Over time, inflation erodes the purchasing power of fiat currencies like the US dollar. With a 7% annual inflation rate, $1,000 today would only be worth about $510 in 10 years, meaning you’d need more money to buy the same goods. This is due to the increasing supply of money (M2) and the decline in value of fiat currency. As a result, the dollar buys less over time, losing its value steadily.

On the other hand, assets like Bitcoin and gold tend to preserve or even increase their purchasing power. Bitcoin, with its fixed supply and increasing demand, could see significant price growth, potentially reaching $5.77 million for 1 BTC in 10 years, assuming a 50% annual growth rate. Similarly, gold, which traditionally hedges against inflation, could rise by about 79% over the same period, reaching $3,580 per ounce. While both Bitcoin and gold outperform fiat currencies in the long run, Bitcoin offers the most dramatic potential for increasing purchasing power.

#btc #bitcoin #nostr #siamstr

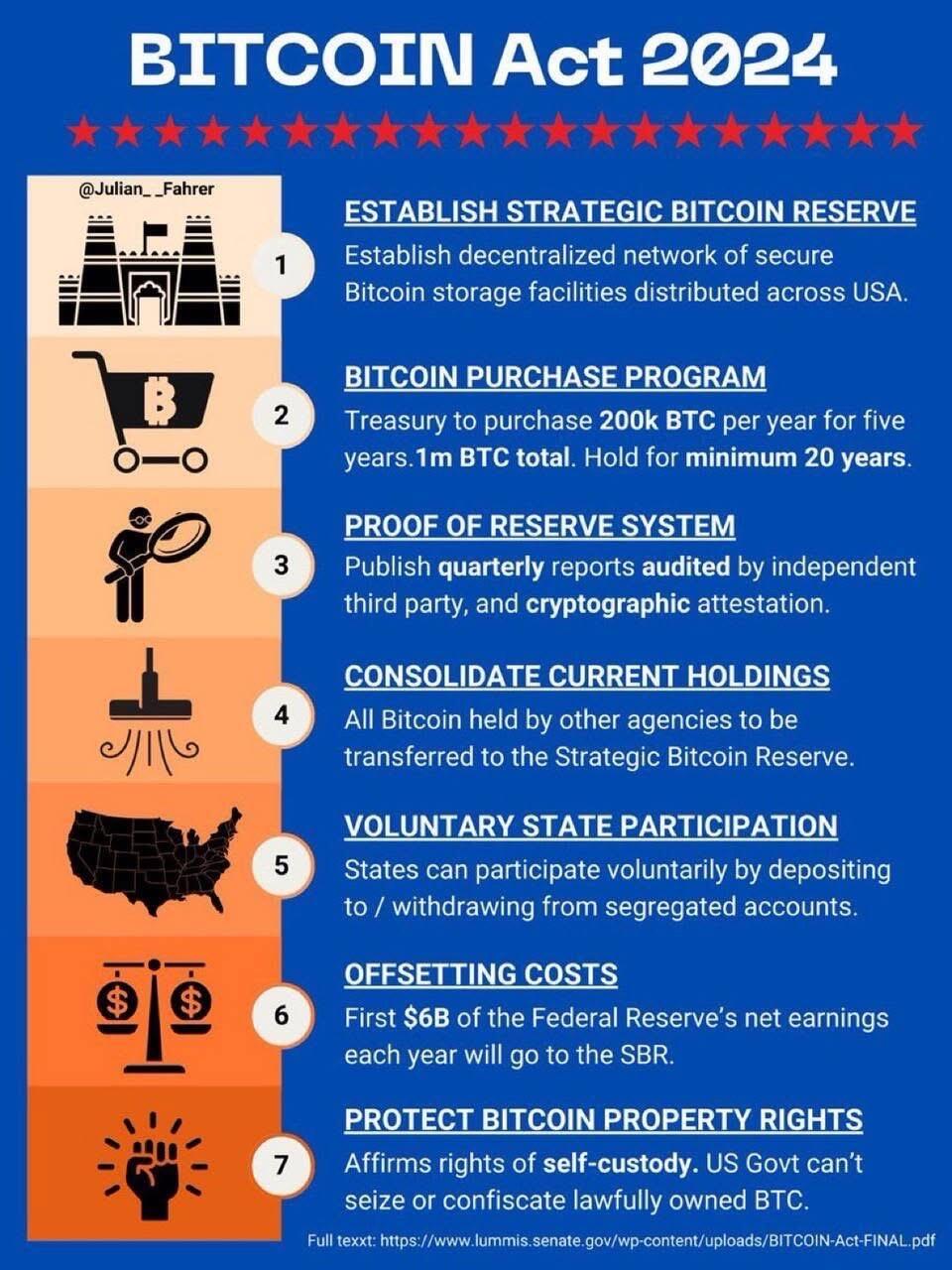

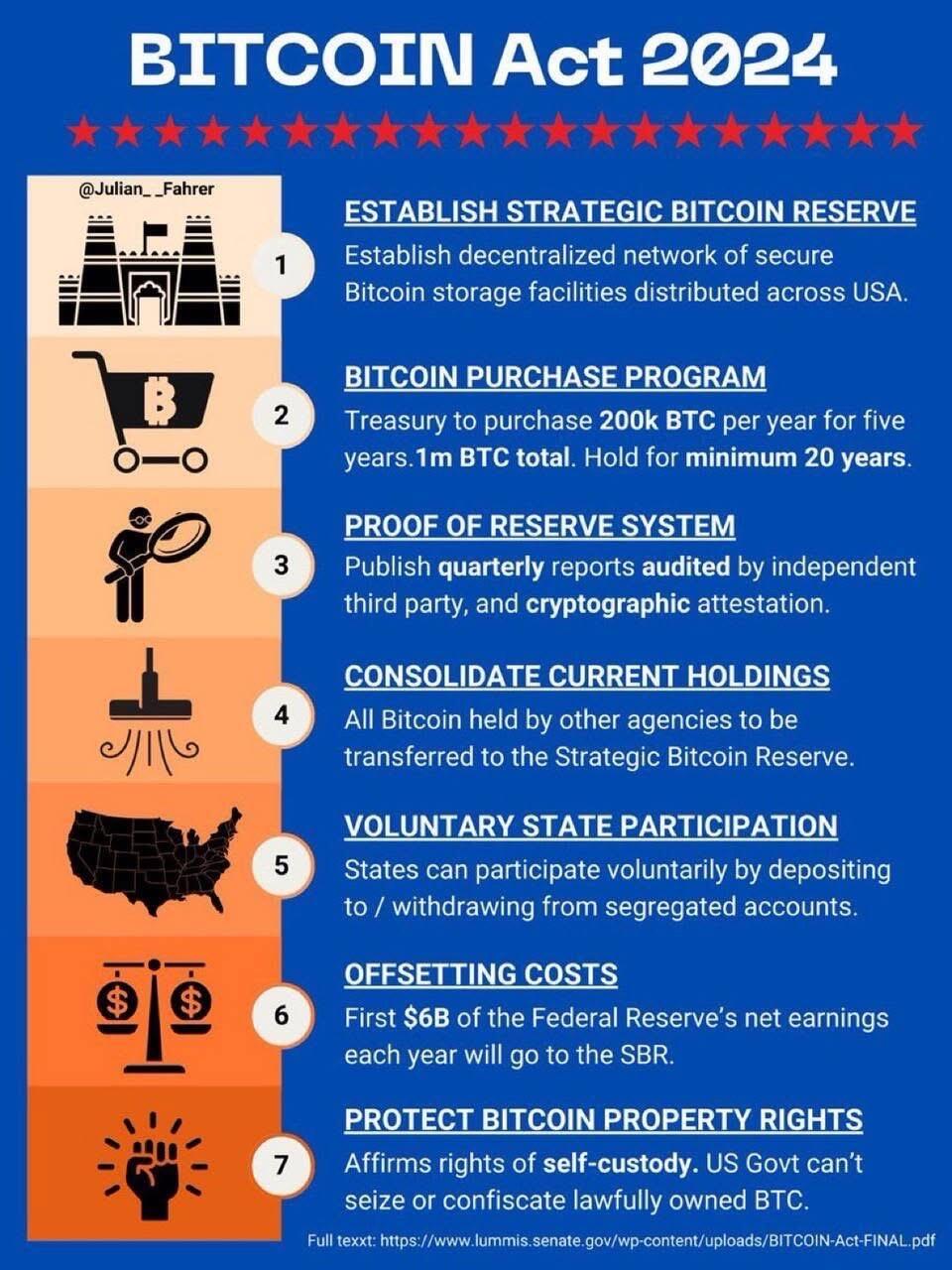

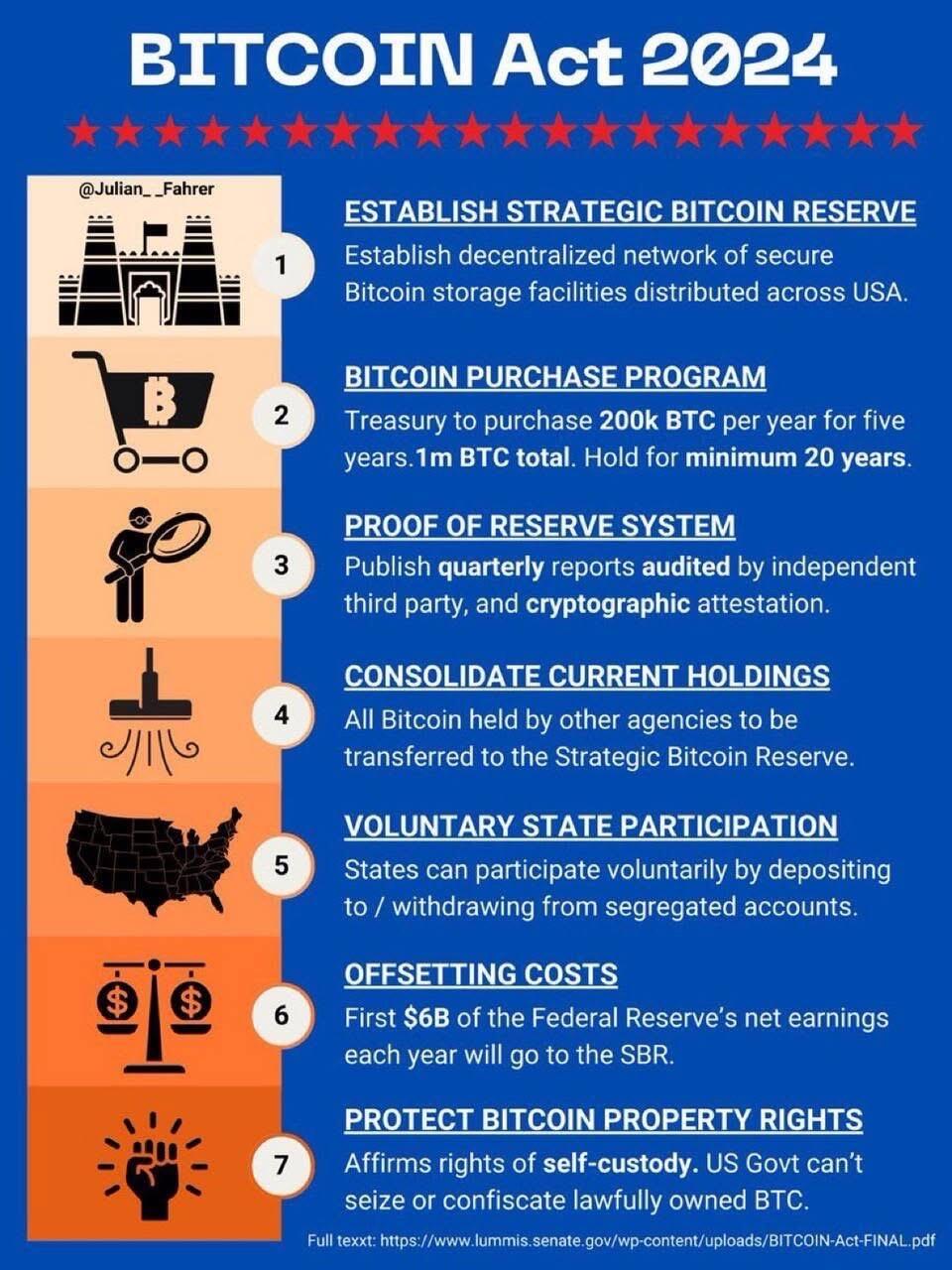

BITCOIN Act 2024

BITCOIN Act 2024 BITCOIN Act 2024

BITCOIN Act 2024 BITCOIN Act 2024

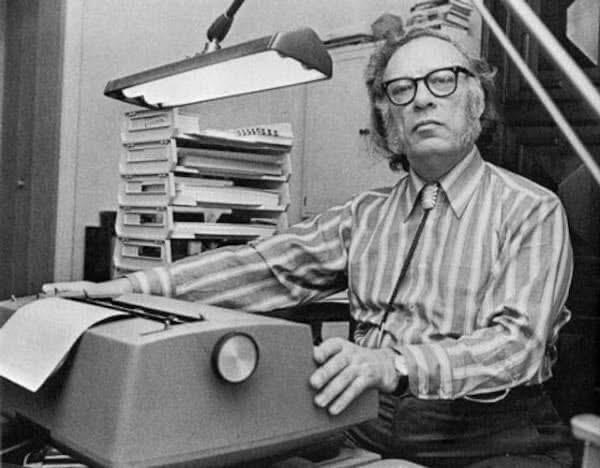

BITCOIN Act 2024 Why Isaac Asimov’s Foundation is Worth Reading for Bitcoiners

1. Decentralization and Resilience

• The series highlights distributing knowledge and resources to withstand societal collapse, similar to Bitcoin’s decentralized network resisting control.

2. Long-Term Vision

• Hari Seldon’s “Psychohistory” involves planning for future stability, paralleling Bitcoin’s long-term impact on financial systems.

3. Challenging Central Authority

• The fall of a centralized empire and rise of independent systems mirrors Bitcoin’s challenge to traditional financial institutions.

4. Philosophical Insight

• Explores themes like technology’s role in societal change, aligning with Bitcoin’s mission to reshape global economics.

#siamstr #btc #bitcoin #nostr

Why Isaac Asimov’s Foundation is Worth Reading for Bitcoiners

1. Decentralization and Resilience

• The series highlights distributing knowledge and resources to withstand societal collapse, similar to Bitcoin’s decentralized network resisting control.

2. Long-Term Vision

• Hari Seldon’s “Psychohistory” involves planning for future stability, paralleling Bitcoin’s long-term impact on financial systems.

3. Challenging Central Authority

• The fall of a centralized empire and rise of independent systems mirrors Bitcoin’s challenge to traditional financial institutions.

4. Philosophical Insight

• Explores themes like technology’s role in societal change, aligning with Bitcoin’s mission to reshape global economics.

#siamstr #btc #bitcoin #nostr Over time, inflation erodes the purchasing power of fiat currencies like the US dollar. With a 7% annual inflation rate, $1,000 today would only be worth about $510 in 10 years, meaning you’d need more money to buy the same goods. This is due to the increasing supply of money (M2) and the decline in value of fiat currency. As a result, the dollar buys less over time, losing its value steadily.

On the other hand, assets like Bitcoin and gold tend to preserve or even increase their purchasing power. Bitcoin, with its fixed supply and increasing demand, could see significant price growth, potentially reaching $5.77 million for 1 BTC in 10 years, assuming a 50% annual growth rate. Similarly, gold, which traditionally hedges against inflation, could rise by about 79% over the same period, reaching $3,580 per ounce. While both Bitcoin and gold outperform fiat currencies in the long run, Bitcoin offers the most dramatic potential for increasing purchasing power.

#btc #bitcoin #nostr #siamstr

Over time, inflation erodes the purchasing power of fiat currencies like the US dollar. With a 7% annual inflation rate, $1,000 today would only be worth about $510 in 10 years, meaning you’d need more money to buy the same goods. This is due to the increasing supply of money (M2) and the decline in value of fiat currency. As a result, the dollar buys less over time, losing its value steadily.

On the other hand, assets like Bitcoin and gold tend to preserve or even increase their purchasing power. Bitcoin, with its fixed supply and increasing demand, could see significant price growth, potentially reaching $5.77 million for 1 BTC in 10 years, assuming a 50% annual growth rate. Similarly, gold, which traditionally hedges against inflation, could rise by about 79% over the same period, reaching $3,580 per ounce. While both Bitcoin and gold outperform fiat currencies in the long run, Bitcoin offers the most dramatic potential for increasing purchasing power.

#btc #bitcoin #nostr #siamstr