Global tensions are shaped by economic competition, technological disruption, and shifting alliances. The U.S.-China rivalry over trade, technology, and influence will likely intensify, while regional conflicts like Ukraine and Taiwan could destabilize markets. Resource control, such as energy and rare earth metals, is becoming a focal point, driving protectionist policies. Meanwhile, the rise of de-dollarization and digital currencies challenges traditional financial systems. Conspiracy theories about the Rothschild family’s manipulation often oversimplify these complexities, as modern economic conflicts are primarily driven by governments, corporations, and institutions, not individual families.

Emerging markets like India and Southeast Asia are gaining prominence as older powers face internal divisions and slower growth. Economic fragmentation, debt crises in developing nations, and the push for self-reliance could lead to regional trade blocs and further polarization. While unfounded claims about Rothschild influence persist, the real drivers of change are systemic—shaped by power struggles between nations, technological innovation, and global financial shifts. How these challenges are managed will determine whether cooperation or conflict defines the future.

#siamstr #btc #bitcoin #nostr

Epicurus said, “When I am ill, I do not discuss the state of my body… but instead, I continue to engage in philosophical discussions, focusing on the essential point of how the mind… can remain tranquil and maintain a sense of peace.” He also remarked, “I do not allow doctors to exhibit their arrogance. My life simply follows its natural course.” Take his example: remain steadfast in philosophy, even amidst life’s unexpected challenges, and focus on the task and principles at hand.

Marcus Aurelius wrote, “Is a world without shameless people possible? Clearly, it is not. So why demand the impossible?” He advised countering faults with virtues: “Withdraw the poison of cruelty with kindness.” Harm comes only from our own perceptions of others’ actions, not the actions themselves. “If done in accordance with reason, why expect anything in return? Does the eye seek a reward for seeing? Does the foot expect recognition for walking?” By fulfilling one’s natural role of doing good, one achieves life’s true purpose.

#stoic #siamstr #btc #bitcoin #nostr

Epicurus said, “When I am ill, I do not discuss the state of my body… but instead, I continue to engage in philosophical discussions, focusing on the essential point of how the mind… can remain tranquil and maintain a sense of peace.” He also remarked, “I do not allow doctors to exhibit their arrogance. My life simply follows its natural course.” Take his example: remain steadfast in philosophy, even amidst life’s unexpected challenges, and focus on the task and principles at hand.

Marcus Aurelius wrote, “Is a world without shameless people possible? Clearly, it is not. So why demand the impossible?” He advised countering faults with virtues: “Withdraw the poison of cruelty with kindness.” Harm comes only from our own perceptions of others’ actions, not the actions themselves. “If done in accordance with reason, why expect anything in return? Does the eye seek a reward for seeing? Does the foot expect recognition for walking?” By fulfilling one’s natural role of doing good, one achieves life’s true purpose.

#stoic #siamstr #btc #bitcoin #nostr Epicurus said, “When I am ill, I do not discuss the state of my body… but instead, I continue to engage in philosophical discussions, focusing on the essential point of how the mind… can remain tranquil and maintain a sense of peace.” He also remarked, “I do not allow doctors to exhibit their arrogance. My life simply follows its natural course.” Take his example: remain steadfast in philosophy, even amidst life’s unexpected challenges, and focus on the task and principles at hand.

Marcus Aurelius wrote, “Is a world without shameless people possible? Clearly, it is not. So why demand the impossible?” He advised countering faults with virtues: “Withdraw the poison of cruelty with kindness.” Harm comes only from our own perceptions of others’ actions, not the actions themselves. “If done in accordance with reason, why expect anything in return? Does the eye seek a reward for seeing? Does the foot expect recognition for walking?” By fulfilling one’s natural role of doing good, one achieves life’s true purpose.

#stoic #siamstr #btc #bitcoin #nostr

Epicurus said, “When I am ill, I do not discuss the state of my body… but instead, I continue to engage in philosophical discussions, focusing on the essential point of how the mind… can remain tranquil and maintain a sense of peace.” He also remarked, “I do not allow doctors to exhibit their arrogance. My life simply follows its natural course.” Take his example: remain steadfast in philosophy, even amidst life’s unexpected challenges, and focus on the task and principles at hand.

Marcus Aurelius wrote, “Is a world without shameless people possible? Clearly, it is not. So why demand the impossible?” He advised countering faults with virtues: “Withdraw the poison of cruelty with kindness.” Harm comes only from our own perceptions of others’ actions, not the actions themselves. “If done in accordance with reason, why expect anything in return? Does the eye seek a reward for seeing? Does the foot expect recognition for walking?” By fulfilling one’s natural role of doing good, one achieves life’s true purpose.

#stoic #siamstr #btc #bitcoin #nostr

Damn 🤣

#siamstr #btc #bitcoin #nostr #meme

Damn 🤣

#siamstr #btc #bitcoin #nostr #meme The modern banking system, originating in 1644, shifted financial risks to the public while reserving profits for private shareholders. The first central bank, the Bank of Amsterdam, was followed by the Swedish Riksbank in 1668. By 1694, England established the Bank of England under King William III to finance its navy and the East India Company. The system relied on government-issued bonds backed by tax revenue, which the Bank of England used as collateral to print money. This money supplied private banks, enabling them to lend further and fueling economic growth.

This system created a credit supply chain where governments produced money, central banks distributed it, and private banks profited. The financial framework, designed by bankers, ensured their interests were prioritized, leading to a public loss-private gain dynamic: taxpayers shouldered the risks, while private institutions reaped rewards. This innovation transformed England into a global power within a century but entrenched inequalities in financial systems worldwide.

#nostr #btc #bitcoin #siamstr #bank #history

The modern banking system, originating in 1644, shifted financial risks to the public while reserving profits for private shareholders. The first central bank, the Bank of Amsterdam, was followed by the Swedish Riksbank in 1668. By 1694, England established the Bank of England under King William III to finance its navy and the East India Company. The system relied on government-issued bonds backed by tax revenue, which the Bank of England used as collateral to print money. This money supplied private banks, enabling them to lend further and fueling economic growth.

This system created a credit supply chain where governments produced money, central banks distributed it, and private banks profited. The financial framework, designed by bankers, ensured their interests were prioritized, leading to a public loss-private gain dynamic: taxpayers shouldered the risks, while private institutions reaped rewards. This innovation transformed England into a global power within a century but entrenched inequalities in financial systems worldwide.

#nostr #btc #bitcoin #siamstr #bank #history Elon Musk’s preference for fiction, especially science fiction, stems from its ability to inspire innovation and expand his imagination. Books like The Foundation and The Hitchhiker’s Guide to the Galaxy provide Musk with bold visions of the future, exploring themes like space exploration, advanced technology, and societal evolution. These genres allow him to think beyond current limitations and imagine new possibilities, often influencing his work with SpaceX, Tesla, and other ventures. Fiction serves as a creative outlet that helps Musk tackle real-world challenges by offering complex scenarios and problem-solving frameworks.

Additionally, science fiction aligns with Musk’s personal interests in space, technology, and existential questions. Novels like The Foundation and The Hitchhiker’s Guide delve into the long-term consequences of technological advancement and humanity’s place in the universe, which resonates with Musk’s goals of space colonization and pushing the boundaries of human progress. By reading these works, Musk not only entertains himself but also finds philosophical insights and inspiration for tackling the most ambitious challenges of the future.

#elonmusk #tesla #btc #bitcoin #nostr #siamstr

Elon Musk’s preference for fiction, especially science fiction, stems from its ability to inspire innovation and expand his imagination. Books like The Foundation and The Hitchhiker’s Guide to the Galaxy provide Musk with bold visions of the future, exploring themes like space exploration, advanced technology, and societal evolution. These genres allow him to think beyond current limitations and imagine new possibilities, often influencing his work with SpaceX, Tesla, and other ventures. Fiction serves as a creative outlet that helps Musk tackle real-world challenges by offering complex scenarios and problem-solving frameworks.

Additionally, science fiction aligns with Musk’s personal interests in space, technology, and existential questions. Novels like The Foundation and The Hitchhiker’s Guide delve into the long-term consequences of technological advancement and humanity’s place in the universe, which resonates with Musk’s goals of space colonization and pushing the boundaries of human progress. By reading these works, Musk not only entertains himself but also finds philosophical insights and inspiration for tackling the most ambitious challenges of the future.

#elonmusk #tesla #btc #bitcoin #nostr #siamstr Global tensions are shaped by economic competition, technological disruption, and shifting alliances. The U.S.-China rivalry over trade, technology, and influence will likely intensify, while regional conflicts like Ukraine and Taiwan could destabilize markets. Resource control, such as energy and rare earth metals, is becoming a focal point, driving protectionist policies. Meanwhile, the rise of de-dollarization and digital currencies challenges traditional financial systems. Conspiracy theories about the Rothschild family’s manipulation often oversimplify these complexities, as modern economic conflicts are primarily driven by governments, corporations, and institutions, not individual families.

Emerging markets like India and Southeast Asia are gaining prominence as older powers face internal divisions and slower growth. Economic fragmentation, debt crises in developing nations, and the push for self-reliance could lead to regional trade blocs and further polarization. While unfounded claims about Rothschild influence persist, the real drivers of change are systemic—shaped by power struggles between nations, technological innovation, and global financial shifts. How these challenges are managed will determine whether cooperation or conflict defines the future.

#siamstr #btc #bitcoin #nostr

Global tensions are shaped by economic competition, technological disruption, and shifting alliances. The U.S.-China rivalry over trade, technology, and influence will likely intensify, while regional conflicts like Ukraine and Taiwan could destabilize markets. Resource control, such as energy and rare earth metals, is becoming a focal point, driving protectionist policies. Meanwhile, the rise of de-dollarization and digital currencies challenges traditional financial systems. Conspiracy theories about the Rothschild family’s manipulation often oversimplify these complexities, as modern economic conflicts are primarily driven by governments, corporations, and institutions, not individual families.

Emerging markets like India and Southeast Asia are gaining prominence as older powers face internal divisions and slower growth. Economic fragmentation, debt crises in developing nations, and the push for self-reliance could lead to regional trade blocs and further polarization. While unfounded claims about Rothschild influence persist, the real drivers of change are systemic—shaped by power struggles between nations, technological innovation, and global financial shifts. How these challenges are managed will determine whether cooperation or conflict defines the future.

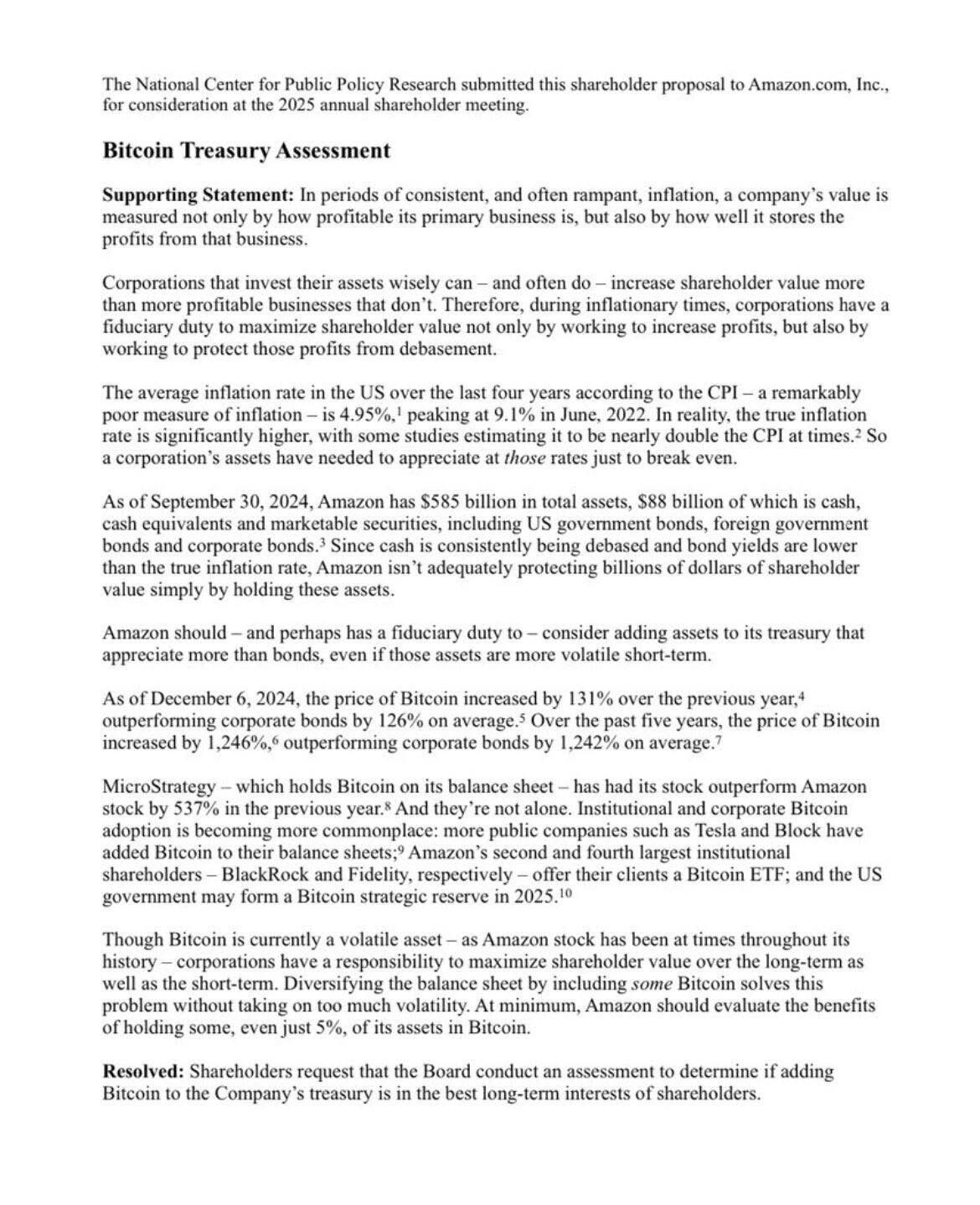

#siamstr #btc #bitcoin #nostr Should Amazon Hold Bitcoin?

A shareholder proposal urges Amazon to explore adding Bitcoin to its treasury.

• Why?

Inflation erodes cash reserves, and Bitcoin has outperformed traditional assets (e.g., +131% in 2024).

• Examples:

Companies like MicroStrategy saw a 537% stock rise by holding Bitcoin. Tesla and BlackRock have adopted it too.

• Proposal:

Allocate even 5% of cash to Bitcoin to hedge against inflation and diversify reserves.

Will Amazon embrace the Bitcoin revolution? Shareholders decide at the 2025 meeting!

#siamstr #bitcoin #btc #nostr #asknostr

Should Amazon Hold Bitcoin?

A shareholder proposal urges Amazon to explore adding Bitcoin to its treasury.

• Why?

Inflation erodes cash reserves, and Bitcoin has outperformed traditional assets (e.g., +131% in 2024).

• Examples:

Companies like MicroStrategy saw a 537% stock rise by holding Bitcoin. Tesla and BlackRock have adopted it too.

• Proposal:

Allocate even 5% of cash to Bitcoin to hedge against inflation and diversify reserves.

Will Amazon embrace the Bitcoin revolution? Shareholders decide at the 2025 meeting!

#siamstr #bitcoin #btc #nostr #asknostr