China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand

China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand

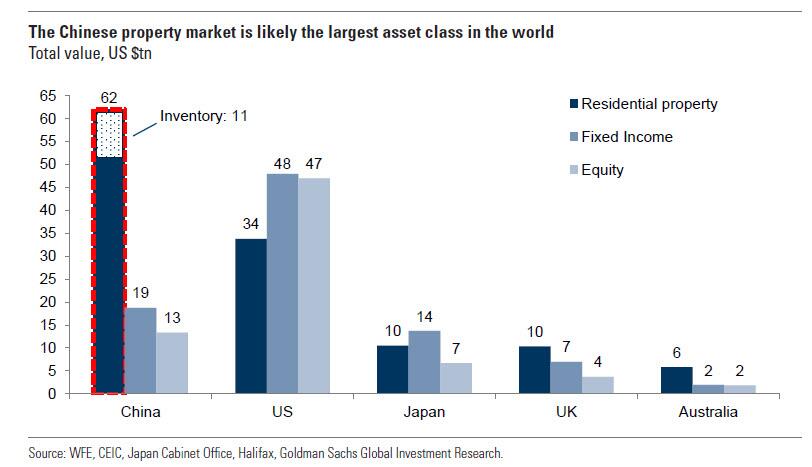

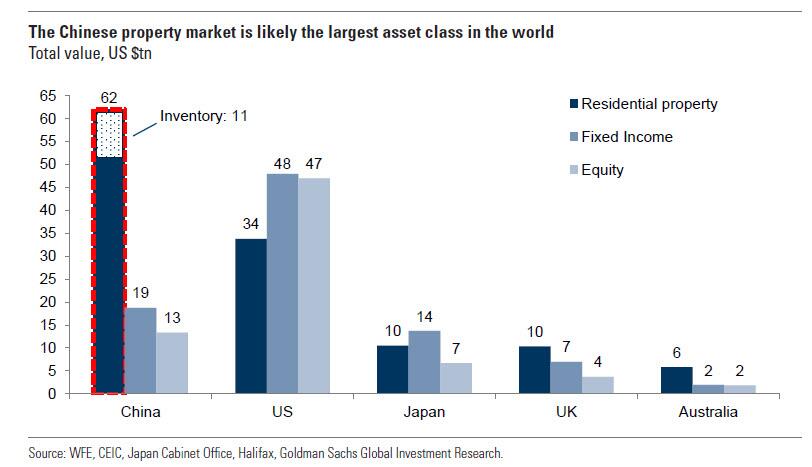

With China's real estate sector now a pale shadow of its former self, when just five years ago Goldman defined China's property market as the world's largest asset class at over $60 trillion...

... following countless bankruptcies and years of price declines, Beijing is again trying - after multiple previous failed attempts - to kickstart the one sector that is without doubt the most important to China's middle class because, unlike the US, most Chinese wealth is concentrated in real estate not capital markets.

As Bloomberg reports, China is tapping "an often overlooked pool of funds worth 10.9 trillion yuan ($1.5 trillion) to salvage its housing sector," offering people a cheaper alternative to bank mortgages to spark lacking demand for housing.

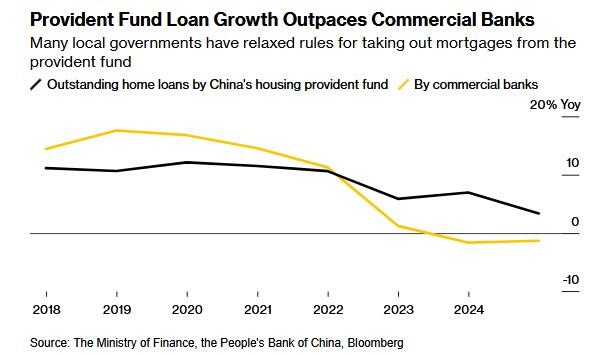

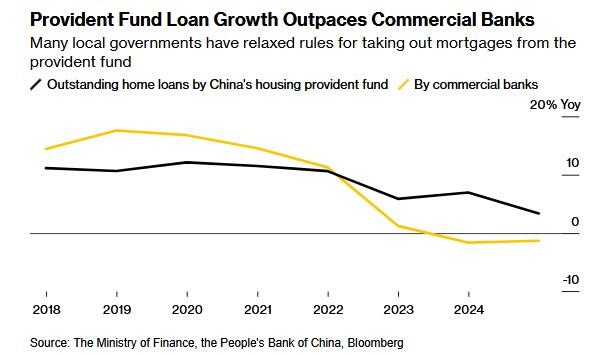

The housing provident fund, a government savings program used to help people buy homes, has become an increasingly important means to obtain financing, as banks turn more cautious with profit challenges. The fund has outpaced banks in giving out loans, hitting 8.1 trillion yuan in outstanding mortgages last year.

In other words, China has unleashed its own Government-Sponsored Entity to create mortgages, and with Fannie and Freddie as guiding lights, all that will take for the next Chinese debt crisis, is a continued decline in the housing market.

“It’s a frontrunner among policies used to support the housing market,” said Chen Wenjing, a research director at China Index Holdings Ltd. “The housing market has seen lingering pressure, and many local governments have leveraged this policy to reduce the mortgage burden.”

A Bloomberg gauge of Chinese developers shares rose as much as 3.2% on Tuesday, the most in more than a month, paring this year’s decline to "only" 16%.

President Xi Jinping has pledged to help the country turn around the ailing property market and counter external shocks, a challenge that was brought back in focus this month after the US and China accused each other of violating a trade truce agreed in May.

The provident fund system, which China adopted from Singapore three decades ago, requires employees and employers to contribute monthly into a pool that can then give out mortgages, often at a lower interest rate than banks.

... following countless bankruptcies and years of price declines, Beijing is again trying - after multiple previous failed attempts - to kickstart the one sector that is without doubt the most important to China's middle class because, unlike the US, most Chinese wealth is concentrated in real estate not capital markets.

As Bloomberg reports, China is tapping "an often overlooked pool of funds worth 10.9 trillion yuan ($1.5 trillion) to salvage its housing sector," offering people a cheaper alternative to bank mortgages to spark lacking demand for housing.

The housing provident fund, a government savings program used to help people buy homes, has become an increasingly important means to obtain financing, as banks turn more cautious with profit challenges. The fund has outpaced banks in giving out loans, hitting 8.1 trillion yuan in outstanding mortgages last year.

In other words, China has unleashed its own Government-Sponsored Entity to create mortgages, and with Fannie and Freddie as guiding lights, all that will take for the next Chinese debt crisis, is a continued decline in the housing market.

“It’s a frontrunner among policies used to support the housing market,” said Chen Wenjing, a research director at China Index Holdings Ltd. “The housing market has seen lingering pressure, and many local governments have leveraged this policy to reduce the mortgage burden.”

A Bloomberg gauge of Chinese developers shares rose as much as 3.2% on Tuesday, the most in more than a month, paring this year’s decline to "only" 16%.

President Xi Jinping has pledged to help the country turn around the ailing property market and counter external shocks, a challenge that was brought back in focus this month after the US and China accused each other of violating a trade truce agreed in May.

The provident fund system, which China adopted from Singapore three decades ago, requires employees and employers to contribute monthly into a pool that can then give out mortgages, often at a lower interest rate than banks.

As Bloomberg notes, the system's importance is growing at a time when banks, which have been enlisted to support the economy over the past few years, are battling record-low margins, slowing profit growth and rising bad debt.

Still, analysts are skeptical that measures to ease the financing needs of borrowers will be enough to cement a housing recovery. The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a note on Tuesday.

Meanwhile, residential sales have continued to fall in May. Distressed giant Country Garden Holdings’ 28% slide in transactions last month underscored buyer concerns about the health of the firm and the broader sector.

Since last year, many cities began easing rules. This year, at least 50 municipalities and cities relaxed the conditions on how people can use loans provided by the provident fund, including increasing the amount they can take out, according to China Index Holdings.

Shenzhen, China’s least affordable city, this week allowed residents to withdraw their deposits in the scheme to fund downpayments. The latest relaxation followed significant easing in March, which included nearly doubling the mortgage loan quota from the level in 2023.

Usage of the fund has been growing. In the capital of Beijing, it financed 33% of residential mortgages last year, up from 29.4% in 2020.

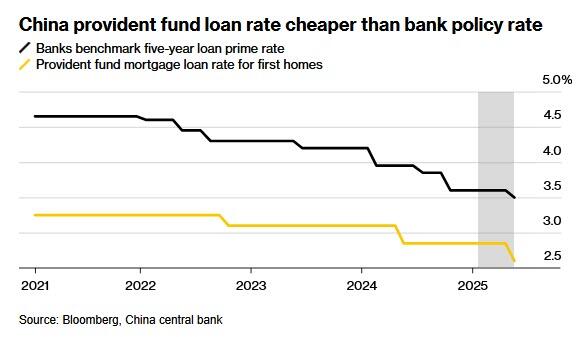

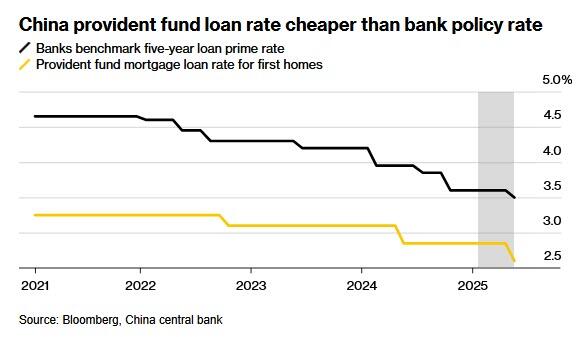

In an attempt to spark demand for housing, among other things, the PBOC recently cut interest rates for mortgage loans given out by the housing provident fund, making it 0.9% cheaper than bank mortgages. While the rate cut reduces borrowing costs for a homebuyer by about 3%, the relief is “rather marginal” and unlikely to cause a rally in home sales, said Liu Jieqi, a Hong Kong-based property analyst at UOB Kay Hian.

“It signals the government’s efforts,” Liu said. “But in the end, a broad property recovery hinges on effective implementation” of policies and a better economic outlook.

The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a Tuesday note.

For now, the provident fund is helping to plug a gap as lenders cut back. Outstanding home loans by the fund grew 3.4% in 2024, while commercial bank loans dipped 1.3%.

As Bloomberg notes, the system's importance is growing at a time when banks, which have been enlisted to support the economy over the past few years, are battling record-low margins, slowing profit growth and rising bad debt.

Still, analysts are skeptical that measures to ease the financing needs of borrowers will be enough to cement a housing recovery. The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a note on Tuesday.

Meanwhile, residential sales have continued to fall in May. Distressed giant Country Garden Holdings’ 28% slide in transactions last month underscored buyer concerns about the health of the firm and the broader sector.

Since last year, many cities began easing rules. This year, at least 50 municipalities and cities relaxed the conditions on how people can use loans provided by the provident fund, including increasing the amount they can take out, according to China Index Holdings.

Shenzhen, China’s least affordable city, this week allowed residents to withdraw their deposits in the scheme to fund downpayments. The latest relaxation followed significant easing in March, which included nearly doubling the mortgage loan quota from the level in 2023.

Usage of the fund has been growing. In the capital of Beijing, it financed 33% of residential mortgages last year, up from 29.4% in 2020.

In an attempt to spark demand for housing, among other things, the PBOC recently cut interest rates for mortgage loans given out by the housing provident fund, making it 0.9% cheaper than bank mortgages. While the rate cut reduces borrowing costs for a homebuyer by about 3%, the relief is “rather marginal” and unlikely to cause a rally in home sales, said Liu Jieqi, a Hong Kong-based property analyst at UOB Kay Hian.

“It signals the government’s efforts,” Liu said. “But in the end, a broad property recovery hinges on effective implementation” of policies and a better economic outlook.

The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a Tuesday note.

For now, the provident fund is helping to plug a gap as lenders cut back. Outstanding home loans by the fund grew 3.4% in 2024, while commercial bank loans dipped 1.3%.

Unlike banks, the provident fund has ample ammunition for more aggressive lending. With contributions from almost 180 million employers and employees across the country, the fund had an outstanding 10.9 trillion yuan as of 2024, higher than the outstanding amount of its mortgage loans, according to official data.

Computer science researcher Eli Zhang is a typical young buyer benefiting from the fund. The 30-year-old snapped up a 700 square foot (65 square meter) home in suburban Beijing in 2023. Since then, Zhang has been tapping the provident fund every month to partially cover her $550,000 mortgage.

“The housing provident loans are getting cheaper and cheaper,” said Zhang, who now pays interest of about 2.85% for mortgages from the provident fund. “With its help, my mortgage is quite affordable.”

Tue, 06/10/2025 - 18:30

Unlike banks, the provident fund has ample ammunition for more aggressive lending. With contributions from almost 180 million employers and employees across the country, the fund had an outstanding 10.9 trillion yuan as of 2024, higher than the outstanding amount of its mortgage loans, according to official data.

Computer science researcher Eli Zhang is a typical young buyer benefiting from the fund. The 30-year-old snapped up a 700 square foot (65 square meter) home in suburban Beijing in 2023. Since then, Zhang has been tapping the provident fund every month to partially cover her $550,000 mortgage.

“The housing provident loans are getting cheaper and cheaper,” said Zhang, who now pays interest of about 2.85% for mortgages from the provident fund. “With its help, my mortgage is quite affordable.”

Tue, 06/10/2025 - 18:30

... following countless bankruptcies and years of price declines, Beijing is again trying - after multiple previous failed attempts - to kickstart the one sector that is without doubt the most important to China's middle class because, unlike the US, most Chinese wealth is concentrated in real estate not capital markets.

As Bloomberg reports, China is tapping "an often overlooked pool of funds worth 10.9 trillion yuan ($1.5 trillion) to salvage its housing sector," offering people a cheaper alternative to bank mortgages to spark lacking demand for housing.

The housing provident fund, a government savings program used to help people buy homes, has become an increasingly important means to obtain financing, as banks turn more cautious with profit challenges. The fund has outpaced banks in giving out loans, hitting 8.1 trillion yuan in outstanding mortgages last year.

In other words, China has unleashed its own Government-Sponsored Entity to create mortgages, and with Fannie and Freddie as guiding lights, all that will take for the next Chinese debt crisis, is a continued decline in the housing market.

“It’s a frontrunner among policies used to support the housing market,” said Chen Wenjing, a research director at China Index Holdings Ltd. “The housing market has seen lingering pressure, and many local governments have leveraged this policy to reduce the mortgage burden.”

A Bloomberg gauge of Chinese developers shares rose as much as 3.2% on Tuesday, the most in more than a month, paring this year’s decline to "only" 16%.

President Xi Jinping has pledged to help the country turn around the ailing property market and counter external shocks, a challenge that was brought back in focus this month after the US and China accused each other of violating a trade truce agreed in May.

The provident fund system, which China adopted from Singapore three decades ago, requires employees and employers to contribute monthly into a pool that can then give out mortgages, often at a lower interest rate than banks.

... following countless bankruptcies and years of price declines, Beijing is again trying - after multiple previous failed attempts - to kickstart the one sector that is without doubt the most important to China's middle class because, unlike the US, most Chinese wealth is concentrated in real estate not capital markets.

As Bloomberg reports, China is tapping "an often overlooked pool of funds worth 10.9 trillion yuan ($1.5 trillion) to salvage its housing sector," offering people a cheaper alternative to bank mortgages to spark lacking demand for housing.

The housing provident fund, a government savings program used to help people buy homes, has become an increasingly important means to obtain financing, as banks turn more cautious with profit challenges. The fund has outpaced banks in giving out loans, hitting 8.1 trillion yuan in outstanding mortgages last year.

In other words, China has unleashed its own Government-Sponsored Entity to create mortgages, and with Fannie and Freddie as guiding lights, all that will take for the next Chinese debt crisis, is a continued decline in the housing market.

“It’s a frontrunner among policies used to support the housing market,” said Chen Wenjing, a research director at China Index Holdings Ltd. “The housing market has seen lingering pressure, and many local governments have leveraged this policy to reduce the mortgage burden.”

A Bloomberg gauge of Chinese developers shares rose as much as 3.2% on Tuesday, the most in more than a month, paring this year’s decline to "only" 16%.

President Xi Jinping has pledged to help the country turn around the ailing property market and counter external shocks, a challenge that was brought back in focus this month after the US and China accused each other of violating a trade truce agreed in May.

The provident fund system, which China adopted from Singapore three decades ago, requires employees and employers to contribute monthly into a pool that can then give out mortgages, often at a lower interest rate than banks.

As Bloomberg notes, the system's importance is growing at a time when banks, which have been enlisted to support the economy over the past few years, are battling record-low margins, slowing profit growth and rising bad debt.

Still, analysts are skeptical that measures to ease the financing needs of borrowers will be enough to cement a housing recovery. The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a note on Tuesday.

Meanwhile, residential sales have continued to fall in May. Distressed giant Country Garden Holdings’ 28% slide in transactions last month underscored buyer concerns about the health of the firm and the broader sector.

Since last year, many cities began easing rules. This year, at least 50 municipalities and cities relaxed the conditions on how people can use loans provided by the provident fund, including increasing the amount they can take out, according to China Index Holdings.

Shenzhen, China’s least affordable city, this week allowed residents to withdraw their deposits in the scheme to fund downpayments. The latest relaxation followed significant easing in March, which included nearly doubling the mortgage loan quota from the level in 2023.

Usage of the fund has been growing. In the capital of Beijing, it financed 33% of residential mortgages last year, up from 29.4% in 2020.

In an attempt to spark demand for housing, among other things, the PBOC recently cut interest rates for mortgage loans given out by the housing provident fund, making it 0.9% cheaper than bank mortgages. While the rate cut reduces borrowing costs for a homebuyer by about 3%, the relief is “rather marginal” and unlikely to cause a rally in home sales, said Liu Jieqi, a Hong Kong-based property analyst at UOB Kay Hian.

“It signals the government’s efforts,” Liu said. “But in the end, a broad property recovery hinges on effective implementation” of policies and a better economic outlook.

The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a Tuesday note.

For now, the provident fund is helping to plug a gap as lenders cut back. Outstanding home loans by the fund grew 3.4% in 2024, while commercial bank loans dipped 1.3%.

As Bloomberg notes, the system's importance is growing at a time when banks, which have been enlisted to support the economy over the past few years, are battling record-low margins, slowing profit growth and rising bad debt.

Still, analysts are skeptical that measures to ease the financing needs of borrowers will be enough to cement a housing recovery. The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a note on Tuesday.

Meanwhile, residential sales have continued to fall in May. Distressed giant Country Garden Holdings’ 28% slide in transactions last month underscored buyer concerns about the health of the firm and the broader sector.

Since last year, many cities began easing rules. This year, at least 50 municipalities and cities relaxed the conditions on how people can use loans provided by the provident fund, including increasing the amount they can take out, according to China Index Holdings.

Shenzhen, China’s least affordable city, this week allowed residents to withdraw their deposits in the scheme to fund downpayments. The latest relaxation followed significant easing in March, which included nearly doubling the mortgage loan quota from the level in 2023.

Usage of the fund has been growing. In the capital of Beijing, it financed 33% of residential mortgages last year, up from 29.4% in 2020.

In an attempt to spark demand for housing, among other things, the PBOC recently cut interest rates for mortgage loans given out by the housing provident fund, making it 0.9% cheaper than bank mortgages. While the rate cut reduces borrowing costs for a homebuyer by about 3%, the relief is “rather marginal” and unlikely to cause a rally in home sales, said Liu Jieqi, a Hong Kong-based property analyst at UOB Kay Hian.

“It signals the government’s efforts,” Liu said. “But in the end, a broad property recovery hinges on effective implementation” of policies and a better economic outlook.

The effort “grants an alternative to bank mortgages but fails to address the shortage of demand that is the root cause of the sector’s weakness,” Bloomberg Intelligence analysts Kristy Hung and Monica Si wrote in a Tuesday note.

For now, the provident fund is helping to plug a gap as lenders cut back. Outstanding home loans by the fund grew 3.4% in 2024, while commercial bank loans dipped 1.3%.

Unlike banks, the provident fund has ample ammunition for more aggressive lending. With contributions from almost 180 million employers and employees across the country, the fund had an outstanding 10.9 trillion yuan as of 2024, higher than the outstanding amount of its mortgage loans, according to official data.

Computer science researcher Eli Zhang is a typical young buyer benefiting from the fund. The 30-year-old snapped up a 700 square foot (65 square meter) home in suburban Beijing in 2023. Since then, Zhang has been tapping the provident fund every month to partially cover her $550,000 mortgage.

“The housing provident loans are getting cheaper and cheaper,” said Zhang, who now pays interest of about 2.85% for mortgages from the provident fund. “With its help, my mortgage is quite affordable.”

Unlike banks, the provident fund has ample ammunition for more aggressive lending. With contributions from almost 180 million employers and employees across the country, the fund had an outstanding 10.9 trillion yuan as of 2024, higher than the outstanding amount of its mortgage loans, according to official data.

Computer science researcher Eli Zhang is a typical young buyer benefiting from the fund. The 30-year-old snapped up a 700 square foot (65 square meter) home in suburban Beijing in 2023. Since then, Zhang has been tapping the provident fund every month to partially cover her $550,000 mortgage.

“The housing provident loans are getting cheaper and cheaper,” said Zhang, who now pays interest of about 2.85% for mortgages from the provident fund. “With its help, my mortgage is quite affordable.”

Tyler Durden | Zero Hedge

Zero Hedge

China Taps $1.5 Trillion Fund To Offer Cheap Mortgages, Boost Housing Demand | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The military said that Ukrainian air defenses intercepted seven Russian missiles and 213 attack drones, and many others were brought down by electronic means.

The military said that Ukrainian air defenses intercepted seven Russian missiles and 213 attack drones, and many others were brought down by electronic means.

As for Europe, the EU is busying preparing its 18th package of anti-Moscow sanctions on Tuesday, including an imposed price cap at which Russian oil can be sold - reportedly from $60 (£44) a barrel to $45. So far these measures have done little to dent Russia's military onslaught, which is now seeing the ground war move west beyond the Donetsk.

Russia and Ukraine have confirmed that Monday saw another successful prisoner swap, involving the return of severely wounded and seriously ill soldiers, which was the second phase of the agreed-to terms of the last Istanbul talks. By the end of it, another 1,000 total POWs are expected to be returned.

As for Europe, the EU is busying preparing its 18th package of anti-Moscow sanctions on Tuesday, including an imposed price cap at which Russian oil can be sold - reportedly from $60 (£44) a barrel to $45. So far these measures have done little to dent Russia's military onslaught, which is now seeing the ground war move west beyond the Donetsk.

Russia and Ukraine have confirmed that Monday saw another successful prisoner swap, involving the return of severely wounded and seriously ill soldiers, which was the second phase of the agreed-to terms of the last Istanbul talks. By the end of it, another 1,000 total POWs are expected to be returned.

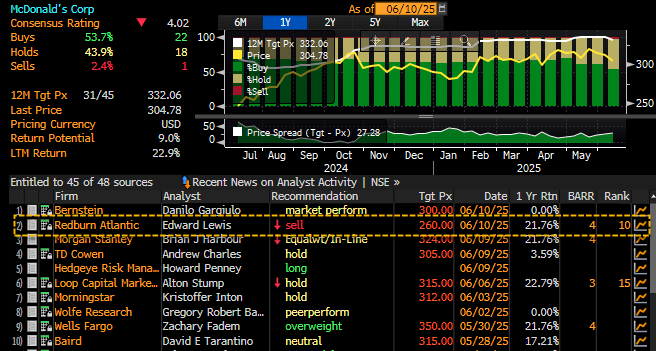

Key reasons for the downgrade:

GLP-1 weight-loss drugs are curbing appetites and pose a long-term structural threat to the fast-food industry.

Lewis argues these drugs will trigger broad behavioral shifts, impacting group dining and reducing habitual demand, especially among lower-income consumers.

He warns that what looks like a "1% drag" today could compound into a 10%+ hit over time.

Additional concerns:

U.S. consumers are fatigued after years of menu price inflation.

Rising tariffs are squeezing brands with limited pricing power.

Also noted:

Initiated coverage on Domino's Pizza with a sell rating.

Rated Chipotle as neutral.

Upgraded Yum Brands to buy, citing a more reasonable valuation, conservative expectations, and strong international exposure.

Separately, last month, we reported that Goldman analysts Leah Jordan and Eli Thompson informed clients that early indications suggest consumers are shifting and seeking "

Key reasons for the downgrade:

GLP-1 weight-loss drugs are curbing appetites and pose a long-term structural threat to the fast-food industry.

Lewis argues these drugs will trigger broad behavioral shifts, impacting group dining and reducing habitual demand, especially among lower-income consumers.

He warns that what looks like a "1% drag" today could compound into a 10%+ hit over time.

Additional concerns:

U.S. consumers are fatigued after years of menu price inflation.

Rising tariffs are squeezing brands with limited pricing power.

Also noted:

Initiated coverage on Domino's Pizza with a sell rating.

Rated Chipotle as neutral.

Upgraded Yum Brands to buy, citing a more reasonable valuation, conservative expectations, and strong international exposure.

Separately, last month, we reported that Goldman analysts Leah Jordan and Eli Thompson informed clients that early indications suggest consumers are shifting and seeking "

Will rainbows translate into more iPhone sales?

Will rainbows translate into more iPhone sales?

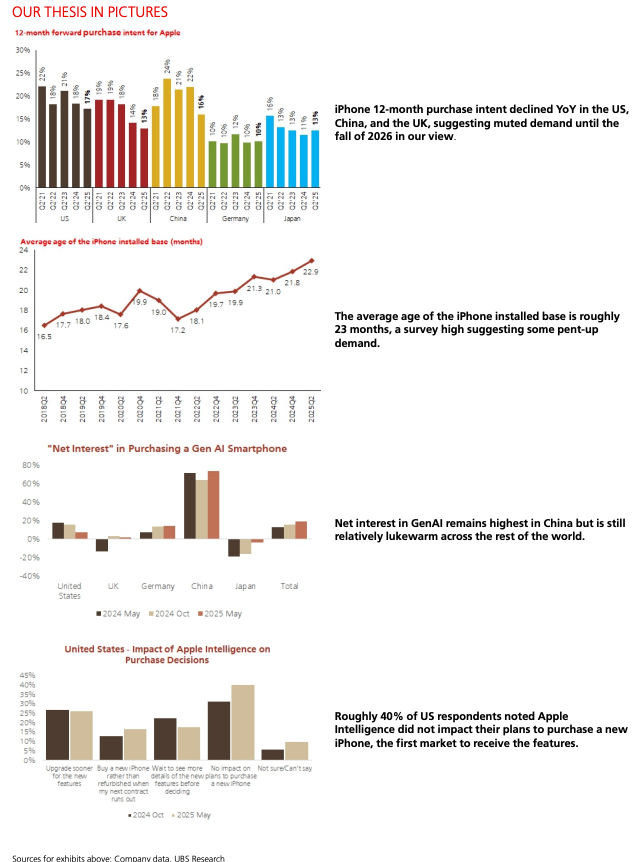

On Sunday, UBS analyst David Vogt shared new survey data with clients based on responses from 7,500 smartphone users across the U.S., U.K., China, Germany, and Japan. The survey data painted a bleak picture of iPhone demand.

Key Survey Findings:

U.S. and China Intent Drops: iPhone purchase intent in the U.S. dropped to 17%—the lowest in five years—while China fell from 22% to 16% year-over-year, hitting its weakest level in nearly a decade.

Other Markets Mixed: The UK and Germany saw flat or slight declines, while Japan was the only country with a modest improvement (13%, up from 11%).

Average iPhone Age Climbs: The average iPhone in use is now 22.9 months old, the highest ever recorded by UBS, indicating delayed upgrade cycles.

On Sunday, UBS analyst David Vogt shared new survey data with clients based on responses from 7,500 smartphone users across the U.S., U.K., China, Germany, and Japan. The survey data painted a bleak picture of iPhone demand.

Key Survey Findings:

U.S. and China Intent Drops: iPhone purchase intent in the U.S. dropped to 17%—the lowest in five years—while China fell from 22% to 16% year-over-year, hitting its weakest level in nearly a decade.

Other Markets Mixed: The UK and Germany saw flat or slight declines, while Japan was the only country with a modest improvement (13%, up from 11%).

Average iPhone Age Climbs: The average iPhone in use is now 22.9 months old, the highest ever recorded by UBS, indicating delayed upgrade cycles.

Vogt noted that Apple's new GenAI suite, branded as Apple Intelligence, has failed to spark any meaningful upgrade cycle outside China.

Watch live here:

. . .

Vogt noted that Apple's new GenAI suite, branded as Apple Intelligence, has failed to spark any meaningful upgrade cycle outside China.

Watch live here:

. . .

Allianz Trade forecasts an overall increase of 11 percent in corporate insolvencies in Germany this year, reaching approximately 24,400 cases. A further 3 percent rise to 25,050 cases is anticipated for 2026. These insolvencies put an estimated 210,000 jobs at risk across Germany.

In the first quarter of this year, 16 large German companies—those with revenues of €50 million or more—filed for insolvency. While this is a slight decrease of three cases compared to the same period last year, it’s double the number recorded in the first quarter of 2023.

She predicted Germany's economic demise 3 years ago.

Now, the German economy, run by the left and Greens, is in shambles.

Volkswagen plans to close 3 plants and cut 30,000 workers.

Allianz Trade forecasts an overall increase of 11 percent in corporate insolvencies in Germany this year, reaching approximately 24,400 cases. A further 3 percent rise to 25,050 cases is anticipated for 2026. These insolvencies put an estimated 210,000 jobs at risk across Germany.

In the first quarter of this year, 16 large German companies—those with revenues of €50 million or more—filed for insolvency. While this is a slight decrease of three cases compared to the same period last year, it’s double the number recorded in the first quarter of 2023.

She predicted Germany's economic demise 3 years ago.

Now, the German economy, run by the left and Greens, is in shambles.

Volkswagen plans to close 3 plants and cut 30,000 workers.