EU Proposes Freezing Israel Trade Pact As Smotrich Declares Gaza 'Real Estate Bonanza'

EU Proposes Freezing Israel Trade Pact As Smotrich Declares Gaza 'Real Estate Bonanza'

On Wednesday the European Commission presented a proposal for new tariffs and sanctions aimed at pressuring Israel to quickly end its military operations in Gaza, in addition to sanctions measures on two Israeli ministers known for their fiery anti-Palestinian rhetoric.

"The horrific events taking place in Gaza on a daily basis must stop," EU Commission President Ursula von der Leyen said after presenting the proposal to the EU Council. "There needs to be an immediate ceasefire, unrestrained access for all humanitarian aid, and the release of all hostages held by Hamas."

The measures would if implemented constitute a major, historic blow to EU-Israel relations. The commission appears to be largely responding to the new Gaza City offensive, confirmed to be in full swing this week, and the major United Nations investigation just released which concluded that Israel is guilty of genocide.

"We're not proposing to suspend trade with Israel, we are proposing to suspend trade preferences,"

"We're not proposing to suspend trade with Israel, we are proposing to suspend trade preferences,"  a senior unnamed European official.

A decades-long deal and trade-related pillar of the

:

Trade Commissioner Maros Sefcovic said on Wednesday that if a qualified majority is reached, the EU will impose 230m euros ($166m) tariffs on 37 percent of the 15.9bn euros of the EU’s imports from Israel, instead of free trade.

Israel is the EU's largest trade partner. In 2024, EU-Israel trade reached a record 42.6bn euros, of which 37 percent is “preferential treatment”, according to the EU's foreign policy chief Kaja Kallas.

"So definitely this step will have a high cost for Israel," Kallas told

a senior unnamed European official.

A decades-long deal and trade-related pillar of the

:

Trade Commissioner Maros Sefcovic said on Wednesday that if a qualified majority is reached, the EU will impose 230m euros ($166m) tariffs on 37 percent of the 15.9bn euros of the EU’s imports from Israel, instead of free trade.

Israel is the EU's largest trade partner. In 2024, EU-Israel trade reached a record 42.6bn euros, of which 37 percent is “preferential treatment”, according to the EU's foreign policy chief Kaja Kallas.

"So definitely this step will have a high cost for Israel," Kallas told  on Tuesday.

The two ministers being targeted in the potential new measures are National Security Minister Itamar Ben-Gvir and Finance Minister Bezalel Smotrich. They would face asset freezes and a blanket travel ban for travel within the European Union.

Smotrich's latest Wednesday comments will not at all help his case in the eyes of European officials. He has newly stated that the Gaza Strip that the Gaza Strip is a "real estate bonanza." Further he claimed to be in talks with the Americans on how to divide the enclave up once the Palestinians are kicked out.

There is "a real estate bonanza" in Gaza that "pays for itself" and he has "already started negotiations with the Americans," he said at a conference in Tel Aviv, https://www.timesofisrael.com/liveblog-september-17-2025/

to local media.

"We have poured a lot of money into this war. We have to see how we are dividing up the land in percentages," Smotrich said, explaining that "the demolition, the first stage in the city’s renewal, we have already done. Now we just need to build."

Wed, 09/17/2025 - 12:40

on Tuesday.

The two ministers being targeted in the potential new measures are National Security Minister Itamar Ben-Gvir and Finance Minister Bezalel Smotrich. They would face asset freezes and a blanket travel ban for travel within the European Union.

Smotrich's latest Wednesday comments will not at all help his case in the eyes of European officials. He has newly stated that the Gaza Strip that the Gaza Strip is a "real estate bonanza." Further he claimed to be in talks with the Americans on how to divide the enclave up once the Palestinians are kicked out.

There is "a real estate bonanza" in Gaza that "pays for itself" and he has "already started negotiations with the Americans," he said at a conference in Tel Aviv, https://www.timesofisrael.com/liveblog-september-17-2025/

to local media.

"We have poured a lot of money into this war. We have to see how we are dividing up the land in percentages," Smotrich said, explaining that "the demolition, the first stage in the city’s renewal, we have already done. Now we just need to build."

Wed, 09/17/2025 - 12:40

"We're not proposing to suspend trade with Israel, we are proposing to suspend trade preferences,"

"We're not proposing to suspend trade with Israel, we are proposing to suspend trade preferences," European Commission proposes new sanctions on Israel over war in Gaza

The European Union's executive arm has made a series of proposals aimed at forcing an end to the Israel–Hamas conflict.

EUR-Lex - 22000A0621(01) - EN

euronews

EU Commission to slap duties on Israeli goods, Kallas tells Euronews

The European Commission is proposing to reimpose duties on Israeli goods in response to the war in Gaza and ongoing violations in the West Bank, Eu...

Tyler Durden | Zero Hedge

Zero Hedge

EU Proposes Freezing Israel Trade Pact As Smotrich Declares Gaza 'Real Estate Bonanza' | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

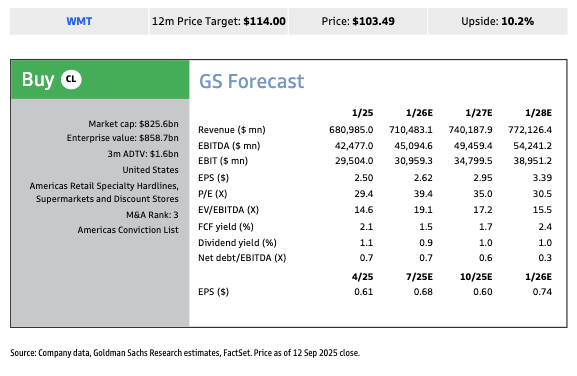

Here are the four most critical questions investors were asking about Walmart following the conferences:

1. How is Walmart's competitive positioning v. Amazon, especially when it comes to delivery?

Walmart, while acknowledging Amazon as a formidable competitor, is confident that their combination of value, its fresh and produce merchandise offering and its speed are key differentiators to their competitive position. Walmart can deliver to 94% of US households in 3 hours or less, with the company expecting that to expand to 95% by year-end. Looking at scheduled deliveries, which are a large part of Walmart's business, about one-third are fast (3 hours or less), with 25% of fast deliveries now occurring in 30 minutes. Walmart has observed that when customers utilize fast delivery, their frequency starts to increase and their basket composition often changes; while many customers start with fresh food, after using fast delivery, they may also purchase general merchandise (i.e., fashion, home goods).

2. How is Walmart's marketplace differentiated both for buyers and sellers?

A key differentiator for Walmart's marketplace versus peers is its grocery offering, given that grocery items move the fastest and Walmart is the largest grocer in the US. To further differentiate themselves from others the company is now displaying select Marketplace seller items in stores, with a QR code to order the item through the Walmart app. These codes allow customers to access digital tools, services and an extended online assortment. Walmart is bringing the extended Marketplace aisle into stores, starting with a few items on display. Customers can purchase through the Walmart app and even have their items professionally installed. And finally for sellers, they offer two services; Walmart Fulfillment System and Data Ventures. When a seller joins the Walmart Fulfillment System, it helps lift a seller's GMV 50% on average. Data ventures can provide sellers with valuable insights on their selling trends.

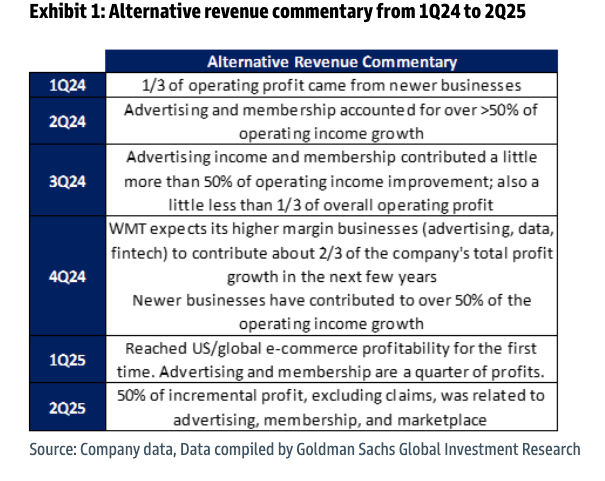

Per management, there is a symbiotic relationship between eCommerce and WMT's higher margin businesses (i.e., advertising, data, membership, marketplace, fulfillment); as eCommerce grows, WMT has a greater opportunity to expand these higher margin businesses, and the company can reinvest those dollars into experience and price.

Here are the four most critical questions investors were asking about Walmart following the conferences:

1. How is Walmart's competitive positioning v. Amazon, especially when it comes to delivery?

Walmart, while acknowledging Amazon as a formidable competitor, is confident that their combination of value, its fresh and produce merchandise offering and its speed are key differentiators to their competitive position. Walmart can deliver to 94% of US households in 3 hours or less, with the company expecting that to expand to 95% by year-end. Looking at scheduled deliveries, which are a large part of Walmart's business, about one-third are fast (3 hours or less), with 25% of fast deliveries now occurring in 30 minutes. Walmart has observed that when customers utilize fast delivery, their frequency starts to increase and their basket composition often changes; while many customers start with fresh food, after using fast delivery, they may also purchase general merchandise (i.e., fashion, home goods).

2. How is Walmart's marketplace differentiated both for buyers and sellers?

A key differentiator for Walmart's marketplace versus peers is its grocery offering, given that grocery items move the fastest and Walmart is the largest grocer in the US. To further differentiate themselves from others the company is now displaying select Marketplace seller items in stores, with a QR code to order the item through the Walmart app. These codes allow customers to access digital tools, services and an extended online assortment. Walmart is bringing the extended Marketplace aisle into stores, starting with a few items on display. Customers can purchase through the Walmart app and even have their items professionally installed. And finally for sellers, they offer two services; Walmart Fulfillment System and Data Ventures. When a seller joins the Walmart Fulfillment System, it helps lift a seller's GMV 50% on average. Data ventures can provide sellers with valuable insights on their selling trends.

Per management, there is a symbiotic relationship between eCommerce and WMT's higher margin businesses (i.e., advertising, data, membership, marketplace, fulfillment); as eCommerce grows, WMT has a greater opportunity to expand these higher margin businesses, and the company can reinvest those dollars into experience and price.

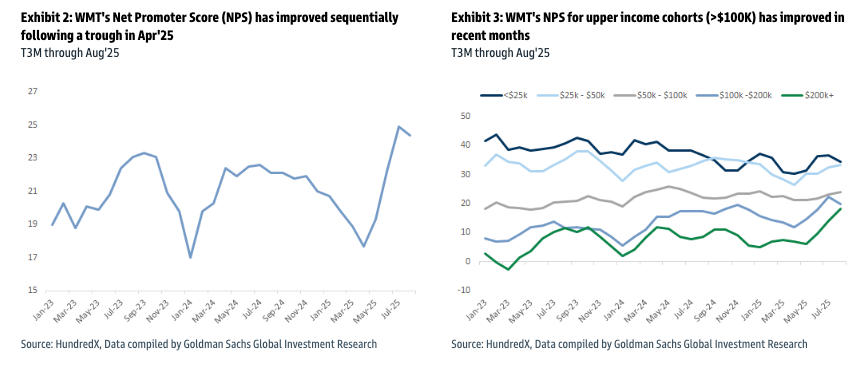

3. What consumer trends are Walmart seeing?

US consumer behavior has been generally consistent. In 2Q, WMT saw ongoing share gains across key categories and all income cohorts, with upper income households contributing the largest gains. The company is seeing strong demand from middle to upper income consumers, while the middle to lower income has experienced a bit of stress, calling out a behavioral change around items with higher costs due to tariffs. That said, consumers have held up well, and WMT expects to see similar trends for the balance of the year. In terms of quarter-to-date trends, WMT started this quarter with similar strength on the top line, noting that 2Q trends are extending into 3Q.

Insights from HundredX

We supplement our work with data from HundredX, a mission-based data and insights company that takes an innovative approach to monitoring consumer perceptions and gathering consumer feedback to understand trends across 80+ industries and 3,000+ brands. HundredX analyzes collective opinions of everyday customers and evaluates how their priorities influence purchasing decisions and attitudes toward businesses and brands.

3. What consumer trends are Walmart seeing?

US consumer behavior has been generally consistent. In 2Q, WMT saw ongoing share gains across key categories and all income cohorts, with upper income households contributing the largest gains. The company is seeing strong demand from middle to upper income consumers, while the middle to lower income has experienced a bit of stress, calling out a behavioral change around items with higher costs due to tariffs. That said, consumers have held up well, and WMT expects to see similar trends for the balance of the year. In terms of quarter-to-date trends, WMT started this quarter with similar strength on the top line, noting that 2Q trends are extending into 3Q.

Insights from HundredX

We supplement our work with data from HundredX, a mission-based data and insights company that takes an innovative approach to monitoring consumer perceptions and gathering consumer feedback to understand trends across 80+ industries and 3,000+ brands. HundredX analyzes collective opinions of everyday customers and evaluates how their priorities influence purchasing decisions and attitudes toward businesses and brands.

4. How is Walmart thinking about price in 2H?

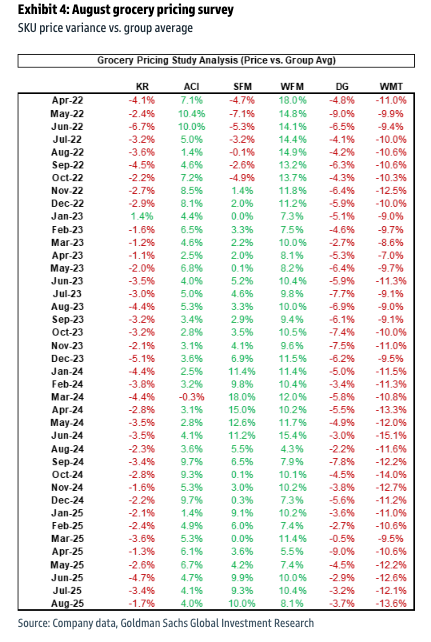

In the US, inflation is in the +LSD range, following price increases in food categories for multiple years now. Looking to general merchandise, prices went up as supply chains were stretched after the pandemic, which was followed by a decline in prices. In the current tariff environment, WMT has seen a gradual increase in cost levels in general merchandise, leading to single-digit inflation. Per management, the elasticity response has been better than expected, noting that when prices go up, units go down correspondingly, but consumers move from one item or category to another as prices change. As of the end of July, about one-third of WMT's assortment would have had a price change, and by the time of 1Q26, it is expected be the full base. When tariffs became a possibility, WMT started value engineering its 3Q/4Q assortment, taking out costs and holding prices when possible. Per management, WMT's price gaps remain consistent, noting that the company made investments a few years ago to establish a position and has maintained that. Looking at the GS grocery pricing survey (ran by Leah Jordan), price gaps for WMT widened in August to -13.6%, versus an average of -11.9% for the last 12 months indicating to us that WMT is focused on providing more value through food in order to keep overall prices low for the consumer and take more share.

4. How is Walmart thinking about price in 2H?

In the US, inflation is in the +LSD range, following price increases in food categories for multiple years now. Looking to general merchandise, prices went up as supply chains were stretched after the pandemic, which was followed by a decline in prices. In the current tariff environment, WMT has seen a gradual increase in cost levels in general merchandise, leading to single-digit inflation. Per management, the elasticity response has been better than expected, noting that when prices go up, units go down correspondingly, but consumers move from one item or category to another as prices change. As of the end of July, about one-third of WMT's assortment would have had a price change, and by the time of 1Q26, it is expected be the full base. When tariffs became a possibility, WMT started value engineering its 3Q/4Q assortment, taking out costs and holding prices when possible. Per management, WMT's price gaps remain consistent, noting that the company made investments a few years ago to establish a position and has maintained that. Looking at the GS grocery pricing survey (ran by Leah Jordan), price gaps for WMT widened in August to -13.6%, versus an average of -11.9% for the last 12 months indicating to us that WMT is focused on providing more value through food in order to keep overall prices low for the consumer and take more share.

These questions come as Walmart shares have gained 15% year-to-date, though the stock remains below the peak reached in mid-February.

These questions come as Walmart shares have gained 15% year-to-date, though the stock remains below the peak reached in mid-February.

. . .

. . .

Meanwhile, the Great Game continues to come into sharper focus in global War Rooms for those not staring too hard at lines on their Bloomberg screens.

The SCMP headline today is, ‘As the US retreats, can Xi Jinping’s new initiative shape the future world order?’ They add, “Analysts say the Global Governance Initiative reflects China’s ambitions to shape a multipolar world, but it needs more substance to avoid becoming an ‘empty shell’.”

That’s as ‘Greenland’s defenses are being bolstered against Russia and China, but Trump may be the real target’ (CNN) – I’m sure the Pentagon is terrified if so; the US warned Canada of potential negative consequences if it dumps F-35 fighter jets; Israel presented Syria with a proposal for a new security agreement, which it hasn’t yet replied to; and Papua New Guinea and Vanuatu have refused to sign the defense treaties with Australia it had drawn up for them.

In short, the boundaries of emergent geopolitical blocs continue to be thrashed out in real time alongside those of the matching geoeconomics.

There, the SCMP claims a Trump China trip many hinge on Boeing and soybean deals and that “significant progress” has been made. Recall the Farce One Trade Deal which was an irrelevant thing in markets nearly six years ago? It’s unlikely to play out again, even as Trump extended TikTok’s deadline as US investors seem set to take 80% control of it while the actual algorithm stays with China.

Rather, the US is beginning the review of trade deal with Canada and Mexico – expect far stronger measures to ringfence US production in some key sectors and guidance on transshipment from outside the bloc. PM Carney reportedly told Anglo American to move its HQ to Canada for the Teck deal approval, which is Anglo American in the broadest sense. The UK has paused its push for a 0% US tariff on steel, which it makes very little of, as PM Starmer prefers to lock in a “permanent” 25% rate, but the Trump state visit is going to see US tech giants pledge billions for UK AI infrastructure. Moreover, the US government will start a multibillion mining initiative for critical minerals via the IDFC and hedge fund Orion.

The EU and Indonesia are set to agree a trade deal next week, which the Financial Times claims is to “seek to reduce reliance on the US.” Except both economies want to be net exporters, so won’t import much from the other, especially against public protests and political populism, and both signed trade deals with the US which don’t allow them to export anything to it they import in volume from China. As such, an EU-Indonesia trade deal is still a step towards a US-centric trading bloc. Just don’t expect many headlines saying so from Brussels or Jakarta.

The EU will reportedly adopt new sanctions against Israel today, which could involve removing trade privileges. As the EU runs hefty trade and services surpluses with Israel, that could mean it takes the larger economic blow should things escalate, while Israel is a key source of defence tech, such as Iron Dome, that a Europe trying to rearm rapidly may have to buy from the US, which will continue to work with Israel, or duplicate domestically at higher cost, and much more slowly.

In Australia,

Meanwhile, the Great Game continues to come into sharper focus in global War Rooms for those not staring too hard at lines on their Bloomberg screens.

The SCMP headline today is, ‘As the US retreats, can Xi Jinping’s new initiative shape the future world order?’ They add, “Analysts say the Global Governance Initiative reflects China’s ambitions to shape a multipolar world, but it needs more substance to avoid becoming an ‘empty shell’.”

That’s as ‘Greenland’s defenses are being bolstered against Russia and China, but Trump may be the real target’ (CNN) – I’m sure the Pentagon is terrified if so; the US warned Canada of potential negative consequences if it dumps F-35 fighter jets; Israel presented Syria with a proposal for a new security agreement, which it hasn’t yet replied to; and Papua New Guinea and Vanuatu have refused to sign the defense treaties with Australia it had drawn up for them.

In short, the boundaries of emergent geopolitical blocs continue to be thrashed out in real time alongside those of the matching geoeconomics.

There, the SCMP claims a Trump China trip many hinge on Boeing and soybean deals and that “significant progress” has been made. Recall the Farce One Trade Deal which was an irrelevant thing in markets nearly six years ago? It’s unlikely to play out again, even as Trump extended TikTok’s deadline as US investors seem set to take 80% control of it while the actual algorithm stays with China.

Rather, the US is beginning the review of trade deal with Canada and Mexico – expect far stronger measures to ringfence US production in some key sectors and guidance on transshipment from outside the bloc. PM Carney reportedly told Anglo American to move its HQ to Canada for the Teck deal approval, which is Anglo American in the broadest sense. The UK has paused its push for a 0% US tariff on steel, which it makes very little of, as PM Starmer prefers to lock in a “permanent” 25% rate, but the Trump state visit is going to see US tech giants pledge billions for UK AI infrastructure. Moreover, the US government will start a multibillion mining initiative for critical minerals via the IDFC and hedge fund Orion.

The EU and Indonesia are set to agree a trade deal next week, which the Financial Times claims is to “seek to reduce reliance on the US.” Except both economies want to be net exporters, so won’t import much from the other, especially against public protests and political populism, and both signed trade deals with the US which don’t allow them to export anything to it they import in volume from China. As such, an EU-Indonesia trade deal is still a step towards a US-centric trading bloc. Just don’t expect many headlines saying so from Brussels or Jakarta.

The EU will reportedly adopt new sanctions against Israel today, which could involve removing trade privileges. As the EU runs hefty trade and services surpluses with Israel, that could mean it takes the larger economic blow should things escalate, while Israel is a key source of defence tech, such as Iron Dome, that a Europe trying to rearm rapidly may have to buy from the US, which will continue to work with Israel, or duplicate domestically at higher cost, and much more slowly.

In Australia,  Besides Cheerios and Blue Buffalo, GIS also controls other top brands, including Cinnamon Toast Crunch, Betty Crocker, Nature Valley, and Yoplait. It delivered better-than-expected EPS and margin despite broad sales declines, with strength in International offset by weakness in North America Retail and Pet.

GIS Q1 Highlights (using Bloomberg Consensus data)

Earnings: Adjusted EPS $0.86 (vs. $1.07 y/y), topping estimates of $0.82.

Margins: Adjusted gross margin 34.2% (vs. 35.4% y/y), above 33.4% consensus.

Sales: Net sales $4.52B, down 6.8% y/y, in line with estimates.

North America Retail: $2.63B (-13% y/y, in line).

Foodservice: $516.7M (-3.6% y/y, slightly above).

Pet: $610M (+5.9% y/y, below est. $622.6M).

International: $760.2M (+6% y/y, above est. $736.3M).

Organic Performance

Organic net sales down 3% (vs. -2.9% est).

North America Retail -5% (vs. -4.8% est).

Pet -5% (vs. -2.9% est).

Foodservice +1% (vs. +0.2% est).

International +4% (vs. +2.4% est)

Organic sales volume -1 pt (in line).

Organic price/mix -2 pts (vs. -1.8% est).

GIS reaffirmed its full-year outlook for adjusted EPS to decline as much as 15% and organic sales between -1% to 1%.

GIS FY26 Outlook

Reaffirmed organic net sales guidance: -1% to +1% (vs. -1.07% consensus).

Maintains forecast for adjusted EPS to decline 10–15% in constant currency.

Expects adjusted operating profit down 10–15% in constant currency.

Food and beverage companies have faced lower volumes and softer demand as cash-strapped shoppers seek value.

One way consumers have tightened budgets is by buying more food for home rather than dining out. This trend began during the inflation surge under the Biden-Harris regime several years ago. Although inflation has eased during Trump's second term, some consumers continue to cook at home.

Besides Cheerios and Blue Buffalo, GIS also controls other top brands, including Cinnamon Toast Crunch, Betty Crocker, Nature Valley, and Yoplait. It delivered better-than-expected EPS and margin despite broad sales declines, with strength in International offset by weakness in North America Retail and Pet.

GIS Q1 Highlights (using Bloomberg Consensus data)

Earnings: Adjusted EPS $0.86 (vs. $1.07 y/y), topping estimates of $0.82.

Margins: Adjusted gross margin 34.2% (vs. 35.4% y/y), above 33.4% consensus.

Sales: Net sales $4.52B, down 6.8% y/y, in line with estimates.

North America Retail: $2.63B (-13% y/y, in line).

Foodservice: $516.7M (-3.6% y/y, slightly above).

Pet: $610M (+5.9% y/y, below est. $622.6M).

International: $760.2M (+6% y/y, above est. $736.3M).

Organic Performance

Organic net sales down 3% (vs. -2.9% est).

North America Retail -5% (vs. -4.8% est).

Pet -5% (vs. -2.9% est).

Foodservice +1% (vs. +0.2% est).

International +4% (vs. +2.4% est)

Organic sales volume -1 pt (in line).

Organic price/mix -2 pts (vs. -1.8% est).

GIS reaffirmed its full-year outlook for adjusted EPS to decline as much as 15% and organic sales between -1% to 1%.

GIS FY26 Outlook

Reaffirmed organic net sales guidance: -1% to +1% (vs. -1.07% consensus).

Maintains forecast for adjusted EPS to decline 10–15% in constant currency.

Expects adjusted operating profit down 10–15% in constant currency.

Food and beverage companies have faced lower volumes and softer demand as cash-strapped shoppers seek value.

One way consumers have tightened budgets is by buying more food for home rather than dining out. This trend began during the inflation surge under the Biden-Harris regime several years ago. Although inflation has eased during Trump's second term, some consumers continue to cook at home.

"General Mills has said a rise in cooking at home among value-conscious consumers struggling with inflation has helped boost some of its staples, including rice and beans," Bloomberg noted, adding, "Still, shoppers who are anxious about the economy have been cautious with their spending and turned to private-label options and smaller package sizes."

"General Mills has said a rise in cooking at home among value-conscious consumers struggling with inflation has helped boost some of its staples, including rice and beans," Bloomberg noted, adding, "Still, shoppers who are anxious about the economy have been cautious with their spending and turned to private-label options and smaller package sizes."

Source: Bloomberg

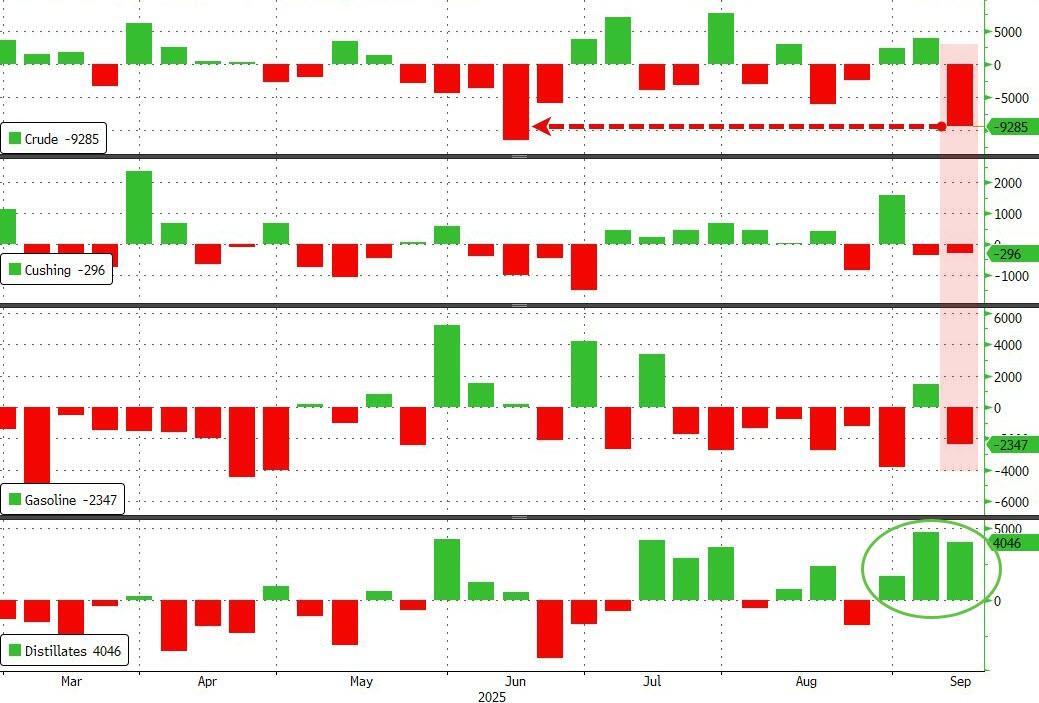

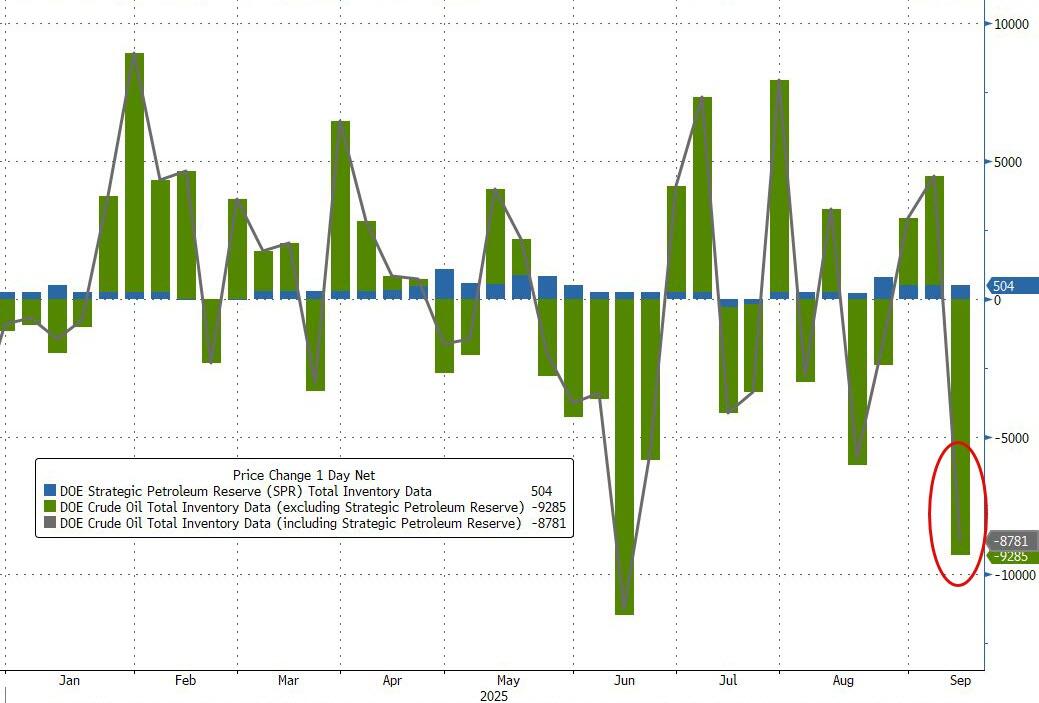

Even accounting for the 504k barrel addition to the SPR, total US commercial crude stocks saw their second biggest weekly decline in 15 months...

Source: Bloomberg

Even accounting for the 504k barrel addition to the SPR, total US commercial crude stocks saw their second biggest weekly decline in 15 months...

Source: Bloomberg

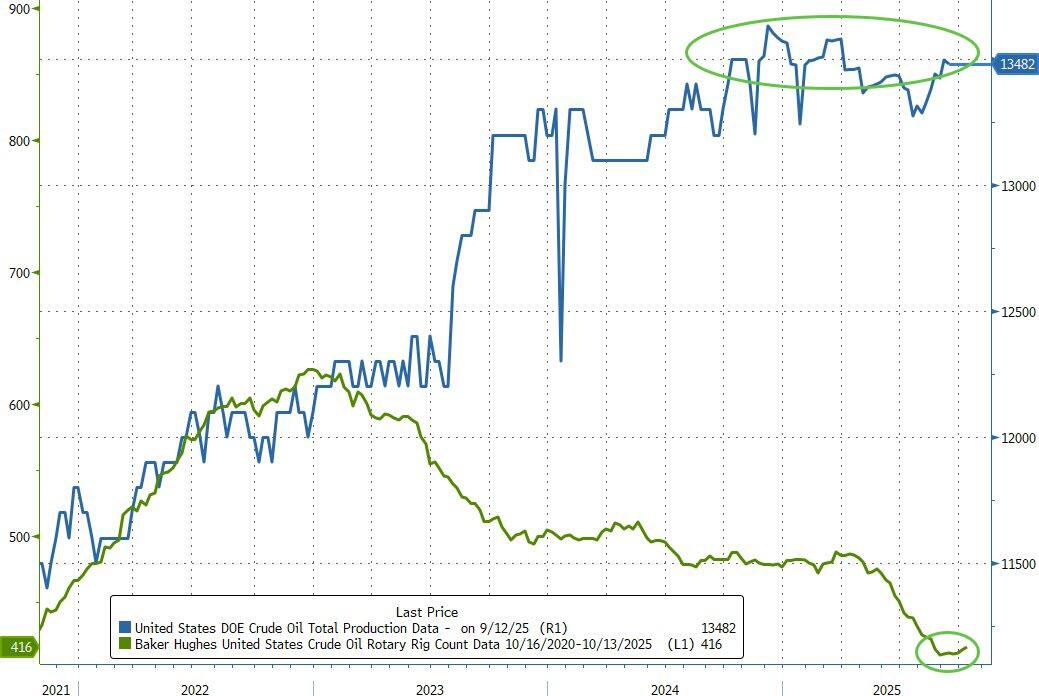

US crude production remains near record highs as the decline the rig count has finally stalled...

Source: Bloomberg

US crude production remains near record highs as the decline the rig count has finally stalled...

Source: Bloomberg

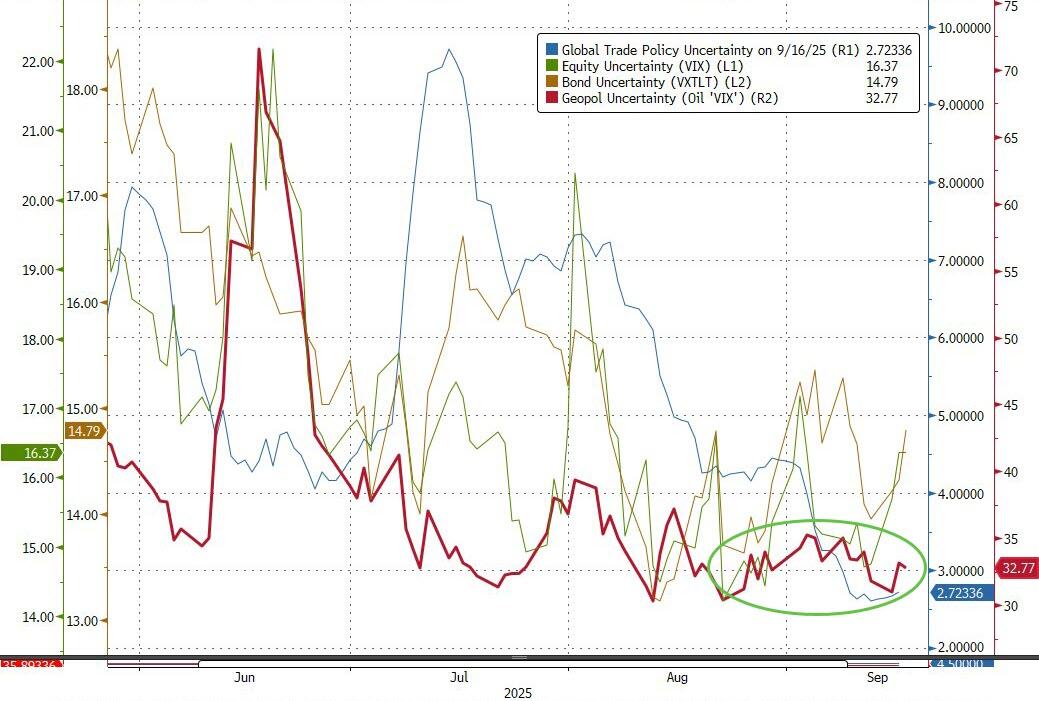

The recent gains haven’t been enough to push oil out of the $5 band it has been in for most of the past month-and-a-half, buffeted between geopolitical tensions and bearish fundamentals.

The accelerated return of OPEC+ supply has boosted predictions that a glut will form later in the year, while surging oil tanker earnings are offering a sign of higher output.

WTI has extended its gains from overnight weakness and is trading just in the green on the day...

Source: Bloomberg

The recent gains haven’t been enough to push oil out of the $5 band it has been in for most of the past month-and-a-half, buffeted between geopolitical tensions and bearish fundamentals.

The accelerated return of OPEC+ supply has boosted predictions that a glut will form later in the year, while surging oil tanker earnings are offering a sign of higher output.

WTI has extended its gains from overnight weakness and is trading just in the green on the day...

Oil markets are focused on Ukrainian attacks on Russian energy infrastructure, as well as the wider risk of escalation following a drone incursion into Poland last week, said Emily Ashford, head of energy research at Standard Chartered Plc.

“We think a 25 basis-point Fed cut is priced in, but a 50 basis-point surprise would be further risk-on for markets,” Ashford said in reference to the imminent Fed decision.

Oil markets are focused on Ukrainian attacks on Russian energy infrastructure, as well as the wider risk of escalation following a drone incursion into Poland last week, said Emily Ashford, head of energy research at Standard Chartered Plc.

“We think a 25 basis-point Fed cut is priced in, but a 50 basis-point surprise would be further risk-on for markets,” Ashford said in reference to the imminent Fed decision.

Oil's implied volatility was subdued after it fell to the lowest in more than three weeks on Monday, as outright prices remain firmly stuck within the narrow range seen since early August.

Oil's implied volatility was subdued after it fell to the lowest in more than three weeks on Monday, as outright prices remain firmly stuck within the narrow range seen since early August.

UK Prime Minister Keir Starmer has confirmed that his country will deploy Royal Air Force jets to Poland, while Italy will contribute two Eurofighter jets, and Germany has readied four Eurofighters. Denmark will also sent jets, and Czech Mi-171S helicopters have also arrived in Poland. Over 150 NATO troops have also initially arrived along with the equipment.

Meanwhile, eastern European and Baltic countries are already calling for more,

UK Prime Minister Keir Starmer has confirmed that his country will deploy Royal Air Force jets to Poland, while Italy will contribute two Eurofighter jets, and Germany has readied four Eurofighters. Denmark will also sent jets, and Czech Mi-171S helicopters have also arrived in Poland. Over 150 NATO troops have also initially arrived along with the equipment.

Meanwhile, eastern European and Baltic countries are already calling for more,

One European politician, MEP Petr Bystron, has revealed that the EU commission has provided Financial support to the American investigative network Organized Crime and Corruption Reporting Project (OCCRP) right after the 2024 EU elections. Major German news outlets like Spiegel, Zeit, and Süddeutsche Zeitung belong to the group, which is the world’s largest network of investigative media.

These outlets are known for their hit pieces on conservative and right-wing parties, often at opportune times. Notably, Spiegel and Süddeutsche Zeitung’s reporting in 2019 on the Ibiza Affair scandal — which involved an undercover video of the Freedom Party of Austria (FPÖ) party’s leader — led to the toppling of the Austrian government at the time, which included the FPÖ. Many critics believed that due to the sophistication of the operation, which included an undercover actress, intelligence services may have played a role.

The OCCRP group was founded in 2006 and is most well known for publishing the “Panama Papers” and the “Azerbaijan Laundromat” evasion scandals.

After a massive flow of U.S. money was cut off to key European establishment outlets and NGOs, Brussels is stepping in to fill the gap. Namely, the Trump administration ended the massive levels of funding headed towards foreign organizations, particularly from USAID, which allowed them to pump out pro-EU and left-wing content to wide swathes of the population across Europe.

The OCCRP group has received an extraordinary amount of money from U.S. taxpayers and other U.S. sources. According to

One European politician, MEP Petr Bystron, has revealed that the EU commission has provided Financial support to the American investigative network Organized Crime and Corruption Reporting Project (OCCRP) right after the 2024 EU elections. Major German news outlets like Spiegel, Zeit, and Süddeutsche Zeitung belong to the group, which is the world’s largest network of investigative media.

These outlets are known for their hit pieces on conservative and right-wing parties, often at opportune times. Notably, Spiegel and Süddeutsche Zeitung’s reporting in 2019 on the Ibiza Affair scandal — which involved an undercover video of the Freedom Party of Austria (FPÖ) party’s leader — led to the toppling of the Austrian government at the time, which included the FPÖ. Many critics believed that due to the sophistication of the operation, which included an undercover actress, intelligence services may have played a role.

The OCCRP group was founded in 2006 and is most well known for publishing the “Panama Papers” and the “Azerbaijan Laundromat” evasion scandals.

After a massive flow of U.S. money was cut off to key European establishment outlets and NGOs, Brussels is stepping in to fill the gap. Namely, the Trump administration ended the massive levels of funding headed towards foreign organizations, particularly from USAID, which allowed them to pump out pro-EU and left-wing content to wide swathes of the population across Europe.

The OCCRP group has received an extraordinary amount of money from U.S. taxpayers and other U.S. sources. According to

House Republicans this week plan to introduce a short-term measure, known as a continuing resolution, that would keep the government open until Nov. 20 while appropriators attempt to negotiate a broader deal on fiscal year 2026 spending. GOP leaders are framing the bill as a “clean” extension, free of partisan add-ons.

But the proposal pointedly excludes provisions Democrats are demanding, particularly on health care. Senate Majority Leader Chuck Schumer (D-NY) and House Minority Leader Hakeem Jeffries (D-NY) have said they will not support a stopgap that fails to address issues such as Medicaid cuts or Affordable Care Act premium subsidies.

“If Republicans follow Donald Trump’s orders to not even bother dealing with Democrats, they will be single handedly putting our country on the path towards a shutdown,” a Schumer spokesperson told

House Republicans this week plan to introduce a short-term measure, known as a continuing resolution, that would keep the government open until Nov. 20 while appropriators attempt to negotiate a broader deal on fiscal year 2026 spending. GOP leaders are framing the bill as a “clean” extension, free of partisan add-ons.

But the proposal pointedly excludes provisions Democrats are demanding, particularly on health care. Senate Majority Leader Chuck Schumer (D-NY) and House Minority Leader Hakeem Jeffries (D-NY) have said they will not support a stopgap that fails to address issues such as Medicaid cuts or Affordable Care Act premium subsidies.

“If Republicans follow Donald Trump’s orders to not even bother dealing with Democrats, they will be single handedly putting our country on the path towards a shutdown,” a Schumer spokesperson told

At an Oval Office press conference, Miller told reporters that when the results of the investigation are finally that, “It will stun you,” adding, “Even though D.C. had the worst crime in America–honestly measured–it dramatically understated how bad it was.”

🚨 BREAKING: In a shocking revelation, Stephen Miller uncovered a massive scandal in Washington, D.C. The Democratic-led police department has been systematically concealing crime statistics, even classifying homicides as accidents rather than murders.

At an Oval Office press conference, Miller told reporters that when the results of the investigation are finally that, “It will stun you,” adding, “Even though D.C. had the worst crime in America–honestly measured–it dramatically understated how bad it was.”

🚨 BREAKING: In a shocking revelation, Stephen Miller uncovered a massive scandal in Washington, D.C. The Democratic-led police department has been systematically concealing crime statistics, even classifying homicides as accidents rather than murders.

The open mic

The open mic