Stocks Hit Record Highs Around The Globe As AI Mania Hit Escape Velocity

Stocks Hit Record Highs Around The Globe As AI Mania Hit Escape Velocity

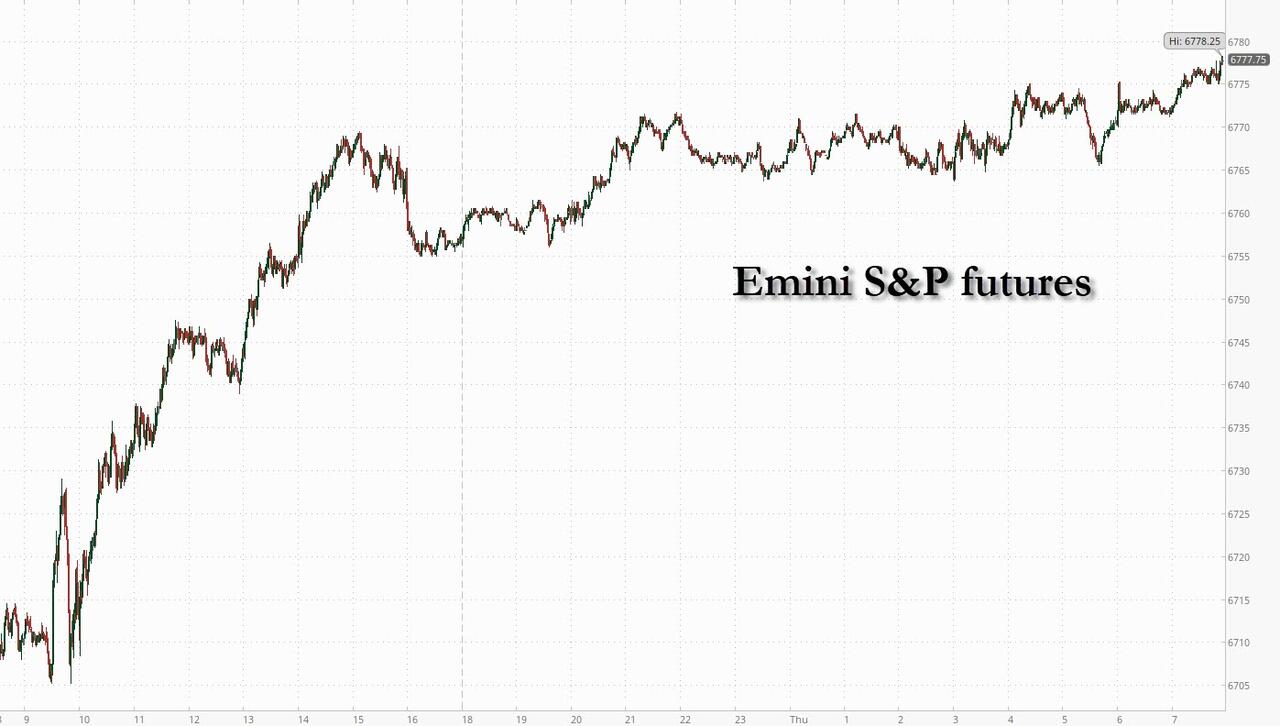

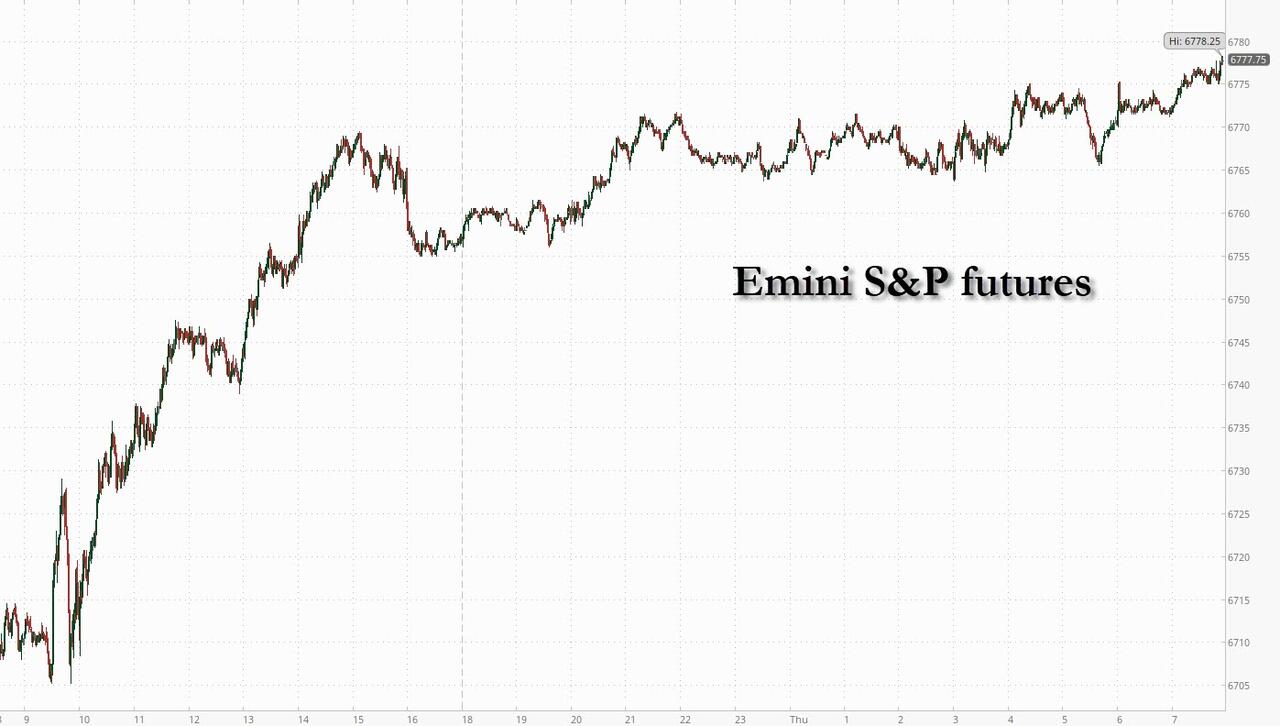

US equity futures are higher with tech and small caps both outperforming as the screaming AI euphoria drove global indexes to fresh highs after an OpenAI share sale valued the company at an eye-popping $500 billion, catapulting the firm to become the world’s most valuable startup, surpassing SpaceX. As of 8:00am ET, S&P futures were 0.2% higher, trading at a fresh all time high, and Nasdaq 100 futures climbed 0.5%, putting the gauge on track for a fifth straight gain. Pre-market, Mag7 tech are mostly higher led by NVDA (+1.3%) and TSLA (+1.5%); global chipmakers soared and energy REIT Fermi jumped for a second day after its IPO. We have also seen overnight outperformance in both European and Asian markets despite relatively muted incremental news flows: Europe’s Stoxx 600 also hit a record after rising 0.8%, led by an advance of more than 2% in technology shares. In Asia, equities rose past last month’s record close as chipmakers rallied. MSCI’s global index also notched a fresh high. Bond yields are unchanged; USD is lower; Oil is lower, while metals are higher. Today's Initial and Continuing Claims data will be delayed due to the shutdown; we should get the final August Durables/Factory orders prints at 10am.

In premarket trading, Mag7 stocks are mostly higher (Tesla +1.7%, Nvidia +1.3%, Meta +0.7%, Apple +0.4%, Amazon +0.3%, Alphabet -0.09%, Microsoft -0.2%).

Absci (ABSI) is up 4% after JPMorgan initiates at overweight, saying the biotech company’s unique expertise in the computational space could change how new therapeutics are found.

AngioDynamics (ANGO) rises 11% after the medical-device maker boosted its net sales guidance for the full year.

Edison International (EIX) falls 1.8% after Jefferies downgraded the utility to hold, citing a higher risk profile.

Equifax (EFX), a credit-reporting company, drops 11% and TransUnion (TRU) falls 10% after Fair Isaac Corp. announced a new program giving mortgage lenders the option to calculate and distribute FICO scores directly to customers. Shares of Fair Isaac Corp. (FICO) are up 20%.

Fermi (FRMI) rises 16% after the Texas-based real estate investment trust rallied 55% in its market debut on Wednesday.

Shoals Technologies Group Inc. (SHLS) climbs 8% after Barclays upgraded the renewable-energy equipment company to overweight, citing growth potential.

Stellantis (STLA) gains 7% after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism on the group’s turnaround prospects.

The US govt shutdown quietly entered its shutdown for a second day and markets could care less. Strategists noted that past shutdowns have typically had little macroeconomic impact, and judging by recent history,

Do Stocks Always Go Up During Government Shutdowns? | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

. At a White House press conference on Wednesday, Vice President JD Vance said he doesn’t anticipate a long shutdown, adding that layoffs will come if it lasts for days or weeks.

“This is all very much a storm in a teacup,” wrote Michael Brown, a senior market strategist at Pepperstone. “The government has shut down 20 times in the past, and reopened 20 times as well – this time will not be different.”

OpenAI’s valuation soared to $500 billion after current and former employees sold about $6.6 billion of stock. In wave of good news that swept along semiconductor and AI companies, the ChatGPT owner also forged agreements with South Korean firms. Separately, OpenAI also released a social app for sharing AI Videos and inked a deal with Samsung and Hynix to supply its ambitious Stargate datacenter project. Apple has paused a planned overhaul of its Vision Pro headset to focus on developing smart glasses that can rival Meta’s products.

The AI boom has powered global stocks to successive highs, with a resumption of interest-rate cuts and resilient earnings adding to the bullish momentum. For now, investors also see limited risk from the political impasse in Washington, which has triggered the first government shutdown in nearly seven years.

“The tech sector is so large and it’s doing so well,” said Marija Veitmane, senior multi-asset strategist at State Street Global Markets. “The reason the market is prepared to pay those high valuations for the tech sector is really because we don’t see good growth opportunities outside tech.”

In the latest tariff news, the EU plans to hike duties on its steel imports to 50%, according to a draft proposal. As for macro data, the government shutdown and other challenges at the government statistics bureaus means clear signals about the economy are difficult to assess.

A relentless buying spree in US equities dominated quarter-end pension rebalancing, overwhelming projected net selling, according to the trading desk at Goldman Sachs. Bank of America derivatives strategists see scope to use options to bet on further gains for tech. If a 45% rally in the sector since early April looks like a bubble, it probably won’t burst any time soon, they said. Also top of mind is the fast-approaching 3Q reporting season. Earnings outlook momentum remains positive although has trended lower in recent weeks, according to Citi’s earnings revisions index.

Turning to the data, the Bureau of Labor Statistics’ nonfarm payrolls data on Friday will likely be delayed, as well as the weekly initial jobless claims numbers usually due Thursdays. Still, figures from outplacement firm Challenger, Gray & Christmas showed US employers dialed back hiring plans in September, even though they also announced fewer job cuts. Even without the data however, money markets are almost fully pricing a quarter-point Fed cut at the end of the month and see an 80% chance of another in December to support the labor market.

“If you really dig into the labor market data, it’s not just an AI structural story, it’s not just a lower immigration story, you are seeing that cyclical demand weakness,” Kim Crawford, global rates portfolio manager at JPMorgan Asset Management, told Bloomberg TV. “The clearest part to this puzzle is wage growth, there is a lack of wage growth in the US.”

European stocks rally to a new record on a boost for tech and car stocks. Tech optimism is bolstered by OpenAI raising funds to value the firm at $500 billion. The Stoxx 600 is up 0.7% and the Euro Stoxx 50 by 1.3% while a gauge of EM stocks hit the highest since 2021 on the AI-driven optimism. Here are some of the biggest movers on Thursday:

Stellantis shares gain as much as 7.6% in Milan after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism about turnaround prospects.

European semiconductor stocks lead a broader market rally on Thursday, following gains among US peers late in Wednesday’s trading.

Rational shares rise as much as 7.4% after the professional kitchen equipment maker was upgraded by Barclays on valuation grounds, while Bernstein lifted its price target to a new Street-high.

Tesco shares rise as much as 4.2% after Britain’s biggest supermarket reported first-half profit that beat estimates and boosted its adjusted operating profit forecast for the year.

Hochtief gains as much as 6.8%, hitting a new record high, as BofA double-upgrades to buy from underperform, citing the construction and infrastructure firm’s attractive growth story.

Novo rises as much as 4.8% while Roche gains as much as 1.5% after the pair were upgraded to buy from hold at HSBC, while AbbVie was downgraded to a hold from buy.

Piaggio shares gain as much as 5.2%, the most since late July, after Italian Cycle and Motorcycle Association data showed a rebound in the two-wheeler market.

Sobi climbs as much as 5.2%, in a fourth straight day of gains, as Danske Bank says there may be scope for the Swedish biopharma company to upgrade its guidance at the upcoming third-quarter results.

Morgan Sindall jumps 13% to a record high as the construction group says it is performing “significantly ahead of previous expectations” after business at its Fit Out division continued to strengthen.

Earlier in the session, Asian shares advanced for a fourth day, turbocharged by technology firms after a deal between OpenAI and South Korean chipmakers brightened the outlook of artificial intelligence. The MSCI Asia Pacific Index rose as much as 1.2%, the most in nearly four weeks. TSMC was among the biggest contributors, along with Alibaba and SK Hynix. The Kospi was the region’s top performer, jumping 2.7% to a fresh record, following Samsung Electronics and SK Hynix’s deal to supply chips to OpenAI’s Stargate project. Benchmarks in Taiwan, Australia and Singapore all climbed over 1%. The tech rally has been underpinning the recent strength of Asian stocks, as investors brushed off geopolitical risks and the first US government shutdown in seven years. An informal survey by Bloomberg also shows that strategists expect the region to outperform the US in the current quarter on attractive valuations and earnings prospects. Chinese stocks listed in Hong Kong jumped as trading resumed after a public holiday. Alibaba was among the lead gainers after JPMorgan boosted its price target by 45%, citing an improved outlook for cloud revenue and growing synergy between its AI and e-commerce operations. Mainland Chinese and Indian markets were shut for a holiday.

In FX, the Bloomberg Dollar Spot Index down 0.2%; kiwi and the yen outperforming.

In rates, treasuries mostly held Wednesday’s gains, with the yield on 10-year notes steady at 4.09%. After Fed rate-cut expectations pulled yields down from January’s high near 4.80%, traders are now contending with a temporary blackout in economic data amid the government shutdown.

In commodity markets, gold extended its record-breaking rally while oil fell for a fourth consecutive day. West Texas Intermediate slid toward $61 a barrel, touching the lowest level in four months as expectations of OPEC+ restoring more idled supply deepened fears of a global glut.

Looking at today's calendar, the 8:30am jobless claims data will be delayed. Factory orders, durable goods and cap goods for August are all due at 10 am New York, but the government shutdown may affect the release of economic data

Market Snapshot

S&P 500 mini +0.1%

Nasdaq 100 mini +0.3%

Russell 2000 mini +0.3%

Stoxx Europe 600 +0.7%

DAX +1.3%

CAC 40 +1.1%

10-year Treasury yield -1 basis point at 4.09%

VIX -0.2 points at 16.06

Bloomberg Dollar Index -0.2% at 1198.34

euro +0.2% at $1.1757

WTI crude -0.5% at $61.48/barrel

Top Overnight News

The shutdown entered a second day with little sign of a breakthrough. The White House is looking to cancel infrastructure projects in Democratic-leaning states. Jobless claims data won’t be released today, a Labor Department spokesman said. BBG

The US will lose $15 billion in GDP each week during a shutdown, Politico reported, citing a White House memo. BBG

Global chipmakers saw their market value soar as investors rushed to get exposure to artificial intelligence, the latest sign of a frenetic bull run that is pushing tech stocks to all-time highs. The combined market capitalization of the Philadelphia Stock Exchange Semiconductor Index and a gauge tracking Asia chip stocks went up by just over $200 billion in the latest session. BBG

Trump said Wednesday that soybeans will be a “major” topic in his meeting with Chinese counterpart Xi Jinping later this month, pledging aid for American farmers after Beijing halted purchases of the staple amid trade tensions. Nikkei

OpenAI’s valuation reached $500 billion, a person familiar said, surpassing SpaceX as the world’s largest startup. Employees sold about $6.6 billion of stock to investors including Joshua Kushner’s Thrive Capital and SoftBank. BBG

Apple (AAPL) has shelved its headset revamp to prioritise Meta-style AI glasses: Bloomberg.

The U.S. will provide Ukraine with intelligence for long-range missile strikes on Russia’s energy infrastructure, American officials said, as the Trump administration weighs sending Kyiv powerful weapons that could put in range more targets within Russia. WSJ

The EU is planning to join US and Canadian efforts to tackle cheap Chinese steel imports by reducing import quotas and increasing tariffs. The European industry commissioner promised industry bosses and unions to levy tariffs of up to 50% on foreign steel at an emergency meeting on Wed. FT

Japanese business mood is improving and corporate profits remain high even as U.S. tariffs weigh on exports, Bank of Japan Deputy Governor Shinichi Uchida said, signalling confidence that conditions for another interest rate hike was falling into place. RTRS

Japan’s bonds fell after an auction of 10-year notes saw the bid-to-cover ratio drop from last month, in a show of weak demand. BBG

Fed’s Goolsbee (2025 voter) said he is starting to get more concerned about inflation moving the wrong way and that counting on it being transitory makes him nervous. He noted that with the BLS down, there are limited indicators on inflation, said he hopes tariff impacts will prove transitory, and added that while the underlying economy is strong enough to allow rates to come down a fair amount, the Fed should be careful: RTRS

Trump's Administration is reportedly working with Pharma, AI, Energy, Ship Building, Battery Products and other sectors: Reuters

US Govt Shutdown

US President Trump plans to cancel Western hydrogen hubs amid the government shutdown fight, according to Bloomberg.

US President Trump posted that Republicans must use the Democrat-forced closure to clear out dead wood, waste, and fraud, adding that billions of dollars can be saved, via Truth Social.

S&P warned that the US government shutdown adds uncertainty to the economic outlook, with extended delays in key economic data releases potentially complicating Fed monetary policy decisions. The agency estimated the shutdown could reduce GDP growth by 0.1–0.2 ppts per week.

Trade/Tariffs

Preparations for US President Trump’s visit to Asia have ground to a halt amidst the government shutdown, Nikkei reported, with officials at the embassies of Malaysia, Japan, and South Korea scrambling to gather information ahead of his visit in just over three weeks.

South Korea’s Foreign Minister said South Korea and the US have broadly reached an agreement in the security sector, Yonhap reported.

Brazil and the US are working to arrange an in-person meeting between Presidents Lula and Trump, according to Bloomberg.

Japan and US reportedly arranging a visit by US President Trump to Japan on October 27, according to Japanese press.

The EU plans to hike steel import tariffs to 50%, according to a draft proposal seen by Bloomberg.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were firmer, with gains across the board following a positive handover from Wall Street, where tech outperformed, whilst the US jobs reports this week look set to be delayed after CR votes failed again on Wednesday, as expected. ASX 200 was propped up by strength in gold and mining names while defensive sectors lagged, with no reaction seen to the RBA Financial Stability Review, which suggested Australia’s financial system remains well positioned to navigate a period of elevated global uncertainty. Nikkei 225 saw upside led by metals and pharma stocks, though gains were capped as the JPY trimmed earlier losses. Hang Seng conformed to regional gains and played catch-up to yesterday’s price action during the National Day closure, though momentum was limited by the absence of Stock Connect, with Mainland China remaining shut until next Thursday. KOSPI outperformed and hit a fresh record high, overlooking stronger-than-expected CPI, with gains driven by surges in SK Hynix and Samsung Electronics after both firms partnered with OpenAI under the Stargate initiative. Sentiment was also supported by news that South Korea and the US agreed on a basic security framework.

Top Asian News

The RBA’s Financial Stability Review said Australia’s financial system remains well positioned to navigate elevated global uncertainty, with the largest risks to stability coming from abroad, including high and rising government debt in major economies, stretched asset valuations and leverage in global markets, and heightened geopolitical and operational risks. The RBA said most households with mortgages are keeping up with repayments and have built savings buffers, many businesses have established financial buffers, and Australian banks continue to maintain high levels of capital and liquidity. It underscored the importance of maintaining prudent lending standards and strengthening operational resilience via the RBA.

A BoK official said the significant impact of US tariffs on exports has not yet been observed, but effects are expected to become more apparent next year, according to Reuters.

BoJ's Uchida says Tankan survey showed positive business sentiment as US tariff outlook recedes; BoJ to raise rates if economic outlook is realised.

European bourses are mostly higher as the solid start to Q4 continues, Euro Stoxx 50 +1.3%. FTSE 100 -0.1% is the main outlier after the healthcare and energy-led gains seen on Wednesday. From a macro perspective, it is very much a case of more of the same as incremental drivers remain light aside from the overhang of the US government shutdown. Sectors mostly firmer, Tech outperforms after the strength on Wall St.; Autos firmer with heavyweight Ferrari supported by a broker upgrade. Luxury also strong after Brunello Cucinelli numbers, supporting peers.

Top European News

BoE DMP: Expectations for year-ahead CPI inflation rose by 0.1 percentage points to 3.4% in the three months to September. The corresponding measure for three-year ahead CPI inflation expectations also remained unchanged at 2.9% in the three months to September.

FX

DXY is currently lower for a 5th consecutive session. Continued focus on the shutdown, which has trimmed the data docket, as such other prints e.g. the Chicago Fed measure may draw greater attention. DXY has delved as low as 97.53 but is holding above yesterday's trough @ 97.46.

Euro is a touch firmer after a choppy Wednesday. Specifics very light. EUR/USD is currently contained within yesterday's 1.1715-79 range.

Sterling also slightly firmer against the UST but relatively even against the EUR. The latest BoE DMP report showed firms year-ahead own-price inflation was unchanged at 3.7%, whilst expectations for year-ahead CPI inflation rose by 0.1 percentage points to 3.4%. Cable has moved back onto a 1.35 handle but is yet to approach yesterday's best @ 1.3527.

JPY firmer, with USD/JPY down to a 146.61 low before returning to a 147 handle. Attention on BoJ's Uchida who noted that the Bank will keep hiking rates if the economic outlook is realised.

Antipodeans both in the green but the Kiwi is currently leading. Specifics light thus far, particularly with China away.

Fixed Income

JGBs hit overnight by a weak 10yr tap. No followthrough to remarks from BoJ's Uchida thereafter, though his positive lens on the Tankan survey underscores the narrative that a hike at the October meeting is the more likely outcome as things stand.

USTs contained in a very narrow range. Specifics unsurprisingly light with the US government shutdown still underway. Currently, USTs chop around the unchanged mark in a 112-25+ to 112-30+ band, entirely within but at the upper end of yesterday’s 112-12 to 112-31 parameters.

EGBs saw a slightly softer start to the day, though within recent parameters. Specifics light aside from supply. Overall, the auctions were slightly soft but still the passing of the morning's docket was sufficient to bring the benchmarks back to earlier highs and marginally firmer, with gains of a handful of ticks in Bunds at best.

Gilts spent the morning near-enoguh flat into supply. A few updates around the Autumn Budget beforehand, but nothing that shifts the dial. Supply on face value was ok, though the cover was the lowest since 2022.

Japan sold JPY 2.6tln 10yr JGB; b/c 3.34x (prev. 3.92x), average yield 1.6350% (prev. 1.6120%)

Fixed Income

Crude spent the morning in a thin c. USD 0.60/bbl bound. However, the complex came under some modest pressure to respective lows of USD 61.22/bbl and USD 64.80/bbl for WTI and Brent respectively, nothing fresh behind the pressure.

Overnight, a spike to session highs occured around an hour after a more modest move higher on reports in the WSJ that the US is to provide Ukraine with intelligence for missile strikes deep inside Russia, and are asking NATO allies to provide similar insight.

Spot gold taking a slight breather from its recent rally, though it remains near the USD 3895/oz ATH into a thinner than usual docket.

Base metals continue to gain despite the absence of its largest buyer, China. 3M LME Copper extended above USD 10.40k/t during APAC trade, a move that has continued to a USD 10.51k/t peak.

Goldman Sachs said upside risks have intensified further for their mid-2026 and Dec-2026 gold price forecasts of USD 4,000/oz and USD 4,300/oz respectively, and reiterated that gold remains their highest-conviction long commodity recommendation, according to Reuters.

Kazakhstan's Energy Minister says they are doing everything possible to implement compensation plan; sees Kazakhstan oil output at 90mln tons in 2026

Geopolitics

The US will provide Ukraine with intelligence for missile strikes deep inside Russia, and US officials are asking NATO allies to provide similar support, via WSJ.

The G7 agreed on the importance of trade measures, including tariffs and import–export bans, to curb Russian revenue, according to Reuters.

US Event Calendar

7:30 am: Sep Challenger Job Cuts YoY, prior 13.3%

8:30 am: Sep 27 Initial Jobless Claims, est. 225k, prior 218k

8:30 am: Sep 20 Continuing Claims, est. 1931k, prior 1926k

10:00 am: Aug Factory Orders, est. 1.4%, prior -1.3%

10:00 am: Aug F Durable Goods Orders, est. 2.9%, prior 2.9%

10:00 am: Aug F Durables Ex Transportation, est. 0.4%, prior 0.4%

10:00 am: Aug F Cap Goods Orders Nondef Ex Air, est. 0.58%, prior 0.6%

10:00 am: Aug F Cap Goods Ship Nondef Ex Air, est. -0.3%, prior -0.3%

Central Bank Speakers

10:30 am: Fed’s Logan Speaks at University of Texas conference

2:30 pm: Fed’s Goolsbee Speaks on Fox Business

DB's Jim Reid concludes the overnight wrap

US markets kicked off Q4 as they ended Q3, with the S&P 500 (+0.34%) reaching another record high despite the shutdown noise and an ADP report showing a contraction in private payrolls. At the same time, fresh fears over the US labour market saw Treasury yields decline sharply as investors priced in more rate cuts. Europe also saw an optimistic session, as positive data helped to push the STOXX 600 (+1.15%) to a new record of its own, finally surpassing its previous peak in early March. Remember that German fiscal stimulus started this week and from my experience of talking to investors around the world in recent weeks, people have largely forgotten about the story, so once you see the impact in the data we might be set for further advances in German and European risk assets all other things being equal.

Meanwhile, the US shutdown remains a huge story, and there’s still no sign of a climbdown from either side. Yesterday the continuing resolution proposal that was earlier approved by Republicans in the House again failed to muster the 60 voters necessary to override the filibuster in the Senate. Just as the previous day, the vote ended five votes short at 55-45 as three Democrats supported the bill while Senator Rand Paul of Kentucky was the lone Republican to vote against. We are unlikely to get another vote today as we have Yom Kippur with the Senate traditionally not sitting given how many of its members celebrate the day.

In terms of expectations, the current view on Polymarket is that it’ll likely be resolved in the next two weeks, with a 34% prospect of the shutdown lasting beyond October 15. Meanwhile, we heard that the administration was using the shutdown to halt federal funding for infrastructure and energy projects in New York City and more than a dozen Democrat-leaning states.

From a market perspective, the most tangible impact is that we won’t get the weekly jobless claims data today, or the jobs report tomorrow. So that’s led investors to put a lot more focus on the private sector data releases, which are generating an outsize market impact as a result. In fact, yesterday we had the ADP’s report of private payrolls, which as we all know pretty much always comes out two days before payrolls, and isn’t too much of a market mover. But this time around, the print caused a significant reaction, as it underwhelmed at -32k (vs. +51k expected), and it raised fears that the next jobs report (whenever we get it) would disappoint like the last two. So investors dialled up their expectations for rate cuts yesterday, with the amount priced in by the June meeting up a sizeable +7.7bps on the day to 90.7bps. And in turn, front-end Treasuries posted a decent decline, with the 2yr yield (-7.4bps) falling to 3.53%, and the 10yr yield (-5.2bps) falling to 4.10%. We are broadly unchanged in Asia trading.

In the latest Fed news, the Supreme Court rejected President Trump's demand to immediately remove Fed Governor Lisa Cook from her post. Cook can thus remain in her post at least until the Supreme Court hears the arguments in the case in January. So that eased some immediate concerns about White House influence over the Fed.

The ADP release initially weighed on equities, but the S&P 500 again recovered as the day went on to close +0.34% higher. In part that was as the weakness in the ADP report wasn’t echoed elsewhere, and the ISM manufacturing came in broadly as expected at 49.1 (vs. 49.0 expected). New orders disappointed (48.9 vs 50.0 expected) but the employment component surprised to the upside (45.3 vs 44.3 expected) and prices paid fell to an 8-month low of 61.9 (vs 62.7 expected). While most of the S&P 500 were lower on the day, specific sectors helped drive the overall advance. Tech outperformance helped the Mag-7 (+0.61%) to a new all-time high, while the healthcare sector (+3.01%) was the outstanding performer in the S&P. That followed news the previous evening that Pfizer had negotiated a 3-year reprieve on pharma tariffs with the White House, leaving investors more confident that US drugmakers would be able to avoid major levies. Pfizer rose +6.79%, with other major pharma companies including Ely Lilly (+8.18%) and Merck (+7.39%) also seeing outsized gains.

Over in Europe, there was an even more robust tone, with equities rising across the board. So that saw the STOXX 600 (+1.15%) and the FTSE 100 (+1.03%) both hit new highs, whilst Spain’s IBEX 35 (+0.41%) moved up to a post-2007 high as well. In part, sentiment was lifted by some robust numbers from the final manufacturing PMIs. So the Euro Area number was revised up three-tenths from the flash print to 49.8, and the German number was revised up a full point to 49.5.

Alongside the PMIs, the latest Euro Area inflation numbers also settled in line with expectations, which eased fears that the ECB might need to pivot more hawkishly. So the flash CPI print was at +2.2%, and the core CPI print at +2.3%, only modestly above the ECB’s target. In turn, that helped front-end sovereign bonds to rally, with yields on 2yr bunds (-0.9bps) and OATs (-1.2bps ) moving lower, though yields were little changed at the 10yr point (+0.1bps for bunds, -0.4bps for OATs).

Italian bonds outperformed (-0.8bps on 10yr) as Bloomberg reported that the country’s draft budget put the deficit at 3% of GDP already this year, matching the EU limit. If realised, that would be the first sub-3% deficit since 2019 before the Covid pandemic. It also contrasts with the French situation, where even former PM Bayrou’s proposals to reach a 3% deficit by 2029 were unable to pass. So that’s coincided with the Italian 10yr yield falling beneath France’s in recent weeks, and yesterday it closed 0.4bps beneath France’s.

Asian equity markets are rallying this morning with the KOSPI (+3.01%) standing out as the top performer, reaching a record high, propelled by significant increases in Samsung Electronics, which is surging +4.50% to approach a six-year peak, and SK Hynix soaring +10.69% to a record high. This is following their preliminary agreement to supply chips to the artificial intelligence leader OpenAI. Elsewhere, the Hang Seng (+1.32%) is also trading significantly higher after resuming trading post holiday helped by a rally in key Chinese internet stocks. Mainland China remains closed. In other markets, the Nikkei (+0.89%) is also climbing along with the S&P/ASX 200 (+1.08%), supported by robust performance in local mining stocks. Meanwhile, trading volumes across the region have remained subdued due to a week-long holiday in mainland Chinese markets. S&P 500 (+0.10%) and NASDAQ 100 (+0.19%) futures are also both edging up.

In early morning data, South Korea’s consumer inflation accelerated in September, rising by +2.1% year-on-year, slightly exceeding the +2.0% forecast, and recovering from a nine-month low of +1.7% recorded the previous month.

To the day ahead now, and central bank speakers include the Fed’s Logan, ECB Vice President de Guindos, the ECB’s Makhlouf and Villeroy, and BoJ Deputy Governor Uchida.

Tyler Durden | Zero Hedge

Zero Hedge

Thu, 10/02/2025 - 08:22

Stocks Hit Record Highs Around The Globe As AI Mania Hits Escape Velocity | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

(emphasis ours),

The current vaccine schedule in the United States may not be optimal, the Food and Drug Administration’s top vaccine official said in a new interview.

(emphasis ours),

The current vaccine schedule in the United States may not be optimal, the Food and Drug Administration’s top vaccine official said in a new interview.

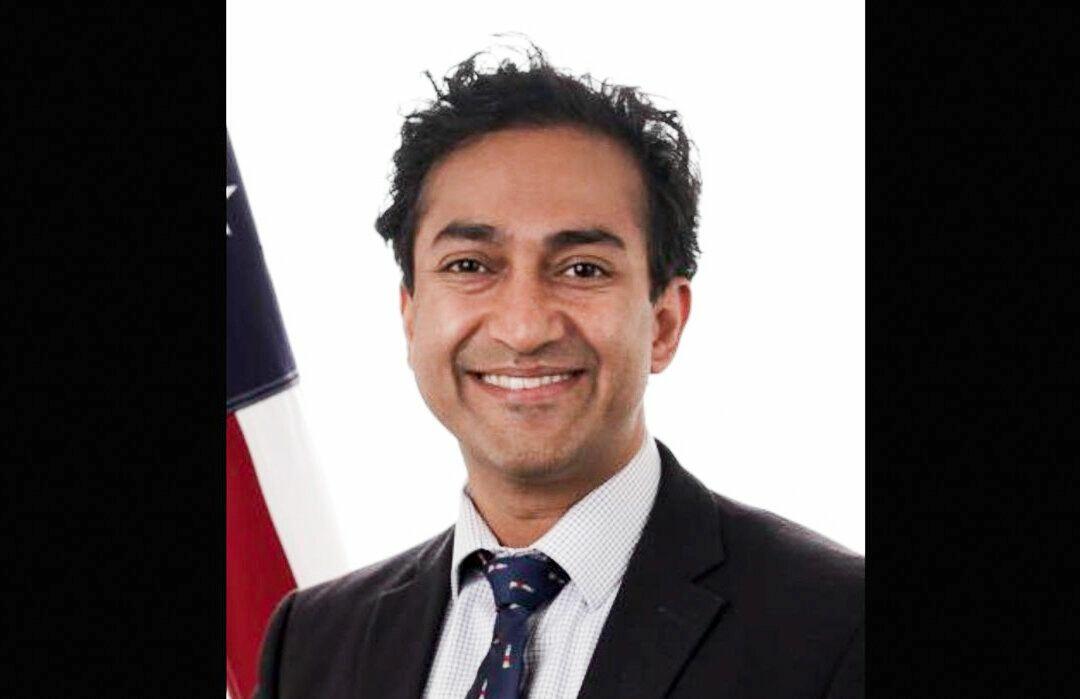

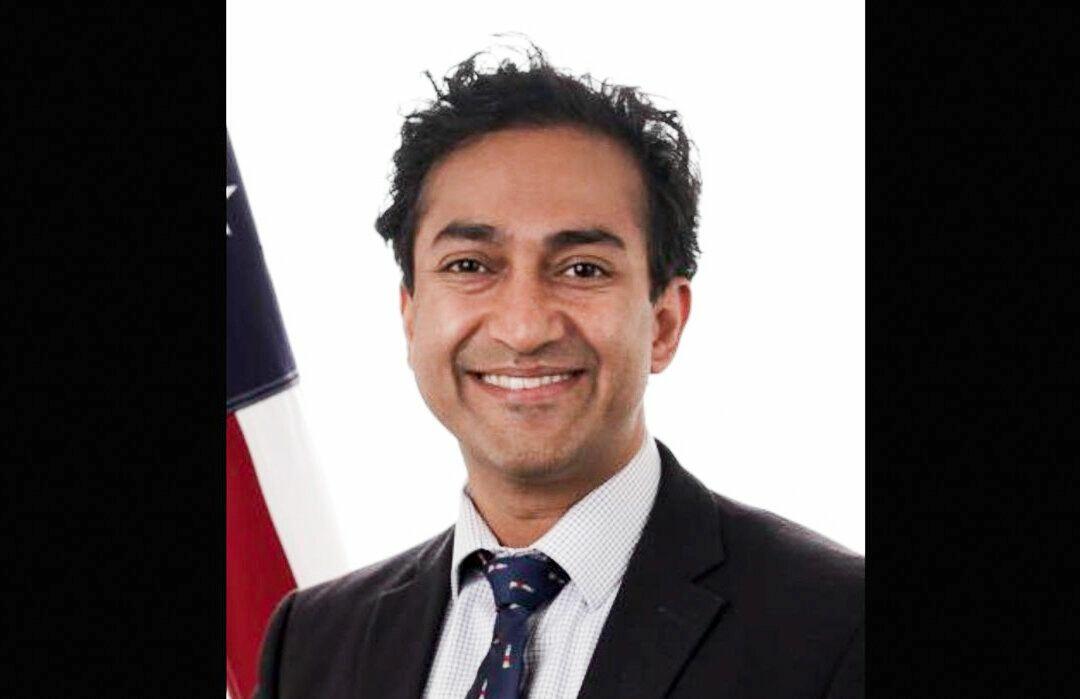

“I think the scientific establishment blindly defending the U.S. vaccine schedule is incorrect,” Dr. Vinay Prasad, director of the FDA’s Center for Biologics Evaluation and Research,

“I think the scientific establishment blindly defending the U.S. vaccine schedule is incorrect,” Dr. Vinay Prasad, director of the FDA’s Center for Biologics Evaluation and Research,  the Free Press in an interview published Sept. 29. “It is possible that our schedule is suboptimal.”

The FDA is part of the Department of Health and Human Services (HHS). Another HHS division, the Centers for Disease Control and Prevention, sets the immunization schedule, which contains more vaccines and doses than many other countries, such as Denmark.

“I’ve seen some pundits claim that Denmark can get away with a different schedule because they’re a smaller country,” Prasad said. “That’s illogical. Denmark is connected to all of Europe. It would be like arguing that Boston could have a different vaccine schedule than the rest of the Eastern Seaboard if we made it its own nation.”

Susan Monarez, who headed the CDC until she was recently fired,

the Free Press in an interview published Sept. 29. “It is possible that our schedule is suboptimal.”

The FDA is part of the Department of Health and Human Services (HHS). Another HHS division, the Centers for Disease Control and Prevention, sets the immunization schedule, which contains more vaccines and doses than many other countries, such as Denmark.

“I’ve seen some pundits claim that Denmark can get away with a different schedule because they’re a smaller country,” Prasad said. “That’s illogical. Denmark is connected to all of Europe. It would be like arguing that Boston could have a different vaccine schedule than the rest of the Eastern Seaboard if we made it its own nation.”

Susan Monarez, who headed the CDC until she was recently fired,  a congressional committee last month that HHS Secretary Robert F. Kennedy Jr. said during a private meeting that the vaccine schedule would be changing.

Monarez said she would only sign off on changes if she were presented with evidence backing them, and said she was not.

“The childhood vaccine schedule has been vetted and validated through science and evidence,” Monarez said.

If children receive vaccines when recommended by the schedule, they receive multiple shots across multiple visits.

President Donald Trump in a Sept. 22 briefing

a congressional committee last month that HHS Secretary Robert F. Kennedy Jr. said during a private meeting that the vaccine schedule would be changing.

Monarez said she would only sign off on changes if she were presented with evidence backing them, and said she was not.

“The childhood vaccine schedule has been vetted and validated through science and evidence,” Monarez said.

If children receive vaccines when recommended by the schedule, they receive multiple shots across multiple visits.

President Donald Trump in a Sept. 22 briefing  that parents should space out vaccines.

“I think the president has a deeper point about the evidence to support combination and concomitant administration. By background, combination vaccines combine two or more into a single vial or shot, while concomitant administration means administering two or more at the same visit. Historically, FDA has had stronger levels of evidence for combination than concomitant administration, but that is changing,” Prasad told the Free Press.

“We are planning new guidance to raise the bar for concomitant administration, and we have a paper now submitted in a medical journal.”

Measles, Hepatitis B Vaccines

Trump also proposed delaying the hepatitis B vaccine, which is currently on the immunization schedule at three doses in early childhood, or two doses for adolescents, and taking separate vaccines against measles, mumps, rubella, and chickenpox rather than combination vaccines.

Also recently, advisers to the CDC

that parents should space out vaccines.

“I think the president has a deeper point about the evidence to support combination and concomitant administration. By background, combination vaccines combine two or more into a single vial or shot, while concomitant administration means administering two or more at the same visit. Historically, FDA has had stronger levels of evidence for combination than concomitant administration, but that is changing,” Prasad told the Free Press.

“We are planning new guidance to raise the bar for concomitant administration, and we have a paper now submitted in a medical journal.”

Measles, Hepatitis B Vaccines

Trump also proposed delaying the hepatitis B vaccine, which is currently on the immunization schedule at three doses in early childhood, or two doses for adolescents, and taking separate vaccines against measles, mumps, rubella, and chickenpox rather than combination vaccines.

Also recently, advisers to the CDC  whether to alter or remove the entire regimen. The CDC has not yet acted on the advice.

“I think the president is 100 percent correct that it is prudent to take the chickenpox shot separately,” Prasad said.

He said that Trump and the Advisory Committee on Immunization Practices (ACIP) were right to question whether hepatitis B shots should be administered to babies born to mothers who tested negative for hepatitis B, noting that some other countries do not give the vaccine to such children.

ACIP is also examining the cumulative impact of the vaccination schedule, advisers

whether to alter or remove the entire regimen. The CDC has not yet acted on the advice.

“I think the president is 100 percent correct that it is prudent to take the chickenpox shot separately,” Prasad said.

He said that Trump and the Advisory Committee on Immunization Practices (ACIP) were right to question whether hepatitis B shots should be administered to babies born to mothers who tested negative for hepatitis B, noting that some other countries do not give the vaccine to such children.

ACIP is also examining the cumulative impact of the vaccination schedule, advisers  in June.

Trump’s comments drew criticism from some, including the American Academy of Pediatrics.

“Pediatricians know firsthand that children’s immune systems perform better after vaccination against serious, contagious diseases like polio, measles, whooping cough and hepatitis B. Spacing out or delaying vaccines means children will not have immunity against these diseases at times when they are most at risk,” the academy

in a statement.

Prasad said that Trump was offering personal advice and not trying to compel anyone to follow that advice. When asked whether Trump’s comments would drive vaccine hesitancy, Prasad said people are getting fewer vaccines due to the imposition of COVID-19 vaccine mandates during the pandemic.

“We will have more vaccine hesitancy for a generation. The president’s comments are not the driver of what we are seeing,” he said.

Prasad

in June.

Trump’s comments drew criticism from some, including the American Academy of Pediatrics.

“Pediatricians know firsthand that children’s immune systems perform better after vaccination against serious, contagious diseases like polio, measles, whooping cough and hepatitis B. Spacing out or delaying vaccines means children will not have immunity against these diseases at times when they are most at risk,” the academy

in a statement.

Prasad said that Trump was offering personal advice and not trying to compel anyone to follow that advice. When asked whether Trump’s comments would drive vaccine hesitancy, Prasad said people are getting fewer vaccines due to the imposition of COVID-19 vaccine mandates during the pandemic.

“We will have more vaccine hesitancy for a generation. The president’s comments are not the driver of what we are seeing,” he said.

Prasad  the FDA in August, several weeks after resigning. He had left the agency after some of his past comments were recirculated, including remarks about supporting Democrats.

“The FDA is steadfast in its commitment to rigorous, gold-standard science in the approval of vaccines, ensuring that every decision reflects the highest standards of safety and effectiveness. Science requires continual review and adaptation; when health recommendations become outdated or no longer align with the latest evidence, it is the responsibility of public health officials to make the necessary changes,” an HHS spokesperson told The Epoch Times in an email on Wednesday.

“Dr. Prasad’s comments underscore the open-mindedness that true gold-standard science demands, and that the health of our citizens depends upon. At this time, HHS and FDA cannot comment on potential future policy changes.”

Thu, 10/02/2025 - 20:35

the FDA in August, several weeks after resigning. He had left the agency after some of his past comments were recirculated, including remarks about supporting Democrats.

“The FDA is steadfast in its commitment to rigorous, gold-standard science in the approval of vaccines, ensuring that every decision reflects the highest standards of safety and effectiveness. Science requires continual review and adaptation; when health recommendations become outdated or no longer align with the latest evidence, it is the responsibility of public health officials to make the necessary changes,” an HHS spokesperson told The Epoch Times in an email on Wednesday.

“Dr. Prasad’s comments underscore the open-mindedness that true gold-standard science demands, and that the health of our citizens depends upon. At this time, HHS and FDA cannot comment on potential future policy changes.”

Thu, 10/02/2025 - 20:35

“I think the scientific establishment blindly defending the U.S. vaccine schedule is incorrect,” Dr. Vinay Prasad, director of the FDA’s Center for Biologics Evaluation and Research,

“I think the scientific establishment blindly defending the U.S. vaccine schedule is incorrect,” Dr. Vinay Prasad, director of the FDA’s Center for Biologics Evaluation and Research,

In premarket trading, Mag7 stocks are mostly higher (Tesla +1.7%, Nvidia +1.3%, Meta +0.7%, Apple +0.4%, Amazon +0.3%, Alphabet -0.09%, Microsoft -0.2%).

Absci (ABSI) is up 4% after JPMorgan initiates at overweight, saying the biotech company’s unique expertise in the computational space could change how new therapeutics are found.

AngioDynamics (ANGO) rises 11% after the medical-device maker boosted its net sales guidance for the full year.

Edison International (EIX) falls 1.8% after Jefferies downgraded the utility to hold, citing a higher risk profile.

Equifax (EFX), a credit-reporting company, drops 11% and TransUnion (TRU) falls 10% after Fair Isaac Corp. announced a new program giving mortgage lenders the option to calculate and distribute FICO scores directly to customers. Shares of Fair Isaac Corp. (FICO) are up 20%.

Fermi (FRMI) rises 16% after the Texas-based real estate investment trust rallied 55% in its market debut on Wednesday.

Shoals Technologies Group Inc. (SHLS) climbs 8% after Barclays upgraded the renewable-energy equipment company to overweight, citing growth potential.

Stellantis (STLA) gains 7% after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism on the group’s turnaround prospects.

The US govt shutdown quietly entered its shutdown for a second day and markets could care less. Strategists noted that past shutdowns have typically had little macroeconomic impact, and judging by recent history,

In premarket trading, Mag7 stocks are mostly higher (Tesla +1.7%, Nvidia +1.3%, Meta +0.7%, Apple +0.4%, Amazon +0.3%, Alphabet -0.09%, Microsoft -0.2%).

Absci (ABSI) is up 4% after JPMorgan initiates at overweight, saying the biotech company’s unique expertise in the computational space could change how new therapeutics are found.

AngioDynamics (ANGO) rises 11% after the medical-device maker boosted its net sales guidance for the full year.

Edison International (EIX) falls 1.8% after Jefferies downgraded the utility to hold, citing a higher risk profile.

Equifax (EFX), a credit-reporting company, drops 11% and TransUnion (TRU) falls 10% after Fair Isaac Corp. announced a new program giving mortgage lenders the option to calculate and distribute FICO scores directly to customers. Shares of Fair Isaac Corp. (FICO) are up 20%.

Fermi (FRMI) rises 16% after the Texas-based real estate investment trust rallied 55% in its market debut on Wednesday.

Shoals Technologies Group Inc. (SHLS) climbs 8% after Barclays upgraded the renewable-energy equipment company to overweight, citing growth potential.

Stellantis (STLA) gains 7% after the maker of Jeep SUVs reported a gain in third-quarter US deliveries, sparking optimism on the group’s turnaround prospects.

The US govt shutdown quietly entered its shutdown for a second day and markets could care less. Strategists noted that past shutdowns have typically had little macroeconomic impact, and judging by recent history,

But no demographic has taken it more on the chin than young Americans.

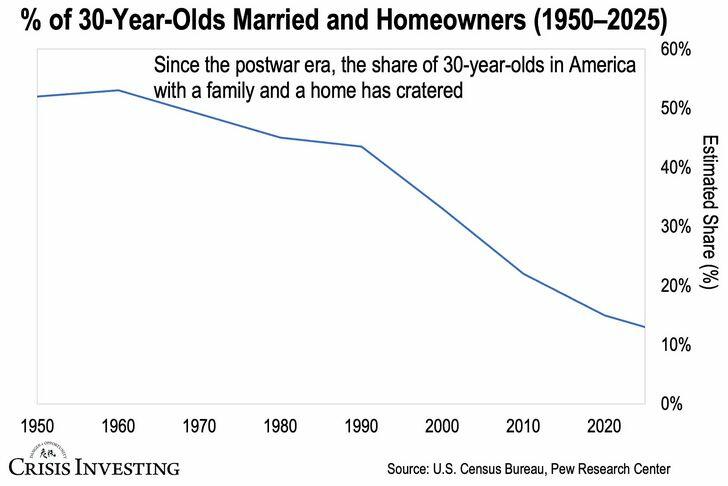

You can see it in stark terms in this week’s chart below. Since the postwar era, the share of 30-year-olds in America with both a family and a home has plummeted—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

But no demographic has taken it more on the chin than young Americans.

You can see it in stark terms in this week’s chart below. Since the postwar era, the share of 30-year-olds in America with both a family and a home has plummeted—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

Let that sink in. In 1950, more than half of 30-year-olds had achieved what most would consider the basic markers of adult stability: marriage and homeownership. Today, it’s barely one in eight.

If you look closer, the graph shows two distinct phases of decline. From 1950 to 1990, there was a steady but manageable erosion—the share of 30-year-olds with both a family and a home dropped from 52% to about 43% over those 40 years.

That represented the gradual social changes we’re all familiar with: more women entering the workforce, people marrying later, changing cultural attitudes toward marriage.

Then something dramatic happened around 2000. The decline went into freefall. Between 1990 and 2025, the rate collapsed from 43% to 13%—a 70% drop in just over three decades.

What explains it?

We could, of course, blame this on changing cultural preferences—young people choosing career over family, prioritizing experiences over stability. That’s certainly part of the story. Young people today do have very different priorities than those more than half a century ago.

But there’s another side to this: the economics of young adulthood have become impossible. Keep in mind, today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation gets worse when you factor in the debt burden crushing young adults. The very institution supposedly preparing young people for economic success—college—has become a wealth destroyer. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024 alone (with total outstanding student debt exploding from $500 billion to $1.8 trillion).

Think about the brutal math facing today’s 30-year-olds.

They graduate with an average of $38,000 in student debt—though plenty are actually walking away with $60,000, $80,000, or even six-figure debt loads. They need $130,000+ in annual income to afford the average home, and compete in a job market where wages haven’t kept pace with housing costs.

In other words, they’re entering their peak family-formation years already financially crippled.

No wonder marriage and homeownership rates have collapsed.

The cruel irony is that we—scratch that, America’s political class—has created a system where the very credentials supposedly required for middle-class success have priced young people out of middle-class life.

Editor’s Note: If you have young people in your life wondering what the future holds in this broken system, Doug Casey and Matt Smith’s “<a href="

Let that sink in. In 1950, more than half of 30-year-olds had achieved what most would consider the basic markers of adult stability: marriage and homeownership. Today, it’s barely one in eight.

If you look closer, the graph shows two distinct phases of decline. From 1950 to 1990, there was a steady but manageable erosion—the share of 30-year-olds with both a family and a home dropped from 52% to about 43% over those 40 years.

That represented the gradual social changes we’re all familiar with: more women entering the workforce, people marrying later, changing cultural attitudes toward marriage.

Then something dramatic happened around 2000. The decline went into freefall. Between 1990 and 2025, the rate collapsed from 43% to 13%—a 70% drop in just over three decades.

What explains it?

We could, of course, blame this on changing cultural preferences—young people choosing career over family, prioritizing experiences over stability. That’s certainly part of the story. Young people today do have very different priorities than those more than half a century ago.

But there’s another side to this: the economics of young adulthood have become impossible. Keep in mind, today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation gets worse when you factor in the debt burden crushing young adults. The very institution supposedly preparing young people for economic success—college—has become a wealth destroyer. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024 alone (with total outstanding student debt exploding from $500 billion to $1.8 trillion).

Think about the brutal math facing today’s 30-year-olds.

They graduate with an average of $38,000 in student debt—though plenty are actually walking away with $60,000, $80,000, or even six-figure debt loads. They need $130,000+ in annual income to afford the average home, and compete in a job market where wages haven’t kept pace with housing costs.

In other words, they’re entering their peak family-formation years already financially crippled.

No wonder marriage and homeownership rates have collapsed.

The cruel irony is that we—scratch that, America’s political class—has created a system where the very credentials supposedly required for middle-class success have priced young people out of middle-class life.

Editor’s Note: If you have young people in your life wondering what the future holds in this broken system, Doug Casey and Matt Smith’s “<a href="

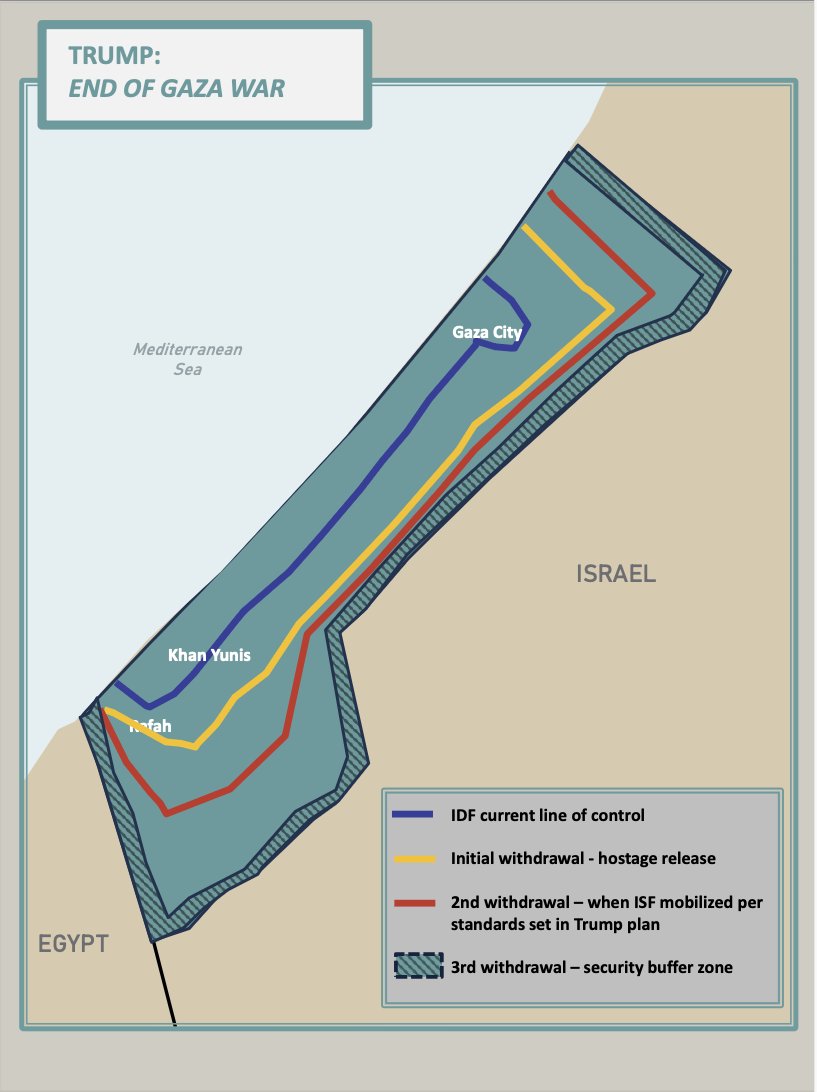

Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for

Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for