Trump Targets Foreign-Owned Meatpacking Cartel To Arrest Beef Prices, Defend Small Ranchers

Trump Targets Foreign-Owned Meatpacking Cartel To Arrest Beef Prices, Defend Small Ranchers

President Trump has directed the Justice Department to investigate the meatpacking cartel - JBS, Cargill, Tyson Foods, and National Beef - for potential collusion, price-fixing, and price manipulation. The four companies, two of which are foreign-owned, now control 85% of the U.S. beef processing market, up from just 36% in 1980.

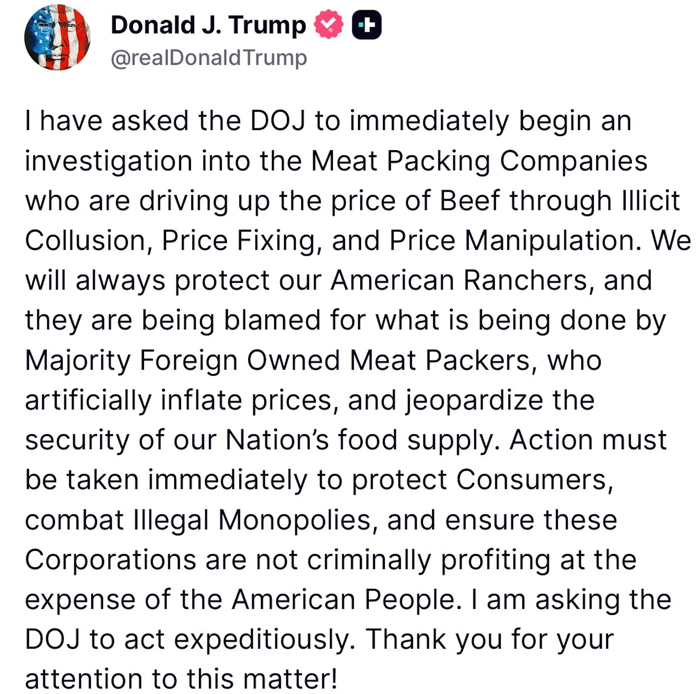

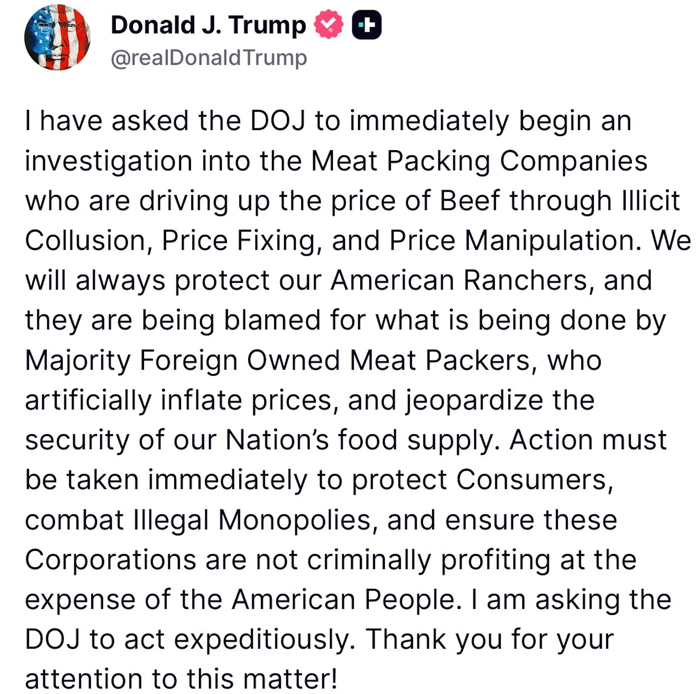

"I have asked the DOJ to immediately begin an investigation into the Meat Packing Companies who are driving up the price of Beef through Illicit Collusion, Price Fixing, and Price Manipulation," Trump wrote on Truth Social.

The president continued, "We will always protect our American Ranchers, and they are being blamed for what is being done by the Majority foreign-owned meat Packers, who artificially inflate prices, and jeopardize the security of our Nation's food supply."

"Action must be taken immediately to protect Consumers, combat Illegal Monopolies, and ensure these Corporations are not criminally profiting at the expense of the American People. I am asking the DOJ to act expeditiously. Thank you for your attention to this matter!" he noted in the post.

The White House released four key takeaways of how America's beef supply chain has been hijacked by globalists that operate in what appears to be a cartel and have eliminated competition by crushing small mom-and-pop ranchers:

For too long, a handful of giant meat packers have squeezed America's cattle producers, shrunk herds, and jacked up prices at the grocery store. By examining whether these companies have violated antitrust laws through coordinated pricing or capacity restrictions, this investigation will root out any illegal collusion, restore fair competition, and protect our food security.

The "Big Four" meat packers — JBS (Brazil), Cargill, Tyson Foods, and National Beef — currently dominate 85% of the U.S. beef processing market, up from just 36% in 1980. Two of these companies, including the largest meat packer in the world, are either foreign-owned or have significant foreign ownership and control.

Industry consolidation has crushed competition and hammered cattle producers. In the 1980s, the top four packers purchased one-third of all fed cattle; by the mid-1990s, that share exploded to over 80% and has only grown more concentrated since.

This has led to the exploitation of American consumers, farmers, and ranchers. In fact, mounting evidence shows this monopoly power has slashed payments to ranchers, reduced herd sizes, driven up consumer prices, and threatened America's food supply chain.

Like Trump's wild success in tackling out-of-control egg prices, he's about to do it again with beef.

The White House released four key takeaways of how America's beef supply chain has been hijacked by globalists that operate in what appears to be a cartel and have eliminated competition by crushing small mom-and-pop ranchers:

For too long, a handful of giant meat packers have squeezed America's cattle producers, shrunk herds, and jacked up prices at the grocery store. By examining whether these companies have violated antitrust laws through coordinated pricing or capacity restrictions, this investigation will root out any illegal collusion, restore fair competition, and protect our food security.

The "Big Four" meat packers — JBS (Brazil), Cargill, Tyson Foods, and National Beef — currently dominate 85% of the U.S. beef processing market, up from just 36% in 1980. Two of these companies, including the largest meat packer in the world, are either foreign-owned or have significant foreign ownership and control.

Industry consolidation has crushed competition and hammered cattle producers. In the 1980s, the top four packers purchased one-third of all fed cattle; by the mid-1990s, that share exploded to over 80% and has only grown more concentrated since.

This has led to the exploitation of American consumers, farmers, and ranchers. In fact, mounting evidence shows this monopoly power has slashed payments to ranchers, reduced herd sizes, driven up consumer prices, and threatened America's food supply chain.

Like Trump's wild success in tackling out-of-control egg prices, he's about to do it again with beef.

Important:

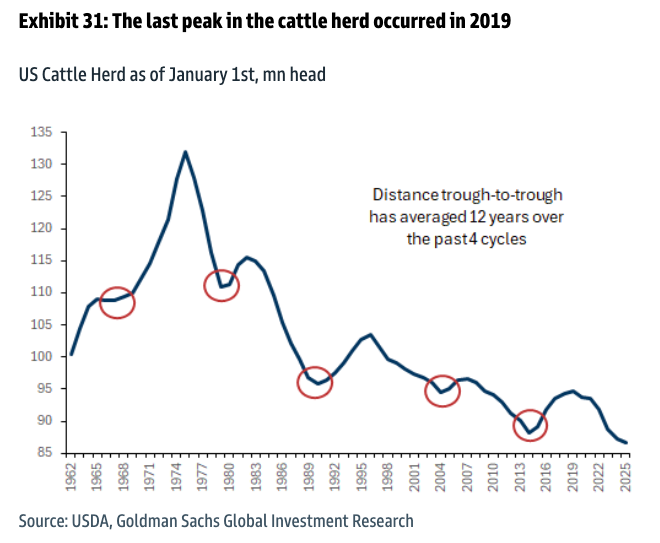

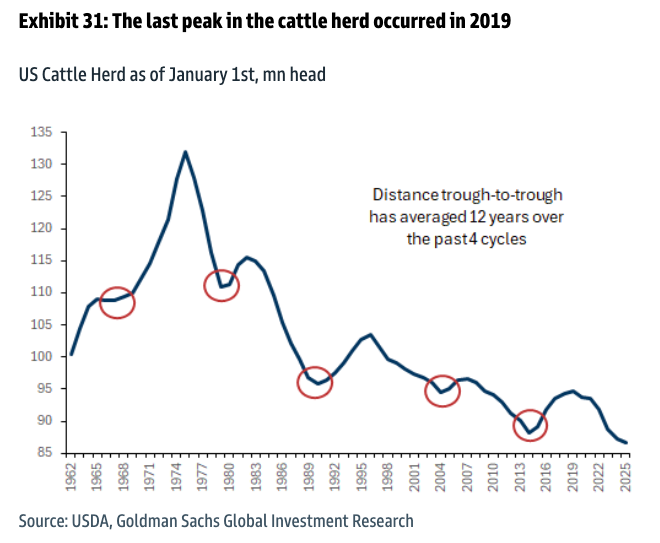

Great news for the Trump administration: In June, Goldman analysts Leah Jordan and Eli Thompson signaled that the 12-year cattle herd cycle has likely reached a cyclical low, suggesting a rebuilding phase may be approaching.

Important:

Great news for the Trump administration: In June, Goldman analysts Leah Jordan and Eli Thompson signaled that the 12-year cattle herd cycle has likely reached a cyclical low, suggesting a rebuilding phase may be approaching.

The new DoJ investigation could mark the early innings of a broader MAHA-aligned effort gaining traction into the 2026 midterm election cycle, aimed at restoring fair competition, ending foreign control of America's meat supply, and empowering Americans to buy from local farmers and ranchers. At its core, the initiative seeks to break the toxic grip of globalist corporations that have hijacked the food supply chain and flooded the nation's food supply chain with chemicals, pesticides, and monopolistic control.

Don't wait for the Trump administration or the DoJ to take on the globalist food cartel - take control now.

The

The new DoJ investigation could mark the early innings of a broader MAHA-aligned effort gaining traction into the 2026 midterm election cycle, aimed at restoring fair competition, ending foreign control of America's meat supply, and empowering Americans to buy from local farmers and ranchers. At its core, the initiative seeks to break the toxic grip of globalist corporations that have hijacked the food supply chain and flooded the nation's food supply chain with chemicals, pesticides, and monopolistic control.

Don't wait for the Trump administration or the DoJ to take on the globalist food cartel - take control now.

The  , sourced straight from America's mom-and-pop farms. It's time to invest in your health and freedom - starting with clean, real food you can trust.

Sat, 11/08/2025 - 09:55

, sourced straight from America's mom-and-pop farms. It's time to invest in your health and freedom - starting with clean, real food you can trust.

Sat, 11/08/2025 - 09:55

The White House released four key takeaways of how America's beef supply chain has been hijacked by globalists that operate in what appears to be a cartel and have eliminated competition by crushing small mom-and-pop ranchers:

For too long, a handful of giant meat packers have squeezed America's cattle producers, shrunk herds, and jacked up prices at the grocery store. By examining whether these companies have violated antitrust laws through coordinated pricing or capacity restrictions, this investigation will root out any illegal collusion, restore fair competition, and protect our food security.

The "Big Four" meat packers — JBS (Brazil), Cargill, Tyson Foods, and National Beef — currently dominate 85% of the U.S. beef processing market, up from just 36% in 1980. Two of these companies, including the largest meat packer in the world, are either foreign-owned or have significant foreign ownership and control.

Industry consolidation has crushed competition and hammered cattle producers. In the 1980s, the top four packers purchased one-third of all fed cattle; by the mid-1990s, that share exploded to over 80% and has only grown more concentrated since.

This has led to the exploitation of American consumers, farmers, and ranchers. In fact, mounting evidence shows this monopoly power has slashed payments to ranchers, reduced herd sizes, driven up consumer prices, and threatened America's food supply chain.

Like Trump's wild success in tackling out-of-control egg prices, he's about to do it again with beef.

The White House released four key takeaways of how America's beef supply chain has been hijacked by globalists that operate in what appears to be a cartel and have eliminated competition by crushing small mom-and-pop ranchers:

For too long, a handful of giant meat packers have squeezed America's cattle producers, shrunk herds, and jacked up prices at the grocery store. By examining whether these companies have violated antitrust laws through coordinated pricing or capacity restrictions, this investigation will root out any illegal collusion, restore fair competition, and protect our food security.

The "Big Four" meat packers — JBS (Brazil), Cargill, Tyson Foods, and National Beef — currently dominate 85% of the U.S. beef processing market, up from just 36% in 1980. Two of these companies, including the largest meat packer in the world, are either foreign-owned or have significant foreign ownership and control.

Industry consolidation has crushed competition and hammered cattle producers. In the 1980s, the top four packers purchased one-third of all fed cattle; by the mid-1990s, that share exploded to over 80% and has only grown more concentrated since.

This has led to the exploitation of American consumers, farmers, and ranchers. In fact, mounting evidence shows this monopoly power has slashed payments to ranchers, reduced herd sizes, driven up consumer prices, and threatened America's food supply chain.

Like Trump's wild success in tackling out-of-control egg prices, he's about to do it again with beef.

Important:

Important:

Trump "Worked Magic" On Beef Deal - Likely With Argentina - As Cattle Futures Surge Most Since 1978 | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Ground Beef Inflation Sizzles, Egg Prices Cool Off | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

12-Year Cattle Cycle Bottoms: Tyson CEO Predicts Rebuild Phase Beginning Next Year | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Got Beef? 12-Year Cycle Signals "Cyclical Low" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The new DoJ investigation could mark the early innings of a broader MAHA-aligned effort gaining traction into the 2026 midterm election cycle, aimed at restoring fair competition, ending foreign control of America's meat supply, and empowering Americans to buy from local farmers and ranchers. At its core, the initiative seeks to break the toxic grip of globalist corporations that have hijacked the food supply chain and flooded the nation's food supply chain with chemicals, pesticides, and monopolistic control.

Don't wait for the Trump administration or the DoJ to take on the globalist food cartel - take control now.

The new DoJ investigation could mark the early innings of a broader MAHA-aligned effort gaining traction into the 2026 midterm election cycle, aimed at restoring fair competition, ending foreign control of America's meat supply, and empowering Americans to buy from local farmers and ranchers. At its core, the initiative seeks to break the toxic grip of globalist corporations that have hijacked the food supply chain and flooded the nation's food supply chain with chemicals, pesticides, and monopolistic control.

Don't wait for the Trump administration or the DoJ to take on the globalist food cartel - take control now.

TikTok - Make Your Day

ZeroHedgeStore

(10 lb) Elkins' Ground Beef & Seasoning Bundle

This Bundle gives you 10 pounds of our USDA Prime, grass-fed & finished ground beef. Flash-frozen and built to last, it’s real beef with noth...

Tyler Durden | Zero Hedge

Zero Hedge

Trump Targets Foreign-Owned Meatpacking Cartel To Arrest Beef Prices, Defend Small Ranchers | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Data & Discussion

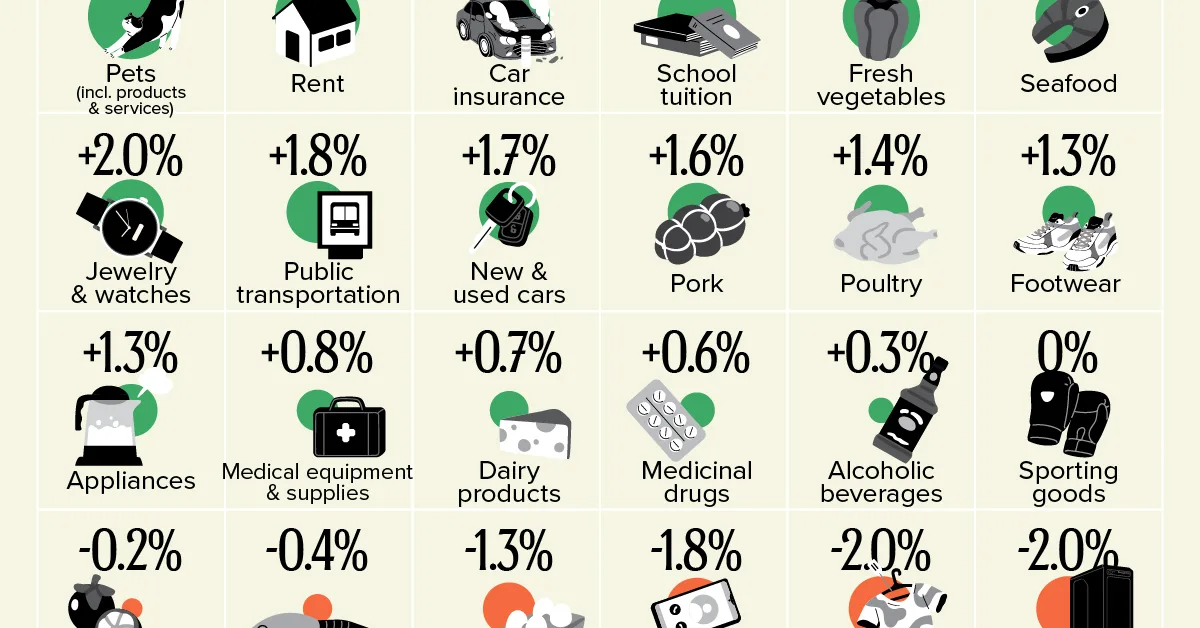

The data for this visualization comes from the Bureau of Labor Statistics (BLS), accessed via

Data & Discussion

The data for this visualization comes from the Bureau of Labor Statistics (BLS), accessed via

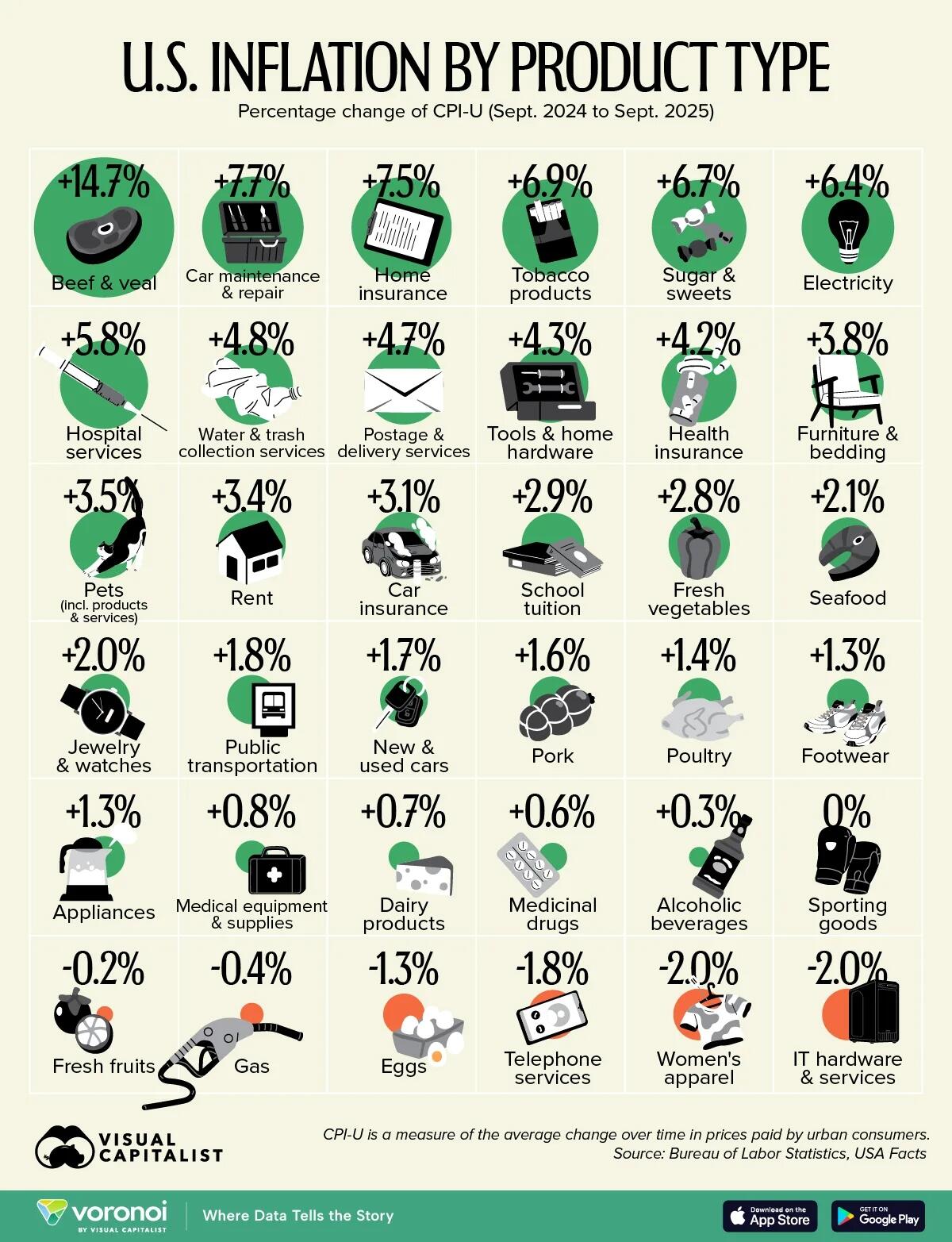

The data for this graphic comes from

The data for this graphic comes from

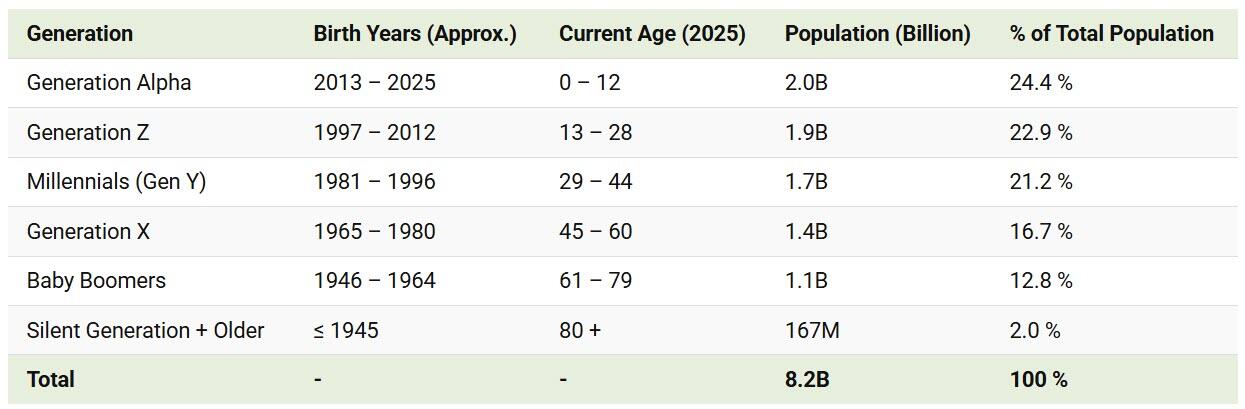

Gen Z and Millennials Dominate the Workforce

Gen Z (ages 13–28) and Millennials (ages 29–44) together account for 44% of all people—and most of the world’s workers. Millennials alone make up 1.7 billion people.

The Aging Populations of Boomers and the Silent Generation

At the upper end of the age spectrum, Baby Boomers (ages 61–79) represent about 12.8% of the population, while those 80 or older—the Silent Generation and older cohorts—make up just 2%.

If you enjoyed today’s post, check out

Gen Z and Millennials Dominate the Workforce

Gen Z (ages 13–28) and Millennials (ages 29–44) together account for 44% of all people—and most of the world’s workers. Millennials alone make up 1.7 billion people.

The Aging Populations of Boomers and the Silent Generation

At the upper end of the age spectrum, Baby Boomers (ages 61–79) represent about 12.8% of the population, while those 80 or older—the Silent Generation and older cohorts—make up just 2%.

If you enjoyed today’s post, check out

The government is currently offering illegal immigrants $1,000 and free flights to self-deport back to their home nations. This gives them a chance to come back legally. Those arrested and deported won’t be able to return to the United States, DHS said.

According to the DHS, law enforcement has been removing the “worst of the worst criminal illegal aliens” from the country, including rapists, murderers, drug dealers, and pedophiles, despite facing opposition from politicians in sanctuary jurisdictions.

Sanctuary

The government is currently offering illegal immigrants $1,000 and free flights to self-deport back to their home nations. This gives them a chance to come back legally. Those arrested and deported won’t be able to return to the United States, DHS said.

According to the DHS, law enforcement has been removing the “worst of the worst criminal illegal aliens” from the country, including rapists, murderers, drug dealers, and pedophiles, despite facing opposition from politicians in sanctuary jurisdictions.

Sanctuary

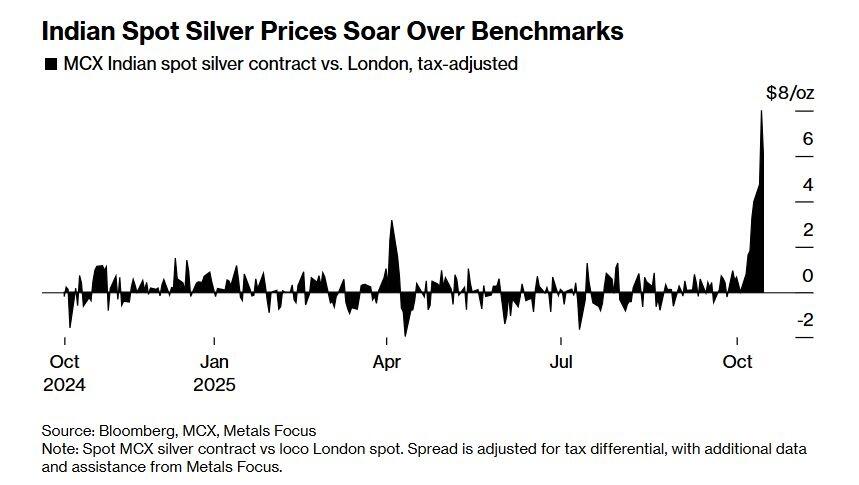

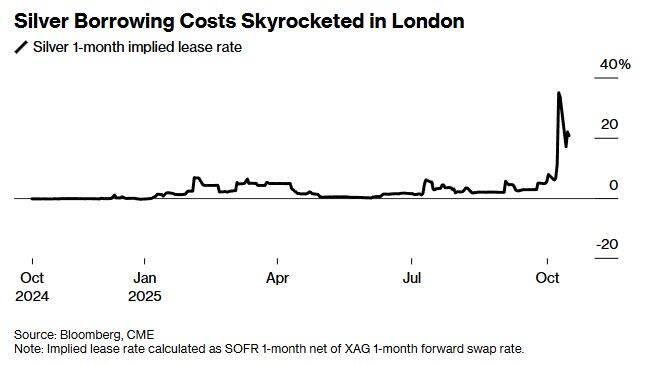

Sold Out in India, Panic in London

Bloomberg comments

Sold Out in India, Panic in London

Bloomberg comments  But when it came, he was still blown away. At the start of last week, his company, India’s largest precious metals refinery, ran out of silver stock for the first time in its history.

“Most people who are dealing silver and silver coins, they’re literally out of stock because silver is not there,” said Raina, who is head of trading at MMTC-Pamp India Pvt.

“This kind of crazy market — where people are buying at these levels — I have not seen in my 27-year career.”

Within days, the shortages were being felt not just in India, but around the world. India’s festival buyers were joined by international investors and hedge funds piling into precious metals as a bet on the fragility of the US dollar — or simply to follow the market’s irrepressible surge higher.

By the end of last week, the frenzy had rippled across to the London silver market, where global prices are set and where the world’s biggest banks buy and sell in huge quantities. Now, it had run out of available metal. Traders describe a market that was all but broken, where even large banks stepped back from quoting prices as they fielded repeated calls from clients yelling down the line in frustration and exhaustion.

This account of how the silver market broke is based on conversations with more than two dozen traders, bankers, refiners, investors and other market participants, many of whom spoke on condition of anonymity as they weren’t authorized to speak publicly.

100-to-1 Ratio

When traders and analysts try to pinpoint the immediate cause of the silver crisis of 2025, they inevitably point to India.

During the Diwali holiday season, hundreds of millions of devotees buy billions of rupees worth of jewelry to celebrate the goddess Lakshmi. Asia’s refineries usually meet this demand, which typically favors gold. But this year, many Indians turned to a different precious metal: silver.

But when it came, he was still blown away. At the start of last week, his company, India’s largest precious metals refinery, ran out of silver stock for the first time in its history.

“Most people who are dealing silver and silver coins, they’re literally out of stock because silver is not there,” said Raina, who is head of trading at MMTC-Pamp India Pvt.

“This kind of crazy market — where people are buying at these levels — I have not seen in my 27-year career.”

Within days, the shortages were being felt not just in India, but around the world. India’s festival buyers were joined by international investors and hedge funds piling into precious metals as a bet on the fragility of the US dollar — or simply to follow the market’s irrepressible surge higher.

By the end of last week, the frenzy had rippled across to the London silver market, where global prices are set and where the world’s biggest banks buy and sell in huge quantities. Now, it had run out of available metal. Traders describe a market that was all but broken, where even large banks stepped back from quoting prices as they fielded repeated calls from clients yelling down the line in frustration and exhaustion.

This account of how the silver market broke is based on conversations with more than two dozen traders, bankers, refiners, investors and other market participants, many of whom spoke on condition of anonymity as they weren’t authorized to speak publicly.

100-to-1 Ratio

When traders and analysts try to pinpoint the immediate cause of the silver crisis of 2025, they inevitably point to India.

During the Diwali holiday season, hundreds of millions of devotees buy billions of rupees worth of jewelry to celebrate the goddess Lakshmi. Asia’s refineries usually meet this demand, which typically favors gold. But this year, many Indians turned to a different precious metal: silver.

The pivot wasn’t random. For months, India’s social media stars promoted the idea that after gold’s record rally, silver was next to soar. The hype began in April, when investment banker and content creator Sarthak Ahuja told his nearly 3 million followers that silver’s 100-to-1 price ratio to gold made it the obvious buy this year. His video went viral during Akshaya Tritiya, an auspicious day for buying gold — second only to the Dhanteras festival on Oct. 18.

The premiums for silver in India above global prices, usually no more than about a few cents an ounce, started to rise above $0.50, and then above $1, as supplies ran short.

And just as Indian demand was soaring, China — a key source of supply — closed for a week-long holiday. So bullion dealers turned to London.

They soon discovered that the city’s precious metals vaults were largely sold out. While London vaults underpinning the global market hold more than $36 billion in silver, the majority of it was owned by investors in exchange-traded funds.

Demand for silver ETFs has soared in recent months, amid concerns about the stability of the US dollar, a wave of investment that’s become known as the “debasement trade.” Since the start of 2025, ETF investors have hoovered up more than 100 million ounces of silver, according to data compiled by Bloomberg — leaving a dwindling stockpile available to supply the sudden boom in Indian demand.

Premiums soared above $5 an ounce, well beyond the normal spread of a few cents. “I have been here in this company for the last 28 years and I have never seen these kind of premiums,” said M.D. Overseas’s Mittal.

Panic in London

Traders described a growing panic as liquidity dried up. The cost of borrowing silver overnight soared to annualized rates of as high as 200%, according to consultancy Metals Focus. As the big banks that dominate the London market started to step back from the silver market, bid-ask spreads became so wide as to make trading near impossible.

In another sign of the disarray in the market, one trader said the big banks were offering such wildly different quotes that he was able to buy from one bank at its ask price and simultaneously sell to another at its bid for an immediate profit – a rare sign of dysfunction in such a large and competitive market.

For the past five years, silver demand has outstripped silver supply from mines and recycled metal — in large part thanks to a boom in the solar industry, which uses silver in its photovoltaic cells. Since 2021, demand has outstripped supply by a total of 678 million ounces, according to the Silver Institute, with photovoltaic demand more than doubling over the period. That compares to total inventories in London of around 1.1 billion ounces at the start of 2021.

The stress in the silver market has been building since the start of the year, as fears that silver would be ensnared by President Donald Trump’s reciprocal tariffs prompted traders to attempt to front-run any possible levies by shipping more than 200 million ounces of metal into New York warehouses.

The pivot wasn’t random. For months, India’s social media stars promoted the idea that after gold’s record rally, silver was next to soar. The hype began in April, when investment banker and content creator Sarthak Ahuja told his nearly 3 million followers that silver’s 100-to-1 price ratio to gold made it the obvious buy this year. His video went viral during Akshaya Tritiya, an auspicious day for buying gold — second only to the Dhanteras festival on Oct. 18.

The premiums for silver in India above global prices, usually no more than about a few cents an ounce, started to rise above $0.50, and then above $1, as supplies ran short.

And just as Indian demand was soaring, China — a key source of supply — closed for a week-long holiday. So bullion dealers turned to London.

They soon discovered that the city’s precious metals vaults were largely sold out. While London vaults underpinning the global market hold more than $36 billion in silver, the majority of it was owned by investors in exchange-traded funds.

Demand for silver ETFs has soared in recent months, amid concerns about the stability of the US dollar, a wave of investment that’s become known as the “debasement trade.” Since the start of 2025, ETF investors have hoovered up more than 100 million ounces of silver, according to data compiled by Bloomberg — leaving a dwindling stockpile available to supply the sudden boom in Indian demand.

Premiums soared above $5 an ounce, well beyond the normal spread of a few cents. “I have been here in this company for the last 28 years and I have never seen these kind of premiums,” said M.D. Overseas’s Mittal.

Panic in London

Traders described a growing panic as liquidity dried up. The cost of borrowing silver overnight soared to annualized rates of as high as 200%, according to consultancy Metals Focus. As the big banks that dominate the London market started to step back from the silver market, bid-ask spreads became so wide as to make trading near impossible.

In another sign of the disarray in the market, one trader said the big banks were offering such wildly different quotes that he was able to buy from one bank at its ask price and simultaneously sell to another at its bid for an immediate profit – a rare sign of dysfunction in such a large and competitive market.

For the past five years, silver demand has outstripped silver supply from mines and recycled metal — in large part thanks to a boom in the solar industry, which uses silver in its photovoltaic cells. Since 2021, demand has outstripped supply by a total of 678 million ounces, according to the Silver Institute, with photovoltaic demand more than doubling over the period. That compares to total inventories in London of around 1.1 billion ounces at the start of 2021.

The stress in the silver market has been building since the start of the year, as fears that silver would be ensnared by President Donald Trump’s reciprocal tariffs prompted traders to attempt to front-run any possible levies by shipping more than 200 million ounces of metal into New York warehouses.

On top of the tariff drawdowns, more than 100 million ounces of silver flowed into global ETFs in the year through September, as a wave of investment demand for precious metals supercharged a rally that helped drive gold through $4,000 an ounce for the first time in history.

Together, the two trends drained London’s reserves, leaving dangerously little metal available to underpin the roughly 250 million ounces of silver that change hands in the London market every day. Based on Metals Focus estimates, by early October the “free float” of metal not owned by ETFs in the London silver market had dropped to less than 150 million ounces.

Silver Falls More Than 6% as Precious Metals Retreat After Rally

Also note

On top of the tariff drawdowns, more than 100 million ounces of silver flowed into global ETFs in the year through September, as a wave of investment demand for precious metals supercharged a rally that helped drive gold through $4,000 an ounce for the first time in history.

Together, the two trends drained London’s reserves, leaving dangerously little metal available to underpin the roughly 250 million ounces of silver that change hands in the London market every day. Based on Metals Focus estimates, by early October the “free float” of metal not owned by ETFs in the London silver market had dropped to less than 150 million ounces.

Silver Falls More Than 6% as Precious Metals Retreat After Rally

Also note  Those same trusts paid $4.5 million to the state and $30.2 million to the feds. The Pritzkers personally kicked in another $1.6 million in federal taxes and $512,000 to Illinois.

As for that gambling income, the campaign clarified that “The Governor had winnings and losses from a casino during the year.”

Thanks for that incredible clarification. Meanwhile, his 2026 running mate, Christian Mitchell, made a modest-by-comparison $583,600. Forbes pegs Pritzker’s net worth at $3.9 billion, up a casual $200 million from last year.

As for Zero Hedge readers, they appear to be skeptical. One responded to our Tweet pointing out this story by

Those same trusts paid $4.5 million to the state and $30.2 million to the feds. The Pritzkers personally kicked in another $1.6 million in federal taxes and $512,000 to Illinois.

As for that gambling income, the campaign clarified that “The Governor had winnings and losses from a casino during the year.”

Thanks for that incredible clarification. Meanwhile, his 2026 running mate, Christian Mitchell, made a modest-by-comparison $583,600. Forbes pegs Pritzker’s net worth at $3.9 billion, up a casual $200 million from last year.

As for Zero Hedge readers, they appear to be skeptical. One responded to our Tweet pointing out this story by

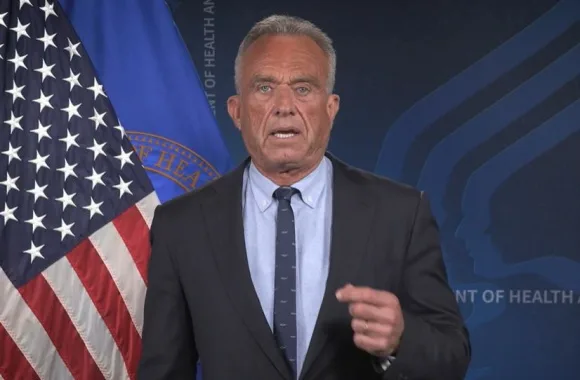

The Health Department, along with the Department of Education, has tasked all medical programs across the nation with adding nutrition education into curricula, medical licensing exams, residency requirements, and board certification,

The Health Department, along with the Department of Education, has tasked all medical programs across the nation with adding nutrition education into curricula, medical licensing exams, residency requirements, and board certification,

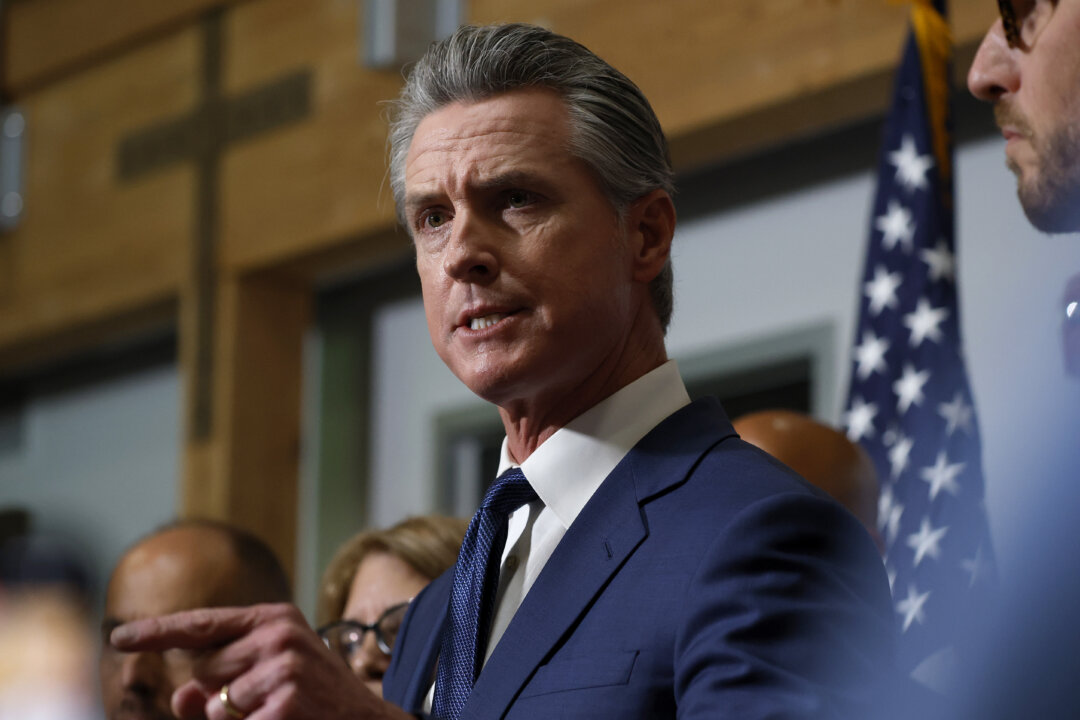

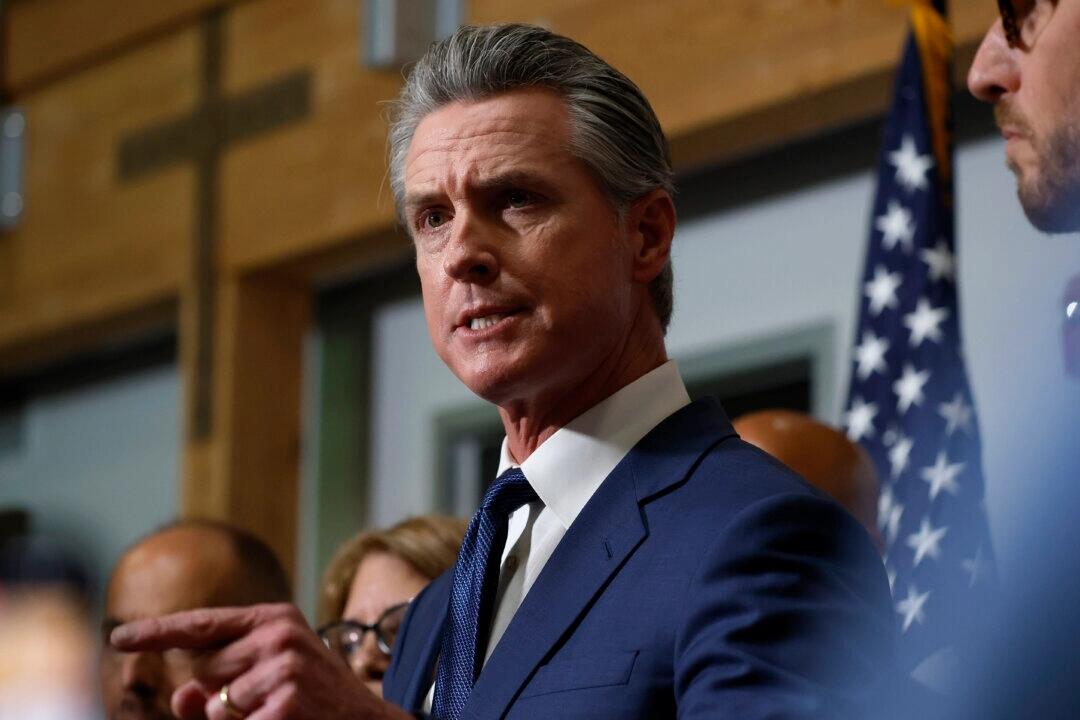

The seven bills were passed by the California Legislature during its 2025–2026 legislative session and were signed on Oct. 12.

Some of the statutes will take effect on Jan. 1, 2027, while others—related to “deepfake” pornography and legal defenses against liability for AI usage—are effective immediately.

“We’ve seen some truly horrific and tragic examples of young people harmed by unregulated tech, and we won’t stand by while companies continue,” Newsom

The seven bills were passed by the California Legislature during its 2025–2026 legislative session and were signed on Oct. 12.

Some of the statutes will take effect on Jan. 1, 2027, while others—related to “deepfake” pornography and legal defenses against liability for AI usage—are effective immediately.

“We’ve seen some truly horrific and tragic examples of young people harmed by unregulated tech, and we won’t stand by while companies continue,” Newsom

The

The  That's a particularly interesting stance, given Benioff is close friends with California Gov. Gavin Newsom -- so close, in fact, that

That's a particularly interesting stance, given Benioff is close friends with California Gov. Gavin Newsom -- so close, in fact, that