Futures Rebound Ahead Of Powell's Speech

Futures Rebound Ahead Of Powell's Speech

After five days of selling - the longest stretch since Jan 2 - US stock futures halted this week’s run of losses in muted trading ahead of Jerome Powell’s Jackson Hole speech, even as markets scaled back bets on imminent interest rate cuts following very strong economic data on Thursday. As of 8:00am ET, S&P 500 rose 0.2% erasing an earlier decline, while Nasdaq futures rose 0.1% as Nvidia shares fall 1% in premarket after the Information reported the chipmaker had instructed component suppliers to stop production related to the H20 AI chip. European stocks advanced 0.2%, nudging toward an all-time high. US Treasuries held steady after Thursday’s pullback, with the 10-year rate at 4.33%. The dollar was little changed. there are no scheduled events on the US economic data calendar; Fed Chair Powell is set to speak at 10am ET at Jackson Hole with a slew of other central bank comments expected from the event. The Fed speaker slate also includes Boston Fed President Collins at 9am and Cleveland Fed President Hammack at 11:30am; hawkish comments by Hammack on Thursday pushed yields to session highs. Swap contracts linked to future Fed rate decisions fully price in one quarter-point rate cut this year in October and a second one by year-end.

In premarket trading, Nvidia shares fell 1.1% after the chip giant instructed component suppliers including Samsung Electronics and Amkor to stop production related to the H20 AI chip. Other Magnificent Seven stocks were all higher (Alphabet +1.1%, Tesla +0.5%, Apple +0.5%, Microsoft +0.09%, Amazon +0.4%, Meta +0.2%). Here are the other notable premarket movers:

Biohaven shares (BHVN) gain 13% after the company said the FDA communicated to the company on Aug. 21 that an expected decision regarding the NDA for Troriluzole will still be the fourth quarter.

Cameco (CCJ) shares rise 1.9% in premarket trading after National Bank Financial raised its price target on the uranium company to C$115 from C$110 as it sees the company’s Westinghouse stake adding value.

Gap shares (GAP) fall 2.1% in premarket trading on Friday as Barclays downgrades to equal-weight from overweight saying the previous bullish scenario for double-digit operating margins by FY26 is off the table.

Intuit shares (INTU) decline 6.1% ahead of the bell after the tax software company’s tepid forecast overshadowed an otherwise strong fourth quarter report.

Ross Stores shares (ROST) rise 2.7% after the retailer posted earnings per share for the second quarter that beat the average analyst estimate after better-than-expected tariff-related costs.

Workday shares (WDAY) drop 5.1% after the human-resources software company reported second-quarter professional services adjusted gross profit that missed estimates. The company also announced it has agreed to acquire Paradox.

Zoom Communications shares (ZM) rise 5.0% in premarket trading on Friday after the video conferencing company raised its revenue guidance for the full year, beating the average analyst estimate.

Trucking stocks might be active on Friday after Secretary of State Marco Rubio said that US will halt issuance of worker visas for commercial truck drivers. Watch: Saia, Old Dominion Freight Line, Knight-Swift Transportation and JB Hunt.

A selloff in big tech this week halted the record-breaking rally in US stocks, ahead of Powell’s latest policy blueprint, which will signal whether the Fed will stay cautious on inflation, which is showing signs of stickiness, or tilt toward supporting a softer labor market. A Bloomberg equal-weighted index of the Mag 7 has dropped 3.4% since Monday, putting it on track for its steepest weekly decline since April’s market rout.

The stakes are heightened by pressure from the Trump administration to cut rates and growing divisions within the Fed’s rate-setting committee. To keep his options open, Powell may emphasize that the Fed’s September move will be guided by employment and inflation figures set for release early next month. Swaps have reduced the odds of aggressive near-term easing, now pricing about a 65% chance of a cut next month and fewer than two moves this year. Little more than a week ago, markets were betting on a full quarter-point cut in September, with some traders even positioning for a half-point move.

Powell is due to speak at 10 a.m. New York time (

"Powell To Support A September Rate Cut": Full Jackson Hole Preview And How To Trade It | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

). A hawkish speech is expected to weigh on shorter-maturity government bond yields. It could also add pressure to the recent series of large options market trades, which are positioned for an outsized rate cut next month and a total of 75 basis points in reductions by year-end.

“If the Fed doesn’t cut in September, markets will drop because they’re expecting the Fed to do something. If they cut too much, markets may take it as a sign that the Fed is losing its independence, which may trigger much higher inflation,” said Joachim Klement, a strategist at Panmure Liberum. “It’s like Goldilocks with two bears and a bull.”

In Europe, the Stoxx 600 rises 0.2%, led by gains in chemical, health care and auto names. Paper and forestry stocks rise after a report that Suzano will increase pulp prices, while Akzo Nobel gained after activist investor Cevian Capital built a stake in the company. Polish banks plunge after the country’s government announced plans to raise corporate taxes on lenders. Here are the biggest movers Friday:

Akzo Nobel gains as much 5.4% after activist investor Cevian Capital acquired a 3% stake in the company, putting its weight behind a strategy overhaul at the struggling Dulux paintmaker

Hensoldt and RENK gain as much as 4.5% and 1.1% after being upgraded to neutral from sell at Citi, with the broker expecting the companies to benefit from Germany’s increased defense spending

European forestry stocks are rising on Friday after a report that Suzano will increase pulp prices starting in September; Metsa Board shares rise as much as 4.7% and Stora Enso as much as 3.6%

Standard Chartered gains as much as 3.5% after the US Department of Justice rejected claims by two whistleblowers that it failed to properly investigate allegations of sanctions violations by the bank, the lender said

Morgan Advanced Materials shares rise as much as 5.1%, the most in more than a month, after the materials and components firm agreed to sell its MMS business unit, including 75% shareholding in MCIL

Polish banks are among the worst performers in Europe on Friday morning after the country’s Finance Ministry announced plans to raise corporate taxes on lenders to help ease pressure on a strained budget

Dino Polska shares drop as much as 8.4%, briefly hitting their lowest level in over four months, after the Polish supermarket chain reported results below expectations for the second quarter, according to analysts

Aspen shares slide as much as 16% in Johannesburg, to its lowest intraday level since April 2020, after the pharmaceutical company said it expects its full-year normalized headline EPS to come in below analyst expectations

Deutsche Post shares fall as much as 1.5% after Kepler Cheuvreux lowered its recommendation to hold from buy saying the firm will struggle to achieve its Ebit guidance of more than €6 billion

Earlier in the session, Asian stocks crept higher, as a rally in Chinese and South Korean shares helped offset losses in Taiwan and India. The MSCI Asia Pacific Index gained 0.1%, with TSMC among the biggest drags while Tencent supported the regional benchmark. Equities in South Korea gained ahead of President Lee Jae Myung’s visit to Japan. Vietnam’s main equity gauge dropped 2.5%, and Australian shares also fell. A measure of onshore Chinese stocks recorded its biggest weekly rise since November. Gains in local chipmakers provided an added tailwind Friday after a report that US rival Nvidia has instructed component makers to stop production related to its H20 AI chips. Shares also advanced in Hong Kong. Next week will see central bank policy decisions in South Korea and the Philippines.

In FX, the Dollar extended yesterday’s gains overnight and is marginally outperforming across most of the G10 complex as NY sits down. The Norwegian krone is the weakest of the G-10 currencies, falling 0.3% against the greenback. The yen also weakens 0.2%. The Dollar index continued to rally overnight, now at its highest point in two weeks. USDJPY is up 21bps to ~148.75 after Japan’s national CPI data for Jul came in cooler than expectations at +3.1% on headline. And the EUR is mostly unchanged on the day, with mixed signals overnight from data (German Q2 GDP contracted but eurozone wages are up 4% YoY). No major data releases in the US today; all eyes are on Fed Chair Powell at 10AM as well as other speakers at the Jackson Hole Economic Symposium.

In rates, treasuries inch lower, with US 10-year yields rising 1 bp to 4.34%. The 2-year yield is now at the highest level since the beginning of the month at 3.80%, as inflation and price data curbed cuts priced into the next few meetings. There is little price action in USTs overnight after yesterday's sell-off as the market awaits Powell's speech later this morning. Yesterday, we saw 3bps of cuts priced out of the September meeting, down to a 70% chance of a 25bps cut at the meeting. Gilts underperform, pushing UK 10-year borrowing costs up 3 bps to 4.76% despite today's UK Retails Sales print being delayed until September 5th. JGBs are higher across the curve after inflation data continues to sustain the markets expectations for a rate hike by the BOJ. In terms of flows, we saw two way interest in September FOMC, and flattening of the nominal curve.

In credit, macro credit is opening the final session of the week just a touch firmer in sympathy with equity futures in the green and European CDS index spreads largely flat. Risk continued to trade soft yesterday for the fourth session in a row. CDX HY came a touch under pressure with risk generically offered, while there was further negative gamma buying of CDX IG protection into the spread widening. FM was the most active community in vol yesterday, leaning generally better buyers of IG vol, while HY vol was offered by both FM and RM. All eyes and ears will be on Powell this morning (10am ET) with any hawkish tone expected to put pressure on the front end of the curve and synthetic credit spreads.

In commodities, oil prices are steady, with WTI crude futures near $63.50 a barrel. Spot gold falls $10.

Looking at today's US calendar, there are no scheduled events. The Fed speaker slate also includes Boston Fed President Collins at 9am and Cleveland Fed President Hammack at 11:30am; hawkish comments by Hammack on Thursday pushed yields to session highs

Market Snapshot

S&P 500 mini +0.2%

Nasdaq 100 mini +0.1%

Russell 2000 mini +0.5%

Stoxx Europe 600 +0.2%

DAX little changed, CAC 40 +0.2%

10-year Treasury yield +1 basis point at 4.34%

VIX -0.1 points at 16.53

Bloomberg Dollar Index little changed at 1211.1

euro little changed at $1.1598

WTI crude little changed at $63.48/barrel

Top Overnight News

Fed officials are reportedly readying to quietly pull back from the signature Flexible Average Inflation Targeting (FAIT) policy innovation announced five years ago in which they focused on the risks brought on by near-zero interest rates and low prices, with officials to abandon that approach as it is now seen as no longer relevant given the backdrop of high and more volatile inflation. According to Nick "Nikileaks" Timiraos noted that Powell is expected to unveil the shift at Jackson Hole on Friday, although changes won’t impact near-term policy decisions and are instead part of the framework the Fed uses to interpret its mandate inflation and employment mandates: WSJ

Nvidia asked suppliers Samsung and Amkor to stop production related to its H20 AI chip after Beijing urged local firms to avoid using it, The Information reported. CEO Jensen Huang reiterated the processor has no security backdoors. Nvidia shares fell premarket (NVDA -110bps). BBG

The Trump-Putin Alaska summit followed by the visit of European leaders at the White House were supposed to jump-start momentum to end the Russia-Ukraine war. A week later we are back at the same old stand, as Vladimir Putin is playing familiar tricks and showing no serious interest in a deal. The question is what President Trump will do about it. WSJ

Elon Musk unsuccessfully tried to enlist Mark Zuckerberg in his unsolicited bid for OpenAI this year. BBG

Trump said the US is leading the AI race and that AI is the hottest thing in decades.

Trump's administration reportedly considers a plan to reallocate USD 2bln in CHIPS Act funding for critical minerals and aims to give Commerce Secretary Lutnick greater oversight of minerals financing decisions, according to Reuters citing sources.

Rubio said the US is pausing all issuances of worker visas for commercial truck drivers with immediate effect. It was separately reported that President Trump's administration said it is reviewing all 55mln people with US visas for potential deportable violations, according to AP.

Austan Goolsbee called the recent spike in services inflation “dangerous,” but hopes it proves a blip. He also said the September meeting will be “live.” Susan Collins told the WSJ a rate cut may be appropriate if labor market weakness outweighs inflation risks. BBG

The US won’t demand equity stakes from chipmakers including TSMC and Micron, which are expanding in the US, a person familiar said. BBG

Euro-zone negotiated wages jumped 4% from a year ago, the ECB said, supporting its caution on further reducing interest rates. BBG

Japan’s national CPI for Jul came in at +3.1% headline (down from +3.3% in June and inline w/the Street) while the core number (ex-food and energy) was flat at +3.4% (also inline w/the Street) BBG

Germany’s economic output shrank by more than initially estimated in the second quarter, with industry faring worse than expected as U.S. tariffs hurt exports. Germany’s final Q2 GDP report is revised lower from the preliminary reading (now -0.3% vs. the prior -0.1%). WSJ

Fed's Collins (2025 voter) signalled an openness for a rate cut as soon as next month amid labor market concerns and flagged that higher tariffs might squeeze consumers’ purchasing power, which could weaken spending. Furthermore, Collins said she expects inflation to continue rising through the end of the year before resuming a decline in 2026, according to a Wall Street Journal article that noted divisions grow inside the Fed ahead of the September rate cut decision and cited Fed's Hammack (2026 voter) opposing cuts due to rising inflation.

Fed's Goolsbee (2025 voter) said the September FOMC meeting is a live meeting and the Fed has been getting mixed messages on the economy, while he added that the most recent inflation data wasn't great and the Fed still has time to take in more data. Goolsbee responded he doesn't want to get his hands tied, when asked about a September rate cut, as well as commented that a rise in services inflation is a dangerous data point and reacting to a stagflation shock is very difficult. Furthermore, he said central bank independence is critically important, and that tariff increases don't seem close to being done and risk persistent inflation.

Trade/Tariffs

Chinese President Xi is unlikely to attend ASEAN Leaders' Summit in October, "dashing hopes of a meeting with US President Trump at the summit"; while Premier Li is set to represent China, according to two regional sources cited by Reuters.

South Korea's Foreign Minister Cho is expected to meet with US Secretary of State Rubio as early as today before the Trump summit with South Korea President Lee, according to Yonhap. South Korean top security adviser confirms discussions with US on increasing defence spending, citing NATO framework as reference; said US investment and weapons purchases are under review. In talks about nuclear power cooperation with the US.

South Korean top security adviser confirms discussions with US on increasing defence spending, citing NATO framework as reference; said US investment and weapons purchases are under review.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid cautiousness heading into Fed Chair Powell's remarks at Jackson Hole and following the subdued handover from Wall St, where participants digested a slew of data and mostly hawkish Fed comments. ASX 200 marginally declined with price action choppy around the 9,000 focal point as participants continue to mull over the latest earnings releases. Nikkei 225 swung between gains and losses with participants indecisive after recent yen weakness and somewhat mixed Japanese inflation data, which mostly matched estimates, aside from the slightly hotter-than-expected Core CPI reading. Hang Seng and Shanghai Comp were kept afloat with strength seen following recent earnings releases and with chipmakers supported after Beijing summoned Chinese tech companies to discuss their use of NVIDIA (NVDA) chips and encourage them to use more homegrown options, while NVIDIA ordered a halt to H20 production following China’s directive against purchases.

Top Asian News

Japan 2026 budget requests to total around JPY 120tln, according to Kyodo.

China's Industry Ministry said it has issued interim measures for controlling and managing rare earth mining, smelting, and separation.

PBoC seeks feedback on draft regulations for interbank FX market.

European stocks (STOXX 600 +0.1%) are little changed, albeit with a positive bias amid a lack of newsflow into Fed Chair Powell’s speech in the European afternoon. A bout of risk aversion, with no specific fundamental driver, was seen pre-cash open. Nonetheless, this did little to inflict sustained pressure on European bourses, which have been edging higher since the lacklustre open. European sectors opened mostly in the red after a quiet open. However, positivity has since dominated across the board as sentiment improved. Chemicals sits at the top, led by Akzo Nobel (+5%), after the FT reported that Activist Cevian acquired a more than 3% (EUR 300ln) stake in the company. Banks also underperform, though they are off their worst levels; this comes after Bloomberg reported that Poland is planning to increase corporate income tax for banks, proposing to increase the tax to 30% from 19%.

Top European News

German Economy Minister said Q2 GDP figures show "urgent need for action"; Further and courageous reforms are unavoidable to make the German economy competitive.

FX

DXY is firmer on Friday in the run-up to Fed Chair Powell's speech at 15:00BST /10:00 EDT, which is expected to see a text release. Attention will focus on whether Chair Powell’s Jackson Hole remarks indicate any shift in views since recent US data and if he signals a September rate cut, which markets price at ~70% probability. DXY trades in a 98.58-98.83 intraday range after finding support at the 50 DMA (at 98.09 today) earlier in the week. Powell aside, there will be commentary from Collins and Hammack.

Softer in tandem with the firmer Dollar. EUR remains subdued by the diminishing optimism surrounding Russia-Ukraine, in which US President Trump said, "we will know in about two weeks regarding Russia-Ukraine". Meanwhile, Ukrainian President Zelensky said Russia's overnight attacks show that Moscow is trying to avoid the need for meetings aimed at ending the war. On the data front, German GDP for Q2 was revised lower across the board, albeit this prompted little EUR move at the time, with eyes turning to Fed Chair Powell's speech at 15:00 BST for a dollar-induced impulse. EUR/USD currently sits in a 1.1583-1.1668 range.

Choppy trade overall in which USD/JPY initially extended on Thursday's advances overnight after returning to the 148.00 territory and was unfazed by the Japanese inflation data, in which Core CPI printed firmer-than-expected. Inflows into the JPY were seen around 15 minutes before the European equity cash open, in tandem with some broader risk aversion despite a lack of fresh catalysts at the time, though it was short-lived. USD/JPY trades in a 148.27-148.77 parameter.

Not much in the way of Sterling-specific catalysts nor newsflow, with Cable moving in tandem with the Dollar ahead of a long weekend (UK bank holiday on Monday).

PBoC set USD/CNY mid-point at 7.1321 vs exp. 7.1871 (Prev. 7.1287).

Fixed Income

USTs are flat and have been trading in a very narrow 111-16 to 111-20 range, as traders await an appearance from Fed Chair Powell at 15:00 BST / 10:00 EDT. On that, focus will be on whether Chair Powell’s Jackson Hole remarks indicate any shift in views since recent US data and if he signals a September rate cut, which markets price at ~70% probability. In terms of price action, currently contained in a minuscule 4 tick range, and within the confines made in the prior session.

Bunds are also flat/incrementally firmer and trade in a very narrow 128.94 to 129.12 range; the trough today was made in the moments after the release of German GDP revisions, which were lower than the prelim; Q/Q revised down to 0.2% (prev. 0.4%) whilst the Y/Y metric declined 0.3% (prev. no growth).

Gilts are on the back foot today and underperforming vs peers, albeit within narrow ranges. Nothing really fresh driving things at the moment for UK paper, but perhaps as fiscal-related fears resurge into the Autumn Budget. From a yield perspective, the 10yr has been knocking on the door of the 4.75% mark; traders tout levels above 4.80% as the “danger zone” for Chancellor Reeve’s and her “black hole”.

Commodities

Modest gains across the crude complex despite the firmer Dollar and alongside the choppy mood across the stock market, with equity bourses swinging from modest losses to mild gains. Upside in the crude complex comes amid diminishing optimism surrounding Russia-Ukraine, in which US President Trump said, "We will know in about two weeks regarding Russia-Ukraine". Meanwhile, Ukrainian President Zelensky said Russia's overnight attacks show that Moscow is trying to avoid the need for meetings aimed at ending the war. On that note, the Hungarian Foreign Minister said oil deliveries to Hungary via the Druzhba pipeline have been halted due to attacks near the Russia-Belarus border. Deliveries seem to be suspended for at least five days, according to reports. WTI currently resides in a 62.05-62.68/bbl range while Brent sits in a USD 67.44-67.95/bbl range.

Mostly subdued trade across precious metals amid the firmer Dollar as participants look ahead to Fed Chair Powell's speech at 15:00BST /10:00 EDT which is expected to see a text release. Spot gold trades under its 50 DMA (3,346.01) in a USD 3,325.38-3,340.14/oz range.

Mixed within narrow ranges amid a lack of pertinent drivers this morning ahead of risk events. 3M LME copper prices reside in a USD 9,714.05-9,781.00/t range.

Hungary and Slovakia call on European Commission to guarantee energy supply security. As a consequence, deliveries seem to be suspended for at least five days.

Germany said there is no impact on German energy supply security from the Druzhba pipeline disruption.

Geopolitics: Middle East

Iran's Foreign Minister said he will have a joint phone call with French, British and German counterparts on Friday to discuss nuclear talks and sanctions, according to IRNA.

"Israeli Defence Minister: We have approved the army's plans to eliminate Hamas and evacuate the population in Gaza", according to Al Arabiya.

Geopolitics: Ukraine

Hungarian Foreign Minister said oil deliveries to Hungary via the Druzhba pipeline have been halted due to attacks near the Russia-Belarus border.

North Korean leader Kim lauded military officers who participated in overseas military operations as heroes and said soldiers at Kursk proved the might of the North Korean military in the world's eyes, according to KCNA.

Russia conducts naval exercises in the Baltic Sea, according to the defence ministry.

Geopolitics: Other

China condemned US military build-up off Venezuela coast as foreign interference in regional affairs, according to Fox News. China's Concord Resources plans to invest over USD 1bln in two oilfields in Venezuela, according to Reuters sources, and plans to produce 60k BPD by end-2026.

US Event Calendar

Nothing scheduled

DB's Jim Reid concludes the overnight wrap

The theme of “good news is bad news” returned to markets yesterday following a strong US PMI release. This led investors to dial back expectations of Fed rate cuts, which sent 10yr Treasury yields +3.7bps higher and left the S&P 500 (-0.40%) posting a 5th consecutive decline for the first time since early January. That leaves investors in a jittery mood going into the Jackson Hole Symposium that kicks off in full today withFed Chair Powell making a speech at 10am EST (3pm LDN) on the US “Economic outlook and framework review”.

Starting with the data, the flash US PMIs for August exceeded expectations, with the manufacturing index (53.3 vs 49.7 expected) rebounding to its highest level since May 2022, while services (55.4 vs 54.2 exp, 55.7 prev.) was resilient at strong levels. The details were also on the hawkish side, with the employment component edging up to its highest since January and the composite output price index rising to 59.3, its highest in three years. Other data was a bit more mixed, with existing home sales rising in July (+4.01m vs +3.92m exp.) but initial and continuing jobless claims moving higher, with initial claims up to +235k in the week ending August 16 (+225k exp).

With the PMIs painting a picture of a resilient US economy with ongoing inflationary risks, markets lowered the probability of a rate cut in September to 72%, its lowest since the weak jobs report on August 1 and down from being fully priced after last week’s CPI print. Bonds also fell, with yields on the 2yr (+4.5bps to 3.79%) and 10yr (+3.7bps to 4.33%) Treasuries moving higher. Equities similarly saw a soft day, with the S&P 500 down -0.40% and the Mag-7 (-0.54%) also posting a 5th consecutive decline. Meta fell -1.15% after it reported a freeze in AI hiring. Unlike the previous couple of sessions the decline was a broad-based one, with more than two-thirds of the S&P 500 down on the day, led by the defensive utilities (-0.71%) and consumer staples (-1.18%) sectors. The slump in the latter was mostly due to Walmart (-4.49%), which hit a rare miss in its earnings yesterday amid higher insurance claims and restructuring costs.

The paring back of rate cut expectations also came amid a pretty patient tone from current Fed officials. Cleveland President Fed Hammack said that the bank’s biggest concern is staying “laser-focused” on inflation, adding that she would not support a rate cut if the meeting was tomorrow. Kansas Fed President Schmid suggested that inflation risks were marginally higher than risks to the labour market, while Chicago Fed President Goolsbee called the last inflation print a “dangerous data point” though he saw the upcoming September meeting as a live one. These comments contrasted with those made by former St Louis Fed President James Bullard, who called for 100bps of rate cuts by the end of this yearstarting with a cut in September. In an interview with Fox Business,Bullard also confirmed that he’d been in contact with Treasury Secretary Bessent about his candidacy for the Fed Chair role.

We’ll learn more on the Fed’s thinking today at Jackson Hole, with all eyes on Powell’s speech at 10am EST. The last time we heard Powell speak at the July FOMC, the Chair was notably hawkish on the labour market, but in light of the July downward payroll revision, we expect a somewhat different tone today. Investors will be keenly watching whether Powell places more emphasis on weaker payrolls versus more stable measures of labour market slack and still solid activity and inflation data. In case you missed it, see our US economists’ preview of what to expect from Jackson Hole here. The topic of Fed independence will also linger over Jackson Hole, with DoJ official Ed Martin yesterday urging Chair Powell to remove Governor Lisa Cook from the board and saying that he intended to investigate her over allegations of mortgage fraud that surfaced on Wednesday.

Turning to Europe, we also got better-than-anticipated composite PMI prints in the Euro area (51.1 vs 50.6 exp, 50.9 prev), with both France (49.8 vs 48.5 exp) and Germany (50.9 vs 50.2 exp) moving higher, as well as in the UK (53.6 vs 51.8 exp). In the euro area the improvement was led by the manufacturing sector, but in the UK it was due to a jump in the services PMI to a 12-month high of 53.6. These were the first PMI prints after the July EU-US trade deal so signs of improved manufacturing activity will be welcome, though tariff volatility could distort the PMIs’ accuracy. In any case, the data led European sovereign bonds to reverse the previous day’s rally, with 10yr gilt (+5.7bps to 4.73%) leading the rise in yields. 10yr OATs (+4.9bps) and bunds (+3.9bps) also sold off, as pricing of ECB rate cuts this year ticked down by -3.9bps to just 9bps.

Despite those positive readings, European stocks saw declines for much of the day, though the Stoxx 600 was back to unchanged by the close and a late rally helped the FTSE 100 (+0.23%) to a new all-time high. The DAX (+0.07%) and FTSE MIB (+0.35%) also advanced, but the CAC (-0.44%) fell back. Healthcare stocks (+0.43%) outperformed within the Stoxx 600 as a joint EU-US statement formalising their July trade deal confirmed that tariffs on pharmaceuticals, chips and lumber will not exceed 15%. The statement also outlined that European cars will face a 15% tariff (down from 27.5% currently) if the EU eliminates tariffs on US industrial goods, and confirmed exemptions for some goods including aircraft and generic drugs.

European markets weren’t helped by waning optimism on Russia-Ukraine peace negotiations. Russia’s Foreign Minister Lavrov accused the US and Europe of undermining progress made at the Trump-Putin Alaska Summit and suggested that security guarantees for Ukraine should be based on the 2022 Istanbul talks. At the time, Russia had proposed an arrangement that would give Moscow a de facto veto over intervention in Ukraine, which is clearly unacceptable to Kyiv. With Lavrov also deflecting on the proposed Putin-Zelenskiy meeting, Ukrainian bonds fell back to levels seen just over a week ago before the Trump-Putin summit. Meanwhile, Rheinmetall rose +3.27%, erasing most of its -5.5% decline over the previous two days. And oil prices advanced, with Brent crude up +1.24% to $67.67/bbl as White House trade advisor Peter Navarro said he expected the additional 25% tariffs on India for buying Russian oil to come into force as scheduled on August 27.

Asian equity markets are trading mostly higher this morning despite the weak handover from Wall Street. The KOSPI (+0.69%) is enjoying a bright start, building on the previous session’s gains, while the Hang Seng (+0.33%), the CSI (+1.18%) and the Shanghai Composite (+0.67%) are also all decently higher. Sectorally, the Hang Seng Tech index (+1.75%) is leading the way, perhaps benefitting from a report by The Information tech news outlet that Nvidia has told component suppliers to stop production related to its H20 chip that’s been designed specifically for the Chinese market. Nvidia’s shares fell by close to 2% in alternative trading on the news, and NASDAQ futures (-0.10%) are marginally trailing those on the S&P 500 (-0.02%) as a result.

Meanwhile, the Nikkei (-0.13%) is down marginally as Japan’s consumer inflation saw a slight moderation but stayed well above the BOJ’s 2% target in July. Headline CPI eased from 3.3% to 3.1% yoy, in line with expectations, but the core (ex fresh food) CPI was a touch above expectations of (+3.1% vs +3.0% exp). The core-core CPI reading that excludes both fresh food and energy prices remained steady at +3.4% y/y in July, suggesting still sticky underlying inflation momentum. Money markets are pricing a 53% chance of a rate hike from the BoJ over the next two meetings, inching a little higher overnight, while 10yr JGB yields are +0.5bps higher at 1.62%, a new post-2008 high.

To the day ahead now, Fed Chair Powell is set to speak at the Jackson Hole Symposium, with a slew of other central bank comments expected from the event. Data releases include the UK’s July retail sales, France’s August business confidence, July retail sales, and Canada’s June retail sales.

Tyler Durden | Zero Hedge

Zero Hedge

Fri, 08/22/2025 - 08:35

Futures Rebound Ahead Of Powell's Speech | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the "labor market is weak" narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the "labor market is weak" narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

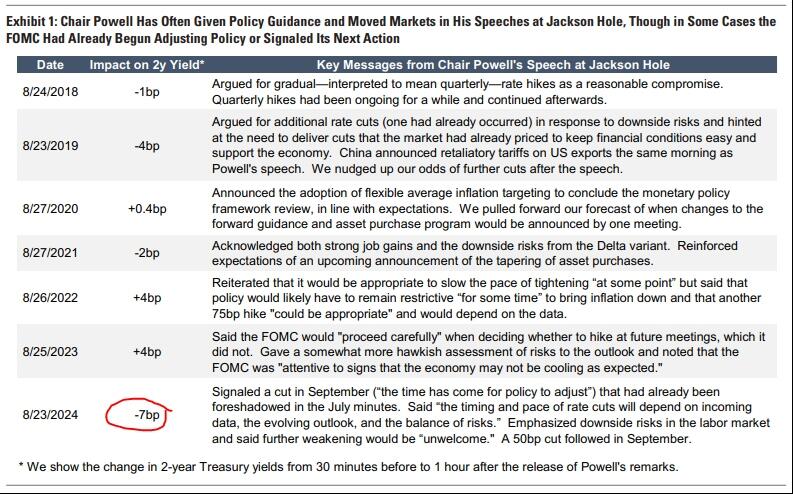

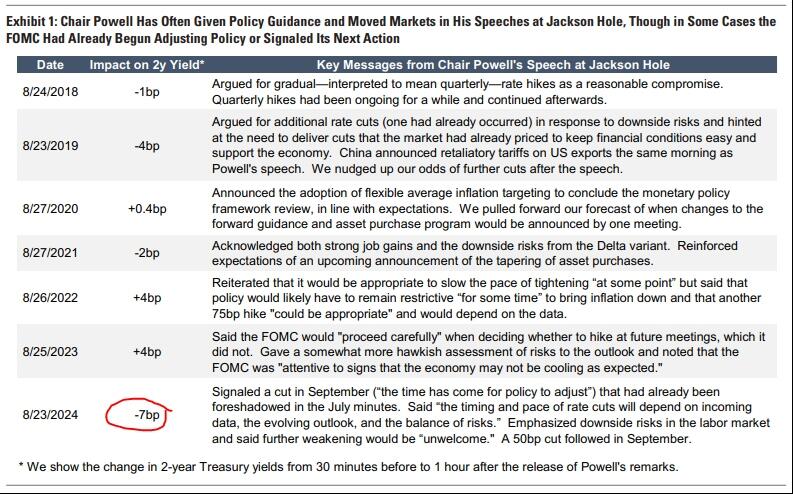

The market's reaction to Powell's has been varied over the years...

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

The market's reaction to Powell's has been varied over the years...

Watch the full speech live here (due to start at 1000ET):

Fri, 08/22/2025 - 09:45

Watch the full speech live here (due to start at 1000ET):

Fri, 08/22/2025 - 09:45

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the "labor market is weak" narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

Amid much speculation of what he will offer up to the market gods amid the summer doldrums, Goldman Sachs expects Powell to modify his statement from the July FOMC press conference that the FOMC is “well positioned” to wait for more information.

Instead, he might note that the FOMC is well positioned to address risks to both sides of its mandate but emphasize that downside risks to the labor market have grown following the July employment report, while reiterating that tariffs are likely to have only a one-time effect on the price level.

We expect the FOMC to partially reverse some of the changes it made in 2020, as it has foreshadowed in the minutes to its recent meetings.

Specifically, we expect the FOMC to return to saying that it will respond to “deviations” from maximum employment in both directions rather than just to “shortfalls” or to at least water down the shortfalls language and to return to flexible inflation targeting (rather than flexible average inflation targeting) as its main strategy while retaining the option to use a make-up strategy at the zero lower bound.

Additionally, Academy Securities, Peter Tchir expects Powell to push back on the "labor market is weak" narrative (which Tchir continues to believe is true and why the Fed should be cutting in September).

Economists seem to be honing in on a “replacement rate” level of hiring, in the 50k to 80k range.

That seems low and if discussed, will likely agitate the President as numbers less than 100k as the level of hiring required to keep the unemployment rate stable, just don’t seem that exciting.

Even if the Fed plans to cut, they would like it to be a bit of a surprise (keeping the probability of a rate cut at the next meeting closer to 50 than 100 likely suits them best).

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

The market's reaction to Powell's has been varied over the years...

If Powell is able to convince markets jobs are comfortable but inflation isn’t, look for bond yields to go higher, dragging stocks down with them.

Some of this already has been priced in, so the move should be “normal” in size, rather than some outlier.

Recent news on the AI/Data Center side seems to have slowed the excitement for investing in those sectors a little this week.

The market's reaction to Powell's has been varied over the years...

Watch the full speech live here (due to start at 1000ET):

Watch the full speech live here (due to start at 1000ET):

"[Defendants] consulted with no stakeholders or experts and did not evaluation of the environmental risks," wrote the 68-year-old Williams, who was appointed by President Obama in 2011. "There weren't 'deficiencies' in the agency's process. There was no process." Williams pointed to "a myriad of risks" to the Everglades environment, including wastewater discharge and rain runoff.

Florida's Division of Emergency Management appealed the ruling almost immediately after it was released. Florida and the Trump administration had argued there was no environmental impact to consider, because there was

"[Defendants] consulted with no stakeholders or experts and did not evaluation of the environmental risks," wrote the 68-year-old Williams, who was appointed by President Obama in 2011. "There weren't 'deficiencies' in the agency's process. There was no process." Williams pointed to "a myriad of risks" to the Everglades environment, including wastewater discharge and rain runoff.

Florida's Division of Emergency Management appealed the ruling almost immediately after it was released. Florida and the Trump administration had argued there was no environmental impact to consider, because there was  In a statement issued after the ruling, Paul Schwiep, who represented Friends of the Everglades and Center for Biological Diversity, offered his own depiction of the project:

“The state and federal government paved over 20 acres of open land, built a parking lot for 1,200 cars and 3,000 detainees, placed miles of fencing and high-intensity lighting on site and moved thousands of detainees and contractors onto land in the heart of the Big Cypress National Preserve, all in flagrant violation of environmental law."

Williams said Florida and the federal government "offered little to no evidence" as to why the facility had to be built in the Everglades. "[It's] apparent ...that in their haste to construct the detention camp,

In a statement issued after the ruling, Paul Schwiep, who represented Friends of the Everglades and Center for Biological Diversity, offered his own depiction of the project:

“The state and federal government paved over 20 acres of open land, built a parking lot for 1,200 cars and 3,000 detainees, placed miles of fencing and high-intensity lighting on site and moved thousands of detainees and contractors onto land in the heart of the Big Cypress National Preserve, all in flagrant violation of environmental law."

Williams said Florida and the federal government "offered little to no evidence" as to why the facility had to be built in the Everglades. "[It's] apparent ...that in their haste to construct the detention camp,

Though it's a preliminary injunction as the case is further litigated, Williams set a 60-day deadline for Florida and the feds to remove current detainees and to start dismantling critical features of the facility, including fencing, lighting and power generators. A temporary restraining order issued on Aug 7 had

Though it's a preliminary injunction as the case is further litigated, Williams set a 60-day deadline for Florida and the feds to remove current detainees and to start dismantling critical features of the facility, including fencing, lighting and power generators. A temporary restraining order issued on Aug 7 had

In premarket trading, Nvidia shares fell 1.1% after the chip giant instructed component suppliers including Samsung Electronics and Amkor to stop production related to the H20 AI chip. Other Magnificent Seven stocks were all higher (Alphabet +1.1%, Tesla +0.5%, Apple +0.5%, Microsoft +0.09%, Amazon +0.4%, Meta +0.2%). Here are the other notable premarket movers:

Biohaven shares (BHVN) gain 13% after the company said the FDA communicated to the company on Aug. 21 that an expected decision regarding the NDA for Troriluzole will still be the fourth quarter.

Cameco (CCJ) shares rise 1.9% in premarket trading after National Bank Financial raised its price target on the uranium company to C$115 from C$110 as it sees the company’s Westinghouse stake adding value.

Gap shares (GAP) fall 2.1% in premarket trading on Friday as Barclays downgrades to equal-weight from overweight saying the previous bullish scenario for double-digit operating margins by FY26 is off the table.

Intuit shares (INTU) decline 6.1% ahead of the bell after the tax software company’s tepid forecast overshadowed an otherwise strong fourth quarter report.

Ross Stores shares (ROST) rise 2.7% after the retailer posted earnings per share for the second quarter that beat the average analyst estimate after better-than-expected tariff-related costs.

Workday shares (WDAY) drop 5.1% after the human-resources software company reported second-quarter professional services adjusted gross profit that missed estimates. The company also announced it has agreed to acquire Paradox.

Zoom Communications shares (ZM) rise 5.0% in premarket trading on Friday after the video conferencing company raised its revenue guidance for the full year, beating the average analyst estimate.

Trucking stocks might be active on Friday after Secretary of State Marco Rubio said that US will halt issuance of worker visas for commercial truck drivers. Watch: Saia, Old Dominion Freight Line, Knight-Swift Transportation and JB Hunt.

A selloff in big tech this week halted the record-breaking rally in US stocks, ahead of Powell’s latest policy blueprint, which will signal whether the Fed will stay cautious on inflation, which is showing signs of stickiness, or tilt toward supporting a softer labor market. A Bloomberg equal-weighted index of the Mag 7 has dropped 3.4% since Monday, putting it on track for its steepest weekly decline since April’s market rout.

The stakes are heightened by pressure from the Trump administration to cut rates and growing divisions within the Fed’s rate-setting committee. To keep his options open, Powell may emphasize that the Fed’s September move will be guided by employment and inflation figures set for release early next month. Swaps have reduced the odds of aggressive near-term easing, now pricing about a 65% chance of a cut next month and fewer than two moves this year. Little more than a week ago, markets were betting on a full quarter-point cut in September, with some traders even positioning for a half-point move.

Powell is due to speak at 10 a.m. New York time (

In premarket trading, Nvidia shares fell 1.1% after the chip giant instructed component suppliers including Samsung Electronics and Amkor to stop production related to the H20 AI chip. Other Magnificent Seven stocks were all higher (Alphabet +1.1%, Tesla +0.5%, Apple +0.5%, Microsoft +0.09%, Amazon +0.4%, Meta +0.2%). Here are the other notable premarket movers:

Biohaven shares (BHVN) gain 13% after the company said the FDA communicated to the company on Aug. 21 that an expected decision regarding the NDA for Troriluzole will still be the fourth quarter.

Cameco (CCJ) shares rise 1.9% in premarket trading after National Bank Financial raised its price target on the uranium company to C$115 from C$110 as it sees the company’s Westinghouse stake adding value.

Gap shares (GAP) fall 2.1% in premarket trading on Friday as Barclays downgrades to equal-weight from overweight saying the previous bullish scenario for double-digit operating margins by FY26 is off the table.

Intuit shares (INTU) decline 6.1% ahead of the bell after the tax software company’s tepid forecast overshadowed an otherwise strong fourth quarter report.

Ross Stores shares (ROST) rise 2.7% after the retailer posted earnings per share for the second quarter that beat the average analyst estimate after better-than-expected tariff-related costs.

Workday shares (WDAY) drop 5.1% after the human-resources software company reported second-quarter professional services adjusted gross profit that missed estimates. The company also announced it has agreed to acquire Paradox.

Zoom Communications shares (ZM) rise 5.0% in premarket trading on Friday after the video conferencing company raised its revenue guidance for the full year, beating the average analyst estimate.

Trucking stocks might be active on Friday after Secretary of State Marco Rubio said that US will halt issuance of worker visas for commercial truck drivers. Watch: Saia, Old Dominion Freight Line, Knight-Swift Transportation and JB Hunt.

A selloff in big tech this week halted the record-breaking rally in US stocks, ahead of Powell’s latest policy blueprint, which will signal whether the Fed will stay cautious on inflation, which is showing signs of stickiness, or tilt toward supporting a softer labor market. A Bloomberg equal-weighted index of the Mag 7 has dropped 3.4% since Monday, putting it on track for its steepest weekly decline since April’s market rout.

The stakes are heightened by pressure from the Trump administration to cut rates and growing divisions within the Fed’s rate-setting committee. To keep his options open, Powell may emphasize that the Fed’s September move will be guided by employment and inflation figures set for release early next month. Swaps have reduced the odds of aggressive near-term easing, now pricing about a 65% chance of a cut next month and fewer than two moves this year. Little more than a week ago, markets were betting on a full quarter-point cut in September, with some traders even positioning for a half-point move.

Powell is due to speak at 10 a.m. New York time ( There are no indicators as of yet that Bolton, who was Trump's national security adviser from 2018 to 2019, has been arrested or taken into custody.

"NO ONE is above the law," FBI Director Kash Patel

There are no indicators as of yet that Bolton, who was Trump's national security adviser from 2018 to 2019, has been arrested or taken into custody.

"NO ONE is above the law," FBI Director Kash Patel

Back in January Bolton had been among former top officials, and Trump adversaries, to get their costly security protections stripped.

Axios also recalls that Bolton

Back in January Bolton had been among former top officials, and Trump adversaries, to get their costly security protections stripped.

Axios also recalls that Bolton

Trump made the remarks during a nearly 30-minute-long interview with Fox News’ Brett Baier which was filmed on Air Force One and aired while the president was in Alaska meeting with Russian President Vladimir Putin.

“I will never do it as long as you’re president; President Xi told me that, and I said, well, I appreciate that,” Trump said.

The guarantee does not extend to future administrations, the president noted.

“But he also said, but I am very patient, and China is very patient,” Trump said. “Say, well, that’s up to you, but it better not happen now.”

It remains unclear when Xi made the remarks.

The White House did not respond to requests for comment before publication.

Taiwan, a self-governing democratic island territory, is viewed by Beijing as a breakaway province. Its freedom remains a volatile point of contention in U.S.-China relations.

The United States guarantees defensive arms to Taipei under the Taiwan Relations Act.

Xi has vowed to achieve “reunification” with the island by any means necessary, and he’s ramped up military exercises in the waters around the island.

Optimism that the president’s foreign policy agenda will deter China’s aggression is a recurring theme in the administration’s first 200 days.

Treasury Secretary Scott Bessent told CNBC host Andrew Ross Sorkin in March that China will stay out of Taiwan.

“I follow President Trump’s lead, and he is confident that President Xi will not make that move during his presidency,” Bessent said.

U.S. Defense Secretary Pete Hegseth publicly

Trump made the remarks during a nearly 30-minute-long interview with Fox News’ Brett Baier which was filmed on Air Force One and aired while the president was in Alaska meeting with Russian President Vladimir Putin.

“I will never do it as long as you’re president; President Xi told me that, and I said, well, I appreciate that,” Trump said.

The guarantee does not extend to future administrations, the president noted.

“But he also said, but I am very patient, and China is very patient,” Trump said. “Say, well, that’s up to you, but it better not happen now.”

It remains unclear when Xi made the remarks.

The White House did not respond to requests for comment before publication.

Taiwan, a self-governing democratic island territory, is viewed by Beijing as a breakaway province. Its freedom remains a volatile point of contention in U.S.-China relations.

The United States guarantees defensive arms to Taipei under the Taiwan Relations Act.

Xi has vowed to achieve “reunification” with the island by any means necessary, and he’s ramped up military exercises in the waters around the island.

Optimism that the president’s foreign policy agenda will deter China’s aggression is a recurring theme in the administration’s first 200 days.

Treasury Secretary Scott Bessent told CNBC host Andrew Ross Sorkin in March that China will stay out of Taiwan.

“I follow President Trump’s lead, and he is confident that President Xi will not make that move during his presidency,” Bessent said.

U.S. Defense Secretary Pete Hegseth publicly

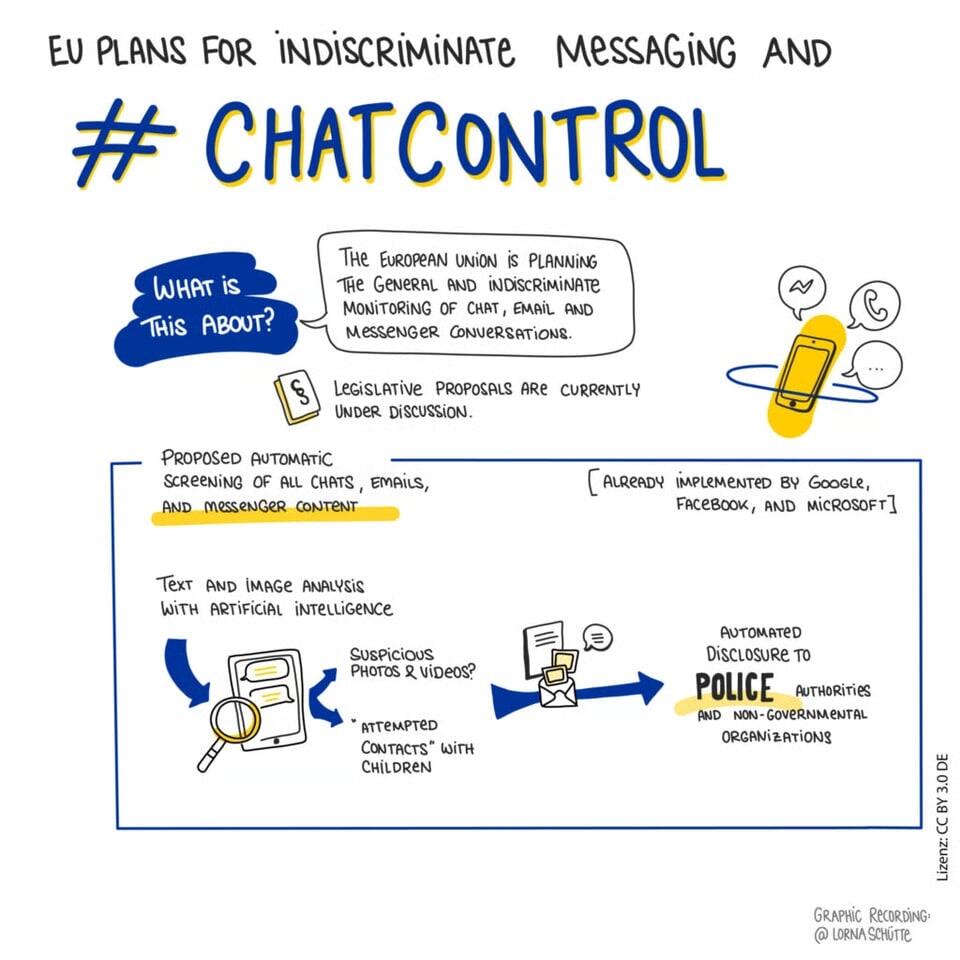

The plan would mandate that messaging platforms, including WhatsApp, Signal and Telegram, must scan every message, photo and video sent by users starting in October, even if end-to-end encryption is in place, popular French tech blogger Korben

The plan would mandate that messaging platforms, including WhatsApp, Signal and Telegram, must scan every message, photo and video sent by users starting in October, even if end-to-end encryption is in place, popular French tech blogger Korben

EU Chat Control bill finds support. Source:

EU Chat Control bill finds support. Source:

An infographic explaining the proposed EU Chat Control bill. Source: Patrick Breyer

France faces societal collapse over censorship

Last month, Telegram founder Pavel Durov warned that

An infographic explaining the proposed EU Chat Control bill. Source: Patrick Breyer

France faces societal collapse over censorship

Last month, Telegram founder Pavel Durov warned that

Then I thought about it a bit more.

Most of us who have been in the markets have probably spent at least six of the 12 first Fridays of the month every year scratching our heads when the monthly report is released. Our staff economist leads us through the various seasonal adjustments, model adjustments, survey participation rates, data revisions to the last two reports and other assorted “kinks” in the reporting, and by the end it usually sounds like nonsense. I believe these monthly reports warrant a good dose of skepticism.

Year-over-year however, I always thought the numbers were relatively accurate, which is why I was pretty surprised when in February

Then I thought about it a bit more.

Most of us who have been in the markets have probably spent at least six of the 12 first Fridays of the month every year scratching our heads when the monthly report is released. Our staff economist leads us through the various seasonal adjustments, model adjustments, survey participation rates, data revisions to the last two reports and other assorted “kinks” in the reporting, and by the end it usually sounds like nonsense. I believe these monthly reports warrant a good dose of skepticism.

Year-over-year however, I always thought the numbers were relatively accurate, which is why I was pretty surprised when in February

A big negative revision for 2024 annual job creation meant that his Democratic opponent had been campaigning on inflated employment numbers. While it was probably just poor data, as Racket’s Matt Taibbi has been tirelessly

A big negative revision for 2024 annual job creation meant that his Democratic opponent had been campaigning on inflated employment numbers. While it was probably just poor data, as Racket’s Matt Taibbi has been tirelessly

Interestingly, while there was much hand-wringing, the incident passed without any investigation. This was a bit “disconcerting” since the Commodity Futures Trading Commission (CFTC) could have discovered who traded right before 8:30 a.m.

The CFTC could have rounded up all the Futures Clearing Merchants and had them divulge which clients placed the trades. It might have taken subpoenas and some investigative work, but the government has folks who do that sort of thing. As far as we know, this was never done, or at least disclosed.

Hilariously, White House Press Secretary Karine Jean-Pierre contorted herself into a pretzel later in the afternoon, essentially telling the press it was no big deal and if it was, the White House wasn’t the leaker!

The Labor Department conducted an initial investigation as to whether the data was hacked and

Interestingly, while there was much hand-wringing, the incident passed without any investigation. This was a bit “disconcerting” since the Commodity Futures Trading Commission (CFTC) could have discovered who traded right before 8:30 a.m.

The CFTC could have rounded up all the Futures Clearing Merchants and had them divulge which clients placed the trades. It might have taken subpoenas and some investigative work, but the government has folks who do that sort of thing. As far as we know, this was never done, or at least disclosed.

Hilariously, White House Press Secretary Karine Jean-Pierre contorted herself into a pretzel later in the afternoon, essentially telling the press it was no big deal and if it was, the White House wasn’t the leaker!

The Labor Department conducted an initial investigation as to whether the data was hacked and

This lab-built virus—A/duck/Hokkaido/Vac-3/2007 (H5N1)—was never observed in nature.

It was artificially assembled, grown in eggs, concentrated, and inactivated with formalin to become the whole-particle vaccine used in long-term testing on nonhuman primates.

The new study comes after NIH-funded researchers at the University of Georgia, Mount Sinai, and Texas Biomed were caught

This lab-built virus—A/duck/Hokkaido/Vac-3/2007 (H5N1)—was never observed in nature.

It was artificially assembled, grown in eggs, concentrated, and inactivated with formalin to become the whole-particle vaccine used in long-term testing on nonhuman primates.

The new study comes after NIH-funded researchers at the University of Georgia, Mount Sinai, and Texas Biomed were caught

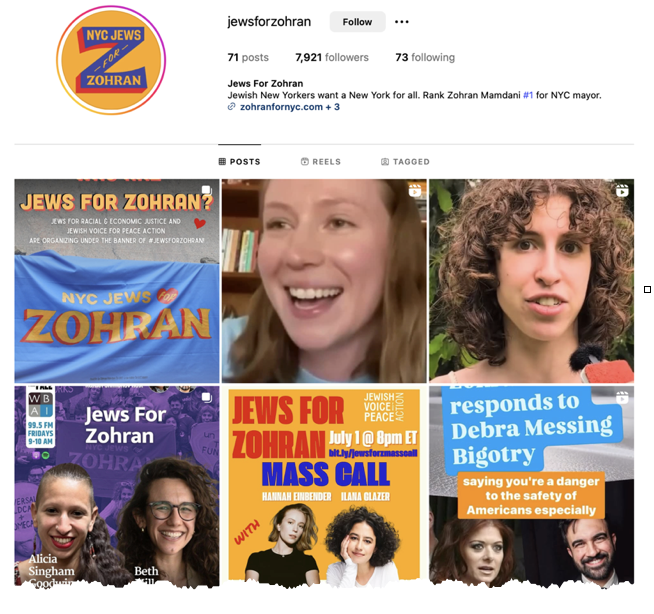

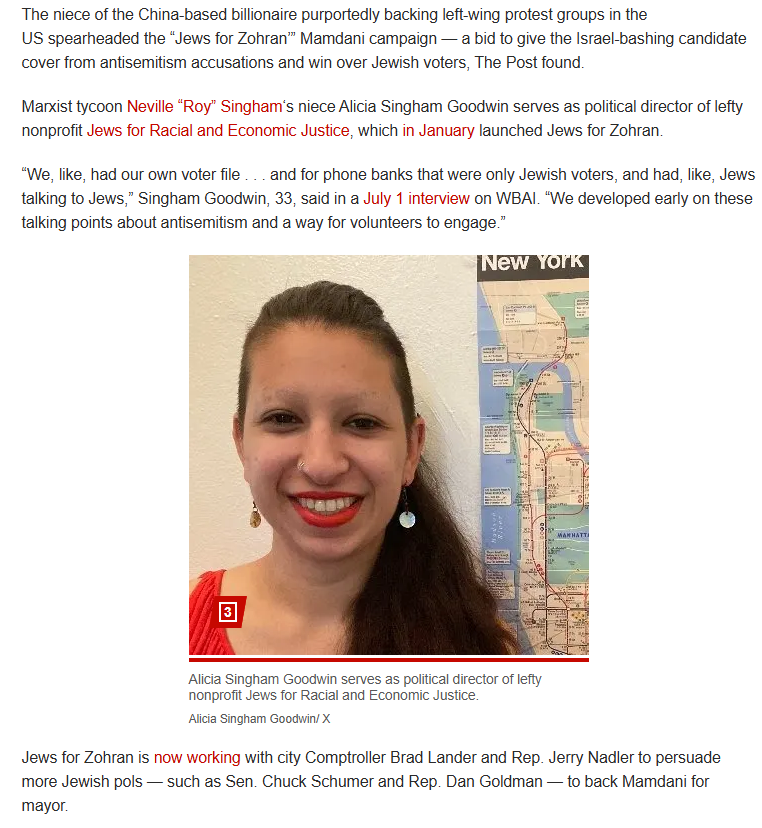

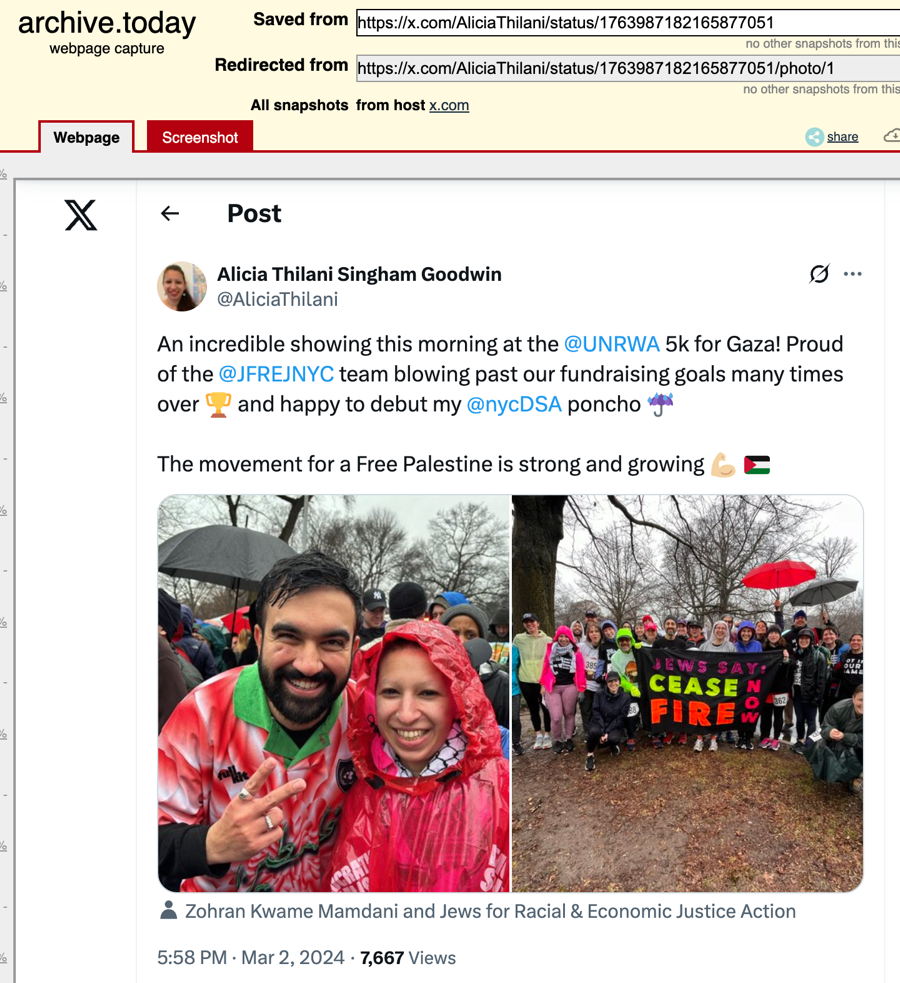

The irony? None of these candidates are Jewish. All of them, however, are staunchly anti-Israel. And the newest addition to this cast of characters has a direct tie to one of the world's most prolific spreaders of Chinese Communist Party (CCP) propaganda.

A

The irony? None of these candidates are Jewish. All of them, however, are staunchly anti-Israel. And the newest addition to this cast of characters has a direct tie to one of the world's most prolific spreaders of Chinese Communist Party (CCP) propaganda.

A  So let me get this straight. The head of "Jews for Zohran" is the niece of Chinese govt allied billionaire Neville Roy Singham. Her mother is not Jewish but rather Sri Lankan/Chinese. The gaslighting they're doing to whitewash Zohran Mamdani's antisemitism is really next level.

So let me get this straight. The head of "Jews for Zohran" is the niece of Chinese govt allied billionaire Neville Roy Singham. Her mother is not Jewish but rather Sri Lankan/Chinese. The gaslighting they're doing to whitewash Zohran Mamdani's antisemitism is really next level.

Singham's network operates like a political virus, infecting vulnerable democracies, seeding chaos, and eroding support for America and its allies from within. It has successfully embedded itself in grassroots movements, NGOs, and now electoral campaigns.

The nexus of Neville Roy Singham's global operation and New York's Democratic machine is no laughing matter. The same tactics that fueled violence in Delhi and sowed unrest in California are now knocking on Gracie Mansion's door.

Singham's network operates like a political virus, infecting vulnerable democracies, seeding chaos, and eroding support for America and its allies from within. It has successfully embedded itself in grassroots movements, NGOs, and now electoral campaigns.

The nexus of Neville Roy Singham's global operation and New York's Democratic machine is no laughing matter. The same tactics that fueled violence in Delhi and sowed unrest in California are now knocking on Gracie Mansion's door.

Musk has floated a Tesla investment in xAI for months. In July, following Tesla’s previous annual meeting, he ran a social media poll asking if Tesla should invest $5 billion “assuming the valuation is set by several credible outside investors.” About two-thirds of nearly a million respondents agreed. Musk then pledged to bring the idea to Tesla’s board.

xAI’s path to AGI is proving costly. Bloomberg estimates the startup, founded in 2023, could burn through $13 billion this year. Musk dismissed the report as “nonsense” but didn’t elaborate. Two weeks later, xAI raised $10 billion—half of it through debt, a rare move for a high-growth tech startup. Morgan Stanley reportedly helped facilitate the raise, with SpaceX’s $2 billion investment included.

Grok also sparked controversy last week by posting antisemitic content on X, likening itself to “a mechanized version of Adolf Hitler.” Following the backlash, X CEO Linda Yaccarino resigned. xAI later apologized: “We deeply apologize for the horrific behavior that many experienced.”

Tesla’s last high-profile deal involving a Musk-led company was the 2016 SolarCity acquisition for $2.6 billion—criticized as a bailout but ultimately upheld by Delaware courts.

“We believe Tesla making a big investment in xAI is a key step forward,” Wedbush analyst Dan Ives wrote on Monday.

Musk has floated a Tesla investment in xAI for months. In July, following Tesla’s previous annual meeting, he ran a social media poll asking if Tesla should invest $5 billion “assuming the valuation is set by several credible outside investors.” About two-thirds of nearly a million respondents agreed. Musk then pledged to bring the idea to Tesla’s board.

xAI’s path to AGI is proving costly. Bloomberg estimates the startup, founded in 2023, could burn through $13 billion this year. Musk dismissed the report as “nonsense” but didn’t elaborate. Two weeks later, xAI raised $10 billion—half of it through debt, a rare move for a high-growth tech startup. Morgan Stanley reportedly helped facilitate the raise, with SpaceX’s $2 billion investment included.

Grok also sparked controversy last week by posting antisemitic content on X, likening itself to “a mechanized version of Adolf Hitler.” Following the backlash, X CEO Linda Yaccarino resigned. xAI later apologized: “We deeply apologize for the horrific behavior that many experienced.”

Tesla’s last high-profile deal involving a Musk-led company was the 2016 SolarCity acquisition for $2.6 billion—criticized as a bailout but ultimately upheld by Delaware courts.

“We believe Tesla making a big investment in xAI is a key step forward,” Wedbush analyst Dan Ives wrote on Monday.