Fool Me Once

Fool Me Once

By Peter Tchir of Academy Securities

One of our favorite sayings is:

Fool me once, shame on you.

Fool me twice, shame on me.

It is good on many levels. It indicates that it is okay to get fooled. We don’t expect people to try to fool us, but we are susceptible to it. It does indicate that you have to take some responsibility (if you’ve been fooled) and not get fooled again. If “Won’t Get Fooled Again” by the Who hasn’t popped into your head at this point, there is little I can do on the musical front.

In any case, focusing on “Foolin’” (Def Leppard, and yes, it’s been a long week) seemed to be a better way to start this report, rather than the other analogy that came to mind - “boiling frogs.” The boiling frog “idiom” (had to look that up), was that if you put a frog in water and gradually increased the temperature, it wouldn’t notice, and would be boiled. Apparently there was research done on this (can’t really think of why anyone would do this), and the frogs do try to escape, but that hasn’t stopped people from using this phrase.

So where is this all headed?

Last weekend we published

Big Beautiful Production for Security | Academy Securities

fits our narrative almost perfectly. We’ve argued that jumpstarting some industries may require government support. This action fits well into the Sovereign Wealth Fund idea that we haven’t heard much about lately. The U.S. will benefit from its investment if it turns out to be a good investment. It isn’t a handout. We’ve seen a lot of headlines about private investment, particularly in chips, but this seems like a new approach (one that makes sense on almost every level).

Using the DoD in this way seems like it can open the door to more investments and allow the American taxpayer to participate in these decisions, rather than just rewarding outsiders. We feel vindicated in our assessment that National Production for National Security is an incredibly important investment theme (and one of the few “concepts” that isn’t entirely dependent on AI spending).

Which brings us to tariffs.

Tariff Angst

In last weekend’s report, the positive outlook was driven by National Production for National Security. We even had some confirmation of that.

The risks were a renewed focus on tariffs. On Monday the President sent some letters, which the market more or less took in stride, prompting us to publish

Fake News Tariffs? | Academy Securities

? As the week went on, much of the news flow from D.C. seemed to indicate a renewed emphasis on tariffs as a key policy tool. We even saw something “new” in the tariff arena – potential 50% tariffs on Brazil over their treatment of Bolsonaro. The U.S. has a trade surplus with Brazil and it is difficult to see how this tariff fits an “economic emergency” which has been the underlying policy supporting the President’s ability to determine tariffs unilaterally.

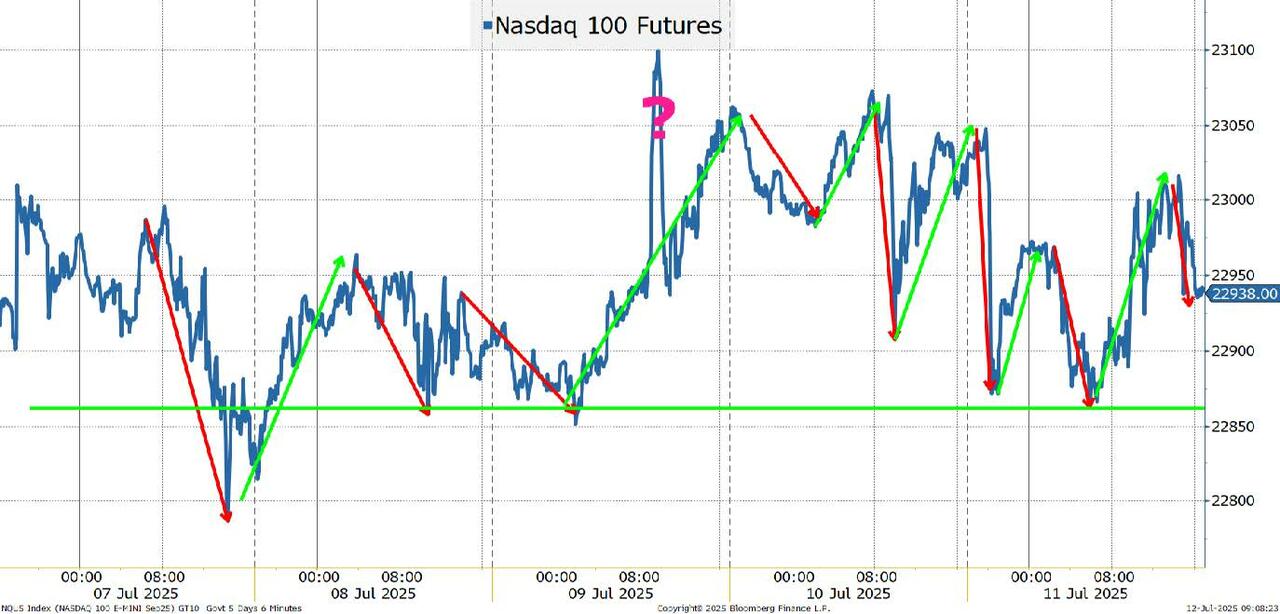

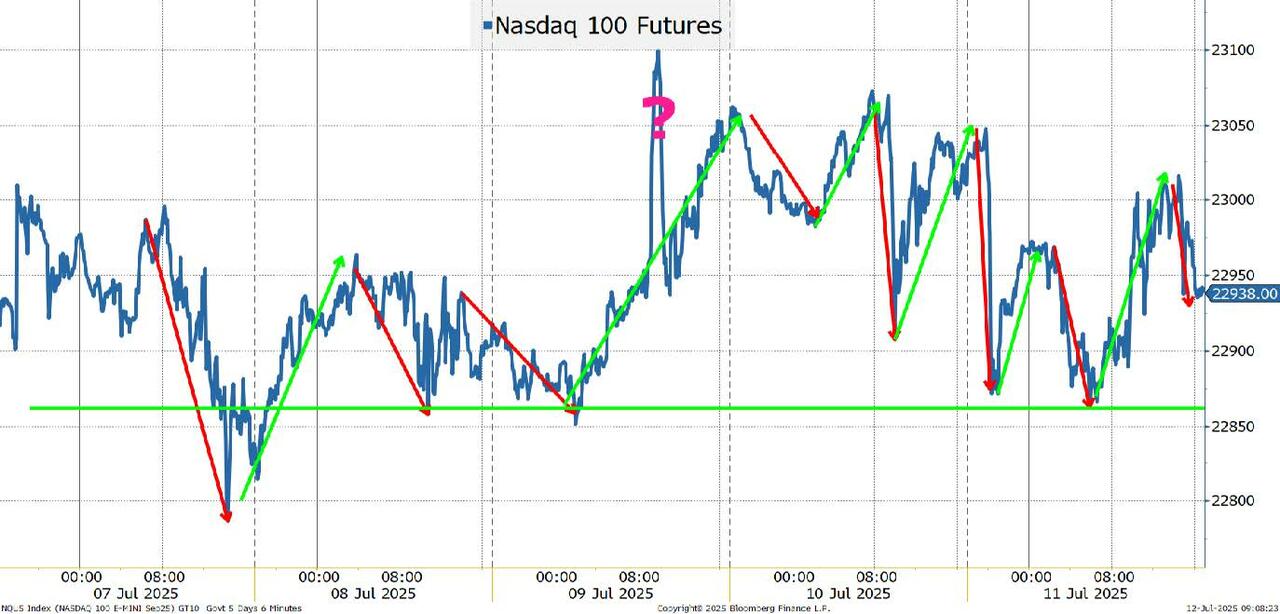

Yet markets barely budged. Every time markets sold off on tariff concerns, the dip was bought and we went through the week virtually unchanged on the S&P 500 and Nasdaq.

The market is either:

Incredibly reluctant to price in higher tariffs, or

No longer believes higher tariffs are bad for the economy, profits, and markets.

Let’s look at these two options for a moment.

Tariffs Don’t Matter

There are some people who will argue this. They argued for it before and after the Liberation Day tariffs. They will claim that despite tariffs, the market and economy have been fine.

But is this a widely held view? I don’t think so and it certainly isn’t my view:

The “pause” put tariffs back into the “neighborhood” of “reciprocal” tariffs. Worse than what many had expected when policy was targeting “reciprocal,” but in the ballpark. There are a number of “estimates” out there for what the “effective” tariff rate is. We’ve seen some as of the end of May as low as 8.8%, but other more current estimates have it around 14%. If we go ahead with these new levels, slated to take effect August 1, the effective rate will increase significantly in the coming months as imports that arrive get hit with these new tariffs. It is difficult to believe that higher tariffs won’t impact the economy over time.

Tariff mitigation strategies. We’ve written repeatedly that many (including ourselves) underestimated the various mitigation strategies that could be employed, especially around the “pause” level of tariffs.

Tariffs take time to have an impact.

Companies pre-ordered ahead of tariffs, delaying any impact of tariffs until they need to re-order.

There will be negotiations with suppliers about “eating” some of the tariff. Not much will be passed on while those negotiations take place.

Finally, with the administration keeping an eye on prices, it behooves some large companies to “eat” the tariffs themselves as price hikes linked to tariffs appear to draw the attention of the administration.

Unexpectedly, the dollar is down about 10% since early January (measured by DXY, a broad index of the dollar), which makes imports even more expensive (and makes U.S. exports less expensive – a side benefit).

Tariffs, so far, have been small in actual dollars (it is easy to get caught up in a world of percentages, but the total dollar amount, so far, has been small relative to the size of the economy).

I find it difficult to believe that markets think that higher tariffs won’t impact the economy and markets negatively over time.

That explanation just doesn’t cut it from my perspective.

Tariffs Won’t Get Implemented

This is the real reason markets are taking all the tariff headlines in stride. We were “fooled” once:

Expect short-term pain for longer-term gains.

Main Street over Wall Street.

Unfair and predatory practices against the U.S. must be eliminated or punished.

Dealz. Countries lining up and begging for deals.

We went through that.

And let’s not forget that the Liberation Day tariffs actually were, in theory, implemented. We went through the midnight deadline with no “stay of execution.” Rallies based on “pauses” or “extensions” headlines faded rapidly, until we got the Big Beautiful Pause.

Since then, stocks have rallied. The first leg was driven by the “pause,” but stocks have been helped by the ongoing commitment to AI spending, progress on Peace Through Strength, and the Big Beautiful Bill.

Will this administration risk the progress to refocus on tariffs? Why do this, when other avenues for economic development exist (National Production for National Security, the Sovereign Wealth Fund, etc.). Heck there is the possibility of “dealz.” Though it is a bit concerning that there is no clarity over what was agreed to with China, there seems to be confusion about what Vietnam agreed to or didn’t agree to, and many nations are signaling that their negotiating teams are struggling to understand the U.S. objective.

So maybe the market doesn’t want to overreact because we could see deals? That is possible, but it seems unlikely as progress on deals has been slow and if 10% with good friends like the U.K. is the best a country can expect, then we might be ripe for disappointment on deals (or the U.K. may regret what they agreed to).

Or is it the belief that the administration will back down again?

Trump Always Chickens Out (TACO) has become a theme. It is not a theme we subscribe to.

The President will PIVOT. He will shift away from “losers” to “winners.” Do a Google Trends search on “Peter Navarro” – it has dropped to almost nothing since peaking in early April. That has been the President’s style.

Having said that, there are reasons to be concerned that this shift back to tariffs could be real and could be implemented:

The President has embraced the concept of tariffs for decades. This is not something he needed to be convinced of. It has been his policy and he believes in tariffs.

It is easy to see how the President could view tariffs as “winning” so far – no inflation, stocks at all-time highs, and tariff revenue is real. It is far too early to take a victory lap based on tariff policy so far, but there is a narrative around it that could encourage those who really believe in tariffs.

The President isn’t afraid of taking a “second bite at the apple.” He can pivot away from something and then pivot back. He walks away from deals only to close them later (sometimes with better terms). He can blame the timing on why market reaction was so bad. To some degree, we would agree that had he started with taxes and other policies, then went to tariffs, with a real focus on China, the market would not have reacted as badly. We would have seen some positives and a more targeted approach. So maybe it is worth another shot? It is not a shot I would take, but we aren’t in charge, and the idea that with some other big wins in hand, it is time to try the tariff policies again, has a certain appeal.

It is easy to interpret market complacency as market acceptance. Our argument is that the market is pricing in a low risk of implementation, rather than accepting that higher tariffs won’t be harmful. But if you believe in tariffs, it is easy to be convinced that the market is signaling that it is ready for another round of higher tariffs.

The idea that the market is simply unwilling to accept that higher tariffs will be implement and kept in place seems to be the best explanation for why tariffs have failed to move the market this past week. The market has been fooled once and won’t be fooled again.

Bottom Line

The market has been fooled once and won’t be fooled again. Or will it? Has the market simply become so complacent that it is not only missing (or ignoring) signs that the administration is serious about trying again on tariffs, but also that the complacency is giving the administration the conviction it needs to try again?

There are a lot of good things going on with the economy and hopefully the MP deal referenced earlier is a template and a sign that the administration is going to aggressively address crucial areas where we are nowhere close enough to being self-sufficient to be secure.

For markets, be overweight anything that should benefit from this theme of National Production for National Security. Be underweight industries most affected by tariffs. While it might be “safe” to assume the administration will back down, extend, and try to move towards deals, there seems to be some real risk to that.

On rates, if it wasn’t for tariffs, I’d be bullish again here, but with tariff risk, probably neutral to slightly bearish the long end.

Credit should continue to do well under most scenarios, but owning the companies that will benefit from domestic production should outperform.

Crypto should continue to benefit from uncertainty, and the increased attention that the administration will pay to it in the coming weeks and months now that they’ve knocked off some other big projects and have time to focus.

A President, who has had several big recent wins, truly believes in tariffs, and cannot like the TACO meme (which we don’t like either) may be far more serious about this then is currently getting priced in. With those other big wins under the belt, the market should not respond as poorly as it did the first go around, but a pullback of 5% would seem highly likely as we near August 1st without any major reprieve.

Academy Securities gets the week started from 6-6:30 Monday morning on Bloomberg Surveillance. I wonder if the President will be watching as he certainly was on jobs day when he po

https://truthsocial.com/@realDonaldTrump/posts/114789565281988967

If so, we will be trying to send one message loudly and clearly – continue to focus on extricating ourselves from supply chain bottlenecks in areas where we need to be truly secure – chips, pharma, and certain refined/processed commodities. That is where the economic opportunity lies and it will be good for jobs, the economy, the national psyche, and markets.

Good luck, I hope I’m wrong on my tariff concerns and hope that we are just at the very beginning of a big push towards national production for national security! We have been “fooled once” but are we set up to be “fooled” in the other direction? That seems to be the biggest risk to this market.

Tyler Durden | Zero Hedge

Zero Hedge

Sun, 07/13/2025 - 15:10

Fool Me Once | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

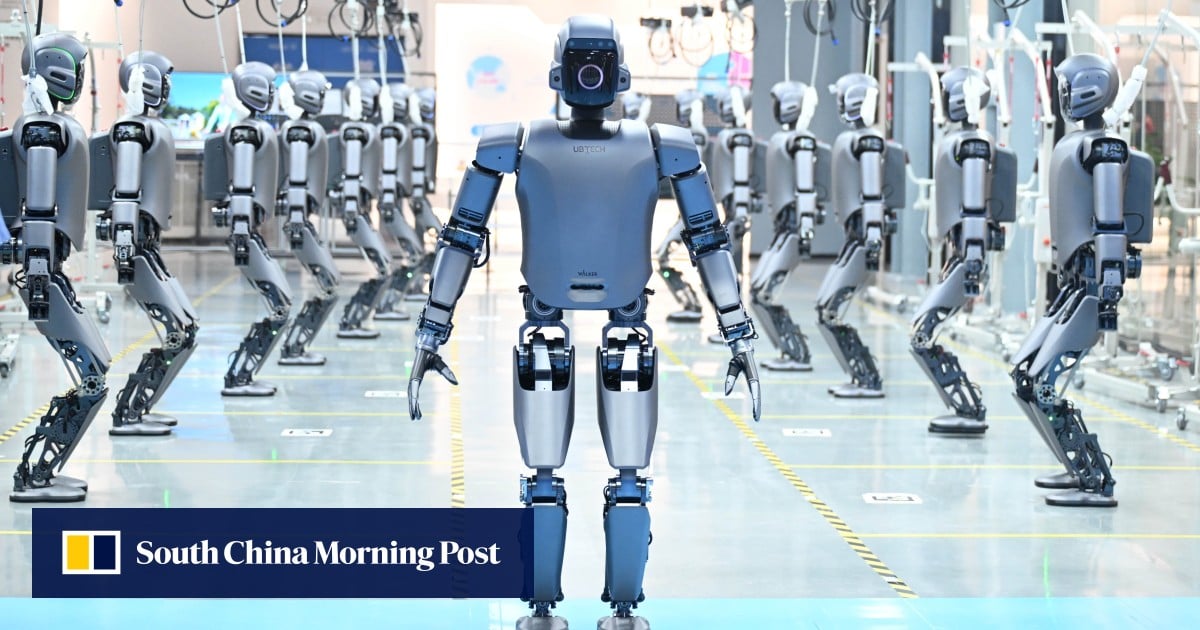

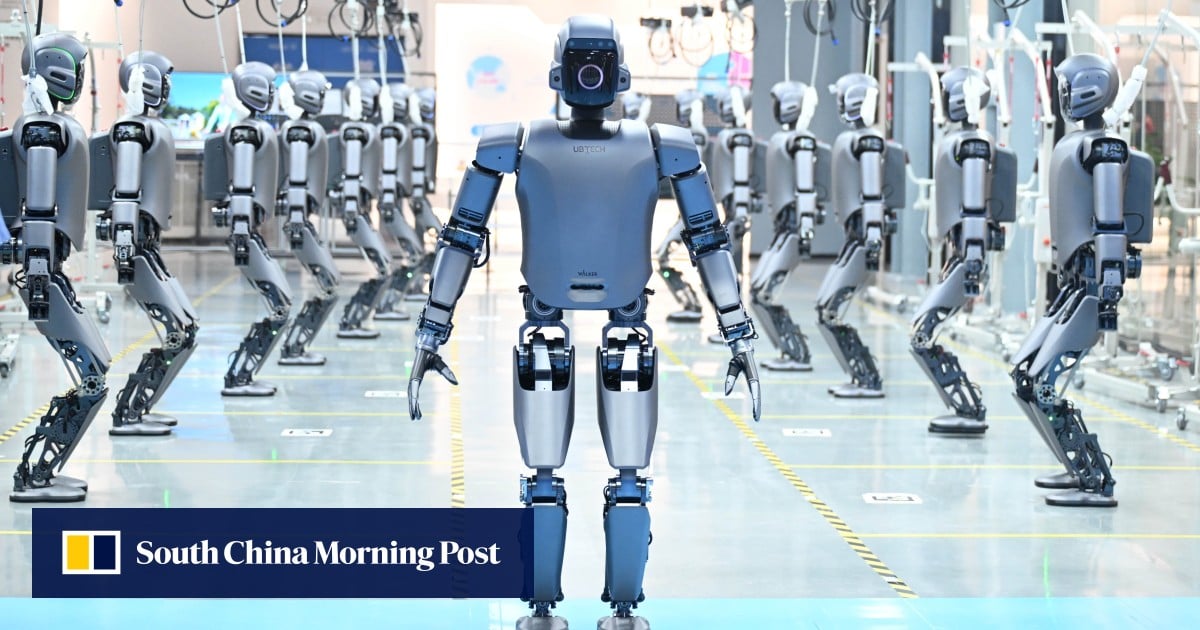

An op-ed published by Yuan Yi, Ma Ye and Yue Shiguang in the People’s Liberation Army (PLA) Daily warned that faulty robots could lead to "indiscriminate killings and accidental death,” which would "inevitably result in legal charges and moral condemnation."

The

An op-ed published by Yuan Yi, Ma Ye and Yue Shiguang in the People’s Liberation Army (PLA) Daily warned that faulty robots could lead to "indiscriminate killings and accidental death,” which would "inevitably result in legal charges and moral condemnation."

The  reports:

The authors cited American science fiction writer Isaac Asimov’s Three Laws of Robotics, a set of principles that have influenced discussions about the ethics of real-world applications in the field.

The authors said that militarised humanoid robots “clearly violate” the first of Asimov’s laws, which states that a robot “may not injure a human being or, through inaction, allow a human being to come to harm”. They added that Asimov’s laws needed to be overhauled in the light of these developments.

They also highlighted legal implications, saying that humanoid robots in military scenarios should comply with the main principles of the laws of war by “obeying humans”, “respecting humans” and “protecting humans”.

The authors emphasized that robots must be designed with constraints to “suspend and limit excessive use of force in a timely manner and not indiscriminately kill people.” Additionally, the trio cautioned against hastily replacing humans with robots, noting that robots still lack essential capabilities such as speed, dexterity, and the ability to navigate complex terrains.

“Even if humanoid robots become mature and widely used in the future, they will not completely replace other unmanned systems,” the article said.

Concurrently, the U.S. Army is intensifying efforts to integrate robotics, artificial intelligence, and autonomous systems, aiming to enhance human-machine collaboration between soldiers and advanced robots on the battlefield, according to

reports:

The authors cited American science fiction writer Isaac Asimov’s Three Laws of Robotics, a set of principles that have influenced discussions about the ethics of real-world applications in the field.

The authors said that militarised humanoid robots “clearly violate” the first of Asimov’s laws, which states that a robot “may not injure a human being or, through inaction, allow a human being to come to harm”. They added that Asimov’s laws needed to be overhauled in the light of these developments.

They also highlighted legal implications, saying that humanoid robots in military scenarios should comply with the main principles of the laws of war by “obeying humans”, “respecting humans” and “protecting humans”.

The authors emphasized that robots must be designed with constraints to “suspend and limit excessive use of force in a timely manner and not indiscriminately kill people.” Additionally, the trio cautioned against hastily replacing humans with robots, noting that robots still lack essential capabilities such as speed, dexterity, and the ability to navigate complex terrains.

“Even if humanoid robots become mature and widely used in the future, they will not completely replace other unmanned systems,” the article said.

Concurrently, the U.S. Army is intensifying efforts to integrate robotics, artificial intelligence, and autonomous systems, aiming to enhance human-machine collaboration between soldiers and advanced robots on the battlefield, according to  .

Scientists at the U.S. Army Combat Capabilities Development Command Army Research Laboratory (DEVCOM ARL) are pioneering advancements in ground and aerial autonomous systems, as well as energy solutions, to bolster the mobility and maneuverability of these technologies, the technology website reports.

“We are bridging the gap between humans and robots, making them more intuitive, responsive, and, ultimately, more useful for the Soldier,” said a lead researcher for the Artificial Intelligence for Maneuver and Mobility program. “ARL researchers have demonstrated an interactive bi-directional communication system that enables real-time exchanges between humans and robots.”

And of course (CGI):

Sun, 07/13/2025 - 19:15

.

Scientists at the U.S. Army Combat Capabilities Development Command Army Research Laboratory (DEVCOM ARL) are pioneering advancements in ground and aerial autonomous systems, as well as energy solutions, to bolster the mobility and maneuverability of these technologies, the technology website reports.

“We are bridging the gap between humans and robots, making them more intuitive, responsive, and, ultimately, more useful for the Soldier,” said a lead researcher for the Artificial Intelligence for Maneuver and Mobility program. “ARL researchers have demonstrated an interactive bi-directional communication system that enables real-time exchanges between humans and robots.”

And of course (CGI):

Sun, 07/13/2025 - 19:15

An op-ed published by Yuan Yi, Ma Ye and Yue Shiguang in the People’s Liberation Army (PLA) Daily warned that faulty robots could lead to "indiscriminate killings and accidental death,” which would "inevitably result in legal charges and moral condemnation."

The

An op-ed published by Yuan Yi, Ma Ye and Yue Shiguang in the People’s Liberation Army (PLA) Daily warned that faulty robots could lead to "indiscriminate killings and accidental death,” which would "inevitably result in legal charges and moral condemnation."

The

According

According

The fallout from the Secret Service’s handling of the assassination attempt has led Republican lawmakers to question the nationwide effort to increase the female recruitment rate to 30% by 2030.

By 2022, the “30×30 pledge” had the signatures of 150 law enforcement agencies. Signees included the Secret Service, FBI and U.S. Marshalls.

Since taking office in January, Trump has signed several

The fallout from the Secret Service’s handling of the assassination attempt has led Republican lawmakers to question the nationwide effort to increase the female recruitment rate to 30% by 2030.

By 2022, the “30×30 pledge” had the signatures of 150 law enforcement agencies. Signees included the Secret Service, FBI and U.S. Marshalls.

Since taking office in January, Trump has signed several

Colby has made clear in a Sunday statement that he's working on implementing President Donald Trump’s agenda of "restoring deterrence and achieving peace through strength." He outlined that this includes "urging allies to step up their defense spending and other efforts related to our collective defense."

And separately, a US defense official described that the "animating theme" of these recent discussions with allies was "to intensify and accelerate efforts to strengthen deterrence in a balanced, equitable way."

The official was quoted in FT as saying "We do not seek war. Nor do we seek to dominate China itself. What we are doing is ensuring the United States and its allies have the military strength to underwrite diplomacy and guarantee peace."

But Beijing might understandably disagree, given that in recent months it has been confirmed that the US maintains hundreds of Marines in Taiwan, including on its small outlying islands near China's coast, ostensibly for "training" purposes.

We can imagine what Washington's reaction would be if China had PLA troops all over Cuba or even US territory Puerto Rico, in support of a Puerto Rican 'independence movement'.

Japan, which has never had an actual military to speak of after its WW2 defeat, would likely be expected to play host to American troop build-ups and naval fleets.

As for Australia, it has clarified it will not commit troops in advance to any conflict. As laid out by the

Colby has made clear in a Sunday statement that he's working on implementing President Donald Trump’s agenda of "restoring deterrence and achieving peace through strength." He outlined that this includes "urging allies to step up their defense spending and other efforts related to our collective defense."

And separately, a US defense official described that the "animating theme" of these recent discussions with allies was "to intensify and accelerate efforts to strengthen deterrence in a balanced, equitable way."

The official was quoted in FT as saying "We do not seek war. Nor do we seek to dominate China itself. What we are doing is ensuring the United States and its allies have the military strength to underwrite diplomacy and guarantee peace."

But Beijing might understandably disagree, given that in recent months it has been confirmed that the US maintains hundreds of Marines in Taiwan, including on its small outlying islands near China's coast, ostensibly for "training" purposes.

We can imagine what Washington's reaction would be if China had PLA troops all over Cuba or even US territory Puerto Rico, in support of a Puerto Rican 'independence movement'.

Japan, which has never had an actual military to speak of after its WW2 defeat, would likely be expected to play host to American troop build-ups and naval fleets.

As for Australia, it has clarified it will not commit troops in advance to any conflict. As laid out by the

The unmanned vessel being tested by II Marine Expeditionary Force is called the "Sea Specter," and it's produced by Gibbs & Cox, is a subsidiary of Reston, VA-based

The unmanned vessel being tested by II Marine Expeditionary Force is called the "Sea Specter," and it's produced by Gibbs & Cox, is a subsidiary of Reston, VA-based

While the program's current emphasis is on logistics missions, the vessels could have a variety of uses. “This thing could loiter in a prescribed area for a very extended duration,” Bowles said, suggesting they could facilitate communications. “It could also form a picket line to look for intruders. You could line these up, you know, and look for human trafficking, or any type of people encroaching on U.S. territory. These things have the endurance to sit there.”

The current version of the Sea Specter is made of wood. "That's not the solution that we believe is right for the long-term, and we're looking to move into preparing for high-volume production out of a different material,” said Bowles, holding out possibilities of fiberglass, aluminum or steel.

Sneaky robotic supply vessels are not the stuff of nightmares. In that realm, concerns are mounting both inside and outside of China as the Communist superpower advances humanoid robot development to replace human soldiers on the battlefield <a href="zerohedge.com/military/china-warns-rogue-robot-troops-unleashing-terminator-style-indiscriminate-killings" rel="nofollow">raising the specter of rogue robot troops unleashing Terminator-style indiscriminate killings</a>.

While the program's current emphasis is on logistics missions, the vessels could have a variety of uses. “This thing could loiter in a prescribed area for a very extended duration,” Bowles said, suggesting they could facilitate communications. “It could also form a picket line to look for intruders. You could line these up, you know, and look for human trafficking, or any type of people encroaching on U.S. territory. These things have the endurance to sit there.”

The current version of the Sea Specter is made of wood. "That's not the solution that we believe is right for the long-term, and we're looking to move into preparing for high-volume production out of a different material,” said Bowles, holding out possibilities of fiberglass, aluminum or steel.

Sneaky robotic supply vessels are not the stuff of nightmares. In that realm, concerns are mounting both inside and outside of China as the Communist superpower advances humanoid robot development to replace human soldiers on the battlefield <a href="zerohedge.com/military/china-warns-rogue-robot-troops-unleashing-terminator-style-indiscriminate-killings" rel="nofollow">raising the specter of rogue robot troops unleashing Terminator-style indiscriminate killings</a>.

The market is either:

Incredibly reluctant to price in higher tariffs, or

No longer believes higher tariffs are bad for the economy, profits, and markets.

Let’s look at these two options for a moment.

Tariffs Don’t Matter

There are some people who will argue this. They argued for it before and after the Liberation Day tariffs. They will claim that despite tariffs, the market and economy have been fine.

But is this a widely held view? I don’t think so and it certainly isn’t my view:

The “pause” put tariffs back into the “neighborhood” of “reciprocal” tariffs. Worse than what many had expected when policy was targeting “reciprocal,” but in the ballpark. There are a number of “estimates” out there for what the “effective” tariff rate is. We’ve seen some as of the end of May as low as 8.8%, but other more current estimates have it around 14%. If we go ahead with these new levels, slated to take effect August 1, the effective rate will increase significantly in the coming months as imports that arrive get hit with these new tariffs. It is difficult to believe that higher tariffs won’t impact the economy over time.

Tariff mitigation strategies. We’ve written repeatedly that many (including ourselves) underestimated the various mitigation strategies that could be employed, especially around the “pause” level of tariffs.

Tariffs take time to have an impact.

Companies pre-ordered ahead of tariffs, delaying any impact of tariffs until they need to re-order.

There will be negotiations with suppliers about “eating” some of the tariff. Not much will be passed on while those negotiations take place.

Finally, with the administration keeping an eye on prices, it behooves some large companies to “eat” the tariffs themselves as price hikes linked to tariffs appear to draw the attention of the administration.

Unexpectedly, the dollar is down about 10% since early January (measured by DXY, a broad index of the dollar), which makes imports even more expensive (and makes U.S. exports less expensive – a side benefit).

Tariffs, so far, have been small in actual dollars (it is easy to get caught up in a world of percentages, but the total dollar amount, so far, has been small relative to the size of the economy).

The market is either:

Incredibly reluctant to price in higher tariffs, or

No longer believes higher tariffs are bad for the economy, profits, and markets.

Let’s look at these two options for a moment.

Tariffs Don’t Matter

There are some people who will argue this. They argued for it before and after the Liberation Day tariffs. They will claim that despite tariffs, the market and economy have been fine.

But is this a widely held view? I don’t think so and it certainly isn’t my view:

The “pause” put tariffs back into the “neighborhood” of “reciprocal” tariffs. Worse than what many had expected when policy was targeting “reciprocal,” but in the ballpark. There are a number of “estimates” out there for what the “effective” tariff rate is. We’ve seen some as of the end of May as low as 8.8%, but other more current estimates have it around 14%. If we go ahead with these new levels, slated to take effect August 1, the effective rate will increase significantly in the coming months as imports that arrive get hit with these new tariffs. It is difficult to believe that higher tariffs won’t impact the economy over time.

Tariff mitigation strategies. We’ve written repeatedly that many (including ourselves) underestimated the various mitigation strategies that could be employed, especially around the “pause” level of tariffs.

Tariffs take time to have an impact.

Companies pre-ordered ahead of tariffs, delaying any impact of tariffs until they need to re-order.

There will be negotiations with suppliers about “eating” some of the tariff. Not much will be passed on while those negotiations take place.

Finally, with the administration keeping an eye on prices, it behooves some large companies to “eat” the tariffs themselves as price hikes linked to tariffs appear to draw the attention of the administration.

Unexpectedly, the dollar is down about 10% since early January (measured by DXY, a broad index of the dollar), which makes imports even more expensive (and makes U.S. exports less expensive – a side benefit).

Tariffs, so far, have been small in actual dollars (it is easy to get caught up in a world of percentages, but the total dollar amount, so far, has been small relative to the size of the economy).

I find it difficult to believe that markets think that higher tariffs won’t impact the economy and markets negatively over time.

That explanation just doesn’t cut it from my perspective.

Tariffs Won’t Get Implemented

This is the real reason markets are taking all the tariff headlines in stride. We were “fooled” once:

Expect short-term pain for longer-term gains.

Main Street over Wall Street.

Unfair and predatory practices against the U.S. must be eliminated or punished.

Dealz. Countries lining up and begging for deals.

We went through that.

And let’s not forget that the Liberation Day tariffs actually were, in theory, implemented. We went through the midnight deadline with no “stay of execution.” Rallies based on “pauses” or “extensions” headlines faded rapidly, until we got the Big Beautiful Pause.

Since then, stocks have rallied. The first leg was driven by the “pause,” but stocks have been helped by the ongoing commitment to AI spending, progress on Peace Through Strength, and the Big Beautiful Bill.

Will this administration risk the progress to refocus on tariffs? Why do this, when other avenues for economic development exist (National Production for National Security, the Sovereign Wealth Fund, etc.). Heck there is the possibility of “dealz.” Though it is a bit concerning that there is no clarity over what was agreed to with China, there seems to be confusion about what Vietnam agreed to or didn’t agree to, and many nations are signaling that their negotiating teams are struggling to understand the U.S. objective.

So maybe the market doesn’t want to overreact because we could see deals? That is possible, but it seems unlikely as progress on deals has been slow and if 10% with good friends like the U.K. is the best a country can expect, then we might be ripe for disappointment on deals (or the U.K. may regret what they agreed to).

Or is it the belief that the administration will back down again?

Trump Always Chickens Out (TACO) has become a theme. It is not a theme we subscribe to.

The President will PIVOT. He will shift away from “losers” to “winners.” Do a Google Trends search on “Peter Navarro” – it has dropped to almost nothing since peaking in early April. That has been the President’s style.

Having said that, there are reasons to be concerned that this shift back to tariffs could be real and could be implemented:

The President has embraced the concept of tariffs for decades. This is not something he needed to be convinced of. It has been his policy and he believes in tariffs.

It is easy to see how the President could view tariffs as “winning” so far – no inflation, stocks at all-time highs, and tariff revenue is real. It is far too early to take a victory lap based on tariff policy so far, but there is a narrative around it that could encourage those who really believe in tariffs.

The President isn’t afraid of taking a “second bite at the apple.” He can pivot away from something and then pivot back. He walks away from deals only to close them later (sometimes with better terms). He can blame the timing on why market reaction was so bad. To some degree, we would agree that had he started with taxes and other policies, then went to tariffs, with a real focus on China, the market would not have reacted as badly. We would have seen some positives and a more targeted approach. So maybe it is worth another shot? It is not a shot I would take, but we aren’t in charge, and the idea that with some other big wins in hand, it is time to try the tariff policies again, has a certain appeal.

It is easy to interpret market complacency as market acceptance. Our argument is that the market is pricing in a low risk of implementation, rather than accepting that higher tariffs won’t be harmful. But if you believe in tariffs, it is easy to be convinced that the market is signaling that it is ready for another round of higher tariffs.

The idea that the market is simply unwilling to accept that higher tariffs will be implement and kept in place seems to be the best explanation for why tariffs have failed to move the market this past week. The market has been fooled once and won’t be fooled again.

Bottom Line

The market has been fooled once and won’t be fooled again. Or will it? Has the market simply become so complacent that it is not only missing (or ignoring) signs that the administration is serious about trying again on tariffs, but also that the complacency is giving the administration the conviction it needs to try again?

There are a lot of good things going on with the economy and hopefully the MP deal referenced earlier is a template and a sign that the administration is going to aggressively address crucial areas where we are nowhere close enough to being self-sufficient to be secure.

For markets, be overweight anything that should benefit from this theme of National Production for National Security. Be underweight industries most affected by tariffs. While it might be “safe” to assume the administration will back down, extend, and try to move towards deals, there seems to be some real risk to that.

On rates, if it wasn’t for tariffs, I’d be bullish again here, but with tariff risk, probably neutral to slightly bearish the long end.

Credit should continue to do well under most scenarios, but owning the companies that will benefit from domestic production should outperform.

Crypto should continue to benefit from uncertainty, and the increased attention that the administration will pay to it in the coming weeks and months now that they’ve knocked off some other big projects and have time to focus.

A President, who has had several big recent wins, truly believes in tariffs, and cannot like the TACO meme (which we don’t like either) may be far more serious about this then is currently getting priced in. With those other big wins under the belt, the market should not respond as poorly as it did the first go around, but a pullback of 5% would seem highly likely as we near August 1st without any major reprieve.

Academy Securities gets the week started from 6-6:30 Monday morning on Bloomberg Surveillance. I wonder if the President will be watching as he certainly was on jobs day when he po

I find it difficult to believe that markets think that higher tariffs won’t impact the economy and markets negatively over time.

That explanation just doesn’t cut it from my perspective.

Tariffs Won’t Get Implemented

This is the real reason markets are taking all the tariff headlines in stride. We were “fooled” once:

Expect short-term pain for longer-term gains.

Main Street over Wall Street.

Unfair and predatory practices against the U.S. must be eliminated or punished.

Dealz. Countries lining up and begging for deals.

We went through that.

And let’s not forget that the Liberation Day tariffs actually were, in theory, implemented. We went through the midnight deadline with no “stay of execution.” Rallies based on “pauses” or “extensions” headlines faded rapidly, until we got the Big Beautiful Pause.

Since then, stocks have rallied. The first leg was driven by the “pause,” but stocks have been helped by the ongoing commitment to AI spending, progress on Peace Through Strength, and the Big Beautiful Bill.

Will this administration risk the progress to refocus on tariffs? Why do this, when other avenues for economic development exist (National Production for National Security, the Sovereign Wealth Fund, etc.). Heck there is the possibility of “dealz.” Though it is a bit concerning that there is no clarity over what was agreed to with China, there seems to be confusion about what Vietnam agreed to or didn’t agree to, and many nations are signaling that their negotiating teams are struggling to understand the U.S. objective.

So maybe the market doesn’t want to overreact because we could see deals? That is possible, but it seems unlikely as progress on deals has been slow and if 10% with good friends like the U.K. is the best a country can expect, then we might be ripe for disappointment on deals (or the U.K. may regret what they agreed to).

Or is it the belief that the administration will back down again?

Trump Always Chickens Out (TACO) has become a theme. It is not a theme we subscribe to.

The President will PIVOT. He will shift away from “losers” to “winners.” Do a Google Trends search on “Peter Navarro” – it has dropped to almost nothing since peaking in early April. That has been the President’s style.

Having said that, there are reasons to be concerned that this shift back to tariffs could be real and could be implemented:

The President has embraced the concept of tariffs for decades. This is not something he needed to be convinced of. It has been his policy and he believes in tariffs.

It is easy to see how the President could view tariffs as “winning” so far – no inflation, stocks at all-time highs, and tariff revenue is real. It is far too early to take a victory lap based on tariff policy so far, but there is a narrative around it that could encourage those who really believe in tariffs.

The President isn’t afraid of taking a “second bite at the apple.” He can pivot away from something and then pivot back. He walks away from deals only to close them later (sometimes with better terms). He can blame the timing on why market reaction was so bad. To some degree, we would agree that had he started with taxes and other policies, then went to tariffs, with a real focus on China, the market would not have reacted as badly. We would have seen some positives and a more targeted approach. So maybe it is worth another shot? It is not a shot I would take, but we aren’t in charge, and the idea that with some other big wins in hand, it is time to try the tariff policies again, has a certain appeal.

It is easy to interpret market complacency as market acceptance. Our argument is that the market is pricing in a low risk of implementation, rather than accepting that higher tariffs won’t be harmful. But if you believe in tariffs, it is easy to be convinced that the market is signaling that it is ready for another round of higher tariffs.

The idea that the market is simply unwilling to accept that higher tariffs will be implement and kept in place seems to be the best explanation for why tariffs have failed to move the market this past week. The market has been fooled once and won’t be fooled again.

Bottom Line

The market has been fooled once and won’t be fooled again. Or will it? Has the market simply become so complacent that it is not only missing (or ignoring) signs that the administration is serious about trying again on tariffs, but also that the complacency is giving the administration the conviction it needs to try again?

There are a lot of good things going on with the economy and hopefully the MP deal referenced earlier is a template and a sign that the administration is going to aggressively address crucial areas where we are nowhere close enough to being self-sufficient to be secure.

For markets, be overweight anything that should benefit from this theme of National Production for National Security. Be underweight industries most affected by tariffs. While it might be “safe” to assume the administration will back down, extend, and try to move towards deals, there seems to be some real risk to that.

On rates, if it wasn’t for tariffs, I’d be bullish again here, but with tariff risk, probably neutral to slightly bearish the long end.

Credit should continue to do well under most scenarios, but owning the companies that will benefit from domestic production should outperform.

Crypto should continue to benefit from uncertainty, and the increased attention that the administration will pay to it in the coming weeks and months now that they’ve knocked off some other big projects and have time to focus.

A President, who has had several big recent wins, truly believes in tariffs, and cannot like the TACO meme (which we don’t like either) may be far more serious about this then is currently getting priced in. With those other big wins under the belt, the market should not respond as poorly as it did the first go around, but a pullback of 5% would seem highly likely as we near August 1st without any major reprieve.

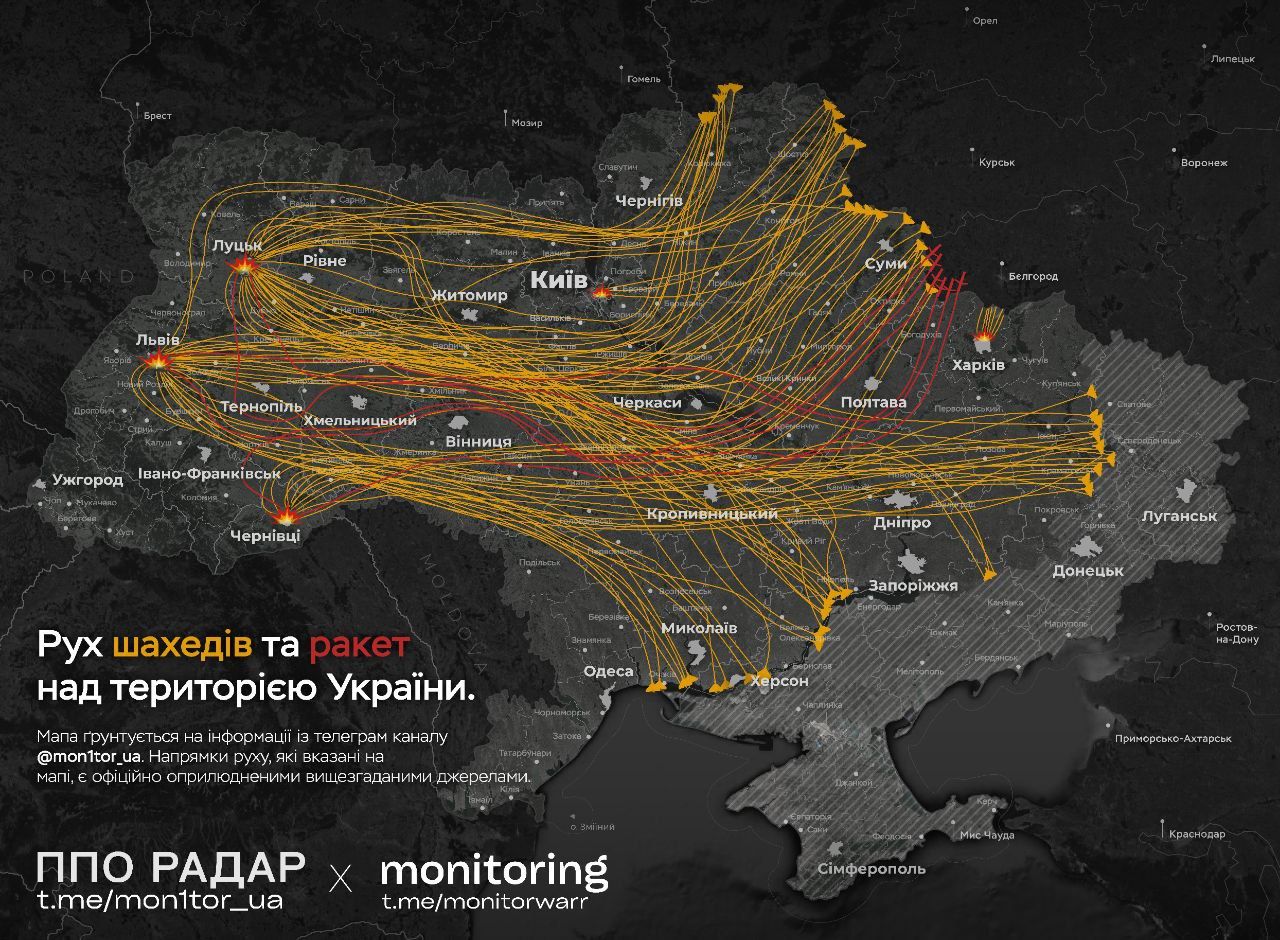

Academy Securities gets the week started from 6-6:30 Monday morning on Bloomberg Surveillance. I wonder if the President will be watching as he certainly was on jobs day when he po "Russia continues its strategy of terror, striking specific cities and regions with concentrated attacks," Ukrainian President Volodymyr Zelensky said in his nightly address.

He described that many of the drones were decoys or "simulators" which are designed to distract and overwhelm defense systems, making it harder to intercept the actual assault kamikaze drones.

Zelensky further said that included in the overnight aerial attack were 26 cruise missiles, and that some half of all the UAVs were Iranian-make Shaheds.

Hits on southwestern Chernivtsi region saw two people killed and 20 injured, even though this area is far from the front lines of battle with Russian forces.

Another distant place, Lviv in the far western Ukraine, saw a dozen wounded from the attacks, and in the east two people died in Dnipropetrovsk and three were injured in Kharkiv.

President Trump within recent days has ramped-up weapons shipments to Kiev, after the Pentagon had announced a stoppage to arms transfers, which the White House sought to dismiss as a misunderstanding.

Zelensky in his latest remarks further touted progress on a "multi-level agreement" for new American Patriot missile systems and interceptors.

All of this is happening despite US defense officials having long sounded the alarm over diminishing US stockpiles. Many Patriots were used in the latest conflict involving Iran and Israel, and now the US looks to give more away to Ukraine.

🔴 Russia conducted one of the most massive attacks on Ukraine to date tonight.

Preliminarily, Russian troops deployed:

- Between 560 and 700 drones.

- Over 15 Kh-101 cruise missiles.

The main targets of the assault were Lviv, Lutsk, and Chernivtsi.

"Russia continues its strategy of terror, striking specific cities and regions with concentrated attacks," Ukrainian President Volodymyr Zelensky said in his nightly address.

He described that many of the drones were decoys or "simulators" which are designed to distract and overwhelm defense systems, making it harder to intercept the actual assault kamikaze drones.

Zelensky further said that included in the overnight aerial attack were 26 cruise missiles, and that some half of all the UAVs were Iranian-make Shaheds.

Hits on southwestern Chernivtsi region saw two people killed and 20 injured, even though this area is far from the front lines of battle with Russian forces.

Another distant place, Lviv in the far western Ukraine, saw a dozen wounded from the attacks, and in the east two people died in Dnipropetrovsk and three were injured in Kharkiv.

President Trump within recent days has ramped-up weapons shipments to Kiev, after the Pentagon had announced a stoppage to arms transfers, which the White House sought to dismiss as a misunderstanding.

Zelensky in his latest remarks further touted progress on a "multi-level agreement" for new American Patriot missile systems and interceptors.

All of this is happening despite US defense officials having long sounded the alarm over diminishing US stockpiles. Many Patriots were used in the latest conflict involving Iran and Israel, and now the US looks to give more away to Ukraine.

🔴 Russia conducted one of the most massive attacks on Ukraine to date tonight.

Preliminarily, Russian troops deployed:

- Between 560 and 700 drones.

- Over 15 Kh-101 cruise missiles.

The main targets of the assault were Lviv, Lutsk, and Chernivtsi.

Gold, beyond its role as a monetary hedge, has geopolitical value as central banks around the world—especially in China and Russia—continue to accumulate it.

If the U.S. dollar were to face a serious challenge—whether from a competing global reserve currency, a loss of confidence due to excessive debt and deficits, or the rise of alternative settlement systems like BRICS-backed gold trade—the government might view control over domestic gold and silver production as a matter of national security.

Gold, in particular, remains a monetary metal held by central banks as a store of value and potential backstop to fiat currency systems. In a scenario where dollar credibility is questioned, the U.S. might move to secure internal gold and silver supply chains to prevent foreign accumulation, stabilize financial markets, and potentially reassert the dollar’s strength through hard-asset backing.

Nationalizing or heavily regulating the domestic mining of these metals could be seen as a strategic safeguard, especially if the metals become central to new monetary architecture or geopolitical power plays.

Silver is essential for solar panels, semiconductors, and medical applications, making it a core input for the green economy.

Copper, often called the “metal of electrification,” underpins nearly every energy transition technology. Platinum group metals play a vital role in emissions control systems and emerging hydrogen fuel technologies.

And last week, former President Trump announced a surprise 50% tariff on copper imports, set to take effect August 1 under national security grounds. The move, aimed at reducing U.S. reliance on foreign copper, caused copper prices to surge over 12% as buyers rushed to import before the deadline. Industry experts warned the tariff could backfire by increasing costs for U.S. manufacturers without meaningfully boosting domestic copper production. Major producers like Chile’s Codelco are awaiting details on which copper products will be affected. The decision has escalated trade tensions and raised concerns about inflation and supply chain stability.

However, it’s important to acknowledge that the comparison between rare earths and these other metals may not be entirely appropriate.

The rare earths situation is far more urgent. China controls nearly 90% of global rare earth processing and over 70% of the raw supply. Just last month, China cut its rare earth exports by 75%, weaponizing its near-monopoly and reminding the world how fragile that supply chain really is.

🔥 70% OFF: Today’s uncomfortable act of self-promotion. Take a run as a paid subscriber to Fringe Finance and I’ll give you 70% off an annual subscription — a discount that you can keep for as long as you wish to stay a subscriber:

Gold, beyond its role as a monetary hedge, has geopolitical value as central banks around the world—especially in China and Russia—continue to accumulate it.

If the U.S. dollar were to face a serious challenge—whether from a competing global reserve currency, a loss of confidence due to excessive debt and deficits, or the rise of alternative settlement systems like BRICS-backed gold trade—the government might view control over domestic gold and silver production as a matter of national security.

Gold, in particular, remains a monetary metal held by central banks as a store of value and potential backstop to fiat currency systems. In a scenario where dollar credibility is questioned, the U.S. might move to secure internal gold and silver supply chains to prevent foreign accumulation, stabilize financial markets, and potentially reassert the dollar’s strength through hard-asset backing.

Nationalizing or heavily regulating the domestic mining of these metals could be seen as a strategic safeguard, especially if the metals become central to new monetary architecture or geopolitical power plays.

Silver is essential for solar panels, semiconductors, and medical applications, making it a core input for the green economy.

Copper, often called the “metal of electrification,” underpins nearly every energy transition technology. Platinum group metals play a vital role in emissions control systems and emerging hydrogen fuel technologies.

And last week, former President Trump announced a surprise 50% tariff on copper imports, set to take effect August 1 under national security grounds. The move, aimed at reducing U.S. reliance on foreign copper, caused copper prices to surge over 12% as buyers rushed to import before the deadline. Industry experts warned the tariff could backfire by increasing costs for U.S. manufacturers without meaningfully boosting domestic copper production. Major producers like Chile’s Codelco are awaiting details on which copper products will be affected. The decision has escalated trade tensions and raised concerns about inflation and supply chain stability.

However, it’s important to acknowledge that the comparison between rare earths and these other metals may not be entirely appropriate.

The rare earths situation is far more urgent. China controls nearly 90% of global rare earth processing and over 70% of the raw supply. Just last month, China cut its rare earth exports by 75%, weaponizing its near-monopoly and reminding the world how fragile that supply chain really is.

🔥 70% OFF: Today’s uncomfortable act of self-promotion. Take a run as a paid subscriber to Fringe Finance and I’ll give you 70% off an annual subscription — a discount that you can keep for as long as you wish to stay a subscriber:

QTR’s Disclaimer: Please read my full legal disclaimer

QTR’s Disclaimer: Please read my full legal disclaimer

"Then the pandemic hit, and our preferences began to feel like more than differences in taste. We were on opposite sides of a cultural civil war. The deepest divide was vaccination. I wasn't shocked when Matt didn't get the Covid shot. But I was baffled. Turning down a vaccine during a pandemic seemed like a rejection of science and self-preservation. It felt like he was tearing up the social contract that, until that point, I'd imagined we shared," the liberal elite millennial opined.

Litt continued, "Had Matt been a friend rather than a family member, I probably would have cut off contact completely."

But only recently — and through shared surf sessions — did Litt's liberal mind experience a revelation: "These days, ostracism might just hurt the ostracizer more than the ostracizee."

Litt's renewed bond with Matt didn't erase political disagreements, but it revealed common ground in unexpected places, showing that personal connection can transcend ideological divides and arguing that shunning people in today's highly polarized America is often ineffective and counterproductive, urging people to keep doors open rather than slam them shut over politics.

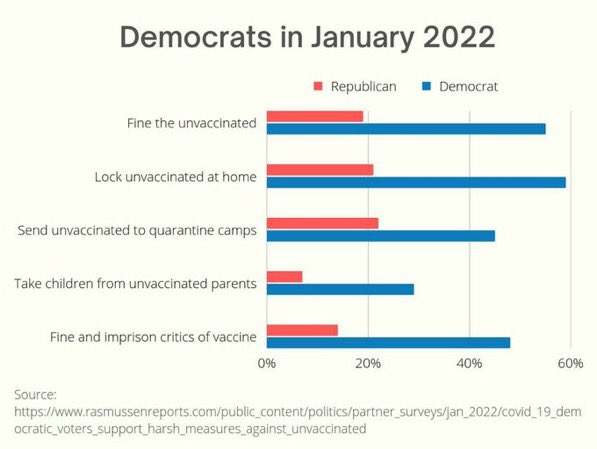

Perhaps Litt's maturity is finally kicking in — after all, with time, people tend to become more conservative (by the mid/late 30s). Remember, it wasn't conservatives rushing to become the "Karens of Science" during Covid, pushing to ban the unvaccinated, with some Democrats even threatening them with jail or quarantine camps…

"Then the pandemic hit, and our preferences began to feel like more than differences in taste. We were on opposite sides of a cultural civil war. The deepest divide was vaccination. I wasn't shocked when Matt didn't get the Covid shot. But I was baffled. Turning down a vaccine during a pandemic seemed like a rejection of science and self-preservation. It felt like he was tearing up the social contract that, until that point, I'd imagined we shared," the liberal elite millennial opined.

Litt continued, "Had Matt been a friend rather than a family member, I probably would have cut off contact completely."

But only recently — and through shared surf sessions — did Litt's liberal mind experience a revelation: "These days, ostracism might just hurt the ostracizer more than the ostracizee."

Litt's renewed bond with Matt didn't erase political disagreements, but it revealed common ground in unexpected places, showing that personal connection can transcend ideological divides and arguing that shunning people in today's highly polarized America is often ineffective and counterproductive, urging people to keep doors open rather than slam them shut over politics.

Perhaps Litt's maturity is finally kicking in — after all, with time, people tend to become more conservative (by the mid/late 30s). Remember, it wasn't conservatives rushing to become the "Karens of Science" during Covid, pushing to ban the unvaccinated, with some Democrats even threatening them with jail or quarantine camps…

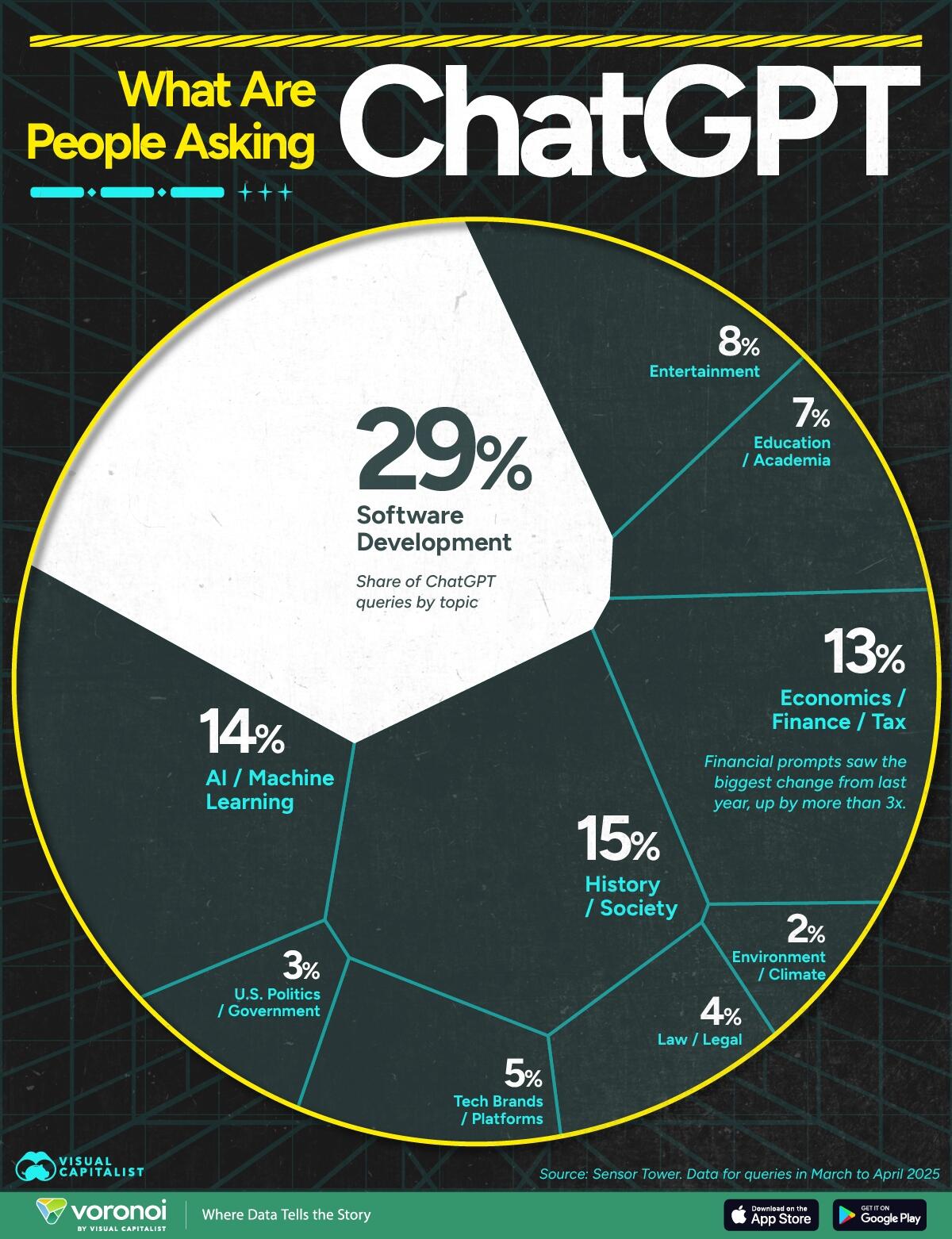

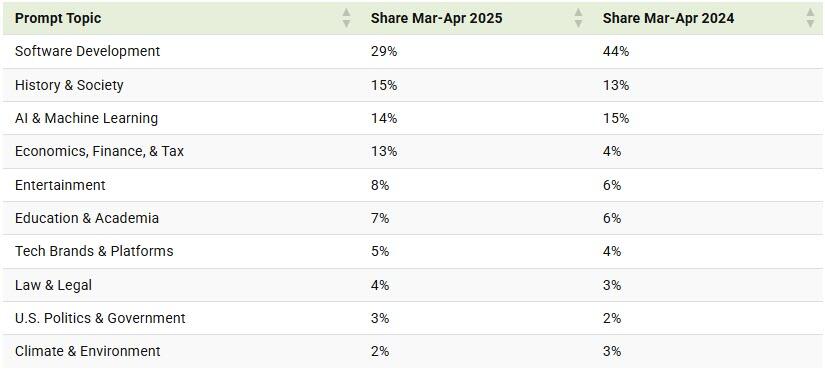

Top Categories for ChatGPT Prompts in 2025

Below, we show the leading prompt categories on

Top Categories for ChatGPT Prompts in 2025

Below, we show the leading prompt categories on

Covering 29% of all prompts, software development is the top category for ChatGPT users.

Along with simplifying coding tasks across multiple programming languages, ChatGPT can help debug and automate tasks. A separate study found that early coders (those with under a year of coding experience) were

Covering 29% of all prompts, software development is the top category for ChatGPT users.

Along with simplifying coding tasks across multiple programming languages, ChatGPT can help debug and automate tasks. A separate study found that early coders (those with under a year of coding experience) were