The Hidden History Of Policy Theft & Skyrocketing Gold

The Hidden History Of Policy Theft & Skyrocketing Gold

As gold continues to rocket north with continuous all-time highs, some investors are still wondering, well… why?

The answer has less to do with gold’s consistent physical and monetary properties, and more to do with historical human –and hence policy—weakness, which makes this metal almost

As gold continues to rocket north with continuous all-time highs, some investors are still wondering, well… why?

The answer has less to do with gold’s consistent physical and monetary properties, and more to do with historical human –and hence policy—weakness, which makes this metal almost  .

Let’s dig in.

Lead to Temptation

Some crimes are harder to see than the classic patterns of masked men robbing citizens at gunpoint.

Here, we examine the ironic yet hard truth that unmasked policy makers are deliberately and quietly robbing their citizens with embarrassing impunity.

This temptation toward

.

Let’s dig in.

Lead to Temptation

Some crimes are harder to see than the classic patterns of masked men robbing citizens at gunpoint.

Here, we examine the ironic yet hard truth that unmasked policy makers are deliberately and quietly robbing their citizens with embarrassing impunity.

This temptation toward  is done without black cowboy hats or stuffing cash into a burlap bag while scared bystanders hold their hands in the air.

Instead, politicos, in neckties and blue suits, commit identical theft with far greater subtlety and destruction—smiling the entire time for re-election.

How?

Currency De-Valuation as Policy: History 101

The answer, as always, lies in the

to pay down unfathomable sovereign debts by robbing from the people.

To see this clearly, let’s start with a little history.

As far back as the 1500s, Sir Thomas Gresham (from which “Gresham’s Law” originated) explained that whenever trusted money (i.e., gold) circulates at the same time as bad currency (i.e., paper/fiat “money”), some folks eventually figure out that it is better to save in gold and spend in fiat.

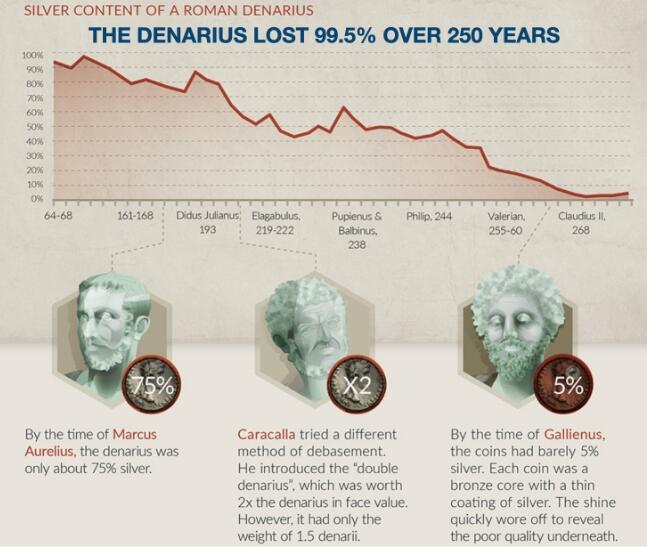

From Ancient Rome Onwards

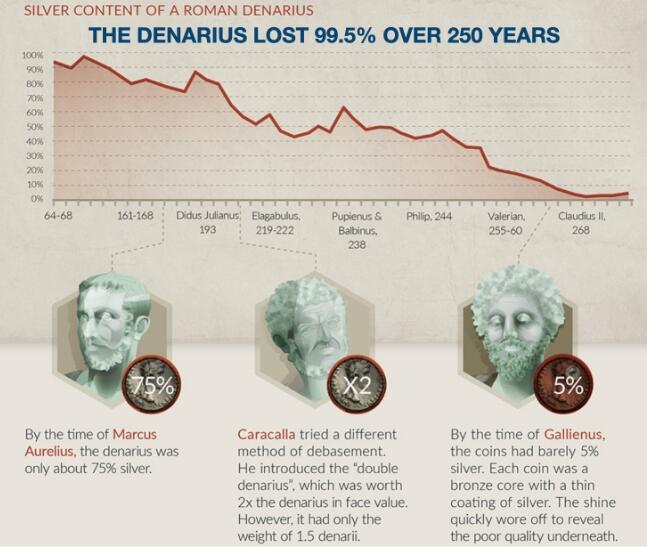

These patterns go as far back as ancient Rome, when leaders—over their ears in debt from too many promises, wars and drunken spending—began to chip away at the silver in their Denarius coins, debasing their currency to “pay” down debt.

Eventually (over a period of about 250 years), this resulted in a Denarius with zero silver content.

is done without black cowboy hats or stuffing cash into a burlap bag while scared bystanders hold their hands in the air.

Instead, politicos, in neckties and blue suits, commit identical theft with far greater subtlety and destruction—smiling the entire time for re-election.

How?

Currency De-Valuation as Policy: History 101

The answer, as always, lies in the

to pay down unfathomable sovereign debts by robbing from the people.

To see this clearly, let’s start with a little history.

As far back as the 1500s, Sir Thomas Gresham (from which “Gresham’s Law” originated) explained that whenever trusted money (i.e., gold) circulates at the same time as bad currency (i.e., paper/fiat “money”), some folks eventually figure out that it is better to save in gold and spend in fiat.

From Ancient Rome Onwards

These patterns go as far back as ancient Rome, when leaders—over their ears in debt from too many promises, wars and drunken spending—began to chip away at the silver in their Denarius coins, debasing their currency to “pay” down debt.

Eventually (over a period of about 250 years), this resulted in a Denarius with zero silver content.

Medieval Europe later followed this desperate playbook by replacing its gold money with copper money.

The French did a similar

Medieval Europe later followed this desperate playbook by replacing its gold money with copper money.

The French did a similar  , and it ended with a lot of rolling heads…

This is because real money eventually drives out bad currencies whenever a fiat system approaches its breaking point.

This cycle became an economic rule which the 18th century French economist, Adolphe Thiers, spelled out clearly and which history subsequently confirmed from the wheelbarrow money of Weimar Germany to similar currency/debt debacles in Zimbabwe and Venezuela.

In such contexts of extreme debt and debased currencies, no one wants to hold worthless paper money.

The desire for real money-gold-becomes a desperate and historical thirst.

Gone With the Wind

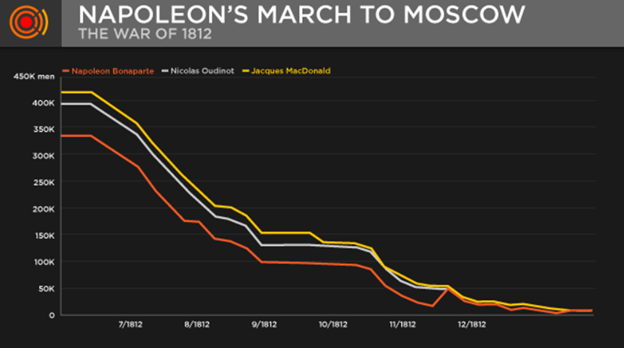

During the US Civil War, for example, the Confederate States of 1865 were on their last leg, as its Army of Northern Virginia bled out during the Petersburg siege.

The army’s commander, Robert E. Lee, was obviously worried about saving his dwindling troops, but in the waning hours of the Confederacy, the primary theme of the letters to his most trusted general, James Longstreet, centred around

, artillery or horses.

Why?

Because without real money, even his most devoted soldiers could not be supplied.

Unfortunately, their fiscally over-stretched Confederate President, Jefferson Davis, had already debased the Confederate currency to pay debts which their rebel economy could not sustain.

Wages, salaries and savings could not keep up with inflation rates (currency debasement), which not even the cleverest liars in Richmond could hide or deny.

After failed policies of familiar

, and it ended with a lot of rolling heads…

This is because real money eventually drives out bad currencies whenever a fiat system approaches its breaking point.

This cycle became an economic rule which the 18th century French economist, Adolphe Thiers, spelled out clearly and which history subsequently confirmed from the wheelbarrow money of Weimar Germany to similar currency/debt debacles in Zimbabwe and Venezuela.

In such contexts of extreme debt and debased currencies, no one wants to hold worthless paper money.

The desire for real money-gold-becomes a desperate and historical thirst.

Gone With the Wind

During the US Civil War, for example, the Confederate States of 1865 were on their last leg, as its Army of Northern Virginia bled out during the Petersburg siege.

The army’s commander, Robert E. Lee, was obviously worried about saving his dwindling troops, but in the waning hours of the Confederacy, the primary theme of the letters to his most trusted general, James Longstreet, centred around

, artillery or horses.

Why?

Because without real money, even his most devoted soldiers could not be supplied.

Unfortunately, their fiscally over-stretched Confederate President, Jefferson Davis, had already debased the Confederate currency to pay debts which their rebel economy could not sustain.

Wages, salaries and savings could not keep up with inflation rates (currency debasement), which not even the cleverest liars in Richmond could hide or deny.

After failed policies of familiar  , the jig was up on the rebel currency, and gold mattered more than bullets…

But there was not enough gold to go around.

Not long after, the Confederacy, like so many other paper-currency nations before and since, was gone with the wind…

But Not the USD!?

Some, of course, will rightly say: “The US today is nothing like ancient Rome, Weimar Germany or the Rebel South of 1865!”

Well, yes and no…

The USA (and USD) is certainly stronger than 19th 19th-century Confederate currency, a 3rd-century Roman Denarius or the German Mark of 20th 20th-century Weimar.

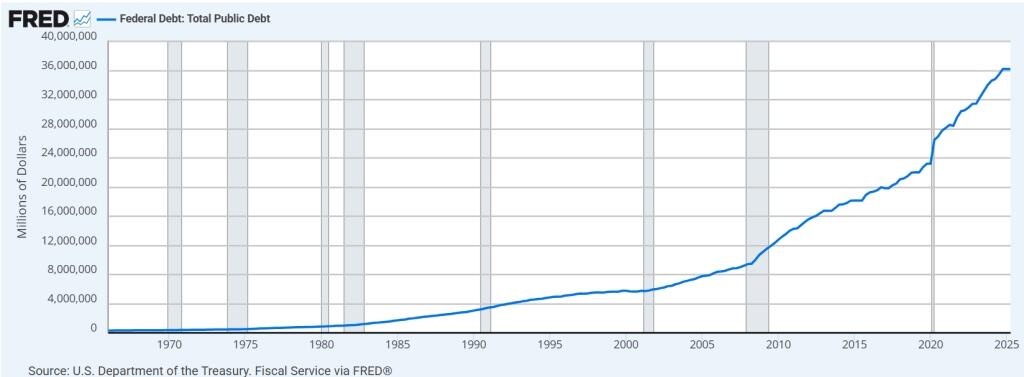

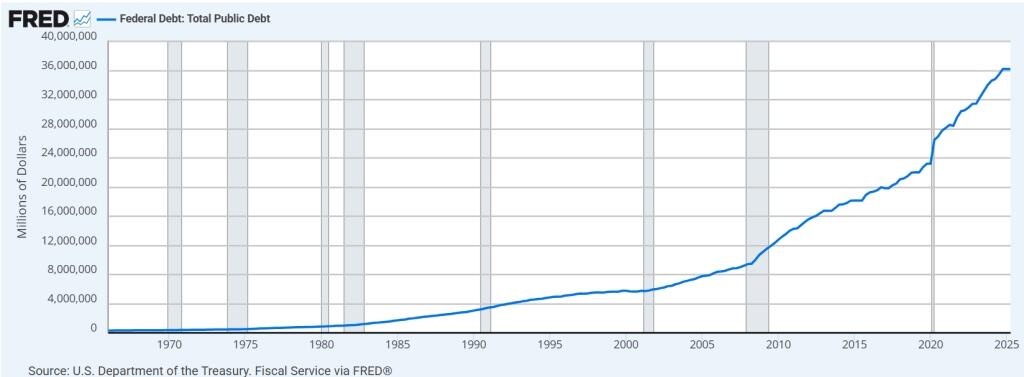

But debt is still debt, and US debt is embarrassing…

, the jig was up on the rebel currency, and gold mattered more than bullets…

But there was not enough gold to go around.

Not long after, the Confederacy, like so many other paper-currency nations before and since, was gone with the wind…

But Not the USD!?

Some, of course, will rightly say: “The US today is nothing like ancient Rome, Weimar Germany or the Rebel South of 1865!”

Well, yes and no…

The USA (and USD) is certainly stronger than 19th 19th-century Confederate currency, a 3rd-century Roman Denarius or the German Mark of 20th 20th-century Weimar.

But debt is still debt, and US debt is embarrassing…

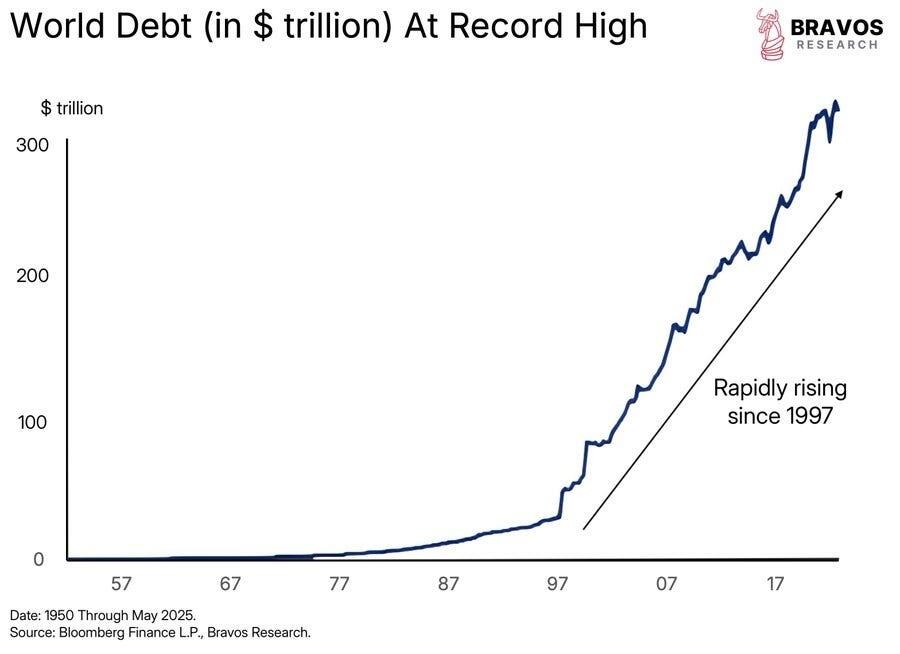

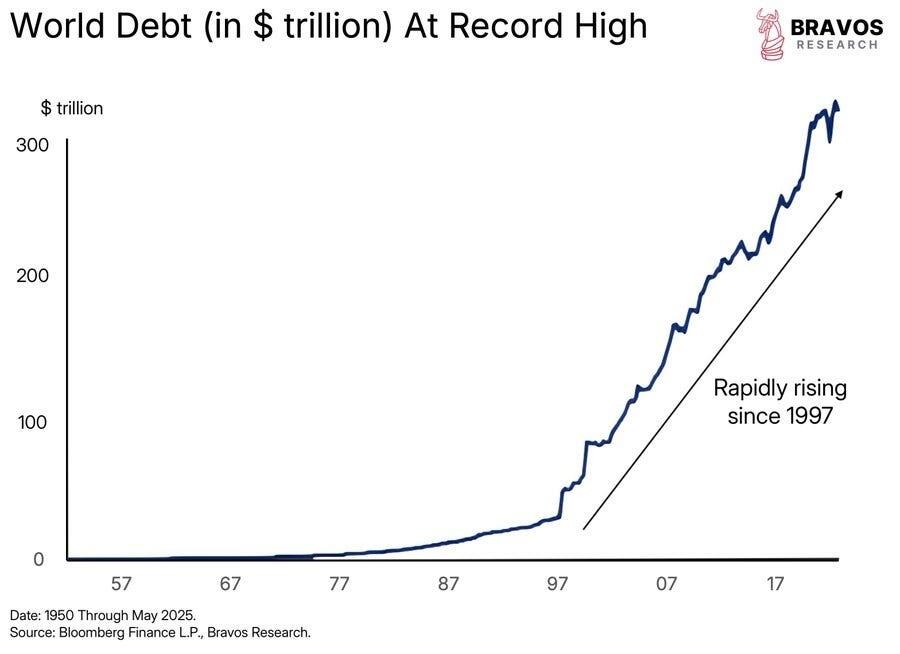

And global debt is no less so…

And global debt is no less so…

Unfortunately, Gresham’s law, like Thiers’ rules, still apply as much today as yesterday. The death just takes a little longer for a world reserve currency…

What we are seeing today with the USD’s open decline and mis-reported inflationary decay is, in fact, nothing new to man, history or economic rules.

Inflation Is Theft

Take another forgotten truth-teller of the forgotten science of honest economics, the 18th century Irish/Frenchman, Richard Cantillon, from which the “Cantillon Effect” got its name.

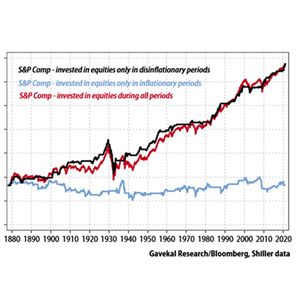

The Cantillon Effect, like history, teaches us that inflation is not only a deliberate theft by policy makers, but also a wealth transfer from the masses to the elites—something familiar to anyone paying attention to US history…

Cantillon shows how new money (i.e., printed or mouse-clicked money) is not accidental nor class-blind.

New money always goes to (and enriches) the top 10% first before it later shafts the bottom 90% second.

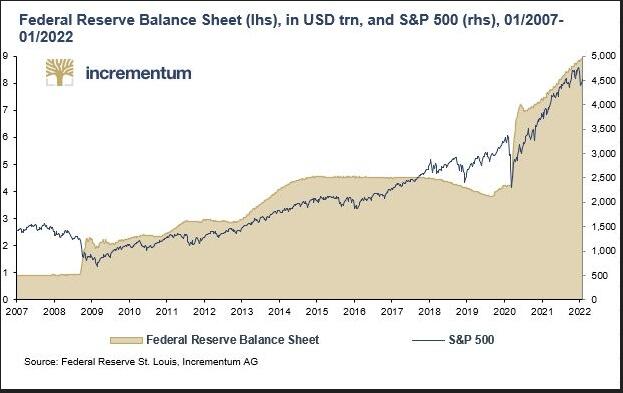

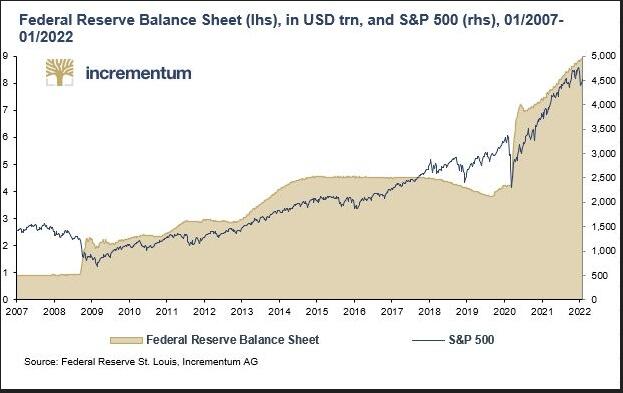

That is, the elites, who already own stocks and real estate (90% of US stocks are held by the top 10%), are the first to benefit from the obvious inflation in stocks and real estate, which always follows money creation in lock-step.

The TARP/QE-rescued Wall Street, for example, saw this first hand, when every new version of QE correlated 1:1 with a rise in a stock market drunk on the money printed post-GFC/2008.

Unfortunately, Gresham’s law, like Thiers’ rules, still apply as much today as yesterday. The death just takes a little longer for a world reserve currency…

What we are seeing today with the USD’s open decline and mis-reported inflationary decay is, in fact, nothing new to man, history or economic rules.

Inflation Is Theft

Take another forgotten truth-teller of the forgotten science of honest economics, the 18th century Irish/Frenchman, Richard Cantillon, from which the “Cantillon Effect” got its name.

The Cantillon Effect, like history, teaches us that inflation is not only a deliberate theft by policy makers, but also a wealth transfer from the masses to the elites—something familiar to anyone paying attention to US history…

Cantillon shows how new money (i.e., printed or mouse-clicked money) is not accidental nor class-blind.

New money always goes to (and enriches) the top 10% first before it later shafts the bottom 90% second.

That is, the elites, who already own stocks and real estate (90% of US stocks are held by the top 10%), are the first to benefit from the obvious inflation in stocks and real estate, which always follows money creation in lock-step.

The TARP/QE-rescued Wall Street, for example, saw this first hand, when every new version of QE correlated 1:1 with a rise in a stock market drunk on the money printed post-GFC/2008.

In fact, commercial banks saw their greatest bonuses the very year that those same banks nearly broke the economy on a subprime mortgage scandal/scam.

But Main Street, temporarily quieted by stimmy checks, was slowly measuring their wages and savings accounts in dollars whose inherent purchasing power was melting by the day from the currency expansion which saved Wall Street while slowly gutting Main Street.

This inflation, of course, is an invisible theft, one which starts slowly and then comes all at once.

Dishonesty as Deliberate Policy

Average citizens feel themselves getting poorer while their leadership tells them

In fact, commercial banks saw their greatest bonuses the very year that those same banks nearly broke the economy on a subprime mortgage scandal/scam.

But Main Street, temporarily quieted by stimmy checks, was slowly measuring their wages and savings accounts in dollars whose inherent purchasing power was melting by the day from the currency expansion which saved Wall Street while slowly gutting Main Street.

This inflation, of course, is an invisible theft, one which starts slowly and then comes all at once.

Dishonesty as Deliberate Policy

Average citizens feel themselves getting poorer while their leadership tells them  .

Actual (as opposed to “reported”) inflation is compounding at levels of at least 10% per year, which means the absolute purchasing power of the USD is dying at a similar rate.

US M2 money supply has expanded by 40% since 2020, which means the USD is effectively debasing at a similar rate.

This is precisely what policy makers in debt (from ancient Rome to modern DC) need to do in order to pay down debt with devalued money.

In other words, policy makers crush the currency—and hence the people—to sustain their debt and themselves.

But as clever thieves, policy-makers (central bankers, treasury secretaries and national leaders) do this slowly and with deliberate complexity, as well as with deliberate dishonesty, a fact which a more modern economist, Charles Goodhart, made clear in the 1970s.

That is, Goodhart was among the first to reveal that whenever sovereigns create inflation, growth or employment “targets” they are almost always, well: Lying.

And as we, and many others, have written with facts rather than drama, the tools, math, and tricks used to measure employment,

.

Actual (as opposed to “reported”) inflation is compounding at levels of at least 10% per year, which means the absolute purchasing power of the USD is dying at a similar rate.

US M2 money supply has expanded by 40% since 2020, which means the USD is effectively debasing at a similar rate.

This is precisely what policy makers in debt (from ancient Rome to modern DC) need to do in order to pay down debt with devalued money.

In other words, policy makers crush the currency—and hence the people—to sustain their debt and themselves.

But as clever thieves, policy-makers (central bankers, treasury secretaries and national leaders) do this slowly and with deliberate complexity, as well as with deliberate dishonesty, a fact which a more modern economist, Charles Goodhart, made clear in the 1970s.

That is, Goodhart was among the first to reveal that whenever sovereigns create inflation, growth or employment “targets” they are almost always, well: Lying.

And as we, and many others, have written with facts rather than drama, the tools, math, and tricks used to measure employment,  , growth, and even the definition of recession are all open lies to anyone willing to look under the hood of the creative math and writing coming out of DC, Brussels or London…

History Made Current

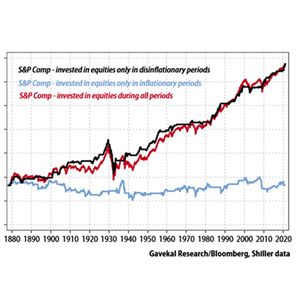

If we apply the admittedly simplified historical lessons and economic rules above to today’s current headlines, as to: 1) the decline of the dollar and 2) the undeniable rise in gold, we see our situation with almost eerie clarity: The more things change, the more they stay the same.

Just as Gresham and Thiers warned, central banks as well as informed investors have already begun to see the debasement of paper money.

They increasingly prefer real money – gold – over fiat toilet paper, even if that paper is the world’s reserve currency.

This explains the BRICS+ rise and

, growth, and even the definition of recession are all open lies to anyone willing to look under the hood of the creative math and writing coming out of DC, Brussels or London…

History Made Current

If we apply the admittedly simplified historical lessons and economic rules above to today’s current headlines, as to: 1) the decline of the dollar and 2) the undeniable rise in gold, we see our situation with almost eerie clarity: The more things change, the more they stay the same.

Just as Gresham and Thiers warned, central banks as well as informed investors have already begun to see the debasement of paper money.

They increasingly prefer real money – gold – over fiat toilet paper, even if that paper is the world’s reserve currency.

This explains the BRICS+ rise and  away from the greenback and UST, which is no longer a slow-drip trend but a rapidly expanding direction.

This explains how

away from the greenback and UST, which is no longer a slow-drip trend but a rapidly expanding direction.

This explains how  since the US M2 expansion became desperate.

This explains why central banks have been net stacking gold and net selling USTs since 2014.

This explains why 20% of

since the US M2 expansion became desperate.

This explains why central banks have been net stacking gold and net selling USTs since 2014.

This explains why 20% of  are now occurring outside the US petrodollar.

This explains the open

are now occurring outside the US petrodollar.

This explains the open  and London exchanges, who are seeing net outflows of physical gold to satisfy counterparty thirst for the metal.

This explains why even the BIS has made gold a Tier-1 asset.

This explains why the IMF sees pure gold as fundamental to its otherwise impure CBDC initiatives.

This explains the three consecutive years of central bank gold stacking at record levels of above 1000 tons per annum since the USA weaponized the USD in 2022.

This explains why central banks now hold more gold than USTs on their balance sheets for the first time since 1996.

This explains why even Morgan Stanley must now openly confess/recommend a 20% gold allocation.

This explains why Judy Shelton wants to introduce a gold-backed UST.

This explains

and London exchanges, who are seeing net outflows of physical gold to satisfy counterparty thirst for the metal.

This explains why even the BIS has made gold a Tier-1 asset.

This explains why the IMF sees pure gold as fundamental to its otherwise impure CBDC initiatives.

This explains the three consecutive years of central bank gold stacking at record levels of above 1000 tons per annum since the USA weaponized the USD in 2022.

This explains why central banks now hold more gold than USTs on their balance sheets for the first time since 1996.

This explains why even Morgan Stanley must now openly confess/recommend a 20% gold allocation.

This explains why Judy Shelton wants to introduce a gold-backed UST.

This explains  to create stablecoin demand for otherwise unloved USTs and USDs.

In short, and just as Gresham and Thiers warned centuries ago, the world is hoarding gold and turning away from bad money.

And just as history also warned, the USD is being openly devalued to pay down a debt crisis of their own making.

We’ve Seen this Movie/De-Valuation Before

But this, too, is nothing new for our clever thieves from above.

In 1933, FDR, by executive order, confiscated gold at $20/ounce and then, overnight, revalued it to $35/ounce, and in doing so, devalued the dollar by 69% in order to make its debt burden 69% less onerous.

In 1971, Nixon shamelessly welched on the USD and the world by removing its gold backing. Since then, the dollar has lost well over 90% of its purchasing power.

Honest vs. Dishonest Money

Such measures certainly made

to create stablecoin demand for otherwise unloved USTs and USDs.

In short, and just as Gresham and Thiers warned centuries ago, the world is hoarding gold and turning away from bad money.

And just as history also warned, the USD is being openly devalued to pay down a debt crisis of their own making.

We’ve Seen this Movie/De-Valuation Before

But this, too, is nothing new for our clever thieves from above.

In 1933, FDR, by executive order, confiscated gold at $20/ounce and then, overnight, revalued it to $35/ounce, and in doing so, devalued the dollar by 69% in order to make its debt burden 69% less onerous.

In 1971, Nixon shamelessly welched on the USD and the world by removing its gold backing. Since then, the dollar has lost well over 90% of its purchasing power.

Honest vs. Dishonest Money

Such measures certainly made  easier to repay, but only by gut-punching those trusting citizens who measure their wealth, savings, portfolio returns and retirement in USDs.

And that, ladies and gentlemen, is how policymakers attempt to stay in power– by quietly robbing their citizens of paper wealth, which in the end, is slowly no wealth at all.

And that too, fully explains the record highs and headlines in the current gold price, for gold is not rising due to speculative mania, it’s merely and honestly reflecting its relatively superior value over dishonest paper money—something gold has done throughout history.

As noted bluntly before,

easier to repay, but only by gut-punching those trusting citizens who measure their wealth, savings, portfolio returns and retirement in USDs.

And that, ladies and gentlemen, is how policymakers attempt to stay in power– by quietly robbing their citizens of paper wealth, which in the end, is slowly no wealth at all.

And that too, fully explains the record highs and headlines in the current gold price, for gold is not rising due to speculative mania, it’s merely and honestly reflecting its relatively superior value over dishonest paper money—something gold has done throughout history.

As noted bluntly before,  .

Or stated even more clearly: Gold is rising because corrupted fiat money is falling, yet again…

Sat, 10/11/2025 - 10:30

.

Or stated even more clearly: Gold is rising because corrupted fiat money is falling, yet again…

Sat, 10/11/2025 - 10:30

VON GREYERZ

The Hidden History of Policy Theft & Skyrocketing Gold

Gold’s record highs now reflect policy-driven currency debasement: fiat erosion & investors and central banks pivot to real money - physical gold...

VON GREYERZ

The 5 Arcs & 7 Cracks of Systemic Collapse

A blunt, evidence-based tour through the debt, debasement & desperation arcs. The cracks now visible across the USD, stocks, bonds, etc.

VON GREYERZ

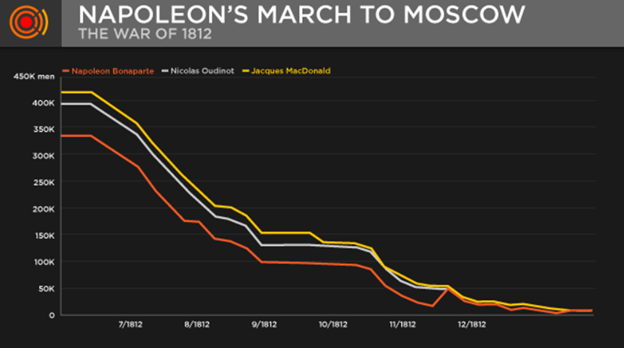

History Lesson: Trust Gold Rather than Sovereigns

History (whether on battle fields or sports fields) is riddled with tragi-comical examples of human blundering (and hubris) in the face of otherwis...

Medieval Europe later followed this desperate playbook by replacing its gold money with copper money.

The French did a similar

Medieval Europe later followed this desperate playbook by replacing its gold money with copper money.

The French did a similar

VON GREYERZ

HISTORY REPEATING ITSELF

For anyone inside or outside of the U.S., it goes without saying that things are indeed heating up in the land of the free. President Trump faces a...

VON GREYERZ

Gold vs Toxic Brews of Financial Repression & Capital Controls

Find out how capital controls affect, restrict, and undermine financial liberty worldwide - and how strategic gold allocation can help protect...

And global debt is no less so…

And global debt is no less so…

Unfortunately, Gresham’s law, like Thiers’ rules, still apply as much today as yesterday. The death just takes a little longer for a world reserve currency…

What we are seeing today with the USD’s open decline and mis-reported inflationary decay is, in fact, nothing new to man, history or economic rules.

Inflation Is Theft

Take another forgotten truth-teller of the forgotten science of honest economics, the 18th century Irish/Frenchman, Richard Cantillon, from which the “Cantillon Effect” got its name.

The Cantillon Effect, like history, teaches us that inflation is not only a deliberate theft by policy makers, but also a wealth transfer from the masses to the elites—something familiar to anyone paying attention to US history…

Cantillon shows how new money (i.e., printed or mouse-clicked money) is not accidental nor class-blind.

New money always goes to (and enriches) the top 10% first before it later shafts the bottom 90% second.

That is, the elites, who already own stocks and real estate (90% of US stocks are held by the top 10%), are the first to benefit from the obvious inflation in stocks and real estate, which always follows money creation in lock-step.

The TARP/QE-rescued Wall Street, for example, saw this first hand, when every new version of QE correlated 1:1 with a rise in a stock market drunk on the money printed post-GFC/2008.

Unfortunately, Gresham’s law, like Thiers’ rules, still apply as much today as yesterday. The death just takes a little longer for a world reserve currency…

What we are seeing today with the USD’s open decline and mis-reported inflationary decay is, in fact, nothing new to man, history or economic rules.

Inflation Is Theft

Take another forgotten truth-teller of the forgotten science of honest economics, the 18th century Irish/Frenchman, Richard Cantillon, from which the “Cantillon Effect” got its name.

The Cantillon Effect, like history, teaches us that inflation is not only a deliberate theft by policy makers, but also a wealth transfer from the masses to the elites—something familiar to anyone paying attention to US history…

Cantillon shows how new money (i.e., printed or mouse-clicked money) is not accidental nor class-blind.

New money always goes to (and enriches) the top 10% first before it later shafts the bottom 90% second.

That is, the elites, who already own stocks and real estate (90% of US stocks are held by the top 10%), are the first to benefit from the obvious inflation in stocks and real estate, which always follows money creation in lock-step.

The TARP/QE-rescued Wall Street, for example, saw this first hand, when every new version of QE correlated 1:1 with a rise in a stock market drunk on the money printed post-GFC/2008.

In fact, commercial banks saw their greatest bonuses the very year that those same banks nearly broke the economy on a subprime mortgage scandal/scam.

But Main Street, temporarily quieted by stimmy checks, was slowly measuring their wages and savings accounts in dollars whose inherent purchasing power was melting by the day from the currency expansion which saved Wall Street while slowly gutting Main Street.

This inflation, of course, is an invisible theft, one which starts slowly and then comes all at once.

Dishonesty as Deliberate Policy

Average citizens feel themselves getting poorer while their leadership tells them

In fact, commercial banks saw their greatest bonuses the very year that those same banks nearly broke the economy on a subprime mortgage scandal/scam.

But Main Street, temporarily quieted by stimmy checks, was slowly measuring their wages and savings accounts in dollars whose inherent purchasing power was melting by the day from the currency expansion which saved Wall Street while slowly gutting Main Street.

This inflation, of course, is an invisible theft, one which starts slowly and then comes all at once.

Dishonesty as Deliberate Policy

Average citizens feel themselves getting poorer while their leadership tells them

VON GREYERZ

“Transitory” Inflation? — Sublime Yet Ridiculous

History is a funny thing, almost as funny as human nature. The policy makers, including their latest meme of “transitory inflation,” are no exc...

VON GREYERZ

The Fed’s Most Convenient Lie: A CPI Charade

Despite a penchant for double-speak that would make a politician blush, the Fed tells us that its primary focus is unemployment not inflation. Let ...

VON GREYERZ

BRICS vs Trump: Who Is the Real “Sucker”?

VON GREYERZ partner Matthew Piepenburg joined Jay Martin, Andy Schechtman, and Taylor Kenny at the recent VRIC conference in Vancouver, Canada, to ...

VON GREYERZ

Dollar Debates & Gold’s Winning End-Game

Explore the strong-dollar case versus de-dollarisation and discover why physical gold’s role as a strategic reserve asset points to its strongest...

VON GREYERZ

Golden Question? Is the Petrodollar the Next Thing to Break?

As we warned throughout 2022, the Fed’s overly rapid and overly steep rate hikes would only “work” until things began breaking, and, well…t...

VON GREYERZ

COMEX Flows: Is the Gold Case Almost Too Obvious?

We’ve been warning about the manipulation of precious metal prices, the risks of commercial banks & the unstoppable de-dollarization tr...

VON GREYERZ

Gold vs. the Stablecoin-CBDC Ruse

Are stablecoins just CBDCs in disguise? Discover why the GENIUS Act threatens financial freedom—and why physical gold remains the ultimate safe h...

VON GREYERZ

Hidden Bankruptcy: The Reality Behind Uncle Sam’s Inflated Bar Tab

With each day bringing new signs of inflation and rates becoming more deeply negative, it’s time to confront reality: The US is declaring a h...

VON GREYERZ

GOLD: The Global Financial System’s Lie Detector?

Discover why physical gold is exposing the cracks in the financial system; increasingly seen as the ultimate lie detector in a world built on illus...

Tyler Durden | Zero Hedge

Zero Hedge

The Hidden History Of Policy Theft & Skyrocketing Gold | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

"The RIFs have begun," Vought wrote, referring to reduction-in-force plans.

The RIFs have begun.

— Russ Vought (@russvought)

"The RIFs have begun," Vought wrote, referring to reduction-in-force plans.

The RIFs have begun.

— Russ Vought (@russvought)

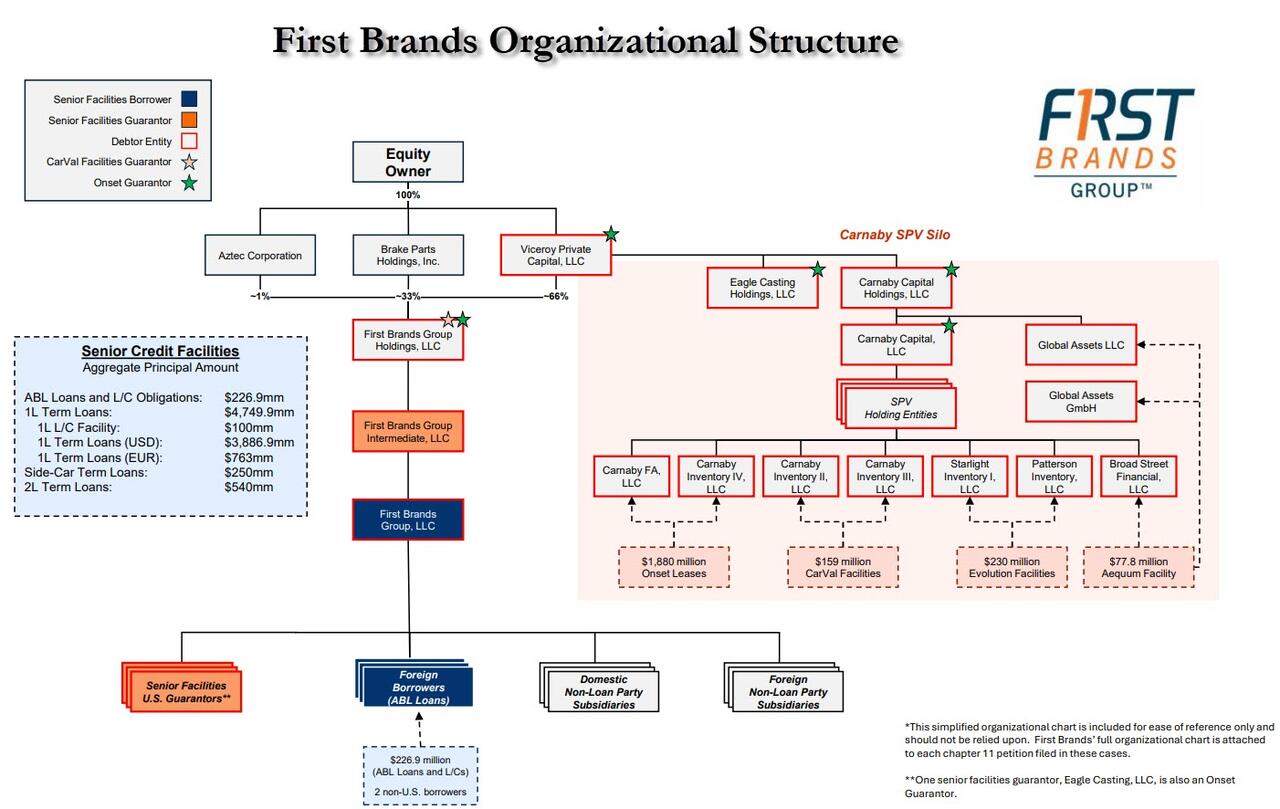

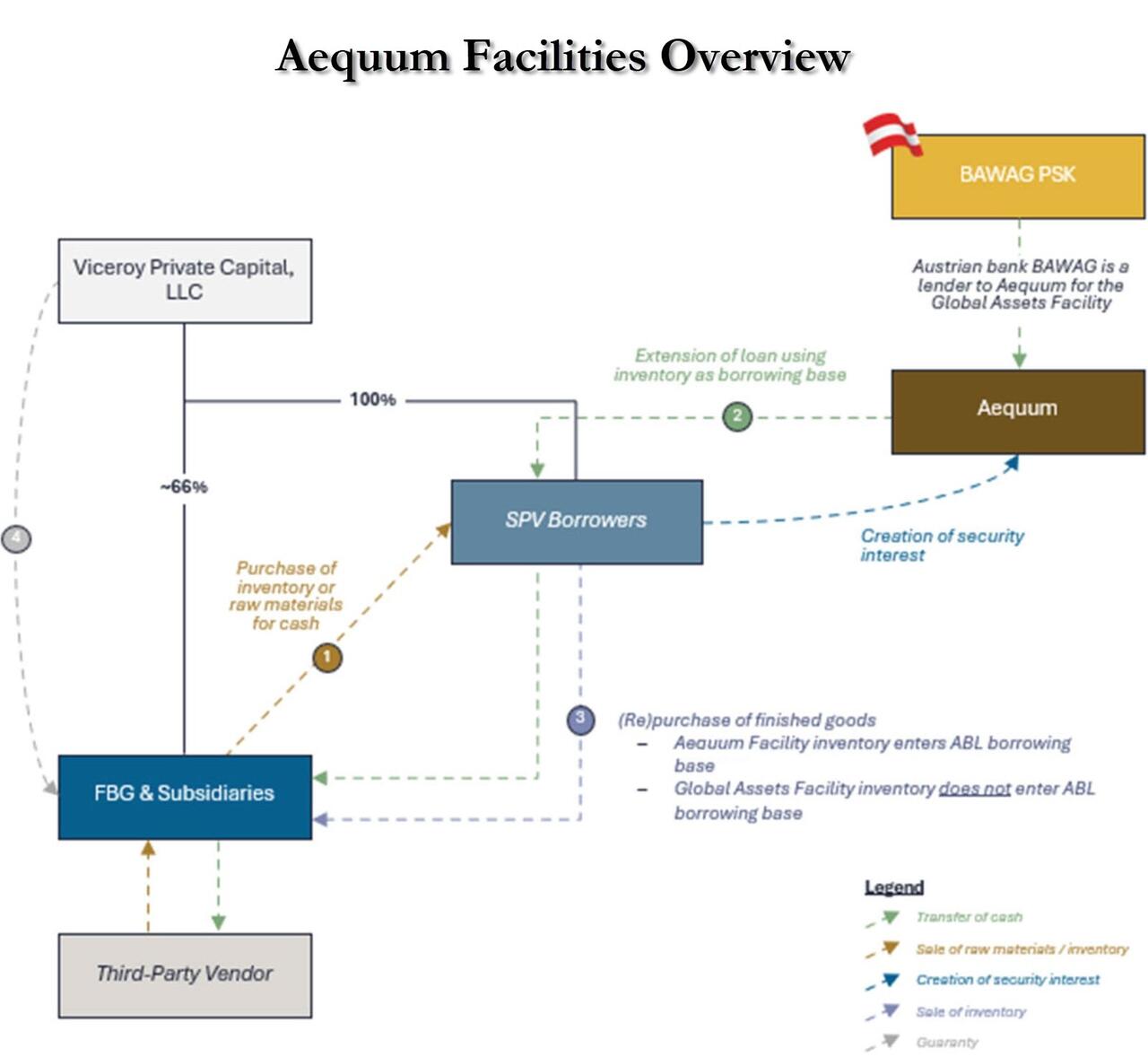

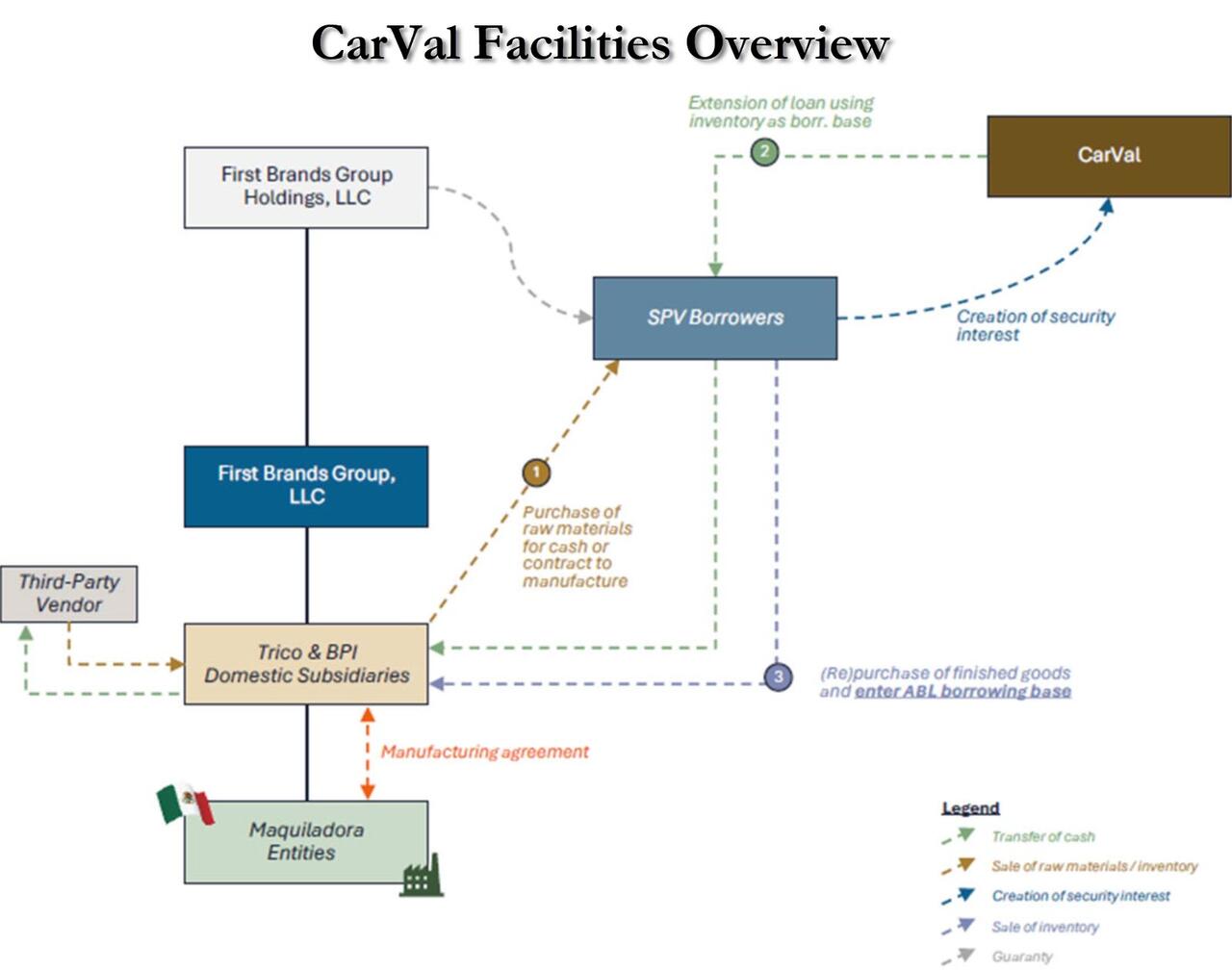

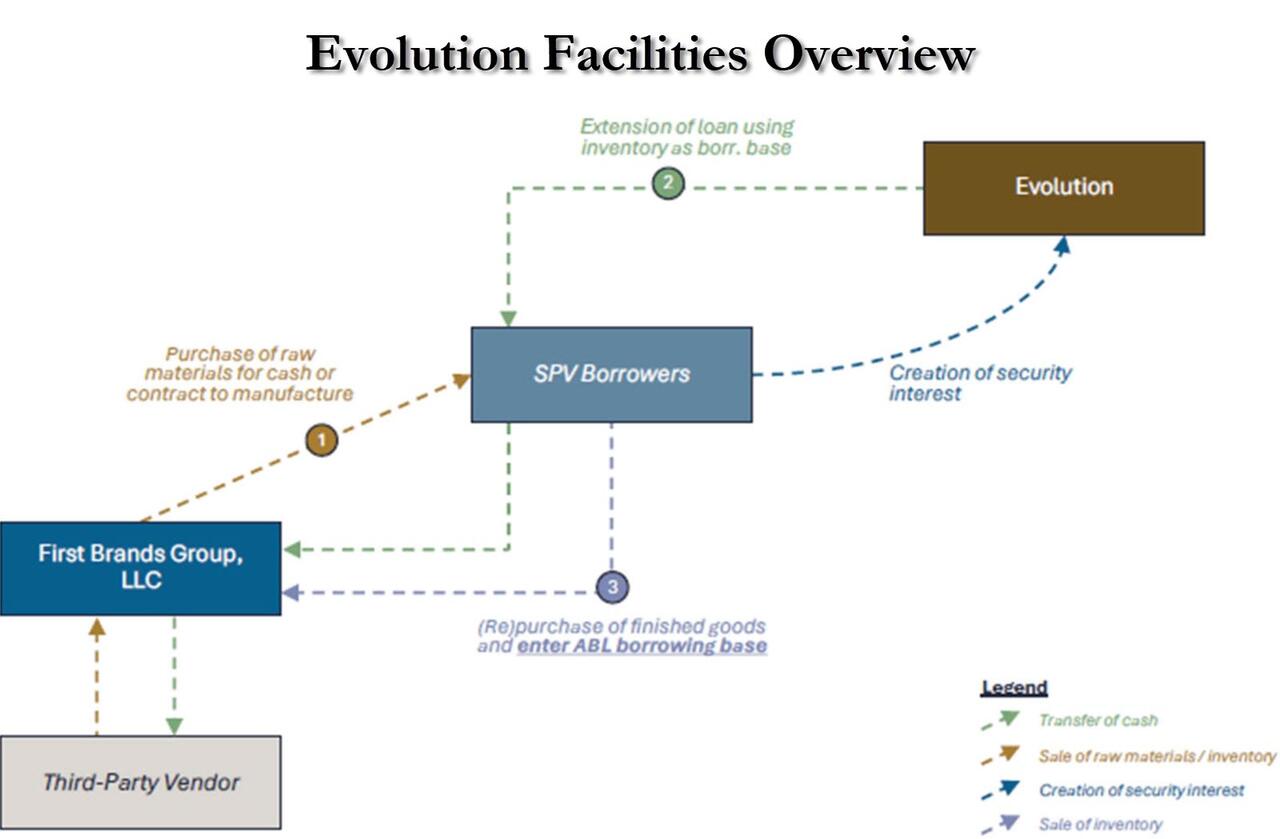

... means that at least $1.9 billion in cash has disappeared, has been completely ignored by virtually everyone due to the far shinier daily AI circle jerk, which helps melt stocks up every single day and serves as a wonderful distraction to everything else.

This is a huge story - rehypothecated off balance sheet debt leading to huge bankruptcy - and nobody cares because daily AI circle jerk

... means that at least $1.9 billion in cash has disappeared, has been completely ignored by virtually everyone due to the far shinier daily AI circle jerk, which helps melt stocks up every single day and serves as a wonderful distraction to everything else.

This is a huge story - rehypothecated off balance sheet debt leading to huge bankruptcy - and nobody cares because daily AI circle jerk

“Informed consent is back,” Jim O'Neill, the CDC’s acting director,

“Informed consent is back,” Jim O'Neill, the CDC’s acting director,

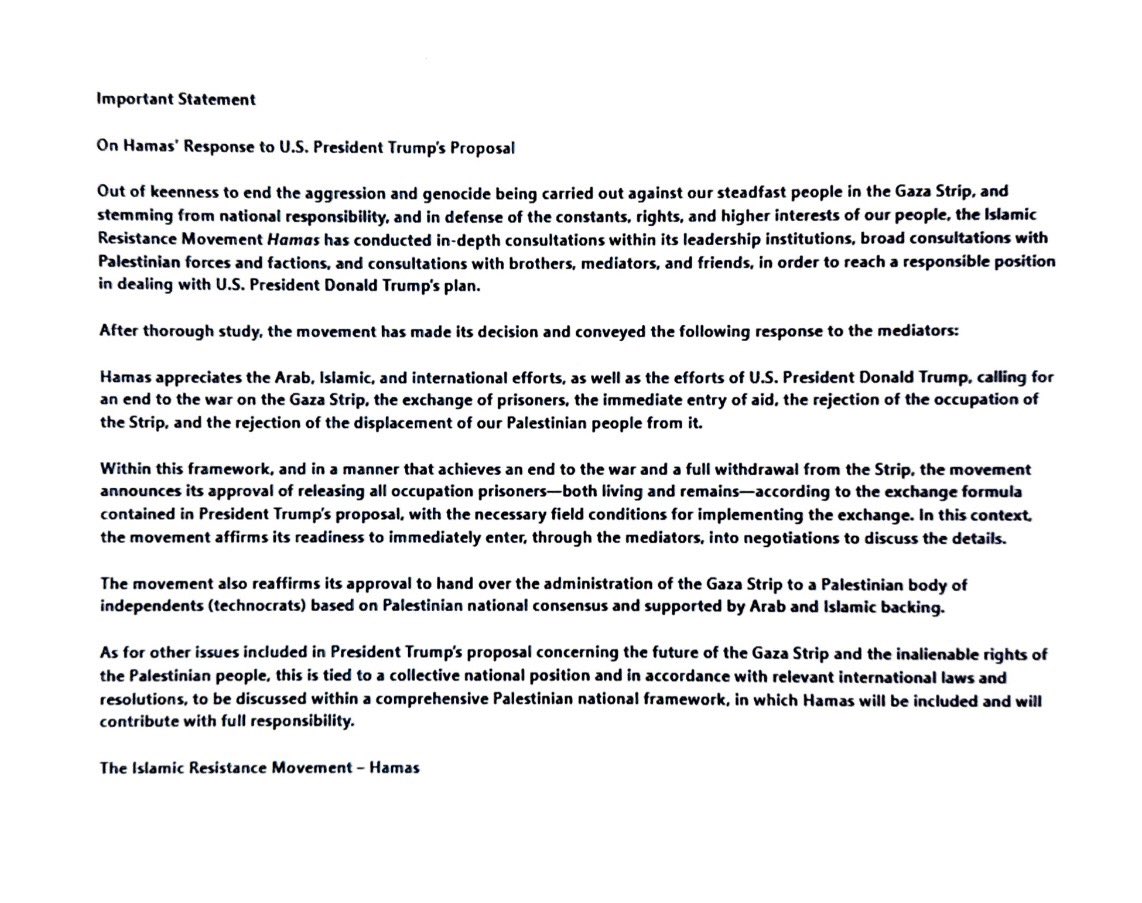

So far, Hamas is said it is willing the release the captives, but indicated it wants to enter negotiations on other points, which is presumably happening through mediators. But Trump has demanded the Palestinian militant group act quickly.

On Sunday Trump told CNN that Hamas faces "complete obliteration" if it doesn't comply to disarming and if it attempts to cling to power in Gaza.

And more, via

So far, Hamas is said it is willing the release the captives, but indicated it wants to enter negotiations on other points, which is presumably happening through mediators. But Trump has demanded the Palestinian militant group act quickly.

On Sunday Trump told CNN that Hamas faces "complete obliteration" if it doesn't comply to disarming and if it attempts to cling to power in Gaza.

And more, via

"This is something that is a direct threat to our nation right now," a top intelligence official told Blaze News. "A direct threat to our nation, and it needs to be shut down today — like ASAP. Only five of them have been taken down so far."

The Blaze's report continues:

The SIM networks were put in place and are managed by China's Ministry of State Security, an ultra-secretive, massive espionage agency that has grown in prominence and global activity in recent years, according to the journal China Leadership Monitor.

The MSS employs more than 800,000 people, nearly double the Soviet KGB at its peak. The MSS "now operates worldwide at a scale and tempo not seen in decades," China Leadership Monitor wrote in a recent newsletter.

Several officials who spoke with Blaze News anonymously said the establishment and use of this destructive network by China should be considered an act of war. The potential threat to America would be "second only to thermonuclear war," one source said.

"It's absolutely an act of war — an internationally recognized act of war," one intelligence expert told Blaze News. "Cyberattacks on critical infrastructure is, and facilitating terrorism to the point where you're trying to kill high-ranking members of the United States government. Those two alone are acts of war."

. . .

"These things were being used all summer to SWAT people since Trump was elected," said one source, speaking anonymously because the source is not authorized to discuss an ongoing investigation. "Swatting — that's a terrorist act. The Trump administration declared that a terrorist act."

While the Chinese facilitated the SWAT raids, it is believed that Americans who are familiar with the system — either through a government or a criminal enterprise — are initiating the hoax calls, the source said.

The swatting of a senior Secret Service official and some Secret Service protectees last spring led to the investigation that discovered the Chinese SIM farms in the Tri-State area, the Secret Service confirmed to Blaze News. A Secret Service engineer assigned to the investigation was key to discovering the SIM network.

An intelligence analyst told Blaze News that:

What's shocking is that there may be up to 100 or more of these sites everywhere. There's probably 60, 80, 100 of these in the United States.

The discovery of weaponized SIM farm nodes by China should not come as a surprise. This is because the Chinese Communist Party's ongoing irregular warfare campaign against the U.S. has been supercharged over the years, especially in the era of Trump.

The book China's Total War Strategy: Next-Generation Weapons of Mass Destruction - published by the CCP BioThreats Initiative and authored by Dr. Ryan Clarke, LJ Eads, Dr. Robert McCreight, and Dr. Xiaoxu Sean Lin - outlines how the CCP pursues an aggressive, multifaceted "total war" against the U.S. that leverages next-generation weapons, including synthetic narcotics (e.g., fentanyl and cannabinoids), bioweapons (e.g., Covid-19), psychological manipulation and influence (e.g., TikTok), and a broad arsenal of irregular warfare tools (

"This is something that is a direct threat to our nation right now," a top intelligence official told Blaze News. "A direct threat to our nation, and it needs to be shut down today — like ASAP. Only five of them have been taken down so far."

The Blaze's report continues:

The SIM networks were put in place and are managed by China's Ministry of State Security, an ultra-secretive, massive espionage agency that has grown in prominence and global activity in recent years, according to the journal China Leadership Monitor.

The MSS employs more than 800,000 people, nearly double the Soviet KGB at its peak. The MSS "now operates worldwide at a scale and tempo not seen in decades," China Leadership Monitor wrote in a recent newsletter.

Several officials who spoke with Blaze News anonymously said the establishment and use of this destructive network by China should be considered an act of war. The potential threat to America would be "second only to thermonuclear war," one source said.

"It's absolutely an act of war — an internationally recognized act of war," one intelligence expert told Blaze News. "Cyberattacks on critical infrastructure is, and facilitating terrorism to the point where you're trying to kill high-ranking members of the United States government. Those two alone are acts of war."

. . .

"These things were being used all summer to SWAT people since Trump was elected," said one source, speaking anonymously because the source is not authorized to discuss an ongoing investigation. "Swatting — that's a terrorist act. The Trump administration declared that a terrorist act."

While the Chinese facilitated the SWAT raids, it is believed that Americans who are familiar with the system — either through a government or a criminal enterprise — are initiating the hoax calls, the source said.

The swatting of a senior Secret Service official and some Secret Service protectees last spring led to the investigation that discovered the Chinese SIM farms in the Tri-State area, the Secret Service confirmed to Blaze News. A Secret Service engineer assigned to the investigation was key to discovering the SIM network.

An intelligence analyst told Blaze News that:

What's shocking is that there may be up to 100 or more of these sites everywhere. There's probably 60, 80, 100 of these in the United States.

The discovery of weaponized SIM farm nodes by China should not come as a surprise. This is because the Chinese Communist Party's ongoing irregular warfare campaign against the U.S. has been supercharged over the years, especially in the era of Trump.

The book China's Total War Strategy: Next-Generation Weapons of Mass Destruction - published by the CCP BioThreats Initiative and authored by Dr. Ryan Clarke, LJ Eads, Dr. Robert McCreight, and Dr. Xiaoxu Sean Lin - outlines how the CCP pursues an aggressive, multifaceted "total war" against the U.S. that leverages next-generation weapons, including synthetic narcotics (e.g., fentanyl and cannabinoids), bioweapons (e.g., Covid-19), psychological manipulation and influence (e.g., TikTok), and a broad arsenal of irregular warfare tools ( And now, SIM farms appear to be another domain of the CCP's irregular warfare campaign, an effort to collapse America from within by paralyzing communication networks. Throughout this year, one high-level Trump official has warned us about the devastation left behind by the years-long "Salt Typhoon" cyberattack carried out by China. On another front, Congressional Republicans of the Oversight Committee have been investigating the dark money networks and political affiliations of billionaire Neville Roy Singham, a U.S. national reportedly residing in Communist China, who allegedly was funding far-left color revolutions in the U.S. to sow chaos. Are you starting to get the picture now?

And now, SIM farms appear to be another domain of the CCP's irregular warfare campaign, an effort to collapse America from within by paralyzing communication networks. Throughout this year, one high-level Trump official has warned us about the devastation left behind by the years-long "Salt Typhoon" cyberattack carried out by China. On another front, Congressional Republicans of the Oversight Committee have been investigating the dark money networks and political affiliations of billionaire Neville Roy Singham, a U.S. national reportedly residing in Communist China, who allegedly was funding far-left color revolutions in the U.S. to sow chaos. Are you starting to get the picture now?

WSJ

WSJ  In premarket trading, Mag7 stocks are mostly higher (Tesla +1.7%, Nvidia +1.3%, Meta +0.7%, Apple +0.4%, Amazon +0.3%, Alphabet -0.09%, Microsoft -0.2%).

Absci (ABSI) is up 4% after JPMorgan initiates at overweight, saying the biotech company’s unique expertise in the computational space could change how new therapeutics are found.

AngioDynamics (ANGO) rises 11% after the medical-device maker boosted its net sales guidance for the full year.

Edison International (EIX) falls 1.8% after Jefferies downgraded the utility to hold, citing a higher risk profile.

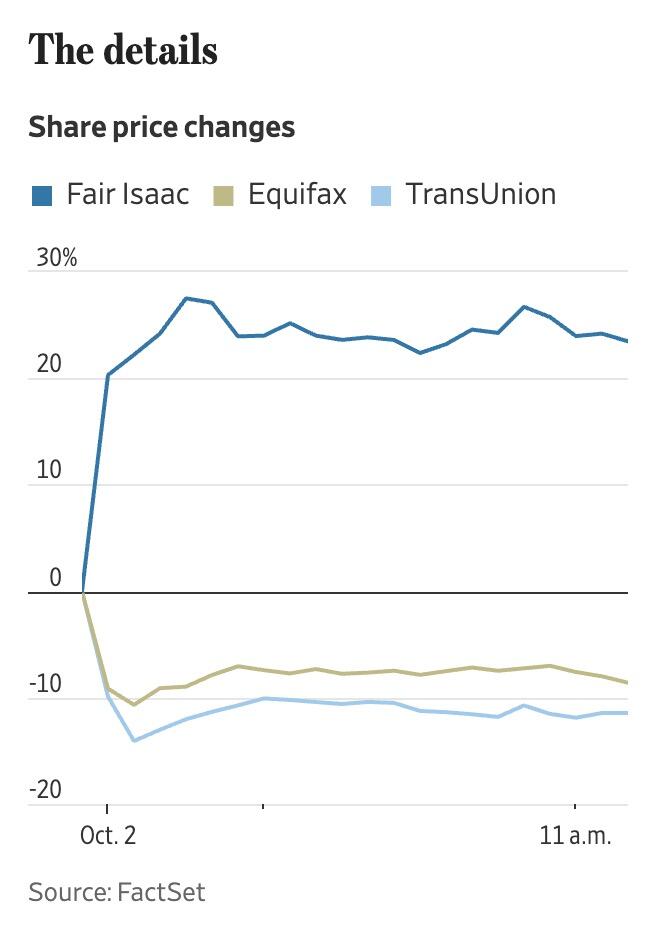

Equifax (EFX), a credit-reporting company, drops 11% and TransUnion (TRU) falls 10% after Fair Isaac Corp. announced a new program giving mortgage lenders the option to calculate and distribute FICO scores directly to customers. Shares of Fair Isaac Corp. (FICO) are up 20%.

Fermi (FRMI) rises 16% after the Texas-based real estate investment trust rallied 55% in its market debut on Wednesday.

Shoals Technologies Group Inc. (SHLS) climbs 8% after Barclays upgraded the renewable-energy equipment company to overweight, citing growth potential.

Stellantis (STLA) gains 7% after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism on the group’s turnaround prospects.

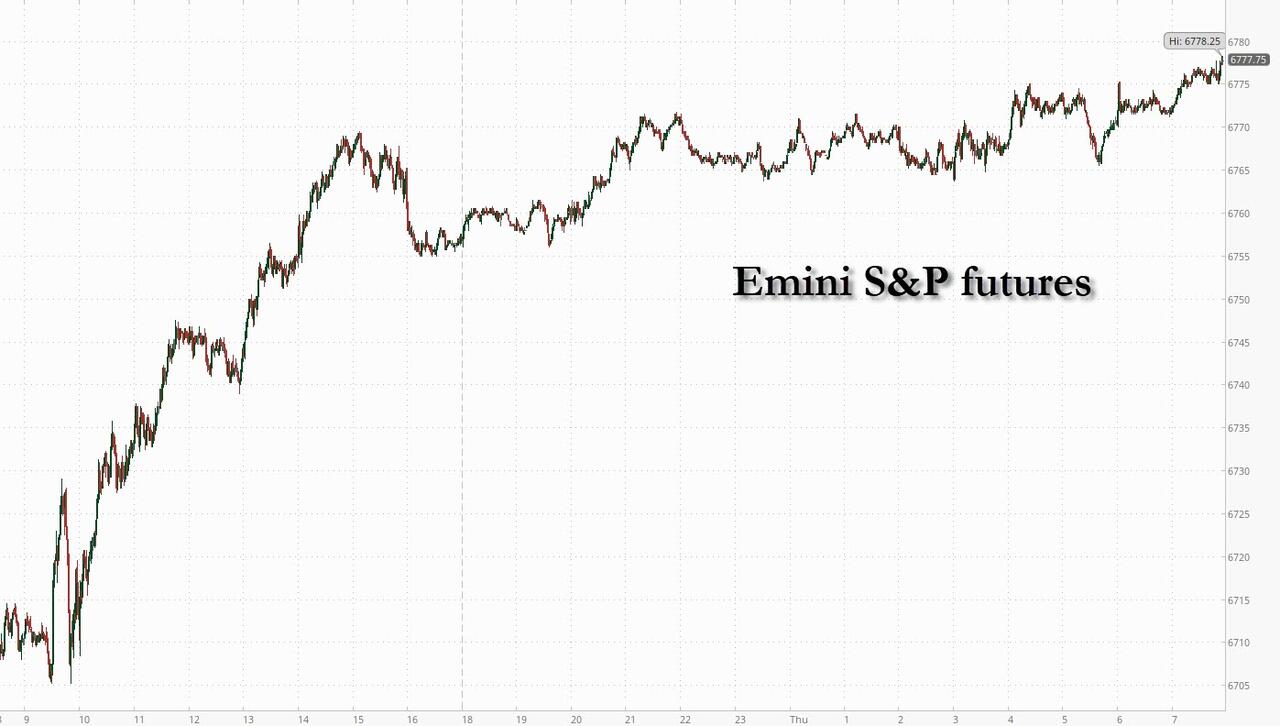

The US govt shutdown quietly entered its shutdown for a second day and markets could care less. Strategists noted that past shutdowns have typically had little macroeconomic impact, and judging by recent history,

In premarket trading, Mag7 stocks are mostly higher (Tesla +1.7%, Nvidia +1.3%, Meta +0.7%, Apple +0.4%, Amazon +0.3%, Alphabet -0.09%, Microsoft -0.2%).

Absci (ABSI) is up 4% after JPMorgan initiates at overweight, saying the biotech company’s unique expertise in the computational space could change how new therapeutics are found.

AngioDynamics (ANGO) rises 11% after the medical-device maker boosted its net sales guidance for the full year.

Edison International (EIX) falls 1.8% after Jefferies downgraded the utility to hold, citing a higher risk profile.

Equifax (EFX), a credit-reporting company, drops 11% and TransUnion (TRU) falls 10% after Fair Isaac Corp. announced a new program giving mortgage lenders the option to calculate and distribute FICO scores directly to customers. Shares of Fair Isaac Corp. (FICO) are up 20%.

Fermi (FRMI) rises 16% after the Texas-based real estate investment trust rallied 55% in its market debut on Wednesday.

Shoals Technologies Group Inc. (SHLS) climbs 8% after Barclays upgraded the renewable-energy equipment company to overweight, citing growth potential.

Stellantis (STLA) gains 7% after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism on the group’s turnaround prospects.

The US govt shutdown quietly entered its shutdown for a second day and markets could care less. Strategists noted that past shutdowns have typically had little macroeconomic impact, and judging by recent history,

But no demographic has taken it more on the chin than young Americans.

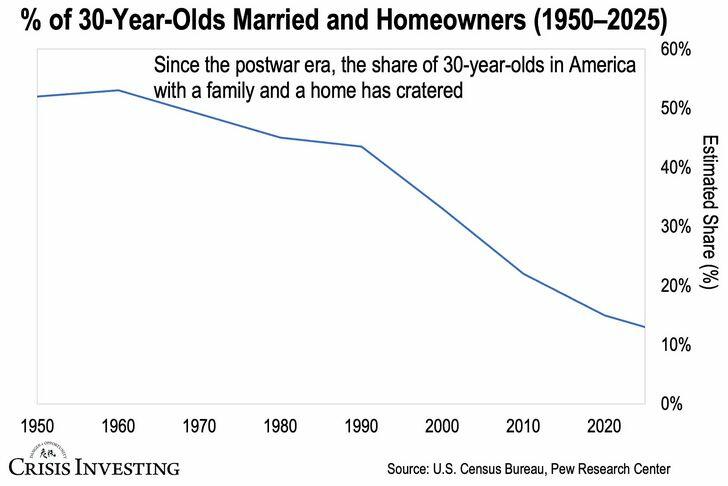

You can see it in stark terms in this week’s chart below. Since the postwar era, the share of 30-year-olds in America with both a family and a home has plummeted—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

But no demographic has taken it more on the chin than young Americans.

You can see it in stark terms in this week’s chart below. Since the postwar era, the share of 30-year-olds in America with both a family and a home has plummeted—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

Let that sink in. In 1950, more than half of 30-year-olds had achieved what most would consider the basic markers of adult stability: marriage and homeownership. Today, it’s barely one in eight.

If you look closer, the graph shows two distinct phases of decline. From 1950 to 1990, there was a steady but manageable erosion—the share of 30-year-olds with both a family and a home dropped from 52% to about 43% over those 40 years.

That represented the gradual social changes we’re all familiar with: more women entering the workforce, people marrying later, changing cultural attitudes toward marriage.

Then something dramatic happened around 2000. The decline went into freefall. Between 1990 and 2025, the rate collapsed from 43% to 13%—a 70% drop in just over three decades.

What explains it?

We could, of course, blame this on changing cultural preferences—young people choosing career over family, prioritizing experiences over stability. That’s certainly part of the story. Young people today do have very different priorities than those more than half a century ago.

But there’s another side to this: the economics of young adulthood have become impossible. Keep in mind, today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation gets worse when you factor in the debt burden crushing young adults. The very institution supposedly preparing young people for economic success—college—has become a wealth destroyer. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024 alone (with total outstanding student debt exploding from $500 billion to $1.8 trillion).

Think about the brutal math facing today’s 30-year-olds.

They graduate with an average of $38,000 in student debt—though plenty are actually walking away with $60,000, $80,000, or even six-figure debt loads. They need $130,000+ in annual income to afford the average home, and compete in a job market where wages haven’t kept pace with housing costs.

In other words, they’re entering their peak family-formation years already financially crippled.

No wonder marriage and homeownership rates have collapsed.

The cruel irony is that we—scratch that, America’s political class—has created a system where the very credentials supposedly required for middle-class success have priced young people out of middle-class life.

Editor’s Note: If you have young people in your life wondering what the future holds in this broken system, Doug Casey and Matt Smith’s “<a href="

Let that sink in. In 1950, more than half of 30-year-olds had achieved what most would consider the basic markers of adult stability: marriage and homeownership. Today, it’s barely one in eight.

If you look closer, the graph shows two distinct phases of decline. From 1950 to 1990, there was a steady but manageable erosion—the share of 30-year-olds with both a family and a home dropped from 52% to about 43% over those 40 years.

That represented the gradual social changes we’re all familiar with: more women entering the workforce, people marrying later, changing cultural attitudes toward marriage.

Then something dramatic happened around 2000. The decline went into freefall. Between 1990 and 2025, the rate collapsed from 43% to 13%—a 70% drop in just over three decades.

What explains it?

We could, of course, blame this on changing cultural preferences—young people choosing career over family, prioritizing experiences over stability. That’s certainly part of the story. Young people today do have very different priorities than those more than half a century ago.

But there’s another side to this: the economics of young adulthood have become impossible. Keep in mind, today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation gets worse when you factor in the debt burden crushing young adults. The very institution supposedly preparing young people for economic success—college—has become a wealth destroyer. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024 alone (with total outstanding student debt exploding from $500 billion to $1.8 trillion).

Think about the brutal math facing today’s 30-year-olds.

They graduate with an average of $38,000 in student debt—though plenty are actually walking away with $60,000, $80,000, or even six-figure debt loads. They need $130,000+ in annual income to afford the average home, and compete in a job market where wages haven’t kept pace with housing costs.

In other words, they’re entering their peak family-formation years already financially crippled.

No wonder marriage and homeownership rates have collapsed.

The cruel irony is that we—scratch that, America’s political class—has created a system where the very credentials supposedly required for middle-class success have priced young people out of middle-class life.

Editor’s Note: If you have young people in your life wondering what the future holds in this broken system, Doug Casey and Matt Smith’s “<a href="

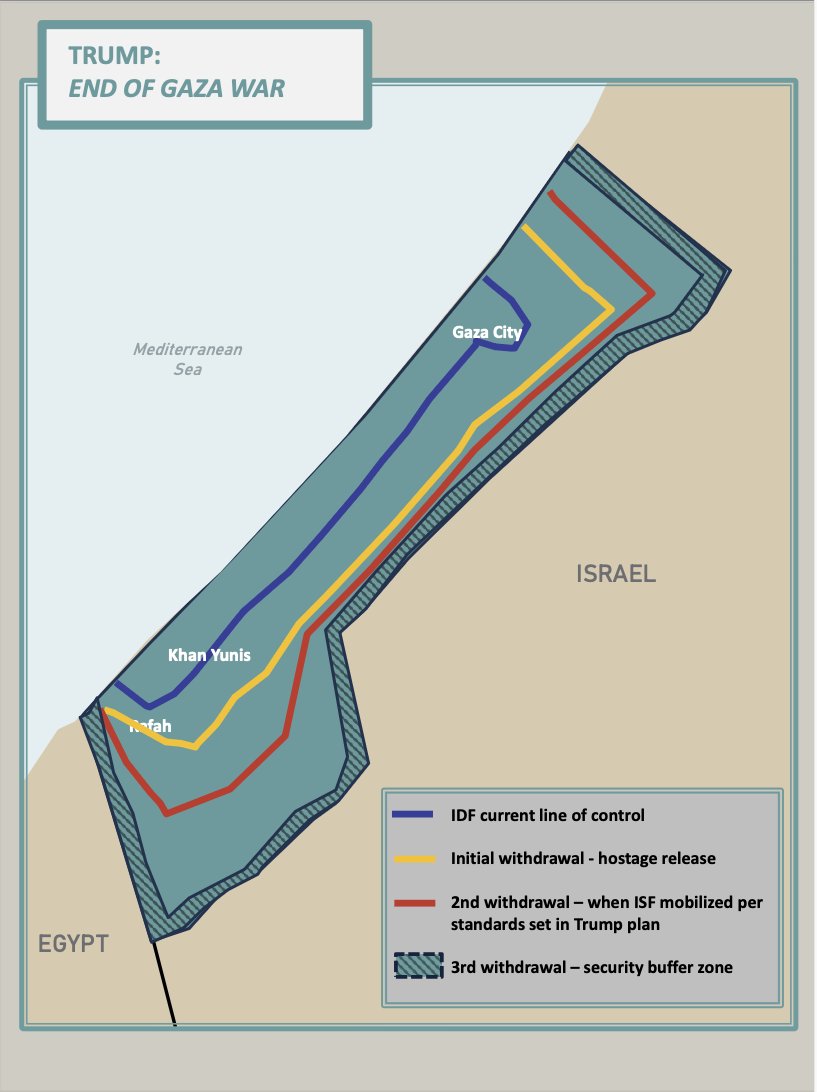

Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for

Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for