"Your 'Equity' Is Fake" - Robinhood Faces Backlash After OpenAI Denounces Tokenized Shares

"Your 'Equity' Is Fake" - Robinhood Faces Backlash After OpenAI Denounces Tokenized Shares

OpenAI has publicly rejected Robinhood’s new “OpenAI tokens,”  in the company.

in the company.

Key Takeaways

OpenAI disavowed Robinhood’s tokenized equity products, stating they do not grant real ownership in OpenAI.

The tokens offer indirect exposure through a Special Purpose Vehicle, not direct shares.

Elon Musk and others have criticized Robinhood’s efforts as misleading.

The move highlights growing tensions between crypto innovation and traditional private equity rules.

In a clash that is drawing widespread attention across finance and tech circles, OpenAI has forcefully rejected Robinhood’s latest effort to sell “OpenAI tokens” to retail investors. The controversy erupted after Robinhood announced it would distribute these tokens to European Union users, promoting them as a way for everyday people to gain exposure to private company equity using blockchain technology. While Robinhood framed the move as

, OpenAI and key industry voices have condemned the tokens as misleading and lacking in substance.

OpenAI’s Public Statement: No Equity, No Endorsement

OpenAI, the well-known artificial intelligence company, issued a rare public statement from its official newsroom account, clearly distancing itself from Robinhood’s offering.

“These ‘OpenAI tokens’ are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful,” the company

Key Takeaways

OpenAI disavowed Robinhood’s tokenized equity products, stating they do not grant real ownership in OpenAI.

The tokens offer indirect exposure through a Special Purpose Vehicle, not direct shares.

Elon Musk and others have criticized Robinhood’s efforts as misleading.

The move highlights growing tensions between crypto innovation and traditional private equity rules.

In a clash that is drawing widespread attention across finance and tech circles, OpenAI has forcefully rejected Robinhood’s latest effort to sell “OpenAI tokens” to retail investors. The controversy erupted after Robinhood announced it would distribute these tokens to European Union users, promoting them as a way for everyday people to gain exposure to private company equity using blockchain technology. While Robinhood framed the move as

, OpenAI and key industry voices have condemned the tokens as misleading and lacking in substance.

OpenAI’s Public Statement: No Equity, No Endorsement

OpenAI, the well-known artificial intelligence company, issued a rare public statement from its official newsroom account, clearly distancing itself from Robinhood’s offering.

“These ‘OpenAI tokens’ are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer. Please be careful,” the company  .

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer.

Please be careful.

— OpenAI Newsroom (@OpenAINewsroom)

.

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfer of OpenAI equity requires our approval—we did not approve any transfer.

Please be careful.

— OpenAI Newsroom (@OpenAINewsroom)  OpenAI’s response was triggered by Robinhood’s announcement earlier in the week, in which the fintech platform rolled out tokenized shares of OpenAI, SpaceX, and other major private firms. These digital assets were distributed to select users in the EU as part of a promotional giveaway.

Robinhood’s Defense: Democratizing Private Assets

Robinhood’s leadership responded by defending the program, emphasizing that the tokens are designed to give retail investors indirect access to previously exclusive markets. A spokesperson for Robinhood clarified, “These tokens give retail investors indirect exposure to private markets, opening up access, and are enabled by Robinhood’s ownership stake in a special purpose vehicle.”

Robinhood CEO Vlad Tenev echoed this sentiment, stating, “While it is true that they are not technically ‘equity,’ the tokens effectively give retail investors exposure to these private assets. Our giveaway plants a seed for something much bigger, and since our announcement we have been hearing from many private companies that are eager to join us in the tokenization revolution.”

The company rolled out the tokens as part of a broader effort to introduce tokenized stocks and real-world asset trading for European customers, building on a newly launched layer two blockchain network for settling tokenized equity trades.

What Are Investors Actually Buying?

Despite Robinhood’s promotional messaging, the underlying structure of the tokens is complex and layered.

Investors are not purchasing actual shares of OpenAI or direct stakes in the company.

The tokens represent contracts linked to Robinhood’s ownership interest in an SPV, which itself holds shares of private companies.

This means buyers are two steps removed from actual equity, and the value of the tokens may diverge significantly from the true value of the underlying shares.

According to Robinhood’s help center, users buying these tokens are acquiring “tokenized contracts that follow the price” of the underlying assets, recorded on blockchain.

Industry Pushback and Criticism

The move by Robinhood has attracted strong criticism, both from within the industry and from high-profile figures.

OpenAI’s response was triggered by Robinhood’s announcement earlier in the week, in which the fintech platform rolled out tokenized shares of OpenAI, SpaceX, and other major private firms. These digital assets were distributed to select users in the EU as part of a promotional giveaway.

Robinhood’s Defense: Democratizing Private Assets

Robinhood’s leadership responded by defending the program, emphasizing that the tokens are designed to give retail investors indirect access to previously exclusive markets. A spokesperson for Robinhood clarified, “These tokens give retail investors indirect exposure to private markets, opening up access, and are enabled by Robinhood’s ownership stake in a special purpose vehicle.”

Robinhood CEO Vlad Tenev echoed this sentiment, stating, “While it is true that they are not technically ‘equity,’ the tokens effectively give retail investors exposure to these private assets. Our giveaway plants a seed for something much bigger, and since our announcement we have been hearing from many private companies that are eager to join us in the tokenization revolution.”

The company rolled out the tokens as part of a broader effort to introduce tokenized stocks and real-world asset trading for European customers, building on a newly launched layer two blockchain network for settling tokenized equity trades.

What Are Investors Actually Buying?

Despite Robinhood’s promotional messaging, the underlying structure of the tokens is complex and layered.

Investors are not purchasing actual shares of OpenAI or direct stakes in the company.

The tokens represent contracts linked to Robinhood’s ownership interest in an SPV, which itself holds shares of private companies.

This means buyers are two steps removed from actual equity, and the value of the tokens may diverge significantly from the true value of the underlying shares.

According to Robinhood’s help center, users buying these tokens are acquiring “tokenized contracts that follow the price” of the underlying assets, recorded on blockchain.

Industry Pushback and Criticism

The move by Robinhood has attracted strong criticism, both from within the industry and from high-profile figures.

, co-founder of OpenAI and SpaceX, took to X to call the equity claims “fake,” highlighting his broader concerns about OpenAI’s shift toward a for-profit model.

Your “equity” is fake

— Elon Musk (@elonmusk)

, co-founder of OpenAI and SpaceX, took to X to call the equity claims “fake,” highlighting his broader concerns about OpenAI’s shift toward a for-profit model.

Your “equity” is fake

— Elon Musk (@elonmusk)  Industry analysts note that private companies typically guard their cap tables and limit share sales to selected investors, making Robinhood’s approach unusual and controversial.

In similar instances, other startups like Figure AI have sent cease-and-desist letters to brokers marketing unauthorized share sales, underlining how sensitive private companies are about third parties trading or referencing their equity.

Broader Context: Tokenization and Financial Inclusion

Robinhood’s foray into tokenized private equity reflects a larger trend in finance, where crypto exchanges and platforms seek to offer access to previously inaccessible asset classes such as private equity, private credit, and commercial real estate.

Traditionally, these assets are reserved for accredited investors with significant wealth or credentials, limiting opportunities for the average retail customer.

Robinhood argues that tokenization and asset fractionalization can help break down these barriers, though critics warn that regulatory and ethical questions remain unresolved.

CoinLaw’s Takeaway

This episode is a clear signal of the growing friction between fast-moving crypto innovation and the strict, carefully controlled world of private company finance. While Robinhood presents tokenization as a breakthrough for retail investors, OpenAI’s sharp rebuke makes it clear that not all stakeholders see it that way. Investors should scrutinize exactly what is being offered and recognize that buying a token does not always mean owning a share in the world’s biggest private companies.

Thu, 07/03/2025 - 12:00

Industry analysts note that private companies typically guard their cap tables and limit share sales to selected investors, making Robinhood’s approach unusual and controversial.

In similar instances, other startups like Figure AI have sent cease-and-desist letters to brokers marketing unauthorized share sales, underlining how sensitive private companies are about third parties trading or referencing their equity.

Broader Context: Tokenization and Financial Inclusion

Robinhood’s foray into tokenized private equity reflects a larger trend in finance, where crypto exchanges and platforms seek to offer access to previously inaccessible asset classes such as private equity, private credit, and commercial real estate.

Traditionally, these assets are reserved for accredited investors with significant wealth or credentials, limiting opportunities for the average retail customer.

Robinhood argues that tokenization and asset fractionalization can help break down these barriers, though critics warn that regulatory and ethical questions remain unresolved.

CoinLaw’s Takeaway

This episode is a clear signal of the growing friction between fast-moving crypto innovation and the strict, carefully controlled world of private company finance. While Robinhood presents tokenization as a breakthrough for retail investors, OpenAI’s sharp rebuke makes it clear that not all stakeholders see it that way. Investors should scrutinize exactly what is being offered and recognize that buying a token does not always mean owning a share in the world’s biggest private companies.

Thu, 07/03/2025 - 12:00

Bot Verification

X (formerly Twitter)

OpenAI Newsroom (@OpenAINewsroom) on X

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfe...

Key Takeaways

OpenAI disavowed Robinhood’s tokenized equity products, stating they do not grant real ownership in OpenAI.

The tokens offer indirect exposure through a Special Purpose Vehicle, not direct shares.

Elon Musk and others have criticized Robinhood’s efforts as misleading.

The move highlights growing tensions between crypto innovation and traditional private equity rules.

In a clash that is drawing widespread attention across finance and tech circles, OpenAI has forcefully rejected Robinhood’s latest effort to sell “OpenAI tokens” to retail investors. The controversy erupted after Robinhood announced it would distribute these tokens to European Union users, promoting them as a way for everyday people to gain exposure to private company equity using blockchain technology. While Robinhood framed the move as

Key Takeaways

OpenAI disavowed Robinhood’s tokenized equity products, stating they do not grant real ownership in OpenAI.

The tokens offer indirect exposure through a Special Purpose Vehicle, not direct shares.

Elon Musk and others have criticized Robinhood’s efforts as misleading.

The move highlights growing tensions between crypto innovation and traditional private equity rules.

In a clash that is drawing widespread attention across finance and tech circles, OpenAI has forcefully rejected Robinhood’s latest effort to sell “OpenAI tokens” to retail investors. The controversy erupted after Robinhood announced it would distribute these tokens to European Union users, promoting them as a way for everyday people to gain exposure to private company equity using blockchain technology. While Robinhood framed the move as Robinhood Unveils Micro Futures for XRP, Solana, and Bitcoin Amid Strategic Expansion • CoinLaw

X (formerly Twitter)

OpenAI Newsroom (@OpenAINewsroom) on X

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfe...

X (formerly Twitter)

OpenAI Newsroom (@OpenAINewsroom) on X

These “OpenAI tokens” are not OpenAI equity. We did not partner with Robinhood, were not involved in this, and do not endorse it. Any transfe...

X (formerly Twitter)

Elon Musk (@elonmusk) on X

@OpenAINewsroom Your “equity” is fake

X (formerly Twitter)

Elon Musk (@elonmusk) on X

@OpenAINewsroom Your “equity” is fake

Tyler Durden | Zero Hedge

Zero Hedge

"Your 'Equity' Is Fake" - Robinhood Faces Backlash After OpenAI Denounces Tokenized Shares | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

In a CNBC interview on Wednesday, Lew expressed deep concern about Mamdani’s platform. “The policies that he outlines are not policies that would be good for New York,” Lew said. “I worry deeply, having spent most of my life in New York, about a city I call home.” He further cautioned against populist-driven policies from both political extremes, stating, “I see a similarity between policies solutions to the left and the right that satisfy populist sentiment, don’t always go through the filter of ‘do they work? I don’t think they work. I think that’s a problem,” Lew added.

Orszag, now Chairman and CEO of Lazard,

In a CNBC interview on Wednesday, Lew expressed deep concern about Mamdani’s platform. “The policies that he outlines are not policies that would be good for New York,” Lew said. “I worry deeply, having spent most of my life in New York, about a city I call home.” He further cautioned against populist-driven policies from both political extremes, stating, “I see a similarity between policies solutions to the left and the right that satisfy populist sentiment, don’t always go through the filter of ‘do they work? I don’t think they work. I think that’s a problem,” Lew added.

Orszag, now Chairman and CEO of Lazard,  “I am hopeful that the Democratic Party will change course and, again, history shows that neither being anti-capitalism nor being antisemitic is the pathway to any sort of good outcome,” Orszag added.

Mamdani’s win is just one example of growing tensions within the Democrat Party. Similar concerns about the party’s direction have surfaced elsewhere. In June, David Hogg, the 25-year-old Parkland shooting survivor and gun control activist, resigned as vice chair of the Democrat National Committee (DNC) amid internal turmoil. Hogg faced backlash for his controversial plan to intervene in primary races against incumbent Democrats, which many viewed as divisive and a breach of DNC neutrality.

After the DNC called for a new election for his position citing procedural issues, Hogg chose not to run again. In his departure, he sharply criticized the party,

“I am hopeful that the Democratic Party will change course and, again, history shows that neither being anti-capitalism nor being antisemitic is the pathway to any sort of good outcome,” Orszag added.

Mamdani’s win is just one example of growing tensions within the Democrat Party. Similar concerns about the party’s direction have surfaced elsewhere. In June, David Hogg, the 25-year-old Parkland shooting survivor and gun control activist, resigned as vice chair of the Democrat National Committee (DNC) amid internal turmoil. Hogg faced backlash for his controversial plan to intervene in primary races against incumbent Democrats, which many viewed as divisive and a breach of DNC neutrality.

After the DNC called for a new election for his position citing procedural issues, Hogg chose not to run again. In his departure, he sharply criticized the party,

The decisions to grant the petitions for certiorari, or review, in two separate cases were

The decisions to grant the petitions for certiorari, or review, in two separate cases were

Data from 2024 showed a 6 percent decrease in violent crime, an 8.4 percent drop in property crime, a more than 10 percent dip in homicides, and 6.5 percent fewer aggravated assaults.

The report also revealed motor vehicle thefts decreased by over 15 percent, while arsons dropped nearly 10 percent and burglaries dipped by more than 9 percent. The robbery rate also decreased by 6.3 percent, according to the 2024 data.

California Gov. Gavin Newsom and Attorney General Rob Bonta applauded the new data.

“In the wake of a nationwide spike in crime during the pandemic, California made the choice to invest—not abandon—our communities,” Newsom said in a

Data from 2024 showed a 6 percent decrease in violent crime, an 8.4 percent drop in property crime, a more than 10 percent dip in homicides, and 6.5 percent fewer aggravated assaults.

The report also revealed motor vehicle thefts decreased by over 15 percent, while arsons dropped nearly 10 percent and burglaries dipped by more than 9 percent. The robbery rate also decreased by 6.3 percent, according to the 2024 data.

California Gov. Gavin Newsom and Attorney General Rob Bonta applauded the new data.

“In the wake of a nationwide spike in crime during the pandemic, California made the choice to invest—not abandon—our communities,” Newsom said in a

An officer puts up tape at a crime scene. Samantha Laurey/AFP via Getty Images

The Brawley Police Department and Plumas County Sheriff’s Office were unable to provide any reports for 2024. Redding Police Department omitted December’s data because of agency challenges and Lodi began reporting in August 2024 because of system issues, according to the report.

Bonta said the crime data were a critical part of understanding the status of statewide crime issues.

“Transparency is key for understanding, preventing, and combating crime in our communities,” Bonta said in a

An officer puts up tape at a crime scene. Samantha Laurey/AFP via Getty Images

The Brawley Police Department and Plumas County Sheriff’s Office were unable to provide any reports for 2024. Redding Police Department omitted December’s data because of agency challenges and Lodi began reporting in August 2024 because of system issues, according to the report.

Bonta said the crime data were a critical part of understanding the status of statewide crime issues.

“Transparency is key for understanding, preventing, and combating crime in our communities,” Bonta said in a

Attorney General Rob Bonta speaks as Gov. Gavin Newsom looks on during a news conference at Gemperle Orchard on April 16, 2025 in Ceres, California. Justin Sullivan/Getty Images

Law enforcement agencies have undergone a transition nationwide in crime reporting.

In 2016, the FBI director announced the bureau was transitioning to a National Incident-Based Reporting System by 2021.

Attorney General Rob Bonta speaks as Gov. Gavin Newsom looks on during a news conference at Gemperle Orchard on April 16, 2025 in Ceres, California. Justin Sullivan/Getty Images

Law enforcement agencies have undergone a transition nationwide in crime reporting.

In 2016, the FBI director announced the bureau was transitioning to a National Incident-Based Reporting System by 2021.

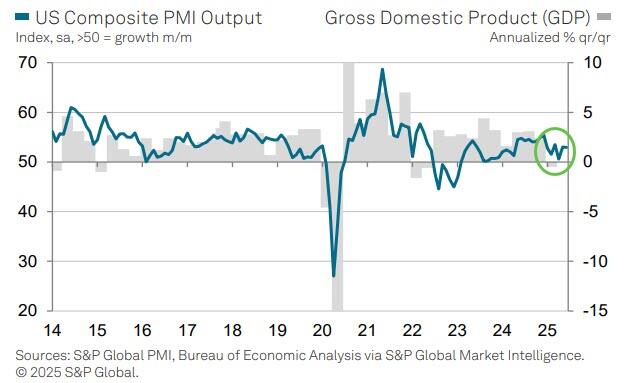

Source: Bloomberg

Under the hood, the picture was more mixed with new orders rising back into expansion territory but employment falling further and prices paid dipping modestly (from two year highs)...

Source: Bloomberg

Under the hood, the picture was more mixed with new orders rising back into expansion territory but employment falling further and prices paid dipping modestly (from two year highs)...

Source: Bloomberg

Chris Williamson,

Source: Bloomberg

Chris Williamson,  "Viewed alongside an improvement in manufacturing growth reported in June, the services PMI indicates that the economy grew at a reasonable annualized rate approaching 1.5% in the second quarter, with momentum having improved since the lull seen in April. Rising demand for services has meanwhile encouraged firms to take on additional staff at a rate not seen since January.

However, Williamson notes that "we are seeing some worrying signs of weakness below the headline numbers."

"...notably in respect to exports and falling activity among consumer-facing service providers, which has curbed the overall pace of economic expansion. Concerns over government policies have meanwhile created uncertainty and dampened spending on services more broadly, while also ensuring confidence in the outlook remains subdued compared to the optimism seen at the start of the year.

The continued expansion of business activity in the coming months along the lines seen in June is therefore by no means assured.

"Price pressures have remained elevated in June. Although weak demand and intense competition were reported to have helped moderate the overall rate of increase compared to May, the overall rate of prices charged inflation for services remains the second-highest for over two years, thanks to widelyreported tariff-related cost increases, and will likely contribute to higher consumer price inflation in the near-term."

So take your pick... did the Services sector improve in June (ISM) or deteriorate (PMI)?

"Viewed alongside an improvement in manufacturing growth reported in June, the services PMI indicates that the economy grew at a reasonable annualized rate approaching 1.5% in the second quarter, with momentum having improved since the lull seen in April. Rising demand for services has meanwhile encouraged firms to take on additional staff at a rate not seen since January.

However, Williamson notes that "we are seeing some worrying signs of weakness below the headline numbers."

"...notably in respect to exports and falling activity among consumer-facing service providers, which has curbed the overall pace of economic expansion. Concerns over government policies have meanwhile created uncertainty and dampened spending on services more broadly, while also ensuring confidence in the outlook remains subdued compared to the optimism seen at the start of the year.

The continued expansion of business activity in the coming months along the lines seen in June is therefore by no means assured.

"Price pressures have remained elevated in June. Although weak demand and intense competition were reported to have helped moderate the overall rate of increase compared to May, the overall rate of prices charged inflation for services remains the second-highest for over two years, thanks to widelyreported tariff-related cost increases, and will likely contribute to higher consumer price inflation in the near-term."

So take your pick... did the Services sector improve in June (ISM) or deteriorate (PMI)?

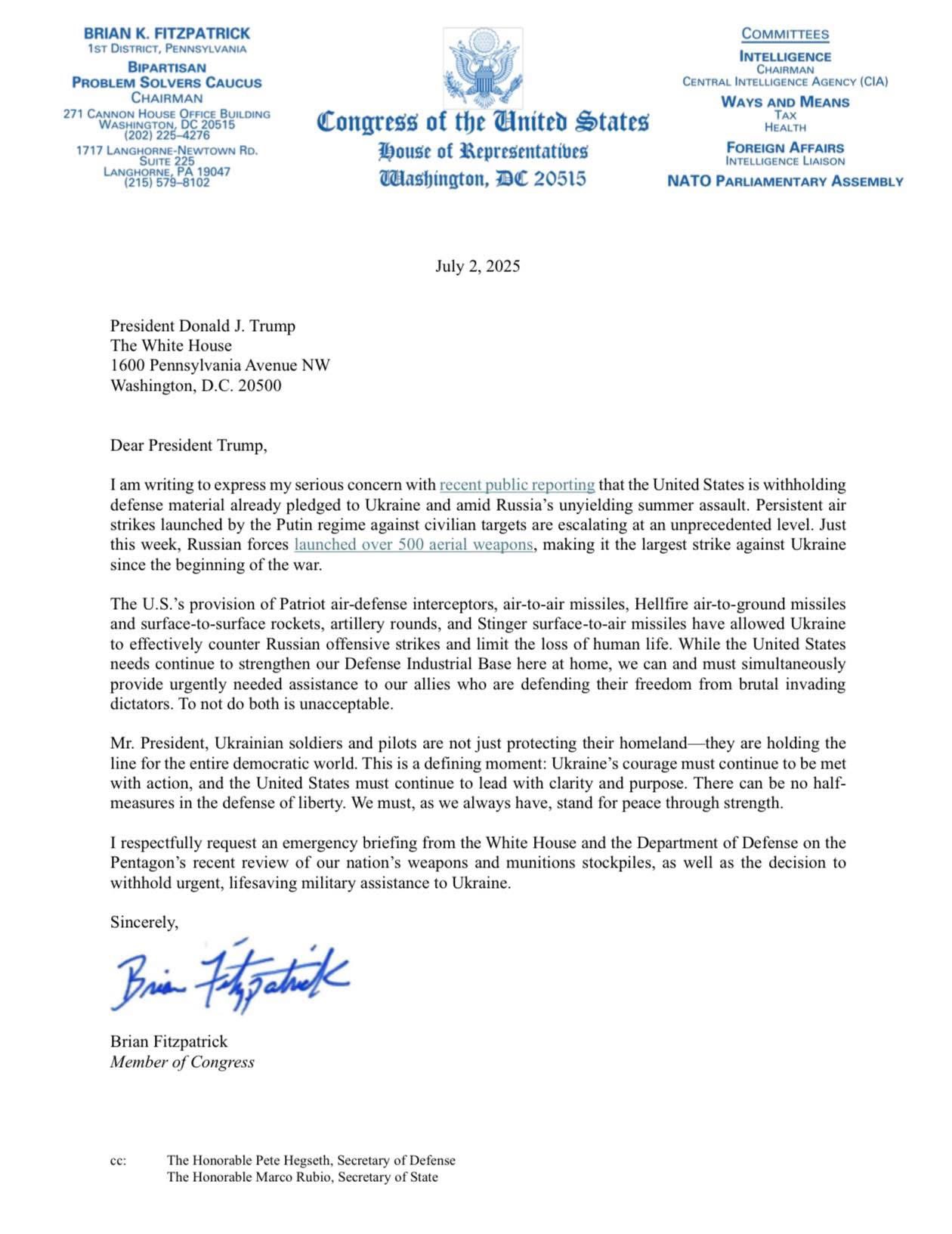

The White House had earlier described that in the context of the Russia-Ukraine war the "decision was made to put America's interests first following" a Defense Department "review of our nation's military support and assistance to other countries across the globe."

Many reports over the last couple years have sounded the alarm that US military stockpiles are falling dangerously low, and that they will continue to be depleted based on past Ukraine policy and pledged future transfers.

The items being halted were key weapons systems previously promised to Ukraine's military, ranging from Hellfire missiles to Patriot missiles to precision-guided artillery shells and munitions for F-16 fighter jets. Newsweek says that Russia is 'celebrating' the

The White House had earlier described that in the context of the Russia-Ukraine war the "decision was made to put America's interests first following" a Defense Department "review of our nation's military support and assistance to other countries across the globe."

Many reports over the last couple years have sounded the alarm that US military stockpiles are falling dangerously low, and that they will continue to be depleted based on past Ukraine policy and pledged future transfers.

The items being halted were key weapons systems previously promised to Ukraine's military, ranging from Hellfire missiles to Patriot missiles to precision-guided artillery shells and munitions for F-16 fighter jets. Newsweek says that Russia is 'celebrating' the

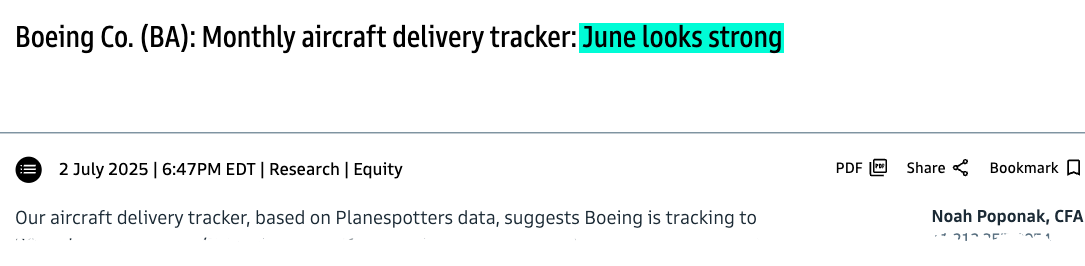

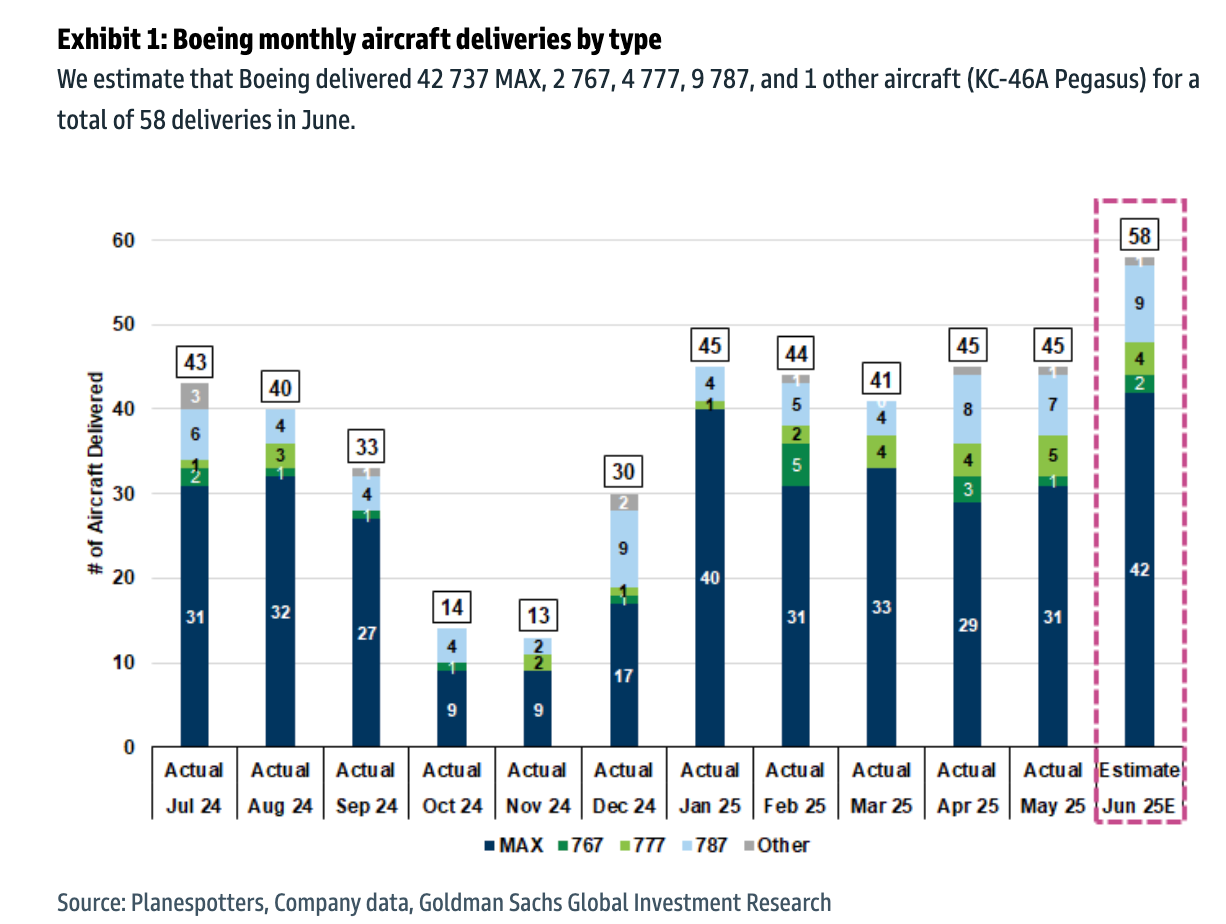

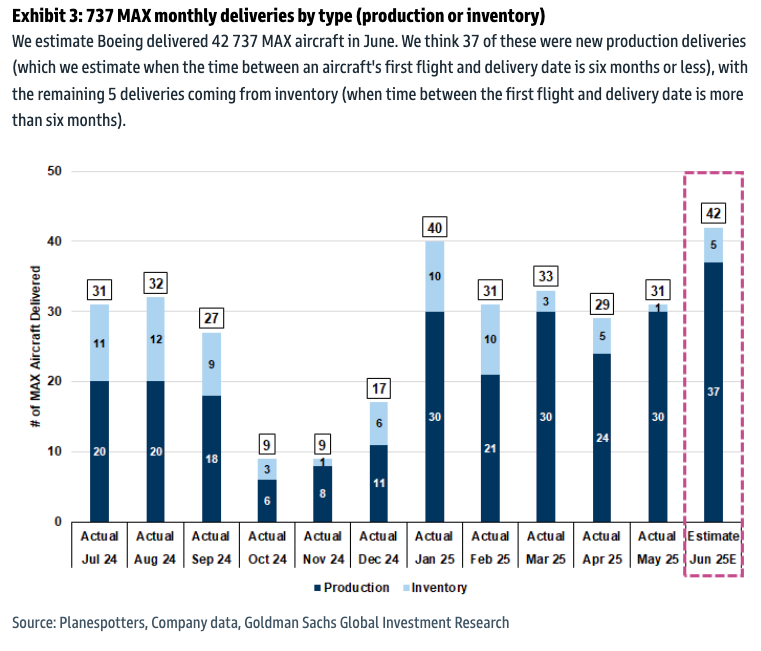

Poponak told clients that Planespotters' aircraft delivery tracker for Boeing planes is trending around 58 deliveries for June (57 excluding 1 KC-46A delivery), including 42 737 MAX and 9 787.

"Of the 42 MAX deliveries, we estimate 37 were new production, with 5 from inventory. 58 deliveries is a step function improvement over the mid-40 delivery rate BA has been holding for the last 5 months," the analyst said.

Poponak told clients that Planespotters' aircraft delivery tracker for Boeing planes is trending around 58 deliveries for June (57 excluding 1 KC-46A delivery), including 42 737 MAX and 9 787.

"Of the 42 MAX deliveries, we estimate 37 were new production, with 5 from inventory. 58 deliveries is a step function improvement over the mid-40 delivery rate BA has been holding for the last 5 months," the analyst said.

Poponak noted the uptick in deliveries, calling June "strong" and "another month of progress," as well as the highest in quite some time, adding that it "indicates to us that product quality improvements are holding, enabling higher production rates, and therefore allowing for more deliveries."

"We think BA will stabilize MAX production at ~38/month over the next several months, request a move to 42/month late in 2025, and raise production in increments of 5/month thereafter," he said.

Poponak noted the uptick in deliveries, calling June "strong" and "another month of progress," as well as the highest in quite some time, adding that it "indicates to us that product quality improvements are holding, enabling higher production rates, and therefore allowing for more deliveries."

"We think BA will stabilize MAX production at ~38/month over the next several months, request a move to 42/month late in 2025, and raise production in increments of 5/month thereafter," he said.

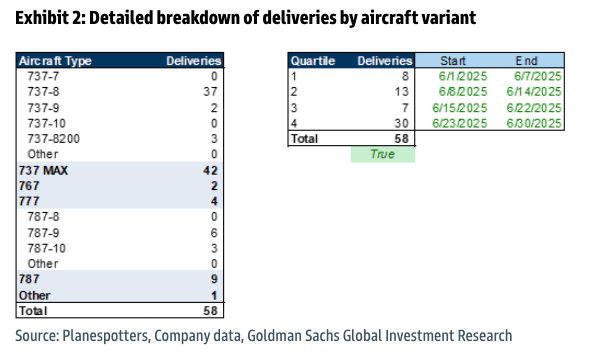

Here's a breakdown of Boeing's June deliveries by aircraft variant.

Here's a breakdown of Boeing's June deliveries by aircraft variant.

Poponak is Buy rated on the stock with a 12-month price target of $226. He said this is derived from targeting a 3.8% free cash flow yield on 2026E free cash.

Poponak is Buy rated on the stock with a 12-month price target of $226. He said this is derived from targeting a 3.8% free cash flow yield on 2026E free cash.

Boeing shares are consolidating, a sign that direction could, at some point, be coming.

Boeing shares are consolidating, a sign that direction could, at some point, be coming.

Related:

Related:

Agents had found that the Chinese manufactured fake driver’s licenses and shipped them to the U.S. in a scheme to help Biden. That not only contradicted the narrative of the election, but Wray’s testimony.

Wray testified before Congress that the FBI had not seen any coordinated voter fraud ahead of the 2020 election:

“We have not seen historically any kind of coordinated national voter fraud effort in a major election, whether it is by mail or otherwise.”

However, that does not appear to be true.

The FBI “recalled” the reporting after his testimony “in order to re-interview the source.” It also directed “recipients” of the original report to “destroy all copies of the original report and remove the original report from all computer holdings.”

In a letter to Sen. Chuck Grassley (R, Iowa), Assistant FBI Director Marshall Yates stated that “Although the source was reengaged and provided additional context to support the initial IIR, FBI Headquarters maintained its position not to republish the report.”

Of course, there is little interest in most of the media on this foreign interference story despite the allegations of a cover up before the election.

Critics are alleging a cover up with FBI agents effectively told that it is my Wray or the highway when it came to Chinese interference with the election.

Agents had found that the Chinese manufactured fake driver’s licenses and shipped them to the U.S. in a scheme to help Biden. That not only contradicted the narrative of the election, but Wray’s testimony.

Wray testified before Congress that the FBI had not seen any coordinated voter fraud ahead of the 2020 election:

“We have not seen historically any kind of coordinated national voter fraud effort in a major election, whether it is by mail or otherwise.”

However, that does not appear to be true.

The FBI “recalled” the reporting after his testimony “in order to re-interview the source.” It also directed “recipients” of the original report to “destroy all copies of the original report and remove the original report from all computer holdings.”

In a letter to Sen. Chuck Grassley (R, Iowa), Assistant FBI Director Marshall Yates stated that “Although the source was reengaged and provided additional context to support the initial IIR, FBI Headquarters maintained its position not to republish the report.”

Of course, there is little interest in most of the media on this foreign interference story despite the allegations of a cover up before the election.

Critics are alleging a cover up with FBI agents effectively told that it is my Wray or the highway when it came to Chinese interference with the election.

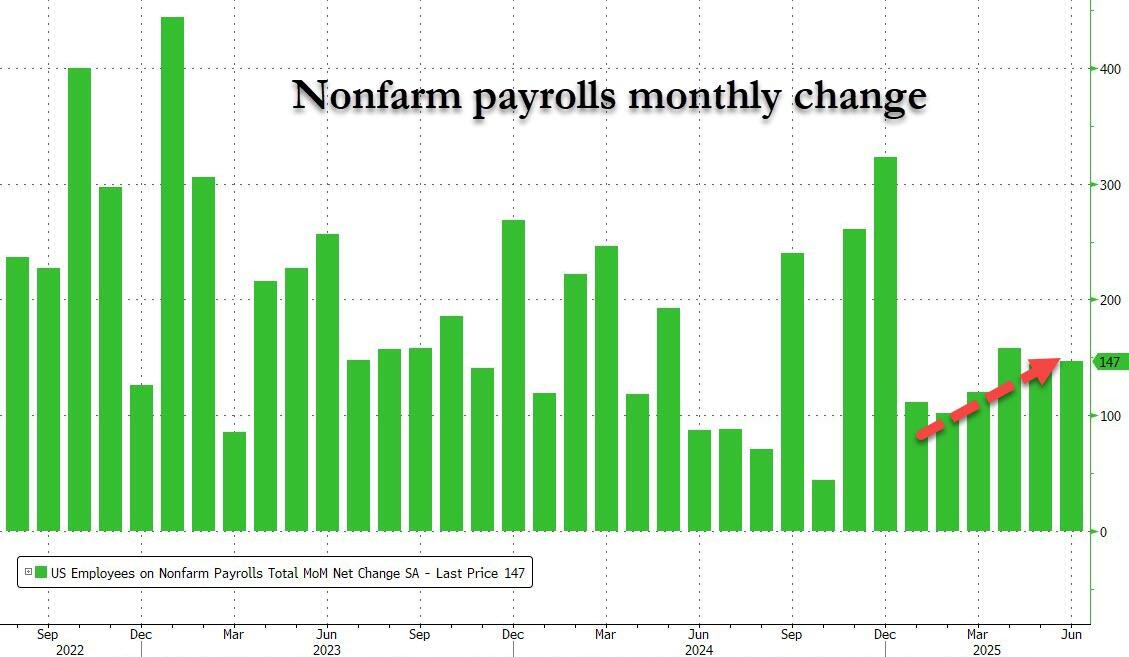

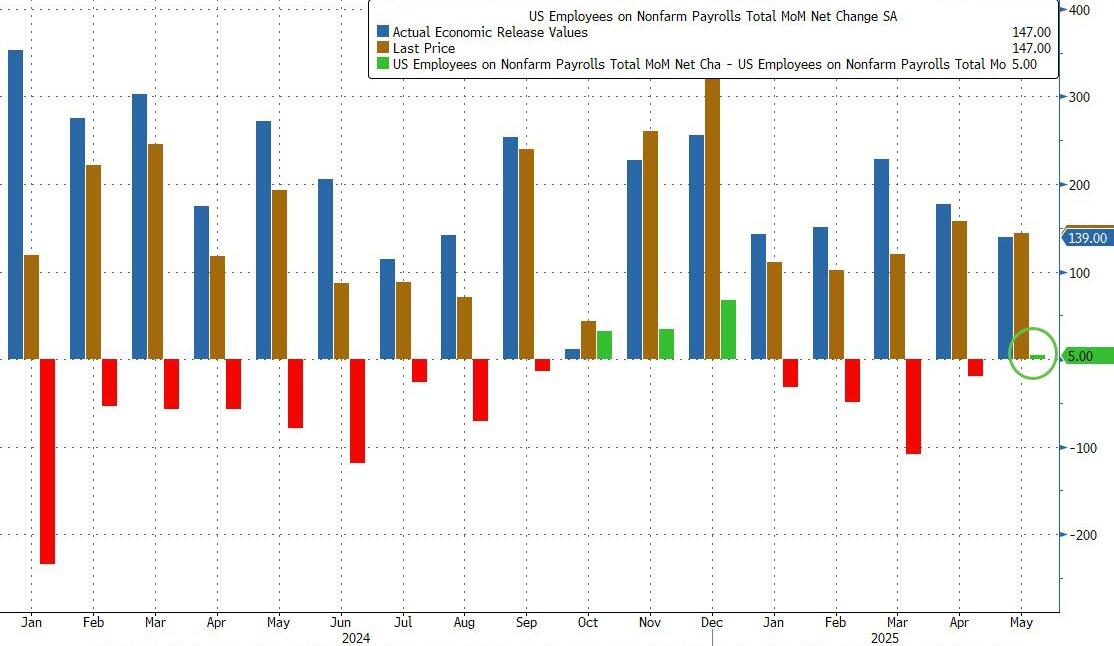

Remarkable, and in a dramatic change from the Biden tradition, previous months were revised higher: April was revised up by 11,000, from +147,000 to +158,000, and the change for May was revised up by 5,000, from +139,000 to +144,000.

Remarkable, and in a dramatic change from the Biden tradition, previous months were revised higher: April was revised up by 11,000, from +147,000 to +158,000, and the change for May was revised up by 5,000, from +139,000 to +144,000.

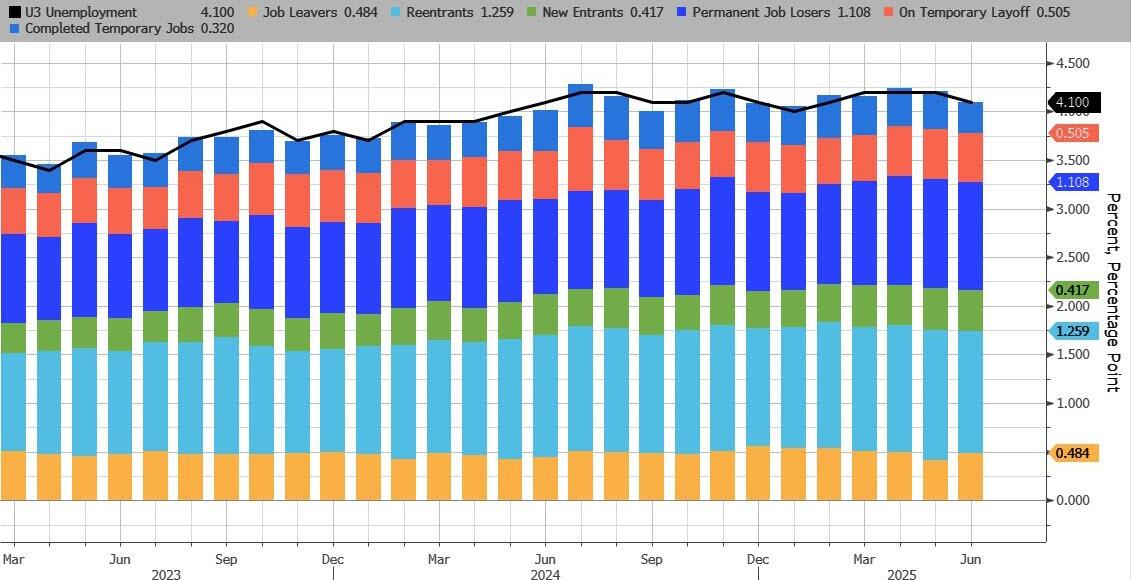

It wasn't just the headline print that surprised to the upside: perhaps an even bigger surprise was the unemployment rate which dropped from 4.2% to 4.1%, denying expectations of an increase to 4.3%, and far below the Fed's recently upward revised estimate of a 4.5%.

It wasn't just the headline print that surprised to the upside: perhaps an even bigger surprise was the unemployment rate which dropped from 4.2% to 4.1%, denying expectations of an increase to 4.3%, and far below the Fed's recently upward revised estimate of a 4.5%.

The drop in the unemp rate was the result of a 93K increase in employed workers, offset by a decline in the civilian labor force to 173,380K from 170,510K and a drop in the number of unemployed workers from 7,237K to 7,1025K.

Developing

The drop in the unemp rate was the result of a 93K increase in employed workers, offset by a decline in the civilian labor force to 173,380K from 170,510K and a drop in the number of unemployed workers from 7,237K to 7,1025K.

Developing