BTC Non-Wholecoiners Show Their Paper Hands

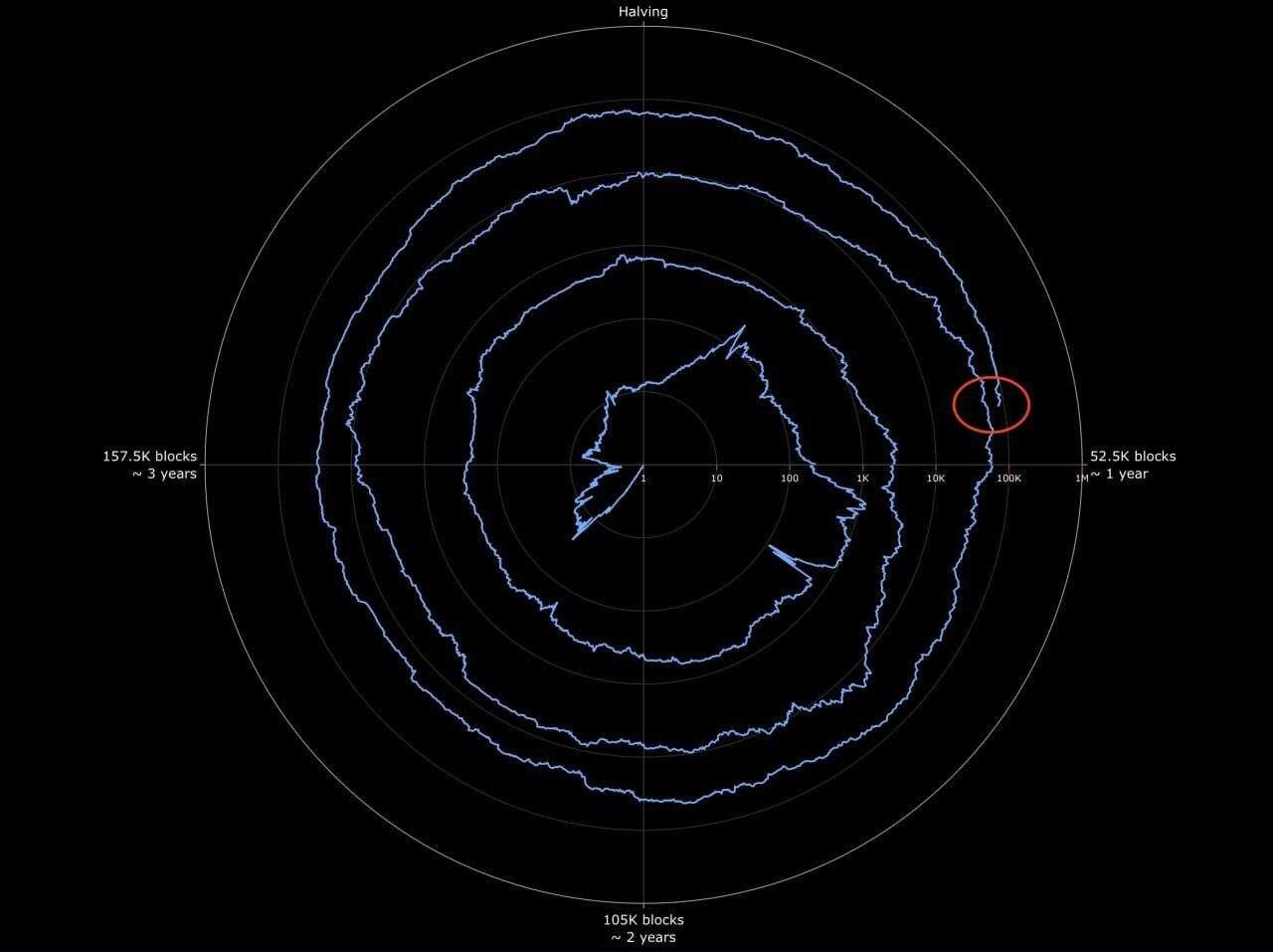

As businesses and governments continue to accumulate Bitcoin, non-wholecoiners (those holding less than 1 BTC) are gradually reducing their holdings, mirroring the trend seen in late 2020.

In the previous cycle, when BTC rose to $40,000, non-wholecoiners sold 0.07M BTC. A similar pattern is emerging in this cycle, although since 2020, retail holdings have still grown 37% to reach 1.75M BTC.

WEAK HANDS