Not Just The EPA: Despite Warnings, Biden's Energy Department Disbursed $42 Billion In Its Final Hours

Not Just The EPA: Despite Warnings, Biden's Energy Department Disbursed $42 Billion In Its Final Hours

RealClearWire

Shovel Ready: Despite Warnings, Biden’s Energy Department Disbursed $42 Billion in Its Final Hours

In its last two working days, the Biden administration’s Energy Department signed off on nearly $42 billion for green energy projects –...

,

In its last two working days, the Biden administration’s Energy Department signed off on nearly $42 billion for green energy projects – a sum that exceeded the total amount its Loan Programs Office (LPO) had put out

Energy.gov

Office of Energy Dominance Financing

The U.S. Department of Energy's Office of Energy Dominance Financing (EDF) provides financing to American energy and manufacturing projects th...

.

The frenzied activity on Jan. 16 and 17, 2025, capped a spending binge that saw the LPO approve at least $93 billion in current and future disbursements after Vice President Kamala Harris lost the 2024 election in November, according to documents provided by the department to RealClearInvestigations. It appears that Biden officials were rushing to deploy billions in approved funding in anticipation that the incoming Trump administration would seek to redirect uncommitted money away from clean energy projects.

The agreements were made despite a warning from the department’s

E&E News by POLITICO

DOE watchdog calls on loan office to suspend financing

The interim report cited concerns around potential conflicts of interests in asking for the pause.

, urging the loan office to suspend operations in December over concerns that post-election loans could present conflicts of interest.

In just a few months, some of the deals have already become dicey, leading to fears that the Biden administration has created multiple Solyndras, the green energy company that went bankrupt after the

Forbes

Remembering “Solyndra” – How Many $570M Green Energy Failures Are Hidden Inside Biden’s Infrastructure Proposal?

The president’s new $2.3 trillion infrastructure proposal includes the same kinds of “green energy” provisions that cost taxpayers billions f...

. These deals include:

Sunnova, a rooftop solar outfit that thus far had $382 million of

Latitude Media

What happens to Sunnova’s DOE loan guarantee if it files for bankruptcy?

The government is unlikely to lose any money, even if the rooftop solar company folds.

. The company did not respond to a request for comment.

Li-Cycle, a battery recycling facility, had a $445 million loan approved in November, but since then, the company was put up for sale and has

https://investors.li-cycle.com/news/news-details/2025/Li-Cycle-Obtains-Creditor-Protection-Under-CCAA-and-Chapter-15/default.aspx

. The Energy Department said no money has been disbursed on that deal. Li-Cycle did not respond to a request for comment.

A $705 million loan was approved on Jan. 17 for Zum Energy, an electric school bus company in California, and its

Energy.gov

LPO Announces Conditional Commitment to Zum Services, Inc. to Deploy Battery-Electric School Buses with V2G Capability, Creating Virtual Power Plants Nationwide

Project Marigold will provide sustainable and safe transportation to public school districts nationwide while supporting grid resilience, giving el...

At $350,000 and more, electric school buses currently cost more than twice as much as their diesel counterparts. So far, Zum has received $21.7 million from the government, according to usaspending.gov. The company did not respond to a request for comment.

A $9.63 billion Blue Oval SK loan on Jan. 16 was the second largest post-election deal, topped only by a $15 billion loan the next day to Pacific Gas & Electric, with most of that for renewables. The Blue Oval project in Kentucky – a joint venture between Ford Motor Co. and a South Korean entity – has been dealing with

https://archive.is/jtXOk

. More than $7 billion has been obligated on that deal, according to the Energy Department. Blue Oval did not respond to a request for comment.

The money and the hasty way in which it was earmarked have drawn the attention of the Trump administration. “It is extremely concerning how many dozens of billions of dollars were rushed out the door without proper due diligence in the final days of the Biden administration,” Energy Secretary Chris Wright said in a statement to RCI. “DOE is undertaking a thorough review of financial assistance that identifies waste of taxpayer dollars.”

The enormous sums came from the 2022 Inflation Reduction Act, which injected $400 billion into the LPO, a previously sleepy Energy Department branch originally intended to spur nuclear energy projects. That total represented more than 10 times the amount the LPO had ever committed in any fiscal year of its existence. Prior to the post-election blowout, the office’s biggest fiscal year was 2024, when it committed $34.8 billion, records show.

Even with the rush to push billions out the door in its last months, close to $300 billion of the Inflation Reduction Act money remains uncommitted by the LPO. Trump administration officials have already nixed some smaller deals. Secretary Wright recently urged Congress to keep the money in place as the LPO now aims to use it to further the Trump administration’s energy policy, particularly with nuclear projects.

That unprecedented gusher of cash from the LPO echoes the efforts of the Biden administration’s Environmental Protection Agency to push $20 billion out the door before it left office. As RCI has previously reported, the EPA – which had never been a consequential grant-making operation – was tasked with awarding $27 billion in Inflation Reduction Act funding through the

RealClearInvestigations

Overnight Success: Biden’s Climate Splurge Gives Billions to Nonprofit Newbies

Although there isn’t much public information available about the Justice Climate Fund, it appears to have been an overnight success.

After ga...

in which Biden officials parked some $20 billion outside the Treasury’s control. That money was earmarked for a handful of nonprofits, some of which had skimpy assets and were linked with politically connected directors.

The LPO’s post-election bonanza was put together in even less time. The Energy Department deals, however, involve mostly for-profit enterprises, which raises questions about whether the Biden administration was propping up companies that would not have survived in the private marketplace. Should any of the companies hit it big in the future, shareholders could get rich, while taxpayers will receive only the interest on the loan.

“The loan office should not be in the virtual venture business,” said Mark Mills, executive director of the

National Center for Energy Analytics

National Center for Energy Analytics

NCEA scholars are devoted to data-driven analyses of policies, plans, and technologies surrounding the supply and use of energy essential for human...

. “But in a few cases, it could make sense to serve as a catalyst or backstop for viable and important projects from a national security or policy perspective.”

RCI spoke with several Trump administration officials who declined to comment on the record, given the extensive ongoing review of both the LPO’s post-election arrangements and other Energy Department projects linked to Biden’s climate agenda.

“They wanted to get the billions to companies that probably wouldn’t exist unless they could get money from the government,” one current official said. “The business plans, such as they were, were ‘how do we secure capital from the government?’”

During Biden’s tenure, the office was run by Jigar Shah, who on June 17 was named to the board of directors of the

Yahoo Finance

Clean Energy Entrepreneur Jigar Shah Joins CSE Board of Directors

Clean energy entrepreneur, investor and strategist Jigar Shah, former director of the U.S. Department of Energy Loan Programs Office, has joined th...

.

ProPublica

Center For Sustainable Energy, Full Filing - Nonprofit Explorer - ProPublica

Since 2013, the IRS has released data culled from millions of nonprofit tax filings. Use this database to find organizations and see details like t...

. The center did not respond to a request to speak with Shah.

Thus far, no entity has received the entire amount of the deals the Biden administration struck since last November, according to the Energy Department and usaspending.gov. In a handful of cases, companies have come to the current administration and opted out of the deals.

Still, millions of taxpayer dollars have already been distributed, in some instances, to deals the department listed as “conditional commitments.” Wright has said there are

https://archive.is/BNiPO#selection-1501.0-1504.0

about the post-election binge, and vowed some of the deals will be scrubbed.

In 2023, the Biden administration made subtle

Federal Register :: Request Access

, cutting strings and stipulations that traditionally attach to loans. Consequently, the office cut deals after the election on terms more favorable to the recipient than the taxpayer, and in several cases, making a “conditional commitment” the same as a loan, according to Trump officials. The changes also moved money that a later administration could have cut into “obligated” silos, making the deals harder to cancel, according to the current Energy Department.

“Essentially, they had the Loan Program Office operating like a graveyard energy venture capital fund,” one Trump official told RCI. “This was all tied to the religious fervor for any green energy project in the prior administration, and the goal was not to get the government repaid but to advance the ‘green new deal.’”

The $93 billion under review represents a separate “green bank” from smaller Biden administration deals that the Energy Department has already canceled. Last month, the Government Accounting Office said the department was not on track to “issue loans and guarantees before billions of dollars of new funding expires.”

As part of the review, Wright issued

Energy.gov

Secretary Wright Announces New Policy for Increasing Accountability, Identifying Wasteful Spending of Taxpayer Dollars

The Department of Energy today announced new actions to increase accountability and promote responsible stewardship of American taxpayer dollars.

that he said offer more protection to taxpayers. The department may now require significantly more information from loan recipients and applicants, such as “a project’s financial health, a project’s technological and engineering viability, market conditions, compliance with award terms and conditions and compliance with legal requirements, including those related to national security.”

The department declined to provide the terms of specific deals, again citing the ongoing review. Trump administration officials claim the business plans for many of these deals were threadbare, that term sheets were essentially tossed out, and the entire process could be described, in the words of a Biden EPA official in December, as “throwing gold bars” off the Titanic

EPA Advisor Admits ‘Insurance Policy’ Against Trump is Funneling Billions to Climate Organizations, “We’re Throwing Gold Bars off the Titanic” | Project Veritas

“Now it’s how to get the money out as fast as possible before they [Trump Administration] come in ... it’s like we’re on the Titanic and we...

Despite these dubious outcomes and the alleged removal of taxpayer protections that accompanied the deals, Trump administration officials said they remain committed to the LPO. The office has a valuable role to play in fulfilling energy policy goals, which include nuclear projects, strengthening the nation’s power grid, and limiting the U.S. reliance on Chinese supply chains for key minerals and elements.

“It’s as if you went away and the kids threw a rager in the house,” one official told RCI. “You may need some new furniture and the like, but it’s still a really nice home. The Office can be a critical resource for the manufacturing base of this country, and our goal is not to end the LPO but to improve it.”

The Trump administration could face some of the same financial issues if it rejiggers the LPO along lines that support its energy policy goals, particularly within the nuclear industry. Projects there have been marred by

📄.pdf

and massive cost overruns and delays in construction, making federal loans to the section inherently risky.

Prominent voices – and investors –

https://illuminem.com/illuminemvoices/bill-gates-is-backing-this-geothermal-company-will-trumps-republicans

with a subsidiary of EnergySource Minerals LLC (ESM), which hopes to extract lithium from geothermal brine.

A deal with

Ioneer

Ioneer - Providing materials for a sustainable and thriving planet

Ioneer is an emerging

lithium-boron producer poised

to become a globally significant

producer of two critical minerals

."

The

Ioneer

Project Overview - Ioneer

Advancing the Rhyolite Ridge Lithium-Boron Project in Nevada. Rhyolite Ridge hosts the largest undeveloped lithium-boron Ore Reserve in the world o...

project is a mining and manufacturing center in Nevada to produce lithium and boron. Those elements have implications for defense and national security in addition to energy, according to ioneer Vice President Chad Yeftich.

“Ioneer believes government policy should encourage projects if we want critical minerals developed domestically,” Yeftich said. “Time is the key risk for development as China continues to provide financial support to its critical minerals industry and dump critical minerals into the market thereby depressing the price.”

Yeftich noted Rhyolite Ridge has secured $200 million in private capital, but in February, its chief private equity partner broke ties with the project. Finance professionals familiar with big deals told RCI that such a rupture so close in timing to the loan would likely deep-six the arrangement, but Trump officials said Biden’s LPO stripped such boilerplate language from many of the post-election deals.

Secretary Wright told RCI that these maneuvers suggested the previous administration was more interested in disbursing funds than protecting taxpayers. “Any reputable business would have a process in place for evaluating spending and investments before money goes out the door, and the American people deserve no less from their federal government.”

Tyler Durden | Zero Hedge

Zero Hedge

Wed, 07/02/2025 - 12:40

Not Just The EPA: Despite Warnings, Biden's Energy Department Disbursed $42 Billion In Its Final Hours | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The bank, to be called Erebor, has formally applied for a national banking charter in the United States, according to documents made public this week. Named after the “Lonely Mountain” in The Lord of the Rings, Erebor would aim to serve the "innovation economy" - start-ups and individuals in sectors often viewed as too risky for traditional lenders, including blockchain, AI, defense, and advanced manufacturing.

Erebor’s founders, who include backers of Donald Trump’s 2024 presidential bid, say their institution will fill a gap left by SVB’s 2023 collapse, which shook the tech sector’s financial infrastructure. That failure triggered panic among start-ups, many of which relied heavily on SVB’s tailored credit offerings. Though SVB’s remnants were absorbed by First Citizens and some staff migrated to HSBC, entrepreneurs and investors continue to complain of tightened credit access and fewer bank partners willing to underwrite emerging technologies,

reports.

Erebor’s co-founders first discussed launching a bank after the collapse of SVB in 2023, according to a person close to the matter. SVB had been the main bank for US start-ups and their venture capital backers.

Its assets were sold to First Citizens, which has since relaunched SVB, and a number of its bankers moved to HSBC in the US. But investors and executives complain about a gap in banking services for fledgling tech companies since SVB’s demise — with some start-ups struggling to get the same access to capital. -FT

The application describes Erebor as “a national bank… providing traditional banking products, as well as virtual currency-related products and services, for businesses and individuals,” with a focus on customers underserved by both traditional and fintech institutions. It will also offer services to non-U.S. companies seeking access to the American banking system.

One of the bank’s major innovations, and potential regulatory flashpoints, is its plan to become a dominant player in stablecoin transactions, a controversial corner of the cryptocurrency world where digital tokens are pegged to traditional currencies like the U.S. dollar. Erebor’s filing describes its goal as becoming “the most regulated entity conducting and facilitating stablecoin transactions.”

Founders Luckey, best known for founding Anduril Industries, and Lonsdale, a co-founder of Palantir and managing partner of 8VC, are not expected to be involved in Erebor’s day-to-day operations. Instead, the bank will be led by co-CEOs Jacob Hirshman, a former adviser to crypto firm Circle, and Owen Rapaport, CEO of digital assets compliance company Aer. Mike Hagedorn, a longtime banking executive and former EVP at Valley National Bank, will serve as president.

Despite its tech-forward posture, Erebor will be headquartered in Columbus, Ohio, with a secondary office in New York City. In keeping with the start-up culture it hopes to serve, Erebor will be a digital-only bank, offering customer support and financial products exclusively through a smartphone app and website.

Much about Erebor remains under wraps. Portions of the application, including its equity structure, business plan, and shareholder identities, were submitted confidentially.

The Erebor venture underscores the ongoing realignment of financial services in the tech sector, as traditional banks grow more cautious and venture-backed firms look to build their own institutions. Whether Erebor succeeds where SVB fell — and whether its fusion of crypto, defense, and Silicon Valley politics finds regulatory favor — remains to be seen. For now, its founders are betting there’s a mountain of opportunity left to reclaim.

Wed, 07/02/2025 - 19:40

The bank, to be called Erebor, has formally applied for a national banking charter in the United States, according to documents made public this week. Named after the “Lonely Mountain” in The Lord of the Rings, Erebor would aim to serve the "innovation economy" - start-ups and individuals in sectors often viewed as too risky for traditional lenders, including blockchain, AI, defense, and advanced manufacturing.

Erebor’s founders, who include backers of Donald Trump’s 2024 presidential bid, say their institution will fill a gap left by SVB’s 2023 collapse, which shook the tech sector’s financial infrastructure. That failure triggered panic among start-ups, many of which relied heavily on SVB’s tailored credit offerings. Though SVB’s remnants were absorbed by First Citizens and some staff migrated to HSBC, entrepreneurs and investors continue to complain of tightened credit access and fewer bank partners willing to underwrite emerging technologies,

reports.

Erebor’s co-founders first discussed launching a bank after the collapse of SVB in 2023, according to a person close to the matter. SVB had been the main bank for US start-ups and their venture capital backers.

Its assets were sold to First Citizens, which has since relaunched SVB, and a number of its bankers moved to HSBC in the US. But investors and executives complain about a gap in banking services for fledgling tech companies since SVB’s demise — with some start-ups struggling to get the same access to capital. -FT

The application describes Erebor as “a national bank… providing traditional banking products, as well as virtual currency-related products and services, for businesses and individuals,” with a focus on customers underserved by both traditional and fintech institutions. It will also offer services to non-U.S. companies seeking access to the American banking system.

One of the bank’s major innovations, and potential regulatory flashpoints, is its plan to become a dominant player in stablecoin transactions, a controversial corner of the cryptocurrency world where digital tokens are pegged to traditional currencies like the U.S. dollar. Erebor’s filing describes its goal as becoming “the most regulated entity conducting and facilitating stablecoin transactions.”

Founders Luckey, best known for founding Anduril Industries, and Lonsdale, a co-founder of Palantir and managing partner of 8VC, are not expected to be involved in Erebor’s day-to-day operations. Instead, the bank will be led by co-CEOs Jacob Hirshman, a former adviser to crypto firm Circle, and Owen Rapaport, CEO of digital assets compliance company Aer. Mike Hagedorn, a longtime banking executive and former EVP at Valley National Bank, will serve as president.

Despite its tech-forward posture, Erebor will be headquartered in Columbus, Ohio, with a secondary office in New York City. In keeping with the start-up culture it hopes to serve, Erebor will be a digital-only bank, offering customer support and financial products exclusively through a smartphone app and website.

Much about Erebor remains under wraps. Portions of the application, including its equity structure, business plan, and shareholder identities, were submitted confidentially.

The Erebor venture underscores the ongoing realignment of financial services in the tech sector, as traditional banks grow more cautious and venture-backed firms look to build their own institutions. Whether Erebor succeeds where SVB fell — and whether its fusion of crypto, defense, and Silicon Valley politics finds regulatory favor — remains to be seen. For now, its founders are betting there’s a mountain of opportunity left to reclaim.

Wed, 07/02/2025 - 19:40

The bank, to be called Erebor, has formally applied for a national banking charter in the United States, according to documents made public this week. Named after the “Lonely Mountain” in The Lord of the Rings, Erebor would aim to serve the "innovation economy" - start-ups and individuals in sectors often viewed as too risky for traditional lenders, including blockchain, AI, defense, and advanced manufacturing.

Erebor’s founders, who include backers of Donald Trump’s 2024 presidential bid, say their institution will fill a gap left by SVB’s 2023 collapse, which shook the tech sector’s financial infrastructure. That failure triggered panic among start-ups, many of which relied heavily on SVB’s tailored credit offerings. Though SVB’s remnants were absorbed by First Citizens and some staff migrated to HSBC, entrepreneurs and investors continue to complain of tightened credit access and fewer bank partners willing to underwrite emerging technologies,

The bank, to be called Erebor, has formally applied for a national banking charter in the United States, according to documents made public this week. Named after the “Lonely Mountain” in The Lord of the Rings, Erebor would aim to serve the "innovation economy" - start-ups and individuals in sectors often viewed as too risky for traditional lenders, including blockchain, AI, defense, and advanced manufacturing.

Erebor’s founders, who include backers of Donald Trump’s 2024 presidential bid, say their institution will fill a gap left by SVB’s 2023 collapse, which shook the tech sector’s financial infrastructure. That failure triggered panic among start-ups, many of which relied heavily on SVB’s tailored credit offerings. Though SVB’s remnants were absorbed by First Citizens and some staff migrated to HSBC, entrepreneurs and investors continue to complain of tightened credit access and fewer bank partners willing to underwrite emerging technologies,

The frenzied activity on Jan. 16 and 17, 2025, capped a spending binge that saw the LPO approve at least $93 billion in current and future disbursements after Vice President Kamala Harris lost the 2024 election in November, according to documents provided by the department to RealClearInvestigations. It appears that Biden officials were rushing to deploy billions in approved funding in anticipation that the incoming Trump administration would seek to redirect uncommitted money away from clean energy projects.

The agreements were made despite a warning from the department’s

The frenzied activity on Jan. 16 and 17, 2025, capped a spending binge that saw the LPO approve at least $93 billion in current and future disbursements after Vice President Kamala Harris lost the 2024 election in November, according to documents provided by the department to RealClearInvestigations. It appears that Biden officials were rushing to deploy billions in approved funding in anticipation that the incoming Trump administration would seek to redirect uncommitted money away from clean energy projects.

The agreements were made despite a warning from the department’s

At the center of the impasse is Senate Majority Leader John Thune of South Dakota, who has struggled to unite a fractured GOP conference around the sprawling bill. dubbed by Trump as the “One Big Beautiful Bill” - which includes sweeping tax cuts, a $5 trillion debt ceiling increase, significant Medicaid reductions, and a rollback of clean energy subsidies.

Currently, eight major Republican holdouts remain opposed or undecided. With only a razor-thin margin for defections, Thune can afford to lose just three votes. Senators Rand Paul of Kentucky and Thom Tillis of North Carolina have declared their opposition, and Maine’s Susan Collins is leaning no. That leaves Sen. Lisa Murkowski of Alaska — a perennial swing vote — as the potential deciding factor. Thune and Senate Finance Chair Mike Crapo (R-ID) spent the early morning hours huddling with Murkowski, offering compromises and tweaks to the bill in hopes of flipping her vote.

At the center of the impasse is Senate Majority Leader John Thune of South Dakota, who has struggled to unite a fractured GOP conference around the sprawling bill. dubbed by Trump as the “One Big Beautiful Bill” - which includes sweeping tax cuts, a $5 trillion debt ceiling increase, significant Medicaid reductions, and a rollback of clean energy subsidies.

Currently, eight major Republican holdouts remain opposed or undecided. With only a razor-thin margin for defections, Thune can afford to lose just three votes. Senators Rand Paul of Kentucky and Thom Tillis of North Carolina have declared their opposition, and Maine’s Susan Collins is leaning no. That leaves Sen. Lisa Murkowski of Alaska — a perennial swing vote — as the potential deciding factor. Thune and Senate Finance Chair Mike Crapo (R-ID) spent the early morning hours huddling with Murkowski, offering compromises and tweaks to the bill in hopes of flipping her vote.

“I think we’re going to get there,” Trump told reporters as he departed the White House Tuesday morning. “It’s tough. We’re trying to bring it down, bring it down so it’s really good for the country.”

But that optimism was not yet matched on the Senate floor, where votes on dozens of amendments continued into a second day. A visibly weary Thune said shortly after 5 a.m., “We’re getting to the end here,” though it remained unclear whether he had secured the votes.

Both Thune and Sen. Markwayne Mullin (R-OK) insist there's a deal to pass the bill, but we shall see...

BREAKING: Sen. Markwayne Mullin (R-OK) says Republicans have the votes to pass the One Big Beautiful Bill in the U.S. Senate, according to Fox News.

“Yeah we got em.”

“I think we’re going to get there,” Trump told reporters as he departed the White House Tuesday morning. “It’s tough. We’re trying to bring it down, bring it down so it’s really good for the country.”

But that optimism was not yet matched on the Senate floor, where votes on dozens of amendments continued into a second day. A visibly weary Thune said shortly after 5 a.m., “We’re getting to the end here,” though it remained unclear whether he had secured the votes.

Both Thune and Sen. Markwayne Mullin (R-OK) insist there's a deal to pass the bill, but we shall see...

BREAKING: Sen. Markwayne Mullin (R-OK) says Republicans have the votes to pass the One Big Beautiful Bill in the U.S. Senate, according to Fox News.

“Yeah we got em.”

Meanwhile, Paul has proposed replacing the $5 trillion debt ceiling hike with a far smaller $500 billion increase — a move he argues would preserve leverage for deeper cuts in a follow-up reconciliation bill. But most Republicans see the idea as a nonstarter. “I don’t want anything,” Paul said when asked if he could be persuaded to support the package in exchange for concessions.

A Late-Night Drama on the Floor

Just before dawn, Murkowski was seen shaking her head repeatedly during an intense discussion with Thune, Crapo, and fellow Alaskan Sen. Dan Sullivan,

Meanwhile, Paul has proposed replacing the $5 trillion debt ceiling hike with a far smaller $500 billion increase — a move he argues would preserve leverage for deeper cuts in a follow-up reconciliation bill. But most Republicans see the idea as a nonstarter. “I don’t want anything,” Paul said when asked if he could be persuaded to support the package in exchange for concessions.

A Late-Night Drama on the Floor

Just before dawn, Murkowski was seen shaking her head repeatedly during an intense discussion with Thune, Crapo, and fellow Alaskan Sen. Dan Sullivan,

Amid the floor chaos, senators did pass a bipartisan amendment, 99 to 1, to strike language in the bill that would have barred states from regulating artificial intelligence for a decade in a blow to Sen. Ted Cruz (R-TX). The language was removed over concerns about consumer and child safety raised by Sen. Marsha Blackburn (R-TN) and Sen. Maria Cantwell (D-WA).

Other proposed amendments, however, failed. Collins’ bid to double the bill’s rural hospital relief fund to $50 billion - funded by restoring the top marginal tax rate for ultra-high earners, was rejected by a wide margin. A conservative amendment to roll back Medicaid expansion under the Affordable Care Act has yet to receive a vote but threatens to split the conference further: if it fails, hardliners like Ron Johnson (R-WI), Mike Lee (R-UT), and Rick Scott (R-FL) may walk away. If it passes, moderates like Murkowski and Collins could defect.

Ron Wyden, the top Democrat on the Senate Finance Committee, equated Collins’ amendment to “a band aid on an amputation.” Her amendment would have increased the top tax rate on individuals earning more than $25 million in a year to 39.6%. -

Amid the floor chaos, senators did pass a bipartisan amendment, 99 to 1, to strike language in the bill that would have barred states from regulating artificial intelligence for a decade in a blow to Sen. Ted Cruz (R-TX). The language was removed over concerns about consumer and child safety raised by Sen. Marsha Blackburn (R-TN) and Sen. Maria Cantwell (D-WA).

Other proposed amendments, however, failed. Collins’ bid to double the bill’s rural hospital relief fund to $50 billion - funded by restoring the top marginal tax rate for ultra-high earners, was rejected by a wide margin. A conservative amendment to roll back Medicaid expansion under the Affordable Care Act has yet to receive a vote but threatens to split the conference further: if it fails, hardliners like Ron Johnson (R-WI), Mike Lee (R-UT), and Rick Scott (R-FL) may walk away. If it passes, moderates like Murkowski and Collins could defect.

Ron Wyden, the top Democrat on the Senate Finance Committee, equated Collins’ amendment to “a band aid on an amputation.” Her amendment would have increased the top tax rate on individuals earning more than $25 million in a year to 39.6%. -

The IRS is much maligned by anyone who wants to keep their well learned money, yet one of their greatest problems they face is that

The IRS is much maligned by anyone who wants to keep their well learned money, yet one of their greatest problems they face is that

Grand Ayatollah Makarem was reportedly responding in the edict to question put forward by his followers is

Grand Ayatollah Makarem was reportedly responding in the edict to question put forward by his followers is

I continue to hold that feminism is the KEY movement that has undermined the success of western culture. Their zealotry has led to the destruction of the nuclear family (the most important factor in a healthy nation). They have helped to facilitate the near collapse of the west and this problem needs to be addressed before it’s too late.

I recently came across an article in the New York Times which explains the decline in western relationships in a way that is both hilarious and depressing. The essay is titled

I continue to hold that feminism is the KEY movement that has undermined the success of western culture. Their zealotry has led to the destruction of the nuclear family (the most important factor in a healthy nation). They have helped to facilitate the near collapse of the west and this problem needs to be addressed before it’s too late.

I recently came across an article in the New York Times which explains the decline in western relationships in a way that is both hilarious and depressing. The essay is titled

At a moment the Trump administration is celebrating to 'obliteration' of the Islamic Republic's core elements and main facilities of its nuclear program, the Ayatollah downplayed the effects of the military campaign.

He described that the United States entered the war along Israel's side "because they felt that if they did not enter, the Zionist regime would be destroyed." He presented this as a sign of Israeli weakness, echoing prior statements issued during the aerial raids.

"However, the Americans did not gain anything in this war," he asserted. He went to say that those that attacked Iran suffered a high cost. According to more from state media

At a moment the Trump administration is celebrating to 'obliteration' of the Islamic Republic's core elements and main facilities of its nuclear program, the Ayatollah downplayed the effects of the military campaign.

He described that the United States entered the war along Israel's side "because they felt that if they did not enter, the Zionist regime would be destroyed." He presented this as a sign of Israeli weakness, echoing prior statements issued during the aerial raids.

"However, the Americans did not gain anything in this war," he asserted. He went to say that those that attacked Iran suffered a high cost. According to more from state media

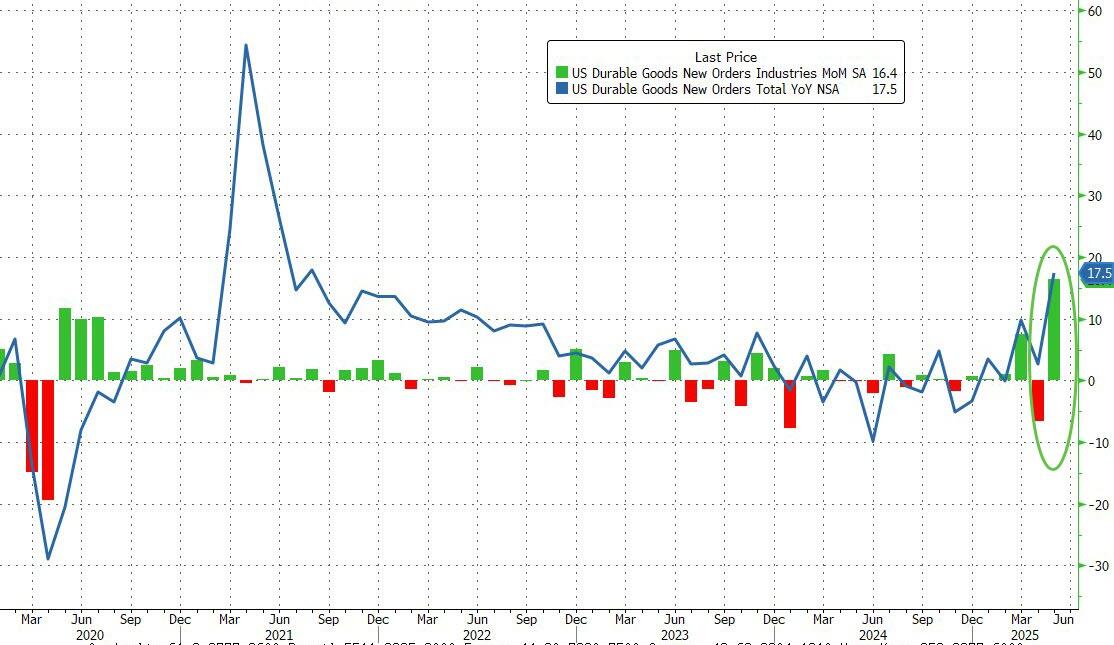

Source: Bloomberg

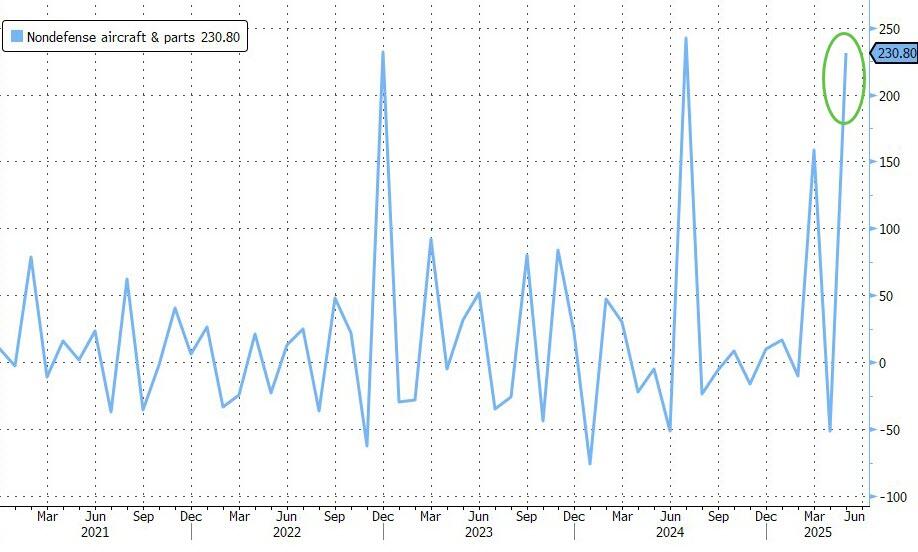

This was all driven by non-defense aircraft orders... which rose 230% MoM..

Source: Bloomberg

This was all driven by non-defense aircraft orders... which rose 230% MoM..

Source: Bloomberg

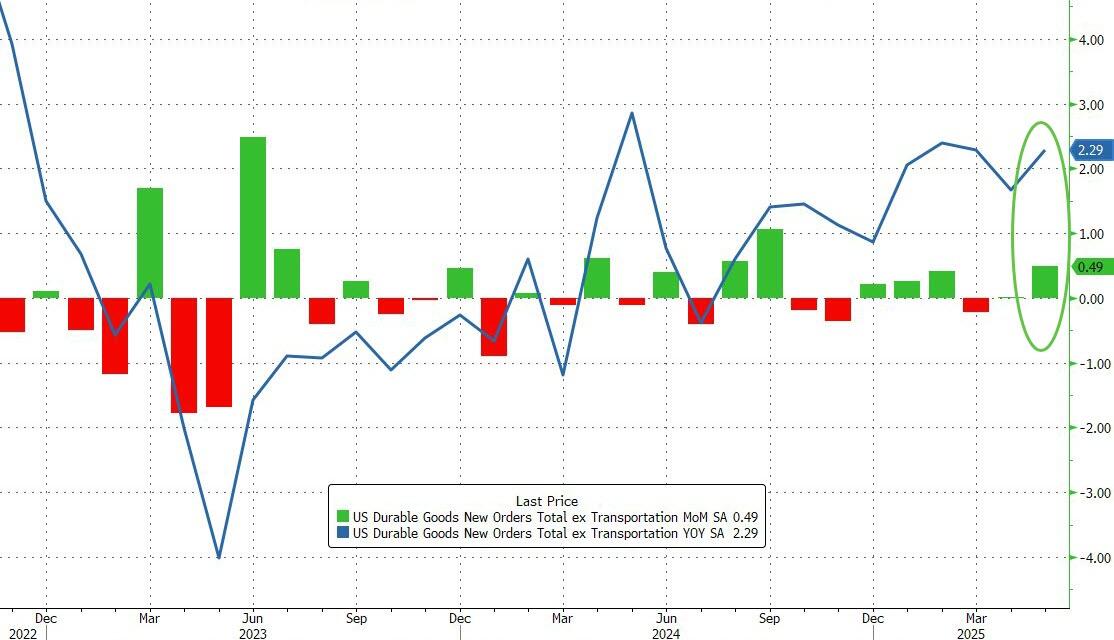

...as 'ex-transports', orders rose just 0.5% MoM (still better than expected)...

Source: Bloomberg

...as 'ex-transports', orders rose just 0.5% MoM (still better than expected)...

Source: Bloomberg

Capital goods shipments rose 0.5%, excluding defense and commercial aircraft, better than expected, adding to Q2 GDP growth hopes.

Source: Bloomberg

Capital goods shipments rose 0.5%, excluding defense and commercial aircraft, better than expected, adding to Q2 GDP growth hopes.