Key Events This Very Busy Week: CPI, PPI, Retail Sales, Tons Of Fed Speakers And Earnings Season Begins

Key Events This Very Busy Week: CPI, PPI, Retail Sales, Tons Of Fed Speakers And Earnings Season Begins

As trade letters from the US continue to get mailed out, DB's Jim Reid writes that April 2nd has become July 9th which has become August 1st for an ever increasing list of countries. In the early hours of Saturday, Trump’s stationary cupboard was opened again and a letter was sent to the EU and Mexico informing them that they would face 30% tariffs on August 1st. To be fair, a month ago Trump threaten the EU with a 50% tariff so you might argue this is an improvement! The market will generally think this is mostly a negotiating tactic and that we’re unlikely to see such rates. The EU have been measured in their response so far and have extended the suspension of trade countermeasures that were supposed to kick-in tomorrow night. This will now be aligned to the August 1st deadline. So the EU and the market are hoping and expecting diplomacy to win out.

However at some stage, the DB strategist warns that someone’s bluff could be called. Trump is under less pressure to back down with US risk markets around their highs and bond markets relatively stable at the moment. If huge tariffs do get imposed on August 1st, in thin holiday markets, we could get a sizeable market reaction. So the next three weeks of negotiating will be key to restful holidays everywhere.

One thing is certain: much will still depend on the inflation trajectory. If all is calm on this front then we could move on but if we start to see slippage here, then a removal of a Fed Chair could be a big problem, at least initially, for a country with huge twin deficits.

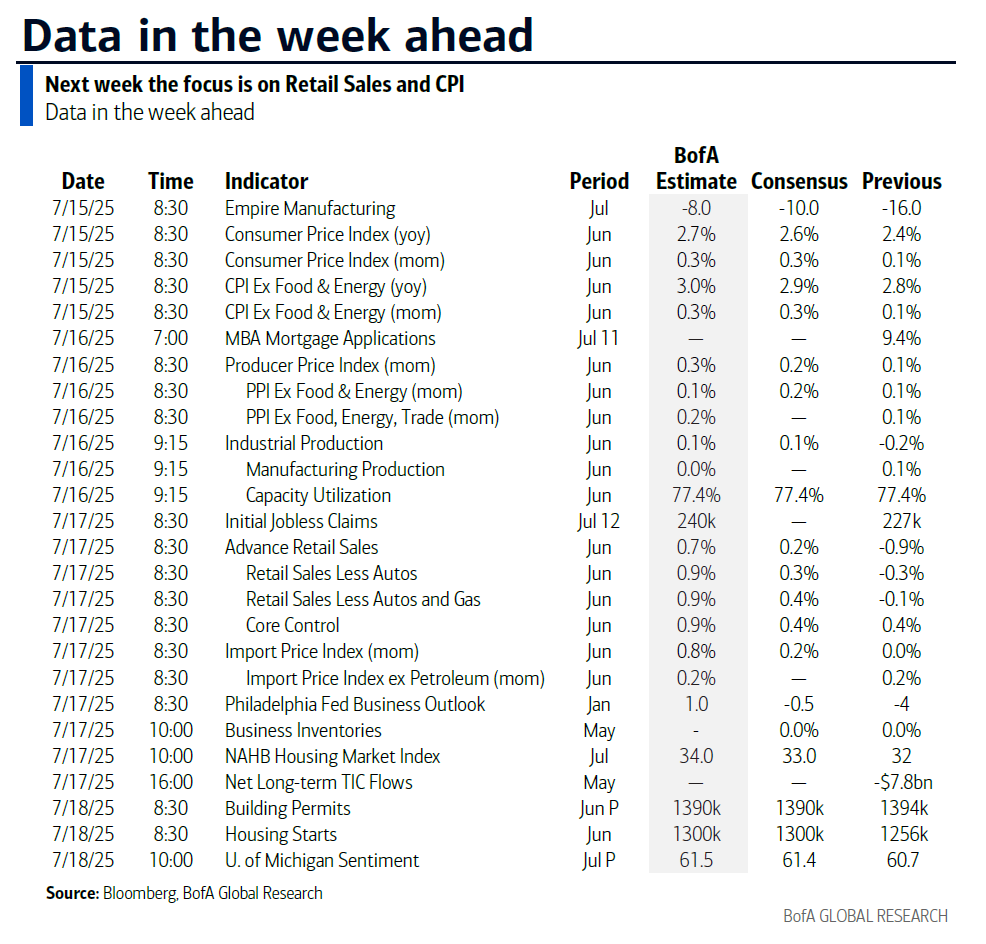

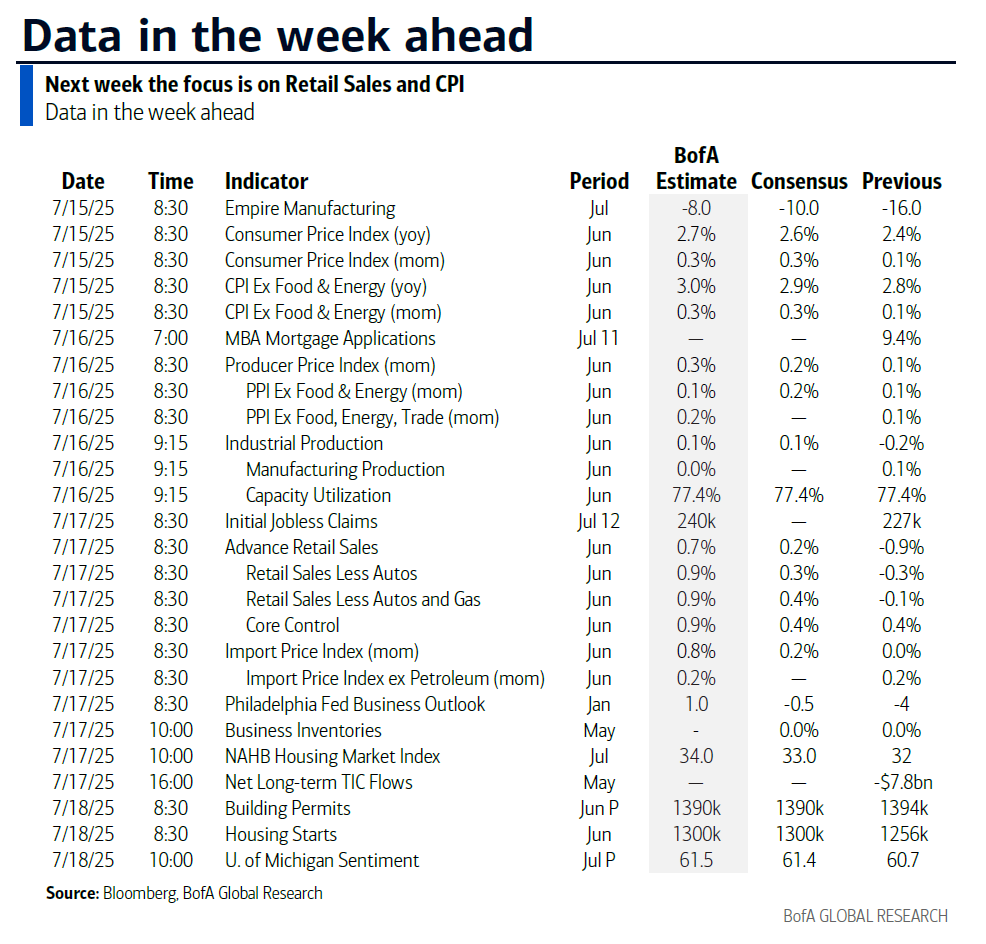

Given the above, this week is important as we see the latest US CPI numbers (tomorrow) with PPI (Wednesday) following. Before we preview these, the other key global releases are the other CPI numbers in Canada (also tomorrow), the UK (Wednesday) and Japan (Friday). In the US, there will also be retail sales (Thursday) and industrial production (Wednesday) reports for June, along with the preliminary University of Michigan survey (Friday) for July. Claims on Thursday corresponds to payroll survey week so it’ll be interesting to see whether the recent improvements continue given the payroll implications. Growth will also be in focus in China, where Q2 GDP and June activity data are out tomorrow. Also important will be the US banks kicking off the Q2 earnings season tomorrow, with semiconductor firms ASML and TSMC also reporting this week.

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists’ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

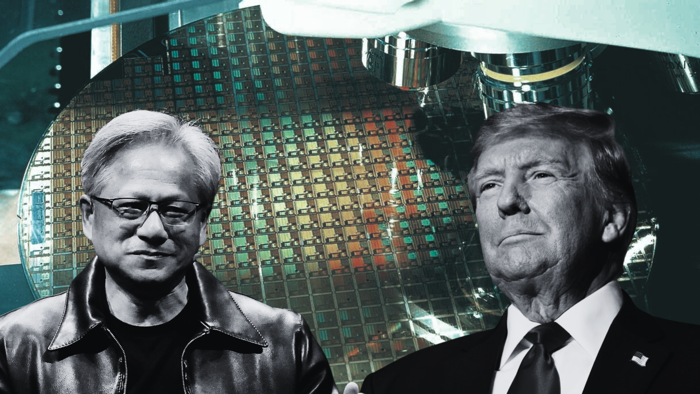

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of "Crypto Week" where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 14

Data: China June trade balance, Japan May core machine orders, capacity utilisation

Central banks: ECB's Vujcic and Cipollone speak

Tuesday July 15

Data: US June CPI, July Empire manufacturing index, China Q2 GDP, June retail sales, industrial production, home prices, Germany July ZEW survey, Eurozone July ZEW survey, May industrial production, Italy May general government debt, Canada June CPI, existing home sales, May manufacturing sales

Central banks: Fed's Bowman, Barr, Collins and Barkin speak, BoE's Bailey speaks

Earnings: JPMorgan Chase, Wells Fargo, Blackrock, Citigroup, Bank of New York Mellon

Wednesday July 16

Data: US June PPI, industrial production, capacity utilisation, July New York Fed services business activity, UK June CPI, RPI, May house price index, Italy May trade balance, Eurozone May trade balance, Canada June housing starts

Central banks: Fed's Beige Book, Fed's Logan, Hammack, Barr, Williams and Barkin speak

Earnings: Johnson & Johnson, Bank of America, ASML, Morgan Stanley, Goldman Sachs, Kinder Morgan, Sandvik, United Airlines, Alcoa

Thursday July 17

Data: US June retail sales, import price index, export price index, July Philadelphia Fed business outlook, NAHB housing market index, May business inventories, total net TIC flows, initial jobless claims, UK May average weekly earnings, unemployment rate, June jobless claims change, Japan June trade balance, Canada May international securities transactions, Australia June labour force survey

Central banks: Fed's Kugler, Daly, Cook and Waller speak

Earnings: TSMC, Netflix, General Electric, Novartis, Abbott Laboratories, PepsiCo, ABB, Interactive Brokers, Elevance Health, Volvo, EQT AB, Evolution

Friday July 18

Data: US July University of Michigan survey, June building permits, housing starts, Japan June national CPI, Germany June PPI, Italy May current account balance, ECB May current account, Eurozone May construction output

Earnings: American Express, Charles Schwab, Schlumberger, Saab

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

There are no major economic data releases scheduled.

Tuesday, July 15

08:30 AM CPI (MoM), June (GS +0.30%, consensus +0.3%, last +0.1%); Core CPI (MoM), June (GS +0.23%, consensus +0.3%, last +0.1%); CPI (YoY), June (GS +2.68%, consensus +2.6%, last +2.4%); Core CPI (YoY), June (GS +2.93%, consensus +2.9%, last +2.8%): We estimate a 0.23% increase in June core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, unchanged new car prices, and a more moderate increase in the car insurance category (+0.3%) based on premiums in our online dataset. We forecast a modest rebound in airfares in June (+1%), though we see meaningful two-sided risk to this component, reflecting a large headwind from seasonal distortions but a large increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation. We expect the shelter components to rebound slightly on net (primary rent +0.25% vs. +0.21% in May; OER +0.27% vs. +0.27%). We estimate a 0.30% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in June. We will update our core PCE forecast after the CPI is released.

08:30 AM Empire State manufacturing survey, July (consensus -9.6, last -16.0)

09:15 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give welcoming remarks at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 23rd, Bowman said that she would “support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

12:45 PM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on financial inclusion at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 24th, Barr said that “monetary policy is well positioned” to allow the Fed to “wait and see how economic conditions unfold.” He also added that he expects “inflation to rise due to tariffs,” and that higher short-term inflation expectations, supply chain adjustments, and second-round effects may cause “some inflation persistence.”

01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver the speech “Forecasting Beyond Today's Data” in Baltimore. He previously gave the same speech on June 26th. Speech text and audience Q&A are expected. On July 2nd, Barkin noted that there is no urgency to adjust policy at the moment, as “the numbers on the economy are very solid.”

02:45 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver the closing keynote at the 2025 Economic Measurement Seminar in Washington DC. Speech text is expected. On June 25th, Collins said that she sees “monetary policy as currently well positioned,” and that she favors “a careful, patient, and highly attentive approach” as the implications of tariffs and other changes in government policies are assessed. She also indicated that her baseline outlook is to resume lowering the fed funds rate later in the year.

07:45 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks and speak about the economy in an event hosted by the World Affairs Council of San Antonio. Speech text and audience Q&A are expected. On June 2nd, Logan said that risks on both sides of the dual mandate appear “fairly balanced,” leaving the Fed well positioned “to wait for the data” and “to be patient.”

Wednesday, July 16

08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the speech “Forecasting Beyond Today's Data” in Westminster, Maryland. Speech text and audience Q&A are expected.

08:30 AM PPI final demand, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, June (GS +0.1%, consensus +0.2%, last +0.1%)

09:15 AM Industrial production, June (GS flat, consensus +0.1%, last -0.2%): Manufacturing production, June (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, June (GS 77.3%, consensus 77.4%, last 77.4%): We estimate industrial production was unchanged in June, as strong electricity production balanced weak auto production. We estimate capacity utilization declined slightly to 77.3%.

09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Corporate College 20th Anniversary Celebration Business Breakfast at Cuyahoga Community College. Speech text is expected. On June 24th, Hammack said that, despite recent progress, the Fed still has “some distance to go” before reaching its inflation target. She indicated that “it may well be the case that policy remains on hold for quite some time before the Committee initiates very modest cuts to return policy to a neutral setting.”

10:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at a Brookings event on financial regulation. Speech text and moderated and audience Q&A are expected.

02:00 PM Beige Book, July meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity had declined slightly since April, with six districts reporting “slight to moderate declines” in activity, three districts reporting “no change” in activity, and the remaining three districts reporting “slight growth.” It also noted that all districts reported “elevated levels” of economic and policy uncertainty. In line with the previous report, the outlook remained slightly pessimistic and uncertain, as a few districts anticipated a deterioration but a few others anticipated an improvement in economic conditions. In this month's Beige Book, we look for anecdotes related to the evolution of policy uncertainty and firms' expectations for the pass-through of tariff-related costs to consumer prices.

05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks on the economic outlook and monetary policy at an event hosted by the New York Association for Business Economics. On June 24th, Williams noted that it is “entirely appropriate” to maintain “a modestly restrictive stance of monetary policy” while assessing the full impact of policy changes on the labor market and inflation. He also indicated that he expects real GDP growth to “slow considerably from last year's pace” as a result of uncertainty, tariffs, and reduced immigration.

Thursday, July 17

08:30 AM Retail sales, June (GS flat, consensus +0.1%, last -0.9%); Retail sales ex-auto, June (GS +0.2%, consensus +0.3%, last -0.3%); Retail sales ex-auto & gas, June (GS +0.2%, consensus +0.3%, last -0.1%); Core retail sales, June (GS +0.4%, consensus +0.3%, last +0.4%); We estimate core retail sales increased: 0.4% in June (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed measures of card spending but a potential boost from spending around the Juneteenth holiday. We estimate headline retail sales were unchanged, reflecting sharply lower auto sales.

08:30 AM Import price index, June (consensus +0.3%, last flat)

08:30 AM Initial jobless claims, week ended July 12 (GS 237k, consensus 233k, last 227k): Continuing jobless claims, week ended July 5 (consensus 1,965k, last 1,965k)

08:30 AM Philadelphia Fed manufacturing index, July (GS -1.0, consensus -1.0, last -4.0)

10:00 AM Business inventories, May (consensus flat, last flat)

10:00 AM NAHB housing market index, July (consensus 33, last 32)

10:00 AM Fed Governor Adriana Kugler speaks: Fed Governor Adriana Kugler will speak on housing and the US economic outlook at an event hosted by the Housing Partnership Network Symposium. Speech text is expected. On June 5th, Kugler said that she sees “greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road,” leading her to “support maintaining the FOMC's policy rate at its current setting if upside risks to inflation remain.”

12:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will appear on Bloomberg TV from the Rocky Mountain Economic Summit in Victor, Idaho. On July 10th, Daly said that she sees two interest rate cuts by the end of the year as “a likely outcome.” She also noted that there is a greater chance that the price effects from tariffs may be more limited than anticipated, as “businesses find ways to adjust” to higher costs.

01:30 PM Fed Governor Lisa Cook speaks: Fed Governor Lisa Cook will speak on AI and innovation at the NBER Summer Institute. Speech text and moderated Q&A are expected. On June 3rd, Cook noted that the economy is still in “a solid position” but “heightened uncertainty due to changes in trade policy poses risks to both price stability and unemployment.” She added that “monetary policy will need to carefully balance our dual mandate goals.”

06:30 PM Fed Governor Christopher Waller speaks: Fed Governor Christopher Waller will speak on the US economic outlook and monetary policy at the Money Marketeers of NYU. Speech text and moderated and audience Q&A are expected. On July 10th, Waller said that the Fed “could consider cutting the policy rate in July.” He also noted that the Fed should continue shrinking the size of its balance sheet, as bank reserves are currently above an “ample” level. On June 20th, Waller noted that policy had been “on pause for six months to wait and see, and so far the data has been fine.”

Friday, July 18

08:30 AM Housing starts, June (GS +2.0%, consensus +3.1%, last -9.8%) ; Building permits, June (consensus -0.5%, last -2.0%)

10:00 AM University of Michigan consumer sentiment, July preliminary (GS 61.5, consensus 61.4, last 60.7); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.9%, consensus 4.0%, last 4.0%)

Source: DB, Goldman

Mon, 07/14/2025 - 10:00

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists’ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of "Crypto Week" where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 14

Data: China June trade balance, Japan May core machine orders, capacity utilisation

Central banks: ECB's Vujcic and Cipollone speak

Tuesday July 15

Data: US June CPI, July Empire manufacturing index, China Q2 GDP, June retail sales, industrial production, home prices, Germany July ZEW survey, Eurozone July ZEW survey, May industrial production, Italy May general government debt, Canada June CPI, existing home sales, May manufacturing sales

Central banks: Fed's Bowman, Barr, Collins and Barkin speak, BoE's Bailey speaks

Earnings: JPMorgan Chase, Wells Fargo, Blackrock, Citigroup, Bank of New York Mellon

Wednesday July 16

Data: US June PPI, industrial production, capacity utilisation, July New York Fed services business activity, UK June CPI, RPI, May house price index, Italy May trade balance, Eurozone May trade balance, Canada June housing starts

Central banks: Fed's Beige Book, Fed's Logan, Hammack, Barr, Williams and Barkin speak

Earnings: Johnson & Johnson, Bank of America, ASML, Morgan Stanley, Goldman Sachs, Kinder Morgan, Sandvik, United Airlines, Alcoa

Thursday July 17

Data: US June retail sales, import price index, export price index, July Philadelphia Fed business outlook, NAHB housing market index, May business inventories, total net TIC flows, initial jobless claims, UK May average weekly earnings, unemployment rate, June jobless claims change, Japan June trade balance, Canada May international securities transactions, Australia June labour force survey

Central banks: Fed's Kugler, Daly, Cook and Waller speak

Earnings: TSMC, Netflix, General Electric, Novartis, Abbott Laboratories, PepsiCo, ABB, Interactive Brokers, Elevance Health, Volvo, EQT AB, Evolution

Friday July 18

Data: US July University of Michigan survey, June building permits, housing starts, Japan June national CPI, Germany June PPI, Italy May current account balance, ECB May current account, Eurozone May construction output

Earnings: American Express, Charles Schwab, Schlumberger, Saab

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

There are no major economic data releases scheduled.

Tuesday, July 15

08:30 AM CPI (MoM), June (GS +0.30%, consensus +0.3%, last +0.1%); Core CPI (MoM), June (GS +0.23%, consensus +0.3%, last +0.1%); CPI (YoY), June (GS +2.68%, consensus +2.6%, last +2.4%); Core CPI (YoY), June (GS +2.93%, consensus +2.9%, last +2.8%): We estimate a 0.23% increase in June core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, unchanged new car prices, and a more moderate increase in the car insurance category (+0.3%) based on premiums in our online dataset. We forecast a modest rebound in airfares in June (+1%), though we see meaningful two-sided risk to this component, reflecting a large headwind from seasonal distortions but a large increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation. We expect the shelter components to rebound slightly on net (primary rent +0.25% vs. +0.21% in May; OER +0.27% vs. +0.27%). We estimate a 0.30% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in June. We will update our core PCE forecast after the CPI is released.

08:30 AM Empire State manufacturing survey, July (consensus -9.6, last -16.0)

09:15 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give welcoming remarks at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 23rd, Bowman said that she would “support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

12:45 PM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on financial inclusion at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 24th, Barr said that “monetary policy is well positioned” to allow the Fed to “wait and see how economic conditions unfold.” He also added that he expects “inflation to rise due to tariffs,” and that higher short-term inflation expectations, supply chain adjustments, and second-round effects may cause “some inflation persistence.”

01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver the speech “Forecasting Beyond Today's Data” in Baltimore. He previously gave the same speech on June 26th. Speech text and audience Q&A are expected. On July 2nd, Barkin noted that there is no urgency to adjust policy at the moment, as “the numbers on the economy are very solid.”

02:45 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver the closing keynote at the 2025 Economic Measurement Seminar in Washington DC. Speech text is expected. On June 25th, Collins said that she sees “monetary policy as currently well positioned,” and that she favors “a careful, patient, and highly attentive approach” as the implications of tariffs and other changes in government policies are assessed. She also indicated that her baseline outlook is to resume lowering the fed funds rate later in the year.

07:45 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks and speak about the economy in an event hosted by the World Affairs Council of San Antonio. Speech text and audience Q&A are expected. On June 2nd, Logan said that risks on both sides of the dual mandate appear “fairly balanced,” leaving the Fed well positioned “to wait for the data” and “to be patient.”

Wednesday, July 16

08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the speech “Forecasting Beyond Today's Data” in Westminster, Maryland. Speech text and audience Q&A are expected.

08:30 AM PPI final demand, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, June (GS +0.1%, consensus +0.2%, last +0.1%)

09:15 AM Industrial production, June (GS flat, consensus +0.1%, last -0.2%): Manufacturing production, June (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, June (GS 77.3%, consensus 77.4%, last 77.4%): We estimate industrial production was unchanged in June, as strong electricity production balanced weak auto production. We estimate capacity utilization declined slightly to 77.3%.

09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Corporate College 20th Anniversary Celebration Business Breakfast at Cuyahoga Community College. Speech text is expected. On June 24th, Hammack said that, despite recent progress, the Fed still has “some distance to go” before reaching its inflation target. She indicated that “it may well be the case that policy remains on hold for quite some time before the Committee initiates very modest cuts to return policy to a neutral setting.”

10:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at a Brookings event on financial regulation. Speech text and moderated and audience Q&A are expected.

02:00 PM Beige Book, July meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity had declined slightly since April, with six districts reporting “slight to moderate declines” in activity, three districts reporting “no change” in activity, and the remaining three districts reporting “slight growth.” It also noted that all districts reported “elevated levels” of economic and policy uncertainty. In line with the previous report, the outlook remained slightly pessimistic and uncertain, as a few districts anticipated a deterioration but a few others anticipated an improvement in economic conditions. In this month's Beige Book, we look for anecdotes related to the evolution of policy uncertainty and firms' expectations for the pass-through of tariff-related costs to consumer prices.

05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks on the economic outlook and monetary policy at an event hosted by the New York Association for Business Economics. On June 24th, Williams noted that it is “entirely appropriate” to maintain “a modestly restrictive stance of monetary policy” while assessing the full impact of policy changes on the labor market and inflation. He also indicated that he expects real GDP growth to “slow considerably from last year's pace” as a result of uncertainty, tariffs, and reduced immigration.

Thursday, July 17

08:30 AM Retail sales, June (GS flat, consensus +0.1%, last -0.9%); Retail sales ex-auto, June (GS +0.2%, consensus +0.3%, last -0.3%); Retail sales ex-auto & gas, June (GS +0.2%, consensus +0.3%, last -0.1%); Core retail sales, June (GS +0.4%, consensus +0.3%, last +0.4%); We estimate core retail sales increased: 0.4% in June (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed measures of card spending but a potential boost from spending around the Juneteenth holiday. We estimate headline retail sales were unchanged, reflecting sharply lower auto sales.

08:30 AM Import price index, June (consensus +0.3%, last flat)

08:30 AM Initial jobless claims, week ended July 12 (GS 237k, consensus 233k, last 227k): Continuing jobless claims, week ended July 5 (consensus 1,965k, last 1,965k)

08:30 AM Philadelphia Fed manufacturing index, July (GS -1.0, consensus -1.0, last -4.0)

10:00 AM Business inventories, May (consensus flat, last flat)

10:00 AM NAHB housing market index, July (consensus 33, last 32)

10:00 AM Fed Governor Adriana Kugler speaks: Fed Governor Adriana Kugler will speak on housing and the US economic outlook at an event hosted by the Housing Partnership Network Symposium. Speech text is expected. On June 5th, Kugler said that she sees “greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road,” leading her to “support maintaining the FOMC's policy rate at its current setting if upside risks to inflation remain.”

12:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will appear on Bloomberg TV from the Rocky Mountain Economic Summit in Victor, Idaho. On July 10th, Daly said that she sees two interest rate cuts by the end of the year as “a likely outcome.” She also noted that there is a greater chance that the price effects from tariffs may be more limited than anticipated, as “businesses find ways to adjust” to higher costs.

01:30 PM Fed Governor Lisa Cook speaks: Fed Governor Lisa Cook will speak on AI and innovation at the NBER Summer Institute. Speech text and moderated Q&A are expected. On June 3rd, Cook noted that the economy is still in “a solid position” but “heightened uncertainty due to changes in trade policy poses risks to both price stability and unemployment.” She added that “monetary policy will need to carefully balance our dual mandate goals.”

06:30 PM Fed Governor Christopher Waller speaks: Fed Governor Christopher Waller will speak on the US economic outlook and monetary policy at the Money Marketeers of NYU. Speech text and moderated and audience Q&A are expected. On July 10th, Waller said that the Fed “could consider cutting the policy rate in July.” He also noted that the Fed should continue shrinking the size of its balance sheet, as bank reserves are currently above an “ample” level. On June 20th, Waller noted that policy had been “on pause for six months to wait and see, and so far the data has been fine.”

Friday, July 18

08:30 AM Housing starts, June (GS +2.0%, consensus +3.1%, last -9.8%) ; Building permits, June (consensus -0.5%, last -2.0%)

10:00 AM University of Michigan consumer sentiment, July preliminary (GS 61.5, consensus 61.4, last 60.7); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.9%, consensus 4.0%, last 4.0%)

Source: DB, Goldman

Mon, 07/14/2025 - 10:00

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists’ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of "Crypto Week" where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 14

Data: China June trade balance, Japan May core machine orders, capacity utilisation

Central banks: ECB's Vujcic and Cipollone speak

Tuesday July 15

Data: US June CPI, July Empire manufacturing index, China Q2 GDP, June retail sales, industrial production, home prices, Germany July ZEW survey, Eurozone July ZEW survey, May industrial production, Italy May general government debt, Canada June CPI, existing home sales, May manufacturing sales

Central banks: Fed's Bowman, Barr, Collins and Barkin speak, BoE's Bailey speaks

Earnings: JPMorgan Chase, Wells Fargo, Blackrock, Citigroup, Bank of New York Mellon

Wednesday July 16

Data: US June PPI, industrial production, capacity utilisation, July New York Fed services business activity, UK June CPI, RPI, May house price index, Italy May trade balance, Eurozone May trade balance, Canada June housing starts

Central banks: Fed's Beige Book, Fed's Logan, Hammack, Barr, Williams and Barkin speak

Earnings: Johnson & Johnson, Bank of America, ASML, Morgan Stanley, Goldman Sachs, Kinder Morgan, Sandvik, United Airlines, Alcoa

Thursday July 17

Data: US June retail sales, import price index, export price index, July Philadelphia Fed business outlook, NAHB housing market index, May business inventories, total net TIC flows, initial jobless claims, UK May average weekly earnings, unemployment rate, June jobless claims change, Japan June trade balance, Canada May international securities transactions, Australia June labour force survey

Central banks: Fed's Kugler, Daly, Cook and Waller speak

Earnings: TSMC, Netflix, General Electric, Novartis, Abbott Laboratories, PepsiCo, ABB, Interactive Brokers, Elevance Health, Volvo, EQT AB, Evolution

Friday July 18

Data: US July University of Michigan survey, June building permits, housing starts, Japan June national CPI, Germany June PPI, Italy May current account balance, ECB May current account, Eurozone May construction output

Earnings: American Express, Charles Schwab, Schlumberger, Saab

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

There are no major economic data releases scheduled.

Tuesday, July 15

08:30 AM CPI (MoM), June (GS +0.30%, consensus +0.3%, last +0.1%); Core CPI (MoM), June (GS +0.23%, consensus +0.3%, last +0.1%); CPI (YoY), June (GS +2.68%, consensus +2.6%, last +2.4%); Core CPI (YoY), June (GS +2.93%, consensus +2.9%, last +2.8%): We estimate a 0.23% increase in June core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, unchanged new car prices, and a more moderate increase in the car insurance category (+0.3%) based on premiums in our online dataset. We forecast a modest rebound in airfares in June (+1%), though we see meaningful two-sided risk to this component, reflecting a large headwind from seasonal distortions but a large increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation. We expect the shelter components to rebound slightly on net (primary rent +0.25% vs. +0.21% in May; OER +0.27% vs. +0.27%). We estimate a 0.30% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in June. We will update our core PCE forecast after the CPI is released.

08:30 AM Empire State manufacturing survey, July (consensus -9.6, last -16.0)

09:15 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give welcoming remarks at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 23rd, Bowman said that she would “support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

12:45 PM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on financial inclusion at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 24th, Barr said that “monetary policy is well positioned” to allow the Fed to “wait and see how economic conditions unfold.” He also added that he expects “inflation to rise due to tariffs,” and that higher short-term inflation expectations, supply chain adjustments, and second-round effects may cause “some inflation persistence.”

01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver the speech “Forecasting Beyond Today's Data” in Baltimore. He previously gave the same speech on June 26th. Speech text and audience Q&A are expected. On July 2nd, Barkin noted that there is no urgency to adjust policy at the moment, as “the numbers on the economy are very solid.”

02:45 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver the closing keynote at the 2025 Economic Measurement Seminar in Washington DC. Speech text is expected. On June 25th, Collins said that she sees “monetary policy as currently well positioned,” and that she favors “a careful, patient, and highly attentive approach” as the implications of tariffs and other changes in government policies are assessed. She also indicated that her baseline outlook is to resume lowering the fed funds rate later in the year.

07:45 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks and speak about the economy in an event hosted by the World Affairs Council of San Antonio. Speech text and audience Q&A are expected. On June 2nd, Logan said that risks on both sides of the dual mandate appear “fairly balanced,” leaving the Fed well positioned “to wait for the data” and “to be patient.”

Wednesday, July 16

08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the speech “Forecasting Beyond Today's Data” in Westminster, Maryland. Speech text and audience Q&A are expected.

08:30 AM PPI final demand, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, June (GS +0.1%, consensus +0.2%, last +0.1%)

09:15 AM Industrial production, June (GS flat, consensus +0.1%, last -0.2%): Manufacturing production, June (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, June (GS 77.3%, consensus 77.4%, last 77.4%): We estimate industrial production was unchanged in June, as strong electricity production balanced weak auto production. We estimate capacity utilization declined slightly to 77.3%.

09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Corporate College 20th Anniversary Celebration Business Breakfast at Cuyahoga Community College. Speech text is expected. On June 24th, Hammack said that, despite recent progress, the Fed still has “some distance to go” before reaching its inflation target. She indicated that “it may well be the case that policy remains on hold for quite some time before the Committee initiates very modest cuts to return policy to a neutral setting.”

10:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at a Brookings event on financial regulation. Speech text and moderated and audience Q&A are expected.

02:00 PM Beige Book, July meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity had declined slightly since April, with six districts reporting “slight to moderate declines” in activity, three districts reporting “no change” in activity, and the remaining three districts reporting “slight growth.” It also noted that all districts reported “elevated levels” of economic and policy uncertainty. In line with the previous report, the outlook remained slightly pessimistic and uncertain, as a few districts anticipated a deterioration but a few others anticipated an improvement in economic conditions. In this month's Beige Book, we look for anecdotes related to the evolution of policy uncertainty and firms' expectations for the pass-through of tariff-related costs to consumer prices.

05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks on the economic outlook and monetary policy at an event hosted by the New York Association for Business Economics. On June 24th, Williams noted that it is “entirely appropriate” to maintain “a modestly restrictive stance of monetary policy” while assessing the full impact of policy changes on the labor market and inflation. He also indicated that he expects real GDP growth to “slow considerably from last year's pace” as a result of uncertainty, tariffs, and reduced immigration.

Thursday, July 17

08:30 AM Retail sales, June (GS flat, consensus +0.1%, last -0.9%); Retail sales ex-auto, June (GS +0.2%, consensus +0.3%, last -0.3%); Retail sales ex-auto & gas, June (GS +0.2%, consensus +0.3%, last -0.1%); Core retail sales, June (GS +0.4%, consensus +0.3%, last +0.4%); We estimate core retail sales increased: 0.4% in June (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed measures of card spending but a potential boost from spending around the Juneteenth holiday. We estimate headline retail sales were unchanged, reflecting sharply lower auto sales.

08:30 AM Import price index, June (consensus +0.3%, last flat)

08:30 AM Initial jobless claims, week ended July 12 (GS 237k, consensus 233k, last 227k): Continuing jobless claims, week ended July 5 (consensus 1,965k, last 1,965k)

08:30 AM Philadelphia Fed manufacturing index, July (GS -1.0, consensus -1.0, last -4.0)

10:00 AM Business inventories, May (consensus flat, last flat)

10:00 AM NAHB housing market index, July (consensus 33, last 32)

10:00 AM Fed Governor Adriana Kugler speaks: Fed Governor Adriana Kugler will speak on housing and the US economic outlook at an event hosted by the Housing Partnership Network Symposium. Speech text is expected. On June 5th, Kugler said that she sees “greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road,” leading her to “support maintaining the FOMC's policy rate at its current setting if upside risks to inflation remain.”

12:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will appear on Bloomberg TV from the Rocky Mountain Economic Summit in Victor, Idaho. On July 10th, Daly said that she sees two interest rate cuts by the end of the year as “a likely outcome.” She also noted that there is a greater chance that the price effects from tariffs may be more limited than anticipated, as “businesses find ways to adjust” to higher costs.

01:30 PM Fed Governor Lisa Cook speaks: Fed Governor Lisa Cook will speak on AI and innovation at the NBER Summer Institute. Speech text and moderated Q&A are expected. On June 3rd, Cook noted that the economy is still in “a solid position” but “heightened uncertainty due to changes in trade policy poses risks to both price stability and unemployment.” She added that “monetary policy will need to carefully balance our dual mandate goals.”

06:30 PM Fed Governor Christopher Waller speaks: Fed Governor Christopher Waller will speak on the US economic outlook and monetary policy at the Money Marketeers of NYU. Speech text and moderated and audience Q&A are expected. On July 10th, Waller said that the Fed “could consider cutting the policy rate in July.” He also noted that the Fed should continue shrinking the size of its balance sheet, as bank reserves are currently above an “ample” level. On June 20th, Waller noted that policy had been “on pause for six months to wait and see, and so far the data has been fine.”

Friday, July 18

08:30 AM Housing starts, June (GS +2.0%, consensus +3.1%, last -9.8%) ; Building permits, June (consensus -0.5%, last -2.0%)

10:00 AM University of Michigan consumer sentiment, July preliminary (GS 61.5, consensus 61.4, last 60.7); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.9%, consensus 4.0%, last 4.0%)

Source: DB, Goldman

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists’ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of "Crypto Week" where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 14

Data: China June trade balance, Japan May core machine orders, capacity utilisation

Central banks: ECB's Vujcic and Cipollone speak

Tuesday July 15

Data: US June CPI, July Empire manufacturing index, China Q2 GDP, June retail sales, industrial production, home prices, Germany July ZEW survey, Eurozone July ZEW survey, May industrial production, Italy May general government debt, Canada June CPI, existing home sales, May manufacturing sales

Central banks: Fed's Bowman, Barr, Collins and Barkin speak, BoE's Bailey speaks

Earnings: JPMorgan Chase, Wells Fargo, Blackrock, Citigroup, Bank of New York Mellon

Wednesday July 16

Data: US June PPI, industrial production, capacity utilisation, July New York Fed services business activity, UK June CPI, RPI, May house price index, Italy May trade balance, Eurozone May trade balance, Canada June housing starts

Central banks: Fed's Beige Book, Fed's Logan, Hammack, Barr, Williams and Barkin speak

Earnings: Johnson & Johnson, Bank of America, ASML, Morgan Stanley, Goldman Sachs, Kinder Morgan, Sandvik, United Airlines, Alcoa

Thursday July 17

Data: US June retail sales, import price index, export price index, July Philadelphia Fed business outlook, NAHB housing market index, May business inventories, total net TIC flows, initial jobless claims, UK May average weekly earnings, unemployment rate, June jobless claims change, Japan June trade balance, Canada May international securities transactions, Australia June labour force survey

Central banks: Fed's Kugler, Daly, Cook and Waller speak

Earnings: TSMC, Netflix, General Electric, Novartis, Abbott Laboratories, PepsiCo, ABB, Interactive Brokers, Elevance Health, Volvo, EQT AB, Evolution

Friday July 18

Data: US July University of Michigan survey, June building permits, housing starts, Japan June national CPI, Germany June PPI, Italy May current account balance, ECB May current account, Eurozone May construction output

Earnings: American Express, Charles Schwab, Schlumberger, Saab

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

There are no major economic data releases scheduled.

Tuesday, July 15

08:30 AM CPI (MoM), June (GS +0.30%, consensus +0.3%, last +0.1%); Core CPI (MoM), June (GS +0.23%, consensus +0.3%, last +0.1%); CPI (YoY), June (GS +2.68%, consensus +2.6%, last +2.4%); Core CPI (YoY), June (GS +2.93%, consensus +2.9%, last +2.8%): We estimate a 0.23% increase in June core CPI (month-over-month SA), which would raise the year-over-year rate by 0.1pp to 2.9%. Our forecast reflects a decline in used car prices (-0.5%) reflecting a decline in auction prices, unchanged new car prices, and a more moderate increase in the car insurance category (+0.3%) based on premiums in our online dataset. We forecast a modest rebound in airfares in June (+1%), though we see meaningful two-sided risk to this component, reflecting a large headwind from seasonal distortions but a large increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in moderate upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation. We expect the shelter components to rebound slightly on net (primary rent +0.25% vs. +0.21% in May; OER +0.27% vs. +0.27%). We estimate a 0.30% rise in headline CPI, reflecting higher food (+0.25%) and energy (+1.2%) prices. Our forecast is consistent with a 0.25% increase in core PCE in June. We will update our core PCE forecast after the CPI is released.

08:30 AM Empire State manufacturing survey, July (consensus -9.6, last -16.0)

09:15 AM Fed Vice Chair for Supervision Bowman speaks: Fed Vice Chair for Supervision Michelle Bowman will give welcoming remarks at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 23rd, Bowman said that she would “support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.”

12:45 PM Fed Governor Barr speaks: Fed Governor Michael Barr will deliver a speech on financial inclusion at the Federal Reserve Board's Second Annual Financial Inclusion Conference. Speech text is expected. On June 24th, Barr said that “monetary policy is well positioned” to allow the Fed to “wait and see how economic conditions unfold.” He also added that he expects “inflation to rise due to tariffs,” and that higher short-term inflation expectations, supply chain adjustments, and second-round effects may cause “some inflation persistence.”

01:00 PM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will deliver the speech “Forecasting Beyond Today's Data” in Baltimore. He previously gave the same speech on June 26th. Speech text and audience Q&A are expected. On July 2nd, Barkin noted that there is no urgency to adjust policy at the moment, as “the numbers on the economy are very solid.”

02:45 PM Boston Fed President Collins (FOMC voter) speaks: Boston Fed President Susan Collins will deliver the closing keynote at the 2025 Economic Measurement Seminar in Washington DC. Speech text is expected. On June 25th, Collins said that she sees “monetary policy as currently well positioned,” and that she favors “a careful, patient, and highly attentive approach” as the implications of tariffs and other changes in government policies are assessed. She also indicated that her baseline outlook is to resume lowering the fed funds rate later in the year.

07:45 PM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks and speak about the economy in an event hosted by the World Affairs Council of San Antonio. Speech text and audience Q&A are expected. On June 2nd, Logan said that risks on both sides of the dual mandate appear “fairly balanced,” leaving the Fed well positioned “to wait for the data” and “to be patient.”

Wednesday, July 16

08:00 AM Richmond Fed President Barkin (FOMC non-voter) speaks: Richmond Fed President Tom Barkin will repeat the speech “Forecasting Beyond Today's Data” in Westminster, Maryland. Speech text and audience Q&A are expected.

08:30 AM PPI final demand, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food and energy, June (GS +0.1%, consensus +0.2%, last +0.1%); PPI ex-food, energy, and trade, June (GS +0.1%, consensus +0.2%, last +0.1%)

09:15 AM Industrial production, June (GS flat, consensus +0.1%, last -0.2%): Manufacturing production, June (GS -0.1%, consensus flat, last +0.1%); Capacity utilization, June (GS 77.3%, consensus 77.4%, last 77.4%): We estimate industrial production was unchanged in June, as strong electricity production balanced weak auto production. We estimate capacity utilization declined slightly to 77.3%.

09:15 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will speak at the Corporate College 20th Anniversary Celebration Business Breakfast at Cuyahoga Community College. Speech text is expected. On June 24th, Hammack said that, despite recent progress, the Fed still has “some distance to go” before reaching its inflation target. She indicated that “it may well be the case that policy remains on hold for quite some time before the Committee initiates very modest cuts to return policy to a neutral setting.”

10:00 AM Fed Governor Barr speaks: Fed Governor Michael Barr will speak at a Brookings event on financial regulation. Speech text and moderated and audience Q&A are expected.

02:00 PM Beige Book, July meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the June FOMC meeting period noted that economic activity had declined slightly since April, with six districts reporting “slight to moderate declines” in activity, three districts reporting “no change” in activity, and the remaining three districts reporting “slight growth.” It also noted that all districts reported “elevated levels” of economic and policy uncertainty. In line with the previous report, the outlook remained slightly pessimistic and uncertain, as a few districts anticipated a deterioration but a few others anticipated an improvement in economic conditions. In this month's Beige Book, we look for anecdotes related to the evolution of policy uncertainty and firms' expectations for the pass-through of tariff-related costs to consumer prices.

05:30 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will give keynote remarks on the economic outlook and monetary policy at an event hosted by the New York Association for Business Economics. On June 24th, Williams noted that it is “entirely appropriate” to maintain “a modestly restrictive stance of monetary policy” while assessing the full impact of policy changes on the labor market and inflation. He also indicated that he expects real GDP growth to “slow considerably from last year's pace” as a result of uncertainty, tariffs, and reduced immigration.

Thursday, July 17

08:30 AM Retail sales, June (GS flat, consensus +0.1%, last -0.9%); Retail sales ex-auto, June (GS +0.2%, consensus +0.3%, last -0.3%); Retail sales ex-auto & gas, June (GS +0.2%, consensus +0.3%, last -0.1%); Core retail sales, June (GS +0.4%, consensus +0.3%, last +0.4%); We estimate core retail sales increased: 0.4% in June (ex-autos, gasoline, and building materials; month-over-month SA). Our forecast reflects mixed measures of card spending but a potential boost from spending around the Juneteenth holiday. We estimate headline retail sales were unchanged, reflecting sharply lower auto sales.

08:30 AM Import price index, June (consensus +0.3%, last flat)

08:30 AM Initial jobless claims, week ended July 12 (GS 237k, consensus 233k, last 227k): Continuing jobless claims, week ended July 5 (consensus 1,965k, last 1,965k)

08:30 AM Philadelphia Fed manufacturing index, July (GS -1.0, consensus -1.0, last -4.0)

10:00 AM Business inventories, May (consensus flat, last flat)

10:00 AM NAHB housing market index, July (consensus 33, last 32)

10:00 AM Fed Governor Adriana Kugler speaks: Fed Governor Adriana Kugler will speak on housing and the US economic outlook at an event hosted by the Housing Partnership Network Symposium. Speech text is expected. On June 5th, Kugler said that she sees “greater upside risks to inflation at this juncture and potential downside risks to employment and output growth down the road,” leading her to “support maintaining the FOMC's policy rate at its current setting if upside risks to inflation remain.”

12:45 PM San Francisco Fed President Daly (FOMC non-voter) speaks: San Francisco Fed President Mary Daly will appear on Bloomberg TV from the Rocky Mountain Economic Summit in Victor, Idaho. On July 10th, Daly said that she sees two interest rate cuts by the end of the year as “a likely outcome.” She also noted that there is a greater chance that the price effects from tariffs may be more limited than anticipated, as “businesses find ways to adjust” to higher costs.

01:30 PM Fed Governor Lisa Cook speaks: Fed Governor Lisa Cook will speak on AI and innovation at the NBER Summer Institute. Speech text and moderated Q&A are expected. On June 3rd, Cook noted that the economy is still in “a solid position” but “heightened uncertainty due to changes in trade policy poses risks to both price stability and unemployment.” She added that “monetary policy will need to carefully balance our dual mandate goals.”

06:30 PM Fed Governor Christopher Waller speaks: Fed Governor Christopher Waller will speak on the US economic outlook and monetary policy at the Money Marketeers of NYU. Speech text and moderated and audience Q&A are expected. On July 10th, Waller said that the Fed “could consider cutting the policy rate in July.” He also noted that the Fed should continue shrinking the size of its balance sheet, as bank reserves are currently above an “ample” level. On June 20th, Waller noted that policy had been “on pause for six months to wait and see, and so far the data has been fine.”

Friday, July 18

08:30 AM Housing starts, June (GS +2.0%, consensus +3.1%, last -9.8%) ; Building permits, June (consensus -0.5%, last -2.0%)

10:00 AM University of Michigan consumer sentiment, July preliminary (GS 61.5, consensus 61.4, last 60.7); University of Michigan 5-10-year inflation expectations, July preliminary (GS 3.9%, consensus 4.0%, last 4.0%)

Source: DB, Goldman

Tyler Durden | Zero Hedge

Zero Hedge

Key Events This Very Busy Week: CPI, PPI, Retail Sales, Tons Of Fed Speakers And Earnings Season Begins | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

...pushing it above AMZN as the 5th largest asset class on earth...

...pushing it above AMZN as the 5th largest asset class on earth...

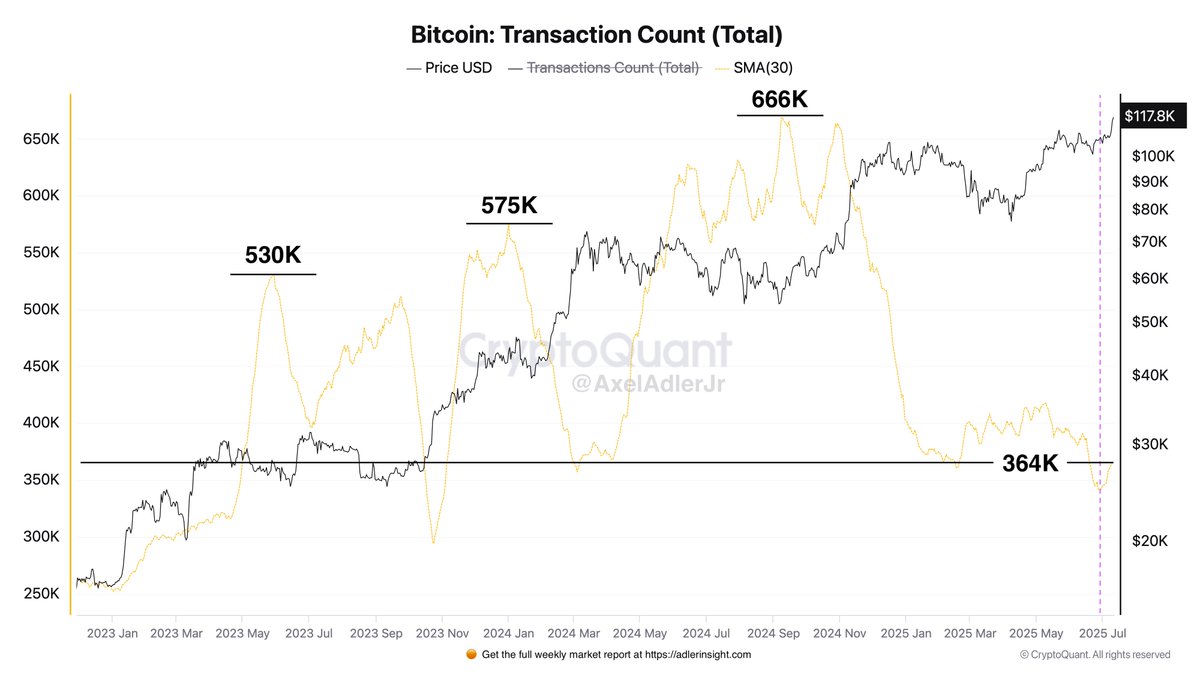

Steady BTC network activity adds to its bullish case

Steady BTC network activity adds to its bullish case

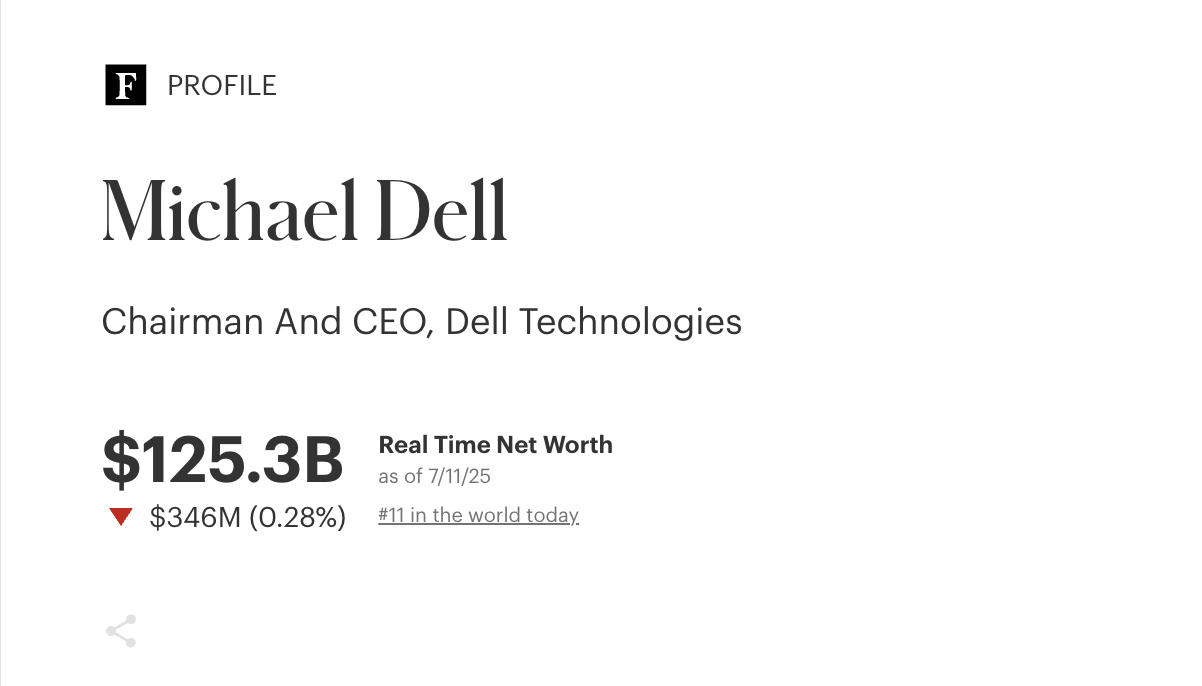

Bitcoin’s creator, Satoshi Nakamoto, became the 11th richest person in the world after Bitcoin tapped $120,000 on Sunday.

Bitcoin’s creator, Satoshi Nakamoto, became the 11th richest person in the world after Bitcoin tapped $120,000 on Sunday.

Source:

Source:

Elon Musk is currently the top-ranked billionaire with a fortune of over $404 billion. Source:

Elon Musk is currently the top-ranked billionaire with a fortune of over $404 billion. Source:

Source:

Source:

Laura Loomer, a political commentator close to the president, also

Laura Loomer, a political commentator close to the president, also

Continuing the trend of Democrats suddenly caring about the Jeffrey Epstein case after four years in power doing nothing, AOC wrote the following…

“Wow who would have thought that electing a rapist would have complicated the release of the Epstein Files?”

Wow who would have thought that electing a rapist would have complicated the release of the Epstein Files?

— Alexandria Ocasio-Cortez (@AOC)

Continuing the trend of Democrats suddenly caring about the Jeffrey Epstein case after four years in power doing nothing, AOC wrote the following…

“Wow who would have thought that electing a rapist would have complicated the release of the Epstein Files?”

Wow who would have thought that electing a rapist would have complicated the release of the Epstein Files?

— Alexandria Ocasio-Cortez (@AOC)

During his 2024 campaign,

During his 2024 campaign,

In premarket trading, Mag 7 stocks are mixed (Tesla +2.7%, Nvidia +0.5%, Meta -0.2%, Alphabet -0.5%, Amazon -0.5%, Microsoft -0.5%, Apple -1%).

Cryptocurrency-exposed stocks including Coinbase (COIN), Strategy (MSTR) and Galaxy Digital (GLXY) rise as Bitcoin extends its record-breaking rally.

Intapp (INTA) falls 3.1% as Barclays cuts to underweight from equal-weight after trimming 2026 revenue estimates for the application software company.

Boeing Co. and General Electric Co. edged higher after investigators said that they found no evidence so far that would require them to take action following last month’s Air India jetliner crash.

Autodesk (ADSK) rises 6% after the software company said it is allocating its capital to organic investment, targeted and tuck-in acquisitions, and continuing its share repurchase program as its free cash flow grows.

Intapp (INTA) falls 3% as Barclays cuts to underweight, trimming 2026 revenue estimates for the software services company.

Kenvue Inc. (KVUE) rises 4% after the maker of Neutrogena and Listerine brands appointed director Kirk Perry as interim CEO effective immediately. The company also said it’s advancing an ongoing comprehensive review of strategic alternatives.

Stitch Fix (SFIX) gains 7% after William Blair upgraded the personal styling company to outperform, positive on changes made at the company under CEO Matt Baer.

Ultragenyx Pharmaceutical (RARE) falls 4% after the FDA rejected the company’s application for its gene therapy for a brain disorder, citing chemistry, manufacturing and controls issues. Analysts note the approval delay as disappointing.

Waters Corp. (WAT) slips 5% after Waters and Becton’s Biosciences & Diagnostic Solutions business are set to combine in a Reverse Morris Trust transaction valued at about $17.5 billion.

In corporate news, Synopsys secured China’s approval to buy out Ansys for $35 billion, while Elon Musk said Tesla plans to poll shareholders on whether to invest in xAI. Nvidia CEO Jensen Huang said the US government doesn’t need to be concerned that the Chinese military will use his company’s products to improve their capabilities. Fastenal is set to report earnings before the market opens. Improved pricing, market share gains and stabilizing short-cycle industrial markets should support accelerated top-line and earnings growth, according to Bloomberg Intelligence. Jane Street has deposited 48.4 billion rupees ($564 million) in an escrow account to comply with an order from India’s securities regulator, part of an ongoing probe into allegations of market manipulation by the US trading giant. Partners Group is selling a large asset in its buyout portfolio to a consortium led by its own infrastructure division.

The week's data will be key to rate-cut expectations and “could set the tone for the direction of the Fed and risk sentiment for the second half of the year,” according to CreditSights. Meanwhile, Trump seized upon a new way to criticize Jerome Powell’s leadership of the Fed: his handling of an expensive renovation of the central bank’s headquarters.

Elsewhere, RBC lifted its S&P 500 year-end target to 6,250 from 5,730, though remains neutral on stocks for the second half, expecting choppy conditions. As reported previously, Goldman strategists expect the S&P 500 to rise by 10% to 6,900 over the next 12 months, implying a P/E multiple on forward consensus earnings of 22 times.

Strategists are also getting worried about earnings. Wall Street is bracing for the weakest season since mid-2023, and are a key source of uncertainty for Goldman clients. Still, earnings revisions are showing a big dispersion between sectors, which creates an opportunity for stock picking, Morgan Stanley’s Michael Wilson said. Key themes include the impact of tariffs and a weaker dollar, and AI-related spending.

Trump’s weekend threat to impose 30% tariffs on the European Union and Mexico is testing market resilience, following a series of escalated trade measures against multiple partners. While traders largely view them as a bargaining tactic and expect final tariffs to be softer, the moves have injected uncertainty just as the S&P 500 was trading near record highs. Elsewhere, Bloomberg reported that the EU is preparing to step up its engagement with other countries hit by Trump’s tariffs following a slew of new threats to the bloc and other US trading partners. Thailand is weighing allowing zero-duty market access for more US goods to help persuade the Trump administration to lower a threatened 36% tariff on its exports.

“The market will generally think this is mostly a negotiation tactic,” noted Deutsche Bank AG strategist Jim Reid. “However, at some stage someone’s bluff could be called. If huge tariffs do get imposed on Aug. 1, in thin holiday markets, we could get a sizable market reaction.”

US inflation figures due on Tuesday is expected to show faster price growth as companies began passing on higher import costs. Alongside retail sales, industrial production and consumer sentiment figures later in the week, the data could test the Federal Reserve’s wait-and-see stance on interest rate cuts. Swaps are still pricing in nearly two quarter-point reductions this year, with a likelihood of around 60% for a first cut in September.

“It is important to note that investors are already pricing in rate cut expectations,” noted Linh Tran, market analyst at XS.com. “If the data points to stronger-than-expected inflationary pressures or a tight labor market, the Fed may be forced to delay rate cuts — potentially triggering a valuation shock for equity markets.”

Meanwhile, Trump again repeated his criticism of Fed Chair Jerome Powell late on Sunday, saying it would be a “good thing” if the central banker stepped down. Deutsche Bank strategist George Saravelos said the potential dismissal of Powell is a major and underpriced risk that could trigger a selloff in the US dollar and Treasuries.

In Europe, major markets are mostly lower with UK leading and Germany lagging after President Donald Trump dials up trade tensions by announcing a 30% tariff on goods from the European Union. Healthcare shares are among the biggest sector gainers, while technology and auto are the biggest laggards. In individual stocks, Hermes falls after Jefferies downgrades to hold after seeing a lack of major growth for the luxury goods maker. The UK's FTSE 100 rose 0.3%, outperforming its European peers that have struggled after Trump threatened the EU with a 30% tariff rate. The Stoxx 50 falls 0.6%. UK equities also benefited from increased bets on interest rate cuts by the Bank of England after Governor Bailey hinted at bigger reductions if the jobs market deteriorates more quickly than the central bank expects. Bailey’s remarks also boosted gilts, most notably at the short-end. UK two-year yields fall 5 bps to 3.81%. Cable dips 0.1% The EU is said to contact other US allies that are tariff targets per BBG, flagging the potential for a coordinated response to the US. Momentum is leading, Cyclicals/Vol are lagging; Growth over Value. UKX +0.4%, SX5E -0.6%, SXXP -0.3%, DAX -0.7%. CSI +0.1%, HSI +0.3%, NKY -0.3%, ASX -0.1%, KOSPI +0.8%.

Earlier in the session, Asian stocks were mixed with China/HK leading and HSTECH was higher but remains in a 2.5 month-long range.

In FX, the Bloomberg Dollar Spot Index adds 0.1% while the yen is the strongest of the G-10 currencies, rising 0.1% against the greenback. The Swedish krona is the weakest with a 0.5% fall.

In rates, treasuries edged lower, with US 10-year yields rising 1 bp to 4.42%. The big overnight bond movers were in Japan and Germany...

GERMAN 30-YEAR YIELD RISES 3BPS TO 3.254%, HIGHEST SINCE 2023

*JAPAN 30-YEAR BOND YIELD RISES 10.5 BASIS POINTS TO 3.145%

... The yield on Japan’s long-term bonds moved sharply higher amid signs of thin liquidity and increasing worries about higher government spending that may spread to other countries. Regarding supply in the US, Treasury coupon auctions are on hiatus until 20-year bond reopening on July 23; investment-grade corporate new issue calendar is blank thus far but expected to feature big-bank offerings later in the week after 2Q results start being reported Tuesday

In commodities, oil prices advance, with WTI rising 1% and above $69 a barrel. Spot gold climbs $10 to around $3,365/oz. Bitcoin rises to another record above $122,000.

Today's US economic calendar is blank and no Fed speakers for Monday; ahead this week are June CPI, PPI and retail sales.

Market Snapshot

S&P 500 mini -0.3%

Nasdaq 100 mini -0.3%

Russell 2000 mini -0.3%

Stoxx Europe 600 -0.3%

DAX -0.7%

CAC 40 -0.4%

10-year Treasury yield +1 basis point at 4.42%

VIX +1 points at 17.36

Bloomberg Dollar Index little changed at 1200.07

euro little changed at $1.1685

WTI crude +0.8% at $69.01/barrel

Top Overnight News

US President Trump sent trade letters to the EU and Mexico announcing 30% tariffs from August 1st which would be separate from sectoral tariffs.

The US will send more Patriot air-defense batteries to Ukraine, Trump said, reversing his halt to new weapons deliveries since the start of his second term. He’s scheduled to meet NATO chief Mark Rutte later today. BBG

White House insiders insist the tariffs will take effect on 8/1 without any further delays. Politico

UK businesses are scaling back hiring for jobs set to be affected by AI, McKinsey analysis found. More broadly, UK hiring plunged at the fastest pace in almost two years last month, KPMG data showed. BBG

The EU plans to step up engagement with other countries hit by the US levies, people familiar said, but paused countermeasures to allow more time for talks. BBG

China’s biotech advance has been as ferocious as the nation’s breakthrough efforts in AI and EVs, eclipsing the EU and catching up to the US. The number of novel drugs in China – for cancer, weight loss and more – entering into development ballooned to over 1,250 last year, far surpassing the EU and nearly catching up to the US count of about 1,440. BBG

Amazon’s Prime Day sale helped boost online spending across all US retailers by a larger-than-estimated 30.3% to $24.1 billion. BBG

China’s exports grew at a faster clip in June, topping market expectations as trade tensions with the U.S. eased following a round of bilateral talks. June trade numbers came in ahead of expectations, including exports (+5.8% vs. the Street +5%) and imports (+1.1% vs. the Street +0.3%). WSJ

The yield on Japan’s long-term bonds moved sharply higher amid signs of thin liquidity and increasing worries about higher government spending that may spread to other countries. BBG

India’s wholesale prices for June undershot the consensus and fell into deflationary territory (they came in at -0.13% M/M vs. the Street +0.52%). BBG

Tariffs/Trade

President Trump sent a trade letter to the EU announcing 30% tariffs from August 1st which would be separate from sectoral tariffs.

Trump commented that the EU is talking to the US and wants to open up their countries.

White House Economic Adviser Hassett said President Trump has seen some outlines of proposed trade deals and thinks they need to do better, while he added that these tariffs are real if Trump gets proposals that he doesn’t think are good enough.

Trump said it would be a good thing if Fed Chair Powell quits and said that Powell should resign immediately, while he repeated criticism that Powell is too late.

White House Economic Adviser Hassett said the Fed has a lot to answer for on renovation cost overruns and if there is cause to fire Fed Chair Powell, President Trump has the authority to do so.

UK's King Charles will host US President Trump for a state visit from September 17th to 19th.

European Commission President von der Leyen said imposing 30% tariffs on EU exports would disrupt the essential transatlantic supply chains, while they remain ready to continue working towards an agreement by August 1st and will take all necessary steps to safeguard EU interests including the adoption of proportionate countermeasures if required. Furthermore, she said they will extend the suspension of their countermeasures to US tariffs until early August and noted they have always been clear that they prefer a negotiated solution with the US which remains the case.

The EU is planning to "step up engagement" with other nations impacted by US President Trump's tariffs, according to Bloomberg sources. Nations include Canada and Japan and could lead to potential coordination.