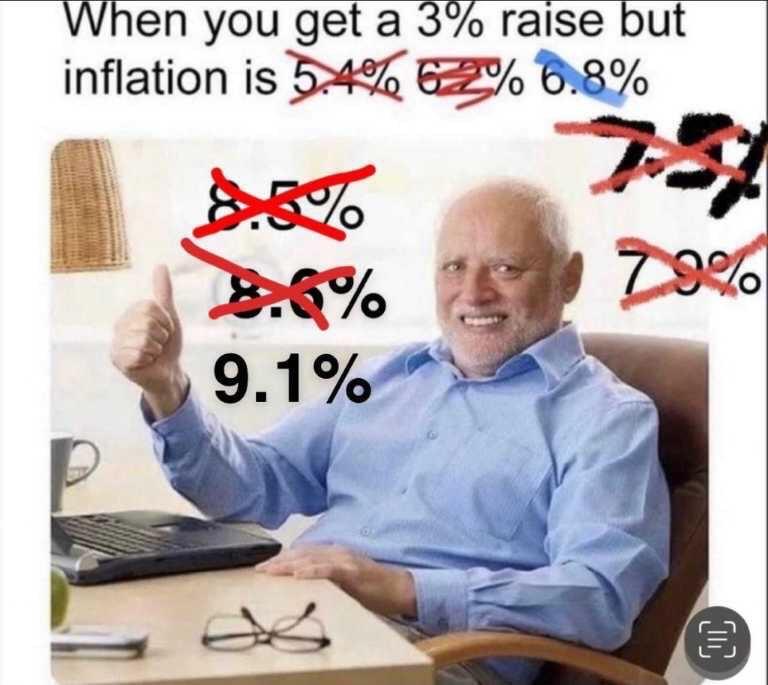

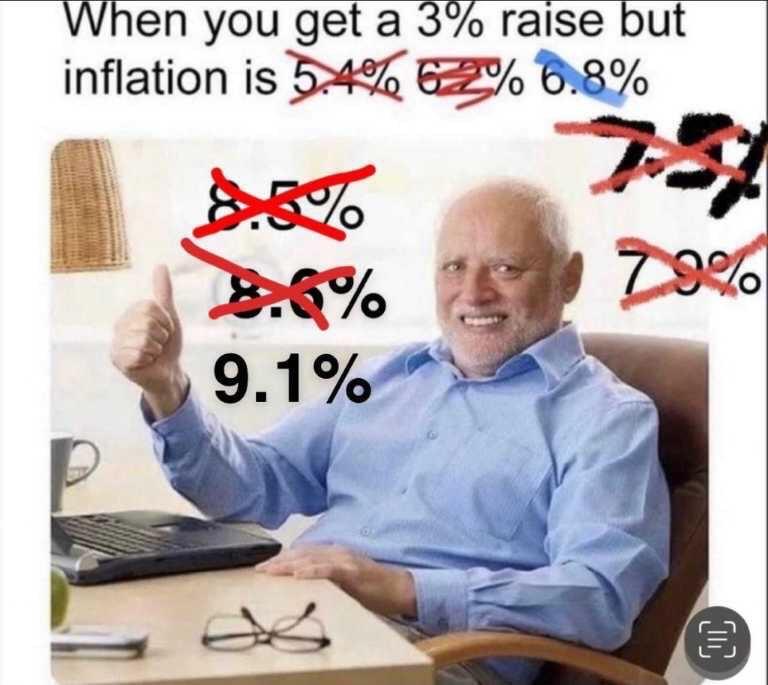

Inflation isn't one-size-fits-all. Everyone's buying different stuff, so when prices jump, we switch to cheaper options. Like ditching name-brand cereal for the store brand. This swap skews real inflation figures, making them hard to pin down. Agree/disagree? @Edward Snowden

Once, during a market crash, I panicked and sold my Bitcoin. I learned that, like Bruce Lee says, being adaptable and resilient is key. Bitcoin adoption thrives on this flexibility. How will you "be water"? @preston .