Futures Jump As Meltup Returns, Gold Soars To New Record High Ahead Of Govt Shutdown

Futures Jump As Meltup Returns, Gold Soars To New Record High Ahead Of Govt Shutdown

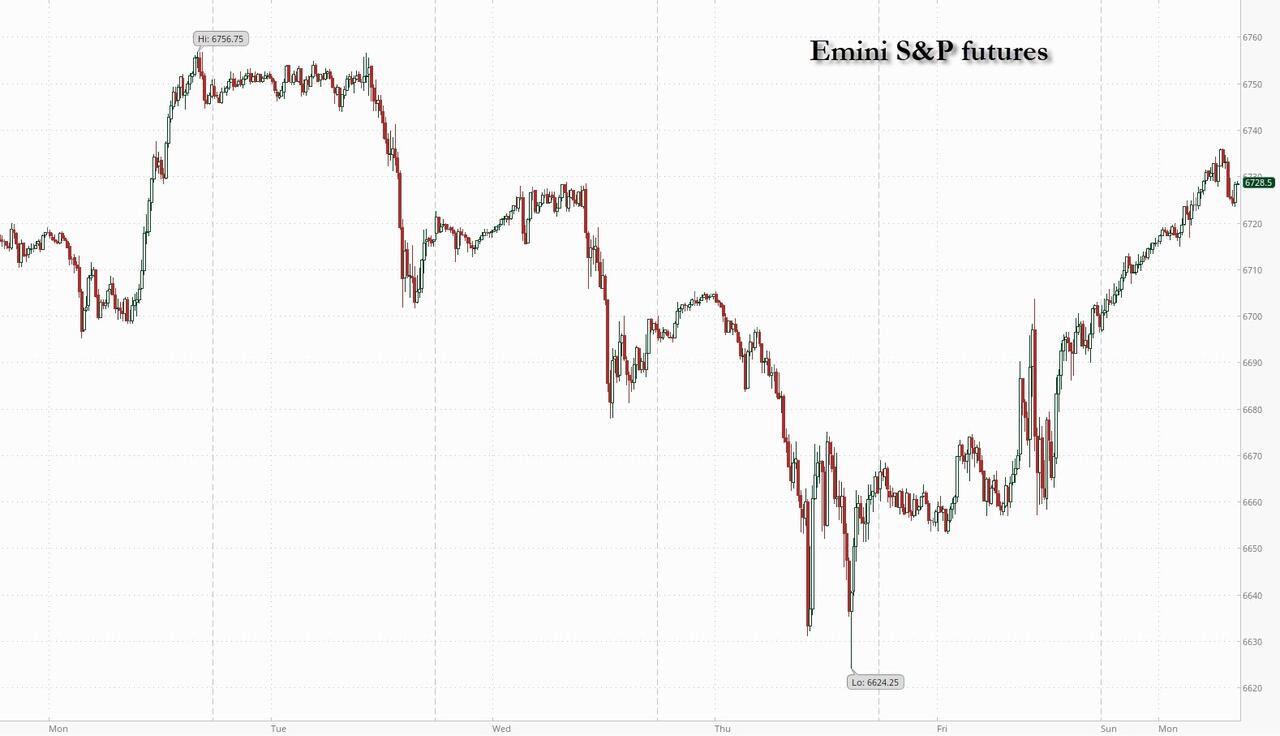

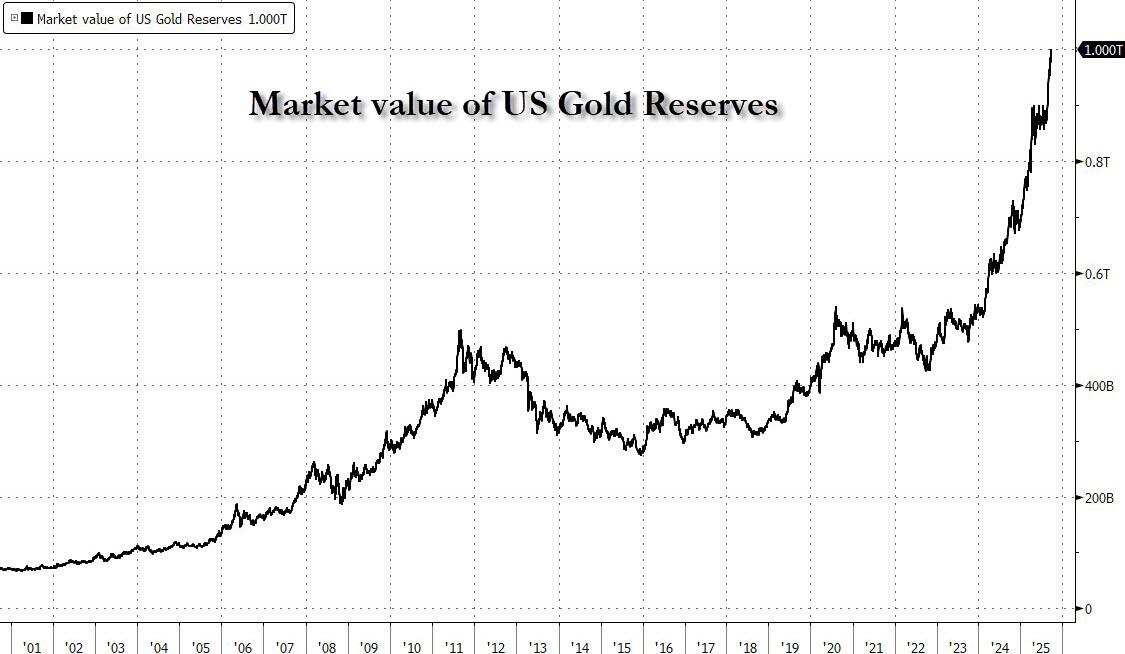

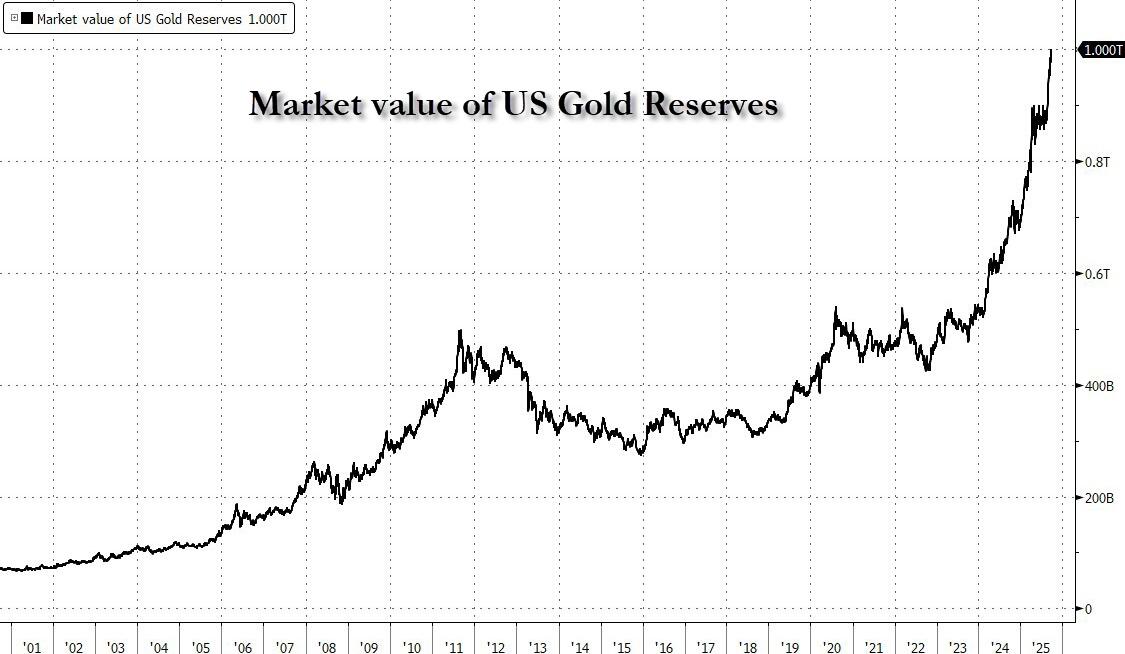

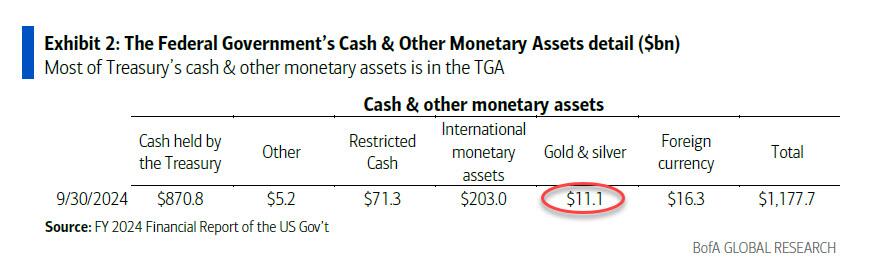

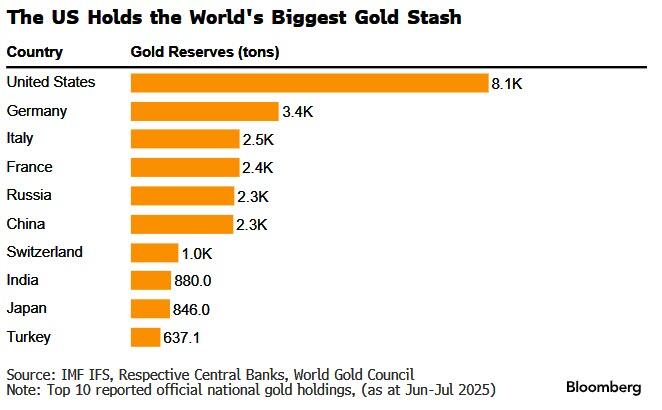

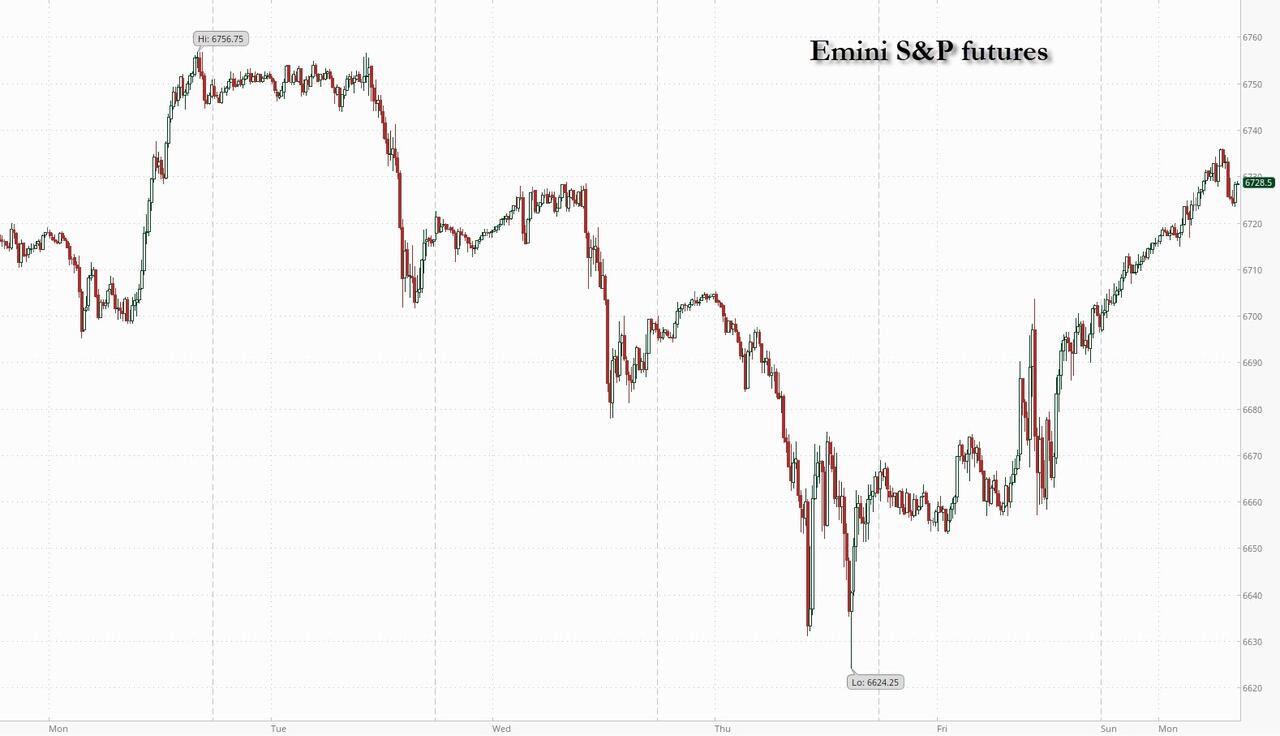

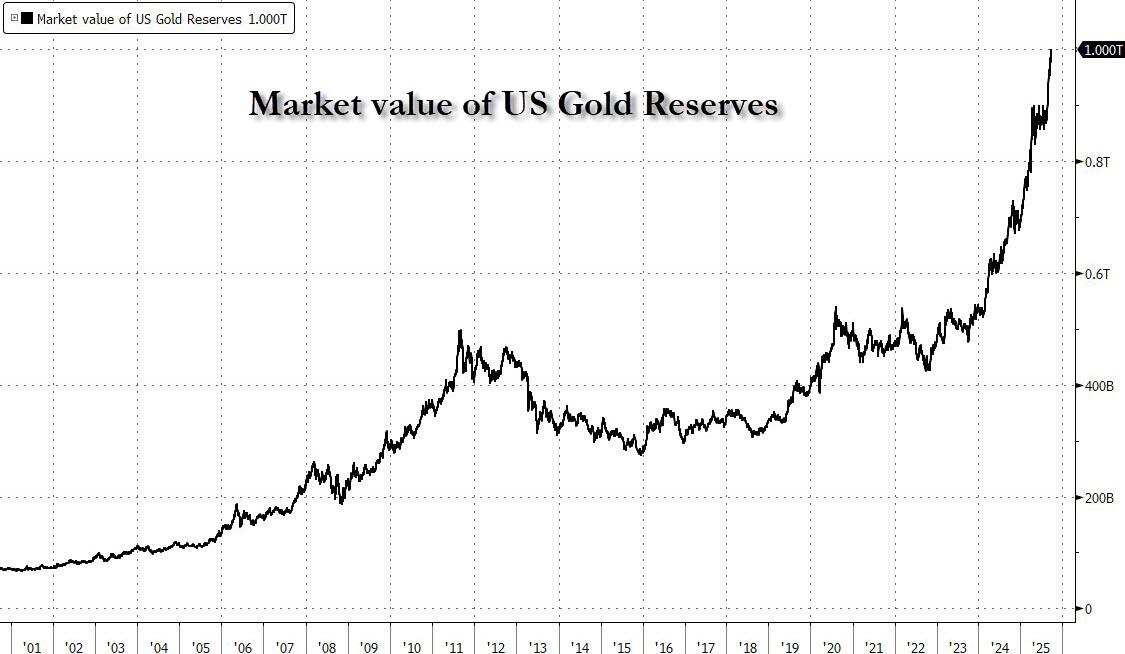

Last week's small market swoon is a distant memory with US equity futures up sharply on Monday, led by tech and small caps as the S&P looks to set a new ATH. As of 8:00am ET, S&P futures are up 0.5% (and off session highs) keeping the benchmark on track for its best September since at least 2013, even as the month is typically difficult for stocks. Mag7 / Semis are mostly higher premarket, and with Cyclicals leading Defensives after last week's stumble, the AI Theme looks resurgent again, helping sending European stocks broadly green. Most Asian equities advance as Chinese tech stocks resume rally. Hang Seng climbs for the first time in three sessions. Gold hit yet another record, topping $3,820 and pushing the market value of US gold reserves above $1 trillion, with a US government shutdown looming in 48 hours, while the dollar tumbles as clock ticks toward US shutdown deadline on Tuesday midnight. The yen strengthens below 149-handle and euro gains 0.2%. Yuan strengthens on industrial profits jump and a solid PBOC fixing. Treasury 10-year yield eases three basis points to 4.15%. WTI crude futures are offered around $65.30 on OPEC+ output hike expectations; commodities are weaker ex-Precious and Coffee which continue their bull runs. This is a heavy data week complicated by a potential government shutdown which could see labor market data delayed. The Fedspeech calendar is heavy with 12x speakers this week

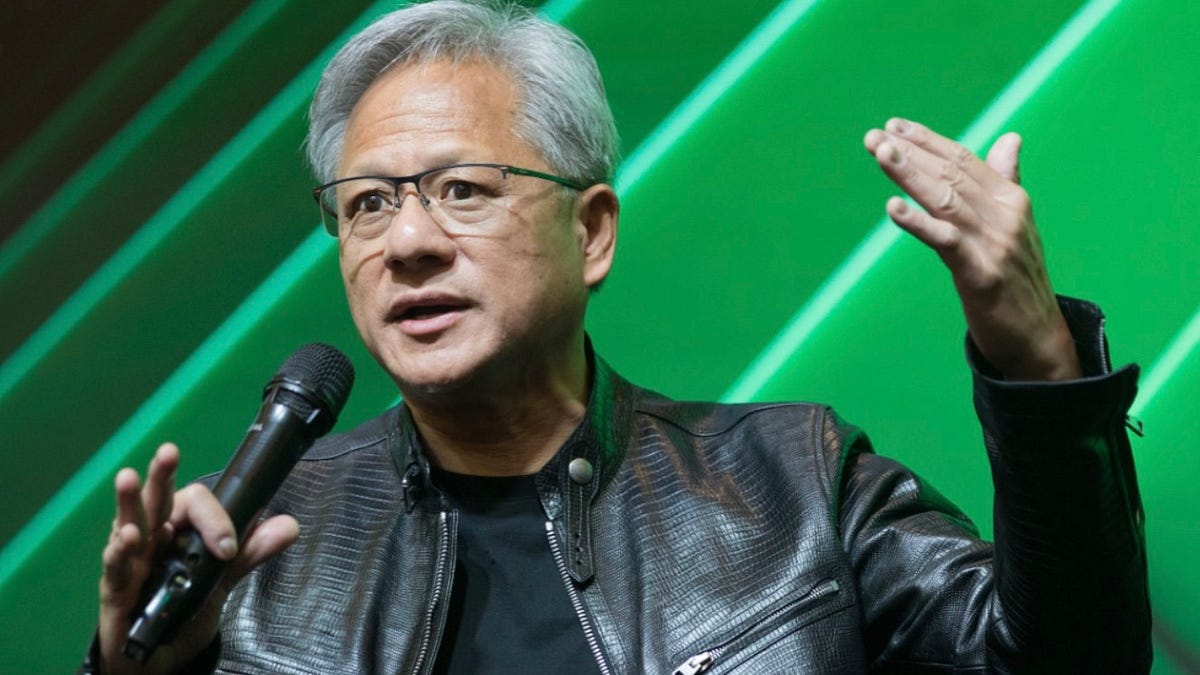

In premarket trading, Mag 7 stocks are mostly higher (Amazon +1%, Alphabet +0.8%, Meta +0.6%, Nvidia (NVDA) +0.8%, Tesla (TSLA) +0.7%, Microsoft (MSFT) +0.3%, Apple (AAPL) -0.2%)

Merus (MRUS) soars 37% after Danish biotechnology group Genmab announced a deal to buy the company for $8 billion.

MoonLake Immunotherapeutics (MLTX) sinks 88% following disappointing late-stage clinical trial data on the biopharmaceutical company’s experimental drug to treat a debilitating skin condition known as hidradenitis suppurativa.

Occidental Petroleum (OXY) gains 1.5% after the Financial Times reported that the company is in talks to sell its OxyChem petrochemical unit in a deal worth at least $10 billion.

Tilray (TLRY) climbs 16%, rising with other cannabis stocks, after President Donald Trump posted a video on social media Sunday that touts medical benefits of “hemp-derived CBD” for seniors.

USA Rare Earth (USAR) gains 5% after the company agreed to acquire UK-based manufacturer LCM in a cash and stock deal.

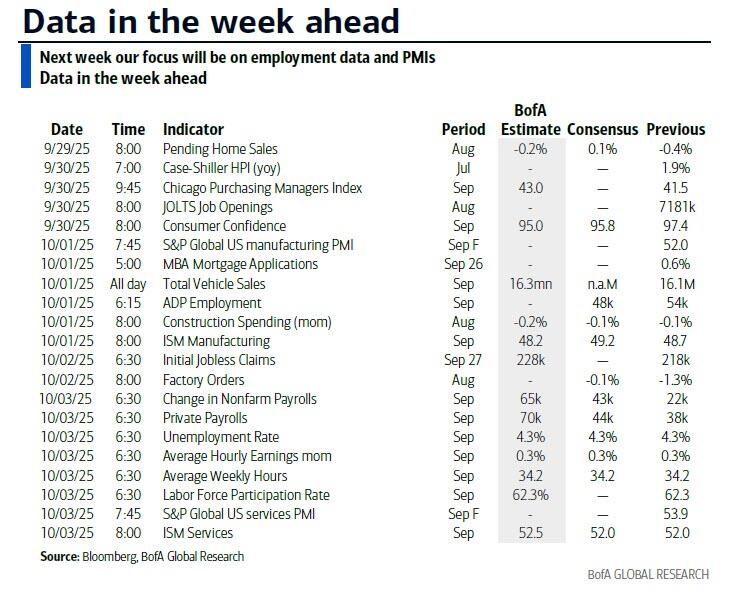

A busy week of data releases will culminate in Friday’s nonfarm payrolls report, as traders price in two Federal Reserve rate cuts by January to support the labor market. In the mix is the risk of a US government shutdown amid an impasse in Congress that could delay some releases.

Friday’s payrolls report is expected to show that the US economy added 50,000 jobs in September, in line with the average from the past three months. The jobless rate is projected to hold steady at 4.3%. Before then, Tuesday’s JOLTS report is expected to show a decline in job openings, while Wednesday’s data on company hiring is likely to confirm a further slowdown. Fed policymakers including Christopher Waller, Alberto Musalem and Raphael Bostic are due to speak Monday.

Global stocks are poised to extend their rally through year-end, driven by a resilient US economy, supportive valuations and a more dovish Fed stance, Goldman Sachs strategists said. A team led by Christian Mueller-Glissmann turned overweight on stocks over a three-month view, noting that the asset class often performs well during late-cycle slowdowns when policy support is in place.

“Good earnings growth, Fed easing without a recession and global fiscal policy easing will continue to support equities,” the team wrote in a note. “With anchored recession risk, we would buy dips in equities into year-end.”

The momentum in markets is “driven by a Goldilocks environment of optimistic growth prospects alongside expectations of a more dovish Fed,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “There might be some adverse effects if the shutdown were to prevail for a longer period, which is not our base case.”

European stocks followed their Asian counterparts higher with the Stoxx 600 climbing 0.4%. European stocks are set for their third straight quarter of gains as investors remain upbeat on the prospect of economic growth, AI advances and interest-rate cuts in the US. Miners and tech are outperforming while the energy and banking sectors are the biggest of the few decliners. Here are some of the biggest movers on Monday:

UCB shares soar as much as 20% to a record high after rival MoonLake Immunotherapeutics released late-stage clinical trial data which JPMorgan analysts called “disappointing.”

European miners are outperforming on Monday, after analysts at BofA Global Research hiked their copper price forecasts as mine supply comes under pressure while flagging a focus on pure plays like Antofagasta, KGHM and Atalaya Mining.

GSK shares rise as much as 3.9% after the drugmaker said Luke Miels will replace Emma Walmsley as CEO, effective Jan. 1.

Lufthansa shares rise as much as 2.3% after the airline outlined new financial goals ahead of its capital markets day.

Exosens rises as much as 4% after securing a contract with the Spanish army to supply 17,000 advanced monocular night vision devices.

Gjensidige rises as much as 5.2% to a new high as Jefferies analyst Derald Goh double-upgrades the Norwegian insurer to buy.

Kloeckner rises as much as 3.9% after the steel- and metal-products distributer agreed to sell seven distribution sites to Russel Metals and one to Service Steel Warehouse for a total of about $119 million.

CMC Markets advances as much as 6.3% after the firm said it has been selected as the preferred platform supplier for Westpac’s online share trading services.

Novo Nordisk shares fall as much as 2.9%. The firm faces a host of negative catalysts over the coming year and a slowdown in US GLP-1 prescription growth, Morgan Stanley writes in note as it downgrades the shares to underweight and sets a joint Street-low price target.

Genmab falls as much as 5.7% after the Danish biotechnology group announced it would buy US firm Merus for $8 billion.

Landis+Gyr falls 3.4% after the Swiss energy management firm announced plans to divest its EMEA business to Aurelius for an enterprise value of $215 million, according to a statement.

Earlier in the session, most Asian equities advance as Chinese tech stocks resume rally. Hang Seng climbs for the first time in three sessions. The ChiNext jumps almost 2% and CSI 300 nudges 0.5% higher. Japanese indexes buck the trend on ex-dividend stocks. The MSCI Asia Pacific Index climbed 0.5%, with Alibaba and Tencent among the biggest contributors. Shares also gained in China, Australia and Thailand. Japanese equities fell as ex-dividend stocks weighed on the nation’s benchmark indexes. China’s financial markets will be shut from Wednesday for the Golden Week holiday. Travel-related spending over the period along with recent stimulus measures for service industries may potentially revive sentiment toward consumer stocks.

Gold hit yet another record, topping $3,820 and pushing the market value of US gold reserves above $1 trillion, while the dollar tumbles as clock ticks toward US shutdown deadline.

In FX, the Bloomberg Dollar Spot Index falls 0.2% as govt shutdown fears emerge; the yen outperformed its G-10 peers, rising 0.6% against the greenback after Bank of Japan board member and noted dove Noguchi pointed to the rising need for an interest rate hike. Yuan strengthens on industrial profits jump and a solid PBOC fixing.

In rates, treasury 10-year yield eases two basis points to 4.16%. Aussie yields shed 4 bps across the curve. JGB futures remain better bid throughout the day. UK gilts held gains as Chancellor of the Exchequer Rachel Reeves addressed the Labour party conference.

In commodities, WTI crude futures are offered around $65.30 on OPEC+ output hike expectations. Bitcoin rises 1%.

Today's US economic data slate includes August pending home sales (10am New York time) and September Dallas Fed manufacturing activity (10:30am). Fed speaker slate includes Waller (7:30am), Hammack (8am), Musalem (1:30pm) and Bostic (6pm)

Market Snapshot

S&P 500 mini +0.5%

Nasdaq 100 mini +0.7%

Russell 2000 mini +0.7%

Stoxx Europe 600 +0.4%

DAX +0.3%

CAC 40 +0.3%

10-year Treasury yield -3 basis points at 4.14%

VIX +0.5 points at 15.82

Bloomberg Dollar Index -0.2% at 1202.11

euro +0.2% at $1.1722

WTI crude -1.5% at $64.75/barrel

Top Overnight News

New York City Mayor Eric Adams dropped his bid for re-election: X

Trump will host Israeli Prime Minister Benjamin Netanyahu at the White House on Monday, with the U.S. president pushing a Gaza peace proposal after a slew of Western leaders embraced Palestinian statehood in defiance of American and Israeli opposition. RTRS

US President Trump posted an image of himself “firing” Fed Chair Powell, via Truth Social.

SEC’s Paul Atkins says he will fast-track Trump’s proposal to allow companies to report earnings on a semi-annual basis instead of quarterly (companies will have the option to continue posting quarterly results if they so choose). FT

US President Trump said he will discuss the looming government shutdown with congressional leaders on Monday and believes Democrats may want to make a deal; he added that if Democrats refuse to make a deal, "the country closes", according to Reuters. US President Trump will meet with the congressional leaders at 20:00BST/15:00ET: Punchbowl

Electronic Arts (EA) is near a roughly USD 50bln deal to go private: WSJ.

Chinese factory workers are facing harsh conditions while racing to produce Apple’s (AAPL) new iPhone 17 lineup: China Labour Watch.

US Vice President JD Vance said he is confident the US has separated TikTok from ByteDance: RTRS

Occidental Petroleum (OXY) is said to be in talks to sell its OxyChem petrochemical unit in a deal worth at least USD 10bln: FT.

Fed’s Hammack reiterated her somewhat hawkish policy view in remarks on CNBC Mon morning, warning that inflation risks remain elevated. More difficult to see that tariffs will be a one-time impact. Need to maintain restrictive policy, current policy is mildly restrictive. Short distance from neutral. Will not get to 2% inflation target until late 2027 or early 2028. CNBC

The ECB’s Gabriel Makhlouf told the FT that the central bank is “near the bottom” of its rate-cutting cycle. FT

Alibaba’s new Qwen3-Omni multimodal artificial intelligence system has quickly become the most popular model in the world’s largest open-source AI community, challenging closed systems from OpenAI and Google while underscoring the growing popularity of Chinese open AI systems. SCMP

China’s ruling Communist Party will convene a closed-door meeting from Oct. 20 to 23 to review development plans for the next five years. BBG

China has slashed its annual output growth target for key non-ferrous metals over 2025 and 2026, underscoring a policy shift from volume expansion to efficiency and sustainability. BBG

A dovish Bank of Japan board member said on Monday the need for an interest rate hike was increasing "more than ever," adding to signs of a hawkish shift on the board that heightens the chance of a rate increase as early as October. RTRS

Huawei aims to double output of its most advanced AI chips over the next year, as part of a plan to unseat Nvidia in China, people familiar said. BBG

Trade/Tariffs

The UK will offer to pay more for drugs in a bid to placate US President Trump and pharmaceutical groups, according to the FT.

US soybean farmers face a crisis as China halts purchases amid the tariff dispute, according to Reuters.

The EU is plotting a “devastating tariff hit” against UK steelmakers, with officials in Brussels aiming to halve the UK’s tariff-free quotas and double tariffs to 50% under pressure from steel industries in member states, according to The Times.

South Korea rejected a US request for USD 350bln in cash under a tariff-reduction deal, a senior official said, according to Reuters.

China is urging the US to oppose the independence of Taiwan, saying it is incompatible with the One China principle.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mostly firmer following the positive Wall Street performance on Friday, albeit participants remain cautious ahead of a risk-packed week that culminates with Friday’s US jobs report. ASX 200 advanced, led by strength in gold miners and a rebound in healthcare, while traders looked ahead to tomorrow’s RBA decision in which Australia's Big 4 banks expect no change in rates. Nikkei 225 underperformed amid yen strength, with sentiment also weighed by the ex-dividend date for end-of-month payouts and risk trimming ahead of the BoJ Tankan Survey and the LDP leadership vote later in the week. Hang Seng and Shanghai Comp initially diverged, with Hong Kong buoyed by tech gains and foreign inflows. The Mainland swung between modest gains and losses heading into its weeklong break amid National Day and the Mid-Autumn Festival, whilst reports also suggested Chinese President Xi is reportedly planning to press US President Trump to formally state that the US opposes Taiwan’s independence, according to WSJ. KOSPI was lifted with tech spearheading the gains, whilst reports over the weekend suggested South Korea rejected a US request for USD 350bln in cash under a tariff-reduction deal. Nifty 50 traded with cautious gains after Friday's losses, and with traders looking ahead to the RBI policy announcement later this week.

Top Asian News

China’s top economic planner, the NDRC, held a symposium on Sunday hosted by agency head Zheng Shanjie, inviting private enterprises to submit opinions and suggestions on expanding effective investment during the 15th Five-Year Plan period (2026–30), according to the NDRC’s official WeChat account via Global Times.

Taiwan is eyeing an expanded tech presence in India amid surging US demand, according to the chief of a trade body, Reuters reported.

BoJ's Noguchi says that Japan is moving towards 2% inflation target; need to adjustment to policy has heightened; economy and prices face downside risks. Vital to adjust easing at right timing. Need to conduct policy in flexible manner. Upside risks becoming more important in making policy decision.

China's Communist Party will be holding its fourth plenum across October 20th-23rd, via Xinhua. Subsequently, China's Politburo has studied draft of next five-year plan; continues to enhance development momentum. Puts emphasis on high-quality growth, reform and opening.

China State Planner Official says China's new policy-base financial tool amounts to 500bln Yuan.

A firmer start to the week for European bourses, Euro Stoxx 50 +0.3%. Largely on a constructive footing, though the periphery is a touch softer. Incremental macro drivers so far a little light for the bloc. Sectors mostly in the green, Basic Resources leads given underlying benchmarks, Tech benefits in a bounce from Fridy's pressure. Banking names lag amid softness in yields, Energy hit alongside crude on reports around OPEC+. Healthcare supported by the White House will honour a 15% cap on pharmaceutical tariffs as part of trade deals with the EU and Japan, according to CNBC; though, a reported 100% level on the UK offsets. Stateside, futures firmer across the board, ES +0.5% & NQ +0.6%. Focus very much on the packed data agenda for the week as a whole, potential gov't shutdown which could impact that data and several Fed speakers.

Top European News

UK PM Starmer urged Labour to unite for the “fight of our lives” against Nigel Farage’s Reform UK, as Starmer faces dire poll ratings and questions over his leadership ahead of the party conference, while ministers unveiled plans for three new towns as part of a broader housebuilding push, according to the FT.

UK Chancellor Reeves risks a confrontation with the head of the government’s fiscal watchdog over plans to scrap her annual spring forecast, according to Bloomberg.

Separately, UK Chancellor Reeves says she will work to bring inflation down; reiterates commitment to fiscal rules and stability and commitments to not increasing VAT, Income Tax or NI. UK does not need a wealth tax.

ECB’s Makhlouf said the ECB is “near the bottom” of its easing cycle but will need to remain vigilant as the impact of tariffs on most EU exports is still to feed through. He added that his mind is not set on how to vote at the upcoming meeting at the end of October, according to FT.

Bank of Italy kept the countercyclical capital buffer for banks in Q4 at zero, according to Reuters.

Portugal will raise taxes on foreign home buyers amid a surge in property prices, according to Reuters.

Switzerland voted to abolish a century-old system of taxing property, a move that will lower dues for homeowners and potentially boost real estate prices, according to Reuters.

The head of Switzerland’s right-wing People’s Party said the government needs to find a compromise with UBS (UBSG SW) to raise the bank’s capital requirements, according to Reuters.

SNB is lowering the threshold factor for the remuneration of sight deposits from 18 to 16.5, as of November 1st.

FX

Dollar is pulling back from the data induced upside seen last week. Focus now on this week's packed agenda of labour market data, Fed speak and angst into a potential gov't shutdown. DXY has slipped below its 50DMA @ 98.02 and made its way back onto a 97 handle. The next level of support comes via the 25th September trough @ 97.73.

EUR is taking advantage of the softer USD with incremental macro drivers for the region on the light side over the weekend. Spanish HICP printed in-line with consensus at 3.0% (prev. 2.7%), whilst the M/M metric only picked up to 0.1% from 0.0% (exp. 0.3%). EUR/USD has continued its ascent on a 1.17 handle with a current session peak @ 1.1733. The next upside target comes via the 25th September peak @ 1.1754.

JPY tops the G10 leaderboard into a pivotal week of domestic events including Tankan and the LDP leadership election. Strength this morning was spurred by BoJ's Noguchi, noting that upside risks are becoming more important in making policy decisions and the need to adjust policy has heightened. USD/JPY has delved as low as 148.48, taking out the 25th September low @ 148.55. Focus is now on a test of the 200DMA to the downside @ 148.41.

Sterling firmer, marginally outpacing the EUR against the USD thus far. Awaiting the speech from Chancellor Reeves at the party conference, due around 12:00BST. Cable has risen as high as 1.3450 with the next resistance point coming via the 50DMA @ 1.3467.

Antipodeans eventually gained after both initially struggling to fully benefit in APAC hours from the softer dollar amid a cautious risk tone at the time. Attention stays on tomorrow’s RBA meeting, where markets price only a slim 8% chance of a 25bps cut. Little reaction to the PBoC's firmer fix.

Fixed Income

Overall, a firmer start to the week. Bunds just off highs in a 128.29 to 128.57 band. Slightly outpacing USTs in terms of gains this far, surpassing last week’s 128.41 peak and looking to 129.02 from September 18th. Relative outperformance that is likely a function of three of the four main Spanish Flash inflation measures printing cooler than forecast.

USTs bid, though as alluded to above the magnitude of performance is slightly more modest. At the top-end of a 112-08+ to 112-17 band, extending above Friday’s 112-15 best but shy of 112-22 and 113-00 from the two preceding sessions. Hammack (2026) was on CNBC this morning, stuck to her language from last week in outlining a need to maintain restrictive policy, describing the current level as mildly restrictive and that the Fed is a short distance from neutral.

Gilts also in the green, opened alongside the discussed Spanish data and seemingly caught a tailwind from this. Focus almost entirely on Chancellor Reeves' upcoming speech, thus far in remarks to Bloomberg she said her commitment to not increasing the tax burden via VAT, Income Tax or NI stand. Remarks that, if held to, limit the Chancellor's revenue generating sources with the general view being that she will need to raise at least GBP 20bln via taxes during the Autumn Budget. No significant moves to those interviews. Benchmark at a 90.82 peak, taking out Friday’s 90.74 best in the process. Resistance ahead at 91.11, 91.12 and 91.28 from last week.

Commodities

Crude clipped by OPEC+ production reports. Further bearishness stemming from the resumption of flows on the Ceyhan pipeline and potentially from Moldova. However, we remain conscious that the actual impact of any OPEC+ increase is likely to be less than the headline suggests, as in August OPEC cautioned that a lack of spare capacity among nations meant the enacted supply increase would be less than the headline figure for September; a narrative that remains in play for October and November.

WTI and Brent weighed on this morning, down by c. USD 1.00/bbl at most and at respective lows of USD 64.72/bbl and USD 69.27/bbl.

Continued upward action for precious metals, both spot gold and silver at fresh highs for the day and yet another ATH for XAU at USD 3819.8/oz thus far. Specifics for the space light with the yellow metal firmer despite the constructive risk tone but potentially benefiting from apprehension into the week’s key labour market data from the US and the looming government shutdown, a shutdown that could impact the delivery of Friday’s BLS report. USD pressure is another source of strength.

Copper was modestly firmer in APAC trade, benefiting from the USD though with gains capped by the cautious risk tone at the time and apprehension into a packed week. Since, 3M LME Copper has continued to tick higher, at a USD 10.29k peak but shy of last week’s USD 10.319k best.

OPEC+ will likely raise oil production quotas by at least 137k bpd at its October 5th meeting, according to Reuters, citing sources. Subsequently, Kpler's Bakr, citing sources on OPEC+, reports "there have been no consultations with regards to the group’s November policy yet.".

An Iraqi OPEC delegate said the country can boost exports beyond current levels once the Iraq–Turkey pipeline resumes and new projects come online, according to the state news agency.

Geopolitics:

NATO

Russian President Putin is to deliver a major speech this week, according to multiple media outlets.

Belarus's President said that if NATO threatens to shoot down Russian and Belarusian fighter jets, the response will come immediately, according to Reuters.

NATO will boost its presence in the Baltic region following drone incidents in Denmark, according to Reuters.

Denmark announced that unknown drones were spotted over several military facilities on Friday night, including the country’s main air base Karup, which houses Denmark’s F-16s and F-35s, according to Reuters.

RUSSIA-UKRAINE

Russian missiles and drones struck Ukraine in a “savage” 12-hour attack, according to Reuters.

Russian sources said the Russian army launched strikes targeting military sites in Kyiv and its surroundings, as well as weapons depots and air defence systems.

Poland closed its airspace after a “massive” Russian attack on Ukraine’s capital killed at least four people, according to Reuters.

Ukrainian President Zelensky said he expects new EU sanctions on Russia this week, according to Reuters.

Russian Foreign Minister Lavrov said no one expects a return to Ukraine’s 2022 borders, calling it politically blind, according to Reuters.

Ukraine said drones struck an oil pumping station in Russia’s Chuvashia region, according to Reuters.

The Kremlin said it has received no signals from Kyiv regarding the resumption of Russia-Ukraine talks, via RIA.

ISRAEL-HAMAS

US President Trump told Axios his 21-point Gaza peace plan is in the final stages, saying it could end the war and open the way for wider Middle East peace. The plan, drafted by Steve Witkoff and Jared Kushner, includes a permanent ceasefire, release of hostages within 48 hours, gradual Israeli withdrawal, release of Palestinian prisoners, a post-war governing mechanism in Gaza without Hamas, Arab and Muslim funding, disarmament of Hamas, amnesty or safe passage for its members, no Israeli annexation of Gaza or the West Bank, an Israeli commitment not to attack Qatar again, and a future path to Palestinian statehood after reforms to the Palestinian Authority, according to Axios.

Israeli PM Netanyahu discussed President Trump’s 21-point Gaza peace plan, saying priorities are freeing hostages and dismantling Hamas while expressing doubt over Palestinian Authority reform, according to Fox News.

Israel’s Channel 12 reported that turning the Gaza Strip into an international trade zone is one of the clauses of the Trump plan.

Israel is ready to consider withdrawing from a number of areas in Syria where IDF forces are deployed, but not from the Hermon Crown, according to Kann News.

Israel’s Kan TV quoted a source close to PM Netanyahu as saying there are “significant gaps” between him and the White House over the terms of ending the war in the Gaza Strip.

US President Trump told Reuters in a phone interview that he has gotten a "very good response" from Israel and Arab leaders to the Gaza peace plan proposal, adding that "everybody wants to make the deal" and he hopes to finalize it in a meeting with Netanyahu on Monday; he said the proposal is aimed not just at Gaza but at reaching a broader peace in the Middle East, according to Reuters.

The US and Israel are reportedly very close to an agreement on President Trump’s plan to end the war in Gaza, though Hamas still needs to agree, according to officials cited by Axios.

IRAN

A Russian and Chinese push to delay the return of Iran sanctions for six months failed at the UN Security Council, according to Reuters.

Russia’s Deputy UN Envoy said the reimposition of UN sanctions on Iran could have very adverse consequences and lead to an escalation in the Middle East, according to Reuters.

Israeli PM Netanyahu told Fox News that 450 kilos of enriched uranium remain, saying Israel knows where it is and shares that information with the US, and that both countries knew before bombing Iranian nuclear sites they would not be able to eliminate it.

An Iranian Armed Forces spokesman said nuclear energy is a national need and that Iran will not abandon it, according to Reuters.

Iraqi media reported the discovery of an unidentified spy drone near the border with Iran.

Iran’s Parliamentary National Security Committee said the country has not yet withdrawn from the Nuclear Non-Proliferation Treaty, according to Reuters.

The European Troika warned Iran against any “escalatory” actions following the reimposition of sanctions, according to Reuters.

Iranian President Pezeshkian said the US offered to postpone snapback sanctions by three months if Tehran handed over all its enriched uranium.

OTHERS

The US is preparing options for military strikes on drug targets inside Venezuela, with potential drone strikes on traffickers and labs being considered, though President Trump has not yet approved any action and talks are ongoing through Middle Eastern intermediaries, according to NBC News.

US President Trump plans to attend a gathering of top generals and admirals in Virginia this week, an event described as a “pep rally” for senior military brass where Defense Secretary Hegseth will outline his vision of the Pentagon as the “Department of War” and set new standards for military personnel, according to CNN.

The Israeli army announced it bombed a Hezbollah weapons depot in southern Lebanon, according to Reuters.

Chinese President Xi is reportedly planning to press US President Trump to formally state that the US opposes Taiwan’s independence, according to WSJ.

Pro-EU party won Moldova polls with over 50% of vote, according to AFP citing the official results.

The North Korean and Chinese Foreign Ministers held talks, though details remain limited, according to KCNA.

US Event Calendar

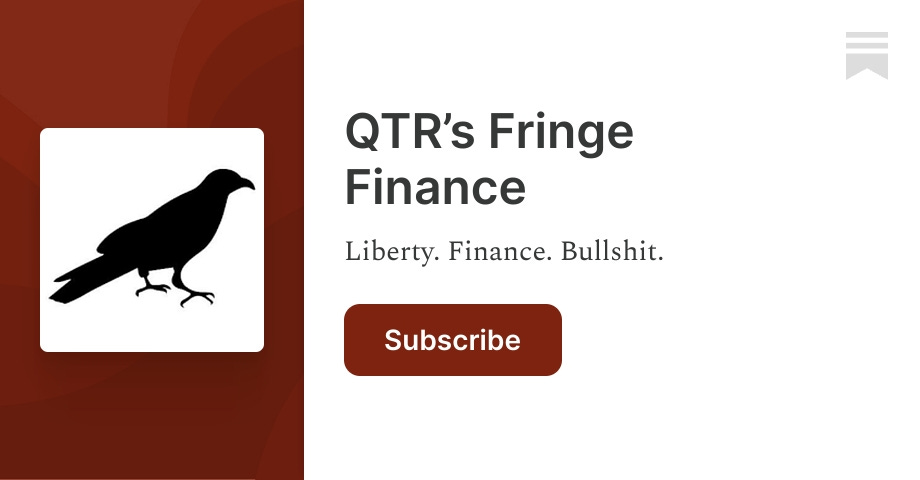

10:00 am: Aug Pending Home Sales MoM, est. 0%, prior -0.4%

10:30 am: Sep Dallas Fed Manf. Activity, est. -1.6, prior -1.8

Central Bank Speakers

7:30 am: Fed’s Waller Speaks on Payments

8:00 am: ECB’s Lane, Cleveland Fed’s Hammack, BOE’s Ramsden Speak

1:30 pm: Fed’s Musalem Speaks on Panel

6:00 pm: Fed’s Bostic Moderates a conversation with Delta CEO

DB's Jim Reid concludes the overnight wrap

It's fair to say that my nerves are shredded this morning. In addition, my sofa now has a big indentation in it after a weekend sat watching the Ryder Cup. Equally my marriage now has a big indentation in it after a weekend sat watching the Ryder Cup.

While the Europeans nearly snatched defeat from the jaws of certain victory, for more on how the world sees the outlook for all things US and European, this morning we've just published the results of our Q3 investor survey. You can see it here. The highlights are that bubble risk perception remains high in US tech but hasn’t increased that much in 2025 and is still just below levels seen in our surveys in 2021 when zero rates were the main valuation prop. The spread of responses to whether Powell stays on as a governor after his chair term ends in May suggests you haven't a clue (same here). Most think Treasury yields should fall and not rise as the Fed is cutting, and most think German stimulus is going to disappoint the initial expectations. Elsewhere, US inflation expectations are the highest since the end of 2022 and we check in on AI adoption at work. There's been a big increase in the last 12 months. See the pack here for lots more and many thanks for those who filled it in.

This week's big event might not actually happen, as payrolls Friday could be the first high profile victim of a potential government shutdown if Congress is unable to reach an agreement on a short-term funding resolution by midnight tomorrow night. Indeed, back in October 2013, the shutdown meant we didn’t get the September jobs report until the 22nd of the month. We'll preview both below, but the other main highlights this week are Waller, Bostic and Hammock speaking today; US consumer confidence, JOLTS, China PMIs, German, French and Italian CPI, the RBA meeting and the Fed Jefferson and Goolsbee speaking tomorrow; US manufacturing ISM, the ADP, Eurozone CPI, and the Fed's Logan speaking on Wednesday; US jobless claims and the Fed’s Logan speaking again on Thursday; and the US services ISM and the Fed’s Williams and Jefferson speaking on Friday. The full day-by-day calendar of events is at the end as usual.

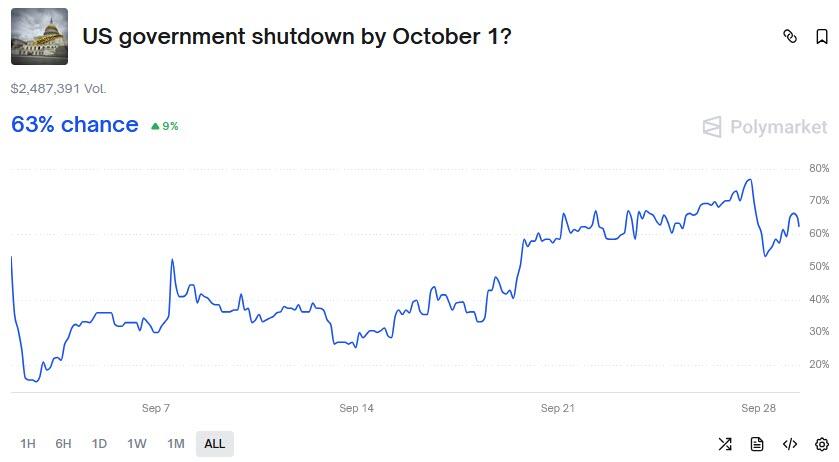

In terms of the potential shutdown by midnight tomorrow, Brett Ryan in our US economist team has outlined "Everything you didn't want to know" about it for those that want to read more. Fears of a shutdown rose significantly last week, particularly after Trump cancelled a meeting planned with the Democratic leaders in the House and the Senate. But yesterday we heard that Trump will be meeting Democrat and Republican leaders today to try to broker a deal. So that helped the probability of a shutdown this year on Polymarket to fall from 84% yesterday to 72% this morning. Such an event could still be later in the year if a stop-gap is put in place this week but overall the probability of one occurring is deemed to be more likely than not before the end of the year. Remember that even though the Republicans have a majority in both chambers, they still need Democratic votes in the Senate, as there’s a 60-vote threshold to avoid the filibuster.

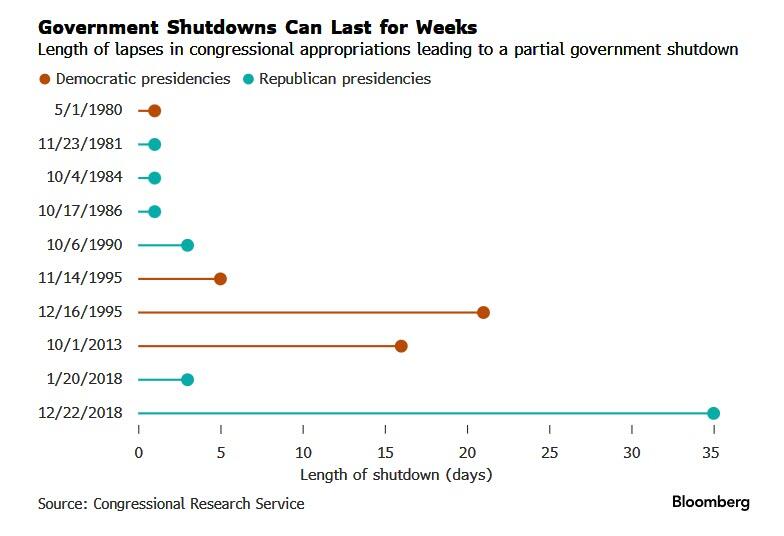

If there is a shutdown, all non-essential federal employees would be furloughed, which our economists estimate would cost the economy 0.2ppts per week on an annualised GDP basis. The longest shutdown was the 35 days straddling the end of 2018 and start of 2019. In 1996, we had one for 21 days and in 2013 one lasting 16 days. Others have lasted a few days or even only hours and before federal workers' alarm clocks went off.

If we don't see the shutdown and payrolls then get released, it’s a very important number given the recent negative revisions and real-time downtrend in new hiring, not to mention the Fed and market reaction function. In my opinion, we could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50k per month. Given the naturally wide distribution of payroll numbers, this brings the prospect, and perhaps even the likelihood, of negative prints. These prints may not reflect the underlying trend but could lead to big moves. Given the breakeven rate has always been higher in our careers, we are not really conditioned to negative prints being within the margin of error, so reactions to such prints may be not be rational if and when they happen. Having said that, for this month our economists expect a rebound on the headline to +75k (consensus +50k) against +22k last month. For private payrolls they also expect +75k (consensus +60k) against +38k last month. The unemployment rate is expected to remain unchanged at 4.3%. So, the point above is more of an ongoing one over the coming months and quarters.

Tomorrow's JOLTS report is also important but only refers to August. So it’s always behind but is perhaps the more reliable indicator of the labour market. So far it has been fairly stable and indicative of a low hiring and low firing labour market. So stable, but with low numbers on both sides, and therefore it wouldn't take a big change in the direction either way to make a big difference. We also have ADP on Wednesday and then we think jobless claims on Thursday would likely be released in a shutdown as it’s compiled by states. This happened in the 2013 shutdown but we can't be 100% sure. Elsewhere for employment trends, the jobs hard/plentiful measure in tomorrow's consumer confidence, as well as the employment subcomponents in the two ISM readings this week will also be important for the current state of play in the US labour market.

The one other thing to say is that the start of Q4 on Wednesday brings the start of the multi-year German stimulus package. Given most of all of our careers have been soundtracked by German fiscal discipline, then we will all have to get used to a changing narrative. It's fair to say that investors have become more pessimistic over the summer as to the extent of the difference it will make (see our survey for more on this). However, some of this is just impatience and we think the momentum will really start to kick into gear very soon. There is some disappointment that more will be directed to consumption than the initial infrastructure and defense bias suggested, but it shouldn't change the near-term multiplier much, just the long-term potential growth rate. See our economists' mark to market of where we are with it here as the big momentous shift in spending in now just days away.

Staying in Europe, the focus will be on the flash CPIs for September starting with Spain and Belgium today. Prints for Germany, France and Italy will be released tomorrow and the Eurozone print will be out on Wednesday. Our European economists preview the releases here. They expect a 2.22% report for the Eurozone, with country-level forecasts including 2.34% for Germany, 1.12% for France and 1.67% for Italy. Finally, the September CPI report is also due for Switzerland on Thursday.

This morning, there’s generally been a positive tone across markets, building on Friday’s gains. There’s been a solid performance for the Hang Seng (+1.40%) and the KOSPI (+1.34%), whilst the CSI 300 (+0.47%) and the Shanghai Comp (+0.13%) have also advanced. Japanese equities have been the exception however, with the TOPIX (-1.45%) and the Nikkei (-0.68%) both struggling, in part because ex-dividend stocks are dragging the market lower. But otherwise, the global trend looks strong, with futures on the S&P 500 (+0.33%) and the German DAX (+0.40%) both pointing higher as well. And more broadly, gold prices (+1.20%) have hit another record overnight, currently trading at $3,805/oz, with this morning being the first time they’ve crossed the $3,800/oz mark on an intraday basis.

Recapping last week now, US markets lost a little momentum after investors grew more anxious about AI tech spending and the likely pace of Fed cuts, although a decent PCE print drove some renewed optimism on Friday. This left the S&P 500 down -0.31% (+0.59% Friday), and the NASDAQ -0.65% (+0.44% Friday). Remarkably, that was the biggest decline for the S&P in eight weeks, illustrating how strong the past couple of months have been for risk assets. The Mag-7 fell -0.71% (+0.81% Friday), led by Amazon (-5.05%) and Meta (-4.45%), while Nvidia ended the week +0.86% after announcing a $100bn deal with OpenAI for AI infrastructure, though the deal also sparked scepticism over potential circular financing. Tariffs were also in focus, as President Trump announced several new tariffs effective October 1st, most notably 100% on branded pharmaceuticals.

Meanwhile, Treasuries sold off last week after a string of mostly stronger US data. That included weekly initial jobless claims (at 218k vs. 233k expected) falling to their lowest level since July and an upward revision to the Q2 GDP data. On Friday, August core PCE inflation came in line with expectations at +0.2% (+0.23% unrounded) and with July revised down a tenth to +0.2%, even as real personal spending was stronger (+0.4% vs +0.2% expected). That left markets pricing 41bps of Fed cuts by year end, down -3.9bps over the week (but +1.4bps on Friday). That meant the 2yr yield moved up +7.1bps to 3.64% (-1.2bps Friday) and the 10yr yield rose +4.8bps to 4.18% (+0.5bps Friday).

Back in Europe, the STOXX 600 (+0.07% on the week, +0.78% Friday) remained stable, while the DAX (+0.42%, +0.87% Friday) and the CAC 40 (+0.22%, +0.97% Friday) moved higher as the Euro Area composite PMI reached a 16-month high of 51.2 (vs. 51.1 expected). European bonds saw muted moves with the 10yr bund yield down -0.1bps at 2.75% (-2.8bps Friday), though OAT (+1.5bps) and BTP (+4.8bps) yields moved higher on the week.

In the UK, despite the composite PMI falling to a 4-month low of 51.0 (vs. 53.0 expected) the FTSE 100 advanced +0.74% (+0.77% Friday). Meanwhile, gilts underperformed as investors’ fiscal concerns grew, particularly after Greater Manchester Mayor Andy Burnham, seen as a potential challenger for PM, called for £40bn of additional borrowing to build council houses. 2yr gilt yields were up +3.2bps (-0.3bps Friday), and 10yr yields were +3.1bps to 4.75% (-1.1bps Friday).

Elsewhere, gold advanced another +2.03% (+0.28% Friday) to $3,760/oz, ending the week just shy of Tuesday’s all-time high and now up more than +43% YTD. The move keeps gold prices on track for their strongest annual performance since 1979, when prices surged +127% after the Iranian Revolution. Brent crude also advanced +5.17% (+1.02% Friday) to $70.13/bbl, its highest level since July. That came as President Trump said that Ukraine could retake all the territory lost to Russia amid escalating rhetoric between the West and Moscow.

Tyler Durden | Zero Hedge

Zero Hedge

Mon, 09/29/2025 - 08:32

Futures Jump As Meltup Returns, Gold Soars To New Record High Ahead Of Govt Shutdown | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

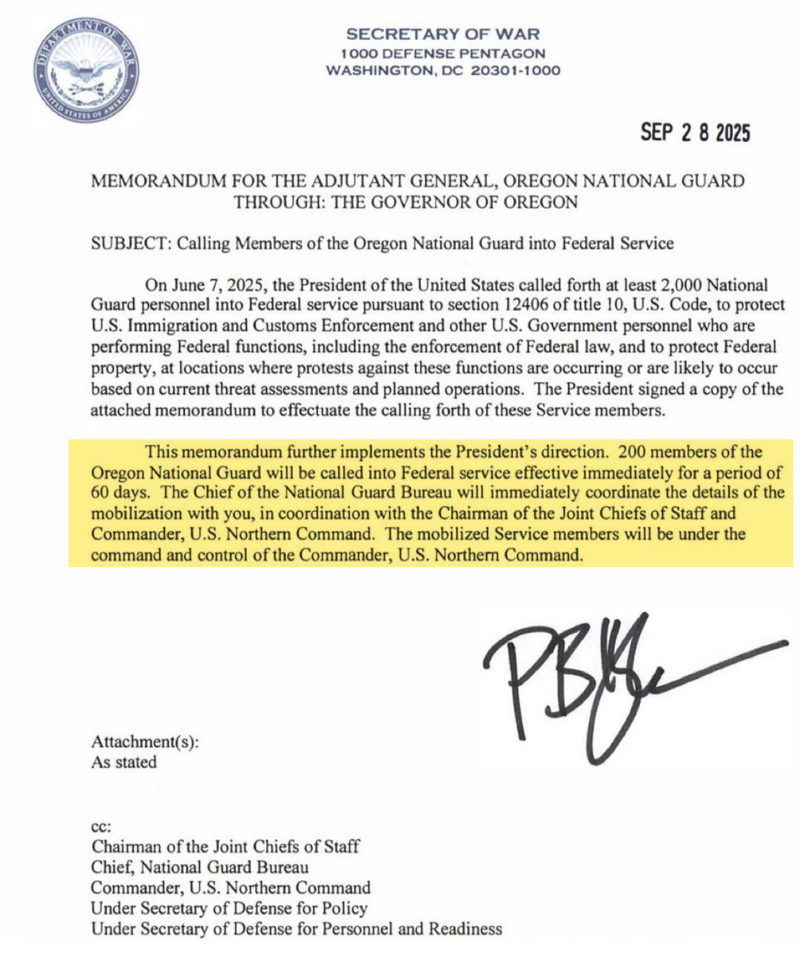

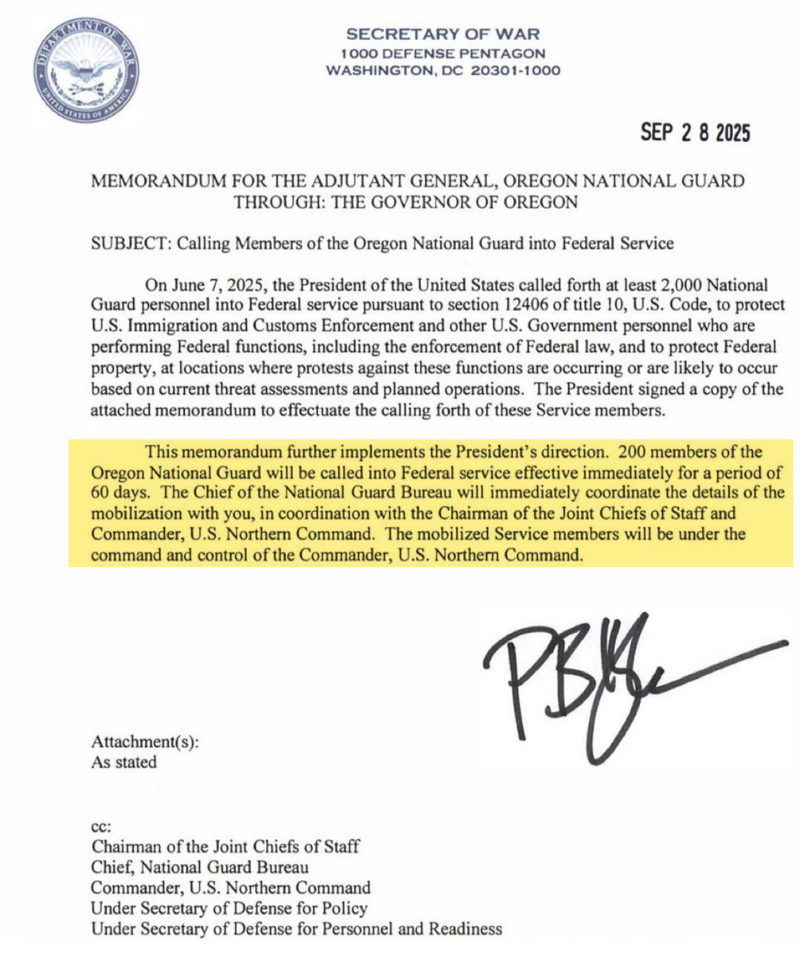

Then followed the suit by Democrats in Oregon, which named President Donald Trump, Defense Secretary Mark Esper, and the Department of Defense, as well as Homeland Security Secretary Kristi Noem and the Department of Homeland Security, as defendants. The suit asked the federal court in Portland to halt Trump's deployment of troops and declare it unlawful.

NBC News quoted White House spokesperson Abigail Jackson as saying that Trump's actions were "lawful" and that they would "make Portland safer."

"President Trump is using his lawful authority to direct the National Guard to protect federal assets and personnel in Portland following months of violent riots where officers have been assaulted and doxxed by left-wing rioters," Jackson explained.

🚨 JUST IN: A resident near ICE Portland PRAISES President Trump for sending reinforcements to the city

“I am SO happy that President Trump is deploying the National Guard. We have been asking for help for months!”

REAL AMERICANS are BEGGING for this!

Then followed the suit by Democrats in Oregon, which named President Donald Trump, Defense Secretary Mark Esper, and the Department of Defense, as well as Homeland Security Secretary Kristi Noem and the Department of Homeland Security, as defendants. The suit asked the federal court in Portland to halt Trump's deployment of troops and declare it unlawful.

NBC News quoted White House spokesperson Abigail Jackson as saying that Trump's actions were "lawful" and that they would "make Portland safer."

"President Trump is using his lawful authority to direct the National Guard to protect federal assets and personnel in Portland following months of violent riots where officers have been assaulted and doxxed by left-wing rioters," Jackson explained.

🚨 JUST IN: A resident near ICE Portland PRAISES President Trump for sending reinforcements to the city

“I am SO happy that President Trump is deploying the National Guard. We have been asking for help for months!”

REAL AMERICANS are BEGGING for this!  — Nick Sortor (@nicksortor)

— Nick Sortor (@nicksortor)  Overnight, at least one cell of the

attempted to disrupt operations at the ICE facility in Portland.

BREAKING - Antifa agitators are now being drug into the Portland ICE facility as if they were rag dolls.

Overnight, at least one cell of the

attempted to disrupt operations at the ICE facility in Portland.

BREAKING - Antifa agitators are now being drug into the Portland ICE facility as if they were rag dolls. — Right Angle News Network (@Rightanglenews)

— Right Angle News Network (@Rightanglenews)  In a shocking display of senseless violence, a black man was viciously assaulted and beaten to the ground by a mob of Antifa militants during a chaotic riot outside an ICE detention facility in Portland. https://t.co/wW6ihvOSeP

— Ian Miles Cheong (@stillgray)

In a shocking display of senseless violence, a black man was viciously assaulted and beaten to the ground by a mob of Antifa militants during a chaotic riot outside an ICE detention facility in Portland. https://t.co/wW6ihvOSeP

— Ian Miles Cheong (@stillgray)  NEW: As the sun sets, hundreds of far-left activists remain outside the Portland ICE building. More Antifa militants dressed in black bloc are now showing up. This is when the mayhem and violence usually escalates.

Officers are trying to clear the driveway.

NEW: As the sun sets, hundreds of far-left activists remain outside the Portland ICE building. More Antifa militants dressed in black bloc are now showing up. This is when the mayhem and violence usually escalates.

Officers are trying to clear the driveway.  — FRONTLINES (@FrontlinesTPUSA)

— FRONTLINES (@FrontlinesTPUSA)  Earlier, leftist Oregon Gov. Tina Kotek was spotted leading the "50501" movement, part of the Democratic Party's protest industrial complex funded by dark-money NGOs and leftist billionaires. These rogue NGOs orchestrated and spread chaos nationwide earlier this year and throughout the summer via color revolution-style operations, with many of the protests/riots directed at Trump and Elon Musk.

Trump, please do something about this gay shit. Signed, a reasonable lesbian.

Earlier, leftist Oregon Gov. Tina Kotek was spotted leading the "50501" movement, part of the Democratic Party's protest industrial complex funded by dark-money NGOs and leftist billionaires. These rogue NGOs orchestrated and spread chaos nationwide earlier this year and throughout the summer via color revolution-style operations, with many of the protests/riots directed at Trump and Elon Musk.

Trump, please do something about this gay shit. Signed, a reasonable lesbian.  — Heidi (@HeidiBriones)

— Heidi (@HeidiBriones)  Democrats are mobilizing their protest industrial complex, funded by leftist billionaires and even some foreign entities, to counter the Trump administration and 'America First' agenda. Many of these dark networks are now under federal investigation as the White House takes an all-of-government approach to counter political violence emanating from Democrats.

Last week, a New York Times report revealed that Soros' Open Society Foundation funneled

Neville Roy Singham is also under investigation for financing chaos, as Antifa and other radical left groups openly declare war on Trump.

This isn't your parents' Democratic Party; it's an elitist political machine that bankrolls organized violence, hate, and socialism/Marxism, with the ultimate aim of overthrowing Trump and dismantling the nation for a socialist reconstruction. If that reconstruction is blocked, the fallback goal is the total destruction of the West. This is civil terrorism, and what we are witnessing now is the rise of

.

Mon, 09/29/2025 - 11:20

Democrats are mobilizing their protest industrial complex, funded by leftist billionaires and even some foreign entities, to counter the Trump administration and 'America First' agenda. Many of these dark networks are now under federal investigation as the White House takes an all-of-government approach to counter political violence emanating from Democrats.

Last week, a New York Times report revealed that Soros' Open Society Foundation funneled

Neville Roy Singham is also under investigation for financing chaos, as Antifa and other radical left groups openly declare war on Trump.

This isn't your parents' Democratic Party; it's an elitist political machine that bankrolls organized violence, hate, and socialism/Marxism, with the ultimate aim of overthrowing Trump and dismantling the nation for a socialist reconstruction. If that reconstruction is blocked, the fallback goal is the total destruction of the West. This is civil terrorism, and what we are witnessing now is the rise of

.

Mon, 09/29/2025 - 11:20

Then followed the suit by Democrats in Oregon, which named President Donald Trump, Defense Secretary Mark Esper, and the Department of Defense, as well as Homeland Security Secretary Kristi Noem and the Department of Homeland Security, as defendants. The suit asked the federal court in Portland to halt Trump's deployment of troops and declare it unlawful.

NBC News quoted White House spokesperson Abigail Jackson as saying that Trump's actions were "lawful" and that they would "make Portland safer."

"President Trump is using his lawful authority to direct the National Guard to protect federal assets and personnel in Portland following months of violent riots where officers have been assaulted and doxxed by left-wing rioters," Jackson explained.

🚨 JUST IN: A resident near ICE Portland PRAISES President Trump for sending reinforcements to the city

“I am SO happy that President Trump is deploying the National Guard. We have been asking for help for months!”

REAL AMERICANS are BEGGING for this!

Then followed the suit by Democrats in Oregon, which named President Donald Trump, Defense Secretary Mark Esper, and the Department of Defense, as well as Homeland Security Secretary Kristi Noem and the Department of Homeland Security, as defendants. The suit asked the federal court in Portland to halt Trump's deployment of troops and declare it unlawful.

NBC News quoted White House spokesperson Abigail Jackson as saying that Trump's actions were "lawful" and that they would "make Portland safer."

"President Trump is using his lawful authority to direct the National Guard to protect federal assets and personnel in Portland following months of violent riots where officers have been assaulted and doxxed by left-wing rioters," Jackson explained.

🚨 JUST IN: A resident near ICE Portland PRAISES President Trump for sending reinforcements to the city

“I am SO happy that President Trump is deploying the National Guard. We have been asking for help for months!”

REAL AMERICANS are BEGGING for this!

I tend to think businesses don’t reinvent themselves as financiers because things are running smoothly. They do it when customers can’t or won’t keep up with the spending binge, and when management wants to paper over cracks with accounting gymnastics. Or, when an announcement absolutely has to hit the market as a PR before it tangibly takes hold.

We’ve all seen it before: telecom leasebacks in the dot-com era, mortgage-backed securities before 2008, all that bullshit — all sold as “innovation” until the music stopped.

My regular readers know this isn’t the first time Nvidia has set off my radar. Back in September 2023, I wrote a piece called As the Market’s Black Swan Just Arrived? In addition to arguing we were nearing a top because a semiconductor executive was signing tits like he was f*cking Jon Bon Jovi…

I tend to think businesses don’t reinvent themselves as financiers because things are running smoothly. They do it when customers can’t or won’t keep up with the spending binge, and when management wants to paper over cracks with accounting gymnastics. Or, when an announcement absolutely has to hit the market as a PR before it tangibly takes hold.

We’ve all seen it before: telecom leasebacks in the dot-com era, mortgage-backed securities before 2008, all that bullshit — all sold as “innovation” until the music stopped.

My regular readers know this isn’t the first time Nvidia has set off my radar. Back in September 2023, I wrote a piece called As the Market’s Black Swan Just Arrived? In addition to arguing we were nearing a top because a semiconductor executive was signing tits like he was f*cking Jon Bon Jovi…

…I also pointed out the circular economics in Nvidia’s relationship with CoreWeave (first brought to light by people like

…I also pointed out the circular economics in Nvidia’s relationship with CoreWeave (first brought to light by people like

Now, add this past week’s leasing story to that backdrop. It looks like the same playbook: potentially circular economics dressed up as innovation. First with CoreWeave, now with OpenAI.

And the entanglements don’t stop there. Nvidia has been spraying money around the sector. Nvidia has combined strategic investments in partners such as OpenAI, Intel, and ElevenLabs. By my count, in 2025 alone, Nvidia made at least six major moves—three acquisitions (Gretel, Lepton AI, CentML) and three strategic investments (Intel, OpenAI, ElevenLabs). Why spread yourself in so many directions, so quickly? How is it possible to even effectuate these deals and partnerships that feel like they are coming literally every other day?

This would be interesting to watch in any company, but Nvidia isn’t just any company. It’s one of the so-called Magnificent Seven, a stock so heavily weighted in ETFs and indices that nearly every investor — pensions, retirement accounts, mom-and-pop 401(k)s — owns it whether they know it or not.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life:

Now, add this past week’s leasing story to that backdrop. It looks like the same playbook: potentially circular economics dressed up as innovation. First with CoreWeave, now with OpenAI.

And the entanglements don’t stop there. Nvidia has been spraying money around the sector. Nvidia has combined strategic investments in partners such as OpenAI, Intel, and ElevenLabs. By my count, in 2025 alone, Nvidia made at least six major moves—three acquisitions (Gretel, Lepton AI, CentML) and three strategic investments (Intel, OpenAI, ElevenLabs). Why spread yourself in so many directions, so quickly? How is it possible to even effectuate these deals and partnerships that feel like they are coming literally every other day?

This would be interesting to watch in any company, but Nvidia isn’t just any company. It’s one of the so-called Magnificent Seven, a stock so heavily weighted in ETFs and indices that nearly every investor — pensions, retirement accounts, mom-and-pop 401(k)s — owns it whether they know it or not.

🔥 50% OFF FOR LIFE: Using this coupon entitles you to 50% off an annual subscription to Fringe Finance for life:

QTR’s Disclaimer: Please read my full legal disclaimer

QTR’s Disclaimer: Please read my full legal disclaimer  Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for

Regional powers have reportedly been involved, including including Saudi Arabia, Qatar, the UAE, Jordan, and Egypt - in planning and backing the agreement, which is crucial for its chances of success.

"It’s called peace in the Middle East - more than Gaza. Gaza is part of it, but it’s peace in the Middle East," Trump said. Per the published schedule for  Source: Bloomberg

The MoM surge exceeded all estimates of economists surveyed by Bloomberg.

“Lower mortgage rates are enabling more homebuyers to go under contract,” NAR Chief Economist Lawrence Yun said in a statement.

The big MoM jump lifted the overall pending home sales index off multi-year lows...

Source: Bloomberg

The MoM surge exceeded all estimates of economists surveyed by Bloomberg.

“Lower mortgage rates are enabling more homebuyers to go under contract,” NAR Chief Economist Lawrence Yun said in a statement.

The big MoM jump lifted the overall pending home sales index off multi-year lows...

Source: Bloomberg

The surge was especially strong in the Midwest, where sales jumped nearly 9% in August, Yun said, which was the most since early 2023. Contract signings also rose in the South and West.

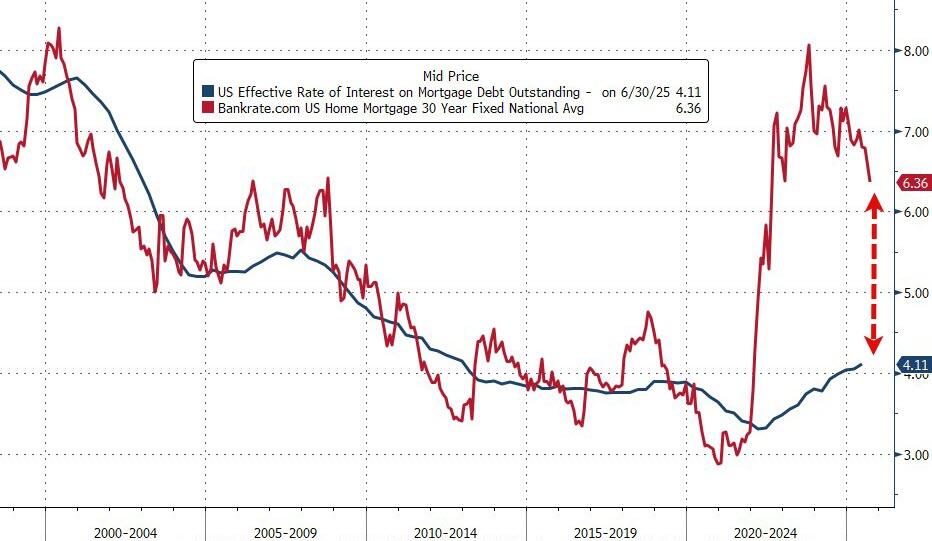

Mortgage rates have fallen to the lowest in a year at 6.34%, encouraging many Americans to get off the sidelines and others to finally list their homes for sale.

While the drop in mortgage rates is welcome, millions of Americans still have rates well below current levels and aren’t inclined to move, which has suppressed inventory and kept prices elevated.

Source: Bloomberg

The surge was especially strong in the Midwest, where sales jumped nearly 9% in August, Yun said, which was the most since early 2023. Contract signings also rose in the South and West.

Mortgage rates have fallen to the lowest in a year at 6.34%, encouraging many Americans to get off the sidelines and others to finally list their homes for sale.

While the drop in mortgage rates is welcome, millions of Americans still have rates well below current levels and aren’t inclined to move, which has suppressed inventory and kept prices elevated.

Source: Bloomberg

The supply of existing homes for sale remains near five-year highs, as more people list their homes for sale, but the extra inventory isn’t yet pushing prices down.

Source: Bloomberg

The supply of existing homes for sale remains near five-year highs, as more people list their homes for sale, but the extra inventory isn’t yet pushing prices down.

Source: Bloomberg

Pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.

Source: Bloomberg

Pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.

Turning to the week's main event, fears of a shutdown rose significantly last week, particularly after Trump cancelled a meeting planned with the Democratic leaders in the House and the Senate. But yesterday we heard that Trump will be meeting Democrat and Republican leaders today to try to broker a deal. So that helped the probability of a shutdown this year on Polymarket to fall from 84% yesterday to 63% this morning.

Turning to the week's main event, fears of a shutdown rose significantly last week, particularly after Trump cancelled a meeting planned with the Democratic leaders in the House and the Senate. But yesterday we heard that Trump will be meeting Democrat and Republican leaders today to try to broker a deal. So that helped the probability of a shutdown this year on Polymarket to fall from 84% yesterday to 63% this morning.

Such an event could still be later in the year if a stop-gap is put in place this week but overall the probability of one occurring is deemed to be more likely than not before the end of the year. Remember that even though the Republicans have a majority in both chambers, they still need Democratic votes in the Senate, as there’s a 60-vote threshold to avoid the filibuster.

If there is a shutdown, all non-essential federal employees would be furloughed, which DB's economists estimate would cost the economy 0.2% per week on an annualized GDP basis. The longest shutdown was the 35 days straddling the end of 2018 and start of 2019. In 1996, we had one for 21 days and in 2013 one lasting 16 days. Others have lasted a few days or even only hours and before federal workers' alarm clocks went off.

Such an event could still be later in the year if a stop-gap is put in place this week but overall the probability of one occurring is deemed to be more likely than not before the end of the year. Remember that even though the Republicans have a majority in both chambers, they still need Democratic votes in the Senate, as there’s a 60-vote threshold to avoid the filibuster.

If there is a shutdown, all non-essential federal employees would be furloughed, which DB's economists estimate would cost the economy 0.2% per week on an annualized GDP basis. The longest shutdown was the 35 days straddling the end of 2018 and start of 2019. In 1996, we had one for 21 days and in 2013 one lasting 16 days. Others have lasted a few days or even only hours and before federal workers' alarm clocks went off.

If we don't see the shutdown and payrolls then get released, it’s a very important number given the recent negative revisions and real-time downtrend in new hiring, not to mention the Fed and market reaction function. We could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50k per month. Given the naturally wide distribution of payroll numbers, this brings the prospect, and perhaps even the likelihood, of negative prints. These prints may not reflect the underlying trend but could lead to big moves. Given the breakeven rate has always been higher in our careers, we are not really conditioned to negative prints being within the margin of error, so reactions to such prints may be not be rational if and when they happen.

Having said that, for this month DB's economists expect a rebound on the headline to +75k (consensus +50k) against +22k last month. For private payrolls they also expect +75k (consensus +60k) against +38k last month. The unemployment rate is expected to remain unchanged at 4.3%. So, the point above is more of an ongoing one over the coming months and quarters.

Tomorrow's JOLTS report is also important but only refers to August. So it’s always behind but is perhaps the more reliable indicator of the labor market. So far it has been fairly stable and indicative of a low hiring and low firing labor market. So stable, but with low numbers on both sides, and therefore it wouldn't take a big change in the direction either way to make a big difference. We also have ADP on Wednesday and then we think jobless claims on Thursday would likely be released in a shutdown as it’s compiled by states. This happened in the 2013 shutdown but we can't be 100% sure. Elsewhere for employment trends, the jobs hard/plentiful measure in tomorrow's consumer confidence, as well as the employment subcomponents in the two ISM readings this week will also be important for the current state of play in the US labor market.

The one other thing to say is that the start of Q4 on Wednesday brings the start of the multi-year German stimulus package. Given most careers have been soundtracked by German fiscal discipline, then we will all have to get used to a changing narrative. It's fair to say that investors have become more pessimistic over the summer as to the extent of the difference it will make (just check out the DAX swoon after the early 2025 blast off) . However, some of this is just impatience and the momentum could kick into gear again soon. There is some disappointment that more will be directed to consumption than the initial infrastructure and defense bias suggested, but it shouldn't change the near-term multiplier much, just the long-term potential growth rate.

Staying in Europe, the focus will be on the flash CPIs for September starting with Spain and Belgium today. Prints for Germany, France and Italy will be released tomorrow and the Eurozone print will be out on Wednesday. Our European economists preview the releases here. They expect a 2.22% report for the Eurozone, with country-level forecasts including 2.34% for Germany, 1.12% for France and 1.67% for Italy. Finally, the September CPI report is also due for Switzerland on Thursday.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 29

Data: US September Dallas Fed manufacturing activity, August pending home sales, UK August net consumer credit, M4, Eurozone September economic, industrial, services confidence

Central banks: Fed's Waller, Bostic and Hammack speak, ECB's Muller, Lane, Cipollone and Centeno speak, BoJ's Noguchi speaks, BoE's Ramsden speaks

Earnings: Carnival

Tuesday September 30

Data: US September Conference Board consumer confidence index, Dallas Fed services activity, MNI Chicago PMI, August JOLTS report, July FHFA house price index, China September PMIs, UK September Lloyds Business Barometer, Q2 current account balance, Japan August industrial production, retail sales, housing starts, Germany September CPI, unemployment claims rate, August retail sales, import price index, France September CPI, August consumer spending, PPI, Italy September CPI, August PPI, July industrial sales

Central banks: RBA decision, Fed's Jefferson and Goolsbee speak, ECB's Lagarde, Rehn, Cipollone and Nagel speak, BoE's Lombardelli, Mann and Breeden speak, BoJ summary of opinions from the September meeting

Earnings: Nike

Wednesday October 1

Data: US September ISM index, ADP report, total vehicle sales, August construction spending, Japan 3Q Tankan survey, Italy September manufacturing PMI, new car registrations, budget balance, Eurozone September CPI, Canada September manufacturing PMI

Central banks: Fed's Logan speaks, ECB's Guindos, Kazimir, Kocher, Nagel and Simkus speak, BoE's Mann speaks

Thursday October 2

Data: US August factory orders, initial jobless claims, Japan September monetary base, consumer confidence index, France August budget balance, Italy August unemployment rate, Eurozone August unemployment rate, Switzerland September CPI

Central banks: Fed's Logan speaks, ECB's Villeroy, Makhlouf and Guindos speak, BoJ's Uchida speaks, BoE's September DMP survey

Earnings: Tesco

Friday October 3

Data: US September jobs report, ISM services, UK September official reserves changes, Japan August jobless rate, job-to-applicant ratio, France August industrial production, Italy September services PMI, August retail sales, Q2 deficit to GDP, Eurozone August PPI

Central banks: Fed's Williams and Jefferson speak, ECB's Lagarde, Sleijpen, Villeroy and Schnabel speak, BoJ's Ueda speaks, BoE's Bailey speaks

Finally, looking at just the US, key economic data releases this week are the JOLTS report on Tuesday, the ISM manufacturing index on Wednesday, and the employment report and the ISM services index on Friday. There are several speaking engagements by Fed officials this week, including events with Governor Jefferson on Tuesday and Friday. But again, if the federal government shuts down on October 1, most data releases from federal agencies will be postponed until after the government reopens.

Monday, September 29

07:30 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver a speech on payments at the Sibos 2025 Conference in Frankfurt, Germany. Speech text is expected. On September 3rd, Governor Waller stressed that the FOMC needs “to get ahead of the labor market [weakening], because usually when the labor market turns bad, it turns bad fast.”

08:00 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will participate in a policy panel at the joint ECB-Cleveland Fed conference in Frankfurt, Germany. On September 22nd, President Hammack said that she has “a lot of concern about the level of inflation and [its] persistence,” adding that “if we remove [the current policy] restriction from the economy, things could start overheating again.”

10:00 AM Pending home sales, August (GS +1.0%, consensus flat, last -0.4%)

10:30 AM Dallas Fed manufacturing index, September (consensus -1.6, last -1.8)

01:30 PM St. Louis Fed President Musalem (FOMC voter) speaks: St. Louis Fed President Alberto Musalem will participate in a panel at Washington University, St. Louis. Q&A is expected. On September 22nd, President Musalem said that while he “supported the 25bps reduction in the FOMC’s policy rate as a precautionary move intended to support the labor market at full employment and against further weakening,” he also believes that “there is limited room for easing further without policy becoming overly accommodative.”

06:00 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will moderate a conversation with Ed Bastian, CEO of Delta Air Lines, as part of the Atlanta Fed’s Leading Voices series. Audience Q&A is expected. On September 23rd, President Bostic said that with inflation “not having been at target for over four and a half years, we definitely need to be concerned about it,” and added that “it is incumbent upon us to continue to stay vigilant in the fight against inflation.”

Tuesday, September 30

06:00 AM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will deliver a keynote speech at the Bank of Finland’s International Monetary Policy Conference in Helsinki, Finland. Speech text and audience Q&A are expected.

09:00 AM FHFA house price index, July (consensus -0.1%, last -0.2%)

09:00 AM S&P Case-Shiller home price index, July (GS -0.2%, consensus -0.2%, last -0.3%)

09:00 AM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver remarks at the Council on Foreign Relation’s Peter McColough Series on International Economics in New York City. Speech text and moderated Q&A with audience are expected. On September 22nd, President Collins noted that “an actively patient approach to monetary policy remains appropriate at this time.”

10:00 AM JOLTS job openings, August (GS 7,250k, consensus 7,170k, last 7,181k)

10:00 AM Conference Board consumer confidence, September (GS 96.0, consensus 96.0, last 97.4)

01:30 PM Chicago Fed President Goolsbee (FOMC voter) speaks: Chicago Fed President Austan Goolsbee will participate in a Q&A at the Chicago Fed’s 2025 Midwest Agriculture Conference in Chicago. Moderated Q&A is expected. On September 25th, President Goolsbee said that he is “somewhat uneasy with frontloading too many cuts based on just the payroll numbers coming down.” He added that “in the short term the most worrying thing is the possibility that after four and a half years of inflation above target, inflation now proves to be more persistent than we wanted it to be.”

07:10 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak in a moderated conversation at the Dallas Fed Survey Participants’ Appreciation Reception. Audience Q&A is expected. On September 25th, President Logan argued that the FOMC should consider targeting short-term interest rates other than the federal funds rate.

Wednesday, October 1

08:15 AM ADP employment change, September (GS +60k, consensus +50k, last +54k)

09:45 AM S&P Global US manufacturing PMI, September final (consensus 52.0, last 52.0)

10:00 AM ISM manufacturing index, September (GS 49.2, consensus 49.0, last 48.7): We estimate the ISM manufacturing index increased 0.5pt to 49.2 in September, reflecting improvement in our manufacturing survey tracker (+0.6pt to 51.7).

10:00 AM Construction spending, August (GS flat, consensus -0.1%, last -0.1%)

05:00 PM Lightweight motor vehicle sales, September (GS 16.2mn, consensus 16.2mn, last 16.1mn)

Thursday, October 2

8:30 AM Initial jobless claims, week ended September 27 (GS 220k, consensus 225k, last 218k); Continuing jobless claims, week ended September 20 (consensus 1,930k, last 1,926k)

10:00 AM Factory orders, August (GS +1.3%, consensus +1.4%, last -1.3%); Durable goods orders, August final (GS +2.9%, consensus +2.9%, last +2.9%); Durable goods orders ex-transportation, August final (last +0.4%); Core capital goods orders, August final (last +0.6%); Core capital goods shipments, August final (last -0.3%)

10:30 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will speak in a moderated conversation at the University of Texas Evolving Energy and Policy Landscape Conference in Austin.

Friday, October 3

06:05 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak at the farewell symposium for Klaas Knot, outgoing President of De Nederlandsche Bank, in Amsterdam, Netherlands. On September 4th, President Williams said that “if progress on our dual mandate goals continues as in my baseline forecast, I anticipate it will become appropriate to move interest rates toward a more neutral stance over time.”

08:30 AM Nonfarm payroll employment, September (GS +80k, consensus +50k, last +22k); Private payroll employment, September (GS +85k, consensus +60k, last +83k); Average hourly earnings (MoM), September (GS +0.2%, consensus +0.3%, last +0.3%); Unemployment rate, September (GS 4.3%, consensus 4.3%, last 4.3%): We estimate nonfarm payrolls rose 80k in September. On the positive side, big data indicators indicated a sequentially firmer pace of private sector job growth. On the negative side, we expect a 5k decline in government payrolls, reflecting a 10k decline in federal government payrolls and a 5k increase in state and local government payrolls. We suspect August payroll growth will be revised higher, as has been typical over the last decade, though revisions so far this year have been disproportionately downward. We estimate that the unemployment rate was unchanged at 4.3% on a rounded basis, reflecting the stabilization in continuing claims over the last month, though the bar for rounding up to 4.4% is not high from an unrounded 4.32% in August. We estimate average hourly earnings rose 0.2% (month-over-month, seasonally adjusted), reflecting negative calendar effects.

09:45 AM S&P Global US services PMI, September final (consensus 53.9, last 53.9)

10:00 AM ISM services index, September (GS 52.0, consensus 51.7, last 52.0): We estimate that the ISM services index was unchanged at 52.0 in September, reflecting sequential softening in our non-manufacturing survey tracker (-1.6pt to 52.4) but a tailwind from residual seasonality.

01:40 PM Fed Vice Chair Jefferson speaks: Fed Vice Chair Philip Jefferson will speak on the economic outlook and the monetary policy framework at Drexel University in Philadelphia. Speech text and audience Q&A are expected.

Source: DB, Goldman

If we don't see the shutdown and payrolls then get released, it’s a very important number given the recent negative revisions and real-time downtrend in new hiring, not to mention the Fed and market reaction function. We could be set for some notable volatility around these prints going forward as the breakeven payroll rate now seems to be around or under 50k per month. Given the naturally wide distribution of payroll numbers, this brings the prospect, and perhaps even the likelihood, of negative prints. These prints may not reflect the underlying trend but could lead to big moves. Given the breakeven rate has always been higher in our careers, we are not really conditioned to negative prints being within the margin of error, so reactions to such prints may be not be rational if and when they happen.

Having said that, for this month DB's economists expect a rebound on the headline to +75k (consensus +50k) against +22k last month. For private payrolls they also expect +75k (consensus +60k) against +38k last month. The unemployment rate is expected to remain unchanged at 4.3%. So, the point above is more of an ongoing one over the coming months and quarters.

Tomorrow's JOLTS report is also important but only refers to August. So it’s always behind but is perhaps the more reliable indicator of the labor market. So far it has been fairly stable and indicative of a low hiring and low firing labor market. So stable, but with low numbers on both sides, and therefore it wouldn't take a big change in the direction either way to make a big difference. We also have ADP on Wednesday and then we think jobless claims on Thursday would likely be released in a shutdown as it’s compiled by states. This happened in the 2013 shutdown but we can't be 100% sure. Elsewhere for employment trends, the jobs hard/plentiful measure in tomorrow's consumer confidence, as well as the employment subcomponents in the two ISM readings this week will also be important for the current state of play in the US labor market.

The one other thing to say is that the start of Q4 on Wednesday brings the start of the multi-year German stimulus package. Given most careers have been soundtracked by German fiscal discipline, then we will all have to get used to a changing narrative. It's fair to say that investors have become more pessimistic over the summer as to the extent of the difference it will make (just check out the DAX swoon after the early 2025 blast off) . However, some of this is just impatience and the momentum could kick into gear again soon. There is some disappointment that more will be directed to consumption than the initial infrastructure and defense bias suggested, but it shouldn't change the near-term multiplier much, just the long-term potential growth rate.

Staying in Europe, the focus will be on the flash CPIs for September starting with Spain and Belgium today. Prints for Germany, France and Italy will be released tomorrow and the Eurozone print will be out on Wednesday. Our European economists preview the releases here. They expect a 2.22% report for the Eurozone, with country-level forecasts including 2.34% for Germany, 1.12% for France and 1.67% for Italy. Finally, the September CPI report is also due for Switzerland on Thursday.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 29

Data: US September Dallas Fed manufacturing activity, August pending home sales, UK August net consumer credit, M4, Eurozone September economic, industrial, services confidence

Central banks: Fed's Waller, Bostic and Hammack speak, ECB's Muller, Lane, Cipollone and Centeno speak, BoJ's Noguchi speaks, BoE's Ramsden speaks

Earnings: Carnival

Tuesday September 30

Data: US September Conference Board consumer confidence index, Dallas Fed services activity, MNI Chicago PMI, August JOLTS report, July FHFA house price index, China September PMIs, UK September Lloyds Business Barometer, Q2 current account balance, Japan August industrial production, retail sales, housing starts, Germany September CPI, unemployment claims rate, August retail sales, import price index, France September CPI, August consumer spending, PPI, Italy September CPI, August PPI, July industrial sales

Central banks: RBA decision, Fed's Jefferson and Goolsbee speak, ECB's Lagarde, Rehn, Cipollone and Nagel speak, BoE's Lombardelli, Mann and Breeden speak, BoJ summary of opinions from the September meeting

Earnings: Nike

Wednesday October 1

Data: US September ISM index, ADP report, total vehicle sales, August construction spending, Japan 3Q Tankan survey, Italy September manufacturing PMI, new car registrations, budget balance, Eurozone September CPI, Canada September manufacturing PMI

Central banks: Fed's Logan speaks, ECB's Guindos, Kazimir, Kocher, Nagel and Simkus speak, BoE's Mann speaks

Thursday October 2

Data: US August factory orders, initial jobless claims, Japan September monetary base, consumer confidence index, France August budget balance, Italy August unemployment rate, Eurozone August unemployment rate, Switzerland September CPI

Central banks: Fed's Logan speaks, ECB's Villeroy, Makhlouf and Guindos speak, BoJ's Uchida speaks, BoE's September DMP survey

Earnings: Tesco

Friday October 3

Data: US September jobs report, ISM services, UK September official reserves changes, Japan August jobless rate, job-to-applicant ratio, France August industrial production, Italy September services PMI, August retail sales, Q2 deficit to GDP, Eurozone August PPI

Central banks: Fed's Williams and Jefferson speak, ECB's Lagarde, Sleijpen, Villeroy and Schnabel speak, BoJ's Ueda speaks, BoE's Bailey speaks