No Crying In The Casino

No Crying In The Casino

Submitted by  Browsing social media last night and this morning, I was greeted with dozens of examples of people posting their “loss porn,” as the Reddit traders would call it, with one P/L after another showing huge losses.

Some traders posted ominous things about blowing up their crypto accounts, forced liquidations, and massive losses. Some even also posted, insinuating they were considering self-harm. I posted some examples on my blog

Browsing social media last night and this morning, I was greeted with dozens of examples of people posting their “loss porn,” as the Reddit traders would call it, with one P/L after another showing huge losses.

Some traders posted ominous things about blowing up their crypto accounts, forced liquidations, and massive losses. Some even also posted, insinuating they were considering self-harm. I posted some examples on my blog  .

Let’s assume half of these posts are people joking around, and the other half are dead serious. That would be alarming. And so, this weekend is a good time to remember a couple important lessons.First is the fact that things can change any day in the market without notice—as I have been saying for years and explained in my comprehensive wrap-up yesterday after the market closed:

.

Let’s assume half of these posts are people joking around, and the other half are dead serious. That would be alarming. And so, this weekend is a good time to remember a couple important lessons.First is the fact that things can change any day in the market without notice—as I have been saying for years and explained in my comprehensive wrap-up yesterday after the market closed:  If you’ve been spending the last five years patting yourself on the back over what a genius you are because you have minted it in cryptocurrencies or equities that are trading at 10,000x sales with no net income, perhaps you should reconsider taking to the public forum to air your grievances with how you’ve managed your capital on one particular day.If you’ve spent the last decade shit-posting seasoned investors like Jim Chanos or Peter Schiff on Twitter and just can’t figure out why they can’t see things your way because you’ve always been right, now would be a good place to see if any of their skepticism or warnings about markets can make their way through your blood-brain barrier.

If you got smacked around on Friday but didn’t take a total loss, turn a shitty day into an asset by starting to tell yourself the honest truth—you don’t know everything, and none of us do—instead of whatever lie you’ve been telling yourself about how you’re going to be able to outperform forever because you happen to have caught the tail end of a nominal hyperinflationary boom that could very well end in the United States dollar dying while your ego portion of your brain was still mushy and developing, like an infant’s skull.

If you’ve been spending the last five years patting yourself on the back over what a genius you are because you have minted it in cryptocurrencies or equities that are trading at 10,000x sales with no net income, perhaps you should reconsider taking to the public forum to air your grievances with how you’ve managed your capital on one particular day.If you’ve spent the last decade shit-posting seasoned investors like Jim Chanos or Peter Schiff on Twitter and just can’t figure out why they can’t see things your way because you’ve always been right, now would be a good place to see if any of their skepticism or warnings about markets can make their way through your blood-brain barrier.

If you got smacked around on Friday but didn’t take a total loss, turn a shitty day into an asset by starting to tell yourself the honest truth—you don’t know everything, and none of us do—instead of whatever lie you’ve been telling yourself about how you’re going to be able to outperform forever because you happen to have caught the tail end of a nominal hyperinflationary boom that could very well end in the United States dollar dying while your ego portion of your brain was still mushy and developing, like an infant’s skull.

It’s a great weekend to ask yourself, “Am I quickly disregarding fraud warnings about a company issued by a man who teaches a class on fraud at Yale and who called Enron’s collapse ahead of time?”

Or, “Am I quick to ridicule someone’s stance on Bitcoin or gold, despite the fact they’ve been in the game for decades and have amassed enormous personal wealth and one of the best grasps of free-market economics out of anybody in finance today?”

If the answer is yes to either of these, maybe it’s time to act a little less like a hyena and a little more like an adult. Buck up. Act like you’ve been here before. Take the pain. Learn from the pain. Come back better.

After all, the stock market is an adult game with real wins and real losses.

Third, assuming that half of posts like these are real it’s stunning to see, after simply one 3% drawdown in the market—after we have done nothing but rage to all-time highs nonstop since the market plunge in April.

It is proof positive that investors have been seduced with insanely unrealistic expectations about risk and how markets work — as I wrote in February:

It’s a great weekend to ask yourself, “Am I quickly disregarding fraud warnings about a company issued by a man who teaches a class on fraud at Yale and who called Enron’s collapse ahead of time?”

Or, “Am I quick to ridicule someone’s stance on Bitcoin or gold, despite the fact they’ve been in the game for decades and have amassed enormous personal wealth and one of the best grasps of free-market economics out of anybody in finance today?”

If the answer is yes to either of these, maybe it’s time to act a little less like a hyena and a little more like an adult. Buck up. Act like you’ve been here before. Take the pain. Learn from the pain. Come back better.

After all, the stock market is an adult game with real wins and real losses.

Third, assuming that half of posts like these are real it’s stunning to see, after simply one 3% drawdown in the market—after we have done nothing but rage to all-time highs nonstop since the market plunge in April.

It is proof positive that investors have been seduced with insanely unrealistic expectations about risk and how markets work — as I wrote in February:  This, as I have been saying for years, is a product of batshit insane monetary policy—which is set based on keeping the stock market at all-time highs, regardless of the two supposed mandates that the Fed has.

Everybody who has been in markets for a couple of decades has learned these lessons the hard way. Nobody knows more about being an arrogant, hubris-filled dickhead and getting a comeuppance multiple times more than I do. At some point, the market humbles you; you throw your hands in the air and surrender to the idea that there are people who know more than you, and that the market and its external driving factors are things that are going to be impossible to always predict.

When I was clearing out my old podcast episodes at the beginning of the year, when I decided I wasn’t going to do the podcast anymore, I left a few up for good measure—a few of my select favorites. One of them was a

This, as I have been saying for years, is a product of batshit insane monetary policy—which is set based on keeping the stock market at all-time highs, regardless of the two supposed mandates that the Fed has.

Everybody who has been in markets for a couple of decades has learned these lessons the hard way. Nobody knows more about being an arrogant, hubris-filled dickhead and getting a comeuppance multiple times more than I do. At some point, the market humbles you; you throw your hands in the air and surrender to the idea that there are people who know more than you, and that the market and its external driving factors are things that are going to be impossible to always predict.

When I was clearing out my old podcast episodes at the beginning of the year, when I decided I wasn’t going to do the podcast anymore, I left a few up for good measure—a few of my select favorites. One of them was a  , how often we’ve done it, and how it is a rite of passage along the way. Skip to about 25 minutes in when we get to it. I left it up in hopes that anybody going through the same thing we had gone through could take some comfort in listening to it.

Finally, to the extent posts about self-harm online are serious, I want to speak directly to anybody who’s having such feelings and reassure them we’ve all been there and they are not alone. They can always DM me on Twitter, shoot me a message on

, how often we’ve done it, and how it is a rite of passage along the way. Skip to about 25 minutes in when we get to it. I left it up in hopes that anybody going through the same thing we had gone through could take some comfort in listening to it.

Finally, to the extent posts about self-harm online are serious, I want to speak directly to anybody who’s having such feelings and reassure them we’ve all been there and they are not alone. They can always DM me on Twitter, shoot me a message on  , or contact me through other means, and I’ll try to do my best to remind them that, as Joey Knish says in Rounders, it’s not the end of the world. “From time to time, everybody goes bust.”

This is the game we choose. Money is not the end of the world and should never be. Would anybody choose to live or die over it, although I realize that’s not the way the world works?

And to my longtime followers—what does it say that I’m writing posts urging people thinking about doing the unthinkable not to do so over one 3% drawdown?

This is exactly the type of situation I’ve been talking about for years: an unexpected move lower in markets at a time when investors are the least mentally prepared to ever handle it. Hope everybody keeps their head on a swivel and ducks and weaves their way through any continuing volatility this coming week.

, or contact me through other means, and I’ll try to do my best to remind them that, as Joey Knish says in Rounders, it’s not the end of the world. “From time to time, everybody goes bust.”

This is the game we choose. Money is not the end of the world and should never be. Would anybody choose to live or die over it, although I realize that’s not the way the world works?

And to my longtime followers—what does it say that I’m writing posts urging people thinking about doing the unthinkable not to do so over one 3% drawdown?

This is exactly the type of situation I’ve been talking about for years: an unexpected move lower in markets at a time when investors are the least mentally prepared to ever handle it. Hope everybody keeps their head on a swivel and ducks and weaves their way through any continuing volatility this coming week.

QTR’s Disclaimer: Please read my full legal disclaimer

QTR’s Disclaimer: Please read my full legal disclaimer  with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Sat, 10/11/2025 - 17:30

with my best effort to uphold what the license asks, or with the permission of the author.

This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. If I’m long I could quickly be short and vice versa. I won’t update my positions. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. If you see numbers and calculations of any sort, assume they are wrong and double check them. I failed Algebra in 8th grade and topped off my high school math accolades by getting a D- in remedial Calculus my senior year, before becoming an English major in college so I could bullshit my way through things easier.

The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Sat, 10/11/2025 - 17:30

No Crying In The Casino

"From time to time, everybody goes bust" - Joey Knish

No Crying In The Casino

"From time to time, everybody goes bust" - Joey Knish

The Columbus Day Massacre: My Thoughts

Here’s where my head is at after today’s chaos.

It’s a great weekend to ask yourself, “Am I quickly disregarding fraud warnings about a company issued by a man who teaches a class on fraud at Yale and who called Enron’s collapse ahead of time?”

Or, “Am I quick to ridicule someone’s stance on Bitcoin or gold, despite the fact they’ve been in the game for decades and have amassed enormous personal wealth and one of the best grasps of free-market economics out of anybody in finance today?”

If the answer is yes to either of these, maybe it’s time to act a little less like a hyena and a little more like an adult. Buck up. Act like you’ve been here before. Take the pain. Learn from the pain. Come back better.

After all, the stock market is an adult game with real wins and real losses.

Third, assuming that half of posts like these are real it’s stunning to see, after simply one 3% drawdown in the market—after we have done nothing but rage to all-time highs nonstop since the market plunge in April.

It is proof positive that investors have been seduced with insanely unrealistic expectations about risk and how markets work — as I wrote in February:

It’s a great weekend to ask yourself, “Am I quickly disregarding fraud warnings about a company issued by a man who teaches a class on fraud at Yale and who called Enron’s collapse ahead of time?”

Or, “Am I quick to ridicule someone’s stance on Bitcoin or gold, despite the fact they’ve been in the game for decades and have amassed enormous personal wealth and one of the best grasps of free-market economics out of anybody in finance today?”

If the answer is yes to either of these, maybe it’s time to act a little less like a hyena and a little more like an adult. Buck up. Act like you’ve been here before. Take the pain. Learn from the pain. Come back better.

After all, the stock market is an adult game with real wins and real losses.

Third, assuming that half of posts like these are real it’s stunning to see, after simply one 3% drawdown in the market—after we have done nothing but rage to all-time highs nonstop since the market plunge in April.

It is proof positive that investors have been seduced with insanely unrealistic expectations about risk and how markets work — as I wrote in February:

This Next Market Crash Will Break Our Fragile Brains

Forget the damage to markets when the passive bid dries up and the Fed is stuck cutting rates into stagflation. The psychological damage will be wo...

Quoth the Raven #166 - Sang Lucci & QTR: Destroying Your Trading Account And Going Broke | Quoth the Raven

I had an idea a couple weeks ago to make a podcast for people who have just blown up their accounts or those who have done it in the past and know ...

No Crying In The Casino

"From time to time, everybody goes bust" - Joey Knish

QTR’s Disclaimer: Please read my full legal disclaimer

QTR’s Disclaimer: Please read my full legal disclaimer

About - QTR’s Fringe Finance

Liberty. Finance. Bullshit. Click to read QTR’s Fringe Finance, by Quoth the Raven, a Substack publication with tens of thousands of subscribers.

Tyler Durden | Zero Hedge

Zero Hedge

No Crying In The Casino | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

With a youth mental health crisis also sweeping the nation (rates of anxiety, depression, suicidal ideation, and diagnosed mental health disorders like ADHD are all at record highs), it’s not hard to imagine that the correlation between kids’ indoor confinement and their mental health struggles is more than a coincidence.

The mental health ramifications of too much screen time are easy to track, and are heavily studied. But the downstream effects of not enough time outside are equally startling. Free play and unstructured time are foundational to a child’s well-being, and in America, our kids aren’t getting it.

Seven minutes a day is barely enough time to begin to imagine the premise of a game or an imaginary adventure. Seven minutes a day is barely the amount of time it takes to walk back and forth from the bus stop. It’s not even long enough to go for a walk around the block.

Why Aren’t the Kids Outside?

The twenty-first century has provided us with a perfect storm of conditions keeping kids away from the outdoors: screens are alluring, the outside is “dangerous,” and parents encourage their kids towards sedentary “for your own good” activities (math olympiad! French tutoring! after school clubs!).

Parents fear the dangers of the outdoors. In the modern world, everything from crime statistics to urban design itself lead parents to keep their kids on a short leash. Urban settings don’t have much room for free play; parks and playgrounds and other child-centric outdoor spaces are strangely sparse, as if urban designers wanted a world without kids in it. More apartment complexes are built with dog-washing stations than playgrounds.

The modern world seems to have been built by people who forgot what childhood is, and fears of crime keep parents nervous about letting their kids freely use the spaces that do exist.

But separate from kid-centric space or the lack thereof, kids are busy. Their days are consumed by ever-expanding school requirements, structured extracurricular activities, and of course the ever-present lure of screen time—to the point that even in suburban neighborhoods with big backyards, kids are barely ever venturing outside.

Which is how we end up with kids getting seven to eight hours of screen time a day, but only four to seven minutes of unstructured free time outside—the latter of which people of our grandparents’ generations couldn’t have even imagined.

The “unstructured” part is important—“time outside” in a blanket sense isn’t enough. Spending an hour on the field for soccer practice gives kids the benefit of fresh air and sunshine and physical movement, but it isn’t giving them the psychological benefits of free play.

Unstructured means time and space away from the rules and instructions of an adult. It exists fully in the wild and whimsical world of the child: free, unimpeded, child-directed, and often tinged with a heavy dose of imagination. There are no set goals of the kind that exist in PE class or a sports club. It’s pure and unfettered, and it’s a biologically hardwired need for children’s development.

Mental Health Crisis in Childhood

Parents worry about the dangers of the outside world, but what about the dangers of the on-screen world, where grooming and exploitation are common occurrences, where adults behind screens pose as other children and talk to young people too naive to know what to watch out for? What about the physical dangers of a sedentary life?

With a youth mental health crisis also sweeping the nation (rates of anxiety, depression, suicidal ideation, and diagnosed mental health disorders like ADHD are all at record highs), it’s not hard to imagine that the correlation between kids’ indoor confinement and their mental health struggles is more than a coincidence.

The mental health ramifications of too much screen time are easy to track, and are heavily studied. But the downstream effects of not enough time outside are equally startling. Free play and unstructured time are foundational to a child’s well-being, and in America, our kids aren’t getting it.

Seven minutes a day is barely enough time to begin to imagine the premise of a game or an imaginary adventure. Seven minutes a day is barely the amount of time it takes to walk back and forth from the bus stop. It’s not even long enough to go for a walk around the block.

Why Aren’t the Kids Outside?

The twenty-first century has provided us with a perfect storm of conditions keeping kids away from the outdoors: screens are alluring, the outside is “dangerous,” and parents encourage their kids towards sedentary “for your own good” activities (math olympiad! French tutoring! after school clubs!).

Parents fear the dangers of the outdoors. In the modern world, everything from crime statistics to urban design itself lead parents to keep their kids on a short leash. Urban settings don’t have much room for free play; parks and playgrounds and other child-centric outdoor spaces are strangely sparse, as if urban designers wanted a world without kids in it. More apartment complexes are built with dog-washing stations than playgrounds.

The modern world seems to have been built by people who forgot what childhood is, and fears of crime keep parents nervous about letting their kids freely use the spaces that do exist.

But separate from kid-centric space or the lack thereof, kids are busy. Their days are consumed by ever-expanding school requirements, structured extracurricular activities, and of course the ever-present lure of screen time—to the point that even in suburban neighborhoods with big backyards, kids are barely ever venturing outside.

Which is how we end up with kids getting seven to eight hours of screen time a day, but only four to seven minutes of unstructured free time outside—the latter of which people of our grandparents’ generations couldn’t have even imagined.

The “unstructured” part is important—“time outside” in a blanket sense isn’t enough. Spending an hour on the field for soccer practice gives kids the benefit of fresh air and sunshine and physical movement, but it isn’t giving them the psychological benefits of free play.

Unstructured means time and space away from the rules and instructions of an adult. It exists fully in the wild and whimsical world of the child: free, unimpeded, child-directed, and often tinged with a heavy dose of imagination. There are no set goals of the kind that exist in PE class or a sports club. It’s pure and unfettered, and it’s a biologically hardwired need for children’s development.

Mental Health Crisis in Childhood

Parents worry about the dangers of the outside world, but what about the dangers of the on-screen world, where grooming and exploitation are common occurrences, where adults behind screens pose as other children and talk to young people too naive to know what to watch out for? What about the physical dangers of a sedentary life?

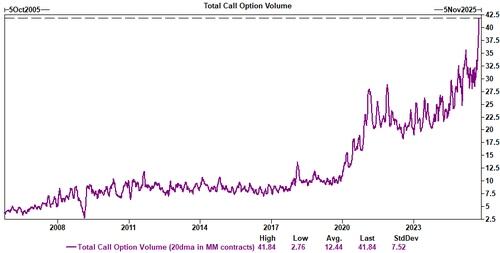

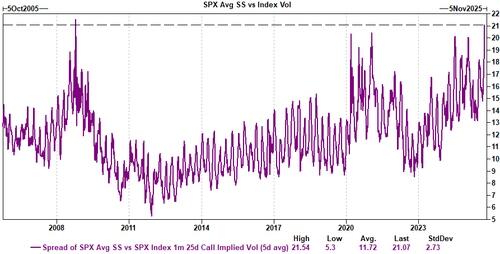

As recently noted by Goldman Sachs:

“In fact, if you look at the spread of single stock volatility to index volatility, it’s at one of the widest levels we have ever seen.”

As recently noted by Goldman Sachs:

“In fact, if you look at the spread of single stock volatility to index volatility, it’s at one of the widest levels we have ever seen.”

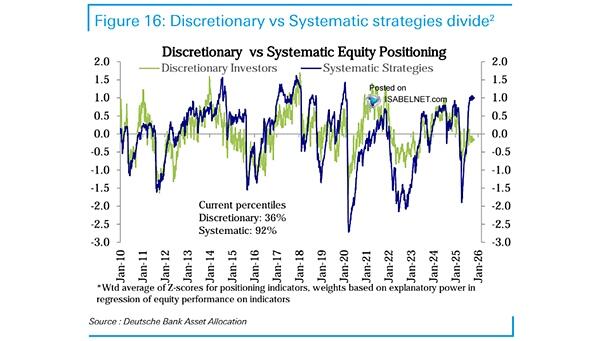

Furthermore, systematic flows had increased equity exposure, reinforcing a feedback loop of rising prices and falling volatility. Many algorithmic trading strategies are volatility-sensitive; therefore, when markets trend upward with low volatility, these strategies increase exposure. This creates a feedback loop where price action drives further buying.

Furthermore, systematic flows had increased equity exposure, reinforcing a feedback loop of rising prices and falling volatility. Many algorithmic trading strategies are volatility-sensitive; therefore, when markets trend upward with low volatility, these strategies increase exposure. This creates a feedback loop where price action drives further buying.

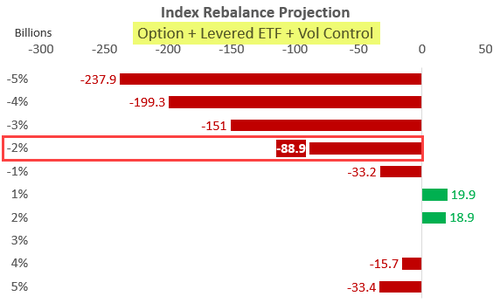

However, when volatility spikes or prices fall, the same models reverse direction and sell, potentially accelerating a downturn, which is why the market crack on Friday was so severe. In fact, we warned about the potential of this event in Friday mornings

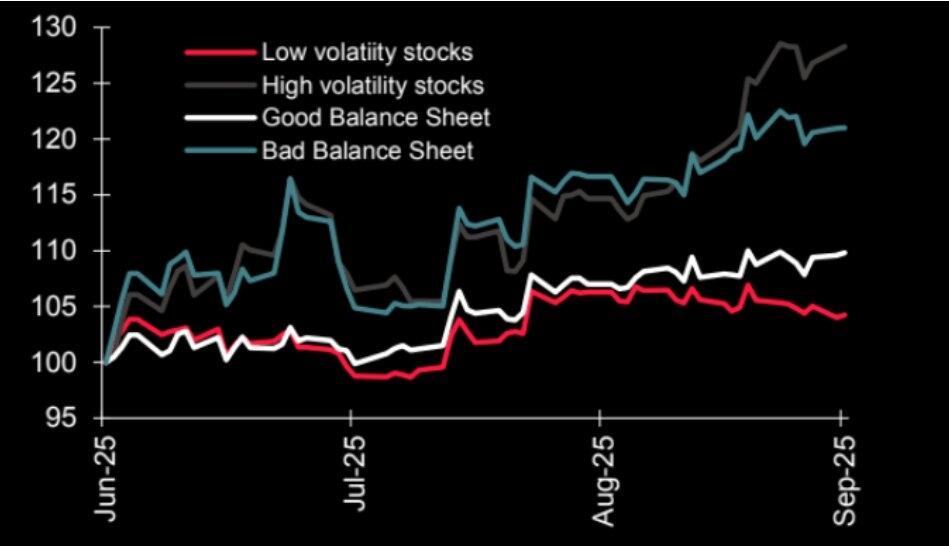

However, when volatility spikes or prices fall, the same models reverse direction and sell, potentially accelerating a downturn, which is why the market crack on Friday was so severe. In fact, we warned about the potential of this event in Friday mornings  Lastly, retail trading volume had climbed significantly, focusing on leveraged ETFs and meme stocks. Many trades are based on social media narratives, not balance sheet strength or revenue forecasts. This shift in behavior to chasing poor fundamentals and high volatility stocks has historically marked peaks, not bottoms.

Lastly, retail trading volume had climbed significantly, focusing on leveraged ETFs and meme stocks. Many trades are based on social media narratives, not balance sheet strength or revenue forecasts. This shift in behavior to chasing poor fundamentals and high volatility stocks has historically marked peaks, not bottoms.

The setup was classic: overconfidence, leverage, concentration, and it only needed a trigger. Trump’s tariff comments became the catalyst, but the fragility was already embedded. High-growth names, semiconductors, and thematic ETFs bore the brunt. Defensive sectors caught a bid, while yields fell as traders rushed to safety.

This wasn’t a crash but a market crack that happens when everyone is on the same side of the boat. On Friday, the same crowd that had been relentlessly pushing prices higher moved in the other direction. The reason the market crack was so severe reflects our previous comments that

The setup was classic: overconfidence, leverage, concentration, and it only needed a trigger. Trump’s tariff comments became the catalyst, but the fragility was already embedded. High-growth names, semiconductors, and thematic ETFs bore the brunt. Defensive sectors caught a bid, while yields fell as traders rushed to safety.

This wasn’t a crash but a market crack that happens when everyone is on the same side of the boat. On Friday, the same crowd that had been relentlessly pushing prices higher moved in the other direction. The reason the market crack was so severe reflects our previous comments that  The market crack has likely not broken the critical tailwind of the bull market as liquidity remains abundant. Fiscal deficits are large, the Fed remains dovish, and global central banks are cutting rates. All of these support continued price appreciation, but the same ingredients that drive the melt-up create instability. That instability was made evident in the market crack on Friday.

The reversal on Friday has not broken the bullish trend, yet. For investors, the risk is not in being wrong directionally, but in timing. Such is why over the last few weeks, we have repeatedly discussed the market’s negative divergences, the risk of chasing momentum, and the offside positioning of investors in general. As is always the case, momentum markets reward participation until they don’t. When everyone is positioned similarly, reversals have no buffer, the exits are narrower, and the market cracks are larger. This is particularly the case with virtually every asset class hitting all-time highs, from large-cap stocks to international and emerging markets to gold and bitcoin.

Everyone has a “narrative” about why their particular asset of choice is rising; however, they can’t all be correct. Furthermore, the eventual reversal is also correlated when all asset classes become highly correlated.

The Risks Of Narratives

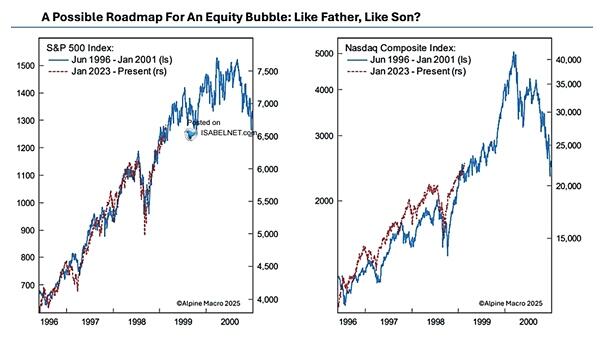

As noted, everyone has a narrative for why their favorite asset class is going higher. Leon Cooperman recently warned that we have entered the phase of the bull market that Warren Buffett feared most. He cited Buffett’s warning:

“Once a market reaches the point where everyone makes money regardless of strategy, the crowd shifts from rational investing to fear of missing out.”

In Cooperman’s view, earnings or interest rate dynamics no longer support the rally; it is just the price action itself. Investors are buying only because prices are rising. That kind of behavior never ends well. As he discussed, valuations, like the Buffett Indicator, and crowd behavior, are key reasons for concern. The Buffett Indicator, the ratio of total market capitalization to GDP, has crossed 200 percent. That level exceeds historical extremes, suggesting that the tether between equities and the real economy broke.

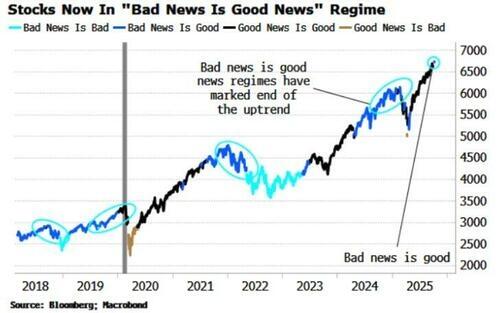

Furthermore, Simon White at Bloomberg recently noted that we have entered the

The market crack has likely not broken the critical tailwind of the bull market as liquidity remains abundant. Fiscal deficits are large, the Fed remains dovish, and global central banks are cutting rates. All of these support continued price appreciation, but the same ingredients that drive the melt-up create instability. That instability was made evident in the market crack on Friday.

The reversal on Friday has not broken the bullish trend, yet. For investors, the risk is not in being wrong directionally, but in timing. Such is why over the last few weeks, we have repeatedly discussed the market’s negative divergences, the risk of chasing momentum, and the offside positioning of investors in general. As is always the case, momentum markets reward participation until they don’t. When everyone is positioned similarly, reversals have no buffer, the exits are narrower, and the market cracks are larger. This is particularly the case with virtually every asset class hitting all-time highs, from large-cap stocks to international and emerging markets to gold and bitcoin.

Everyone has a “narrative” about why their particular asset of choice is rising; however, they can’t all be correct. Furthermore, the eventual reversal is also correlated when all asset classes become highly correlated.

The Risks Of Narratives

As noted, everyone has a narrative for why their favorite asset class is going higher. Leon Cooperman recently warned that we have entered the phase of the bull market that Warren Buffett feared most. He cited Buffett’s warning:

“Once a market reaches the point where everyone makes money regardless of strategy, the crowd shifts from rational investing to fear of missing out.”

In Cooperman’s view, earnings or interest rate dynamics no longer support the rally; it is just the price action itself. Investors are buying only because prices are rising. That kind of behavior never ends well. As he discussed, valuations, like the Buffett Indicator, and crowd behavior, are key reasons for concern. The Buffett Indicator, the ratio of total market capitalization to GDP, has crossed 200 percent. That level exceeds historical extremes, suggesting that the tether between equities and the real economy broke.

Furthermore, Simon White at Bloomberg recently noted that we have entered the  As he concludes:

“Previous times around the last three major market tops, this regime has been in play. It is often preceded by a “good news is good news” regime (white line in chart), where stocks intuitively rally when it looks like the economy is strengthening. If we roll the chart further back, it shows the “bad news is good news” regime was in play before the 2011 and 2015 tops, too.

However, there are a couple of caveats. Firstly, as we can see above, the “bad news is good” regimes can last for several months before the market corrects. This time could be no different. Secondly, in the 2000s and 2010s there were several periods where the “bad news is good” regime came mid-cycle, ie, in the middle of the rally.

It’s possible that’s the case today, but with potentially huge overinvestment in the AI sphere, all-time high valuations, and increasing signs of speculative froth, you wouldn’t want to bank on it.“

As we saw on Friday, small shocks can create significant price moves in these environments when fundamentals no longer anchor pricing. Bob Farrell once noted that crowd behavior is naturally unstable; “when all experts agree, something else tends to happen.” All the “experts” and investors expect higher prices on everything.

That one-sided bias, and most importantly, “rationalized narratives” to justify overpaying for an asset, increases the probability that even minor disappointments cause outsized reactions.

This is not about fear. It is about risk math. Expected returns are lower, volatility is rising, and the asymmetry now favors caution.

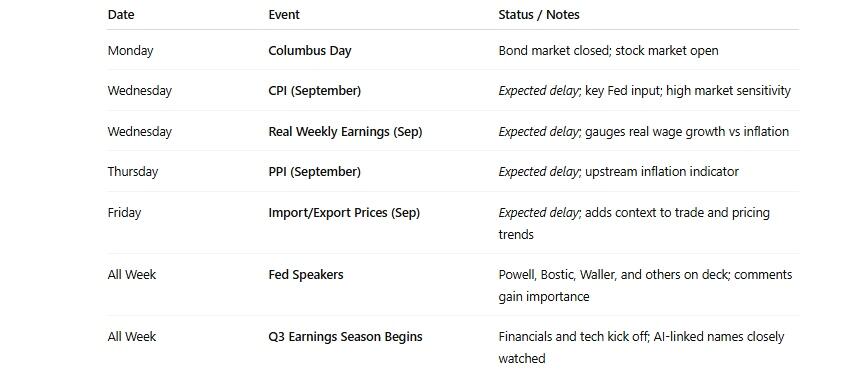

🔑 Key Catalysts Next Week

The economic calendar for the upcoming week was expected to provide critical updates on inflation and wage growth. However, due to the ongoing government shutdown, the release of major reports from the Bureau of Labor Statistics and the Census Bureau is uncertain. If not resolved by early next week, most federal economic data, including CPI and PPI, will be delayed. That removes essential guidance at a time when investor positioning is heavily dependent on a soft-landing narrative.

Below is the updated calendar, based on current scheduling and shutdown contingencies:

As he concludes:

“Previous times around the last three major market tops, this regime has been in play. It is often preceded by a “good news is good news” regime (white line in chart), where stocks intuitively rally when it looks like the economy is strengthening. If we roll the chart further back, it shows the “bad news is good news” regime was in play before the 2011 and 2015 tops, too.

However, there are a couple of caveats. Firstly, as we can see above, the “bad news is good” regimes can last for several months before the market corrects. This time could be no different. Secondly, in the 2000s and 2010s there were several periods where the “bad news is good” regime came mid-cycle, ie, in the middle of the rally.

It’s possible that’s the case today, but with potentially huge overinvestment in the AI sphere, all-time high valuations, and increasing signs of speculative froth, you wouldn’t want to bank on it.“

As we saw on Friday, small shocks can create significant price moves in these environments when fundamentals no longer anchor pricing. Bob Farrell once noted that crowd behavior is naturally unstable; “when all experts agree, something else tends to happen.” All the “experts” and investors expect higher prices on everything.

That one-sided bias, and most importantly, “rationalized narratives” to justify overpaying for an asset, increases the probability that even minor disappointments cause outsized reactions.

This is not about fear. It is about risk math. Expected returns are lower, volatility is rising, and the asymmetry now favors caution.

🔑 Key Catalysts Next Week

The economic calendar for the upcoming week was expected to provide critical updates on inflation and wage growth. However, due to the ongoing government shutdown, the release of major reports from the Bureau of Labor Statistics and the Census Bureau is uncertain. If not resolved by early next week, most federal economic data, including CPI and PPI, will be delayed. That removes essential guidance at a time when investor positioning is heavily dependent on a soft-landing narrative.

Below is the updated calendar, based on current scheduling and shutdown contingencies:

Markets will monitor any resolution to the shutdown early in the week. There is little hope of any resolution to the shutdown this coming week, so traders will be forced to rely on Fed guidance and earnings to interpret macro conditions. Speaking of earnings, they will likely carry more influence than usual. With macro data paused, forward guidance and margin commentary from large-cap tech, semiconductors, and banks will shape sentiment. If guidance softens or margins compress, equity markets could face pressure, particularly with positioning heavy in AI and high-beta growth.

Without inflation data, volatility could increase as investor expectations become more speculative. Rate assumptions are increasingly disconnected from policy statements. Once released, that gap may close quickly if CPI or PPI points away from disinflation. Until then, markets will be trading on limited visibility.

Markets will monitor any resolution to the shutdown early in the week. There is little hope of any resolution to the shutdown this coming week, so traders will be forced to rely on Fed guidance and earnings to interpret macro conditions. Speaking of earnings, they will likely carry more influence than usual. With macro data paused, forward guidance and margin commentary from large-cap tech, semiconductors, and banks will shape sentiment. If guidance softens or margins compress, equity markets could face pressure, particularly with positioning heavy in AI and high-beta growth.

Without inflation data, volatility could increase as investor expectations become more speculative. Rate assumptions are increasingly disconnected from policy statements. Once released, that gap may close quickly if CPI or PPI points away from disinflation. Until then, markets will be trading on limited visibility.

Related:

Related:

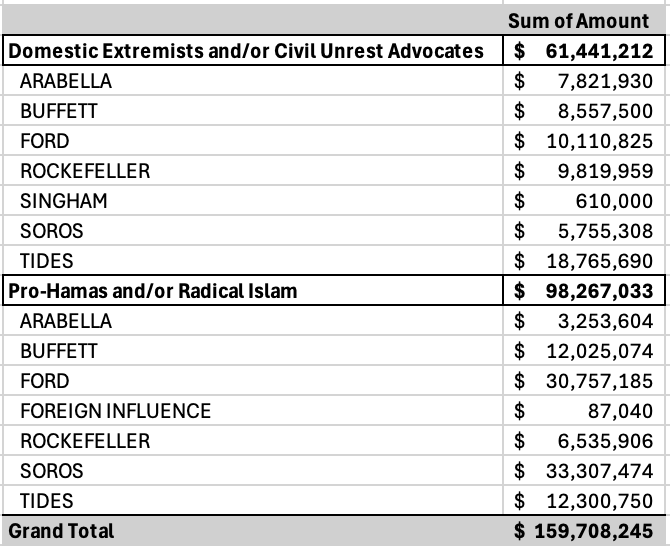

Listen to Bruner.

Way more than $100M of US taxpayer money

— Elon Musk (@elonmusk)

Listen to Bruner.

Way more than $100M of US taxpayer money

— Elon Musk (@elonmusk)

Jørgen Watne Frydnes, chair of the Norwegian Nobel Committee, displays a photo of winner María Corina Machado on his smartphone in Oslo on Friday © Rodrigo Freitas/NTB/AFP/Getty Images

Roughly 11 hours before the closely watched award was given to Venezuelan resistance leader Maria Corina Machado this morning, the odds of her victory surged from near-zero to over 70% on Polymarket.

The market on this year’s Nobel Peace Prize winner has accumulated over $21.4 million in trading volume since opening in July.

For nearly all of that time, the odds of Machado receiving the coveted prize have hovered around a 1% or 2% likelihood.

Then, Thursday night, shortly before 1:00 am Norway time, the Venezualan’s odds of winning surged to over 43%.

By 2:00 am, they hit 73%.

Jørgen Watne Frydnes, chair of the Norwegian Nobel Committee, displays a photo of winner María Corina Machado on his smartphone in Oslo on Friday © Rodrigo Freitas/NTB/AFP/Getty Images

Roughly 11 hours before the closely watched award was given to Venezuelan resistance leader Maria Corina Machado this morning, the odds of her victory surged from near-zero to over 70% on Polymarket.

The market on this year’s Nobel Peace Prize winner has accumulated over $21.4 million in trading volume since opening in July.

For nearly all of that time, the odds of Machado receiving the coveted prize have hovered around a 1% or 2% likelihood.

Then, Thursday night, shortly before 1:00 am Norway time, the Venezualan’s odds of winning surged to over 43%.

By 2:00 am, they hit 73%.

The identity of the recipient of the Nobel Peace Prize -one of the most coveted awards in the world - is typically kept tightly under wraps. Even Machado herself did not find out she had won the award until minutes before the news was announced publicly in Oslo at 11:00 am this morning.

The five-member

The identity of the recipient of the Nobel Peace Prize -one of the most coveted awards in the world - is typically kept tightly under wraps. Even Machado herself did not find out she had won the award until minutes before the news was announced publicly in Oslo at 11:00 am this morning.

The five-member

"Last night, the enemy attacked energy and civilian infrastructure in the Odesa region," regional governor Oleh Kiper confirmed on Telegram. "Power engineers are making every effort to fully restore the power supply," he added.

To give a sense of just how vast the outage was, Ukrainian energy firm DTEK later said it was able to restore power to over 240,000 households in the region, but with many more still in need of help.

Just within the 24-hour prior, the Kyiv area also experienced rare blackouts, along with many other regions, after a key electrical generation plant was directly struck by either missiles or drones.

Reuters has attempted to calculate the scale of the prior Thursday to Friday overnight attack

"Last night, the enemy attacked energy and civilian infrastructure in the Odesa region," regional governor Oleh Kiper confirmed on Telegram. "Power engineers are making every effort to fully restore the power supply," he added.

To give a sense of just how vast the outage was, Ukrainian energy firm DTEK later said it was able to restore power to over 240,000 households in the region, but with many more still in need of help.

Just within the 24-hour prior, the Kyiv area also experienced rare blackouts, along with many other regions, after a key electrical generation plant was directly struck by either missiles or drones.

Reuters has attempted to calculate the scale of the prior Thursday to Friday overnight attack

Such is the case with the liberal media’s fawning over the Republican governor of Wyoming for his embrace of “alternatives,” including a glowing profile last year on CBS’

Such is the case with the liberal media’s fawning over the Republican governor of Wyoming for his embrace of “alternatives,” including a glowing profile last year on CBS’

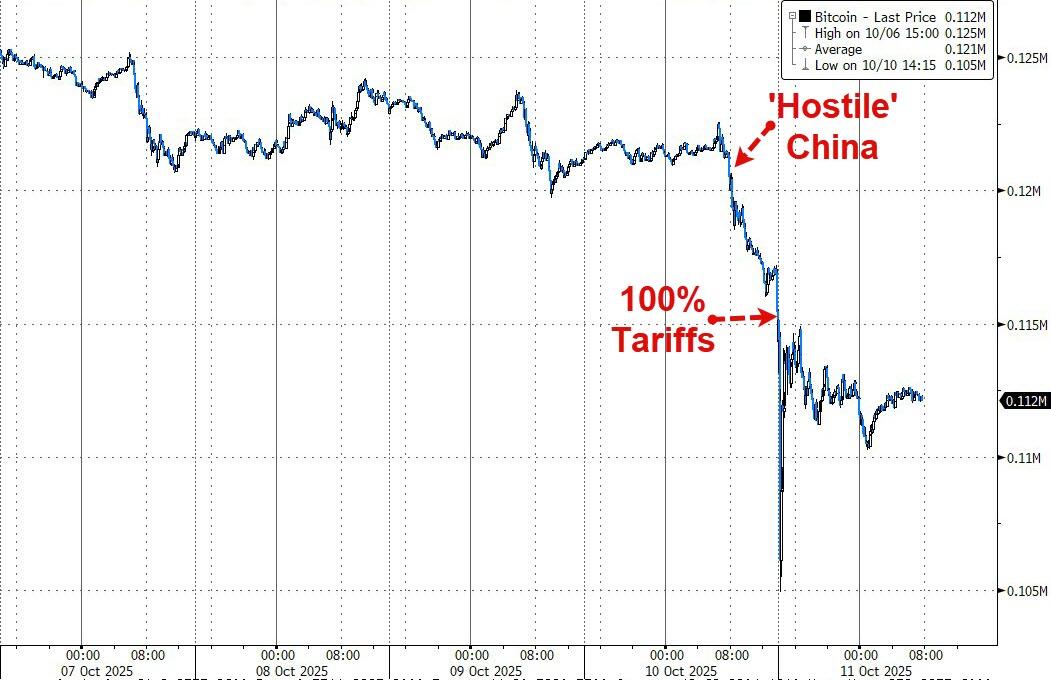

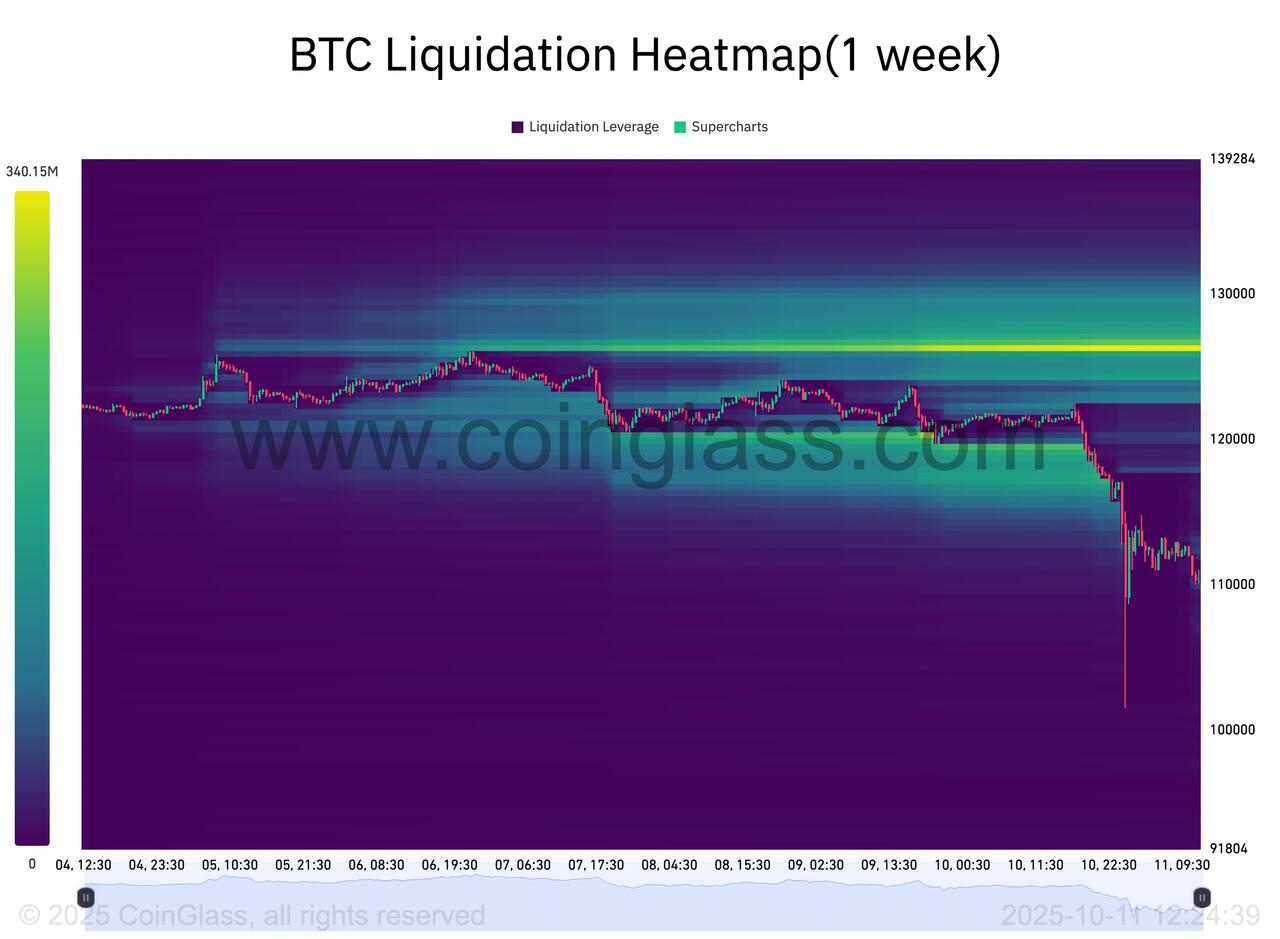

October has historically been a particularly strong month for Bitcoin’s price - a longstanding pattern that has led much of the crypto industry to expect the same results come every fall. The trend at first seemed poised to continue this year; the first week of this month, BTC surged some 10.5% to a new all-time high price north of $126,000.

Bitcoin plunged to $105,000 - its lowest since June - following Trump's aft-hours tweet yesterday...

October has historically been a particularly strong month for Bitcoin’s price - a longstanding pattern that has led much of the crypto industry to expect the same results come every fall. The trend at first seemed poised to continue this year; the first week of this month, BTC surged some 10.5% to a new all-time high price north of $126,000.

Bitcoin plunged to $105,000 - its lowest since June - following Trump's aft-hours tweet yesterday...

...before bouncing back above $112,000

...before bouncing back above $112,000

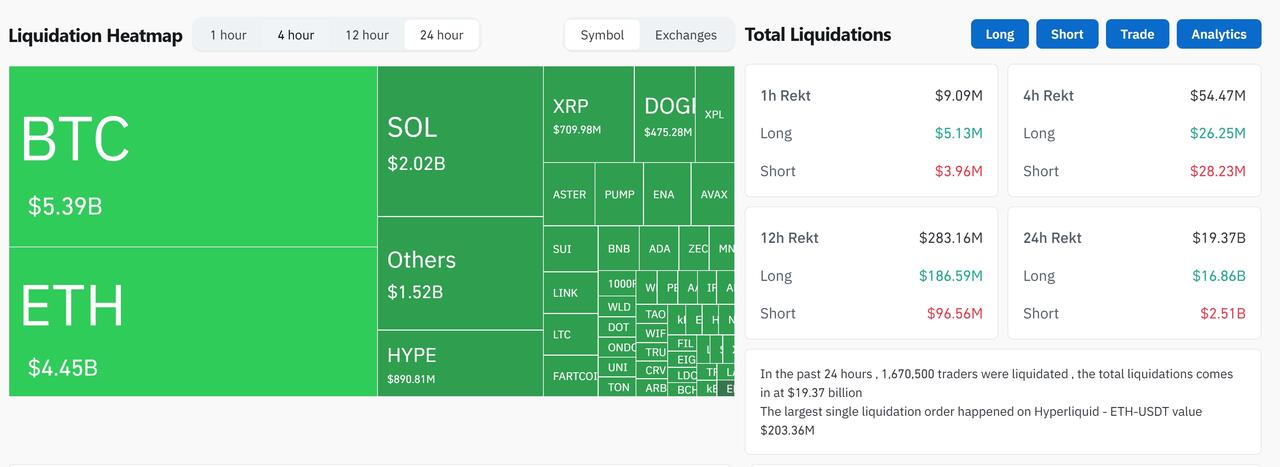

Ethereum was also clubbed like a baby seal...

Ethereum was also clubbed like a baby seal...

But that was the least of it as dozens of so-called alt-coins saw almost total wipe-outs.

But that was the least of it as dozens of so-called alt-coins saw almost total wipe-outs.

“The actual total is likely much higher — Binance only reports one liquidation order per second,” CoinGlass

“The actual total is likely much higher — Binance only reports one liquidation order per second,” CoinGlass

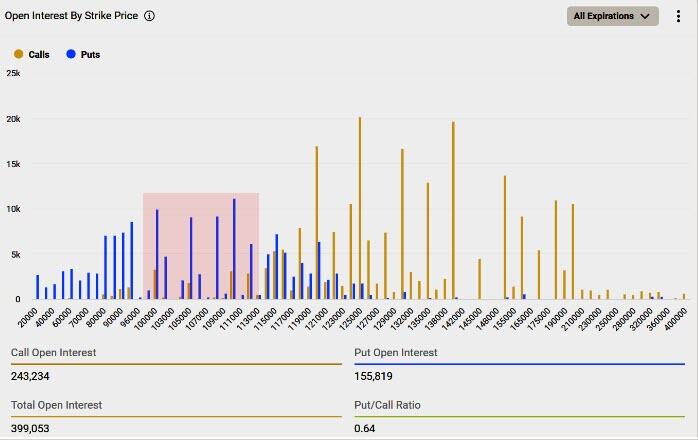

Exchange order-book liquidity showed a severe imbalance between bids and asks - resistance was stacked around $120,000, while little support was in place to prevent a fresh dive toward the $100,000 mark.

Exchange order-book liquidity showed a severe imbalance between bids and asks - resistance was stacked around $120,000, while little support was in place to prevent a fresh dive toward the $100,000 mark.

Perhaps the most impacted asset of the day was Trump’s own crypto token. WLFI, the native token of World Liberty Financial, the Trump family’s crypto platform, plummeted almost 50% immediately following the president’s China announcement, to just south of $0.10 a token. It has since partially recovered to $0.13...

Perhaps the most impacted asset of the day was Trump’s own crypto token. WLFI, the native token of World Liberty Financial, the Trump family’s crypto platform, plummeted almost 50% immediately following the president’s China announcement, to just south of $0.10 a token. It has since partially recovered to $0.13...

David Jeong, chief executive officer at Tread.fi, an algorithmic crypto trading platform for institutional traders, said the market was experiencing a “black swan event.”

“It is likely that many institutions did not expect this level of volatility and with how leveraged perpetual futures are designed, many large traders, including institutions, would have gotten liquidated,” he said.

Perpetual futures are a type of contract with no expiration, and are used by crypto traders to trade leveraged positions around the clock.

The next major support level for Bitcoin is $100,000, according to Caroline Mauron, co-founder of Orbit Markets, below which “would signal the end of past three-year bull cycle.”

Vincent Liu, chief investment officer at Kronos Research, said the rout was “sparked by US-China tariff fears but fueled by institutional over-leverage.”

“This highlights crypto’s macro ties,” he said.

“Expect volatility, but watch for rebound signals in cleared markets.”

Bitcoin options market reflected Mauron’s views with highest number of ‘put’ or sell strikes at $110,000 and next highest at $100,000, according to data on Deribit platform.

David Jeong, chief executive officer at Tread.fi, an algorithmic crypto trading platform for institutional traders, said the market was experiencing a “black swan event.”

“It is likely that many institutions did not expect this level of volatility and with how leveraged perpetual futures are designed, many large traders, including institutions, would have gotten liquidated,” he said.

Perpetual futures are a type of contract with no expiration, and are used by crypto traders to trade leveraged positions around the clock.

The next major support level for Bitcoin is $100,000, according to Caroline Mauron, co-founder of Orbit Markets, below which “would signal the end of past three-year bull cycle.”

Vincent Liu, chief investment officer at Kronos Research, said the rout was “sparked by US-China tariff fears but fueled by institutional over-leverage.”

“This highlights crypto’s macro ties,” he said.

“Expect volatility, but watch for rebound signals in cleared markets.”

Bitcoin options market reflected Mauron’s views with highest number of ‘put’ or sell strikes at $110,000 and next highest at $100,000, according to data on Deribit platform.

“The focus now turns to counterparty exposure and whether this triggers broader market contagion,” said Brian Strugats, head trader at Multicoin Capital. He added that some estimates place total liquidations above $30 billion.

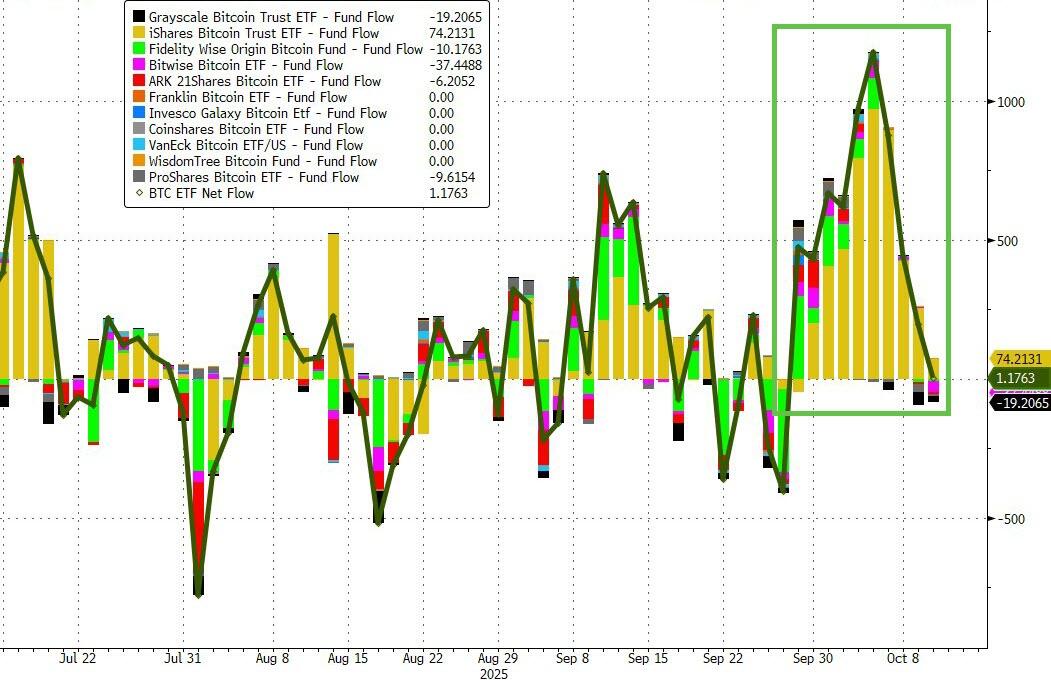

Ahead of all this carnage, US spot Bitcoin ETFs continued their strong “Uptober” performance with $2.71 billion in weekly inflows, marking another strong week for institutional demand.

“Capital keeps flowing into BTC as allocators double down on the digital gold conviction trade. Liquidity is building now as the market momentum takes shape,” Vincent Liu, chief investment officer at quantitative trading firm Kronos Research, told Cointelegraph.

“The focus now turns to counterparty exposure and whether this triggers broader market contagion,” said Brian Strugats, head trader at Multicoin Capital. He added that some estimates place total liquidations above $30 billion.

Ahead of all this carnage, US spot Bitcoin ETFs continued their strong “Uptober” performance with $2.71 billion in weekly inflows, marking another strong week for institutional demand.

“Capital keeps flowing into BTC as allocators double down on the digital gold conviction trade. Liquidity is building now as the market momentum takes shape,” Vincent Liu, chief investment officer at quantitative trading firm Kronos Research, told Cointelegraph.

Obviously, these flows came before the after-hours collapse that triggered the massive liquidations, but we are seeing a bid return in quiet Saturday trading.

“Trump’s tariff threat looks more like a negotiation tactic than a policy pivot, classic pressure play,” Liu said.

“Markets may flinch short term, but smart money knows the game: macro noise, conviction unchanged,” he added.

Finally,

Obviously, these flows came before the after-hours collapse that triggered the massive liquidations, but we are seeing a bid return in quiet Saturday trading.

“Trump’s tariff threat looks more like a negotiation tactic than a policy pivot, classic pressure play,” Liu said.

“Markets may flinch short term, but smart money knows the game: macro noise, conviction unchanged,” he added.

Finally,

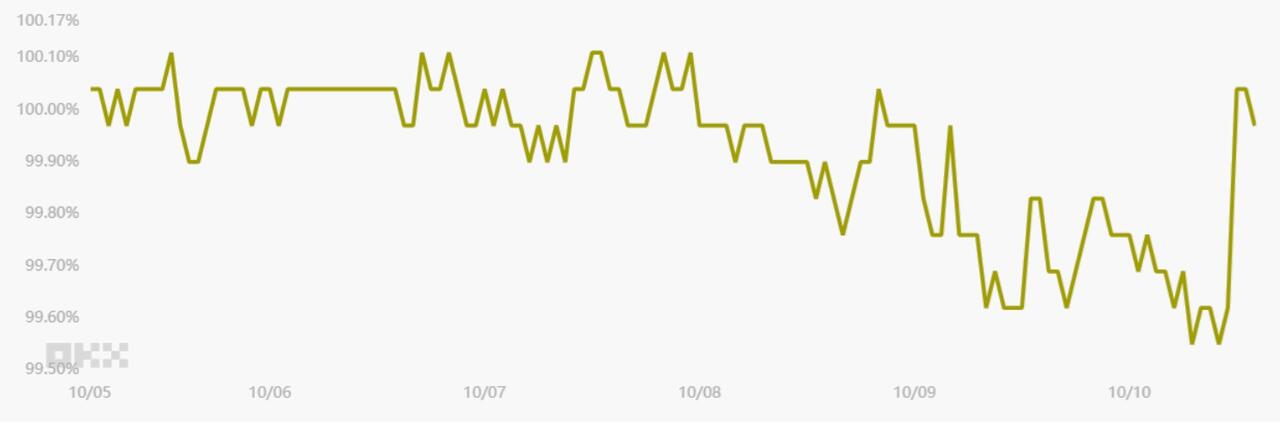

Tether (USDT/CNY) vs. US dollar/CNY. Source: OKX

Tether had been trading at a slight discount since Wednesday, suggesting traders were previously cashing out as Bitcoin struggled to maintain bullish momentum.

However, the metric returned to parity after BTC fell below $120,000, indicating that traders are no longer eager to exit the crypto market.

Tether (USDT/CNY) vs. US dollar/CNY. Source: OKX

Tether had been trading at a slight discount since Wednesday, suggesting traders were previously cashing out as Bitcoin struggled to maintain bullish momentum.

However, the metric returned to parity after BTC fell below $120,000, indicating that traders are no longer eager to exit the crypto market.

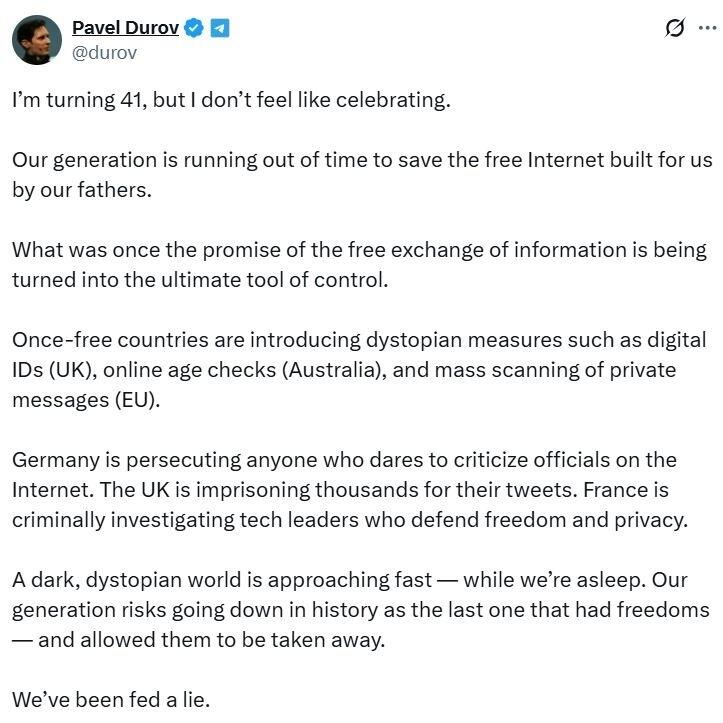

“I’m turning 41, but I don’t feel like celebrating. Our generation is running out of time to save the free internet built for us by our fathers,”

“I’m turning 41, but I don’t feel like celebrating. Our generation is running out of time to save the free internet built for us by our fathers,”

Source:

Source:

Source:

Source:

Ukrainian scholar and historian,

Ukrainian scholar and historian,