On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Yakihonne. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

🧠Quote(s) of the week:

> 'What’s the common denominator with all of these issues?

> High rent — Money

> Can’t buy homes — Money

> Groceries too damn high — Money

> Student debt — Money

> Credit card debt — Money

> Health insurance — Money

> Saving to invest — Money

> Dating and marriage — Money (heavy burden because of monetary costs), Trust in institutions — shattered because of broken money

>

> Belief in the future — not possible when your money is GUARANTEED to lose value in the future BY DESIGN

> No meaning — heavy time and energy pressure because your time and energy decline when your money, which is a representation of your time and energy, declines in value

>

> Maybe the money is the problem??

> Spoiler alert: it is.

>

> A socialist mayor or leader of your country isn’t going to fix it.

> Broken money breaks the world.

> All of these issues, including one of the biggest cities in the world electing a socialist, stem from the money being broken.

> The world will not be fixed until the money is fixed.

> The solution is here. All that remains is understanding.

> Study Bitcoin.' - Cole Walmsley

## 🧡Bitcoin news🧡

Just want to start with the following...

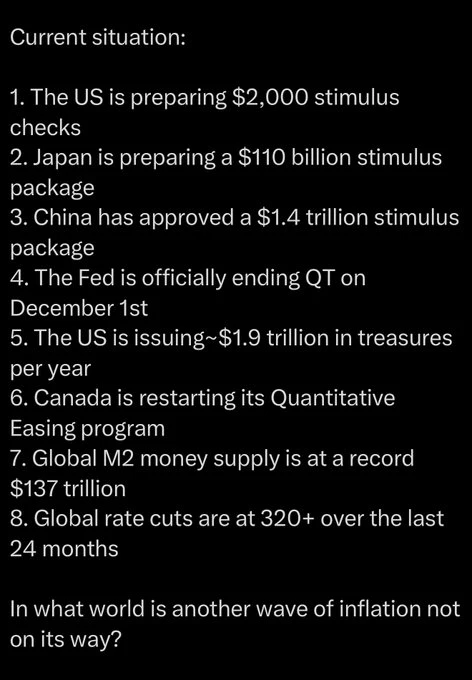

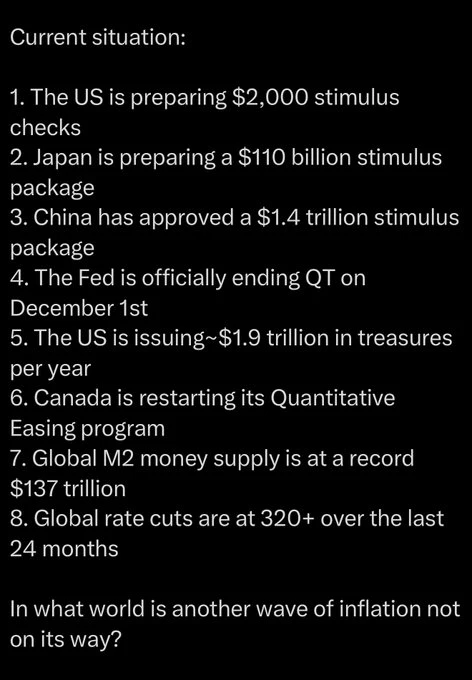

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

Azzamo

Azzamo | Web Hosting, Bitcoin Payment & Nostr Relay Services

Azzamo offers fast web hosting, BTCpay & LNbits hosting, and Nostr relays. Build your online presence with secure, reliable solutions.

)

On the 16th of November:

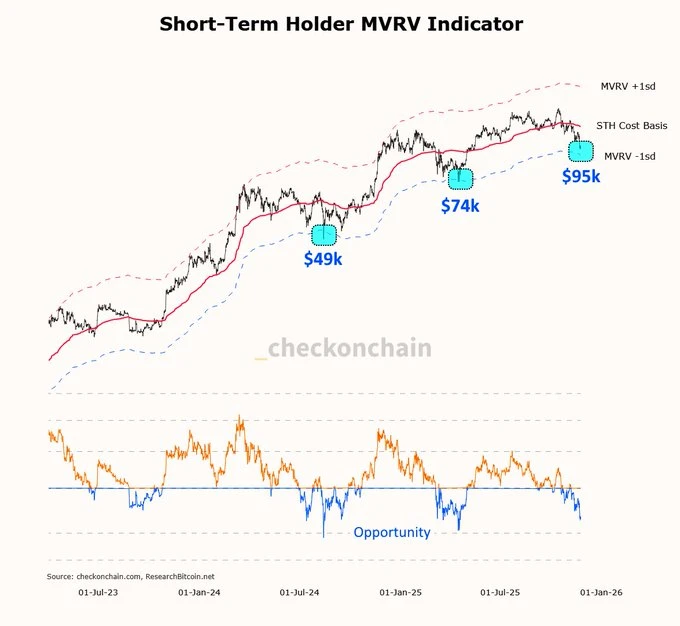

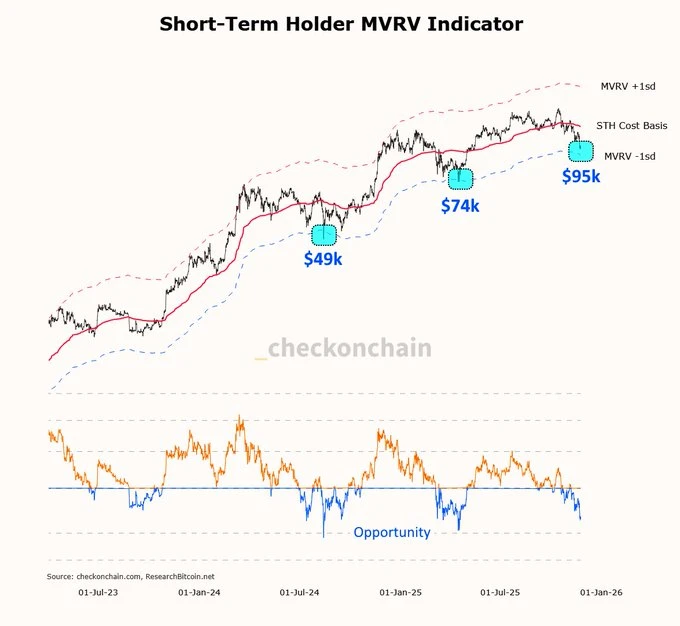

➡️I’m a buyer of standard deviation moves to the downside; they don’t come often, but they tend to be excellent opportunities.

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

On the 17th of November:

➡️

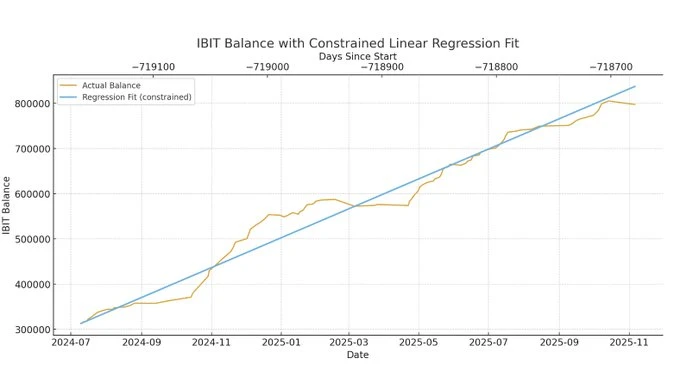

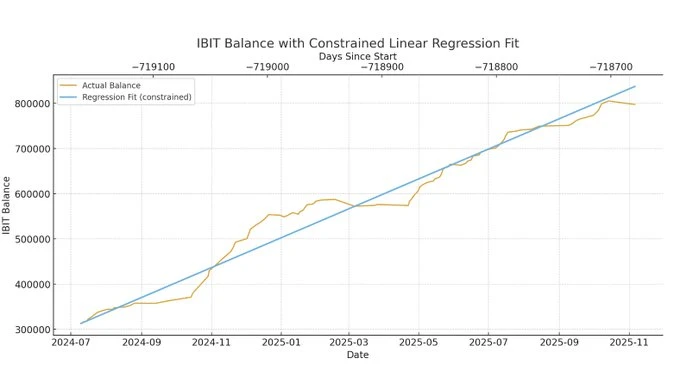

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

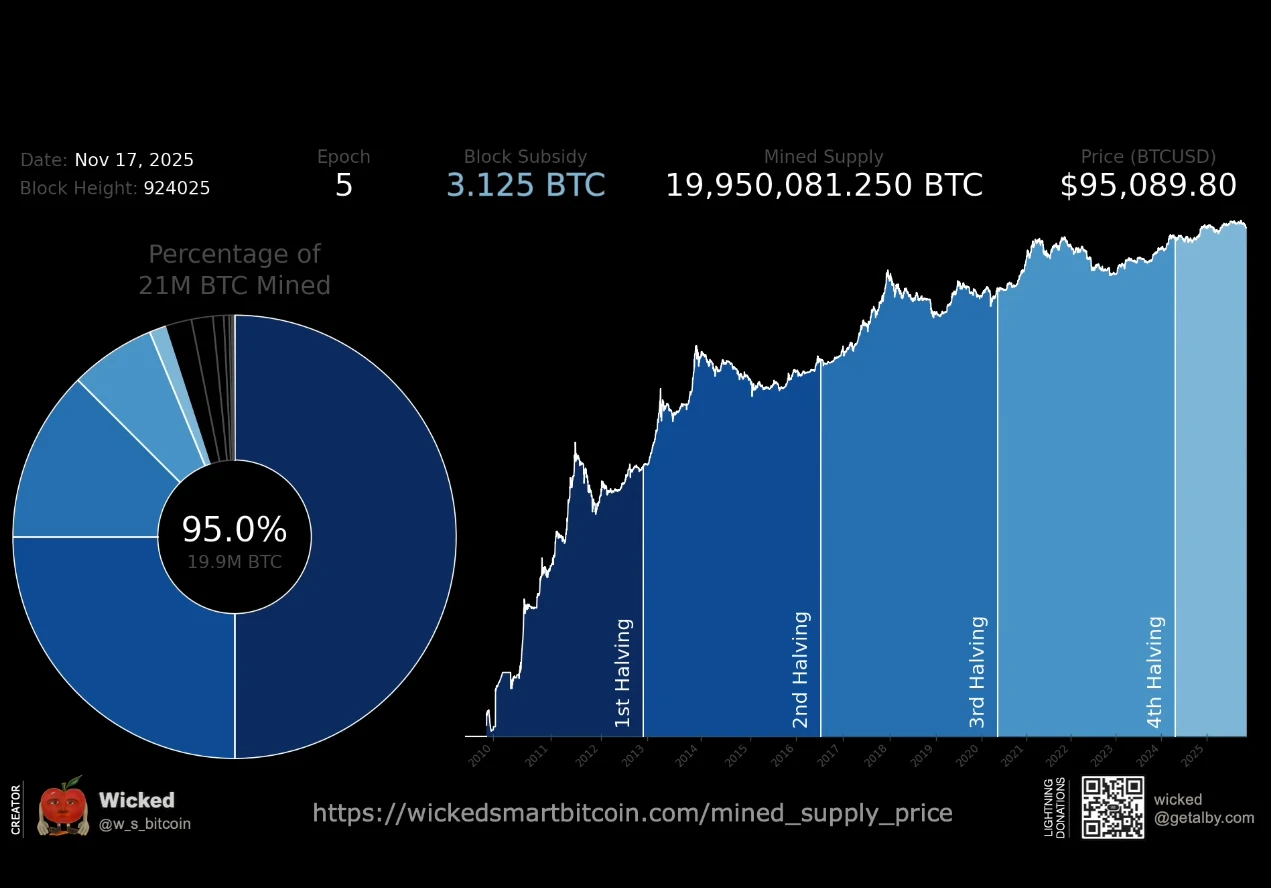

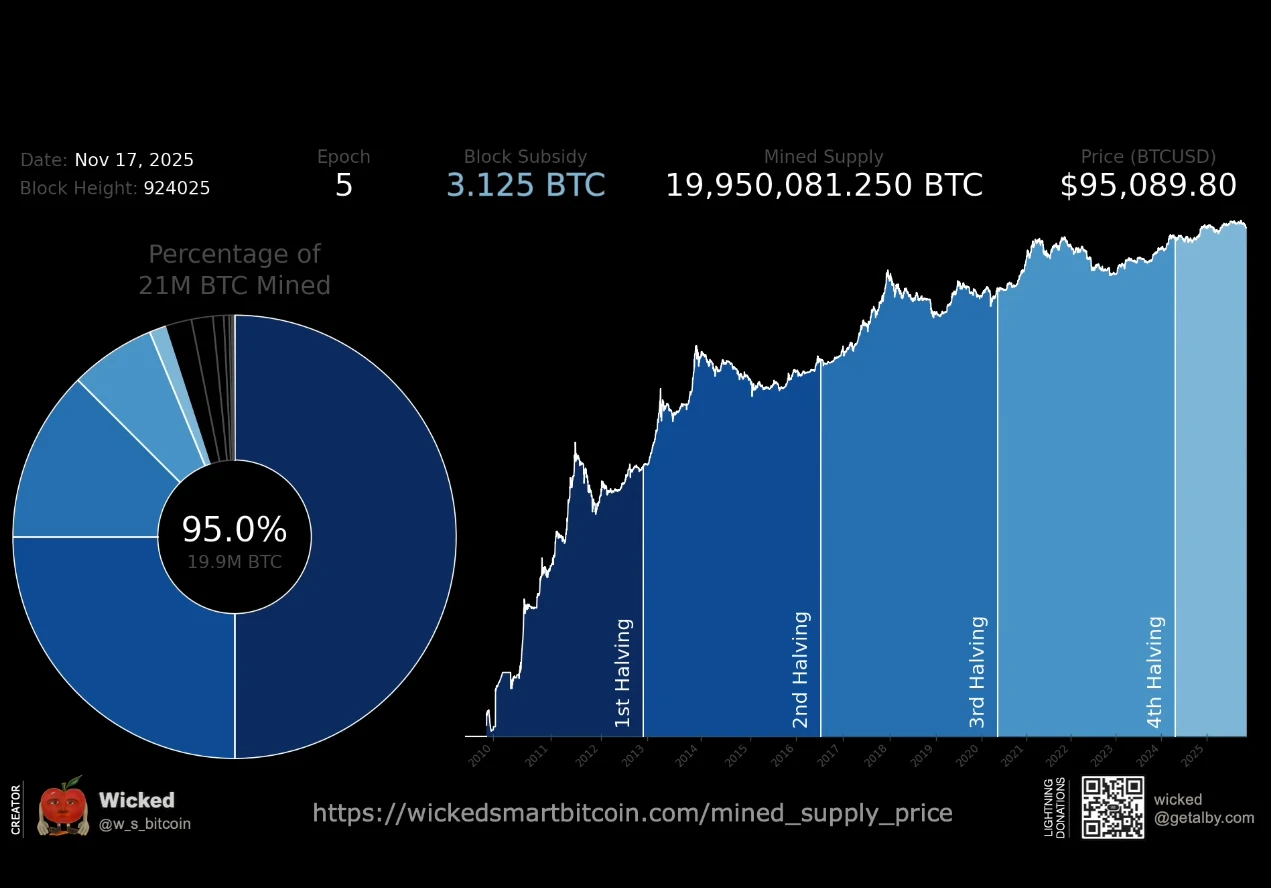

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

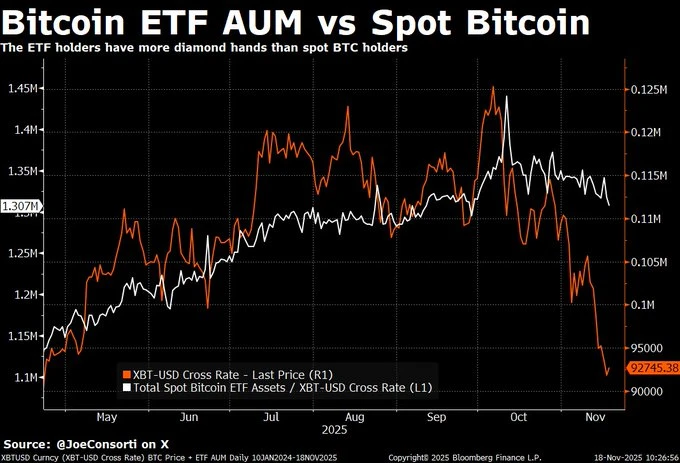

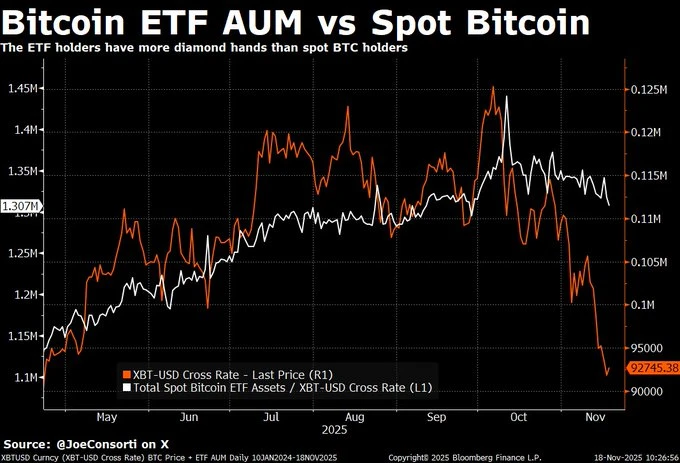

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

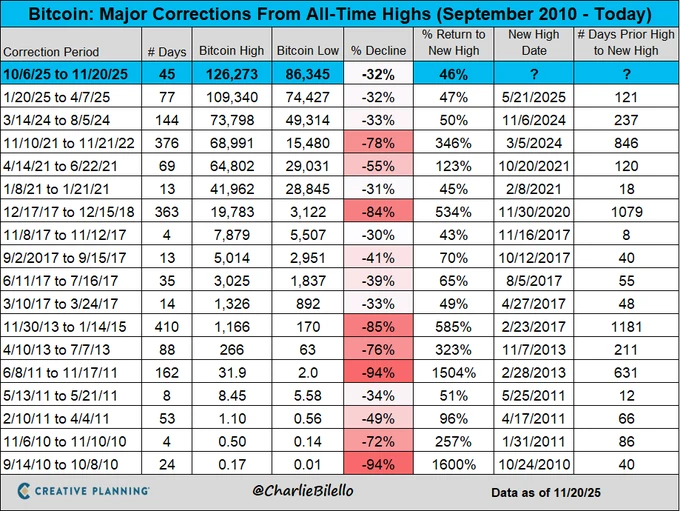

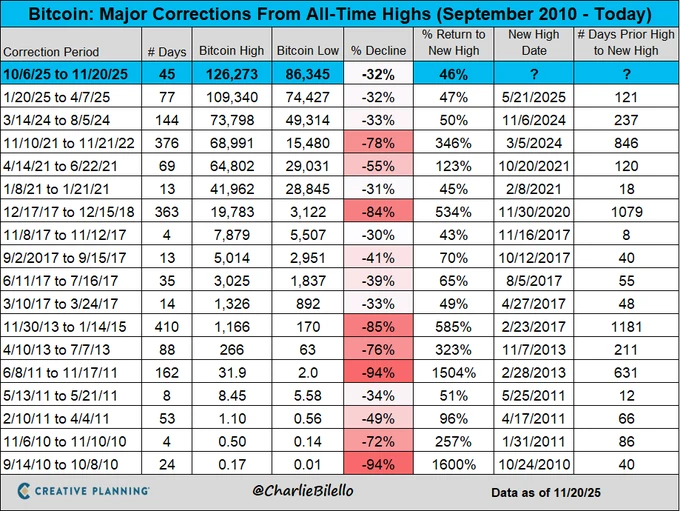

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

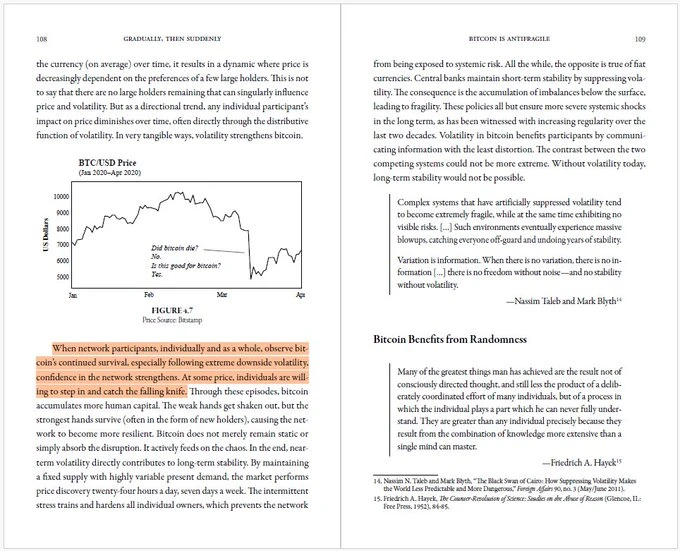

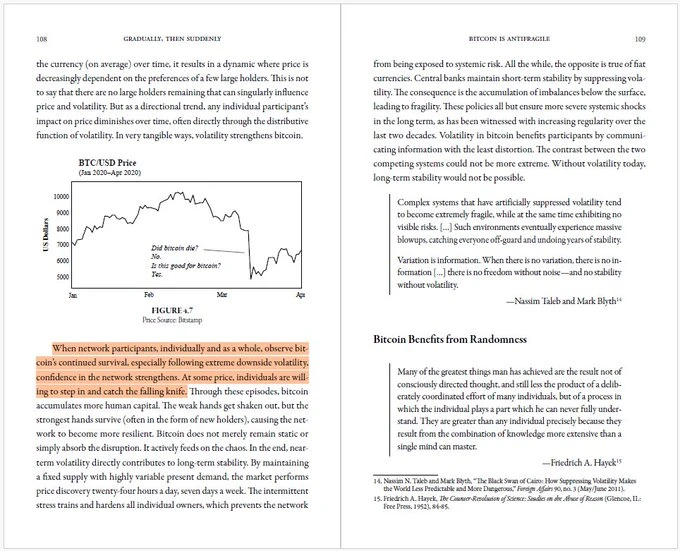

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

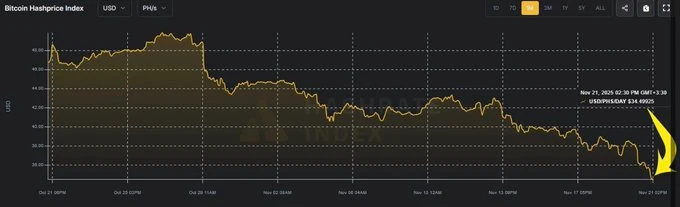

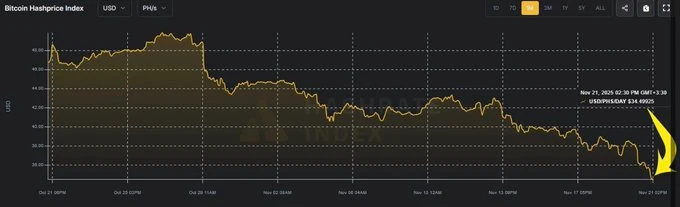

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Photos hosted by Azzamo (

Photos hosted by Azzamo (

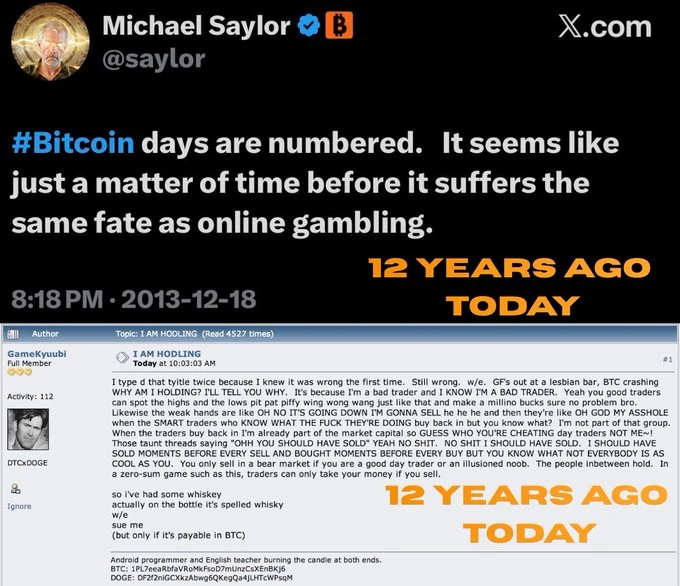

➡️Bitcoin history is wild. The birth of the HODL meme and Michael Saylor’s now iconic Bitcoin FUD tweet both happened on this day, December 18, exactly 12 years ago.

➡️Bitcoin history is wild. The birth of the HODL meme and Michael Saylor’s now iconic Bitcoin FUD tweet both happened on this day, December 18, exactly 12 years ago.

On the 19th of December:

➡️US Senate confirms pro-Bitcoin and crypto Michael Selig as chairman of the CFTC

➡️Bitcoin is energy, as you have read above (Daniel Batten post).

Documenting Bitcoin: 'This video shows a portable Bitcoin mine plugged into an oil well in the North Dakota wilderness. It makes a profit by recycling methane gas that would otherwise be vented or flared, converting it into electricity for mining while reducing waste and harmful emissions.'

Video:

On the 19th of December:

➡️US Senate confirms pro-Bitcoin and crypto Michael Selig as chairman of the CFTC

➡️Bitcoin is energy, as you have read above (Daniel Batten post).

Documenting Bitcoin: 'This video shows a portable Bitcoin mine plugged into an oil well in the North Dakota wilderness. It makes a profit by recycling methane gas that would otherwise be vented or flared, converting it into electricity for mining while reducing waste and harmful emissions.'

Video:  ➡️Adam Back: pro-tip for quantum FUD promoters. Bitcoin does not use encryption. Get your basics right, or it's a tell.

I kinda lean to the following:

Adrian: 'Sorry, but that's the facts, and @adam3us is right to point out that if you don't understand this rather simple distinction, you probably should not be talking about a QC cracking Bitcoin.

TL/DR: A Quantum Computer wouldn't "decrypt" a private key; it would use Shor’s Algorithm to calculate a private key from a public key.

The Basics:

Encryption refers to the act of hiding information so only those with a key can read it. Bitcoin doesn't do this. The blockchain is a public ledger, so anyone can see every transaction, every amount, and every address. Nothing is "encrypted".

Bitcoin previously relied solely on the Elliptic Curve Digital Signature Algorithm (ECDSA) and upgraded to include Schnorr signatures with Taproot. Neither are encryption tools; they are authentication tools. Bitcoin uses SHA-256 (for hashing) to confirm that data hasn't been tampered with. A hash is more like a data fingerprint, not encryption.'

On the 20th of December:

➡️Rajat Soni: The value of your labor/time is trending to 0 in terms of Bitcoin. Today, your annual salary might be 0.5-0.7 BTC. Eventually, you will be paid 0.01 BTC or less for a year of your time. Every 0.1 BTC you own will give you a decade or more of time freedom and financial freedom.

Yes, Bitcoin is time, and I get the point, but I don't think labor will trend to zero. Productivity changes what kind of labor gets paid. Skills still create income. Focus less on income and more on exposure. Bitcoin protects savings.

➡️BlackRock’s Bitcoin ETF took in more money than GLD this year, even with BTC down YTD.

➡️Bitcoin News: Bitcoin miners are facing capitulation risks as revenue and difficulty diverge, with miner revenue down 11% since mid-October.

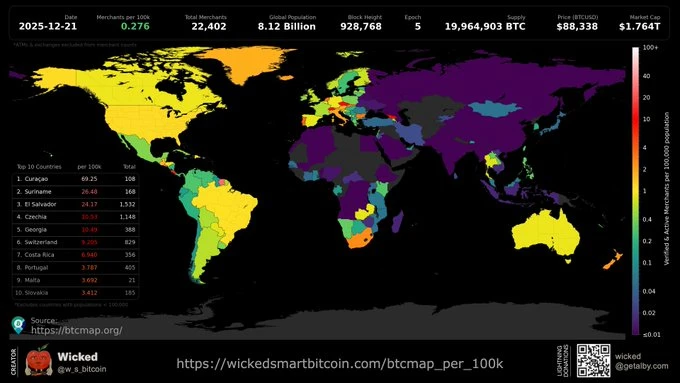

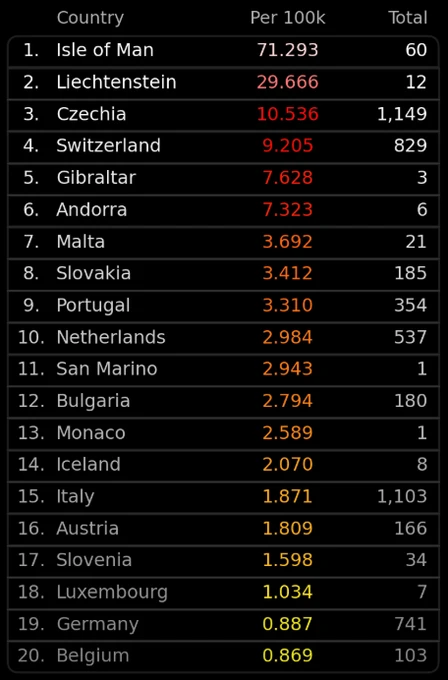

➡️Wicked: Look who’s leading the way in using Bitcoin as a medium of exchange. And the rest of the world isn’t far behind. Gradually, then suddenly.

➡️Adam Back: pro-tip for quantum FUD promoters. Bitcoin does not use encryption. Get your basics right, or it's a tell.

I kinda lean to the following:

Adrian: 'Sorry, but that's the facts, and @adam3us is right to point out that if you don't understand this rather simple distinction, you probably should not be talking about a QC cracking Bitcoin.

TL/DR: A Quantum Computer wouldn't "decrypt" a private key; it would use Shor’s Algorithm to calculate a private key from a public key.

The Basics:

Encryption refers to the act of hiding information so only those with a key can read it. Bitcoin doesn't do this. The blockchain is a public ledger, so anyone can see every transaction, every amount, and every address. Nothing is "encrypted".

Bitcoin previously relied solely on the Elliptic Curve Digital Signature Algorithm (ECDSA) and upgraded to include Schnorr signatures with Taproot. Neither are encryption tools; they are authentication tools. Bitcoin uses SHA-256 (for hashing) to confirm that data hasn't been tampered with. A hash is more like a data fingerprint, not encryption.'

On the 20th of December:

➡️Rajat Soni: The value of your labor/time is trending to 0 in terms of Bitcoin. Today, your annual salary might be 0.5-0.7 BTC. Eventually, you will be paid 0.01 BTC or less for a year of your time. Every 0.1 BTC you own will give you a decade or more of time freedom and financial freedom.

Yes, Bitcoin is time, and I get the point, but I don't think labor will trend to zero. Productivity changes what kind of labor gets paid. Skills still create income. Focus less on income and more on exposure. Bitcoin protects savings.

➡️BlackRock’s Bitcoin ETF took in more money than GLD this year, even with BTC down YTD.

➡️Bitcoin News: Bitcoin miners are facing capitulation risks as revenue and difficulty diverge, with miner revenue down 11% since mid-October.

➡️Wicked: Look who’s leading the way in using Bitcoin as a medium of exchange. And the rest of the world isn’t far behind. Gradually, then suddenly.

On the 22nd of December:

➡️Saylor stacks $2.19 BILLION cash to back dividend payments on preferred shares.

Strategy has increased its USD Reserve by $748 million and now holds $2.19 billion and ₿671,268.

➡️If you bought Bitcoin with your $1,400 stimulus check in 2020, you'd now have over $16,113. - Bitcoin Magazine

On the 24th of December:

➡️Bitcoin network hashrate every Christmas Eve:

2009: 9 MH/s

2010: 108 GH/s

2011: 8 TH/s

2012: 22 TH/s

2013: 9 PH/s

2014: 271 PH/s

2015: 709 PH/s

2016: 2.3 EH/s

2017: 14 EH/s

2018: 39 EH/s

2019: 99 EH/s

2020: 134 EH/s

2021: 177 EH/s

2022: 240 EH/s

2023: 521 EH/s

2024: 779 EH/s

2025: 1.1 ZH/s

From 9 megahashes to 1.1 zettahashes. 122 trillion times more computational power is securing the network.' - Javier Hermosa

➡️Quinten:

Gold added $13 TRILLION in market cap.

Silver added $1.7 TRILLION in market cap.

If that capital flew into Bitcoin, it would be at $800,000. Still one of the biggest opportunities for long-term wealth

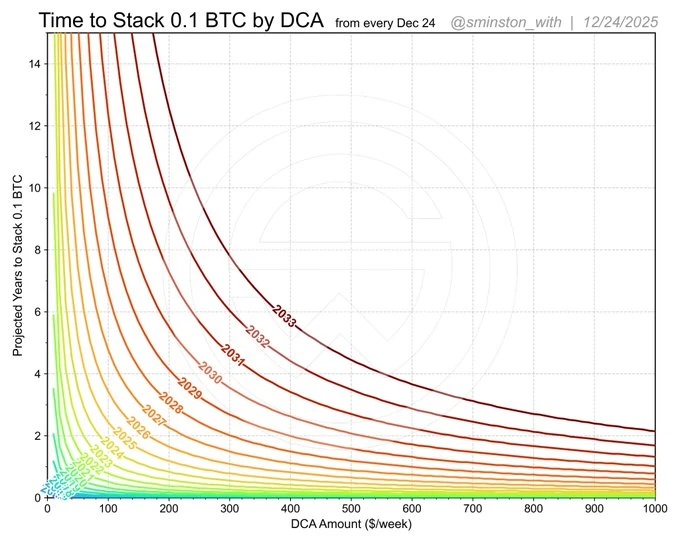

➡️Sminston With: If I were to show ONE chart to my family at dinner tonight (which I will), I would share this one. Use it to explain how if they start DCA'ing $100/week now, they can accumulate 0.1 BTC in 2.5 years. Then explain how if they wait 2 years to start, it will take them 5 years (7 years including wait time). Then explain how if they wait 5 years to start, it will take them 12 years (17 years including wait time). If they're smart enough to understand the price is presently undervalued, they MAY find it reasonable to work towards that starting point NOW, and STACK HARD, STACK EARLY.

On the 22nd of December:

➡️Saylor stacks $2.19 BILLION cash to back dividend payments on preferred shares.

Strategy has increased its USD Reserve by $748 million and now holds $2.19 billion and ₿671,268.

➡️If you bought Bitcoin with your $1,400 stimulus check in 2020, you'd now have over $16,113. - Bitcoin Magazine

On the 24th of December:

➡️Bitcoin network hashrate every Christmas Eve:

2009: 9 MH/s

2010: 108 GH/s

2011: 8 TH/s

2012: 22 TH/s

2013: 9 PH/s

2014: 271 PH/s

2015: 709 PH/s

2016: 2.3 EH/s

2017: 14 EH/s

2018: 39 EH/s

2019: 99 EH/s

2020: 134 EH/s

2021: 177 EH/s

2022: 240 EH/s

2023: 521 EH/s

2024: 779 EH/s

2025: 1.1 ZH/s

From 9 megahashes to 1.1 zettahashes. 122 trillion times more computational power is securing the network.' - Javier Hermosa

➡️Quinten:

Gold added $13 TRILLION in market cap.

Silver added $1.7 TRILLION in market cap.

If that capital flew into Bitcoin, it would be at $800,000. Still one of the biggest opportunities for long-term wealth

➡️Sminston With: If I were to show ONE chart to my family at dinner tonight (which I will), I would share this one. Use it to explain how if they start DCA'ing $100/week now, they can accumulate 0.1 BTC in 2.5 years. Then explain how if they wait 2 years to start, it will take them 5 years (7 years including wait time). Then explain how if they wait 5 years to start, it will take them 12 years (17 years including wait time). If they're smart enough to understand the price is presently undervalued, they MAY find it reasonable to work towards that starting point NOW, and STACK HARD, STACK EARLY.

➡️Spot gold prices surge above $4,500/oz for the first time in history. Gold is now a $31.5 TRILLION asset, nearly 7 TIMES larger than Nvidia.

Louis: 'Gold is a hard asset that produces no cash flow, and yet it has 7x the market cap of Nvidia, the most profitable company on earth.

The base case for Bitcoin is being digital gold. Gold is 15.75x larger than Bitcoin. Bitcoin has a lot of room to grow.'

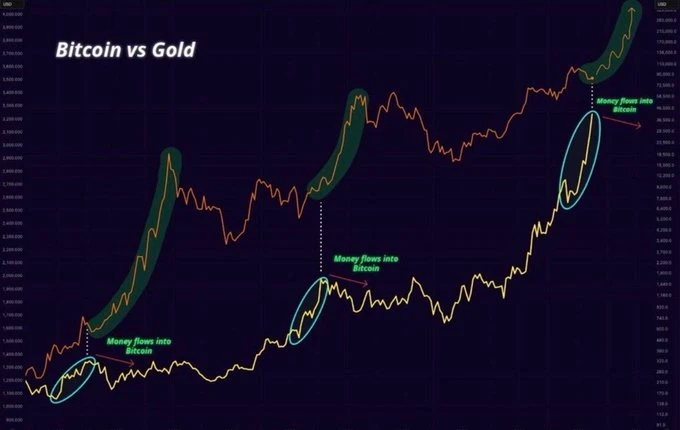

Gold rallies first, then bitcoin rallies harder...right?

➡️Spot gold prices surge above $4,500/oz for the first time in history. Gold is now a $31.5 TRILLION asset, nearly 7 TIMES larger than Nvidia.

Louis: 'Gold is a hard asset that produces no cash flow, and yet it has 7x the market cap of Nvidia, the most profitable company on earth.

The base case for Bitcoin is being digital gold. Gold is 15.75x larger than Bitcoin. Bitcoin has a lot of room to grow.'

Gold rallies first, then bitcoin rallies harder...right?

➡️Wicked: Working on the per 100,000 population version of the European map now. The Isle of Man is putting in work on a per capita basis...but that's because they've only got an estimated population of 84,160.

➡️Wicked: Working on the per 100,000 population version of the European map now. The Isle of Man is putting in work on a per capita basis...but that's because they've only got an estimated population of 84,160.

➡️Satoshi Flipper: 'If Bitcoin had been around for the last 75 years, those circles are all your bull market cycle tops. It doesn't happen EXACTLY every 4 years and has nothing to do with a calendar period LMAO. Now look at the current cycle and how flat it is; it should be obvious if you have a pair of working eyes that we haven't even started to form this bull market's cycle top yet.'

The only thing I am going to say is that markets rhyme with liquidity and growth, not with dates. Yes, the halving plays a role in the past, but won't be as important in the (nearby) future.

On the 26th of December:

➡️Bitcoin News: 'If you’re a Bitcoiner, don’t get jealous of silver going parabolic. It’s a trade that’s nearly 50 years in the making. The lesson? No matter how hard they try, assets harder than fiat cannot be held down forever.'

Silver has had 3 generational bull runs in the last 140 years: 1979, 2011, and today.

Good luck to everyone buying the top.

➡️Bitcoin News: 'Bitcoin fair value vs. Gold: $169,000 When priced against gold’s long-term trend, BTC remains significantly undervalued. If risk appetite returns to the market, the upside potential is massive. The Gold-Inferred Power Law suggests the "fair" price is nearly 2x the current price.'

On the 27th of December:

➡️Simple Mining: 'Hash rate down 4%. Weak miners are shutting off. That's not a warning. That's a signal. Historically, 90-day returns are positive 65% of the time after hash rate drops. Corporate treasuries just bought 42k BTC. Their largest accumulation since July. Weak miners leave. Strong miners stay. New miners enter. Difficulty adjusts. Competition thins. Block rewards remain.'

➡️The quote of the week is awesome, but how much energy backs the Bitcoin network, and roughly how much energy does that equate per coin?

The Bitcoin network's annual energy consumption is approximately 204 TWh (equivalent to 204 billion kWh), based on the latest estimates. With ~19.96 million Bitcoins mined, this equates to roughly 10,200 kWh per coin per year. Alternatively, the energy to mine one new Bitcoin is about 1.2 million kWh.

To put it in perspective, that 1.2M kWh to mine one BTC equals about 3,300 years of human labor (at 1 kWh/day equivalent). Bitcoin as ultimate stored energy?

The 2025 / 2026 market is trying to tell you something. The question is, are you listening?

➡️Bitcoin Archive: '14 of the top 25 U.S. banks are building Bitcoin products. Bitcoin isn’t being institutionalized. Institutions are being Bitcoinized.'

Anyway, sometimes you need to remember to zoom out.

You have been in this asset for a decade. Or for the next decade. Once you zoom out to a decade, day-to-day volatility stops being information and starts being a distraction.

You are betting on the fact that this is digital gold, a pristine monetary asset. You own 1 Bitcoin; you own 1 /21 Millionth of everything.

Everything else is noise. Everything else is just short-term emotion trying to rent space in a long-term decision.

I buy Bitcoin and do nothing. No charts, no earnings calls, no timing anything, no nothing… I use all the time I used to waste on research and managing a portfolio to spend with my new daughter, wife, my friends, and many hobbies. Bitcoin gave me a simple life.

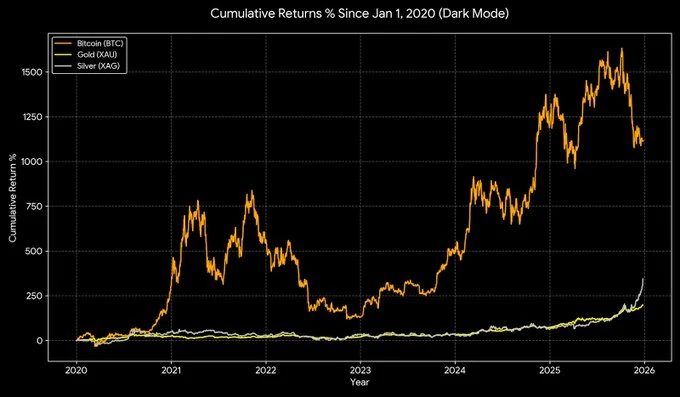

➡️Adam Livingston: Bitcoin vs. Silver vs. Gold since January 1st, 2015: Silver: 405% Gold: 283% Bitcoin: 27,701% Even ignoring the first 6 years of Bitcoin's existence for the crybabies who whine about the timeframe comparison... ...gold and silver drastically underperform the APEX ASSET. BITCOIN IS INEVITABLE.

Now I do know it's a bit of cherry picking...So let's pick a different starting date, say 2020, and see how that works out.

➡️Satoshi Flipper: 'If Bitcoin had been around for the last 75 years, those circles are all your bull market cycle tops. It doesn't happen EXACTLY every 4 years and has nothing to do with a calendar period LMAO. Now look at the current cycle and how flat it is; it should be obvious if you have a pair of working eyes that we haven't even started to form this bull market's cycle top yet.'

The only thing I am going to say is that markets rhyme with liquidity and growth, not with dates. Yes, the halving plays a role in the past, but won't be as important in the (nearby) future.

On the 26th of December:

➡️Bitcoin News: 'If you’re a Bitcoiner, don’t get jealous of silver going parabolic. It’s a trade that’s nearly 50 years in the making. The lesson? No matter how hard they try, assets harder than fiat cannot be held down forever.'

Silver has had 3 generational bull runs in the last 140 years: 1979, 2011, and today.

Good luck to everyone buying the top.

➡️Bitcoin News: 'Bitcoin fair value vs. Gold: $169,000 When priced against gold’s long-term trend, BTC remains significantly undervalued. If risk appetite returns to the market, the upside potential is massive. The Gold-Inferred Power Law suggests the "fair" price is nearly 2x the current price.'

On the 27th of December:

➡️Simple Mining: 'Hash rate down 4%. Weak miners are shutting off. That's not a warning. That's a signal. Historically, 90-day returns are positive 65% of the time after hash rate drops. Corporate treasuries just bought 42k BTC. Their largest accumulation since July. Weak miners leave. Strong miners stay. New miners enter. Difficulty adjusts. Competition thins. Block rewards remain.'

➡️The quote of the week is awesome, but how much energy backs the Bitcoin network, and roughly how much energy does that equate per coin?

The Bitcoin network's annual energy consumption is approximately 204 TWh (equivalent to 204 billion kWh), based on the latest estimates. With ~19.96 million Bitcoins mined, this equates to roughly 10,200 kWh per coin per year. Alternatively, the energy to mine one new Bitcoin is about 1.2 million kWh.

To put it in perspective, that 1.2M kWh to mine one BTC equals about 3,300 years of human labor (at 1 kWh/day equivalent). Bitcoin as ultimate stored energy?

The 2025 / 2026 market is trying to tell you something. The question is, are you listening?

➡️Bitcoin Archive: '14 of the top 25 U.S. banks are building Bitcoin products. Bitcoin isn’t being institutionalized. Institutions are being Bitcoinized.'

Anyway, sometimes you need to remember to zoom out.

You have been in this asset for a decade. Or for the next decade. Once you zoom out to a decade, day-to-day volatility stops being information and starts being a distraction.

You are betting on the fact that this is digital gold, a pristine monetary asset. You own 1 Bitcoin; you own 1 /21 Millionth of everything.

Everything else is noise. Everything else is just short-term emotion trying to rent space in a long-term decision.

I buy Bitcoin and do nothing. No charts, no earnings calls, no timing anything, no nothing… I use all the time I used to waste on research and managing a portfolio to spend with my new daughter, wife, my friends, and many hobbies. Bitcoin gave me a simple life.

➡️Adam Livingston: Bitcoin vs. Silver vs. Gold since January 1st, 2015: Silver: 405% Gold: 283% Bitcoin: 27,701% Even ignoring the first 6 years of Bitcoin's existence for the crybabies who whine about the timeframe comparison... ...gold and silver drastically underperform the APEX ASSET. BITCOIN IS INEVITABLE.

Now I do know it's a bit of cherry picking...So let's pick a different starting date, say 2020, and see how that works out.

Bitcoin massively outperformed shiny rocks by orders of magnitude.

Gold and silver are infinitely abundant. Bitcoin is fixed. Long-term, that's all that matters.

➡️Lugano, Switzerland, has emerged as a rare example of citywide Bitcoin adoption, where crypto is used for everything from buying coffee at McDonald’s to paying taxes, parking fines, and tuition. Through its Plan ₿ initiative, launched in 2022, residents and merchants can pay with Bitcoin or USDT via simple QR codes, attracted by Lightning Network fees often below 1%.' - Bitcoin News.

I truly hope, as I am part of the group Zwolle Bitcoinstad, we can achieve the same here in the Netherlands, Zwolle.

On the 28th of December:

➡️MicroSeed.io: 'When it comes to securing your Bitcoin seed phrase, never say never. Complacency loses a lot more Bitcoin than hacks. Don't trust, verify, including your process for recovery! Regular check-ups, just like the dentist!'

## 🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin in 2025: What Everyone Got Wrong | HODL & Odell

American HODL & Matt Odell join the show for a review of a year that left most Bitcoin narratives exposed. We unpack why expectations ran ahead of reality, why the super cycle never materialised, and how ETFs, treasury companies, and institutional capital quietly changed how this market actually operates. They get into Bitcoin’s underperformance versus gold and equities, the absence of meaningful retail demand, and how leverage distorted outcomes rather than driving real adoption.

They discuss what this means long-term. From institutional involvement and shifting power structures, to the breakdown of the four-year cycle framework. We also get into custody, incentives, freedom, and whether Bitcoin has to pass through the traditional system before it can meaningfully reshape it.

Click here:

Credit: I have used multiple sources!

My savings account:Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Bitcoin massively outperformed shiny rocks by orders of magnitude.

Gold and silver are infinitely abundant. Bitcoin is fixed. Long-term, that's all that matters.

➡️Lugano, Switzerland, has emerged as a rare example of citywide Bitcoin adoption, where crypto is used for everything from buying coffee at McDonald’s to paying taxes, parking fines, and tuition. Through its Plan ₿ initiative, launched in 2022, residents and merchants can pay with Bitcoin or USDT via simple QR codes, attracted by Lightning Network fees often below 1%.' - Bitcoin News.

I truly hope, as I am part of the group Zwolle Bitcoinstad, we can achieve the same here in the Netherlands, Zwolle.

On the 28th of December:

➡️MicroSeed.io: 'When it comes to securing your Bitcoin seed phrase, never say never. Complacency loses a lot more Bitcoin than hacks. Don't trust, verify, including your process for recovery! Regular check-ups, just like the dentist!'

## 🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin in 2025: What Everyone Got Wrong | HODL & Odell

American HODL & Matt Odell join the show for a review of a year that left most Bitcoin narratives exposed. We unpack why expectations ran ahead of reality, why the super cycle never materialised, and how ETFs, treasury companies, and institutional capital quietly changed how this market actually operates. They get into Bitcoin’s underperformance versus gold and equities, the absence of meaningful retail demand, and how leverage distorted outcomes rather than driving real adoption.

They discuss what this means long-term. From institutional involvement and shifting power structures, to the breakdown of the four-year cycle framework. We also get into custody, incentives, freedom, and whether Bitcoin has to pass through the traditional system before it can meaningfully reshape it.

Click here:

Credit: I have used multiple sources!

My savings account:Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

The Latest Bitcoin & Macro news: Weekly Recap 22.11.2025

If you would rather read the long format, enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity. (outside of Nostr) Click here:

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo (

## 🧡Bitcoin news🧡

Just want to start with the following...

What produces inflation? Milton Friedman had the answer decades ago: “Too much government spending and too much government creation of money - and nothing else.”

Study Bitcoin!

Photos hosted by Azzamo ( ➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

➡️Bitcoin News: Bitcoin just hit its 4th “death cross” of this cycle. The last three marked excellent buying opportunities. Historically, one year after a death cross, Bitcoin has been higher 50% of the time, with an average return of 85%.

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

On the 17th of November:

➡️

> 'IBIT alone is buying 1,200 BTC / day (all day average). All ETFs + MSTR 2,000 BTC / day = 1 MM BTC+ every 2 Years. (R2 = 93%).

> Most of the freely tradable supply will be bought in the next decade.' - Fred Krueger

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️95% of the total Bitcoin supply has now been mined.

➡️Jeff Swanson: Bitcoin continues its collapse, ultimately going to zero. You can really see it here on this chart.

*On the 18th of November:*

➡️Bitcoin whales bought the dip below $100k

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️The last time Bitcoin was here, global liquidity was $7 trillion lower.

➡️BTCosmonaut: 'This is without a doubt one of the most dangerous bear traps in Bitcoin history. Plebs are losing the plot and selling to Blackrock, Harvard, UAE, Czech, etc., because their WATCH is telling them to. Unfortunately, they will never see that Bitcoin again.'

➡️Joe Consorti: 'Bitcoin may be at its lowest price since April, but the assets held by spot ETFs are ~200,000 BTC higher. Don't let Goldman Sachs be more bullish than you.'

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

➡️Pre Black Friday deal: Bitcoin's on sale. 30% discount.

➡️El Salvador just bought $100 MILLION Bitcoin during the dip.

➡️'95% of the 21 million Bitcoins have officially been mined. Only 5% of BTC supply left to be mined over the next 114 years!' - Wicked

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

> Chapo:

> '21M total BTC

> 3M lost = 18M

> 75% owned by institutions, govts, funds

> Only ~4M BTC available for individuals globally to own.

> Individual average ownership = 1/2000 (0.0005) Bitcoin

> If you own anywhere close to a whole Bitcoin, you are rich AF.'

*On the 19th of November:*

➡️Bitcoin has broken below the 0.75 cost-basis quantile, a level that has historically marked bear-market territory. Across cycles, reclaiming and holding above it has been key to restoring bullish structure. Bulls will want to see this level regained. -Glassnode

➡️New Hampshire launches First Bitcoin-backed municipal bond.

*On the 20th of November:*

➡️'Short-term holders underwater:

• 2020 COVID crash 92% in a loss of $3,850

• 2022 FTX collapse 94% in a loss of $16,000

• Today: 99% in a loss at $89,000

This is the highest short-term holder capitulation ever recorded.'

➡️Charlie Bilello: At $86,000, Bitcoin is now down around 32% from its all-time high of $126,000 in early October. That's the biggest drawdown since April, but not unusual at all given its historical volatility.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

➡️ Bitcoin's weekly RSI is at a level historically reserved for the bottom of bear market cycles, yet we're only 30% off the highs. It might be the fastest washout in Bitcoin history.

➡️Strategy: 'At current $BTC levels, we have 71 years of dividend coverage assuming the price stays flat. And any $BTC appreciation beyond 1.41% a year fully offsets our annual dividend obligations.'

Market: "We're gonna take Bitcoin down and force liquidate Saylor." Strategy: "Okay, sure. Assuming we do nothing else, you know that we have 71 years of dividends at this current Bitcoin price, right?"

Market: "Oh...um...well..."

On the 21st of November:

➡️At $80,600, Bitcoin is now down around 36% from its all-time high of $126,300 in early October. That's the biggest correction off an all-time high since 2022. Is this unusual volatility for Bitcoin? Not at all. We've seen similar or bigger drawdowns every year.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

I saw Bitcoin crash from $20k to $3k, from $69k to $16k, and from $126k to $80k. Every dip was said to be Bitcoin's death, while in reality, every single one was a once-in-a-lifetime buying opportunity. Zoom out, chill, and HODL. Bitcoin will recover.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

Aged like fine red wine.

➡️Bitcoin News: Bitcoin's Mean Reversion Oscillator just printed its first green (oversold) bar since April this year.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

➡️The number of Bitcoin addresses worth over $100K has dropped 30% over the last two weeks.

➡️Bitcoin realized losses surge to levels last seen during the FTX collapse (Glassnode)

➡️'Binance spot orderbook just printed the single largest positive Depth Delta spike on record (deepest depth). Buy orders now massively outnumber sell orders below price, the strongest absorption signal we’ve seen all cycle. Previous extremes like this marked local lows within hours/days.' - ExitpumpBTC

➡️Bitcoin realized losses have surged to levels last seen during the FTX collapse, with short-term holders driving the bulk of the capitulation. The scale and speed of these losses reflect a meaningful washout of marginal demand as recent buyers unwind into the drawdown. - Glassnode

➡️Bit Paine: If this dip is truly being caused by a liquidity contraction before a wave of stimulus, then the only real historical comparison we have is the 2019 COVID crash, like the ocean going out before a tidal wave.

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️Parker Lewis: "The most important learning from bitcoin's volatility is that bitcoin doesn't die. No central coordination, no bailouts, no moral hazard. On March 12th, 2020, Bitcoin crashed by 50% in a single day to $4,000. Did Bitcoin die? No. Is this good for Bitcoin? Yes. Same story."

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SOLO BLOCK FOUND A home miner with only ~6.73TH/s of total hashrate just mined a block for 3.146 BTC, totaling $264,558. The device that mined block 924569 appears to be a Bitaxe Gamma at 1.2TH/s.

*On the 22nd of November:*

➡️Bitcoin's weekly RSI has only been this low twice before:

1. 2019 bear market

2. 2022 bear market.

➡️Even if Bitcoin adoption completely froze today, its price could still track M2 money supply growth at about 8% per year. ~8% more USD. ~0% more BTC. Each year. But adoption is accelerating, not stopping, so a CAGR of 30% - 50%+ is more realistic.

➡️Billy Boone: 'If Bitcoin closes in the red in 2025, it will break the pattern, and everything you've ever thought to be predictable about the asset is over. In uncharted territory, macro makes the rules. And macro is ALWAYS forced to appreciate scarce assets eventually. Remember, we live in a world denominated in pieces of paper represented by numbers on a screen.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

➡️SwanDesk: 'Bitcoin Hashprice COLLAPSES to all-time low of $34.49/PH/s, down over -50% in weeks and the lowest in BTC’s entire history. This is much worse than even the 2021 China ban or the 2022 bear market. Miners are now hemorrhaging cash, which means forced selling and shutdowns are imminent.'

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

Miners capitulating at historic lows isn't a crisis; it's the reset Bitcoin needed. Weak hands exit, difficulty adjusts down, survivors mine profitably again. This is how BTC self-heals.

Anyway, people, just calm your tits and behold,

The Great Bitcoin Collapse:

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did: Bitcoin, AI & The Fourth Turning | George Bodine**

George Bodine joins the show for a wild conversation about the fourth turning, AI, quantum, and why he believes the next 3–5 years will be the most volatile period in Bitcoin history. We get into his insane life story — from trailer parks to flying F-18s at Top Gun, ejecting from a crashing jet, working underground as a miner, becoming a pro artist, and eventually going all-in on Bitcoin. George breaks down why he thinks the financial crisis never ended, how AI and robotics will erase millions of jobs, the global arms race for compute and energy, and why quantum could hit faster than people expect. We dig into Bitcoin’s real threats — mining centralisation, quantum-vulnerable coins, BIP444, and the Core vs Knots fight dividing the community.

Click here:

Credit: I have used multiple sources!

My savings account:

Bitcoin The tool I recommend for setting up a Bitcoin savings plan: **PocketBitcoin **, especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (from now on, full KYC, so be aware)

> Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ 🧡Bitcoin news🧡

"The premise required for the universe to function is the conservation of energy. A person without energy is a ghost. An object without energy is an image. Money without energy is credit." —Michael Saylor

🧡Bitcoin news🧡

"The premise required for the universe to function is the conservation of energy. A person without energy is a ghost. An object without energy is an image. Money without energy is credit." —Michael Saylor On the 26th of May:

➡️'Bitcoin capital flows could exceed $120B by the end of 2025 and reach $300B in 2026, per Bitwise. U.S. spot Bitcoin ETFs attracted over $36.2B in net inflows during 2024, outperforming expectations and exceeding early SPDR Gold Shares (GLD) performance by 20x.' -Bitcoin News

On the 26th of May:

➡️'Bitcoin capital flows could exceed $120B by the end of 2025 and reach $300B in 2026, per Bitwise. U.S. spot Bitcoin ETFs attracted over $36.2B in net inflows during 2024, outperforming expectations and exceeding early SPDR Gold Shares (GLD) performance by 20x.' -Bitcoin News

➡️Michael Saylor's STRATEGY becomes the first company to hold over 500,000 Bitcoin on its balance sheet. Over the last 64 days, Saylor has purchased approximately 80,000 Bitcoin.

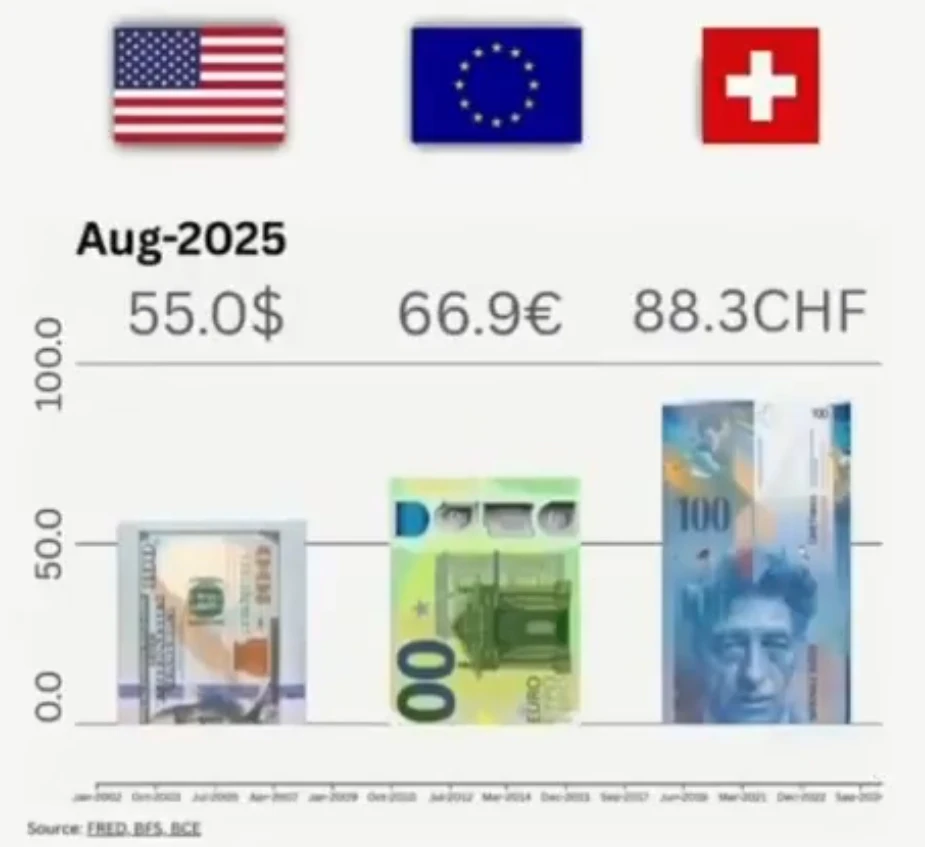

➡️River: '2-3% inflation per year sounds harmless... until you zoom out. Every line on this chart is a reason Bitcoin exists.'

➡️Michael Saylor's STRATEGY becomes the first company to hold over 500,000 Bitcoin on its balance sheet. Over the last 64 days, Saylor has purchased approximately 80,000 Bitcoin.

➡️River: '2-3% inflation per year sounds harmless... until you zoom out. Every line on this chart is a reason Bitcoin exists.'

➡️State Street Corporation has bought 1.13 million Strategy₿ $MSTR stocks for 344.78 million dollars at an average price of $304.41 per share in Q1 2025. Their total holdings are 4.98 million shares worth over 1.84 billion dollars.

On the 27th of May:

➡️Cantor Fitzgerald officially launches $2 BILLION Bitcoin-backed lending with first loans, partnering with Anchorage Digital and Copper. - Bloomberg

➡️Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal. Trump Media is following the MSTR playbook. With that amount, you can now buy over 22,500 BTC. TMTG would then enter the list of largest corporate Bitcoin holders in fourth place.

Pledditor: "Trump just sabotaged Cynthia Lummis's BITCOIN ACT by doing this I see no future where Trump buys billions of dollars of bitcoin and then Congress codifies SBR into law. The corruption is just too brazen." Spot on! Considering the brazen corruption so far this actually makes it more likely.

➡️'Jack Dorsey’s Block to launch Bitcoin Lightning Payments on all Square terminals!' -Bitcoin Archive

Jack Dorsey’s Block is launching Bitcoin payments on Square at the Bitcoin Conference. Merchants can choose to hold the BTC or automatically convert it to fiat. The feature will expand to more sellers later this year.

➡️Sminston With: "But yes, I'm sure this cycle has peaked."

'Bitcoin cycles @ power law fit, a la 365-day SMA At ~$110,000/coin today, the 365-dSMA is only touching the trendline; History shows each cycle moving 2-3x higher than this. Have a nice day!'

➡️State Street Corporation has bought 1.13 million Strategy₿ $MSTR stocks for 344.78 million dollars at an average price of $304.41 per share in Q1 2025. Their total holdings are 4.98 million shares worth over 1.84 billion dollars.

On the 27th of May:

➡️Cantor Fitzgerald officially launches $2 BILLION Bitcoin-backed lending with first loans, partnering with Anchorage Digital and Copper. - Bloomberg

➡️Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal. Trump Media is following the MSTR playbook. With that amount, you can now buy over 22,500 BTC. TMTG would then enter the list of largest corporate Bitcoin holders in fourth place.

Pledditor: "Trump just sabotaged Cynthia Lummis's BITCOIN ACT by doing this I see no future where Trump buys billions of dollars of bitcoin and then Congress codifies SBR into law. The corruption is just too brazen." Spot on! Considering the brazen corruption so far this actually makes it more likely.

➡️'Jack Dorsey’s Block to launch Bitcoin Lightning Payments on all Square terminals!' -Bitcoin Archive

Jack Dorsey’s Block is launching Bitcoin payments on Square at the Bitcoin Conference. Merchants can choose to hold the BTC or automatically convert it to fiat. The feature will expand to more sellers later this year.

➡️Sminston With: "But yes, I'm sure this cycle has peaked."

'Bitcoin cycles @ power law fit, a la 365-day SMA At ~$110,000/coin today, the 365-dSMA is only touching the trendline; History shows each cycle moving 2-3x higher than this. Have a nice day!'

➡️Whales have shifted to net distribution with a score around 0.3, reversing their earlier accumulation pattern during this year's price rallies, according to data from Glassnode.

➡️Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments '#Bitcoin is faster than credit cards'

➡️BlackRock increases Bitcoin exposure for their own funds. The Strategic Income Opportunities Portfolio now holds 2,123,592 shares of IBIT as of March 31 (worth $99.4M) up from 1,691,143 shares on December 31.

➡️Interesting, so Michael Saylor is refusing to publish on-chain proof of Bitcoin reserves...

If Metaplanet and El Salvador can do proof of reserves, why not Strategy? At the end of the day, it's investors' money that is being used to buy Bitcoin. What am I missing?

Arkham: 'SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES ... SO WE DID We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to identify these holdings publicly. This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody).'

➡️Whales have shifted to net distribution with a score around 0.3, reversing their earlier accumulation pattern during this year's price rallies, according to data from Glassnode.

➡️Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments '#Bitcoin is faster than credit cards'

➡️BlackRock increases Bitcoin exposure for their own funds. The Strategic Income Opportunities Portfolio now holds 2,123,592 shares of IBIT as of March 31 (worth $99.4M) up from 1,691,143 shares on December 31.

➡️Interesting, so Michael Saylor is refusing to publish on-chain proof of Bitcoin reserves...

If Metaplanet and El Salvador can do proof of reserves, why not Strategy? At the end of the day, it's investors' money that is being used to buy Bitcoin. What am I missing?

Arkham: 'SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES ... SO WE DID We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to identify these holdings publicly. This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody).'

➡️Ryan Gentry: 'The biggest news at @TheBitcoinConf just dropped. @milessuter shared that the c= routing node is earning 9.7% APR on its bitcoin liquidity (which I’d estimate at ~$10M, 50% of its 184 BTC of public capacity). True non-custodial yield based on the utility of bitcoin payments.'

Great response on the matter by Sam Callahan: "Imagine a treasury company with 1,000 BTC earning ~10% annual yield. Sovereign, Bitcoin-native yield without counterparty risk that’s tied to the economic activity of Lightning instead of interest rate policy. At $1M per BTC, that’s $100M in annual recurring revenue."

9.7% REAL yield on a payment network while holding the keys to their BTC the entire time!! Madness! The constant claims that no one uses lightning are ridiculous.

On the 29th of May:

➡️ Investors are selling gold for Bitcoin - Bloomberg Gold ETF outflows: -$2.8 billion Bitcoin ETF inflows: +$9 billion.

➡️'Spanish banking giant Banco Santander looking to make Bitcoin and stablecoins available to retail clients. Santander has 175 million customers worldwide and is the BIGGEST lender in the Eurozone.' - Bitcoin Archive

➡️The U.S. Department of Labor rescinded 2022 guidance discouraging 401(k) plans from including Bitcoin and cryptocurrency, allowing retirement plans to potentially include Bitcoin and other digital assets. If just 1% of the $8 trillion in 401k funds flows into Bitcoin, that’s $80 billion of new demand, and 2x more than what’s flowed into Bitcoin ETFs.

➡️ Blockstream launches the Blockstream App, enabling users to buy Bitcoin directly and store it in a self-custodial wallet, eliminating the need for third-party custodians.

➡️$550 billion DBS bank says Bitcoin mining could help stabilize the grid and reduce emissions.

➡️Tether reveals that it owns over 100,000 Bitcoin & +50 tons of gold.

➡️Paris Saint Germain adopts Bitcoin as a Treasury Reserve asset.

➡️'The supply of BTC held by long-term holders has now increased by OVER 1.4 MILLION in under 3 months! The market's most experienced participants are refusing to sell Bitcoin at these prices, and soon there won't be enough $BTC left for those late to the party...' - Bitcoin Magazine Pro

On the 30th of May:

➡️Joe Consorti:

It was foretold. Should Bitcoin follow global M2 all the way down on this correction, we may see $97,500. May not happen, may see lower, nobody knows. The only certainty is that the global aggregate of fiat denominated in USD will rise, and so too will BTC follow it in time.

➡️Ryan Gentry: 'The biggest news at @TheBitcoinConf just dropped. @milessuter shared that the c= routing node is earning 9.7% APR on its bitcoin liquidity (which I’d estimate at ~$10M, 50% of its 184 BTC of public capacity). True non-custodial yield based on the utility of bitcoin payments.'

Great response on the matter by Sam Callahan: "Imagine a treasury company with 1,000 BTC earning ~10% annual yield. Sovereign, Bitcoin-native yield without counterparty risk that’s tied to the economic activity of Lightning instead of interest rate policy. At $1M per BTC, that’s $100M in annual recurring revenue."

9.7% REAL yield on a payment network while holding the keys to their BTC the entire time!! Madness! The constant claims that no one uses lightning are ridiculous.

On the 29th of May:

➡️ Investors are selling gold for Bitcoin - Bloomberg Gold ETF outflows: -$2.8 billion Bitcoin ETF inflows: +$9 billion.

➡️'Spanish banking giant Banco Santander looking to make Bitcoin and stablecoins available to retail clients. Santander has 175 million customers worldwide and is the BIGGEST lender in the Eurozone.' - Bitcoin Archive

➡️The U.S. Department of Labor rescinded 2022 guidance discouraging 401(k) plans from including Bitcoin and cryptocurrency, allowing retirement plans to potentially include Bitcoin and other digital assets. If just 1% of the $8 trillion in 401k funds flows into Bitcoin, that’s $80 billion of new demand, and 2x more than what’s flowed into Bitcoin ETFs.

➡️ Blockstream launches the Blockstream App, enabling users to buy Bitcoin directly and store it in a self-custodial wallet, eliminating the need for third-party custodians.

➡️$550 billion DBS bank says Bitcoin mining could help stabilize the grid and reduce emissions.

➡️Tether reveals that it owns over 100,000 Bitcoin & +50 tons of gold.

➡️Paris Saint Germain adopts Bitcoin as a Treasury Reserve asset.

➡️'The supply of BTC held by long-term holders has now increased by OVER 1.4 MILLION in under 3 months! The market's most experienced participants are refusing to sell Bitcoin at these prices, and soon there won't be enough $BTC left for those late to the party...' - Bitcoin Magazine Pro

On the 30th of May:

➡️Joe Consorti:

It was foretold. Should Bitcoin follow global M2 all the way down on this correction, we may see $97,500. May not happen, may see lower, nobody knows. The only certainty is that the global aggregate of fiat denominated in USD will rise, and so too will BTC follow it in time.

➡️Buy Real Bitcoin, and NOT:

⇒ BTC Companies,

⇒ Wrapped BTC

⇒ BTC IOU's

⇒ ...

Bitcoin in self-custody is the only way you get all the benefits of BTC.

➡️Buy Real Bitcoin, and NOT:

⇒ BTC Companies,

⇒ Wrapped BTC

⇒ BTC IOU's

⇒ ...

Bitcoin in self-custody is the only way you get all the benefits of BTC.

And please, as Wicked described it perfectly: 'Don’t run a node for Bitcoin, run and use it for yourself. Your humble little node isn’t saving the network, but it can protect your privacy and verify that the coins you receive are legit…if you’re actually using it.'

On the 31st of May:

➡️The Texas legislature has passed the Strategic Bitcoin Reserve bill. It now goes to Governor Abbott who is expected to sign it into law. This is a historic moment for Bitcoin and Texas, one of the largest (8th largest) economies in the world.

➡️Bitcoin News: 'Norwegian digital asset firm K33 has raised 60 million SEK (about $5.6 million) to expand its Bitcoin treasury. The funds were secured from insiders and strategic investors, including Klein Group and Modiola AS. CEO Torbjørn Bull Jenssen said the move reflects K33’s belief in Bitcoin’s long-term role in global finance and strengthens the company’s balance sheet as it grows its presence as a leading crypto broker in Europe.'

➡️ IMF raises concern over Pakistan‘s Bitcoin mining power plans. They want everyone under their control. They can't do it with Bitcoin. They might be losing another 'customer'. The IMF sees all the debt slaves becoming financially sovereign and independent by embracing Bitcoin.

And please, as Wicked described it perfectly: 'Don’t run a node for Bitcoin, run and use it for yourself. Your humble little node isn’t saving the network, but it can protect your privacy and verify that the coins you receive are legit…if you’re actually using it.'

On the 31st of May:

➡️The Texas legislature has passed the Strategic Bitcoin Reserve bill. It now goes to Governor Abbott who is expected to sign it into law. This is a historic moment for Bitcoin and Texas, one of the largest (8th largest) economies in the world.

➡️Bitcoin News: 'Norwegian digital asset firm K33 has raised 60 million SEK (about $5.6 million) to expand its Bitcoin treasury. The funds were secured from insiders and strategic investors, including Klein Group and Modiola AS. CEO Torbjørn Bull Jenssen said the move reflects K33’s belief in Bitcoin’s long-term role in global finance and strengthens the company’s balance sheet as it grows its presence as a leading crypto broker in Europe.'

➡️ IMF raises concern over Pakistan‘s Bitcoin mining power plans. They want everyone under their control. They can't do it with Bitcoin. They might be losing another 'customer'. The IMF sees all the debt slaves becoming financially sovereign and independent by embracing Bitcoin.

I have rewritten Daniel Batten's quote/post on this matter:

**

'Why Pakistan’s Bitcoin Plans May Not Survive the IMF"

**

While I’m an optimist by nature—and I truly hope I’m wrong—I believe Pakistan will struggle to follow through on its Bitcoin and Bitcoin mining ambitions.

Short Answer: The IMF

Mid-Length Explanation:

Bitcoin poses a significant threat to the IMF’s influence—on at least five fronts.

Pakistan is heavily indebted to the IMF, and history shows a clear pattern: the IMF has already derailed or scaled back Bitcoin initiatives in all of the three countries that attempted adoption—El Salvador, Argentina, and the Central African Republic.

Pakistan will likely face similar pushback.

And given Pakistan’s economic vulnerabilities, it’s equally likely that the IMF will succeed.

What the IMF’s Next Steps Might Look Like

Manufacturing Doubt and Delay The IMF will likely begin by generating fear, uncertainty, and doubt (FUD) around the viability of Pakistan’s Bitcoin program. Expect references to:

“Energy shortages”

“High electricity costs”

“Unclear regulatory frameworks”

“Anti-money laundering (AML) concerns”

These will be framed as responsible concerns by a seasoned financial guardian. The IMF may also imply that Pakistan acted prematurely, noting the country did not consult the IMF before announcing its Bitcoin initiative—suggesting a lack of due diligence. However, these objections are highly debatable. Multiple peer-reviewed studies show that Bitcoin mining can improve grid stability and lower electricity costs. Moreover, examples like Bhutan and El Salvador demonstrate how Bitcoin can enhance economic sovereignty. But that’s precisely the issue: economic sovereignty reduces the IMF’s lending relevance, and that’s not in the IMF’s institutional interest.

Weaponizing Debt and Conditionality

Under its $7 billion Extended Fund Facility program, the IMF is likely to:

Demand FATF-compliant crypto regulation

Prohibit state-level Bitcoin accumulation

Tie loan disbursements to rollbacks on Bitcoin and mining-related policies

This approach exploits Pakistan’s financial dependence on IMF loans to meet external debt obligations and maintain its foreign exchange reserves.

Enforcing Compliance Through Vulnerability

Pakistan’s financial position leaves little room for defiance:

It faces $12.7 billion in debt repayments in FY 2025.

Without IMF support, reserves could fall below $4 billion, covering less than one month of imports—far below the threshold needed for macroeconomic stability.

A repeat of early 2023, when reserves fell to $2.92 billion, would likely trigger another balance-of-payments crisis.

This would pressure the Pakistani rupee, already having depreciated from PKR 100 to over 330 per USD since 2017, and could push the country closer to default. Given its past FATF grey-listing, Pakistan cannot afford another multilateral funding freeze.

So What Does This All Mean?

It means the gloves are off.

The IMF is no longer merely advising—it’s actively resisting. Bitcoin threatens its long-standing monopoly over financially vulnerable nations, and Pakistan is shaping up to be the fourth test case of this resistance. If the IMF pressures Pakistan into reversing course, it will mark a 4-for-4 track record in blocking Bitcoin adoption efforts by countries under its financial umbrella.

The Bigger Picture

This is how entrenched institutions behave when facing disruption. They won’t stand aside—they’ll use every tool available to defend the system they control.

If a nation wants to adopt Bitcoin, it must either:

Be financially independent, like Bhutan or even the United States, or

Secure alternative funding, so IMF leverage becomes ineffective.

Bitcoin isn’t just a financial network. It’s a threat to the debt-based global order—and that means those invested in the status quo will fight back.'

➡️'Recent analysis by market research firm Alphractal suggests that, based on its current Sharpe Ratio, a key measure of risk-adjusted returns, Bitcoin still has room to run. The metric, which compares excess returns to volatility, is trending upward but remains well below the historical levels that have marked past market tops in 2013, 2017, and 2021.' - Bitcoin News

I have rewritten Daniel Batten's quote/post on this matter:

**

'Why Pakistan’s Bitcoin Plans May Not Survive the IMF"

**

While I’m an optimist by nature—and I truly hope I’m wrong—I believe Pakistan will struggle to follow through on its Bitcoin and Bitcoin mining ambitions.

Short Answer: The IMF

Mid-Length Explanation:

Bitcoin poses a significant threat to the IMF’s influence—on at least five fronts.

Pakistan is heavily indebted to the IMF, and history shows a clear pattern: the IMF has already derailed or scaled back Bitcoin initiatives in all of the three countries that attempted adoption—El Salvador, Argentina, and the Central African Republic.

Pakistan will likely face similar pushback.

And given Pakistan’s economic vulnerabilities, it’s equally likely that the IMF will succeed.

What the IMF’s Next Steps Might Look Like

Manufacturing Doubt and Delay The IMF will likely begin by generating fear, uncertainty, and doubt (FUD) around the viability of Pakistan’s Bitcoin program. Expect references to:

“Energy shortages”

“High electricity costs”

“Unclear regulatory frameworks”

“Anti-money laundering (AML) concerns”

These will be framed as responsible concerns by a seasoned financial guardian. The IMF may also imply that Pakistan acted prematurely, noting the country did not consult the IMF before announcing its Bitcoin initiative—suggesting a lack of due diligence. However, these objections are highly debatable. Multiple peer-reviewed studies show that Bitcoin mining can improve grid stability and lower electricity costs. Moreover, examples like Bhutan and El Salvador demonstrate how Bitcoin can enhance economic sovereignty. But that’s precisely the issue: economic sovereignty reduces the IMF’s lending relevance, and that’s not in the IMF’s institutional interest.

Weaponizing Debt and Conditionality

Under its $7 billion Extended Fund Facility program, the IMF is likely to:

Demand FATF-compliant crypto regulation

Prohibit state-level Bitcoin accumulation

Tie loan disbursements to rollbacks on Bitcoin and mining-related policies

This approach exploits Pakistan’s financial dependence on IMF loans to meet external debt obligations and maintain its foreign exchange reserves.

Enforcing Compliance Through Vulnerability

Pakistan’s financial position leaves little room for defiance:

It faces $12.7 billion in debt repayments in FY 2025.

Without IMF support, reserves could fall below $4 billion, covering less than one month of imports—far below the threshold needed for macroeconomic stability.

A repeat of early 2023, when reserves fell to $2.92 billion, would likely trigger another balance-of-payments crisis.

This would pressure the Pakistani rupee, already having depreciated from PKR 100 to over 330 per USD since 2017, and could push the country closer to default. Given its past FATF grey-listing, Pakistan cannot afford another multilateral funding freeze.

So What Does This All Mean?

It means the gloves are off.

The IMF is no longer merely advising—it’s actively resisting. Bitcoin threatens its long-standing monopoly over financially vulnerable nations, and Pakistan is shaping up to be the fourth test case of this resistance. If the IMF pressures Pakistan into reversing course, it will mark a 4-for-4 track record in blocking Bitcoin adoption efforts by countries under its financial umbrella.

The Bigger Picture

This is how entrenched institutions behave when facing disruption. They won’t stand aside—they’ll use every tool available to defend the system they control.

If a nation wants to adopt Bitcoin, it must either:

Be financially independent, like Bhutan or even the United States, or

Secure alternative funding, so IMF leverage becomes ineffective.

Bitcoin isn’t just a financial network. It’s a threat to the debt-based global order—and that means those invested in the status quo will fight back.'

➡️'Recent analysis by market research firm Alphractal suggests that, based on its current Sharpe Ratio, a key measure of risk-adjusted returns, Bitcoin still has room to run. The metric, which compares excess returns to volatility, is trending upward but remains well below the historical levels that have marked past market tops in 2013, 2017, and 2021.' - Bitcoin News

➡️Publicly-listed Brazilian fintech Méliuz to raise $78m to buy more Bitcoin, after buying $26.5m Bitcoin yesterday.

On the 1st of June:

➡️Bitcoin made its Highest Monthly Close ever last night!

➡️ Someone just donated 300 Bitcoin worth +$30m to Ross Ulbricht, founder of SilkRoad.

➡️Publicly-listed Brazilian fintech Méliuz to raise $78m to buy more Bitcoin, after buying $26.5m Bitcoin yesterday.

On the 1st of June:

➡️Bitcoin made its Highest Monthly Close ever last night!

➡️ Someone just donated 300 Bitcoin worth +$30m to Ross Ulbricht, founder of SilkRoad.

Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s.

➡️Top Bitcoin holders:

Satoshi Nakamoto: 1.1M BTC ($114B)

Coinbase: 983K BTC ($103B)

Binance: 619K BTC ($65B)

BlackRock: 600K BTC ($63B)

Strategy: 580K BTC ($47B)

Fidelity: 346K BTC ($36B)

Grayscale: 218K BTC ($23B)

U.S. Government: 196K BTC ($20B)

On the 2nd of June:

➡️IG Group becomes the first UK-listed firm to offer Bitcoin trading to retail investors - Financial Times “Customer demand [for bitcoin] is reaching a tipping point,” says MD Michael Healy

➡️Tether moved 14,000 Bitcoin worth +$1.4 BILLION to Twenty-One Capital (XXI) as part of its investment.

➡️Hong Kong-based Reitar Logtech announces they will buy $1.5 billion Bitcoin for their reserves — SEC filing The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Russia's largest bank Sberbank launches structured bonds tied to Bitcoin. Source

"No power on earth can stop an idea whose time has come"

Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s.

➡️Top Bitcoin holders:

Satoshi Nakamoto: 1.1M BTC ($114B)

Coinbase: 983K BTC ($103B)

Binance: 619K BTC ($65B)

BlackRock: 600K BTC ($63B)

Strategy: 580K BTC ($47B)