Zelensky Proposes 3-Way Meeting With Trump, Putin As US Rejects More Anti-Moscow Sanctions

Zelensky Proposes 3-Way Meeting With Trump, Putin As US Rejects More Anti-Moscow Sanctions

Ukrainian President Volodymyr Zelenskyy has called for a three-way summit with Donald Trump and Vladimir Putin at a moment aerial strikes between the warring sides have been escalating for several consecutive days. "If Putin is not comfortable with a bilateral meeting, or if everyone wants it to be a trilateral meeting, I don't mind. I am ready for any format," Zelensky said Tuesday, in comments which were published Wednesday.

Zelensky said he's ready for a "Trump-Putin-me" meeting, but simultaneously called for Washington to slap more sanctions on the Kremlin. "We are waiting for sanctions from the United States of America," the Ukrainian leader said. And Trump's response?... "If I think I’m close to getting a [peace] deal, I don’t wanna screw it up by doing that," he told reporters at the White House.

Reporter: What’s stopping you from imposing sanctions on Russia?

Trump: If I think I’m close to a deal, I don’t want to screw it up. Let me tell you: I’m much tougher than those you’re talking about. You have to know when to use it. I think it would hurt the deal.

‘I don’t want to screw it up’ – Trump explains why he won’t impose sanctions

– What’s stopping you from imposing sanctions on Russia?

– If I think I’m close to a deal, I don’t want to screw it up. Let me tell you: I’m much tougher than those you’re talking about. You have to…  — Zlatti71 (@Zlatti_71)

— Zlatti71 (@Zlatti_71)  Mainstream media and pundits have also of late been pressuring the White House to escalate the economic war against Russia, despite some seventeen waves of sanctions since the conflict began not doing much if anything to change the actual course of the war.

Zelensky had also said in his comments, "Trump confirmed that if Russia does not stop, sanctions will be imposed. We discussed two main aspects with him – energy and the banking system. Will the U.S. be able to impose sanctions on these two sectors? I would very much like that."

The Ukrainian leader is at the same time alleging that Russia is surging more troops to https://www.newsmax.com/world/globaltalk/war-ukraine-russia/2025/05/28/id/1212593/

:

On the battlefield, Zelenskyy said Russia was "amassing" more than 50,000 troops on the front line around the northeastern Sumy border region, where Moscow's army has captured a number of settlements as it seeks to establish what Putin has called a "buffer zone" inside Ukrainian territory.

NATO appears to be 'answering' with a build-up of its own, per Reuters https://www.reuters.com/business/aerospace-defense/nato-ask-berlin-seven-more-brigades-under-new-targets-sources-say-2025-05-28/

:

NATO will ask Germany to provide seven more brigades, or some 40,000 troops, for the alliance's defencs, three sources told Reuters, under new targets for weapons and troop numbers that its members' defence ministers are set to agree on next week.

The alliance is dramatically increasing its military capability targets as it views Russia as a much greater threat since its 2022 full-scale invasion of Ukraine.

So Trump's instincts to avoid sanctions, seeking to prevent further uncontrollable escalation at this sensitive point, are correct - at least from the perspective of avoiding action which would unnecessarily sabotage the chance for peace.

Mainstream media and pundits have also of late been pressuring the White House to escalate the economic war against Russia, despite some seventeen waves of sanctions since the conflict began not doing much if anything to change the actual course of the war.

Zelensky had also said in his comments, "Trump confirmed that if Russia does not stop, sanctions will be imposed. We discussed two main aspects with him – energy and the banking system. Will the U.S. be able to impose sanctions on these two sectors? I would very much like that."

The Ukrainian leader is at the same time alleging that Russia is surging more troops to https://www.newsmax.com/world/globaltalk/war-ukraine-russia/2025/05/28/id/1212593/

:

On the battlefield, Zelenskyy said Russia was "amassing" more than 50,000 troops on the front line around the northeastern Sumy border region, where Moscow's army has captured a number of settlements as it seeks to establish what Putin has called a "buffer zone" inside Ukrainian territory.

NATO appears to be 'answering' with a build-up of its own, per Reuters https://www.reuters.com/business/aerospace-defense/nato-ask-berlin-seven-more-brigades-under-new-targets-sources-say-2025-05-28/

:

NATO will ask Germany to provide seven more brigades, or some 40,000 troops, for the alliance's defencs, three sources told Reuters, under new targets for weapons and troop numbers that its members' defence ministers are set to agree on next week.

The alliance is dramatically increasing its military capability targets as it views Russia as a much greater threat since its 2022 full-scale invasion of Ukraine.

So Trump's instincts to avoid sanctions, seeking to prevent further uncontrollable escalation at this sensitive point, are correct - at least from the perspective of avoiding action which would unnecessarily sabotage the chance for peace.

After all, there's little the United States can do and each option is a 'bad' option, given Russia is in control on the ground in the Donbass. However, the US can lean on Kiev to make territorial concessions, given this is likely the only realistic option for permanent peace.

Meanwhile, Kremlin officials have been saying this week that they are concerned that the intelligence being provided to Trump is highly skewed in a hawkish direction. Lavrov has asserted that info given to the US Commander-in-Chief is likely "filtered" - and that he doesn't have the full picture on the intensity of ongoing Ukrainian attacks on Russian territory.

VERY interesting.

Lavrov alleges that Trump is not being fully briefed on everything regarding the situation in Ukraine, and that bad actors are giving him information “through a filter” in order to coerce the Trump admin into supporting Ukraine.

After all, there's little the United States can do and each option is a 'bad' option, given Russia is in control on the ground in the Donbass. However, the US can lean on Kiev to make territorial concessions, given this is likely the only realistic option for permanent peace.

Meanwhile, Kremlin officials have been saying this week that they are concerned that the intelligence being provided to Trump is highly skewed in a hawkish direction. Lavrov has asserted that info given to the US Commander-in-Chief is likely "filtered" - and that he doesn't have the full picture on the intensity of ongoing Ukrainian attacks on Russian territory.

VERY interesting.

Lavrov alleges that Trump is not being fully briefed on everything regarding the situation in Ukraine, and that bad actors are giving him information “through a filter” in order to coerce the Trump admin into supporting Ukraine. — Clandestine (@WarClandestine)

— Clandestine (@WarClandestine)  As an example of these kinds of recent attacks, the below shows a major strike on a site

As an example of these kinds of recent attacks, the below shows a major strike on a site  Russia's "Silicon Valley"....

Moments ago, Ukrainian attack drones hit a major Russian cruise missile manufacturer north of Moscow, the Dubna Machine-Building Plant.

At least one drone slammed into the complex that produces long-range cruise missiles used to strike Ukraine.

Russia's "Silicon Valley"....

Moments ago, Ukrainian attack drones hit a major Russian cruise missile manufacturer north of Moscow, the Dubna Machine-Building Plant.

At least one drone slammed into the complex that produces long-range cruise missiles used to strike Ukraine.  — OSINTtechnical (@Osinttechnical)

— OSINTtechnical (@Osinttechnical)  "A major Ukrainian drone assault targeted the city of Zelenograd, known as Russia’s 'Silicon Valley,' as well as a machine-building plant north of Moscow, Russian media and Ukrainian officials reported Wednesday," a regional source reported.

Wed, 05/28/2025 - 17:20

"A major Ukrainian drone assault targeted the city of Zelenograd, known as Russia’s 'Silicon Valley,' as well as a machine-building plant north of Moscow, Russian media and Ukrainian officials reported Wednesday," a regional source reported.

Wed, 05/28/2025 - 17:20

X (formerly Twitter)

Zlatti71 (@Zlatti_71) on X

‘I don’t want to screw it up’ – Trump explains why he won’t impose sanctions

– What’s stopping you from imposing sanctions on Russia...

X (formerly Twitter)

Zlatti71 (@Zlatti_71) on X

‘I don’t want to screw it up’ – Trump explains why he won’t impose sanctions

– What’s stopping you from imposing sanctions on Russia...

After all, there's little the United States can do and each option is a 'bad' option, given Russia is in control on the ground in the Donbass. However, the US can lean on Kiev to make territorial concessions, given this is likely the only realistic option for permanent peace.

Meanwhile, Kremlin officials have been saying this week that they are concerned that the intelligence being provided to Trump is highly skewed in a hawkish direction. Lavrov has asserted that info given to the US Commander-in-Chief is likely "filtered" - and that he doesn't have the full picture on the intensity of ongoing Ukrainian attacks on Russian territory.

VERY interesting.

Lavrov alleges that Trump is not being fully briefed on everything regarding the situation in Ukraine, and that bad actors are giving him information “through a filter” in order to coerce the Trump admin into supporting Ukraine.

After all, there's little the United States can do and each option is a 'bad' option, given Russia is in control on the ground in the Donbass. However, the US can lean on Kiev to make territorial concessions, given this is likely the only realistic option for permanent peace.

Meanwhile, Kremlin officials have been saying this week that they are concerned that the intelligence being provided to Trump is highly skewed in a hawkish direction. Lavrov has asserted that info given to the US Commander-in-Chief is likely "filtered" - and that he doesn't have the full picture on the intensity of ongoing Ukrainian attacks on Russian territory.

VERY interesting.

Lavrov alleges that Trump is not being fully briefed on everything regarding the situation in Ukraine, and that bad actors are giving him information “through a filter” in order to coerce the Trump admin into supporting Ukraine.

X (formerly Twitter)

RT (@RT_com) on X

Lavrov says Trump is being misled on Ukraine by advisors pushing 'more aggressive actions against Russia'

Information Trump receives is 'filtered'...

X (formerly Twitter)

Clandestine (@WarClandestine) on X

VERY interesting.

Lavrov alleges that Trump is not being fully briefed on everything regarding the situation in Ukraine, and that bad actors are g...

The Moscow Times

Russia’s ‘Silicon Valley’ Targeted in Major Ukrainian Drone Assault - The Moscow Times

A major Ukrainian drone assault targeted the city of Zelenograd, known as Russia’s “Silicon Valley,” as well as a machine-building plant nort...

X (formerly Twitter)

OSINTtechnical (@Osinttechnical) on X

Moments ago, Ukrainian attack drones hit a major Russian cruise missile manufacturer north of Moscow, the Dubna Machine-Building Plant.

At least o...

X (formerly Twitter)

OSINTtechnical (@Osinttechnical) on X

Moments ago, Ukrainian attack drones hit a major Russian cruise missile manufacturer north of Moscow, the Dubna Machine-Building Plant.

At least o...

Tyler Durden | Zero Hedge

Zero Hedge

Zelensky Proposes 3-Way Meeting With Trump, Putin As US Rejects More Anti-Moscow Sanctions | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The answer is clear: a significant dollar devaluation.

Devaluing the dollar is a boon to debtors, especially the US government, allowing it to borrow in dollars and repay in dimes. Short of an outright default—which Washington is unlikely to do—a weaker dollar is the only practical way to address the spiraling debt crisis.

At the same time, devaluation directly addresses the Trump administration’s concern that the US dollar is dangerously overvalued, a problem they believe is crippling American industry and exports.

That’s why a significant dollar devaluation isn’t just possible—I believe it’s a near certainty.

The only question is how the Trump administration will do it. And if history is any guide, gold will once again be at the center of it all.

Before going further, it’s essential to understand Trump’s stance on gold.

It’s no secret that Trump has a deep appreciation for gold—a fact reflected in his buildings, branding, and personal style. From the towering gold letters on his properties to the lavish gold-themed decor of Trump Tower, his affinity for the yellow metal is unmistakable.

Trump’s fascination with gold goes back to the 1970s when he made big profits as a gold investor. After the US government legalized private gold ownership in 1975, he aggressively bought in at around $185 per ounce. Reflecting on the investment, he later remarked:

“We sold in the range of $780, $790. We did very well. It’s easier than the construction business.”

Then, in September 2011, Trump accepted gold bars as a security deposit from a commercial tenant—one of the largest precious metals dealers in the US, APMEX. Instead of cash, the company paid its deposit with three one-kilo gold bars, each 99.99% pure and collectively weighing about 96.5 troy ounces.

“The Trump Organization has always strived to be ‘the gold standard.’ We welcome APMEX as our tenant at 40 Wall, a prestigious and historical location. The legacy of gold as a precious commodity has transcended to become a viable currency and an accepted universal monetary standard. Central banks around the world are holding gold as a reserve asset. It is also a terrific, potentially lucrative diversifier in a portfolio, especially with such volatility in the stock market.”

In a 2015 GQ interview, Trump openly expressed his admiration for a gold-backed monetary system, stating:

“Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money.”

He echoed this sentiment in another interview when asked about the possibility of returning to a gold standard:

Interviewer: Can you envision a scenario in which this country ever goes back to the gold standard?

Trump: I like the gold standard. There’s something very nice about the gold standard. There’s something very nice about having something solid, you know we used to have a very very solid country because it was based on a gold standard. We don’t have that anymore. There is something very nice about the concept of that.

Trump’s Treasury Secretary, Scott Bessent, shares a similar enthusiasm for gold. In an interview last November, he made his stance clear:

“I think we’re in a long-term bull market in Gold. We’re seeing reserve accumulation by central banks. I follow it closely. It’s my biggest position.”

With both Trump and Bessent signaling a strong interest in gold, the idea of a gold-backed monetary shift is no longer just speculation—it may be part of the broader monetary realignment already in motion.

So, how might gold be involved in a monetary reset today?

A significant dollar devaluation is likely necessary to address the debt crisis and growing trade imbalances. In previous monetary resets, the solution was straightforward—the US government simply revalued gold at a higher price, effectively devaluing the dollar.

However, today’s situation is different. Since 1973, the US government no longer directly sets the price of gold—it now floats freely on the open market.

This raises an important question: How could the Trump administration use gold to weaken the dollar today?

While no one can say for sure, one potential method would be for the US government to print dollars to buy gold on the open market—driving the price of gold higher and, in turn, devaluing the dollar against it.

Remember, Trump has no interest in a minor tweak. He has made it clear that he wants a fundamental and permanent realignment to fix two existential problems: the debt crisis and the overvalued dollar hindering US industry.

Given the scale of these challenges, it’s reasonable to expect a materially higher gold price as part of the solution. A gold price of $10,000, $20,000, or even higher is within the realm of possibility.

Once this major dollar devaluation is achieved, a logical next step could be re-pegging the dollar to gold to ensure monetary stability and restore global confidence. This is where Fort Knox could become relevant again, as its gold reserves would potentially be used to back a new gold-linked dollar.

Pegging the dollar to gold at a much higher price post-devaluation would also drastically reduce the burden of US debt. If gold were revalued to $20,000 per ounce, the 261 million ounces that Washington claims to own would suddenly be worth around $5.2 trillion, significantly strengthening the asset side of the US government’s balance sheet.

The exact form this new gold standard might take is uncertain. The government could back 20%, 40%, or more of the money supply with gold or go to a fully gold-backed system, even allowing gold coins to circulate as legal tender, as they did before the 1933 confiscation.

When we connect the dots, the big picture emerges.

Trump has put Fort Knox’s gold holdings back in the national spotlight, calling for an audit for the first time in decades.

Central bank gold purchases are accelerating at record-breaking levels.

An unusually large influx of physical gold is flowing into the US, far beyond regular market activity—an intriguing development ahead of a potential Fort Knox audit.

The US debt crisis has reached an inflection point and is spiraling out of control, making a monetary reset practically inevitable.

The Trump administration sees the dollar as dangerously overvalued, blaming it for America’s worsening trade imbalances and economic stagnation.

The conditions today are ripe for a monetary reset.

The US has undergone numerous monetary resets in its history, and most have followed the same pattern: gold revaluation and dollar devaluation.

If the Trump administration were to reset the monetary system, it would likely involve devaluing the dollar, revaluing gold to a much higher price, and re-pegging the US dollar to gold. A gold-backed dollar would require an audit of Fort Knox’s reserves.

When you lay out all the facts, it becomes clear that a new monetary reset is likely on the horizon.

All signs point to a historic shift: Trump is eyeing a dollar reset, gold is quietly moving into US vaults, and the debt crisis is reaching a breaking point.

This isn’t speculation—it’s a playbook that’s been used before.

What does it all mean for your money—and how can you turn this shift into opportunity?

That’s why I’ve just released an urgent new report revealing the top three strategies you need to prepare—and profit—from what’s coming next.

The answer is clear: a significant dollar devaluation.

Devaluing the dollar is a boon to debtors, especially the US government, allowing it to borrow in dollars and repay in dimes. Short of an outright default—which Washington is unlikely to do—a weaker dollar is the only practical way to address the spiraling debt crisis.

At the same time, devaluation directly addresses the Trump administration’s concern that the US dollar is dangerously overvalued, a problem they believe is crippling American industry and exports.

That’s why a significant dollar devaluation isn’t just possible—I believe it’s a near certainty.

The only question is how the Trump administration will do it. And if history is any guide, gold will once again be at the center of it all.

Before going further, it’s essential to understand Trump’s stance on gold.

It’s no secret that Trump has a deep appreciation for gold—a fact reflected in his buildings, branding, and personal style. From the towering gold letters on his properties to the lavish gold-themed decor of Trump Tower, his affinity for the yellow metal is unmistakable.

Trump’s fascination with gold goes back to the 1970s when he made big profits as a gold investor. After the US government legalized private gold ownership in 1975, he aggressively bought in at around $185 per ounce. Reflecting on the investment, he later remarked:

“We sold in the range of $780, $790. We did very well. It’s easier than the construction business.”

Then, in September 2011, Trump accepted gold bars as a security deposit from a commercial tenant—one of the largest precious metals dealers in the US, APMEX. Instead of cash, the company paid its deposit with three one-kilo gold bars, each 99.99% pure and collectively weighing about 96.5 troy ounces.

“The Trump Organization has always strived to be ‘the gold standard.’ We welcome APMEX as our tenant at 40 Wall, a prestigious and historical location. The legacy of gold as a precious commodity has transcended to become a viable currency and an accepted universal monetary standard. Central banks around the world are holding gold as a reserve asset. It is also a terrific, potentially lucrative diversifier in a portfolio, especially with such volatility in the stock market.”

In a 2015 GQ interview, Trump openly expressed his admiration for a gold-backed monetary system, stating:

“Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money.”

He echoed this sentiment in another interview when asked about the possibility of returning to a gold standard:

Interviewer: Can you envision a scenario in which this country ever goes back to the gold standard?

Trump: I like the gold standard. There’s something very nice about the gold standard. There’s something very nice about having something solid, you know we used to have a very very solid country because it was based on a gold standard. We don’t have that anymore. There is something very nice about the concept of that.

Trump’s Treasury Secretary, Scott Bessent, shares a similar enthusiasm for gold. In an interview last November, he made his stance clear:

“I think we’re in a long-term bull market in Gold. We’re seeing reserve accumulation by central banks. I follow it closely. It’s my biggest position.”

With both Trump and Bessent signaling a strong interest in gold, the idea of a gold-backed monetary shift is no longer just speculation—it may be part of the broader monetary realignment already in motion.

So, how might gold be involved in a monetary reset today?

A significant dollar devaluation is likely necessary to address the debt crisis and growing trade imbalances. In previous monetary resets, the solution was straightforward—the US government simply revalued gold at a higher price, effectively devaluing the dollar.

However, today’s situation is different. Since 1973, the US government no longer directly sets the price of gold—it now floats freely on the open market.

This raises an important question: How could the Trump administration use gold to weaken the dollar today?

While no one can say for sure, one potential method would be for the US government to print dollars to buy gold on the open market—driving the price of gold higher and, in turn, devaluing the dollar against it.

Remember, Trump has no interest in a minor tweak. He has made it clear that he wants a fundamental and permanent realignment to fix two existential problems: the debt crisis and the overvalued dollar hindering US industry.

Given the scale of these challenges, it’s reasonable to expect a materially higher gold price as part of the solution. A gold price of $10,000, $20,000, or even higher is within the realm of possibility.

Once this major dollar devaluation is achieved, a logical next step could be re-pegging the dollar to gold to ensure monetary stability and restore global confidence. This is where Fort Knox could become relevant again, as its gold reserves would potentially be used to back a new gold-linked dollar.

Pegging the dollar to gold at a much higher price post-devaluation would also drastically reduce the burden of US debt. If gold were revalued to $20,000 per ounce, the 261 million ounces that Washington claims to own would suddenly be worth around $5.2 trillion, significantly strengthening the asset side of the US government’s balance sheet.

The exact form this new gold standard might take is uncertain. The government could back 20%, 40%, or more of the money supply with gold or go to a fully gold-backed system, even allowing gold coins to circulate as legal tender, as they did before the 1933 confiscation.

When we connect the dots, the big picture emerges.

Trump has put Fort Knox’s gold holdings back in the national spotlight, calling for an audit for the first time in decades.

Central bank gold purchases are accelerating at record-breaking levels.

An unusually large influx of physical gold is flowing into the US, far beyond regular market activity—an intriguing development ahead of a potential Fort Knox audit.

The US debt crisis has reached an inflection point and is spiraling out of control, making a monetary reset practically inevitable.

The Trump administration sees the dollar as dangerously overvalued, blaming it for America’s worsening trade imbalances and economic stagnation.

The conditions today are ripe for a monetary reset.

The US has undergone numerous monetary resets in its history, and most have followed the same pattern: gold revaluation and dollar devaluation.

If the Trump administration were to reset the monetary system, it would likely involve devaluing the dollar, revaluing gold to a much higher price, and re-pegging the US dollar to gold. A gold-backed dollar would require an audit of Fort Knox’s reserves.

When you lay out all the facts, it becomes clear that a new monetary reset is likely on the horizon.

All signs point to a historic shift: Trump is eyeing a dollar reset, gold is quietly moving into US vaults, and the debt crisis is reaching a breaking point.

This isn’t speculation—it’s a playbook that’s been used before.

What does it all mean for your money—and how can you turn this shift into opportunity?

That’s why I’ve just released an urgent new report revealing the top three strategies you need to prepare—and profit—from what’s coming next.

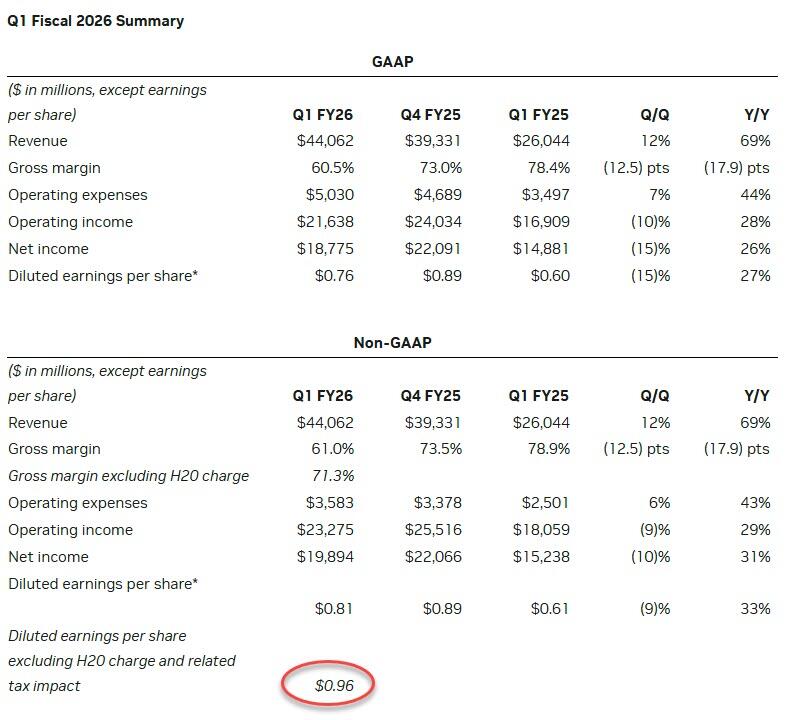

While the Q1 results were ok, the company's guidance came slightly on the weak side of the buyside expectations we discussed in our premium preview.

Revenue is expected to be $45.0 billion, plus or minus 2%; the mid-point is below the consensus of $45.5 billion

The outlook for fiscal second quarter sales reflects a loss in H20 revenue of around $8 billion

Also notes that while the official consensus estimate was $45.5 billion, recall that some analysts factored in the potential of lost revenue from H20 and some did not. As a result, the number is rather flexible.

Sees adjusted gross margin 71.5% to 72.5%, in line with estimates of 71.7%

Sees adjusted operating expenses $4.0 billion, above estimates of $3.86 billion

Commenting on the results, CEO Jensen Huang said that “Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.”

Just like AAPL in its early days, Nvidia is now building a big cash pile: "Cash, cash equivalents and marketable securities were $53.7 billion, up from $31.4 billion a year ago and $43.2 billion a quarter ago."

With the company's recent attempt to buy Arm stopped by regulators, how long before investors start demanding greater payouts, either in the form of bigger dividends, stock buybacks, or maybe even a one-time dividend.

To be sure, there was the usual cautionary language too. Here are some of the warnings from the company's 10Q:

May Be Unable to Create A Competitive Product for China

Expect to Begin Shipping Blackwell Ultra 2Q Fiscal ‘26

Would Have to Foreclose From Competing in China Market

China Market Foreclosure Would Materially Hit Business

Export Controls Applicable to China Are Complex

Still Evaluating Limited Options to Comply W/ Usg Rules

Still Looking at How to Supply Usg Compliant Compute

Separately, the 10Q also has this disclosure about China and China’s own questions for Nvidia:

Regulators in China have inquired about our sales and efforts to supply the China market and our fulfillment of the commitments we entered at the close of our Mellanox acquisition. For example, regulators in China are investigating whether complying with applicable U.S. export controls discriminates unfairly against customers in the China market. If regulators conclude that we have failed to fulfill such commitments or we have violated any applicable law in China, we could be subject to financial penalties, restrictions on our ability to conduct our business, restrictions or other orders regarding our networking business, products, and services, or otherwise impact our operations in China, any of which could have a material and adverse impact on our business, operating results and financial condition.

Usual boilerplate stuff.

So as they look at the market reaction, investors are asking a question: how did Nvidia make up for the lost sales of H20 to China? Bloomberg answers that the deals announced during President Trump’s tour of the Middle East (which Jensen Huang attended) seem to be too recent to make their way into that 2Q outlook, and adds that "hopefully someone will ask on the call with analysts."

Overall, the results were solid despite the expected miss in China sales due to the H20 sales loss. And, as Bloomberg put it, how many companies could front-load their earnings release with details of what they’re missing out on and still get a positive reaction from investors? The stock is holding a solid 5% gain after hours.

While the Q1 results were ok, the company's guidance came slightly on the weak side of the buyside expectations we discussed in our premium preview.

Revenue is expected to be $45.0 billion, plus or minus 2%; the mid-point is below the consensus of $45.5 billion

The outlook for fiscal second quarter sales reflects a loss in H20 revenue of around $8 billion

Also notes that while the official consensus estimate was $45.5 billion, recall that some analysts factored in the potential of lost revenue from H20 and some did not. As a result, the number is rather flexible.

Sees adjusted gross margin 71.5% to 72.5%, in line with estimates of 71.7%

Sees adjusted operating expenses $4.0 billion, above estimates of $3.86 billion

Commenting on the results, CEO Jensen Huang said that “Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.”

Just like AAPL in its early days, Nvidia is now building a big cash pile: "Cash, cash equivalents and marketable securities were $53.7 billion, up from $31.4 billion a year ago and $43.2 billion a quarter ago."

With the company's recent attempt to buy Arm stopped by regulators, how long before investors start demanding greater payouts, either in the form of bigger dividends, stock buybacks, or maybe even a one-time dividend.

To be sure, there was the usual cautionary language too. Here are some of the warnings from the company's 10Q:

May Be Unable to Create A Competitive Product for China

Expect to Begin Shipping Blackwell Ultra 2Q Fiscal ‘26

Would Have to Foreclose From Competing in China Market

China Market Foreclosure Would Materially Hit Business

Export Controls Applicable to China Are Complex

Still Evaluating Limited Options to Comply W/ Usg Rules

Still Looking at How to Supply Usg Compliant Compute

Separately, the 10Q also has this disclosure about China and China’s own questions for Nvidia:

Regulators in China have inquired about our sales and efforts to supply the China market and our fulfillment of the commitments we entered at the close of our Mellanox acquisition. For example, regulators in China are investigating whether complying with applicable U.S. export controls discriminates unfairly against customers in the China market. If regulators conclude that we have failed to fulfill such commitments or we have violated any applicable law in China, we could be subject to financial penalties, restrictions on our ability to conduct our business, restrictions or other orders regarding our networking business, products, and services, or otherwise impact our operations in China, any of which could have a material and adverse impact on our business, operating results and financial condition.

Usual boilerplate stuff.

So as they look at the market reaction, investors are asking a question: how did Nvidia make up for the lost sales of H20 to China? Bloomberg answers that the deals announced during President Trump’s tour of the Middle East (which Jensen Huang attended) seem to be too recent to make their way into that 2Q outlook, and adds that "hopefully someone will ask on the call with analysts."

Overall, the results were solid despite the expected miss in China sales due to the H20 sales loss. And, as Bloomberg put it, how many companies could front-load their earnings release with details of what they’re missing out on and still get a positive reaction from investors? The stock is holding a solid 5% gain after hours.

Erasing all of the loses since the last earnings...

Erasing all of the loses since the last earnings...

Still, at today’s close, Nvidia shares were about 10% below the record high hit in early January. The downward pressure on shares had also lowered its valuation. The stock trades at about 29 times forward earnings, a big step down from where shares were valued at the start of the year, around 35 times forward earnings. It appears that investors see room for the stock to run

Still, at today’s close, Nvidia shares were about 10% below the record high hit in early January. The downward pressure on shares had also lowered its valuation. The stock trades at about 29 times forward earnings, a big step down from where shares were valued at the start of the year, around 35 times forward earnings. It appears that investors see room for the stock to run

For years, the federal government has been telling us that the unemployment rate in the U.S. is very low.

Everyone knows that is a bunch of hogwash.

According to a report that was recently released by the Ludwig Institute for Shared Economic Prosperity, the true rate of unemployment in the U.S. was

For years, the federal government has been telling us that the unemployment rate in the U.S. is very low.

Everyone knows that is a bunch of hogwash.

According to a report that was recently released by the Ludwig Institute for Shared Economic Prosperity, the true rate of unemployment in the U.S. was

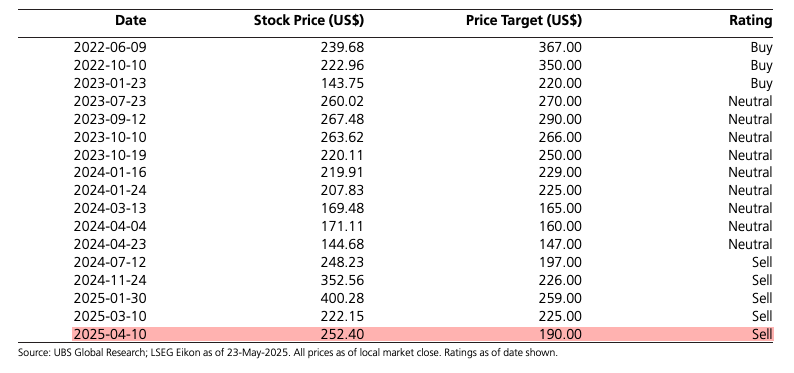

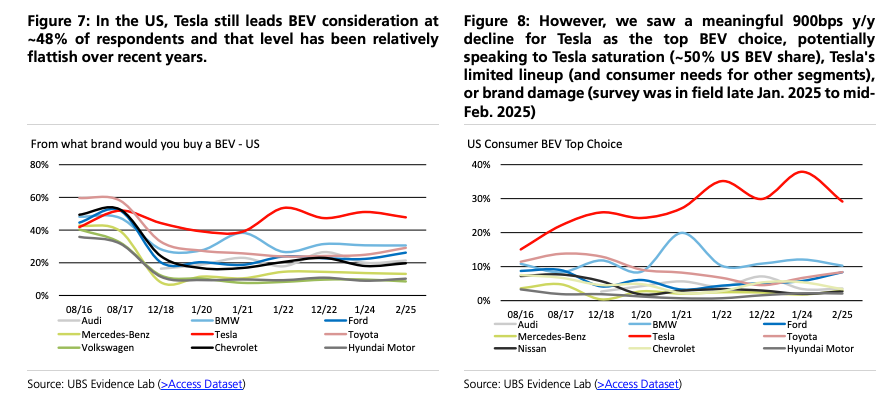

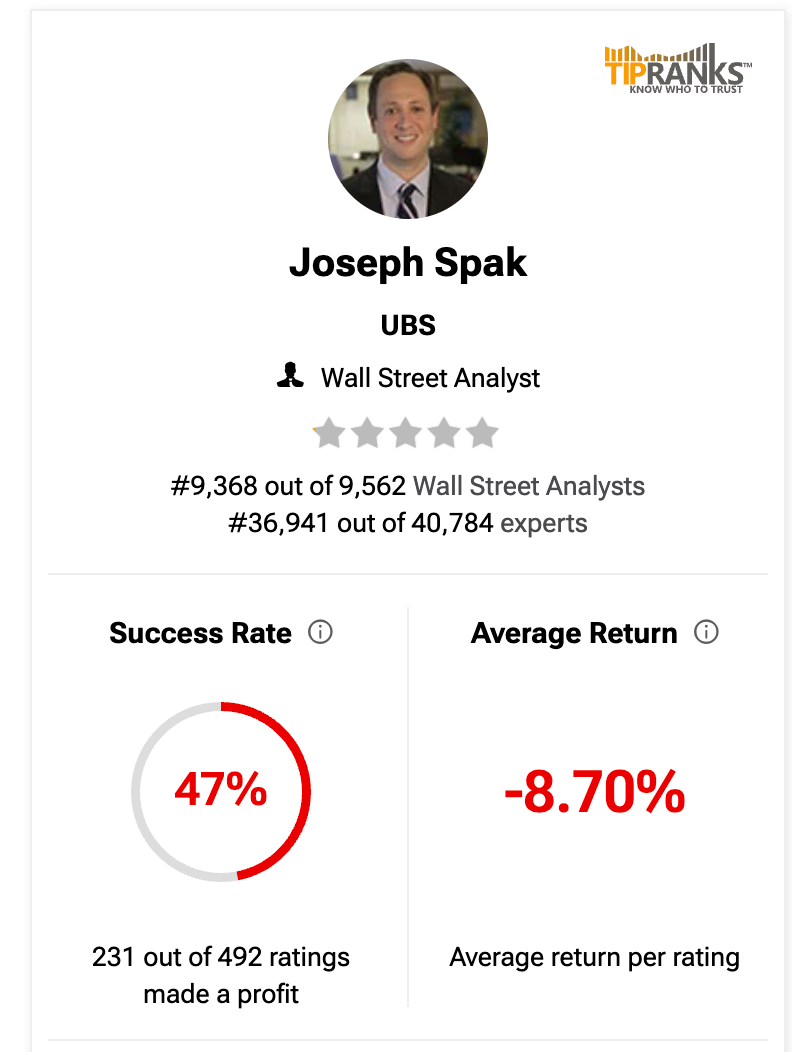

UBS analysts Joseph Spak and others published a note on Tuesday, focusing on its proprietary UBS EV Consumer Survey, in which the latest survey found declining global interest in Tesla's EVs across all major regions (U.S., China, Europe), as well as growing pressure across its core automotive business, where fundamentals continue to deteriorate.

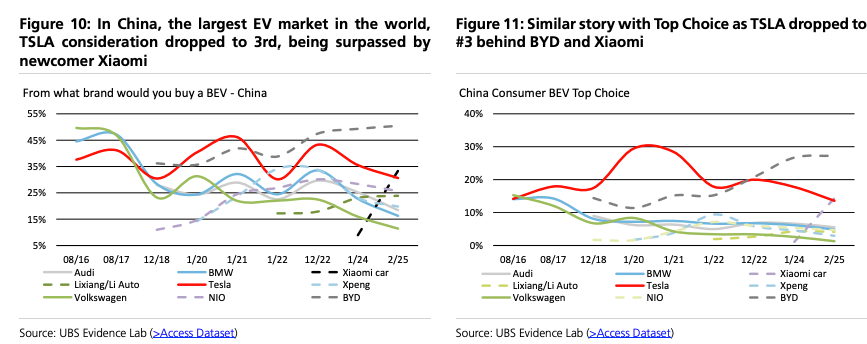

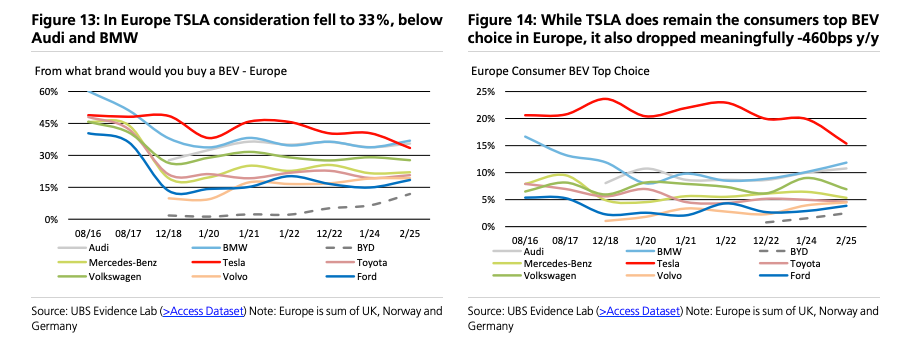

Spak outlined results from each key market:

In the U.S., we see Tesla saturation (~48% US BEV share), a limited vehicle lineup and affordability are concerns.

In China, we see intense competition and Tesla is no longer seen as the technology leader.

In Europe, we believe there may have been brand damage from Musk's political involvement

"Overall, we remain cautious on Tesla stock," Spak said in the note. UBS maintains a Sell rating with a 12-month price target of $190, implying significant downside from current levels. Shares were trading around $366 in premarket on Wednesday.

UBS analysts Joseph Spak and others published a note on Tuesday, focusing on its proprietary UBS EV Consumer Survey, in which the latest survey found declining global interest in Tesla's EVs across all major regions (U.S., China, Europe), as well as growing pressure across its core automotive business, where fundamentals continue to deteriorate.

Spak outlined results from each key market:

In the U.S., we see Tesla saturation (~48% US BEV share), a limited vehicle lineup and affordability are concerns.

In China, we see intense competition and Tesla is no longer seen as the technology leader.

In Europe, we believe there may have been brand damage from Musk's political involvement

"Overall, we remain cautious on Tesla stock," Spak said in the note. UBS maintains a Sell rating with a 12-month price target of $190, implying significant downside from current levels. Shares were trading around $366 in premarket on Wednesday.

Spak sees through the robotaxis and humanoid robots hype, telling clients:

"We understand that there is enthusiasm over robotaxis and humanoid robots, but the automotive business faces mounting challenges and a source of earnings/cash flow may be at risk with removal of California waiver. Musk has indicated the value of Tesla is in AV and humanoid robots. This may be true. But given the deteriorating outlook for the auto business , that means the implied valuation assigned to these ventures is already quite robust."

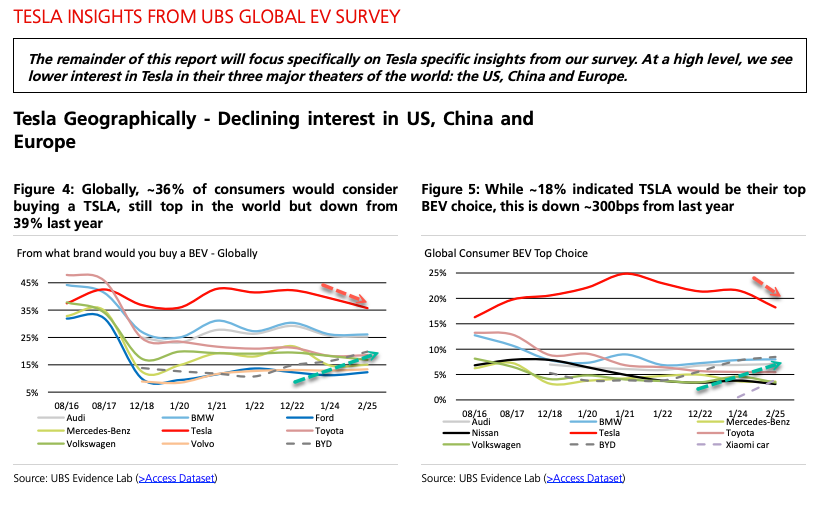

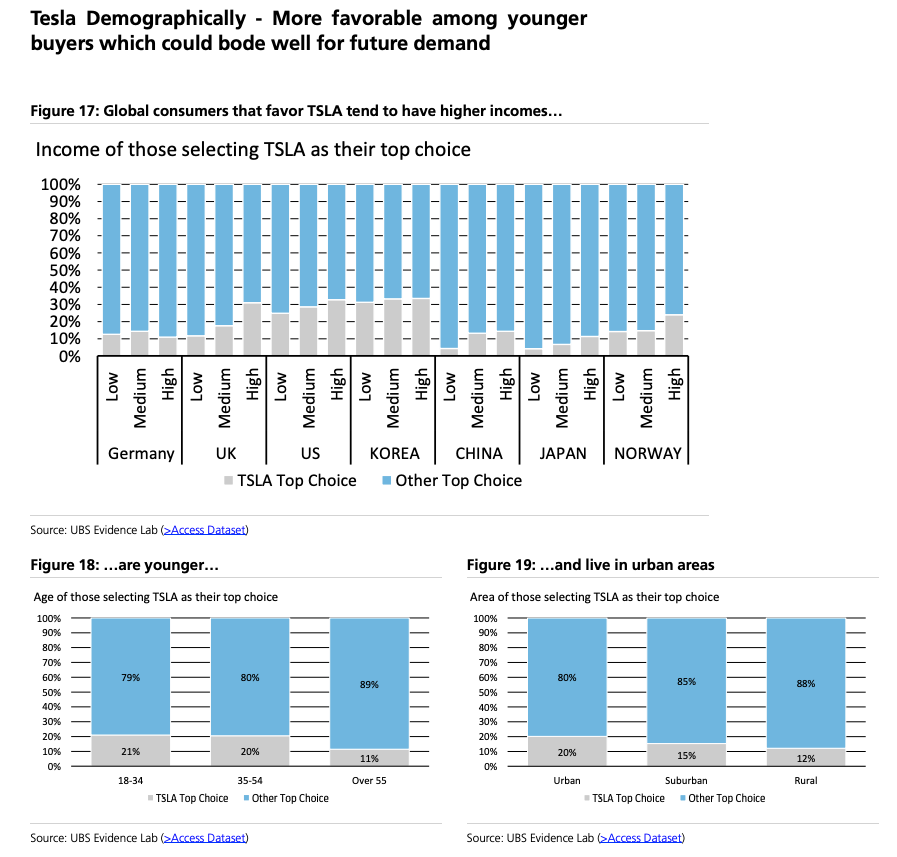

According to the survey of consumers around the world, only 36% of respondents globally would consider purchasing a Tesla—down from 39% a year ago. The share of consumers selecting Tesla as their top BEV (battery electric vehicle) choice fell even more sharply, from 22% to 18%.

Here are the highlights of the survey:

Globally, 36% of consumers would consider a Tesla, down from 39% last year. As a consumer's top BEV choice, Tesla is down to 18%, from 22% last year. The top choice decline was fairly prominent across the 3 major regions for Tesla:

In the U.S. top choice went to 29% vs. 38% last year (and note vs. 2024 BEV share of 48%).

In China, Tesla as a top choice was down to 14% from 18% last year and now behind both BYD and Xiaomi. More broadly, China consumers prefer to buy domestic OEM brands vs TSLA, although they do favor TSLA over other foreign OEM brands.

In Europe, top choice went to 15% from 20% last year. In Europe, we also saw brand consideration for Audi and BMW surpass TSLA.

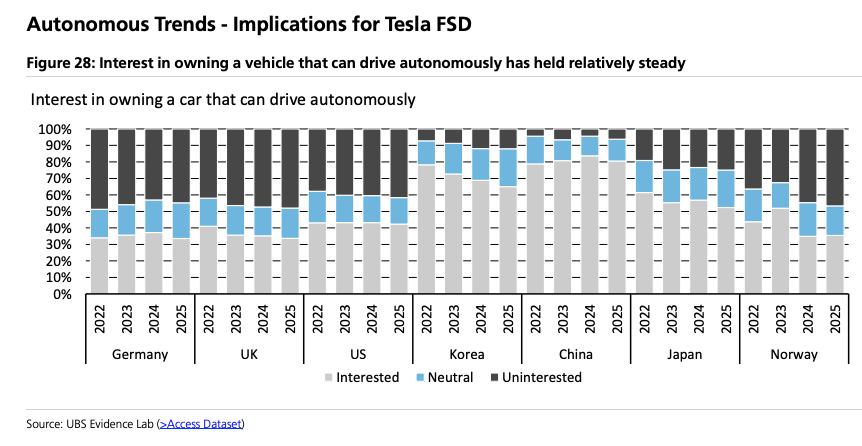

The survey also asked about autonomous/ADAS. Importance of ADAS as a feature held steady. When it comes to paying for autonomous features, only 1~12% would pay more than $7.6k upfront for autonomous features. TSLA's FSD currently costs $8k to buy outright. Meanwhile, only ~18% would pay >$100/ month for autonomous features; FSD subscription is currently $99/month.

It's hard to ignore the shifting sentiment in the global EV survey data, which shows consumer interest steadily moving away from Tesla and toward Chinese rival BYD.

Spak sees through the robotaxis and humanoid robots hype, telling clients:

"We understand that there is enthusiasm over robotaxis and humanoid robots, but the automotive business faces mounting challenges and a source of earnings/cash flow may be at risk with removal of California waiver. Musk has indicated the value of Tesla is in AV and humanoid robots. This may be true. But given the deteriorating outlook for the auto business , that means the implied valuation assigned to these ventures is already quite robust."

According to the survey of consumers around the world, only 36% of respondents globally would consider purchasing a Tesla—down from 39% a year ago. The share of consumers selecting Tesla as their top BEV (battery electric vehicle) choice fell even more sharply, from 22% to 18%.

Here are the highlights of the survey:

Globally, 36% of consumers would consider a Tesla, down from 39% last year. As a consumer's top BEV choice, Tesla is down to 18%, from 22% last year. The top choice decline was fairly prominent across the 3 major regions for Tesla:

In the U.S. top choice went to 29% vs. 38% last year (and note vs. 2024 BEV share of 48%).

In China, Tesla as a top choice was down to 14% from 18% last year and now behind both BYD and Xiaomi. More broadly, China consumers prefer to buy domestic OEM brands vs TSLA, although they do favor TSLA over other foreign OEM brands.

In Europe, top choice went to 15% from 20% last year. In Europe, we also saw brand consideration for Audi and BMW surpass TSLA.

The survey also asked about autonomous/ADAS. Importance of ADAS as a feature held steady. When it comes to paying for autonomous features, only 1~12% would pay more than $7.6k upfront for autonomous features. TSLA's FSD currently costs $8k to buy outright. Meanwhile, only ~18% would pay >$100/ month for autonomous features; FSD subscription is currently $99/month.

It's hard to ignore the shifting sentiment in the global EV survey data, which shows consumer interest steadily moving away from Tesla and toward Chinese rival BYD.

Tesla's favorability in the U.S. has remained stagnant at around 50% for several years.

Tesla's favorability in the U.S. has remained stagnant at around 50% for several years.

In China, respondents have been increasingly favoring domestic brands over Tesla.

In China, respondents have been increasingly favoring domestic brands over Tesla.

In Europe, respondents were also beginning to shift to domestic brands.

In Europe, respondents were also beginning to shift to domestic brands.

The survey found that youngsters around the world are increasingly favoring Tesla. This bodes well for future demand.

The survey found that youngsters around the world are increasingly favoring Tesla. This bodes well for future demand.

Interest in owning a vehicle that can drive autonomously differs per country.

Interest in owning a vehicle that can drive autonomously differs per country.

Contrary to UBS analyst Joseph Spak's warning of a "deteriorating outlook" for Tesla's automotive business, one user on X pointed to fresh sales data from China showing the Model Y ranked as the best-selling mid-size SUV for the week beginning May 19.

Tesla’s Model Y is the best selling car in the list of Top 10 weekly sales of mid-size SUVs for the week May.19-May.25 in China🔥

With 7400 units delivered, we need a telescope to see the runner up, Tiguan L by Volkswagen, with 2900 units 🔭

Contrary to UBS analyst Joseph Spak's warning of a "deteriorating outlook" for Tesla's automotive business, one user on X pointed to fresh sales data from China showing the Model Y ranked as the best-selling mid-size SUV for the week beginning May 19.

Tesla’s Model Y is the best selling car in the list of Top 10 weekly sales of mid-size SUVs for the week May.19-May.25 in China🔥

With 7400 units delivered, we need a telescope to see the runner up, Tiguan L by Volkswagen, with 2900 units 🔭

. . .

. . .

Sacks

that while he “can’t promise anything,” a pathway does exist for the government to buy more Bitcoin.

However, it would require convincing Commerce Secretary Howard Lutnick or Treasury Secretary Scott Besson to OK the buy and fund it “without a new tax or adding to the debt,” Sacks said, adding that “maybe by finding the money from some other program that’s not using it — then we could potentially acquire more Bitcoin.”

David Sacks said the US could buy more Bitcoin, but he can’t make any promises. Source:

“The question is, can we get either the Treasury Department or the Commerce Department to get excited about that because if they do and they can figure out how to fund it, they actually do have presidential authorization,” Sacks said.

US can buy Bitcoin if it doesn’t sting budget

The March 6 executive order

Sacks

that while he “can’t promise anything,” a pathway does exist for the government to buy more Bitcoin.

However, it would require convincing Commerce Secretary Howard Lutnick or Treasury Secretary Scott Besson to OK the buy and fund it “without a new tax or adding to the debt,” Sacks said, adding that “maybe by finding the money from some other program that’s not using it — then we could potentially acquire more Bitcoin.”

David Sacks said the US could buy more Bitcoin, but he can’t make any promises. Source:

“The question is, can we get either the Treasury Department or the Commerce Department to get excited about that because if they do and they can figure out how to fund it, they actually do have presidential authorization,” Sacks said.

US can buy Bitcoin if it doesn’t sting budget

The March 6 executive order

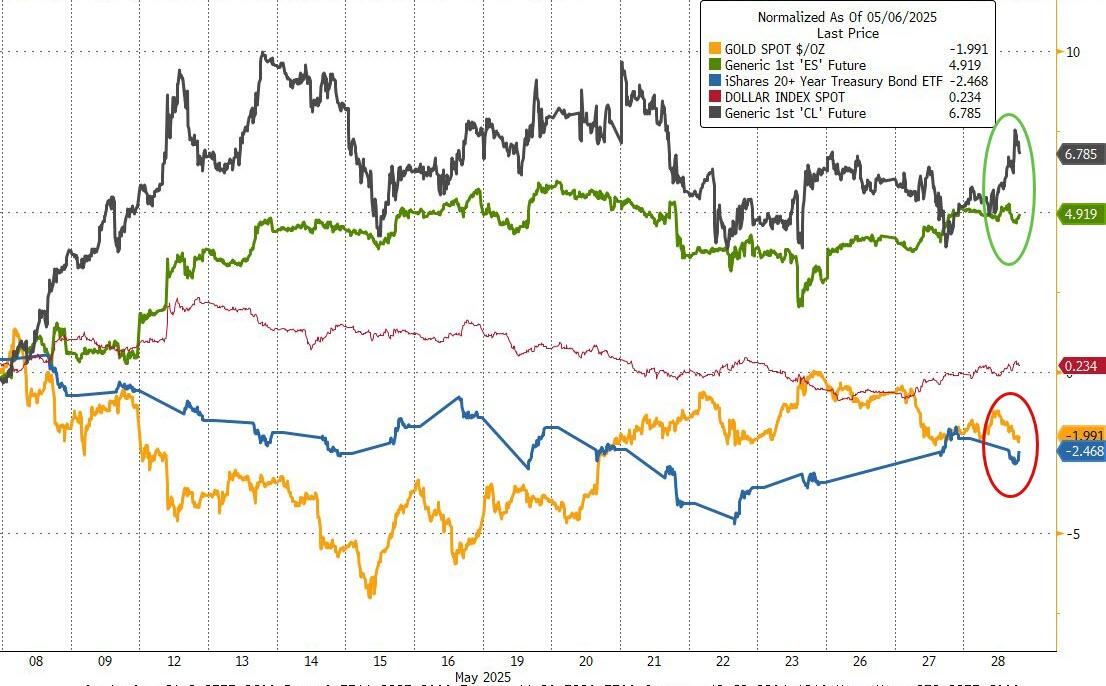

Source: Bloomberg

...but bitcoin has soared over 15% since the last FOMC meeting...

Source: Bloomberg

...but bitcoin has soared over 15% since the last FOMC meeting...

Source: Bloomberg

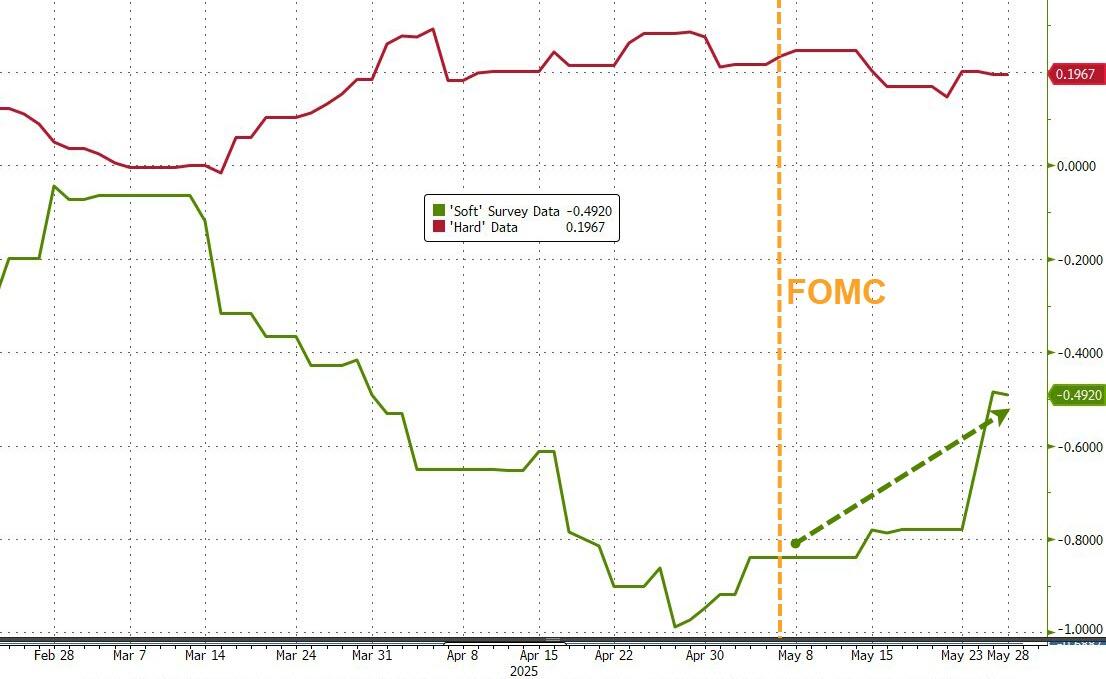

Hard data continues to be steady and growing while 'soft' survey data has surged in the three weeks since the last Fed meeting...

Source: Bloomberg

Hard data continues to be steady and growing while 'soft' survey data has surged in the three weeks since the last Fed meeting...

Source: Bloomberg

Which has pushed rate-cut expectations lower overall (with cuts shifting from 2025 to 2026)...

Source: Bloomberg

Which has pushed rate-cut expectations lower overall (with cuts shifting from 2025 to 2026)...

Source: Bloomberg

As a reminder, in spite of the exact same macro background of a dramatic tightening in financial conditions (orange oval) and weakness morphing into strength for US Macro data (red and green arrow), Powell and his pals decided a 50bps rate-cut (red oval) was not necessary this time... we wonder why (black line)?

Source: Bloomberg

As a reminder, in spite of the exact same macro background of a dramatic tightening in financial conditions (orange oval) and weakness morphing into strength for US Macro data (red and green arrow), Powell and his pals decided a 50bps rate-cut (red oval) was not necessary this time... we wonder why (black line)?

Source: Bloomberg

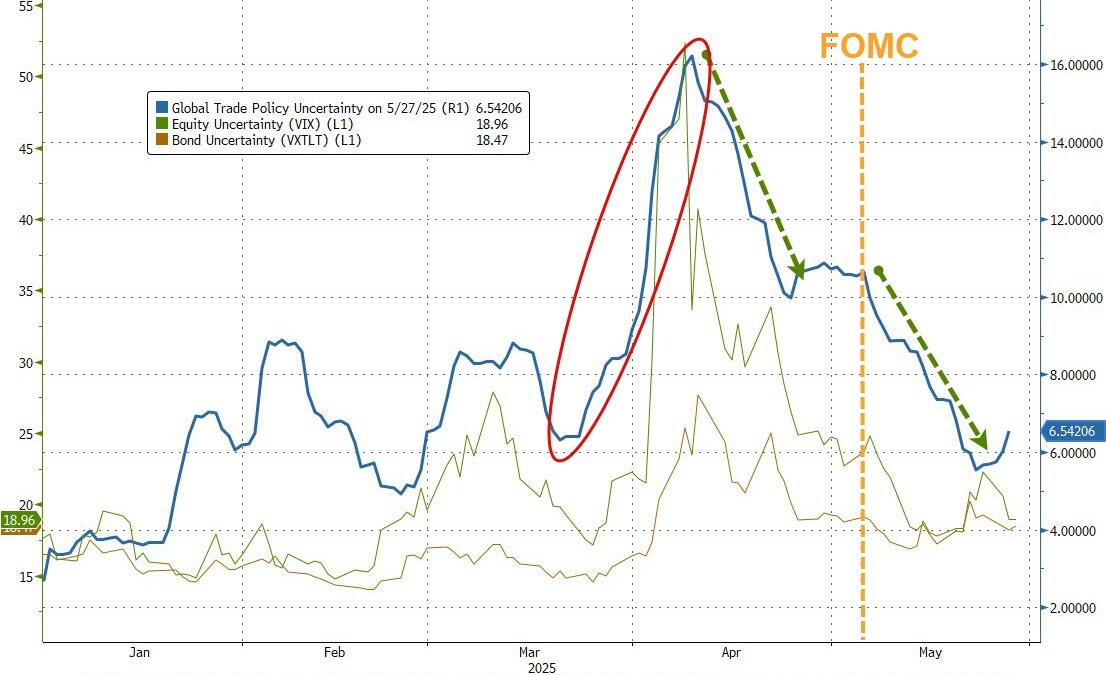

Finally, before we see what they said (or want us to know), we noted that "uncertainty" was a key word used by Powell (during the statement and the press conference). Overall 'Uncertainty' had fallen into the meeting and since then it has plunged to its lowest since February (before Liberation Day)...

Source: Bloomberg

Finally, before we see what they said (or want us to know), we noted that "uncertainty" was a key word used by Powell (during the statement and the press conference). Overall 'Uncertainty' had fallen into the meeting and since then it has plunged to its lowest since February (before Liberation Day)...

Source: Bloomberg

Source: Bloomberg

Francesca Gino, a star behavioral scientist at Harvard Business School whose work focused on why people cheat, was found to have manipulated observations in four studies so that their findings supported her hypotheses - according to a 1,300-page report detailing the university's months-long investigation.

Of note, Harvard hasn't revoked a professor's tenure since the 1940s - when the American Association of University Professors formalized termination rules, the

Francesca Gino, a star behavioral scientist at Harvard Business School whose work focused on why people cheat, was found to have manipulated observations in four studies so that their findings supported her hypotheses - according to a 1,300-page report detailing the university's months-long investigation.

Of note, Harvard hasn't revoked a professor's tenure since the 1940s - when the American Association of University Professors formalized termination rules, the

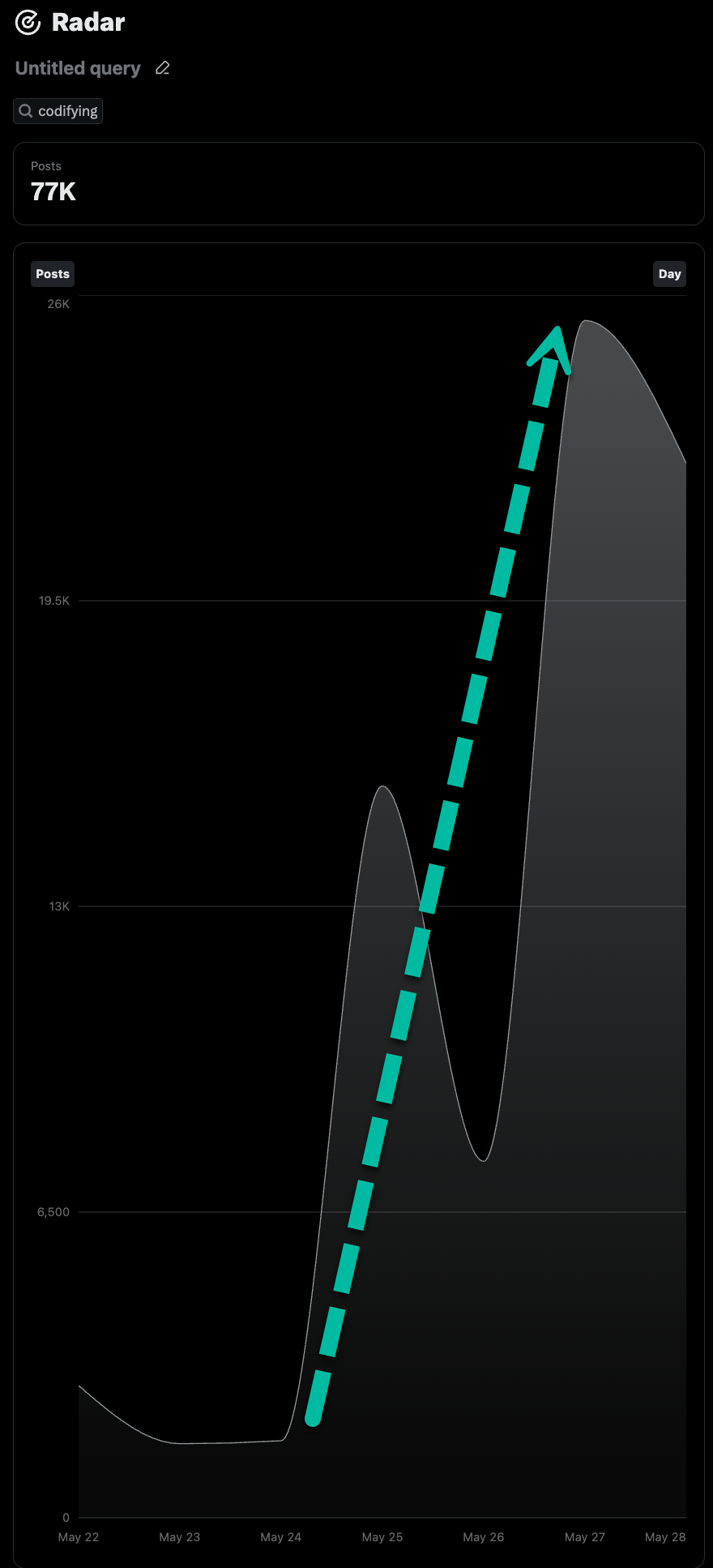

An online pressure campaign aimed at "codifying" the DOGE cuts is taking shape. The number of X posts mentioning "codifying" has jumped from around 1,000 five days ago to 25,000 on Tuesday.

An online pressure campaign aimed at "codifying" the DOGE cuts is taking shape. The number of X posts mentioning "codifying" has jumped from around 1,000 five days ago to 25,000 on Tuesday.

All DOGE cuts must be codified.

* * *

Elon Musk had ambitious plans when he took the helm of the Department of Government Efficiency (DOGE), famously pledging to slash at least $1 trillion in government waste. Back in February, we noted that while Musk's mission in Washington, DC, was admirable, the ultimate cost savings would be decided by Congress.

Fast forward to Tuesday, Musk appeared in a

All DOGE cuts must be codified.

* * *

Elon Musk had ambitious plans when he took the helm of the Department of Government Efficiency (DOGE), famously pledging to slash at least $1 trillion in government waste. Back in February, we noted that while Musk's mission in Washington, DC, was admirable, the ultimate cost savings would be decided by Congress.

Fast forward to Tuesday, Musk appeared in a