Futures Flat, Dollar Jumps Ahead Of Nvidia's Critical Earnings

Futures Flat, Dollar Jumps Ahead Of Nvidia's Critical Earnings

Futures are flat with all eyes on NVDA - the largest S&P component by far accounting for a record 8% of the S&P - set to report after the bell. As of 8:00am, S&P futures are just barely in the green recovering from a modest loss earlier, while Nasdaq futures gain 0.1%, with NVDA up +54bps premarket, tracking most of the Mag7 higher and Semis also bid. Cyclicals are mixed (Industrials up, Fins down) with Defensives mostly higher. The yield curve is twisting steeper but with a lesser magnitude to yesterday: bonds steadied after long-dated debt from the US to France and the UK retreated Tuesday, with the yield on 10-year Treasuries little changed at 4.27%. $70 billion of 5Y notes will be auctioned at 1pm ET; yesterday’s 2Y auction saw strong demand closing 1.5bp through. The USD jumps to the highest since Friday's Jackson Hole dovish pivot, with the Euro sliding to a 3 week low as attention turns to the political mess in Europe, and gold continues to trade rangebound. The market’s focus is on NVDA today (our preview is here).

In premarket trading, Mag 7 stocks are mixed (Nvidia +0.6%, Microsoft +0.2%, Tesla +0.1%, Apple little changed, Amazon little changed, Meta -0.2%, Alphabet -0.3%).

Elanco Animal Health (ELAN) gains 4.9% with the company to replace Sarepta Therapeutics in the S&P MidCap 400 effective Sept. 2.

MongoDB (MDB) shares soar 31% after the software company reported second-quarter results that were much stronger than expected. It also raised its full-year forecast.

nCino (NCNO) gains 11% after reporting adjusted earnings per share for the second quarter that beat the average analyst estimate.

Okta (OKTA) is up 5.4% after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

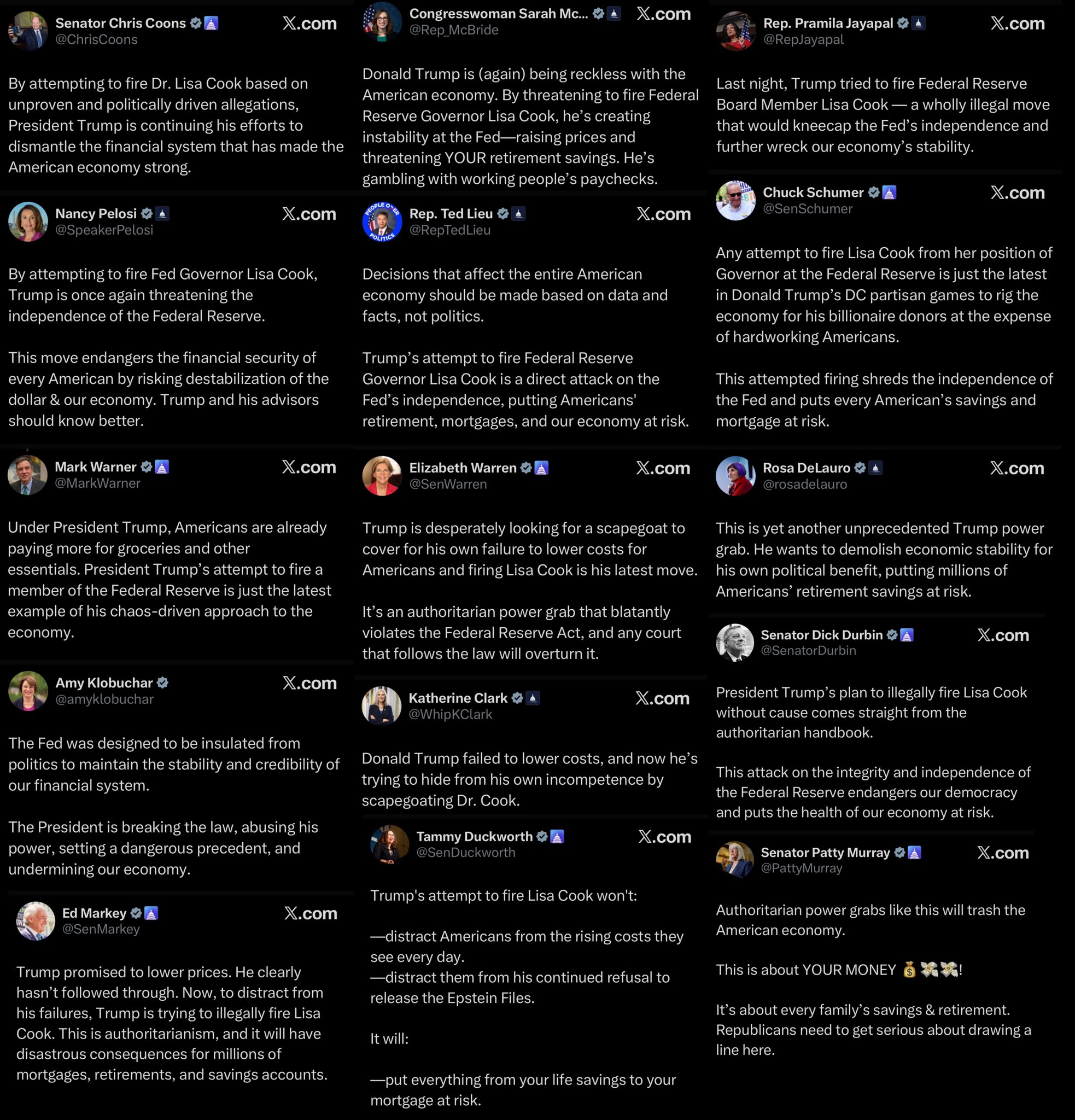

There’s been plenty to rattle markets in recent days, including French political turmoil and the Trump administration’s attacks on the Fed, as well as fresh tariff threats. But investors are now focusing on Nvidia’s earnings, due after the bell (our

Nvidia Earnings Preview: All You Need To Know | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

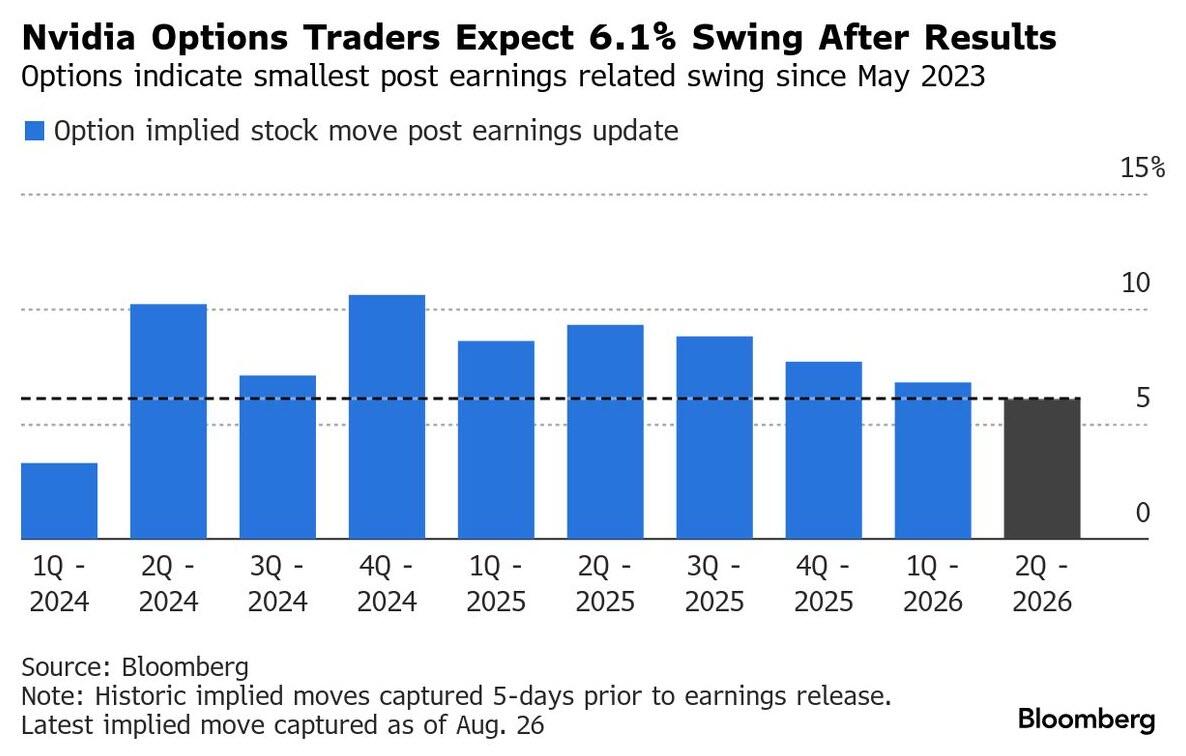

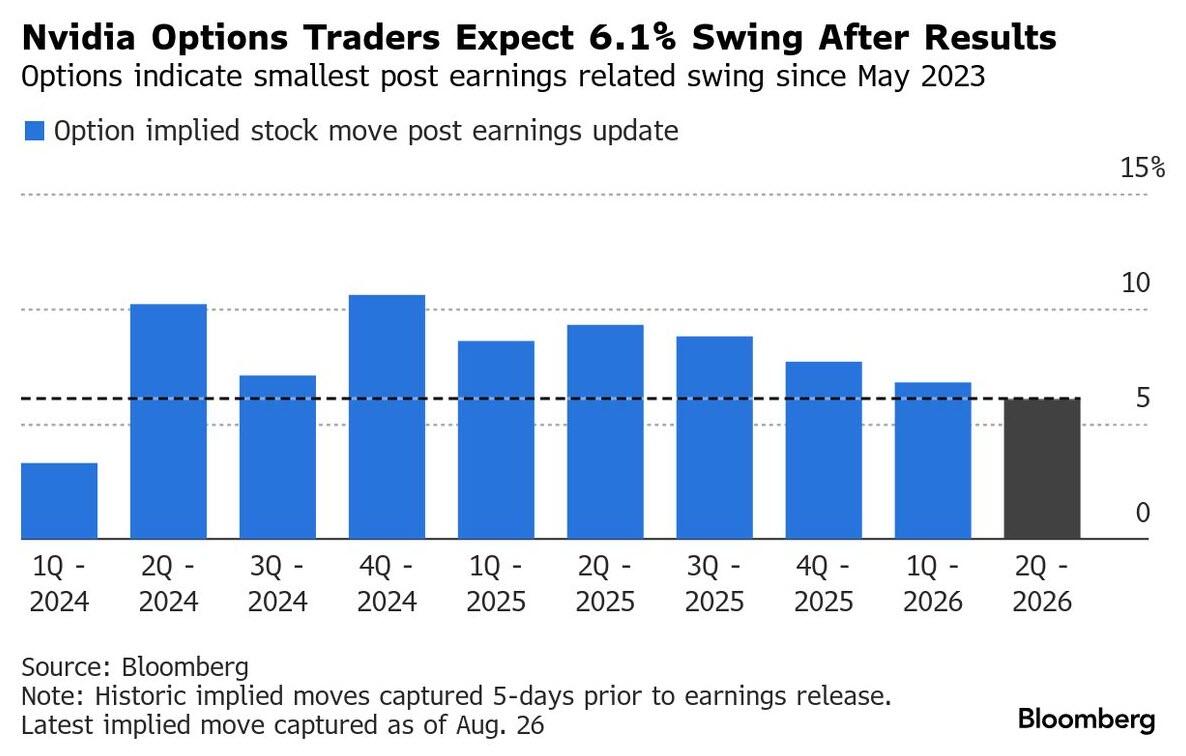

). The chipmaking giant is expected to provide clues on the sustainability of massive AI spending, and how the US-China rivalry is limiting growth. Options currently imply a 6.1% swing in the stock, which would represent a move of roughly $270 billion in either direction in market value, larger than about 95% of the S&P 500 companies.

“Nvidia is the story of the week. We’ve seen some erosion of the AI premium, so this is an important number to determine whether the AI story has got further to go,” said Guy Miller, chief strategist at Zurich Insurance Group. “This could either allow the technology cycle, the AI dream, to continue, or it could get significantly dented.”

Dimming the excitement is uncertainty over how much business Nvidia will be able to do in China. The US government has curbed China’s access to Nvidia products on national security grounds. While the Trump administration recently eased some of those export restrictions, Beijing has pressed domestic customers to seek alternative suppliers.

“A miss could spark meaningful volatility, while a positive surprise would likely see the major indexes make a run at all-time highs,” said Tom Essaye at The Sevens Report.

Elsewhere, in a reminder of the lingering tariff threat to global trade and inflation, Trump’s 50% levy on most Indian imports took effect Wednesday, penalizing the country for buying Russian oil. In Europe, the EU aims to fast-track legislation by the end of the week to scrap all tariffs on US industrial goods — a Trump demand before Washington lowers duties on the bloc’s car exports.

In Europe, The Stoxx 600 is steady after giving up earlier gains. The CAC 40 outperforms with a 0.4% rise even as the OAT-bund spreads widens slightly.

Earlier in the session, Asian stocks declined, weighed down by a sudden drop in Chinese equities, as an absence of new reasons to buy paved the way for profit-taking. The MSCI Asia Pacific Index slipped as much as 1.1%, with Tencent, Woolworths Group and Meituan the biggest drags on the gauge. Major equity indexes in the region were mixed, with those in China and Hong Kong dropping, while the Philippines and Taiwan were among the top gainers. Chinese equities slid in the afternoon session, reversing an earlier advance. One reason for the reversal may have been the fact that chipmaker Cambricon Technologies Corp. briefly became the country’s most expensive onshore stock, which then triggered some profit taking. Chinese officials are seeking to manage bubble risks as the rally extends. Sinolink Securities Co. raised its margin deposit ratio for new client financing to 100%, becoming the first broker to introduce tightening measures amid surging interest in stocks.

In FX, the Bloomberg Dollar Spot Index is up 0.3% as the greenback strengthens versus its G-10 peers. The kiwi is the weakest, falling 0.5% while the Canadian dollar is the most resilient, slipping just 0.1%.

In rates, the Treasury curve steepens further following Tuesday’s front-end rally, stoked in part by strong demand for 2-year note auction. However, new 2-year note’s yield dipped below 3.65%, the lowest for the tenor since early May. Supply cycle continues with $70 billion auction of 5-year notes, the largest of the seven nominal coupon sales, at 1 p.m. New York time. Yields are within 1bp of Tuesday’s closing levels; the 10-year near 4.27%; swap contracts linked to future Fed rate decisions continue to fully price in one quarter-point rate cut this year in October and a second one by year-end.

In commodities, WTI crude futures fall 0.4% to $63 a barrel. Spot gold drops $12. Bitcoin is down 0.5%.

US economic data calendar is blank; second estimate of 2Q GDP is ahead Thursday, July personal income and spending (includes PCE price indexes) Friday. Fed speaker slate includes Richmond Fed President Barkin repeating his Aug. 12 remarks on the economy (time TBD). Nvidia’s earnings after the US close will be the main highlight.

Market Snapshot

S&P 500 mini little changed

Nasdaq 100 mini little changed

Russell 2000 mini -0.1%

Stoxx Europe 600 little changed

DAX -0.3%

CAC 40 +0.2%

10-year Treasury yield little changed at 4.26%

VIX +0.2 points at 14.77

Bloomberg Dollar Index +0.3% at 1208.98

euro -0.4% at $1.159

WTI crude -0.4% at $63.01/barrel

Top Overnight News

New tariffs on Indian goods, the highest in Asia, took effect at 12:01 a.m. in Washington on Wednesday, doubling the existing 25% duty on Indian exports: BBG

Cracker Barrel said it is reverting to its “Old Timer” logo after a rebrand ignited a culture war. “We said we would listen, and we have. Our new logo is going away and our ‘Old Timer’ will remain,” the company said Tuesday. Cracker Barrel’s shares jumped more than 9% in after-hours trading.

Musk’s Starship carries out successful space mission after multiple failures. Giant SpaceX rocket’s 10th test flight deploys dummy satellites and reinforces billionaire’s dominance of commercial space flight: FT

Exxon Mobil Corp. held talks with Russia’s state-controlled oil company about returning to its Sakhalin-1 oil development: WSJ

Commerce Secretary Howard Lutnick sparked a minor rally in shares of defense contractors with his suggestion that the US might take ownership stakes in some of them, even as industry analysts warned the idea poses serious conflict-of-interest concerns: CNBC

Why the Democrats are losing post-industrial America. Former steel town of Bethlehem, Pennsylvania will be crucial battleground in next year’s midterms and the 2028 White House race: FT

US offers air and intelligence support to postwar force in Ukraine. Washington prepared to contribute surveillance, command and control and air defence assets, say European officials: FT

China’s industrial companies saw their profits fall at a slower pace in July, with industrial profits declining 1.5% last month from a year earlier, Bloomberg Economics had forecast a decline of 5.8%: BBG

Cambricon Technologies Corp. swung to a record profit in the first half, reflecting a wave of demand for Chinese chips after Beijing encouraged the use of homegrown technology in a post-DeepSeek AI boom: BBG

Ukraine to allow young men to leave the country. Change to border rules aims to address high number of males being sent abroad by their parents before they reach 18: FT

Microsoft Investigating Employees After Gaza Protest Locks Down Building. The tech company is weighing disciplinary measures for employees who occupied President Brad Smith’s office in protest of Microsoft’s relationship with the Israeli government during its war in Gaza: WSJ

America’s most senior envoy in Pakistan has told the South Asian nation that US companies are showing “strong interest” in its oil and gas sector: BBG

French assets hit by prospect of government collapse. Investors warn government is likely to lose a snap confidence vote on September 8: FT

Trump media group in $6bn deal to buy Crypto.com tokens. Venture will be the ‘first and largest publicly traded CRO treasury company’: FT

US tariff threat over Indian imports of Russian oil could backfire. If New Delhi reduced its purchases to zero, oil prices and inflation would jump: FT

Top Corporate News

Royal Bank of Canada beat estimates on strong performance across its biggest businesses and as the firm set aside less money than expected to cover possible loan losses, a rebound from notable misses on credit earlier this year.

Newmont Corp., the world’s largest gold miner, is studying plans to drive down costs that could lead to deep job cuts.

MongoDB Inc. soared 29% in premarket trading after the software company reported second-quarter results well above expectations and significantly raised its forecast, with analysts at Citi calling the report a “blowout” that showed a strong AI contribution.

Cracker Barrel Old Country Store Inc. said it’s getting rid of a new logo that had sparked controversy and prompted a slump in its share price.

Meituan’s profit got wiped out in a price-based battle with rivals Alibaba Group Holding Ltd. and JD.com Inc., the most striking sign yet that its longstanding dominance in a lucrative home market is under threat.

Nikon Corp.’s shares surged 21% after Bloomberg reported that EssilorLuxottica SA, the maker of Ray-Ban sunglasses, is exploring a potential deal to increase its stake in the Japanese optical equipment manufacturer.

Rio Tinto Group’s new chief executive officer has combined some of its biggest businesses as he looks to simplify the world’s No. 2 miner.

Vitol Group is set to load the first cargo of Syrian crude oil since the lifting of western sanctions on Damascus as the country’s energy industry attempts to recover of more than a decade of destruction from armed conflict.

Trade/Tariffs

US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

US Senate panel is preparing to hold a hearing next week on Trump's Fed pick Stephen Miran for the seat vacated by former Fed governor Kugler.

The Trump administration is reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks that would potentially extend its reach beyond personnel appointments in Washington, according to Bloomberg citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with trade rangebound amid recent Fed independence concerns and as participants braced for NVIDIA's earnings. ASX 200 was kept afloat amid outperformance in the mining and materials industries, although gains are capped by heavy losses in consumer staples and tech, with supermarket operator Woolworths suffering a double-digit percentage drop after it reported a 19% decline in profits. Nikkei 225 traded indecisively, swinging between gains and losses before eventually recovering on currency weakness. Hang Seng and Shanghai Comp lacked firm conviction as the focus turns to earnings releases with the big banks set to report tomorrow, while participants are also awaiting the resumption of US-China talks later in the week.

Top Asian News

Chinese Commerce Ministry official Sheng Qiuping said China is to announce policies to broaden services consumption in September.

Mitsubishi Motor (7211 JT) cuts guidance (JPY): net seen at 10bln (prev. 40bln); operating at 70bln (prev. 100bln), recurring 60bln (prev. 90bln); Co. cites US tariffs, decline in sales volume, increase in selling expenses, competition, inflation.

European bourses (STOXX 600 U/C) opened modestly firmer across the board, but sentiment did dip a little bit off best levels to currently show a mixed picture. European sectors hold a slight positive bias. Consumer Products takes the top spot joined thereafter by Healthcare whilst Banks lag; the latter pressured by Commerzbank (-2.6%) and Deutsche Bank (-2.5%) after the pair received broker downgrades.

Top European News

UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight).

EU is preparing emergency measures to support the ailing aluminium industry amid recycling plants in the bloc shutting down capacity due to US producers paying more for European scrap metal, according to FT.

SNB's Martin said the SNB does not see a risk of deflationary developments and forecasts show a jump in inflation in coming quarters, adds inflation dynamics in Switzerland should not be dramatically disrupted by recent dollar movements. Martin added the current Swiss franc value is more due to dollar weakness than franc strength, but forex market interventions may be necessary to ensure price stability. The SNB currently has no reason to increase or reduce gold holdings. The bar for taking rates into negative territory is higher than for cutting rates when above zero.

UK ONS said June 2025 Producer output Price inflation estimated to be -1.0% Y/Y.

FX

DXY is on a firmer footing and continuing to gain this morning amid a weaker EUR (see below) and following the prior day's marginal losses owing to Fed independence concerns after President Trump moved to fire Fed Governor Cook who will be challenging the attempt in court. On top of that, it was also reported that the Trump administration is reviewing options for exerting more influence over the Federal Reserve’s regional banks that would potentially extend its reach beyond personnel appointments in Washington. DXY trades in a 98.24-98.70 range.

EUR/USD pared recent gains amid a lack of fresh catalysts from the bloc and with France facing political uncertainty. Losses accumulated for the EUR despite a lack of headlines around the European equity open, with market contacts noting of potential stops tripped under 1.1600 after the pair found support near the level in the prior two session. German GfK Consumer Sentiment did little to sway the EUR at the time, which printed below expectations. EUR/USD currently sits in a 1.1578-1.1651 range.

USD/JPY steadily advanced towards the 148.00 handle as the dollar regained poise with newsflow on the lighter end, but the pair influenced by a rebound in the Buck. USD/JPY trades in a 147.29-147.97 range.

GBP is softer amid the firmer Dollar but losses cushioned by a weaker EUR. On the inflation front, UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight). The price cap limits the amount suppliers can charge per unit of energy and is revised every three months. Cable trades in a 1.3431-1.3482 parameter and sandwiched between its 50 DMA (1.3493) and 100 DMA (1.3436).

AUD/USD failed to sustain the initial knee-jerk uplift seen following hot Monthly CPI data and stronger-than-expected Construction Work which feeds into Australia's GDP data.

PBoC set USD/CNY mid-point at 7.1108 vs exp. 7.1559 (Prev. 7.1188)

Fixed Income

USTs traded with a negative bias earlier but caught a slight bid as the risk tone deteriorated a touch; in a very narrow 112-02+ to 112-06+ range. Price action overnight was lacklustre, as US paper took a breather following the bull steepening seen on Tuesday, spurred by US President Trump’s move to oust Fed Governor Cook. Today’s session has seen yields rise across the curve, generally to a similar degree. Recent newsflow has not really had too much of an impact on price action today; US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

Bunds are outperforming vs peers; initial trade was sloppy in-fitting with global peers but has recently picked up a little to trade higher by a handful of ticks. Currently trading at the upper end of a 129.33 to 129.71 range. The docket is void of any pertinent European data/ECB speakers. German GfK earlier saw sentiment drop a little from the prior, and more than expected. Germany's new 2032 line which was very weak, had little impact on price action.

Gilt price action today has been dictated by global peers; initially opened lower amid the subdued trade seen in USTs/Bunds, but then reversed, but without a clear driver. Currently higher by around 17 ticks, and trades in a 90.26-62 range.

UK sells GBP 5bln 4.375% 2028 Gilt: b/c 3.16x (prev. 3.71x), average yield 3.991% (prev. 3.941%) & tail 0.2bps (prev. 0.2bps).

Germany sells EUR 2.675bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.2x, average yield 2.46% and retention 33.13%.

Commodities

Crude futures have tilted lower following a flat overnight session and after retreating throughout the prior day and with demand not helped by the narrower-than-expected headline crude draw in private sector inventory data, while there were also bearish views on oil including from US President Trump who thinks oil will fall beneath the USD 60/bbl level soon and with Goldman Sachs forecasting Brent to decline to the low USD 50s by late 2026. WTI currently resides in a 62.99-63.46/bbl range while Brent sits in a USD 66.40-66.91/bbl range.

Spot gold pulled back from near the USD 3,400/oz level after advancing yesterday amid a softer dollar. The yellow metal has been unfazed by the recent bout of Dollar strength, suggesting deteriorating risk across the market. Spot gold trades in a USD 3,373.78-3,393.55/oz parameter within Tuesday's 3,351.33-3,393.75/oz range.

Softer trade across base metals amid the deteriorating risk and broader Dollar strength. 3M LME copper resides in a USD 9,785.00-9,865.00/t range.

US President Trump thinks oil prices will break below USD 60/bbl soon.

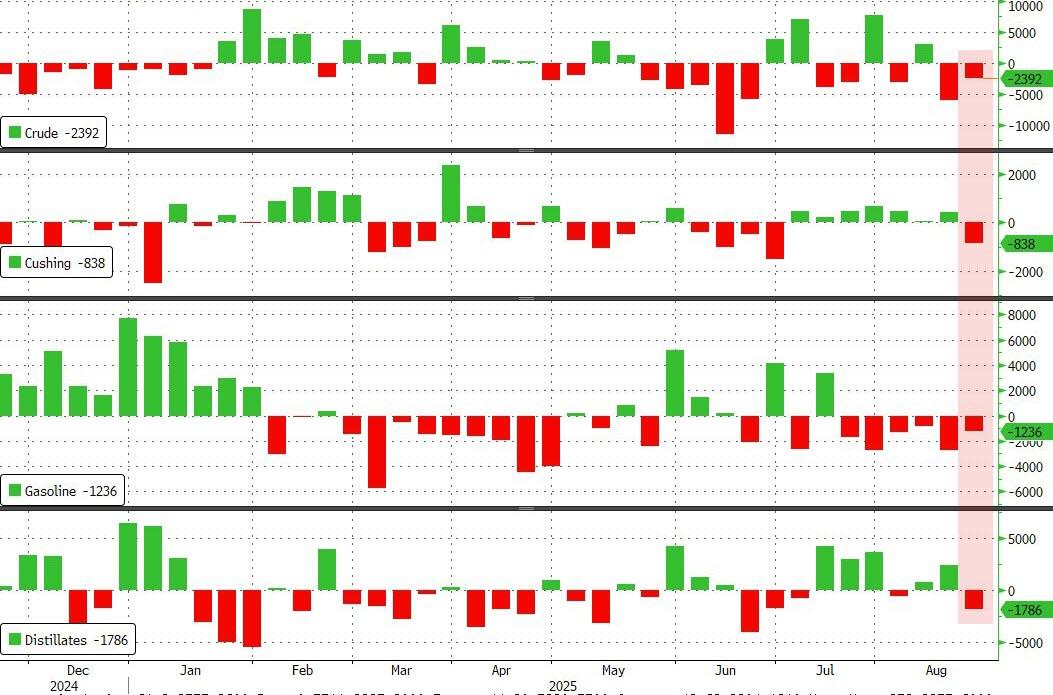

US Private Energy Inventories (bbls): Crude -1.0mln (exp. -1.9mln), Distillate -1.5mln (exp. +0.9mln), Gasoline -2.1mln (exp. -2.2mln), Cushing -0.5mln.

Kazakhstan holds talks to resume oil transit via BTC, according to Tass citing the energy ministry; oil supplies to Europe are proceeding without delays.

Two Chinese investors are interested in taking a stake in Vietnam’s largest tungsten business, via Reuters citing sources.

Ukraine's Energy Ministry said Russia attacked energy and gas transit infrastructure in six Ukrainian regions overnight.

Geopolitics - Middle East

US special envoy Witkoff said they are negotiating multiple entries into peace accords with Israel, while Witkoff said President Trump will chair a meeting on Gaza at the White House on Wednesday.

US Secretary of State Rubio is to meet with Israeli Foreign Minister Sa'ar at the State Department on Wednesday.

Hamas said all Palestinians killed by Israel in Gaza’s Nasser Hospital attack on Monday were civilians and that two of the six Palestinians identified by Israel as alleged militants were killed in separate attacks away from the hospital.

WSJ's Norman posts "If SnapBack happens this week, very strong odds it happens tomorrow"; in relation to the Iranian snapback mechanism. "If no SnapBack, either things change dramatically or extension. Odds of dropping SnapBack without extension are tiny at this point. There is still a very real possibility that SnapBack triggered but extension agreed during 30-day process. Depends on Iran".

Geopolitics - Ukraine

US special envoy Witkoff said he is meeting with Ukrainians in New York this week and that Russian President Putin made a good-faith effort to engage.

"Moscow: No agreement yet to upgrade the level of Russian and Ukrainian negotiating delegations", according to Al Arabiya.

Ukrainian President Zelensky said Russians are currently sending negative signals regarding meetings and further developments.

US Event Calendar

7:00 am: Aug 22 MBA Mortgage Applications -0.5%, prior -1.4%

DB's Jim Reid concludes the overnight wrap

Markets had a very eventful session yesterday, as concerns mounted about the Federal Reserve’s independence, whilst French assets came under fresh pressure ahead of the upcoming confidence vote. So that led to some pretty big milestones, and with investors pricing in faster rate cuts, the US 2yr inflation swap rose to 3.05%, marking its highest level since late-2022 when inflation was still above 6% and the Fed were hiking aggressively. Meanwhile in Europe, the reappraisal of sovereign risk meant that the 10yr French yield closed just 6bps above its Italian counterpart, which is the smallest gap between the two since 2003. So that’s a huge turnaround relative to most of the period since the Euro Crisis, as the spread between the two never fell beneath 50bps until late last year. Bear in mind we’ve also got Nvidia’s earnings after the US close tonight, so there’s plenty on the agenda right now.

We’ll start with the Fed, as investors are watching closely after President Trump’s letter on Monday night that he was removing Lisa Cook from the Board of Governors “effective immediately”. In terms of the latest, Cook’s lawyer, Abbe David Lowell, said yesterday that they would be filing a lawsuit challenging the firing. And later in the day, the Fed issued a statement reiterating that Fed governors “may be removed by the president only “for cause””, but that the Fed would “abide by any court decision” resulting from Cook’s challenge.

The move comes as President Trump is seeking to reshape the Federal Reserve in his direction, and yesterday he commented how “We’ll have a majority, very shortly so that’ll be great once we have a majority, and housing is going to swing and it’s going to be great”. Indeed, of the seven currently on the Board of Governors, two of the appointees from President Trump’s first term (Bowman and Waller) have already dissented in favour of rate cuts, and CEA Chair Stephen Miran has been nominated to fill Adriana Kugler’s old seat. So if Cook were replaced as well, then a majority of the Board could be in favour of rate cuts after Miran’s appointment, even before Chair Powell’s term comes to an end.

Later on, multiple press reports added to this theme. For instance, the WSJ reported that President Trump was considering quickly announcing a replacement for Cook, with former World Bank President David Malpass being one candidate whom President Trump had discussed. Interestingly, Bloomberg separately reported that the administration was looking at ways to have more influence over the Fed’s 12 regional banks, which is important given that 5 of the 12 regional bank Presidents sit on the FOMC at a given time. This is particularly noteworthy at the moment, because every five years, the 12 regional bank presidents come up for approval by the Board of Governors. The next five-year approval is slated for Q1 next year, and theoretically a majority could refuse to approve some of the regional voters.

Our US economists looked in more depth at some of these issues in a note yesterday (link here ). They don’t anticipate a titanic shift in near-term policy, as Cook had been one of the most dovish officials on the Committee already. However, there could be broader implications for the Fed, as it only takes a majority of the Board of Governors (rather than the wider FOMC that also includes 5 of the regional Fed Presidents) to adjust the interest rate on reserve balances (IORB). Historically, the IORB has been set at an appropriate level to maintain the fed funds rate within the target set by the FOMC. But at least theoretically, a Board that didn’t agree with the FOMC could set IORB at a lower level.

For now at least, markets have reacted broadly in line with other episodes where the Fed’s independence has been questioned this year. So we saw a significant yield curve steepening yesterday, with the 2yr yield (-4.5bps) down to 3.68% (helped by a strong auction), the 10yr yield (-1.4bps) down to 4.26%, and the 30yr yield (+3.0bps) moving up to 4.92%. Indeed, for the 2s30s curve, that’s now the steepest it’s been since January 2022. Those moves came as investors priced in a more dovish path for near-term policy, with futures dialling up the expected rate cuts over the months ahead. For example, 109bps of cuts were priced in by the June 2026 meeting at the close, up +5.3bps on the day. So that helped put downward pressure on the dollar index, which weakened by -0.21%, whilst the prospect of more inflation helped push gold prices up +0.82%.

Interestingly, equities advanced despite the news, with the S&P 500 (+0.41%) closing just -0.04% beneath its record high. In part, that was because investors were still unsure if there’d actually be a radical policy shift at the Fed. But several data points also helped to support risk appetite, as they leant against the idea that the US economy was slowing down, particularly after the recent jobs report. For example, the Conference Board’s consumer confidence reading was better than expected in August, at 97.4 (vs. 96.5 expected). Similarly, core capital goods orders were up +1.1% in July (vs. +0.2% expected), and the Richmond Fed’s manufacturing index moved up to -7 (vs. -11 expected).

Over in Europe, however, it was a very different story as fears continued to mount about the fiscal situation in France. As a reminder, Prime Minister Bayrou has called a confidence vote for September 8, but the National Rally, France Unbowed and the Socialists have all said they’ll oppose the government. So as it stands, the government would fall, and that would open the way for a new PM, or even fresh legislative elections. So that’s reinforced existing concerns about France’s deficit, and the country’s assets saw a clear underperformance yesterday.

Those moves were evident across the board. For instance, France’s CAC 40 (-1.70%) built on its -1.59% decline on the Monday, with banks including Société Générale (-6.84%), Crédit Agricole (-5.44%) and BNP Paribas (-4.23%) seeing even bigger losses. That outpaced the Europe-wide STOXX 600 (-0.83%), and means the CAC 40 is now up just +4.46% this year, making it one of the worst performers among the major equity indices in local currency terms. Likewise for sovereign bonds, French 10yr yields were only down -1.1bps, compared with larger falls for bunds (-3.4bps) and OATs (-3.8bps). So by the close, the Franco-German 10yr spread was up to 78bps, which is its widest since April. And significantly, the French 10yr yield closed just 6bps beneath its Italian counterpart, which is the tightest it’s been since 2003.

Elsewhere in Europe, UK markets returned from their public holiday on Monday, with 10yr gilt yields up +4.9bps as they caught up with Monday’s moves elsewhere. We also heard from the BoE’s Mann, who was one of four members on the MPC (out of nine) who voted against a cut at the recent meeting. She said that a “more persistent hold on Bank Rate is appropriate right now”, and investors remain sceptical that there’ll be another rate cut this year. Indeed, the likelihood of another rate cut by the December meeting fell to 42% by the close, down from 48% the day before.

Overnight in Asia, the mood has generally remained positive, with investors turning their focus to Nvidia’s earnings later today. So that’s meant that most of the major equity indices are trading higher, and the CSI 300 (+0.72%) is currently on track for its highest closing level since 2022. Elsewhere, there’ve been more modest gains, including for the Shanghai Comp (+0.33%), the Hang Seng (+0.06%), the Nikkei (+0.36%), and the KOSPI (+0.11%). And US equity futures are also pointing slightly higher, with those on the S&P 500 (+0.07%) up enough to push the index to a new record if realised.

Elsewhere this morning, data has also shown an unexpectedly large jump in Australia’s inflation, with CPI up to +2.8% in July (vs. +2.3% expected). Moreover, the trimmed mean measure also moved up to +2.7%, having been at +2.1% in June. That’s the highest headline inflation in 12 months, and investors have dialled back the likelihood of a rate cut at the RBA’s next meeting in response, with the probability of a cut now down to 22%.

To the day ahead now, and it’s a quiet one on the calendar. Nvidia’s earnings after the US close will be the main highlight. Otherwise, data releases include the GfK consumer confidence reading from Germany.

Tyler Durden | Zero Hedge

Zero Hedge

Wed, 08/27/2025 - 08:51

Futures Flat, Dollar Jumps Ahead Of Nvidia's Critical Earnings | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Cook, an 'autopen-appointed' (we assume) DEI hire who was

the Fed's decision to help former President Biden by dropping interest rates in the home stretch of the 2024 election (with inflation soaring), has yet to actually deny the allegations - which Treasury Secretary Scott Bessent pointed out today during an appearance on Fox Business.

"She keeps saying Trump doesn't have the authority to fire her, but we haven't heard her say that she didn't do it," he told host Maria Bartiromo - calling for Cook to be investigated and prosecuted if true.

🚨 JUST NOW: Treasury Secretary Scott Besset calls for the prosecution of Fed Governor Lisa Cook

"She keeps saying Trump doesn't have the authority to fire her, but we haven't heard her say that she didn't do it."

Cook, an 'autopen-appointed' (we assume) DEI hire who was

the Fed's decision to help former President Biden by dropping interest rates in the home stretch of the 2024 election (with inflation soaring), has yet to actually deny the allegations - which Treasury Secretary Scott Bessent pointed out today during an appearance on Fox Business.

"She keeps saying Trump doesn't have the authority to fire her, but we haven't heard her say that she didn't do it," he told host Maria Bartiromo - calling for Cook to be investigated and prosecuted if true.

🚨 JUST NOW: Treasury Secretary Scott Besset calls for the prosecution of Fed Governor Lisa Cook

"She keeps saying Trump doesn't have the authority to fire her, but we haven't heard her say that she didn't do it."  — The Patriot Oasis™ (@ThePatriotOasis)

— The Patriot Oasis™ (@ThePatriotOasis)  via

via  Meanwhile, White House top economic adviser Kevin Hassett said on Wednesday that Cook should go on leave while her status is litigated.

"If I were her, in her circumstance, I would take leave right now," said Hassett, director of the National Economic Council, adding that it would be the "honorable thing to do."

Meanwhile, the talking points have gone out...

The NPCs are doing the script thing again.

Meanwhile, White House top economic adviser Kevin Hassett said on Wednesday that Cook should go on leave while her status is litigated.

"If I were her, in her circumstance, I would take leave right now," said Hassett, director of the National Economic Council, adding that it would be the "honorable thing to do."

Meanwhile, the talking points have gone out...

The NPCs are doing the script thing again.  — Bad Hombre (@joma_gc)

— Bad Hombre (@joma_gc)  Sen. Elizabeth Warren (D-MA) - who committed fraud masquerading as a Native American to reap manifold benefits, took to CNBC to insist that Cook's alleged mortgage fraud doesn't matter because it wasn't 'related to her job' - and therefore not 'for cause.'

"What I care most about is that we follow the law here and the law is pretty clear that firing for cause means job related... like someone who has been inefficient or someone who's been corrupt in doing the job," Warren said.

We'd show you the clip, but nobody thought Warren's comments warren-ted clipping and sharing. That said, we should point out that Warren demanded an investigation into Dallas Fed President Kaplan's "ethically questionable" stock trades.

Last night Warren appeared on CNN to criticize Bill Pulte for exposing the fraud!

Pocahontas is crusading against

Sen. Elizabeth Warren (D-MA) - who committed fraud masquerading as a Native American to reap manifold benefits, took to CNBC to insist that Cook's alleged mortgage fraud doesn't matter because it wasn't 'related to her job' - and therefore not 'for cause.'

"What I care most about is that we follow the law here and the law is pretty clear that firing for cause means job related... like someone who has been inefficient or someone who's been corrupt in doing the job," Warren said.

We'd show you the clip, but nobody thought Warren's comments warren-ted clipping and sharing. That said, we should point out that Warren demanded an investigation into Dallas Fed President Kaplan's "ethically questionable" stock trades.

Last night Warren appeared on CNN to criticize Bill Pulte for exposing the fraud!

Pocahontas is crusading against  . After melting down on MSNBC, she ran to CNN and used the same script.

Why doesn't Warren want blatant fraud exposed? Especially by someone working at the Federal Reserve?

Weird, I think this reaction warrants a closer look into her past.

. After melting down on MSNBC, she ran to CNN and used the same script.

Why doesn't Warren want blatant fraud exposed? Especially by someone working at the Federal Reserve?

Weird, I think this reaction warrants a closer look into her past.  — Gunther Eagleman™ (@GuntherEagleman)

— Gunther Eagleman™ (@GuntherEagleman)  And of course, Cook is a 'special case' when it comes to Fed officials exiting stage right amid financial fuckery...

2021: Dallas Fed president Kaplan busted for suspicious stock trades, resigns

2021: Boston Fed president Rosengren busted for suspicious stock trades, resigns

2022: Fed vice chair Richard Clarida busted for suspicious trades, resigns

2025: Lisa Cook vows to stay on

— zerohedge (@zerohedge)

And of course, Cook is a 'special case' when it comes to Fed officials exiting stage right amid financial fuckery...

2021: Dallas Fed president Kaplan busted for suspicious stock trades, resigns

2021: Boston Fed president Rosengren busted for suspicious stock trades, resigns

2022: Fed vice chair Richard Clarida busted for suspicious trades, resigns

2025: Lisa Cook vows to stay on

— zerohedge (@zerohedge)  And while the Fed claims to be 'apolitical,' in 2020 Cook said that Donald Trump was "definitely a fascist."

Flashback: Fired Federal Reserve Governor Lisa Cook said in 2020 that Donald Trump was "definitely a fascist."

This is who was in charge of our nation's monetary policy

And while the Fed claims to be 'apolitical,' in 2020 Cook said that Donald Trump was "definitely a fascist."

Flashback: Fired Federal Reserve Governor Lisa Cook said in 2020 that Donald Trump was "definitely a fascist."

This is who was in charge of our nation's monetary policy — Greg Price (@greg_price11)

— Greg Price (@greg_price11)  So it appears Cook will continue to dig in. It'll be interesting when 'indicted pre-trial Cook' insists on remaining in her role until the very last possible second.

Wed, 08/27/2025 - 11:25

So it appears Cook will continue to dig in. It'll be interesting when 'indicted pre-trial Cook' insists on remaining in her role until the very last possible second.

Wed, 08/27/2025 - 11:25

Cook, an 'autopen-appointed' (we assume) DEI hire who was

Cook, an 'autopen-appointed' (we assume) DEI hire who was

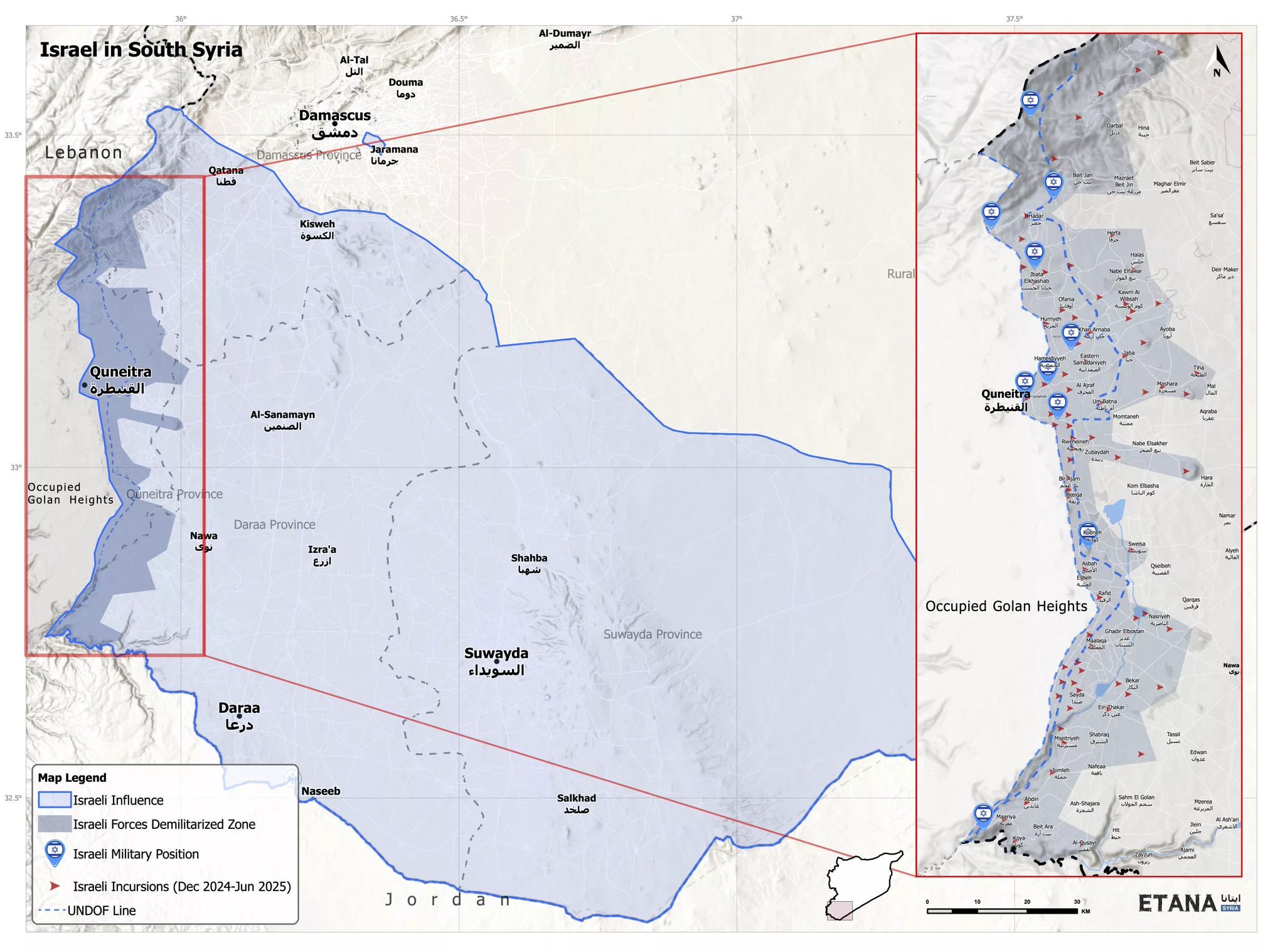

Within the last months, IDF tanks and ground units have been observed a mere dozen miles from the outskirts of Damascus, also after literally hundreds of air raids destroying former Syrian Arab Army bases, equipment, and anti-air defense units since the government overthrow.

Katz referenced alleged "threats" from the Syrian sides which has included the occasional rocket fired from unknown groups or locations.

Syrian Foreign Minister Asaad al-Shaibani of the Jolani/Sharaa regime has meanwhile blasted Israel for pursuing "expansionist and partitionist" goals. Indeed some hardline Israeli ministers have even openly called for the Israeli capture and occupation of Damascus.

Israel's long term strategy has been known since the 1980's and the

Within the last months, IDF tanks and ground units have been observed a mere dozen miles from the outskirts of Damascus, also after literally hundreds of air raids destroying former Syrian Arab Army bases, equipment, and anti-air defense units since the government overthrow.

Katz referenced alleged "threats" from the Syrian sides which has included the occasional rocket fired from unknown groups or locations.

Syrian Foreign Minister Asaad al-Shaibani of the Jolani/Sharaa regime has meanwhile blasted Israel for pursuing "expansionist and partitionist" goals. Indeed some hardline Israeli ministers have even openly called for the Israeli capture and occupation of Damascus.

Israel's long term strategy has been known since the 1980's and the

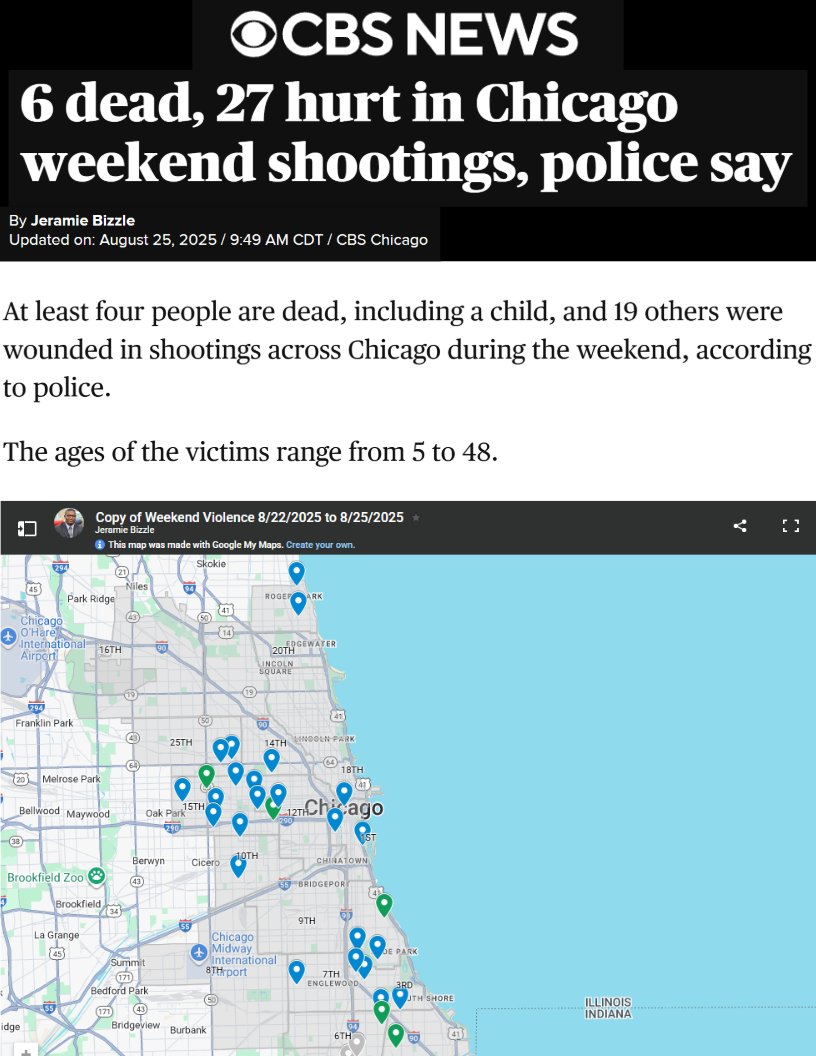

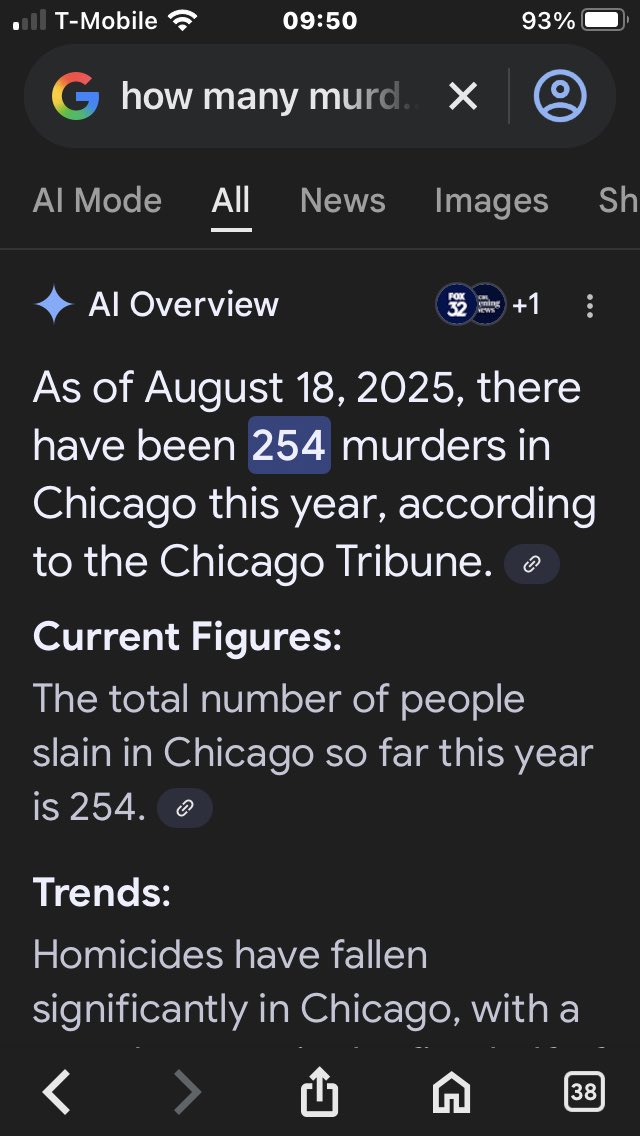

The failing network brought on former Republican Ohio Gov. John Kasich, who refused to back Trump and infamously endorsed Joe Biden, presumably thinking he would slam Trump again, but no.

“I heard the term ‘manufacturing crisis. This is a manufactured crisis,'” Kasich remarked, urging “No! It’s not! It is a crisis!”

This MSNBC host just got a brutal fact check by former Ohio Gov. John Kasich on the alleged "manufactured crisis" surrounding crime in blue cities.

This may be the last appearance for Kasich, as he just broke their entire narrative apart.

"I heard the term 'manufacturing…

The failing network brought on former Republican Ohio Gov. John Kasich, who refused to back Trump and infamously endorsed Joe Biden, presumably thinking he would slam Trump again, but no.

“I heard the term ‘manufacturing crisis. This is a manufactured crisis,'” Kasich remarked, urging “No! It’s not! It is a crisis!”

This MSNBC host just got a brutal fact check by former Ohio Gov. John Kasich on the alleged "manufactured crisis" surrounding crime in blue cities.

This may be the last appearance for Kasich, as he just broke their entire narrative apart.

"I heard the term 'manufacturing…

Source: Bloomberg

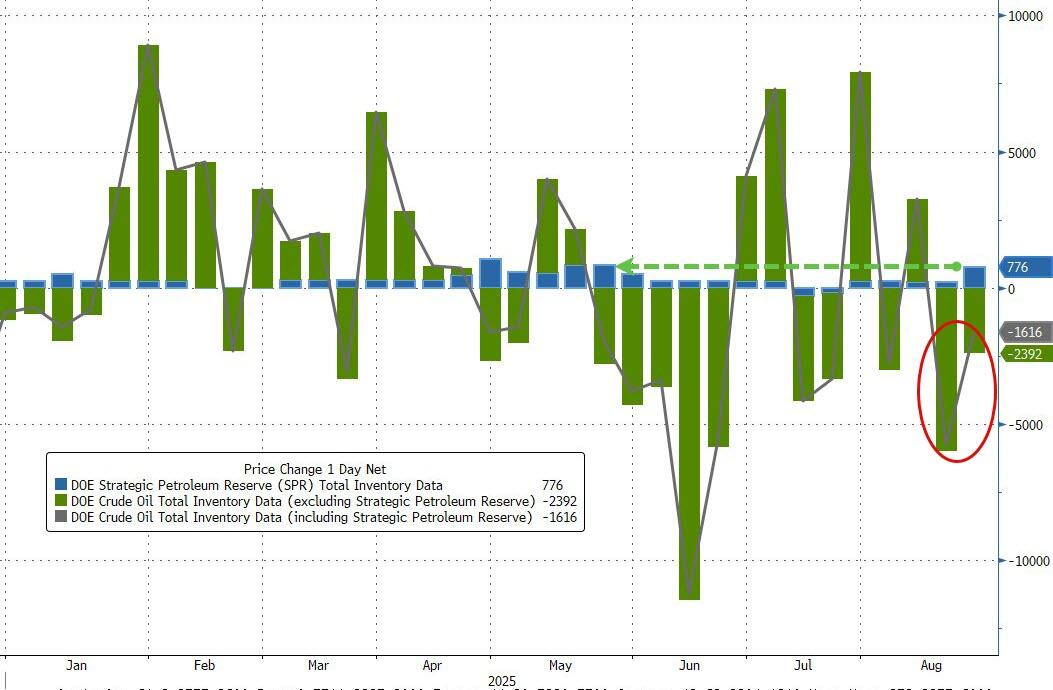

Despite a sizable 776k addition to the SPR (largest since May), US commercial crude stocks still fell for the second week in a row...

Source: Bloomberg

Despite a sizable 776k addition to the SPR (largest since May), US commercial crude stocks still fell for the second week in a row...

Source: Bloomberg

US Crude production hovered near record highs as the decline in rig counts has stalled...

Source: Bloomberg

US Crude production hovered near record highs as the decline in rig counts has stalled...

Source: Bloomberg

WTI prices sustained their earlier gains after the bigger than expected crude draw...

Source: Bloomberg

WTI prices sustained their earlier gains after the bigger than expected crude draw...

Source: Bloomberg

Finally, Bloomberg reports that a key physical market flashed a sign of weakness on Tuesday.

In a North Sea pricing window that helps underpin benchmark futures prices, top traders lined up with eight offers of benchmark grades and no willing bidders.

One grade fell to near a two-month low and related swaps contracts also softened.

Source: Bloomberg

Finally, Bloomberg reports that a key physical market flashed a sign of weakness on Tuesday.

In a North Sea pricing window that helps underpin benchmark futures prices, top traders lined up with eight offers of benchmark grades and no willing bidders.

One grade fell to near a two-month low and related swaps contracts also softened.

When Trump asked her to speak, she told him that the intel community’s corruption was worse than anyone thought.

She doubled down on her mission statement of transparency.

Gabbard:

“Mr. President, you have charged me with the mission of finding the truth and telling the truth to the American people, and we’ve exposed some of the worst examples of the weaponization of intelligence in the last several weeks.”

“I will continue down that mission and that path, wherever it leads. Transparency, telling the truth is what will drive true accountability for the American people who deserve nothing less.”

Then Trump dropped a jaw-dropper of his own.

He revealed that Gabbard’s team had recovered unburned “burn bags” stuffed with classified material tied to the 2020 election…and asked when the public would see them.

Trump: “And you’ve also found many bags of information, I think they call them burn bags. They’re supposed to be burned and they didn’t get burned having to do with how corrupt the 2020 election was, and when will that all come out?”

Gabbard:

“Mr. President, I will be the first to brief you once we have that information collected.”

“But you’re right - we are finding documents literally tucked away in the back of safes, in random offices, in these bags and in other areas, which, again, speaks to the intent of those who are trying to hide the truth from the American people and trying to cover up the politicization that was led by people like John Brennan and James Clapper and others that have caused immeasurable harm to the American people and to our country.”

Wow.

Transparency is FINALLY coming and what’s buried inside those bags could shake the nation.

This is when things got interesting.

As Director of National Intelligence, Tulsi Gabbard has spent months shaking Washington with bombshell after bombshell on the Russia Coup of 2017.

When Trump asked her to speak, she told him that the intel community’s corruption was worse…

When Trump asked her to speak, she told him that the intel community’s corruption was worse than anyone thought.

She doubled down on her mission statement of transparency.

Gabbard:

“Mr. President, you have charged me with the mission of finding the truth and telling the truth to the American people, and we’ve exposed some of the worst examples of the weaponization of intelligence in the last several weeks.”

“I will continue down that mission and that path, wherever it leads. Transparency, telling the truth is what will drive true accountability for the American people who deserve nothing less.”

Then Trump dropped a jaw-dropper of his own.

He revealed that Gabbard’s team had recovered unburned “burn bags” stuffed with classified material tied to the 2020 election…and asked when the public would see them.

Trump: “And you’ve also found many bags of information, I think they call them burn bags. They’re supposed to be burned and they didn’t get burned having to do with how corrupt the 2020 election was, and when will that all come out?”

Gabbard:

“Mr. President, I will be the first to brief you once we have that information collected.”

“But you’re right - we are finding documents literally tucked away in the back of safes, in random offices, in these bags and in other areas, which, again, speaks to the intent of those who are trying to hide the truth from the American people and trying to cover up the politicization that was led by people like John Brennan and James Clapper and others that have caused immeasurable harm to the American people and to our country.”

Wow.

Transparency is FINALLY coming and what’s buried inside those bags could shake the nation.

This is when things got interesting.

As Director of National Intelligence, Tulsi Gabbard has spent months shaking Washington with bombshell after bombshell on the Russia Coup of 2017.

When Trump asked her to speak, she told him that the intel community’s corruption was worse…

At 10:00 p.m. last night., approximately 150 to 200 people set up roadblocks and began burning containers and garbage cans. They also severely damaged a bus.

Officers were hit with Molotov cocktails, paving stones, and construction fences, along with other objects,

At 10:00 p.m. last night., approximately 150 to 200 people set up roadblocks and began burning containers and garbage cans. They also severely damaged a bus.

Officers were hit with Molotov cocktails, paving stones, and construction fences, along with other objects,

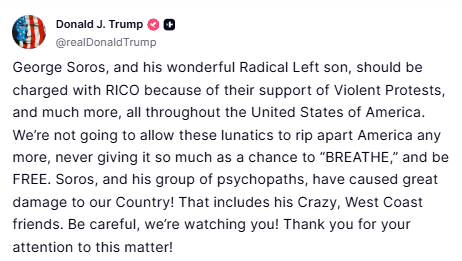

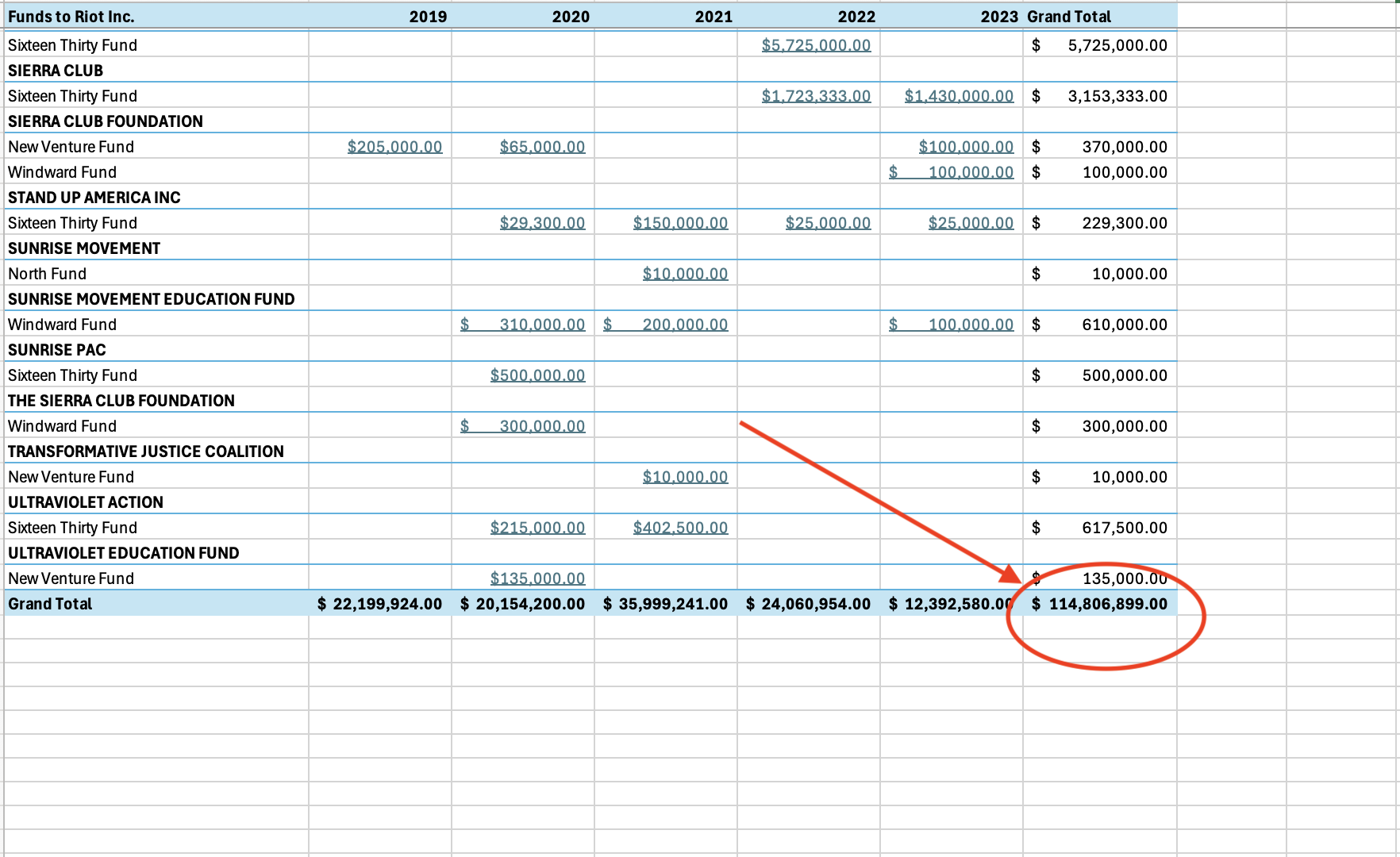

Equally significant in the news cycle this morning, President Trump stated on Truth Social that George Soros and his radical leftist son, Alex Soros, "should be charged with RICO because of their support of violent protests."

Trump: "George Soros, and his wonderful Radical Left son, should be charged with RICO because of their support of Violent Protests, and much more, all throughout the United States of America."

Equally significant in the news cycle this morning, President Trump stated on Truth Social that George Soros and his radical leftist son, Alex Soros, "should be charged with RICO because of their support of violent protests."

Trump: "George Soros, and his wonderful Radical Left son, should be charged with RICO because of their support of Violent Protests, and much more, all throughout the United States of America."

In premarket trading, Mag 7 stocks are mixed (Nvidia +0.6%, Microsoft +0.2%, Tesla +0.1%, Apple little changed, Amazon little changed, Meta -0.2%, Alphabet -0.3%).

Elanco Animal Health (ELAN) gains 4.9% with the company to replace Sarepta Therapeutics in the S&P MidCap 400 effective Sept. 2.

MongoDB (MDB) shares soar 31% after the software company reported second-quarter results that were much stronger than expected. It also raised its full-year forecast.

nCino (NCNO) gains 11% after reporting adjusted earnings per share for the second quarter that beat the average analyst estimate.

Okta (OKTA) is up 5.4% after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

There’s been plenty to rattle markets in recent days, including French political turmoil and the Trump administration’s attacks on the Fed, as well as fresh tariff threats. But investors are now focusing on Nvidia’s earnings, due after the bell (our

In premarket trading, Mag 7 stocks are mixed (Nvidia +0.6%, Microsoft +0.2%, Tesla +0.1%, Apple little changed, Amazon little changed, Meta -0.2%, Alphabet -0.3%).

Elanco Animal Health (ELAN) gains 4.9% with the company to replace Sarepta Therapeutics in the S&P MidCap 400 effective Sept. 2.

MongoDB (MDB) shares soar 31% after the software company reported second-quarter results that were much stronger than expected. It also raised its full-year forecast.

nCino (NCNO) gains 11% after reporting adjusted earnings per share for the second quarter that beat the average analyst estimate.

Okta (OKTA) is up 5.4% after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

There’s been plenty to rattle markets in recent days, including French political turmoil and the Trump administration’s attacks on the Fed, as well as fresh tariff threats. But investors are now focusing on Nvidia’s earnings, due after the bell (our  “Nvidia is the story of the week. We’ve seen some erosion of the AI premium, so this is an important number to determine whether the AI story has got further to go,” said Guy Miller, chief strategist at Zurich Insurance Group. “This could either allow the technology cycle, the AI dream, to continue, or it could get significantly dented.”

Dimming the excitement is uncertainty over how much business Nvidia will be able to do in China. The US government has curbed China’s access to Nvidia products on national security grounds. While the Trump administration recently eased some of those export restrictions, Beijing has pressed domestic customers to seek alternative suppliers.

“A miss could spark meaningful volatility, while a positive surprise would likely see the major indexes make a run at all-time highs,” said Tom Essaye at The Sevens Report.

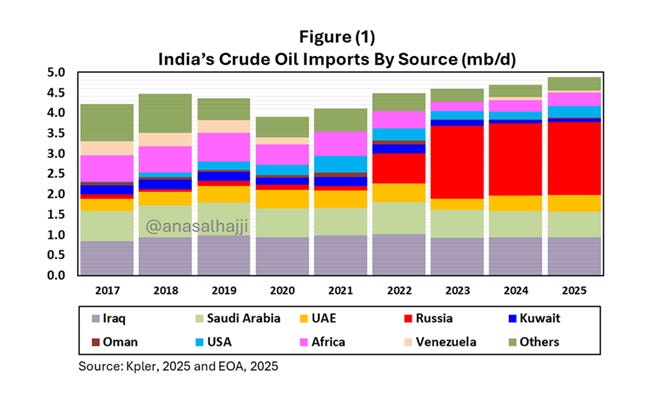

Elsewhere, in a reminder of the lingering tariff threat to global trade and inflation, Trump’s 50% levy on most Indian imports took effect Wednesday, penalizing the country for buying Russian oil. In Europe, the EU aims to fast-track legislation by the end of the week to scrap all tariffs on US industrial goods — a Trump demand before Washington lowers duties on the bloc’s car exports.

In Europe, The Stoxx 600 is steady after giving up earlier gains. The CAC 40 outperforms with a 0.4% rise even as the OAT-bund spreads widens slightly.

Earlier in the session, Asian stocks declined, weighed down by a sudden drop in Chinese equities, as an absence of new reasons to buy paved the way for profit-taking. The MSCI Asia Pacific Index slipped as much as 1.1%, with Tencent, Woolworths Group and Meituan the biggest drags on the gauge. Major equity indexes in the region were mixed, with those in China and Hong Kong dropping, while the Philippines and Taiwan were among the top gainers. Chinese equities slid in the afternoon session, reversing an earlier advance. One reason for the reversal may have been the fact that chipmaker Cambricon Technologies Corp. briefly became the country’s most expensive onshore stock, which then triggered some profit taking. Chinese officials are seeking to manage bubble risks as the rally extends. Sinolink Securities Co. raised its margin deposit ratio for new client financing to 100%, becoming the first broker to introduce tightening measures amid surging interest in stocks.

In FX, the Bloomberg Dollar Spot Index is up 0.3% as the greenback strengthens versus its G-10 peers. The kiwi is the weakest, falling 0.5% while the Canadian dollar is the most resilient, slipping just 0.1%.

In rates, the Treasury curve steepens further following Tuesday’s front-end rally, stoked in part by strong demand for 2-year note auction. However, new 2-year note’s yield dipped below 3.65%, the lowest for the tenor since early May. Supply cycle continues with $70 billion auction of 5-year notes, the largest of the seven nominal coupon sales, at 1 p.m. New York time. Yields are within 1bp of Tuesday’s closing levels; the 10-year near 4.27%; swap contracts linked to future Fed rate decisions continue to fully price in one quarter-point rate cut this year in October and a second one by year-end.

In commodities, WTI crude futures fall 0.4% to $63 a barrel. Spot gold drops $12. Bitcoin is down 0.5%.

US economic data calendar is blank; second estimate of 2Q GDP is ahead Thursday, July personal income and spending (includes PCE price indexes) Friday. Fed speaker slate includes Richmond Fed President Barkin repeating his Aug. 12 remarks on the economy (time TBD). Nvidia’s earnings after the US close will be the main highlight.

Market Snapshot

S&P 500 mini little changed

Nasdaq 100 mini little changed

Russell 2000 mini -0.1%

Stoxx Europe 600 little changed

DAX -0.3%

CAC 40 +0.2%

10-year Treasury yield little changed at 4.26%

VIX +0.2 points at 14.77

Bloomberg Dollar Index +0.3% at 1208.98

euro -0.4% at $1.159

WTI crude -0.4% at $63.01/barrel

Top Overnight News

New tariffs on Indian goods, the highest in Asia, took effect at 12:01 a.m. in Washington on Wednesday, doubling the existing 25% duty on Indian exports: BBG

Cracker Barrel said it is reverting to its “Old Timer” logo after a rebrand ignited a culture war. “We said we would listen, and we have. Our new logo is going away and our ‘Old Timer’ will remain,” the company said Tuesday. Cracker Barrel’s shares jumped more than 9% in after-hours trading.

Musk’s Starship carries out successful space mission after multiple failures. Giant SpaceX rocket’s 10th test flight deploys dummy satellites and reinforces billionaire’s dominance of commercial space flight: FT

Exxon Mobil Corp. held talks with Russia’s state-controlled oil company about returning to its Sakhalin-1 oil development: WSJ

Commerce Secretary Howard Lutnick sparked a minor rally in shares of defense contractors with his suggestion that the US might take ownership stakes in some of them, even as industry analysts warned the idea poses serious conflict-of-interest concerns: CNBC

Why the Democrats are losing post-industrial America. Former steel town of Bethlehem, Pennsylvania will be crucial battleground in next year’s midterms and the 2028 White House race: FT

US offers air and intelligence support to postwar force in Ukraine. Washington prepared to contribute surveillance, command and control and air defence assets, say European officials: FT

China’s industrial companies saw their profits fall at a slower pace in July, with industrial profits declining 1.5% last month from a year earlier, Bloomberg Economics had forecast a decline of 5.8%: BBG

Cambricon Technologies Corp. swung to a record profit in the first half, reflecting a wave of demand for Chinese chips after Beijing encouraged the use of homegrown technology in a post-DeepSeek AI boom: BBG

Ukraine to allow young men to leave the country. Change to border rules aims to address high number of males being sent abroad by their parents before they reach 18: FT

Microsoft Investigating Employees After Gaza Protest Locks Down Building. The tech company is weighing disciplinary measures for employees who occupied President Brad Smith’s office in protest of Microsoft’s relationship with the Israeli government during its war in Gaza: WSJ

America’s most senior envoy in Pakistan has told the South Asian nation that US companies are showing “strong interest” in its oil and gas sector: BBG

French assets hit by prospect of government collapse. Investors warn government is likely to lose a snap confidence vote on September 8: FT

Trump media group in $6bn deal to buy Crypto.com tokens. Venture will be the ‘first and largest publicly traded CRO treasury company’: FT

US tariff threat over Indian imports of Russian oil could backfire. If New Delhi reduced its purchases to zero, oil prices and inflation would jump: FT

Top Corporate News

Royal Bank of Canada beat estimates on strong performance across its biggest businesses and as the firm set aside less money than expected to cover possible loan losses, a rebound from notable misses on credit earlier this year.

Newmont Corp., the world’s largest gold miner, is studying plans to drive down costs that could lead to deep job cuts.

MongoDB Inc. soared 29% in premarket trading after the software company reported second-quarter results well above expectations and significantly raised its forecast, with analysts at Citi calling the report a “blowout” that showed a strong AI contribution.

Cracker Barrel Old Country Store Inc. said it’s getting rid of a new logo that had sparked controversy and prompted a slump in its share price.

Meituan’s profit got wiped out in a price-based battle with rivals Alibaba Group Holding Ltd. and JD.com Inc., the most striking sign yet that its longstanding dominance in a lucrative home market is under threat.

Nikon Corp.’s shares surged 21% after Bloomberg reported that EssilorLuxottica SA, the maker of Ray-Ban sunglasses, is exploring a potential deal to increase its stake in the Japanese optical equipment manufacturer.

Rio Tinto Group’s new chief executive officer has combined some of its biggest businesses as he looks to simplify the world’s No. 2 miner.

Vitol Group is set to load the first cargo of Syrian crude oil since the lifting of western sanctions on Damascus as the country’s energy industry attempts to recover of more than a decade of destruction from armed conflict.

Trade/Tariffs

US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

US Senate panel is preparing to hold a hearing next week on Trump's Fed pick Stephen Miran for the seat vacated by former Fed governor Kugler.

The Trump administration is reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks that would potentially extend its reach beyond personnel appointments in Washington, according to Bloomberg citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with trade rangebound amid recent Fed independence concerns and as participants braced for NVIDIA's earnings. ASX 200 was kept afloat amid outperformance in the mining and materials industries, although gains are capped by heavy losses in consumer staples and tech, with supermarket operator Woolworths suffering a double-digit percentage drop after it reported a 19% decline in profits. Nikkei 225 traded indecisively, swinging between gains and losses before eventually recovering on currency weakness. Hang Seng and Shanghai Comp lacked firm conviction as the focus turns to earnings releases with the big banks set to report tomorrow, while participants are also awaiting the resumption of US-China talks later in the week.

Top Asian News

Chinese Commerce Ministry official Sheng Qiuping said China is to announce policies to broaden services consumption in September.

Mitsubishi Motor (7211 JT) cuts guidance (JPY): net seen at 10bln (prev. 40bln); operating at 70bln (prev. 100bln), recurring 60bln (prev. 90bln); Co. cites US tariffs, decline in sales volume, increase in selling expenses, competition, inflation.

European bourses (STOXX 600 U/C) opened modestly firmer across the board, but sentiment did dip a little bit off best levels to currently show a mixed picture. European sectors hold a slight positive bias. Consumer Products takes the top spot joined thereafter by Healthcare whilst Banks lag; the latter pressured by Commerzbank (-2.6%) and Deutsche Bank (-2.5%) after the pair received broker downgrades.

Top European News

UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight).

EU is preparing emergency measures to support the ailing aluminium industry amid recycling plants in the bloc shutting down capacity due to US producers paying more for European scrap metal, according to FT.

SNB's Martin said the SNB does not see a risk of deflationary developments and forecasts show a jump in inflation in coming quarters, adds inflation dynamics in Switzerland should not be dramatically disrupted by recent dollar movements. Martin added the current Swiss franc value is more due to dollar weakness than franc strength, but forex market interventions may be necessary to ensure price stability. The SNB currently has no reason to increase or reduce gold holdings. The bar for taking rates into negative territory is higher than for cutting rates when above zero.

UK ONS said June 2025 Producer output Price inflation estimated to be -1.0% Y/Y.

FX

DXY is on a firmer footing and continuing to gain this morning amid a weaker EUR (see below) and following the prior day's marginal losses owing to Fed independence concerns after President Trump moved to fire Fed Governor Cook who will be challenging the attempt in court. On top of that, it was also reported that the Trump administration is reviewing options for exerting more influence over the Federal Reserve’s regional banks that would potentially extend its reach beyond personnel appointments in Washington. DXY trades in a 98.24-98.70 range.

EUR/USD pared recent gains amid a lack of fresh catalysts from the bloc and with France facing political uncertainty. Losses accumulated for the EUR despite a lack of headlines around the European equity open, with market contacts noting of potential stops tripped under 1.1600 after the pair found support near the level in the prior two session. German GfK Consumer Sentiment did little to sway the EUR at the time, which printed below expectations. EUR/USD currently sits in a 1.1578-1.1651 range.

USD/JPY steadily advanced towards the 148.00 handle as the dollar regained poise with newsflow on the lighter end, but the pair influenced by a rebound in the Buck. USD/JPY trades in a 147.29-147.97 range.

GBP is softer amid the firmer Dollar but losses cushioned by a weaker EUR. On the inflation front, UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight). The price cap limits the amount suppliers can charge per unit of energy and is revised every three months. Cable trades in a 1.3431-1.3482 parameter and sandwiched between its 50 DMA (1.3493) and 100 DMA (1.3436).

AUD/USD failed to sustain the initial knee-jerk uplift seen following hot Monthly CPI data and stronger-than-expected Construction Work which feeds into Australia's GDP data.

PBoC set USD/CNY mid-point at 7.1108 vs exp. 7.1559 (Prev. 7.1188)

Fixed Income

USTs traded with a negative bias earlier but caught a slight bid as the risk tone deteriorated a touch; in a very narrow 112-02+ to 112-06+ range. Price action overnight was lacklustre, as US paper took a breather following the bull steepening seen on Tuesday, spurred by US President Trump’s move to oust Fed Governor Cook. Today’s session has seen yields rise across the curve, generally to a similar degree. Recent newsflow has not really had too much of an impact on price action today; US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

Bunds are outperforming vs peers; initial trade was sloppy in-fitting with global peers but has recently picked up a little to trade higher by a handful of ticks. Currently trading at the upper end of a 129.33 to 129.71 range. The docket is void of any pertinent European data/ECB speakers. German GfK earlier saw sentiment drop a little from the prior, and more than expected. Germany's new 2032 line which was very weak, had little impact on price action.

Gilt price action today has been dictated by global peers; initially opened lower amid the subdued trade seen in USTs/Bunds, but then reversed, but without a clear driver. Currently higher by around 17 ticks, and trades in a 90.26-62 range.

UK sells GBP 5bln 4.375% 2028 Gilt: b/c 3.16x (prev. 3.71x), average yield 3.991% (prev. 3.941%) & tail 0.2bps (prev. 0.2bps).

Germany sells EUR 2.675bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.2x, average yield 2.46% and retention 33.13%.

Commodities

Crude futures have tilted lower following a flat overnight session and after retreating throughout the prior day and with demand not helped by the narrower-than-expected headline crude draw in private sector inventory data, while there were also bearish views on oil including from US President Trump who thinks oil will fall beneath the USD 60/bbl level soon and with Goldman Sachs forecasting Brent to decline to the low USD 50s by late 2026. WTI currently resides in a 62.99-63.46/bbl range while Brent sits in a USD 66.40-66.91/bbl range.

Spot gold pulled back from near the USD 3,400/oz level after advancing yesterday amid a softer dollar. The yellow metal has been unfazed by the recent bout of Dollar strength, suggesting deteriorating risk across the market. Spot gold trades in a USD 3,373.78-3,393.55/oz parameter within Tuesday's 3,351.33-3,393.75/oz range.

Softer trade across base metals amid the deteriorating risk and broader Dollar strength. 3M LME copper resides in a USD 9,785.00-9,865.00/t range.

US President Trump thinks oil prices will break below USD 60/bbl soon.

US Private Energy Inventories (bbls): Crude -1.0mln (exp. -1.9mln), Distillate -1.5mln (exp. +0.9mln), Gasoline -2.1mln (exp. -2.2mln), Cushing -0.5mln.

Kazakhstan holds talks to resume oil transit via BTC, according to Tass citing the energy ministry; oil supplies to Europe are proceeding without delays.

Two Chinese investors are interested in taking a stake in Vietnam’s largest tungsten business, via Reuters citing sources.

Ukraine's Energy Ministry said Russia attacked energy and gas transit infrastructure in six Ukrainian regions overnight.

Geopolitics - Middle East

US special envoy Witkoff said they are negotiating multiple entries into peace accords with Israel, while Witkoff said President Trump will chair a meeting on Gaza at the White House on Wednesday.

US Secretary of State Rubio is to meet with Israeli Foreign Minister Sa'ar at the State Department on Wednesday.

Hamas said all Palestinians killed by Israel in Gaza’s Nasser Hospital attack on Monday were civilians and that two of the six Palestinians identified by Israel as alleged militants were killed in separate attacks away from the hospital.

WSJ's Norman posts "If SnapBack happens this week, very strong odds it happens tomorrow"; in relation to the Iranian snapback mechanism. "If no SnapBack, either things change dramatically or extension. Odds of dropping SnapBack without extension are tiny at this point. There is still a very real possibility that SnapBack triggered but extension agreed during 30-day process. Depends on Iran".

Geopolitics - Ukraine

US special envoy Witkoff said he is meeting with Ukrainians in New York this week and that Russian President Putin made a good-faith effort to engage.

"Moscow: No agreement yet to upgrade the level of Russian and Ukrainian negotiating delegations", according to Al Arabiya.

Ukrainian President Zelensky said Russians are currently sending negative signals regarding meetings and further developments.

US Event Calendar

7:00 am: Aug 22 MBA Mortgage Applications -0.5%, prior -1.4%

DB's Jim Reid concludes the overnight wrap

Markets had a very eventful session yesterday, as concerns mounted about the Federal Reserve’s independence, whilst French assets came under fresh pressure ahead of the upcoming confidence vote. So that led to some pretty big milestones, and with investors pricing in faster rate cuts, the US 2yr inflation swap rose to 3.05%, marking its highest level since late-2022 when inflation was still above 6% and the Fed were hiking aggressively. Meanwhile in Europe, the reappraisal of sovereign risk meant that the 10yr French yield closed just 6bps above its Italian counterpart, which is the smallest gap between the two since 2003. So that’s a huge turnaround relative to most of the period since the Euro Crisis, as the spread between the two never fell beneath 50bps until late last year. Bear in mind we’ve also got Nvidia’s earnings after the US close tonight, so there’s plenty on the agenda right now.

We’ll start with the Fed, as investors are watching closely after President Trump’s letter on Monday night that he was removing Lisa Cook from the Board of Governors “effective immediately”. In terms of the latest, Cook’s lawyer, Abbe David Lowell, said yesterday that they would be filing a lawsuit challenging the firing. And later in the day, the Fed issued a statement reiterating that Fed governors “may be removed by the president only “for cause””, but that the Fed would “abide by any court decision” resulting from Cook’s challenge.

The move comes as President Trump is seeking to reshape the Federal Reserve in his direction, and yesterday he commented how “We’ll have a majority, very shortly so that’ll be great once we have a majority, and housing is going to swing and it’s going to be great”. Indeed, of the seven currently on the Board of Governors, two of the appointees from President Trump’s first term (Bowman and Waller) have already dissented in favour of rate cuts, and CEA Chair Stephen Miran has been nominated to fill Adriana Kugler’s old seat. So if Cook were replaced as well, then a majority of the Board could be in favour of rate cuts after Miran’s appointment, even before Chair Powell’s term comes to an end.

Later on, multiple press reports added to this theme. For instance, the WSJ reported that President Trump was considering quickly announcing a replacement for Cook, with former World Bank President David Malpass being one candidate whom President Trump had discussed. Interestingly, Bloomberg separately reported that the administration was looking at ways to have more influence over the Fed’s 12 regional banks, which is important given that 5 of the 12 regional bank Presidents sit on the FOMC at a given time. This is particularly noteworthy at the moment, because every five years, the 12 regional bank presidents come up for approval by the Board of Governors. The next five-year approval is slated for Q1 next year, and theoretically a majority could refuse to approve some of the regional voters.

Our US economists looked in more depth at some of these issues in a note yesterday (link here ). They don’t anticipate a titanic shift in near-term policy, as Cook had been one of the most dovish officials on the Committee already. However, there could be broader implications for the Fed, as it only takes a majority of the Board of Governors (rather than the wider FOMC that also includes 5 of the regional Fed Presidents) to adjust the interest rate on reserve balances (IORB). Historically, the IORB has been set at an appropriate level to maintain the fed funds rate within the target set by the FOMC. But at least theoretically, a Board that didn’t agree with the FOMC could set IORB at a lower level.

For now at least, markets have reacted broadly in line with other episodes where the Fed’s independence has been questioned this year. So we saw a significant yield curve steepening yesterday, with the 2yr yield (-4.5bps) down to 3.68% (helped by a strong auction), the 10yr yield (-1.4bps) down to 4.26%, and the 30yr yield (+3.0bps) moving up to 4.92%. Indeed, for the 2s30s curve, that’s now the steepest it’s been since January 2022. Those moves came as investors priced in a more dovish path for near-term policy, with futures dialling up the expected rate cuts over the months ahead. For example, 109bps of cuts were priced in by the June 2026 meeting at the close, up +5.3bps on the day. So that helped put downward pressure on the dollar index, which weakened by -0.21%, whilst the prospect of more inflation helped push gold prices up +0.82%.

Interestingly, equities advanced despite the news, with the S&P 500 (+0.41%) closing just -0.04% beneath its record high. In part, that was because investors were still unsure if there’d actually be a radical policy shift at the Fed. But several data points also helped to support risk appetite, as they leant against the idea that the US economy was slowing down, particularly after the recent jobs report. For example, the Conference Board’s consumer confidence reading was better than expected in August, at 97.4 (vs. 96.5 expected). Similarly, core capital goods orders were up +1.1% in July (vs. +0.2% expected), and the Richmond Fed’s manufacturing index moved up to -7 (vs. -11 expected).

Over in Europe, however, it was a very different story as fears continued to mount about the fiscal situation in France. As a reminder, Prime Minister Bayrou has called a confidence vote for September 8, but the National Rally, France Unbowed and the Socialists have all said they’ll oppose the government. So as it stands, the government would fall, and that would open the way for a new PM, or even fresh legislative elections. So that’s reinforced existing concerns about France’s deficit, and the country’s assets saw a clear underperformance yesterday.

Those moves were evident across the board. For instance, France’s CAC 40 (-1.70%) built on its -1.59% decline on the Monday, with banks including Société Générale (-6.84%), Crédit Agricole (-5.44%) and BNP Paribas (-4.23%) seeing even bigger losses. That outpaced the Europe-wide STOXX 600 (-0.83%), and means the CAC 40 is now up just +4.46% this year, making it one of the worst performers among the major equity indices in local currency terms. Likewise for sovereign bonds, French 10yr yields were only down -1.1bps, compared with larger falls for bunds (-3.4bps) and OATs (-3.8bps). So by the close, the Franco-German 10yr spread was up to 78bps, which is its widest since April. And significantly, the French 10yr yield closed just 6bps beneath its Italian counterpart, which is the tightest it’s been since 2003.

Elsewhere in Europe, UK markets returned from their public holiday on Monday, with 10yr gilt yields up +4.9bps as they caught up with Monday’s moves elsewhere. We also heard from the BoE’s Mann, who was one of four members on the MPC (out of nine) who voted against a cut at the recent meeting. She said that a “more persistent hold on Bank Rate is appropriate right now”, and investors remain sceptical that there’ll be another rate cut this year. Indeed, the likelihood of another rate cut by the December meeting fell to 42% by the close, down from 48% the day before.

Overnight in Asia, the mood has generally remained positive, with investors turning their focus to Nvidia’s earnings later today. So that’s meant that most of the major equity indices are trading higher, and the CSI 300 (+0.72%) is currently on track for its highest closing level since 2022. Elsewhere, there’ve been more modest gains, including for the Shanghai Comp (+0.33%), the Hang Seng (+0.06%), the Nikkei (+0.36%), and the KOSPI (+0.11%). And US equity futures are also pointing slightly higher, with those on the S&P 500 (+0.07%) up enough to push the index to a new record if realised.

Elsewhere this morning, data has also shown an unexpectedly large jump in Australia’s inflation, with CPI up to +2.8% in July (vs. +2.3% expected). Moreover, the trimmed mean measure also moved up to +2.7%, having been at +2.1% in June. That’s the highest headline inflation in 12 months, and investors have dialled back the likelihood of a rate cut at the RBA’s next meeting in response, with the probability of a cut now down to 22%.

To the day ahead now, and it’s a quiet one on the calendar. Nvidia’s earnings after the US close will be the main highlight. Otherwise, data releases include the GfK consumer confidence reading from Germany.

“Nvidia is the story of the week. We’ve seen some erosion of the AI premium, so this is an important number to determine whether the AI story has got further to go,” said Guy Miller, chief strategist at Zurich Insurance Group. “This could either allow the technology cycle, the AI dream, to continue, or it could get significantly dented.”

Dimming the excitement is uncertainty over how much business Nvidia will be able to do in China. The US government has curbed China’s access to Nvidia products on national security grounds. While the Trump administration recently eased some of those export restrictions, Beijing has pressed domestic customers to seek alternative suppliers.

“A miss could spark meaningful volatility, while a positive surprise would likely see the major indexes make a run at all-time highs,” said Tom Essaye at The Sevens Report.

Elsewhere, in a reminder of the lingering tariff threat to global trade and inflation, Trump’s 50% levy on most Indian imports took effect Wednesday, penalizing the country for buying Russian oil. In Europe, the EU aims to fast-track legislation by the end of the week to scrap all tariffs on US industrial goods — a Trump demand before Washington lowers duties on the bloc’s car exports.

In Europe, The Stoxx 600 is steady after giving up earlier gains. The CAC 40 outperforms with a 0.4% rise even as the OAT-bund spreads widens slightly.

Earlier in the session, Asian stocks declined, weighed down by a sudden drop in Chinese equities, as an absence of new reasons to buy paved the way for profit-taking. The MSCI Asia Pacific Index slipped as much as 1.1%, with Tencent, Woolworths Group and Meituan the biggest drags on the gauge. Major equity indexes in the region were mixed, with those in China and Hong Kong dropping, while the Philippines and Taiwan were among the top gainers. Chinese equities slid in the afternoon session, reversing an earlier advance. One reason for the reversal may have been the fact that chipmaker Cambricon Technologies Corp. briefly became the country’s most expensive onshore stock, which then triggered some profit taking. Chinese officials are seeking to manage bubble risks as the rally extends. Sinolink Securities Co. raised its margin deposit ratio for new client financing to 100%, becoming the first broker to introduce tightening measures amid surging interest in stocks.

In FX, the Bloomberg Dollar Spot Index is up 0.3% as the greenback strengthens versus its G-10 peers. The kiwi is the weakest, falling 0.5% while the Canadian dollar is the most resilient, slipping just 0.1%.

In rates, the Treasury curve steepens further following Tuesday’s front-end rally, stoked in part by strong demand for 2-year note auction. However, new 2-year note’s yield dipped below 3.65%, the lowest for the tenor since early May. Supply cycle continues with $70 billion auction of 5-year notes, the largest of the seven nominal coupon sales, at 1 p.m. New York time. Yields are within 1bp of Tuesday’s closing levels; the 10-year near 4.27%; swap contracts linked to future Fed rate decisions continue to fully price in one quarter-point rate cut this year in October and a second one by year-end.

In commodities, WTI crude futures fall 0.4% to $63 a barrel. Spot gold drops $12. Bitcoin is down 0.5%.