Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox

Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox

(emphasis ours),

The number of new vehicles sold annually in the United States is expected to hit 15.7 million units according to October estimations, industry expert Cox Automotive said in an Oct. 27

(emphasis ours),

The number of new vehicles sold annually in the United States is expected to hit 15.7 million units according to October estimations, industry expert Cox Automotive said in an Oct. 27  .

.

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent  on auto imports in April, followed by 25 percent tariffs on the imports of auto parts. The rates have been adjusted for certain nations based on their negotiations with Washington.

Until Sept. 30, Americans who bought EVs could get a $7,500 tax credit. This incentive ended in line with the requirement of the One Big Beautiful Bill Act, signed into law by President Donald Trump in July.

Cox stated that EV sales had accelerated after the passage of the Act, with Q3 EV sales volume hitting an all-time high.

“Sales of EVs and PHEVs are expected to collapse in October as tax credits expire,” Chesbrough said.

PHEV refers to a plug-in hybrid electric vehicle.

“In addition, market conditions for other vehicles are expected to become more challenging in future months as prices increase,” he said.

Amid slowing sales, car buyers are faced with high acquisition costs. The typical monthly

on auto imports in April, followed by 25 percent tariffs on the imports of auto parts. The rates have been adjusted for certain nations based on their negotiations with Washington.

Until Sept. 30, Americans who bought EVs could get a $7,500 tax credit. This incentive ended in line with the requirement of the One Big Beautiful Bill Act, signed into law by President Donald Trump in July.

Cox stated that EV sales had accelerated after the passage of the Act, with Q3 EV sales volume hitting an all-time high.

“Sales of EVs and PHEVs are expected to collapse in October as tax credits expire,” Chesbrough said.

PHEV refers to a plug-in hybrid electric vehicle.

“In addition, market conditions for other vehicles are expected to become more challenging in future months as prices increase,” he said.

Amid slowing sales, car buyers are faced with high acquisition costs. The typical monthly  for a new vehicle has jumped by 1.9 percent to hit $766, the highest monthly payment level in 15 months, Cox said in an Oct. 15 statement.

Meanwhile, 28.1 percent of cars traded in for new vehicles in the third quarter this year had negative equity, a situation where the car value is less than the loan amount, industry resource Edmunds said in an Oct. 15 https://www.edmunds.com/industry/press/underwater-and-sinking-deeper-the-average-amount-owed-on-upside-down-auto-loans-climbed-to-an-all-time-high-of-6905-according-to-edmunds.html

.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” Ivan Drury, Edmunds’ director of insights, said in the statement.

Auto Loan Burden

According to an Oct. 30

for a new vehicle has jumped by 1.9 percent to hit $766, the highest monthly payment level in 15 months, Cox said in an Oct. 15 statement.

Meanwhile, 28.1 percent of cars traded in for new vehicles in the third quarter this year had negative equity, a situation where the car value is less than the loan amount, industry resource Edmunds said in an Oct. 15 https://www.edmunds.com/industry/press/underwater-and-sinking-deeper-the-average-amount-owed-on-upside-down-auto-loans-climbed-to-an-all-time-high-of-6905-according-to-edmunds.html

.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” Ivan Drury, Edmunds’ director of insights, said in the statement.

Auto Loan Burden

According to an Oct. 30  by financial tech company WalletHub, the average American household owed roughly $13,800 in auto loans as of Q2 2025, just a few hundred dollars shy of the record high. The total auto loan debt has gone up to nearly $1.7 trillion.

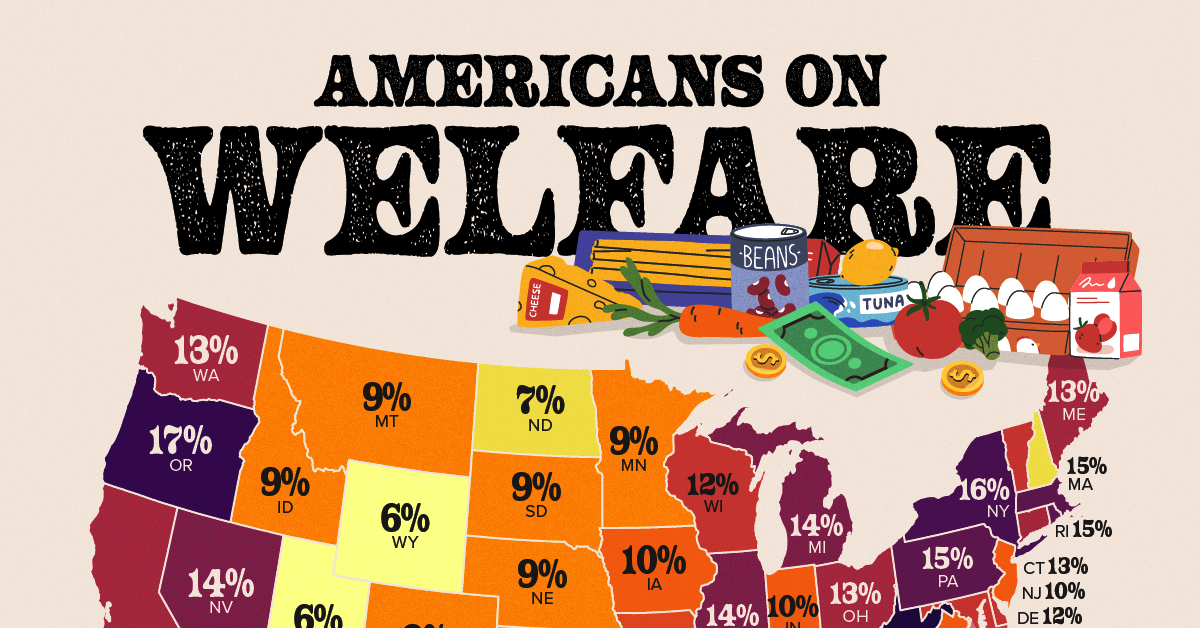

Auto debt is rising the most in Vermont, followed by Delaware, New Mexico, Idaho, and Utah, it said. In contrast, it is rising the least in Ohio, South Dakota, Hawaii, Oregon, and Arkansas.

John Kiernan, editor at WalletHub, said that residents in some states saw average auto loan balances rise by almost 2.4 percent between Q1 and Q2, which he called “dramatic increases.”

This “suggests that people in some states are more affected by inflation in car prices or are biting off more than they can chew when it comes to loans,” he said.

Meanwhile, despite rising prices, auto demand from middle-income Americans is trending higher, according to an Oct. 16

by financial tech company WalletHub, the average American household owed roughly $13,800 in auto loans as of Q2 2025, just a few hundred dollars shy of the record high. The total auto loan debt has gone up to nearly $1.7 trillion.

Auto debt is rising the most in Vermont, followed by Delaware, New Mexico, Idaho, and Utah, it said. In contrast, it is rising the least in Ohio, South Dakota, Hawaii, Oregon, and Arkansas.

John Kiernan, editor at WalletHub, said that residents in some states saw average auto loan balances rise by almost 2.4 percent between Q1 and Q2, which he called “dramatic increases.”

This “suggests that people in some states are more affected by inflation in car prices or are biting off more than they can chew when it comes to loans,” he said.

Meanwhile, despite rising prices, auto demand from middle-income Americans is trending higher, according to an Oct. 16  from financial institution Santander US.

A survey of middle-income Americans showed that 54 percent were considering buying a vehicle in the year ahead, up from 43 percent a year back, it stated.

More than seven in 10 said they were willing to sacrifice other items in their budgets to ensure access to vehicles, which Santander said was the highest level in two years.

Sat, 11/01/2025 - 18:40

from financial institution Santander US.

A survey of middle-income Americans showed that 54 percent were considering buying a vehicle in the year ahead, up from 43 percent a year back, it stated.

More than seven in 10 said they were willing to sacrifice other items in their budgets to ensure access to vehicles, which Santander said was the highest level in two years.

Sat, 11/01/2025 - 18:40

The Epoch Times

Annual Sales of New Vehicles Expected to Hit Only 15.7 Million Units: Cox

Americans are no longer eligible for the $7,500 electric vehicle tax credit.

Cox Automotive Inc.

Cox Automotive Forecast: October U.S. New-Vehicle Sales Pace Expected to Slow to 15.7 Million; EV Sales Slump Weighs on Market - Cox Automotive Inc.

Cox Automotive publishes its U.S. auto sales forecast each month prior to the automakers reporting their sales results.

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The seasonally adjusted annual rate is down from 16.4 million in September and 16.1 million a year back, said the company, attributing the slowdown to auto tariffs and the end of electric vehicle (EV) incentives.

“The new-vehicle sales pace was surprisingly strong this summer despite ongoing tariff uncertainty,” Charlie Chesbrough, senior economist at Cox, said in the statement.

“However, as more tariffed products replace non-tariffed inventory, prices are tracking higher, which should lead to slower sales through the remainder of the year. With the expiration of EV tax credits and a decline in alternative powertrain sales, the sales pace is anticipated to decrease as we move into a new season.”

Sales volume is forecast to be 1.3 million units in October, down by more than 3 percent from last year. While this figure is 2.7 percent higher than September, October had three more selling days than last month, Cox stated.

The federal government instituted 25 percent

The Epoch Times

Average New Car Price Surpasses $50,000, Breaks Record: Kelley Blue Book

New vehicle prices have been rising steadily for more than a year, with the pace picking up over the past months.

The Epoch Times

IRS Offers Compliance Relief on Auto Loan Interest Reporting

Out of the roughly 2.4 million cars sold last year, more than 80 percent were financed.

WalletHub

States Where Auto Loan Debt Is Increasing the Most

States Where Auto Loan Debt Is Increasing the Most

Santander US

Auto Demand Up in 2025 as More Americans Car Shop and Prioritize Vehicle Access, Santander US Survey Finds - Santander US

Tyler Durden | Zero Hedge

Zero Hedge

Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Ukrainian Foreign Minister Andrii Sybiha has

Ukrainian Foreign Minister Andrii Sybiha has

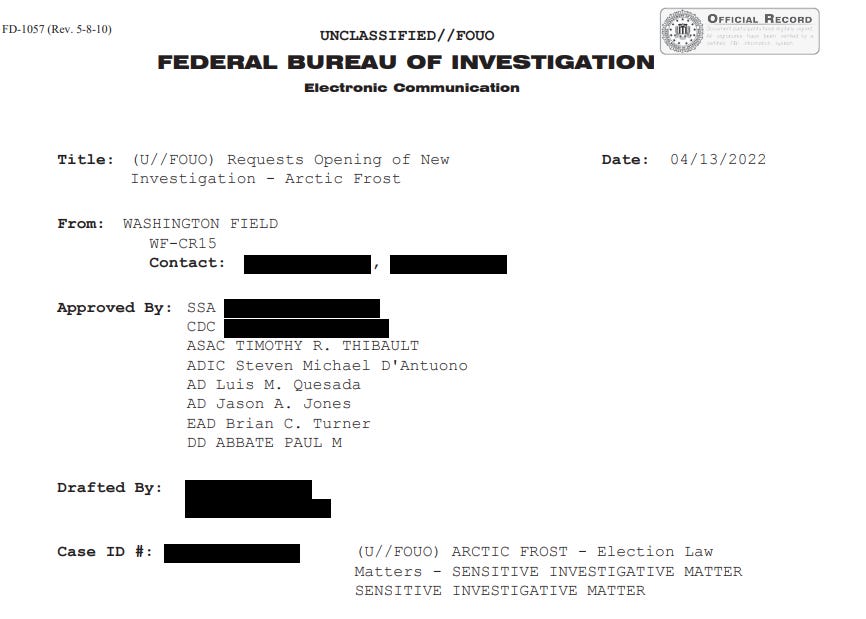

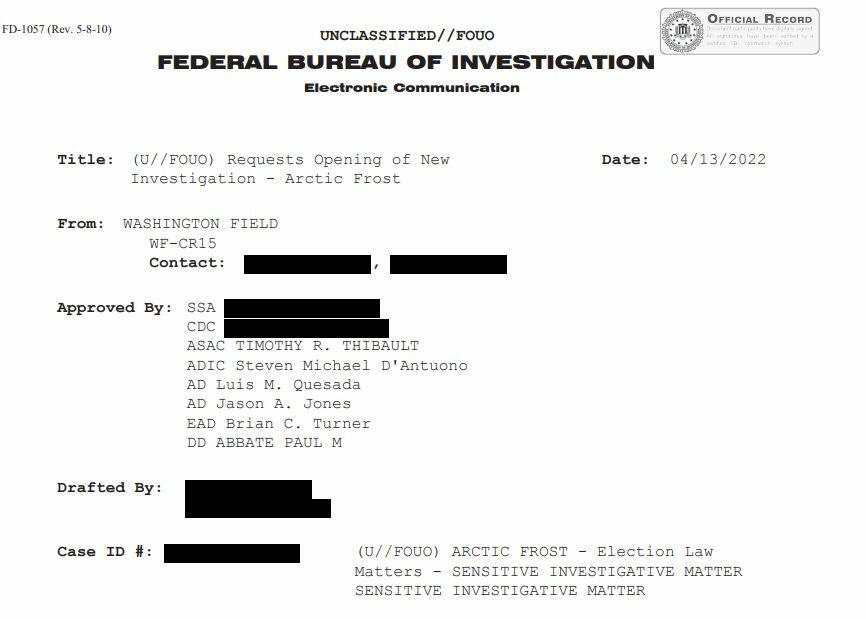

The Artic Frost opening document, dated April 13, 2022, provides a number of potential statutory violations that justified its opening. Here is the exact text.

“By conspiring, attempting to submit, and/or submitting allegedly fraudulent elector certificates, subjects, both known and unknown, may have violated one or more of the following federal statutes of which the FBI has enforcement responsibility:

Attempt or conspiracy to corruptly obstruct, influence, and impede the certification of the Electoral College vote (18 USC § 1512(c)(2) and (k)).

Obstruction of certain proceedings (18 USC § 1505).

Falsification of records (18 USC § 1519).

Conspiracy to defraud the United States (18 USC § 371).

Mail Fraud (18 USC § 1341).

Seditious Conspiracy (18 USC § 2384).”

Now, that April 13, 2022 document wasn’t the original Artic Frost opening communication. Rather, from the records that have been published, the original was dated March 22, 2022. And if you look into the alleged statutory violations (which we outlined above), the March 22, 2022 document omits “Mail Fraud.” That’s an important addition for the reasons we’ve outlined below.

By the time Artic Frost commenced, a related grand jury investigation had been opened “with federal law enforcement agencies on January 31, 2022.” Those other agencies were identified as the US Postal Inspection Service and the Investigative Unit of the Office of the Inspector General for the National Archives. The subjects of Artic Frost included: Donald J. Trump for President, Inc. (and those involved in the campaign); attorney John Eastman, who helped lead some of the challenges to the 2020 election; Rudy Giuliani; and Trump advisor (and campaign attorney) Boris Epshteyn. The subjects also included the electors – 60+ persons from Arizona, Georgia, Michigan, Nevada, Wisconsing who were part of the election challenge efforts.

As we have known for a while, Artic Frost was expansive. Previous filings in Trump’s DC criminal case (which we

The Artic Frost opening document, dated April 13, 2022, provides a number of potential statutory violations that justified its opening. Here is the exact text.

“By conspiring, attempting to submit, and/or submitting allegedly fraudulent elector certificates, subjects, both known and unknown, may have violated one or more of the following federal statutes of which the FBI has enforcement responsibility:

Attempt or conspiracy to corruptly obstruct, influence, and impede the certification of the Electoral College vote (18 USC § 1512(c)(2) and (k)).

Obstruction of certain proceedings (18 USC § 1505).

Falsification of records (18 USC § 1519).

Conspiracy to defraud the United States (18 USC § 371).

Mail Fraud (18 USC § 1341).

Seditious Conspiracy (18 USC § 2384).”

Now, that April 13, 2022 document wasn’t the original Artic Frost opening communication. Rather, from the records that have been published, the original was dated March 22, 2022. And if you look into the alleged statutory violations (which we outlined above), the March 22, 2022 document omits “Mail Fraud.” That’s an important addition for the reasons we’ve outlined below.

By the time Artic Frost commenced, a related grand jury investigation had been opened “with federal law enforcement agencies on January 31, 2022.” Those other agencies were identified as the US Postal Inspection Service and the Investigative Unit of the Office of the Inspector General for the National Archives. The subjects of Artic Frost included: Donald J. Trump for President, Inc. (and those involved in the campaign); attorney John Eastman, who helped lead some of the challenges to the 2020 election; Rudy Giuliani; and Trump advisor (and campaign attorney) Boris Epshteyn. The subjects also included the electors – 60+ persons from Arizona, Georgia, Michigan, Nevada, Wisconsing who were part of the election challenge efforts.

As we have known for a while, Artic Frost was expansive. Previous filings in Trump’s DC criminal case (which we

One of the key questions remaining is what the FBI did with that information - whether that source was trusted, and whether investigations were opened into Corrigan or Kushner based on that obviously false intelligence. We’ll see.

One of the key questions remaining is what the FBI did with that information - whether that source was trusted, and whether investigations were opened into Corrigan or Kushner based on that obviously false intelligence. We’ll see.

The lenders, led by HPS Investment Partners, which BlackRock acquired earlier this year, accused businessman Bankim Brahmbhatt of fabricating invoices and accounts receivable that he used as collateral for loans totaling more than $500 million to his telecom-services firms, Broadband Telecom and Bridgevoice. The alleged scheme is now the subject of an August lawsuit and multiple bankruptcies.

Brahmbhatt, through his attorney, has denied the fraud allegations to the

The lenders, led by HPS Investment Partners, which BlackRock acquired earlier this year, accused businessman Bankim Brahmbhatt of fabricating invoices and accounts receivable that he used as collateral for loans totaling more than $500 million to his telecom-services firms, Broadband Telecom and Bridgevoice. The alleged scheme is now the subject of an August lawsuit and multiple bankruptcies.

Brahmbhatt, through his attorney, has denied the fraud allegations to the  The loans were held in two HPS-managed funds. A person close to BlackRock said the exposure represents a small portion of the firm’s $179 billion in assets under management and won’t materially affect fund performance.

Still, the incident underscores how even the largest asset managers are struggling to contain risks as they pour billions into direct lending.

A Trail of Fake Emails and Empty Offices

The unraveling began this summer, when an HPS employee spotted suspicious email addresses supposedly belonging to Carriox customers. The domains mimicked legitimate telecom firms but were slightly altered — a red flag suggesting someone was fabricating customer correspondence.

When confronted, Brahmbhatt assured HPS there was nothing to worry about, then abruptly stopped answering calls, people familiar with the matter said.

The loans were held in two HPS-managed funds. A person close to BlackRock said the exposure represents a small portion of the firm’s $179 billion in assets under management and won’t materially affect fund performance.

Still, the incident underscores how even the largest asset managers are struggling to contain risks as they pour billions into direct lending.

A Trail of Fake Emails and Empty Offices

The unraveling began this summer, when an HPS employee spotted suspicious email addresses supposedly belonging to Carriox customers. The domains mimicked legitimate telecom firms but were slightly altered — a red flag suggesting someone was fabricating customer correspondence.

When confronted, Brahmbhatt assured HPS there was nothing to worry about, then abruptly stopped answering calls, people familiar with the matter said.

An HPS representative visiting the company’s Garden City, N.Y. offices found them shuttered. Neighbors said the office had appeared empty for weeks.

The lenders’ subsequent investigation, led by accounting firm CBIZ and law firm Quinn Emanuel, allegedly revealed that every customer email provided by Brahmbhatt’s companies to verify invoices over the previous two years was fake. One supposed customer, Belgium’s BICS, confirmed in writing that the invoices were “a fraud attempt.”

“Brahmbhatt created an elaborate balance sheet of assets that existed only on paper,” lawyers for the lenders wrote in their complaint.

Bankruptcy Filings and Vanishing Collateral

Brahmbhatt’s companies filed for Chapter 11 protection in August, alongside Carriox Capital II and related entities. The lenders allege that millions in pledged assets were quietly transferred to offshore accounts in India and Mauritius before the defaults.

On the same day the corporate bankruptcies were filed, Brahmbhatt himself sought personal bankruptcy protection, despite having previously provided a personal guarantee to his lenders.

HPS and its partners believe Brahmbhatt has since traveled to India, according to people briefed on the matter. His lawyer has not commented on his whereabouts.

For BlackRock and HPS, the direct financial hit appears modest. But for the broader private-credit industry - now rivaling the leveraged-loan market in size - the reputational damage could prove more lasting.

An HPS representative visiting the company’s Garden City, N.Y. offices found them shuttered. Neighbors said the office had appeared empty for weeks.

The lenders’ subsequent investigation, led by accounting firm CBIZ and law firm Quinn Emanuel, allegedly revealed that every customer email provided by Brahmbhatt’s companies to verify invoices over the previous two years was fake. One supposed customer, Belgium’s BICS, confirmed in writing that the invoices were “a fraud attempt.”

“Brahmbhatt created an elaborate balance sheet of assets that existed only on paper,” lawyers for the lenders wrote in their complaint.

Bankruptcy Filings and Vanishing Collateral

Brahmbhatt’s companies filed for Chapter 11 protection in August, alongside Carriox Capital II and related entities. The lenders allege that millions in pledged assets were quietly transferred to offshore accounts in India and Mauritius before the defaults.

On the same day the corporate bankruptcies were filed, Brahmbhatt himself sought personal bankruptcy protection, despite having previously provided a personal guarantee to his lenders.

HPS and its partners believe Brahmbhatt has since traveled to India, according to people briefed on the matter. His lawyer has not commented on his whereabouts.

For BlackRock and HPS, the direct financial hit appears modest. But for the broader private-credit industry - now rivaling the leveraged-loan market in size - the reputational damage could prove more lasting.

Men who once worked hard to support families lose the reason to do so when it makes no real difference, when basics of life and leisure are equally available to those who work for them and those who do nothing. It is not a political issue, just a human behavioural and psychological one. Removing the need to work and the dignity that striving and succeeding brings, especially for one’s family, leads to inaction, loss of interest in the world, a loss of role, loss of dignity and depression. This is dampened by alcohol or drugs. Wives and children suffer by being beaten up by drunk, frustrated and drug-addled men. Having two frequently drunk parents ensures children are malnourished and aimless.

This is not theoretical – it is seen all over the world where people of one culture are overrun by those of another and confined to subservience, economic and societal irrelevance, and handouts. Some people and communities break out of it, usually by finding ways to grow their local economy and achieve some form of self-governance and self-reliance. Breaking out is not common and requires an opportunity, the possibility, to do so.

Our brave new technocratic world

The road much of the ‘developed’ world is currently on is towards UBI, but without that potential for escape. I use this term ‘developed’ in a technological sense – not a human sense – as it denotes technology rather than awareness. UBI will be introduced as a panacea to the problem of artificial intelligence replacing a lot of jobs. The use of AI is increasing because it can accumulate wealth for investors more reliably than employees can.

Men who once worked hard to support families lose the reason to do so when it makes no real difference, when basics of life and leisure are equally available to those who work for them and those who do nothing. It is not a political issue, just a human behavioural and psychological one. Removing the need to work and the dignity that striving and succeeding brings, especially for one’s family, leads to inaction, loss of interest in the world, a loss of role, loss of dignity and depression. This is dampened by alcohol or drugs. Wives and children suffer by being beaten up by drunk, frustrated and drug-addled men. Having two frequently drunk parents ensures children are malnourished and aimless.

This is not theoretical – it is seen all over the world where people of one culture are overrun by those of another and confined to subservience, economic and societal irrelevance, and handouts. Some people and communities break out of it, usually by finding ways to grow their local economy and achieve some form of self-governance and self-reliance. Breaking out is not common and requires an opportunity, the possibility, to do so.

Our brave new technocratic world

The road much of the ‘developed’ world is currently on is towards UBI, but without that potential for escape. I use this term ‘developed’ in a technological sense – not a human sense – as it denotes technology rather than awareness. UBI will be introduced as a panacea to the problem of artificial intelligence replacing a lot of jobs. The use of AI is increasing because it can accumulate wealth for investors more reliably than employees can.

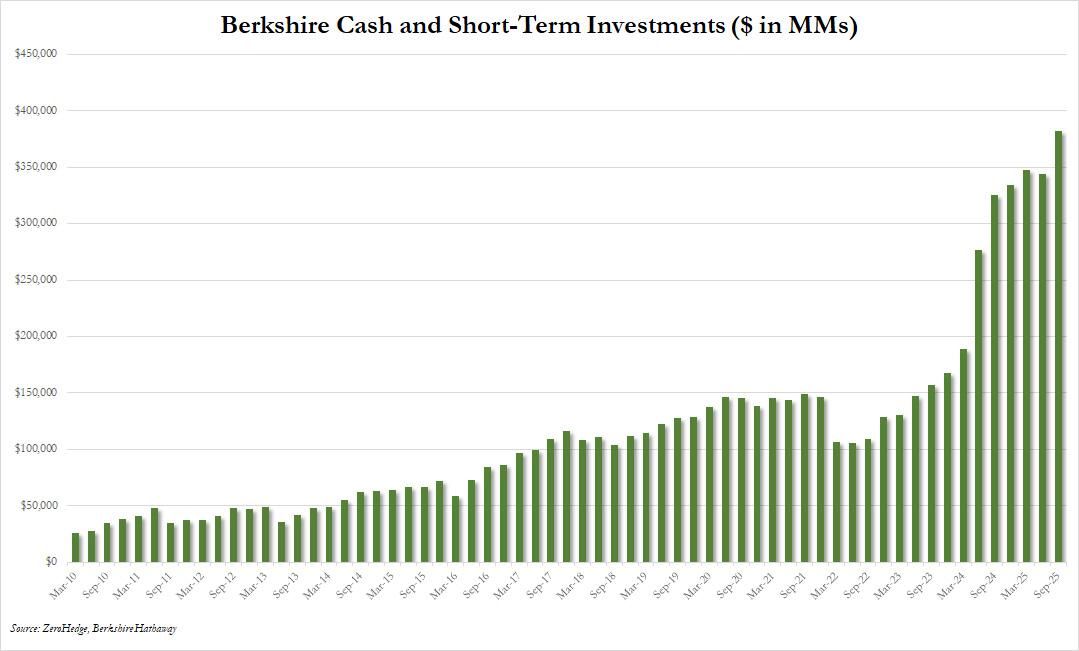

At the same time operating earnings jumped 34% to $13.5 billion from $10.1 billion, as the firm’s insurance underwriting profit more than tripled in the third quarter boosted by lower insurance losses, offsetting declines in the Insurance-investment income and Berkshire's Energy company.

At the same time operating earnings jumped 34% to $13.5 billion from $10.1 billion, as the firm’s insurance underwriting profit more than tripled in the third quarter boosted by lower insurance losses, offsetting declines in the Insurance-investment income and Berkshire's Energy company.

The $13.49 billion quarterly operating profit, or $9,376 per Class A share, grew from $10.09 billion a year earlier. Currency fluctuations accounted for more than two-fifths of the increase.

While results benefited in part from an absence of major catastrophes such as hurricanes, Berkshire auto insurer Geico’s pretax underwriting profit fell 13% amid higher claims and a 40% increase in underwriting costs, which the firm said is due to “increased policy acquisition-related expenses" i.e., advertising, to acquire new policies in a period of soaring insurance costs. Additionally, insurance will likely face headwinds as falling interest rates reduce income from Berkshire's cash holdings, which also occurred in the third quarter.

Meanwhile, Berkshire’s utilities business, which runs PacifiCorp, MidAmerican and NV Energy, posted a 9% decline in operating earnings, to $1.5 billion over the period, and reflected legal bills from wildfires, and higher costs from natural gas pipelines and Northern Powergrid in Britain. Berkshire is still evaluating how U.S. President Donald Trump's One Big Beautiful Bill Act signed in July might affect the viability of its renewable energy projects.

One especially sore point was Pilot, which posted a $17 million loss in the third quarter. Berkshire said the decline is driven by lower wholesale fuel and retail margins, as well as higher expenses. “The Pilot business is not really doing very well,” Shanahan said. “I’m interested to see what the plan might be to turn that around.”

On the positive side, the BNSF railroad boosted operating earnings rose 6% to $1.4 billion, on lower fuel costs and "improved employee productivity" while revenue from the transportation of agricultural and energy products grew, driven in part by slightly higher grain exports.

Berkshire's $30.8 billion of net income, or $21,413 per Class A share, rose from $26.25 billion a year earlier. Net results include gains and losses on stocks Berkshire is not selling. This adds volatility, and Buffett believes such results are useless in understanding his company.

Also of note: revenue for Berkshire, which is seen by many as a mini model of the broader US economy due to its extensive diversification, grew just 2%, slower than the overall U.S. economy's growth rate.

Economic uncertainty and waning consumer confidence have been drags, Berkshire said, stalling sales growth at the Clayton Homes homebuilder and reducing revenue from Duracell batteries, Fruit of the Loom apparel and Squishmallows toymaker Jazwares.

"Berkshire, which is often considered a microcosm of the U.S. economy, isn't even keeping up," said Cathy Seifert, a CFRA Research analyst with a "hold" rating on Berkshire. "Investors will struggle to find a catalyst for this stock."

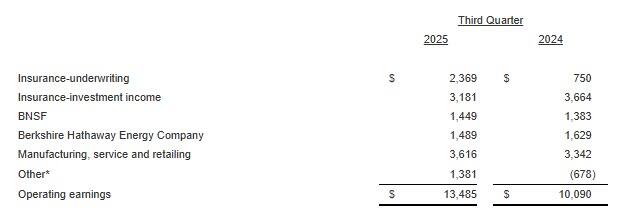

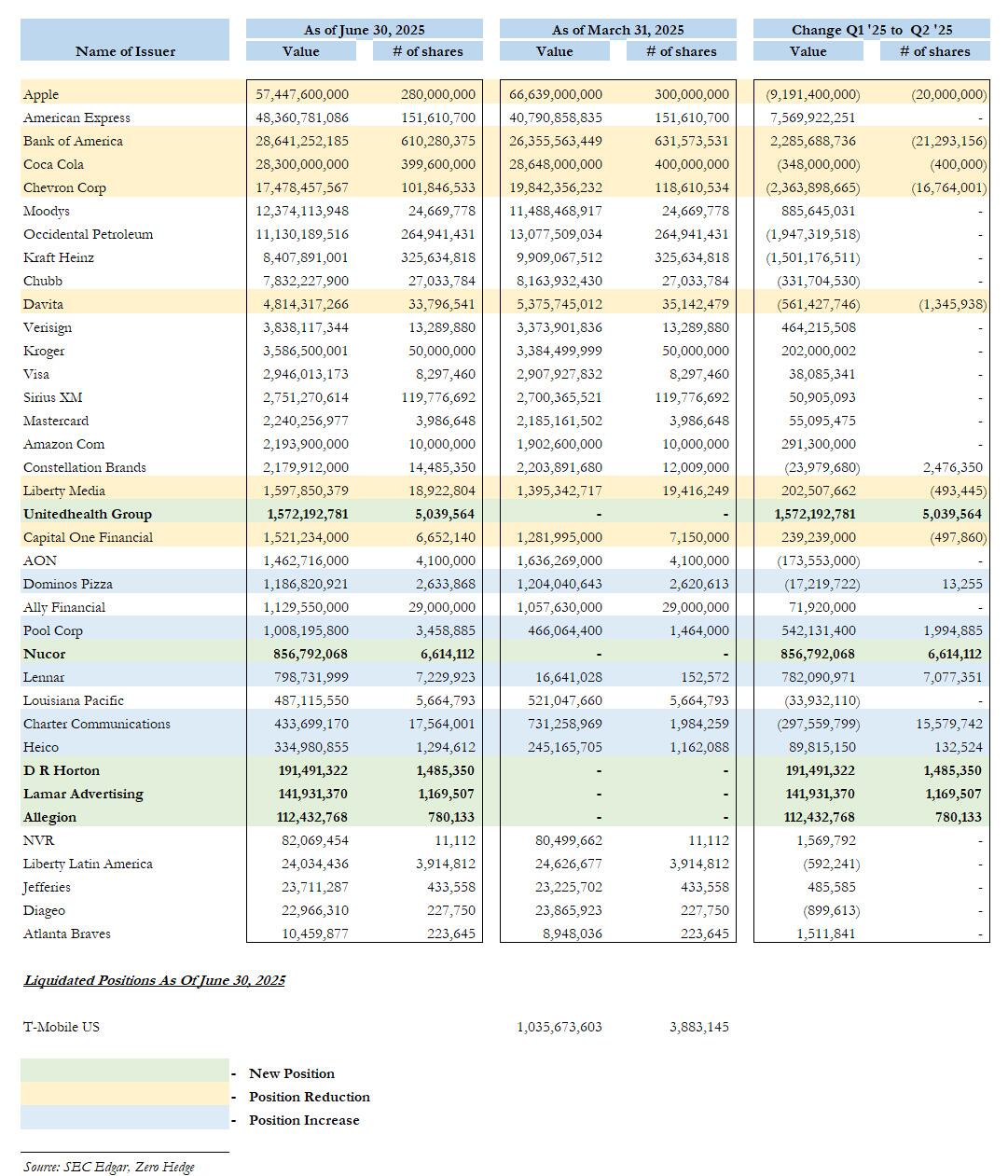

Turning to the company's investment activities, for the 12th straight quarter, Berkshire sold more stocks than it bought for its $283.2 billion equity portfolio...

The $13.49 billion quarterly operating profit, or $9,376 per Class A share, grew from $10.09 billion a year earlier. Currency fluctuations accounted for more than two-fifths of the increase.

While results benefited in part from an absence of major catastrophes such as hurricanes, Berkshire auto insurer Geico’s pretax underwriting profit fell 13% amid higher claims and a 40% increase in underwriting costs, which the firm said is due to “increased policy acquisition-related expenses" i.e., advertising, to acquire new policies in a period of soaring insurance costs. Additionally, insurance will likely face headwinds as falling interest rates reduce income from Berkshire's cash holdings, which also occurred in the third quarter.

Meanwhile, Berkshire’s utilities business, which runs PacifiCorp, MidAmerican and NV Energy, posted a 9% decline in operating earnings, to $1.5 billion over the period, and reflected legal bills from wildfires, and higher costs from natural gas pipelines and Northern Powergrid in Britain. Berkshire is still evaluating how U.S. President Donald Trump's One Big Beautiful Bill Act signed in July might affect the viability of its renewable energy projects.

One especially sore point was Pilot, which posted a $17 million loss in the third quarter. Berkshire said the decline is driven by lower wholesale fuel and retail margins, as well as higher expenses. “The Pilot business is not really doing very well,” Shanahan said. “I’m interested to see what the plan might be to turn that around.”

On the positive side, the BNSF railroad boosted operating earnings rose 6% to $1.4 billion, on lower fuel costs and "improved employee productivity" while revenue from the transportation of agricultural and energy products grew, driven in part by slightly higher grain exports.

Berkshire's $30.8 billion of net income, or $21,413 per Class A share, rose from $26.25 billion a year earlier. Net results include gains and losses on stocks Berkshire is not selling. This adds volatility, and Buffett believes such results are useless in understanding his company.

Also of note: revenue for Berkshire, which is seen by many as a mini model of the broader US economy due to its extensive diversification, grew just 2%, slower than the overall U.S. economy's growth rate.

Economic uncertainty and waning consumer confidence have been drags, Berkshire said, stalling sales growth at the Clayton Homes homebuilder and reducing revenue from Duracell batteries, Fruit of the Loom apparel and Squishmallows toymaker Jazwares.

"Berkshire, which is often considered a microcosm of the U.S. economy, isn't even keeping up," said Cathy Seifert, a CFRA Research analyst with a "hold" rating on Berkshire. "Investors will struggle to find a catalyst for this stock."

Turning to the company's investment activities, for the 12th straight quarter, Berkshire sold more stocks than it bought for its $283.2 billion equity portfolio...

... whose largest holdings are Apple, American Express and Bank of America.

... whose largest holdings are Apple, American Express and Bank of America.

In fact, at $13.7BN in sales in Q3, this was the most aggressive purging of risk since the same quarter in 2024.

“There isn’t much opportunity in Buffett’s eyes right now,” said Jim Shanahan, an analyst for Edward Jones.

For Berkshire's bulls this may be vexing, since earlier this year, Buffett appeared to be back on the hunt for deals, with the acquisition of a $1.6 billion stake in UnitedHealth Group and a $9.7 billion deal to buy OxyChem last month. But the famed billionaire remained on the sidelines in the third quarter. Berkshire Hathaway offloaded $6.1 billion of shares during the period.

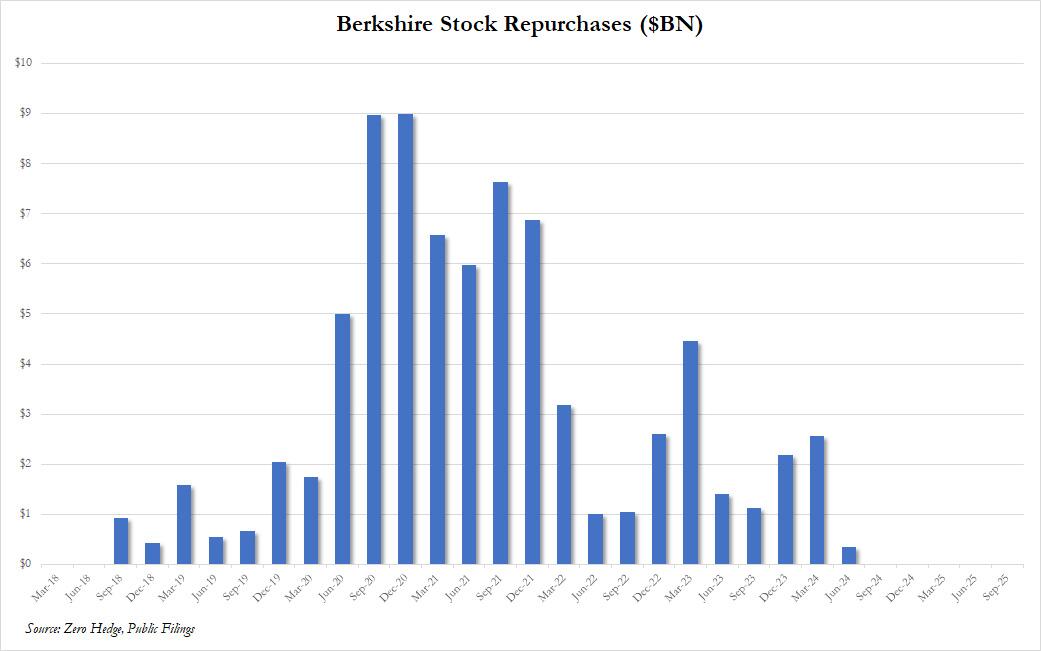

Also notable: after a burst of stock buybacks in the aftermath of the covid crash, Berkshire has not repurchased any of its own stock since Q2 2024...

In fact, at $13.7BN in sales in Q3, this was the most aggressive purging of risk since the same quarter in 2024.

“There isn’t much opportunity in Buffett’s eyes right now,” said Jim Shanahan, an analyst for Edward Jones.

For Berkshire's bulls this may be vexing, since earlier this year, Buffett appeared to be back on the hunt for deals, with the acquisition of a $1.6 billion stake in UnitedHealth Group and a $9.7 billion deal to buy OxyChem last month. But the famed billionaire remained on the sidelines in the third quarter. Berkshire Hathaway offloaded $6.1 billion of shares during the period.

Also notable: after a burst of stock buybacks in the aftermath of the covid crash, Berkshire has not repurchased any of its own stock since Q2 2024...

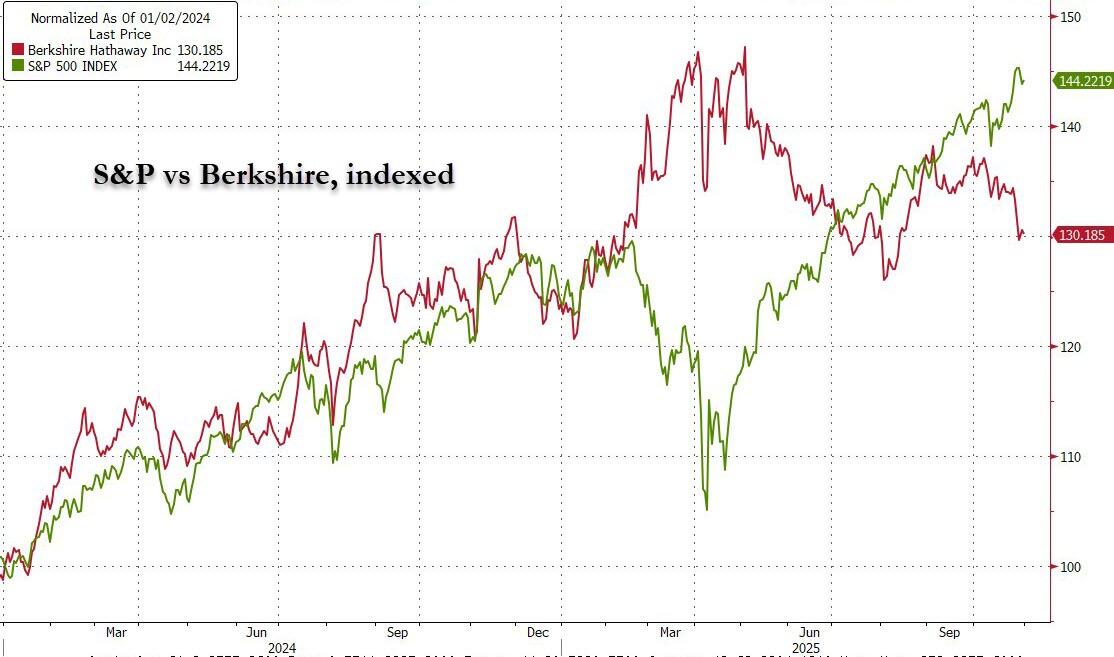

.... which may explain why Berkshire's stock price has significantly lagged the broader market, and is now trading where it was last August

.... which may explain why Berkshire's stock price has significantly lagged the broader market, and is now trading where it was last August

“I think that sends a very powerful message to shareholders,” said Cathy Seifert, an analyst at CFRA Research. “If they’re not buying back their shares, why should you?”

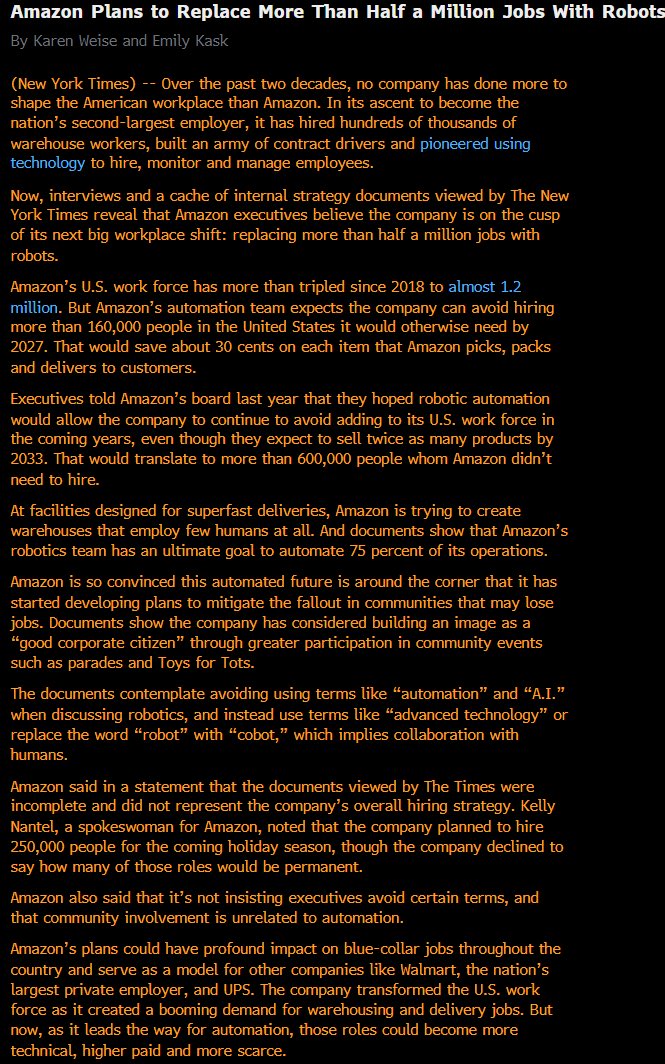

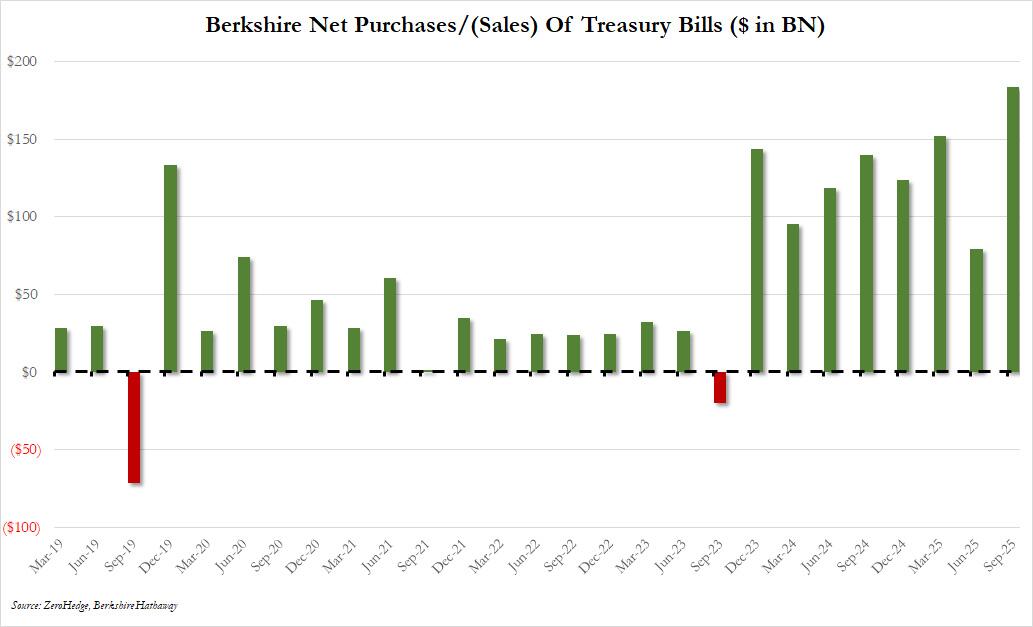

And since Berkshire isn't buying either others shares, or its own, it had to park all this record cash somewhere; and once again it did so by buying a record $183 billion (net) in treasuries in the quarter, bringing total purchases during the past 12 months to a record $540 billion.

“I think that sends a very powerful message to shareholders,” said Cathy Seifert, an analyst at CFRA Research. “If they’re not buying back their shares, why should you?”

And since Berkshire isn't buying either others shares, or its own, it had to park all this record cash somewhere; and once again it did so by buying a record $183 billion (net) in treasuries in the quarter, bringing total purchases during the past 12 months to a record $540 billion.

Berkshire's massive holdings of T-Bills is also why the firm’s net investment income declined 13% to $3.2 billion amid lower short-term interest rates.

As previously reported, Buffett, 95, is set to end his six-decade tenure as chief executive at the end of the year. Vice Chairman Greg Abel, 63, will succeed the legendary investor, though Buffett will remain chairman. Abel is known as a more hands-on manager than Buffett.

It is unclear what he will do with Berkshire's record cash, with options including paying the $1.03 trillion conglomerate's first dividend since 1967. Berkshire is planning to use $9.7 billion of cash to buy Occidental Petroleum's chemicals business, a transaction announced on October 2. James Shanahan, an Edward Jones analyst who upgraded his Berkshire rating to "buy" in September, said the company's resistance to spending more cash during this year's market rally has been disappointing.

"If you feel like stocks are expensive, including your own shares, you're eventually going to be right, but you can be wrong for a long time, and that's what happened here," he said.

And indeed, it's not just Berkshire that has not been buying back its own stock: investors have voted their apprehension about Berkshire's outlook and pending management change by selling its stock. Since Buffett announced on May 3 he would step down, Berkshire's stock price has fallen 12%, and trailed the S&P by 32%. For all of 2025, Berkshire is 11% points behind the index.

"Impatient investors feel an urgent need for Berkshire to deploy its cash, and have been casting their nets elsewhere," said Tom Russo, a partner at Gardner Russo & Quinn in Lancaster, Pennsylvania, which invests $10 billion.

Russo has owned Berkshire stock since 1982 and said Berkshire remains "extremely well-positioned" for the long term. "Berkshire isn't going to deploy capital that won't increase intrinsic value on a per share basis," he said. "Knowing that guides Berkshire means investors won't have to second-guess it."

The conglomerate owns close to 200 businesses that also include chemical and industrial companies, and familiar consumer brands such as Dairy Queen and See's Candies. As noted yesterday, many US businesses which rely on the strength of the consumer has been hammered in recent weeks because while the AI trade continue to soar, the US consumer has hit a brick wall and even Goldman Sachs is warning that the deterioration in K-Shaped economy is starting to spread from the lower income class to America's otherwise unstoppable middle class.

Berkshire has not made a huge acquisition since paying $32.1 billion for aerospace parts maker Precision Castparts in 2016, a deal which ended up being a disaster.

"Abel has a tremendous opportunity," Shanahan said. "He has a lot of available cash and by all accounts he is an excellent operator, so he may want to deploy capital in Berkshire's operating businesses to improve their performance."

Still, despite the earnings gains and massive cash pile, the firm’s tepid revenue growth in the period is not going to help investor sentiment, according to CFRA's Seifert.

“I’m struggling to find a catalyst” for an increase in the stock price, she said.

Berkshire's massive holdings of T-Bills is also why the firm’s net investment income declined 13% to $3.2 billion amid lower short-term interest rates.

As previously reported, Buffett, 95, is set to end his six-decade tenure as chief executive at the end of the year. Vice Chairman Greg Abel, 63, will succeed the legendary investor, though Buffett will remain chairman. Abel is known as a more hands-on manager than Buffett.

It is unclear what he will do with Berkshire's record cash, with options including paying the $1.03 trillion conglomerate's first dividend since 1967. Berkshire is planning to use $9.7 billion of cash to buy Occidental Petroleum's chemicals business, a transaction announced on October 2. James Shanahan, an Edward Jones analyst who upgraded his Berkshire rating to "buy" in September, said the company's resistance to spending more cash during this year's market rally has been disappointing.

"If you feel like stocks are expensive, including your own shares, you're eventually going to be right, but you can be wrong for a long time, and that's what happened here," he said.

And indeed, it's not just Berkshire that has not been buying back its own stock: investors have voted their apprehension about Berkshire's outlook and pending management change by selling its stock. Since Buffett announced on May 3 he would step down, Berkshire's stock price has fallen 12%, and trailed the S&P by 32%. For all of 2025, Berkshire is 11% points behind the index.

"Impatient investors feel an urgent need for Berkshire to deploy its cash, and have been casting their nets elsewhere," said Tom Russo, a partner at Gardner Russo & Quinn in Lancaster, Pennsylvania, which invests $10 billion.

Russo has owned Berkshire stock since 1982 and said Berkshire remains "extremely well-positioned" for the long term. "Berkshire isn't going to deploy capital that won't increase intrinsic value on a per share basis," he said. "Knowing that guides Berkshire means investors won't have to second-guess it."

The conglomerate owns close to 200 businesses that also include chemical and industrial companies, and familiar consumer brands such as Dairy Queen and See's Candies. As noted yesterday, many US businesses which rely on the strength of the consumer has been hammered in recent weeks because while the AI trade continue to soar, the US consumer has hit a brick wall and even Goldman Sachs is warning that the deterioration in K-Shaped economy is starting to spread from the lower income class to America's otherwise unstoppable middle class.

Berkshire has not made a huge acquisition since paying $32.1 billion for aerospace parts maker Precision Castparts in 2016, a deal which ended up being a disaster.

"Abel has a tremendous opportunity," Shanahan said. "He has a lot of available cash and by all accounts he is an excellent operator, so he may want to deploy capital in Berkshire's operating businesses to improve their performance."

Still, despite the earnings gains and massive cash pile, the firm’s tepid revenue growth in the period is not going to help investor sentiment, according to CFRA's Seifert.

“I’m struggling to find a catalyst” for an increase in the stock price, she said.

In the

In the

APT's 31-page analysis (first revealed on

APT's 31-page analysis (first revealed on

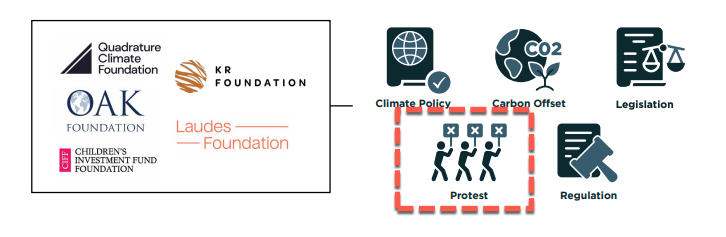

The key findings are shocking:

Quadrature Climate Foundation (QCF): Founded in 2019 by hedge-fund billionaires Greg Skinner and Suneil Setiya. Has given roughly $530 million to 41 U.S. groups, including ClimateWorks Foundation ($147 M), Growald Climate Fund ($80 M), Grantham Foundation ($80 M), Windward Fund ($49 M), and Sunrise Project ($36 M). QCF also funds controversial solar-geoengineering research and "climate litigation and regulation advocacy."

KR Foundation: Danish climate charity tied to the Carlsberg family. Has provided $36 million to 53 U.S. groups backing climate litigation, ESG advocacy, and fossil-fuel divestment. Major recipients include Center for International Environmental Law ($1.4 M), Conservation Law Foundation ($0.4 M), Oil Change International ($2.2 M), and Fossil Free Media ($1 M). It even funded The Associated Press ($300 K) for climate-related programming.

Oak Foundation: Swiss-based trust founded by British billionaire Alan Parker. Gave >$750 million to 152 U.S. groups advancing "climate justice" and lawsuits against fossil-fuel firms.

Key recipients include:

Environmental Law Institute ($650 K, creator of the Climate Judiciary Project)

Community Change ($1.6 M, linked to Free DC protests)

Rockefeller Philanthropy Advisors ($108 M)

New Venture Fund ($67 M)

NRDC ($6.5 M)

Tides Center ($8.2 M)

Laudes Foundation: Established in 2020 by the secretive Brenninkmeijer family (C&A clothing empire). Has sent $20 million to 17 U.S. groups promoting ESG disclosure, "climate-friendly diets," and equity mandates. Largest grants: Pulitzer Center ($3.7 M) for climate-justice reporting, Ceres ($1.7 M), Community Initiatives ($1 M), and World Resources Institute ($2.8 M).

Children's Investment Fund Foundation (CIFF): Run by British hedge-fund billionaire Sir Christopher Hohn. Sent $553 million to 39 U.S. entities before pledging in late 2025 to halt U.S. funding after APT's exposure.

Key recipients include:

Energy Foundation China ($70 M) — under House investigation for links to former CCP officials

Institute for Governance & Sustainable Development ($25 M)

Environmental Defense Fund ($17 M)

Sunrise Project ($36 M)

ATP points out that these funding flows exploit gaps in U.S. oversight laws, which prohibit foreign election donations but allow influence through 501(c)(3) and 501(c)(4) organizations. Through the nonprofit world, foreign billionaires can conduct foreign influence operations through leftist nonprofits, including funding protest industrial complex against Trump, get-out-the-vote drives, anti-Trump ads, lobbying, and whatever else.

Sutherland said, "There's not a question about where it's going and where it is coming from. We know that it's foreign money coming into our U.S. policy fights, climate litigation, research, protests, lobbying, you name it".

The key findings are shocking:

Quadrature Climate Foundation (QCF): Founded in 2019 by hedge-fund billionaires Greg Skinner and Suneil Setiya. Has given roughly $530 million to 41 U.S. groups, including ClimateWorks Foundation ($147 M), Growald Climate Fund ($80 M), Grantham Foundation ($80 M), Windward Fund ($49 M), and Sunrise Project ($36 M). QCF also funds controversial solar-geoengineering research and "climate litigation and regulation advocacy."

KR Foundation: Danish climate charity tied to the Carlsberg family. Has provided $36 million to 53 U.S. groups backing climate litigation, ESG advocacy, and fossil-fuel divestment. Major recipients include Center for International Environmental Law ($1.4 M), Conservation Law Foundation ($0.4 M), Oil Change International ($2.2 M), and Fossil Free Media ($1 M). It even funded The Associated Press ($300 K) for climate-related programming.

Oak Foundation: Swiss-based trust founded by British billionaire Alan Parker. Gave >$750 million to 152 U.S. groups advancing "climate justice" and lawsuits against fossil-fuel firms.

Key recipients include:

Environmental Law Institute ($650 K, creator of the Climate Judiciary Project)

Community Change ($1.6 M, linked to Free DC protests)

Rockefeller Philanthropy Advisors ($108 M)

New Venture Fund ($67 M)

NRDC ($6.5 M)

Tides Center ($8.2 M)

Laudes Foundation: Established in 2020 by the secretive Brenninkmeijer family (C&A clothing empire). Has sent $20 million to 17 U.S. groups promoting ESG disclosure, "climate-friendly diets," and equity mandates. Largest grants: Pulitzer Center ($3.7 M) for climate-justice reporting, Ceres ($1.7 M), Community Initiatives ($1 M), and World Resources Institute ($2.8 M).

Children's Investment Fund Foundation (CIFF): Run by British hedge-fund billionaire Sir Christopher Hohn. Sent $553 million to 39 U.S. entities before pledging in late 2025 to halt U.S. funding after APT's exposure.

Key recipients include:

Energy Foundation China ($70 M) — under House investigation for links to former CCP officials

Institute for Governance & Sustainable Development ($25 M)

Environmental Defense Fund ($17 M)

Sunrise Project ($36 M)

ATP points out that these funding flows exploit gaps in U.S. oversight laws, which prohibit foreign election donations but allow influence through 501(c)(3) and 501(c)(4) organizations. Through the nonprofit world, foreign billionaires can conduct foreign influence operations through leftist nonprofits, including funding protest industrial complex against Trump, get-out-the-vote drives, anti-Trump ads, lobbying, and whatever else.

Sutherland said, "There's not a question about where it's going and where it is coming from. We know that it's foreign money coming into our U.S. policy fights, climate litigation, research, protests, lobbying, you name it".

Besides funding anti-Trump protests, Sutherland warned about one very alarming use of the dark European money that flowed from the Oak Foundation into a group called Community Change. "They are the front group that has led the charge against Trump's crackdown on crime. So again, we're seeing where foreign money coming in to protest, litigation, training is ending up," she noted.

"It seems clear to me that this foreign money is coming into the United States because they want to implement their extremist European vision for America," Sutherland concluded. "And it seems to me that when you take a look at the money, they just want to have a more extreme United States that is radicalized and further left than what we want."

The pattern of foreign foundations exporting nation-destroying far-left policies into the U.S., funding protests (and possibly even riots), and working to dismantle President Trump's agenda, chosen by the American people, serves as an urgent wake-up call for Republicans about the unchecked flow of foreign philanthropy pouring billions into the dark NGO world.

APT is urging policymakers to fix this absolute mess by:

Close FARA loopholes;

Require foreign-funded nonprofits to disclose sources;

Consider banning foreign financing of politically active 501(c)(4)s;

Investigate whether foreign charities violated U.S. law through advocacy or litigation.

What's clear is that it's not just European billionaires exploiting America's NGO network ... it's happening from around the world, from Latin American Marxists to Communist China. It's as if globalists and the Democratic Party are weaponizing nonprofits in a coordinated effort to undermine President Trump's agenda, with the ultimate goal of regime change.

Remember this...

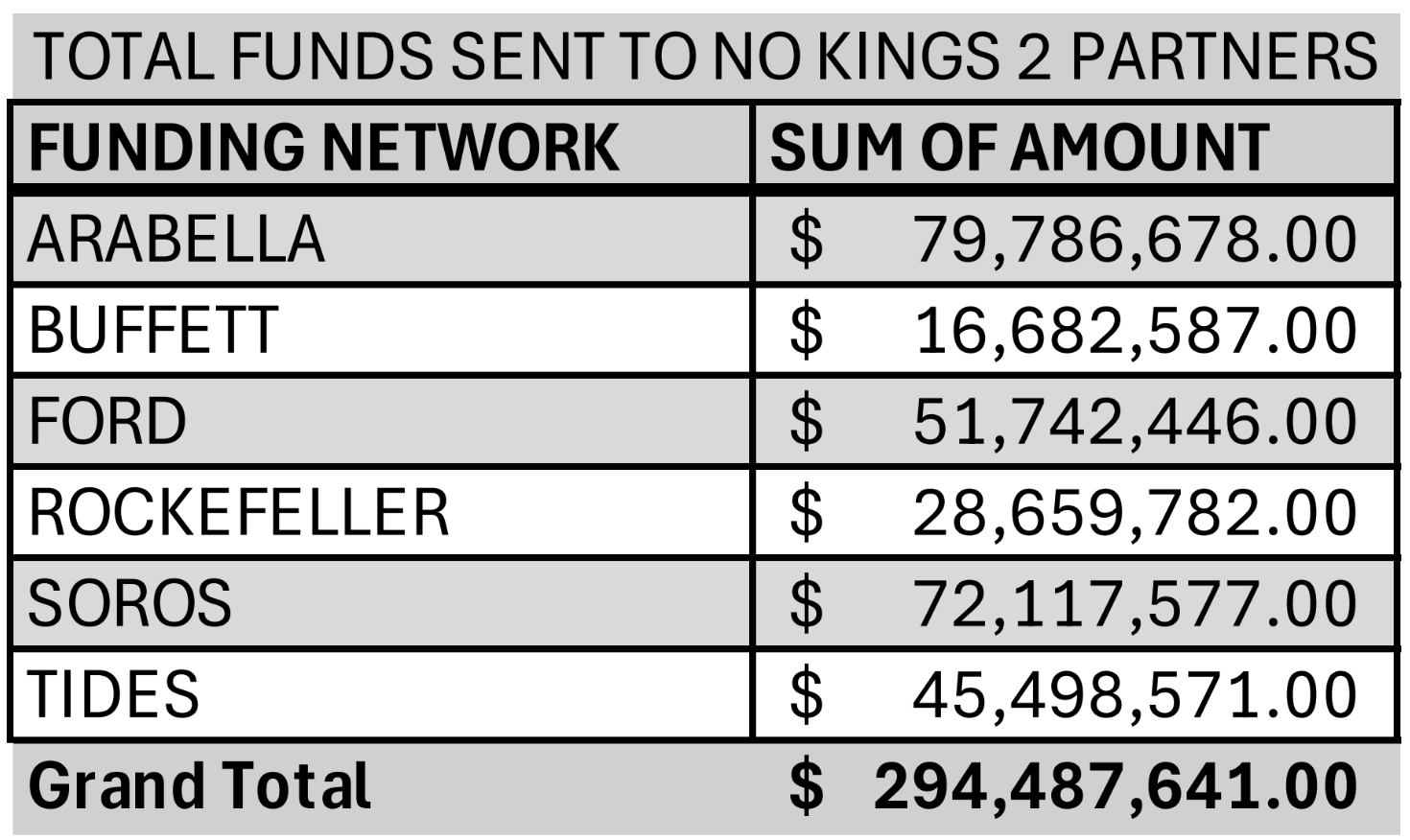

📊We traced $294,487,641 to the official No Kings 2.0 partners & organizers...all funneled through the same “Riot Inc.” dark-money networks:

💰 Arabella network $79.7M+

💰 Soros network $72.1M+

💰 Ford network $51.7M+

💰Tides $45.5M+

💰 Rockefeller $28.6M+

💰 Buffett $16.6M+

Besides funding anti-Trump protests, Sutherland warned about one very alarming use of the dark European money that flowed from the Oak Foundation into a group called Community Change. "They are the front group that has led the charge against Trump's crackdown on crime. So again, we're seeing where foreign money coming in to protest, litigation, training is ending up," she noted.

"It seems clear to me that this foreign money is coming into the United States because they want to implement their extremist European vision for America," Sutherland concluded. "And it seems to me that when you take a look at the money, they just want to have a more extreme United States that is radicalized and further left than what we want."

The pattern of foreign foundations exporting nation-destroying far-left policies into the U.S., funding protests (and possibly even riots), and working to dismantle President Trump's agenda, chosen by the American people, serves as an urgent wake-up call for Republicans about the unchecked flow of foreign philanthropy pouring billions into the dark NGO world.

APT is urging policymakers to fix this absolute mess by:

Close FARA loopholes;

Require foreign-funded nonprofits to disclose sources;

Consider banning foreign financing of politically active 501(c)(4)s;

Investigate whether foreign charities violated U.S. law through advocacy or litigation.

What's clear is that it's not just European billionaires exploiting America's NGO network ... it's happening from around the world, from Latin American Marxists to Communist China. It's as if globalists and the Democratic Party are weaponizing nonprofits in a coordinated effort to undermine President Trump's agenda, with the ultimate goal of regime change.

Remember this...

📊We traced $294,487,641 to the official No Kings 2.0 partners & organizers...all funneled through the same “Riot Inc.” dark-money networks:

💰 Arabella network $79.7M+

💰 Soros network $72.1M+

💰 Ford network $51.7M+

💰Tides $45.5M+

💰 Rockefeller $28.6M+

💰 Buffett $16.6M+

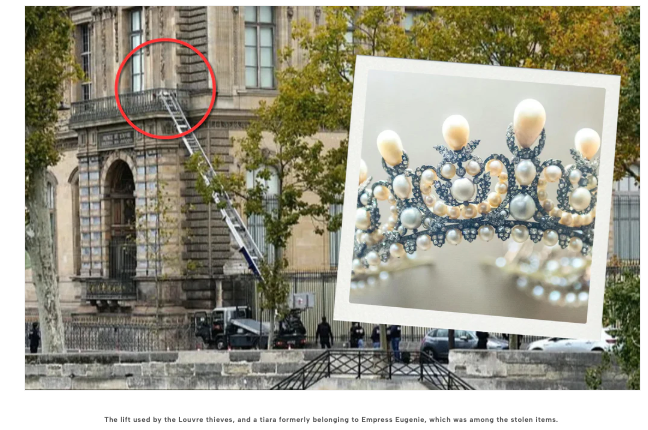

On Sunday, 19 October, a team of highly choreographed thieves disguised as construction workers carried out one of history's most daring robberies at one of the world's most high-profile locations, the Musée du Louvre in Paris. Arriving shortly after the famous museum's opening, four thieves entered the Louvre with a vehicle-mounted lift, wielding power tools that they would use to open display cases containing jewels with direct connections to French royalty, including Empress Eugénie, wife of Napoleon III.

Even more important culturally than for their considerable material value, which has been estimated at 88 million Euros (approximately 102 million freedom dollars), the stolen jewels accompanied the thieves on a pair of awaiting scooters, making good their escape. While I am not

On Sunday, 19 October, a team of highly choreographed thieves disguised as construction workers carried out one of history's most daring robberies at one of the world's most high-profile locations, the Musée du Louvre in Paris. Arriving shortly after the famous museum's opening, four thieves entered the Louvre with a vehicle-mounted lift, wielding power tools that they would use to open display cases containing jewels with direct connections to French royalty, including Empress Eugénie, wife of Napoleon III.

Even more important culturally than for their considerable material value, which has been estimated at 88 million Euros (approximately 102 million freedom dollars), the stolen jewels accompanied the thieves on a pair of awaiting scooters, making good their escape. While I am not

Over the past few months, we've done our best to follow the rapidly evolving global tariff situation, particularly as it relates to Switzerland, the birthplace of so many of the great watches at the center of our Use Your Tools ethos. The current tariff for Swiss watches entering the United States stands at 39%. Established back in August, the weighty figure has cast a long shadow over export statistics. In September, Swiss watch exports to the US dropped by over 55.6% to 157.7M Swiss francs (approximately $198.5M), according to the Federation of the Swiss Watch Industry. Even more surprisingly, the United States is no longer the number one market for Swiss watches, with the UK taking over the top spot for the first time in a long time.

Over the past few months, we've done our best to follow the rapidly evolving global tariff situation, particularly as it relates to Switzerland, the birthplace of so many of the great watches at the center of our Use Your Tools ethos. The current tariff for Swiss watches entering the United States stands at 39%. Established back in August, the weighty figure has cast a long shadow over export statistics. In September, Swiss watch exports to the US dropped by over 55.6% to 157.7M Swiss francs (approximately $198.5M), according to the Federation of the Swiss Watch Industry. Even more surprisingly, the United States is no longer the number one market for Swiss watches, with the UK taking over the top spot for the first time in a long time.

If you appreciate Swiss watches and don't want the inevitable price hike brands will likely be forced to implement, this is not great news. As we've speculated before, the 39% figure is likely intended to apply pressure to the Swiss government for bargaining purposes, which appears to be working. However, how this will shake down is anyone's guess. I think everyone on both sides of the aisle can agree we don't want a $10,000 Rolex to suddenly become a $14,000 Rolex, which seems to be where we're headed. Only time will tell.

JD Vance is Wearing His Apple Watch Again

If you appreciate Swiss watches and don't want the inevitable price hike brands will likely be forced to implement, this is not great news. As we've speculated before, the 39% figure is likely intended to apply pressure to the Swiss government for bargaining purposes, which appears to be working. However, how this will shake down is anyone's guess. I think everyone on both sides of the aisle can agree we don't want a $10,000 Rolex to suddenly become a $14,000 Rolex, which seems to be where we're headed. Only time will tell.

JD Vance is Wearing His Apple Watch Again

In a move eliciting deep sighs among intelligence professionals everywhere, Vice President JD Vance was once again spotted wearing an Apple Watch while en route to the 250th anniversary US Marine Corps celebration at Camp Pendleton in California. After W.O.E. penned

In a move eliciting deep sighs among intelligence professionals everywhere, Vice President JD Vance was once again spotted wearing an Apple Watch while en route to the 250th anniversary US Marine Corps celebration at Camp Pendleton in California. After W.O.E. penned

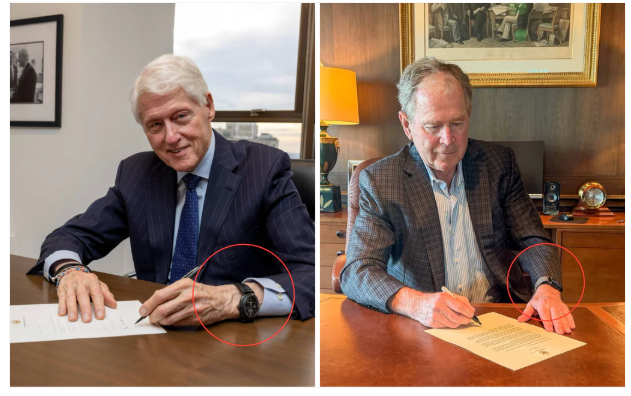

Along with the US Marine Corps, the US Navy also celebrated its 250th anniversary with a series of ceremonies and international military exercises. Former presidents Bill Clinton (42) and George W. Bush (43) also got in on the action, penning letters in front of the press honoring the Navy's history. If there's one thing we love about a letter-writing photo op, it is that watches are often front and center, with Clinton wearing his Panerai Radiomir Black Seal PAM00292 for the occasion. An established watch nerd, Clinton has worn watches from Panerai, Cartier, JLC, Audemars Piguet, and other brands.

Bush, who is historically loyal to his modest white dial Timex Indiglo with an American flag at 12 o'clock, has broken our hearts by wearing an Apple Watch. Sure, he's not the priority intelligence target he would have been while in office, but it still hurts to see an important political figure give up the analog life in favor of monitoring their heart rate or knowing how many theoretical flights of stairs they have climbed. That detour aside, the history of watches and US Presidents is deep, bipartisan, and intriguing. Read our article on the subject

Along with the US Marine Corps, the US Navy also celebrated its 250th anniversary with a series of ceremonies and international military exercises. Former presidents Bill Clinton (42) and George W. Bush (43) also got in on the action, penning letters in front of the press honoring the Navy's history. If there's one thing we love about a letter-writing photo op, it is that watches are often front and center, with Clinton wearing his Panerai Radiomir Black Seal PAM00292 for the occasion. An established watch nerd, Clinton has worn watches from Panerai, Cartier, JLC, Audemars Piguet, and other brands.

Bush, who is historically loyal to his modest white dial Timex Indiglo with an American flag at 12 o'clock, has broken our hearts by wearing an Apple Watch. Sure, he's not the priority intelligence target he would have been while in office, but it still hurts to see an important political figure give up the analog life in favor of monitoring their heart rate or knowing how many theoretical flights of stairs they have climbed. That detour aside, the history of watches and US Presidents is deep, bipartisan, and intriguing. Read our article on the subject

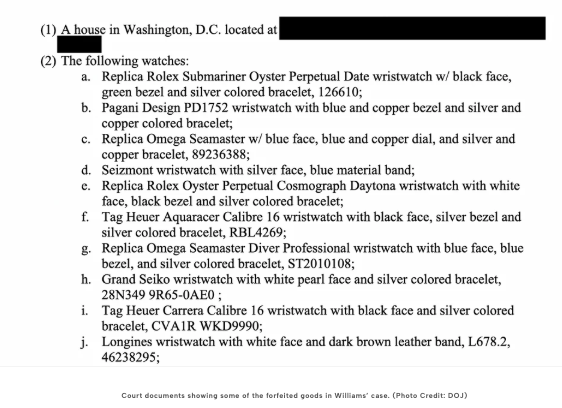

In a developing story that we intend to cover with a dedicated Dispatch, a tech executive at a defense contractor has been accused of selling trade secrets to a buyer in Russia to the tune of $1.3 million. The accused, Peter Williams, is the former general manager at Trenchant, a division of a company called L3Harris that develops hacking and surveillance tools, typically for Western government organizations. Between 2022 and 2025, Williams is accused of stealing and selling eight trade secrets to an unnamed Russian party.

This appears to be espionage, but where it falls under the purview of W.O.E. is in DOJ documents that call for the forfeiture of Williams' home and assets, allegedly purchased with his misbegotten funds. Among the goods ordered forfeited were twenty-two watches, including several replica Rolex models, as well as an authentic Grand Seiko, a couple of Tag Heuers, and several Apple Watches. It's a wild story. Stay tuned for more.

French Politician Accused Of Hiding Luxury Wristwatch

In a developing story that we intend to cover with a dedicated Dispatch, a tech executive at a defense contractor has been accused of selling trade secrets to a buyer in Russia to the tune of $1.3 million. The accused, Peter Williams, is the former general manager at Trenchant, a division of a company called L3Harris that develops hacking and surveillance tools, typically for Western government organizations. Between 2022 and 2025, Williams is accused of stealing and selling eight trade secrets to an unnamed Russian party.

This appears to be espionage, but where it falls under the purview of W.O.E. is in DOJ documents that call for the forfeiture of Williams' home and assets, allegedly purchased with his misbegotten funds. Among the goods ordered forfeited were twenty-two watches, including several replica Rolex models, as well as an authentic Grand Seiko, a couple of Tag Heuers, and several Apple Watches. It's a wild story. Stay tuned for more.

French Politician Accused Of Hiding Luxury Wristwatch

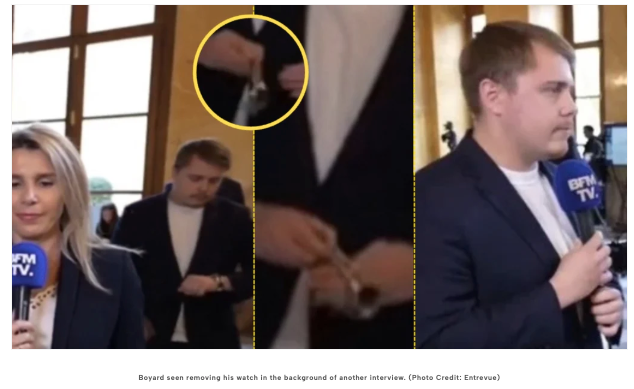

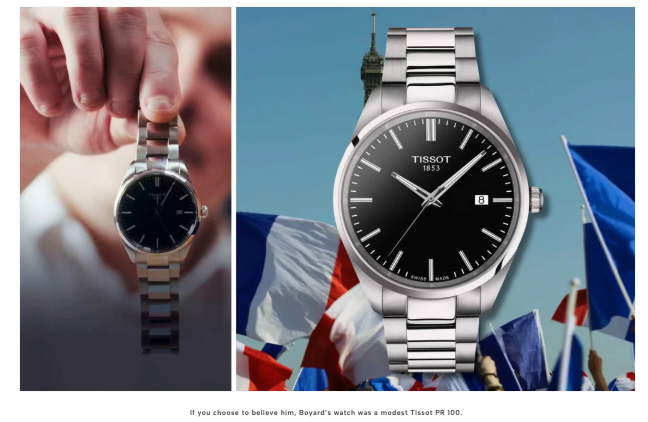

Diving deep into international politics, Louis Boyard, a prominent member of France's far-left Unbowed party, was accused of removing his watch before a television interview. After being filmed in the act, many online had words for Boyard, including Argentina's radical right-wing President Javier Milei. Boyard is famously critical of the ultra-rich, which led Argentina's president and the rest of the internet Illuminati to accuse the French politician of hypocrisy, assuming the watch he was hiding was a Rolex, Patek Philippe, or something else ostentatious.

Diving deep into international politics, Louis Boyard, a prominent member of France's far-left Unbowed party, was accused of removing his watch before a television interview. After being filmed in the act, many online had words for Boyard, including Argentina's radical right-wing President Javier Milei. Boyard is famously critical of the ultra-rich, which led Argentina's president and the rest of the internet Illuminati to accuse the French politician of hypocrisy, assuming the watch he was hiding was a Rolex, Patek Philippe, or something else ostentatious.

All was not as it seemed, however, and Boyard quickly clapped back with a video where he reveals the watch in question was, in fact, a modest Tissot, stating, "Sorry to disappoint you, but I don't have a Rolex, I have this watch, which costs €295. My friends bought it for my 25th birthday, thanks, guys!" While the narrative here didn't play out as intended for Boyard's critics, the situation emphasizes the power of watches as tools of communication in political scenarios. Boyard could be shining us on, but whether it was in fact a $10,000 Rolex or an affordable Tissot PR 100, we can agree that his watch is doing a lot more than simply telling the time.

Man Robbed of Rolex, Jewelry, & Cash While Pumping Gas

All was not as it seemed, however, and Boyard quickly clapped back with a video where he reveals the watch in question was, in fact, a modest Tissot, stating, "Sorry to disappoint you, but I don't have a Rolex, I have this watch, which costs €295. My friends bought it for my 25th birthday, thanks, guys!" While the narrative here didn't play out as intended for Boyard's critics, the situation emphasizes the power of watches as tools of communication in political scenarios. Boyard could be shining us on, but whether it was in fact a $10,000 Rolex or an affordable Tissot PR 100, we can agree that his watch is doing a lot more than simply telling the time.

Man Robbed of Rolex, Jewelry, & Cash While Pumping Gas

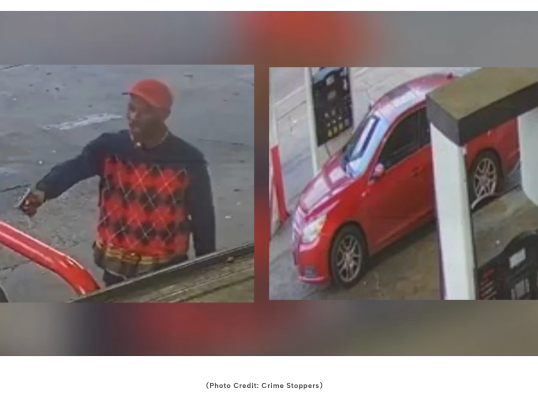

Delving into watch crime, a man in Memphis, TN, was robbed of his $7,000 Rolex, $17,000 in jewelry, and $4,000 in cash while pumping gas at a Circle K. Details are sparse, but the victim told investigators he was getting gas when a man approached from behind, brandished a firearm, and demanded he "empty his pockets" before absconding in a black sedan with tinted windows. Surveillance cameras captured the perpetrator, but no arrests have been made. Given the value of the stolen goods, we can't help but wonder whether this was a targeted crime, but the incident still serves as a reminder to be aware of your surroundings at all times, and maybe, just maybe, don't carry $28k worth of stuff on your person.

We have discussed the most common modalities for luxury watch theft in a separate article, and this is another reminder that even your local gas station may be unsafe. If you're flexing your AP at an upscale bar in Mayfair or going out in Miami looking for paid evening company with a GMT-Master II on your wrist, you've made yourself a target, but apparently, you will also need your head on a swivel just to wear your Richard Mille to gas up the ride. What is the world coming to?

Would-be Rolex Thief Targets the Wrong Guy

Delving into watch crime, a man in Memphis, TN, was robbed of his $7,000 Rolex, $17,000 in jewelry, and $4,000 in cash while pumping gas at a Circle K. Details are sparse, but the victim told investigators he was getting gas when a man approached from behind, brandished a firearm, and demanded he "empty his pockets" before absconding in a black sedan with tinted windows. Surveillance cameras captured the perpetrator, but no arrests have been made. Given the value of the stolen goods, we can't help but wonder whether this was a targeted crime, but the incident still serves as a reminder to be aware of your surroundings at all times, and maybe, just maybe, don't carry $28k worth of stuff on your person.

We have discussed the most common modalities for luxury watch theft in a separate article, and this is another reminder that even your local gas station may be unsafe. If you're flexing your AP at an upscale bar in Mayfair or going out in Miami looking for paid evening company with a GMT-Master II on your wrist, you've made yourself a target, but apparently, you will also need your head on a swivel just to wear your Richard Mille to gas up the ride. What is the world coming to?

Would-be Rolex Thief Targets the Wrong Guy

In a heartwarming case of mistaken identity, an armed man jumped out of a car in West Hollywood, California, hell bent on stealing a Rolex he spotted on the wrist of a pedestrian. Proof that the Uno Reverse Card is a real thing, the intended target turned out to be a former professional fighter who proved reluctant to surrender his timepiece, instead peeling back the lid on a can of whoopass that, despite his assailant's loaded gun, ended with the freshly-pummeled thief pinned to the ground awaiting the arrival of law enforcement. According to eyewitnesses, the man's girlfriend, with whom he had been walking, also got a few licks in. And they say no news is good news.

Final Thoughts

As October winds down, the kids go trick-or-treating, and we collectively transition into soup mode, this month's SITREP proves that the broader world of Watches of Espionage remains as unpredictable and entertaining as ever. From jewel thieves channeling Ocean's Eleven in Paris to politicians fumbling their horological optics to a former professional fighter serving a would-be thief his comeuppance and VP Vance once again tempting the SIGINT gods, there's never a dull moment when timepieces intersect with power, crime, and culture.

Remember, whether you're wearing a $300 Tissot or a $30,000 Rolex, your watch says something about you, sometimes more than you intend. We'll see you next month.

If you enjoyed this article, please consider signing up for our weekly free newsletter for further updates <a href="

In a heartwarming case of mistaken identity, an armed man jumped out of a car in West Hollywood, California, hell bent on stealing a Rolex he spotted on the wrist of a pedestrian. Proof that the Uno Reverse Card is a real thing, the intended target turned out to be a former professional fighter who proved reluctant to surrender his timepiece, instead peeling back the lid on a can of whoopass that, despite his assailant's loaded gun, ended with the freshly-pummeled thief pinned to the ground awaiting the arrival of law enforcement. According to eyewitnesses, the man's girlfriend, with whom he had been walking, also got a few licks in. And they say no news is good news.

Final Thoughts

As October winds down, the kids go trick-or-treating, and we collectively transition into soup mode, this month's SITREP proves that the broader world of Watches of Espionage remains as unpredictable and entertaining as ever. From jewel thieves channeling Ocean's Eleven in Paris to politicians fumbling their horological optics to a former professional fighter serving a would-be thief his comeuppance and VP Vance once again tempting the SIGINT gods, there's never a dull moment when timepieces intersect with power, crime, and culture.

Remember, whether you're wearing a $300 Tissot or a $30,000 Rolex, your watch says something about you, sometimes more than you intend. We'll see you next month.

If you enjoyed this article, please consider signing up for our weekly free newsletter for further updates <a href="

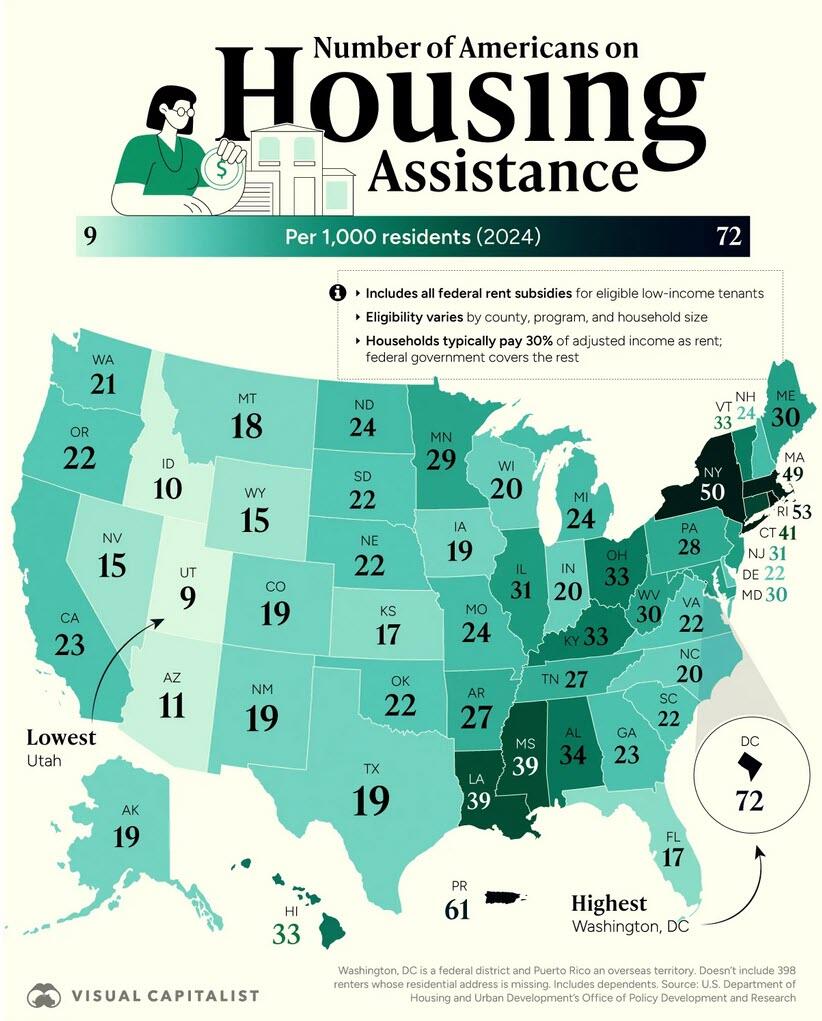

Data is sourced from the

Data is sourced from the