Kremlin Issues Outline Of Putin's Truce Demands, Warns "Peace Tomorrow Will Be Even More Painful"

Kremlin Issues Outline Of Putin's Truce Demands, Warns "Peace Tomorrow Will Be Even More Painful"

Russian Foreign Minister Sergey Lavrov started off the week by saying the Kremlin will announce the date of the next direct talks with Ukraine in the near future following the first 'direct' Istanbul meeting on May 16. Lavrov has in follow-up to his initial Monday remarks stated that work on a formal peace outline is at an "advanced stage." On Wednesday he has announced that the next talks are set for June 2 in Istanbul.

But in the meantime, Russia and Ukraine have stepped up drone and missile attacks on each other's territories in a massive way. This has led President Trump to warn of "very bad things" to come for Moscow, and he provocatively mused whether Putin has gone "crazy" in a Truth Social post.

Trump even said Putin is "playing with fire". Moscow has largely shrugged off the hardline rhetoric out of the White House, instead warning that emotionalism shouldn't thwart genuine efforts toward ending the conflict.

It's been obvious to all honest observers of the war that Russia has the clear battlefield momentum and manpower to keep that momentum, amid more reports of slow but steady gains in the Donbass. Given this, Russia's spy chief in fresh statements Wednesday has said that Moscow cannot afford to be 'weak' right now.

The country’s Foreign Intelligence Service (SVR), Sergey Naryshkin, said as

It's been obvious to all honest observers of the war that Russia has the clear battlefield momentum and manpower to keep that momentum, amid more reports of slow but steady gains in the Donbass. Given this, Russia's spy chief in fresh statements Wednesday has said that Moscow cannot afford to be 'weak' right now.

The country’s Foreign Intelligence Service (SVR), Sergey Naryshkin, said as  :

"Russia has no right to be weak… and to abandon its own values and pursue the chimera of totalitarian liberalism and globalism."

According to Naryshkin, "history teaches us that the security on the Eurasian continent and ultimately the whole world depends on Russia’s firm standing."

Amid this backdrop, one senior Russian source has

:

"Russia has no right to be weak… and to abandon its own values and pursue the chimera of totalitarian liberalism and globalism."

According to Naryshkin, "history teaches us that the security on the Eurasian continent and ultimately the whole world depends on Russia’s firm standing."

Amid this backdrop, one senior Russian source has  in a Wednesday report that "Putin is ready to make peace but not at any price."

Multiple Russian sources cited in the reaport said Putin wants a "written" pledge by major Western powers not to enlarge the NATO military alliance eastward. This is being taken to mean he's asking to West to formal ruling out ever extending membership to Ukraine, Georgia and Moldova.

These written guarantees and other conditions have been spelled out in English-language Russian state media as follows:

Ukraine’s permanent neutrality

Partial sanctions relief for Russia

Return of frozen Russian assets

Protections for Ukraine’s Russian-speaking people

And then an or else was offered as part of the ultimatum. While not officially issued by the Kremlin, this appears some very intentional signaling by Putin officials. It was conveyed via the

in a Wednesday report that "Putin is ready to make peace but not at any price."

Multiple Russian sources cited in the reaport said Putin wants a "written" pledge by major Western powers not to enlarge the NATO military alliance eastward. This is being taken to mean he's asking to West to formal ruling out ever extending membership to Ukraine, Georgia and Moldova.

These written guarantees and other conditions have been spelled out in English-language Russian state media as follows:

Ukraine’s permanent neutrality

Partial sanctions relief for Russia

Return of frozen Russian assets

Protections for Ukraine’s Russian-speaking people

And then an or else was offered as part of the ultimatum. While not officially issued by the Kremlin, this appears some very intentional signaling by Putin officials. It was conveyed via the  :

The first source said that, if Putin realizes he is unable to reach a peace deal on his own terms, he will seek to show the Ukrainians and the Europeans through military strength that "peace tomorrow will be even more painful."

Trump’s frustration with Putin boils over with no Ukraine peace deal in sighthttps://t.co/ZnuRCtRa23

— carin jodha fischer (@carin__fischer)

:

The first source said that, if Putin realizes he is unable to reach a peace deal on his own terms, he will seek to show the Ukrainians and the Europeans through military strength that "peace tomorrow will be even more painful."

Trump’s frustration with Putin boils over with no Ukraine peace deal in sighthttps://t.co/ZnuRCtRa23

— carin jodha fischer (@carin__fischer)  But Ukraine's President Zelensky has made clear of the Donbass and even Crimea, "this is our land" - and has repeatedly said he won't make territorial concessions. While hawks in Europe are supporting this unbending stance, it's as yet unclear whether Washington is brining the pressure on Kiev to at least offer Crimea.

Meanwhile, we highlighted earlier what one prominent conservative American commentator

: "Sorry, but if you want to destroy your base and watch your presidency go down in flames, start something with Russia. It's absolutely asinine."

This could all spiral into WW3 in the blink of an eye...

Word in Moscow is if Merz uses German weapons to strike Moscow - and we all know that Kiev has no independent capacity to operate Tauruses or other long-range missiles - then Russia will have no choice but to strike Berlin directly.

Simple enough.

But Ukraine's President Zelensky has made clear of the Donbass and even Crimea, "this is our land" - and has repeatedly said he won't make territorial concessions. While hawks in Europe are supporting this unbending stance, it's as yet unclear whether Washington is brining the pressure on Kiev to at least offer Crimea.

Meanwhile, we highlighted earlier what one prominent conservative American commentator

: "Sorry, but if you want to destroy your base and watch your presidency go down in flames, start something with Russia. It's absolutely asinine."

This could all spiral into WW3 in the blink of an eye...

Word in Moscow is if Merz uses German weapons to strike Moscow - and we all know that Kiev has no independent capacity to operate Tauruses or other long-range missiles - then Russia will have no choice but to strike Berlin directly.

Simple enough.  — Margarita Simonyan (@M_Simonyan)

— Margarita Simonyan (@M_Simonyan)  Wed, 05/28/2025 - 13:00

Wed, 05/28/2025 - 13:00

It's been obvious to all honest observers of the war that Russia has the clear battlefield momentum and manpower to keep that momentum, amid more reports of slow but steady gains in the Donbass. Given this, Russia's spy chief in fresh statements Wednesday has said that Moscow cannot afford to be 'weak' right now.

The country’s Foreign Intelligence Service (SVR), Sergey Naryshkin, said as

It's been obvious to all honest observers of the war that Russia has the clear battlefield momentum and manpower to keep that momentum, amid more reports of slow but steady gains in the Donbass. Given this, Russia's spy chief in fresh statements Wednesday has said that Moscow cannot afford to be 'weak' right now.

The country’s Foreign Intelligence Service (SVR), Sergey Naryshkin, said as

RT International

Russia can’t afford to be weak – spy chief

The country is the linchpin of security in Eurasia and the whole world, Sergey Naryshkin has said

The Moscow Times

Putin Wants End to NATO Expansion, Sanctions Relief for Peace in Ukraine – Reuters - The Moscow Times

President Vladimir Putin's conditions for ending the war in Ukraine include a demand that Western leaders pledge in writing to stop enlarging ...

The Moscow Times

Putin Wants End to NATO Expansion, Sanctions Relief for Peace in Ukraine – Reuters - The Moscow Times

President Vladimir Putin's conditions for ending the war in Ukraine include a demand that Western leaders pledge in writing to stop enlarging ...

X (formerly Twitter)

carin jodha fischer (@carin__fischer) on X

Trump’s frustration with Putin boils over with no Ukraine peace deal in sight

https://t.co/ZnuRCtRa23

Trump Admin Refuses To Confirm Whether It's Lifted Range Restrictions On Missiles To Ukraine | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

X (formerly Twitter)

Margarita Simonyan (@M_Simonyan) on X

Word in Moscow is if Merz uses German weapons to strike Moscow - and we all know that Kiev has no independent capacity to operate Tauruses or other...

X (formerly Twitter)

Margarita Simonyan (@M_Simonyan) on X

Word in Moscow is if Merz uses German weapons to strike Moscow - and we all know that Kiev has no independent capacity to operate Tauruses or other...

Tyler Durden | Zero Hedge

Zero Hedge

Kremlin Issues Outline Of Putin's Truce Demands, Warns "Peace Tomorrow Will Be Even More Painful" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Unveiled this week, alongside Defense Secretary Pete Hegseth, the Golden Dome is a $175 billion project aimed at doing something the Biden regime never prioritized: protecting the U.S. homeland from a foreign attack. And get this—it’s expected to be fully operational by the end of Trump’s term. That’s what real leadership looks like.

According to Trump, this dome will be able to intercept anything—hypersonic missiles, ballistic missiles, cruise missiles, even missiles launched from the other side of the world or from space. That’s not just national defense. That’s next-level deterrence.

If the idea sounds familiar, it’s because Ronald Reagan once dreamed of it. His Strategic Defense Initiative—mocked by the left as “Star Wars”—was a bold vision that never got the full support it deserved. Trump is finally making that dream a reality.

The name is a patriotic play on Israel’s Iron Dome, which has saved countless lives. Trump’s version? Bigger, better, and focused on our homeland. The first $25 billion to fund this project is tucked into Trump’s “One Big, Beautiful Bill” currently being debated in the House.

That’s a lot of money up front, but in the long run, it’s a great deal, because it will inevitably cut down on the need for foreign intervention. For decades, Washington has funneled trillions into foreign wars based on the idea that “we have to fight them over there, or we’ll fight them here.” That logic has cost us far too many American lives, plagued our economy, and demolished public trust in nearly every institution in Washington. But with Trump’s Golden Dome—and his rock-solid border policies—it’s hard to imagine a hypothetical war that could reach our soil from a foreign land. The DC sales pitch for endless war has been dismantled!

Predictably, the usual suspects are upset. China says they’re “seriously concerned” and warns that the Golden Dome could “undermine global strategic balance.”

Good! Maybe they should be more concerned about not launching missiles in the first place.

The Golden Dome is proof that America First isn’t just a slogan. It’s a strategy. It’s a shield. And it’s the very definition of peace through strength (and yes, I have that tattooed on my arm in Latin, because I’ve always loved that.)

Unveiled this week, alongside Defense Secretary Pete Hegseth, the Golden Dome is a $175 billion project aimed at doing something the Biden regime never prioritized: protecting the U.S. homeland from a foreign attack. And get this—it’s expected to be fully operational by the end of Trump’s term. That’s what real leadership looks like.

According to Trump, this dome will be able to intercept anything—hypersonic missiles, ballistic missiles, cruise missiles, even missiles launched from the other side of the world or from space. That’s not just national defense. That’s next-level deterrence.

If the idea sounds familiar, it’s because Ronald Reagan once dreamed of it. His Strategic Defense Initiative—mocked by the left as “Star Wars”—was a bold vision that never got the full support it deserved. Trump is finally making that dream a reality.

The name is a patriotic play on Israel’s Iron Dome, which has saved countless lives. Trump’s version? Bigger, better, and focused on our homeland. The first $25 billion to fund this project is tucked into Trump’s “One Big, Beautiful Bill” currently being debated in the House.

That’s a lot of money up front, but in the long run, it’s a great deal, because it will inevitably cut down on the need for foreign intervention. For decades, Washington has funneled trillions into foreign wars based on the idea that “we have to fight them over there, or we’ll fight them here.” That logic has cost us far too many American lives, plagued our economy, and demolished public trust in nearly every institution in Washington. But with Trump’s Golden Dome—and his rock-solid border policies—it’s hard to imagine a hypothetical war that could reach our soil from a foreign land. The DC sales pitch for endless war has been dismantled!

Predictably, the usual suspects are upset. China says they’re “seriously concerned” and warns that the Golden Dome could “undermine global strategic balance.”

Good! Maybe they should be more concerned about not launching missiles in the first place.

The Golden Dome is proof that America First isn’t just a slogan. It’s a strategy. It’s a shield. And it’s the very definition of peace through strength (and yes, I have that tattooed on my arm in Latin, because I’ve always loved that.)

Now we have craziness at the international trade level. At its core, it’s all politics.

The now dead George Carlin had a skit where he told us why he doesn’t vote. To quote:

“I don’t vote. Two reasons I don’t vote. First of all, it’s meaningless. This country was bought and sold and paid for a long time ago. The isht they shuffle around every four years… doesn’t mean a f* thing.

And secondly, I don’t vote because I believe if you vote, you have no right to complain. If you vote, and you elect dishonest incompetent people and they get into office and screw everything up, well… you are responsible for what they have done.”

We’ve had some conversations with clients who are questioning their own voting after the trade war kicked off. The problem with taking a position for or against any politician is that probability is not in our favour. We’re bound to be disappointed because the vast majority of these podium donuts aren’t there for our benefit. Sure, some of the things they may espouse are to our benefit, but then others aren’t. What to do?

Well, I think it’s best not to get caught up in the mental gymnastics of it all and simply keep reviewing the actions and data and then making decisions for ourselves accordingly.

As far as the tariffs go, at first glance they make no sense. The orange man said they are “reciprocal,” but any idiot with two thumbs and an interwebs connection can quickly do the math and determine this is hogwash. What they are is quite simple — they are based on other countries’ trade surplus with the US.

The supposition around “reciprocal” came unglued as soon as they tried to figure out why on God’s green earth there were tariffs on an uninhabited island that has only penguins. Wait… what!? Anyone then following their nose saw that the narrative fell apart faster than logic at a climate change gathering.

What this amounts to is an attempt to restructure creditors. It’s what you do in bankruptcy. Trump appears now to be bringing his experience in chapter 11 proceedings onto the global stage.

This is a big deal! From where we sit, there are four big forces through history that drive everything, all of these are interconnected and in many instances causal to each other:

The monetary and credit cycle where nations get into a sovereign debt problem, which needs to be dealt with.

Domestic conflict, typically beginning as political disagreement, but where disagreement isn’t resolved by discourse.

A rising power challenging the existing power and causing international conflict.

Technological changes that assist in disrupting the status quo.

So the first changes the monetary order. The second changes the political order. And the third changes the international order, while the fourth assists in ushering it in.

How does this all play out?

Well, let’s start with what we’ve been watching recently. No, not the Chinese laughing at bringing manufacturing back to the US…

Now we have craziness at the international trade level. At its core, it’s all politics.

The now dead George Carlin had a skit where he told us why he doesn’t vote. To quote:

“I don’t vote. Two reasons I don’t vote. First of all, it’s meaningless. This country was bought and sold and paid for a long time ago. The isht they shuffle around every four years… doesn’t mean a f* thing.

And secondly, I don’t vote because I believe if you vote, you have no right to complain. If you vote, and you elect dishonest incompetent people and they get into office and screw everything up, well… you are responsible for what they have done.”

We’ve had some conversations with clients who are questioning their own voting after the trade war kicked off. The problem with taking a position for or against any politician is that probability is not in our favour. We’re bound to be disappointed because the vast majority of these podium donuts aren’t there for our benefit. Sure, some of the things they may espouse are to our benefit, but then others aren’t. What to do?

Well, I think it’s best not to get caught up in the mental gymnastics of it all and simply keep reviewing the actions and data and then making decisions for ourselves accordingly.

As far as the tariffs go, at first glance they make no sense. The orange man said they are “reciprocal,” but any idiot with two thumbs and an interwebs connection can quickly do the math and determine this is hogwash. What they are is quite simple — they are based on other countries’ trade surplus with the US.

The supposition around “reciprocal” came unglued as soon as they tried to figure out why on God’s green earth there were tariffs on an uninhabited island that has only penguins. Wait… what!? Anyone then following their nose saw that the narrative fell apart faster than logic at a climate change gathering.

What this amounts to is an attempt to restructure creditors. It’s what you do in bankruptcy. Trump appears now to be bringing his experience in chapter 11 proceedings onto the global stage.

This is a big deal! From where we sit, there are four big forces through history that drive everything, all of these are interconnected and in many instances causal to each other:

The monetary and credit cycle where nations get into a sovereign debt problem, which needs to be dealt with.

Domestic conflict, typically beginning as political disagreement, but where disagreement isn’t resolved by discourse.

A rising power challenging the existing power and causing international conflict.

Technological changes that assist in disrupting the status quo.

So the first changes the monetary order. The second changes the political order. And the third changes the international order, while the fourth assists in ushering it in.

How does this all play out?

Well, let’s start with what we’ve been watching recently. No, not the Chinese laughing at bringing manufacturing back to the US…

Confucius philosophy says:

“If you want to govern a country, you must first govern your family. If you want to govern your family, you must first govern yourself.”

The issue here isn’t about “fair trade.” It is about survival, though.

Former Greek finance minister Yanis Varoufakis dropped some hard truths about the real reason behind the US- China trade war.

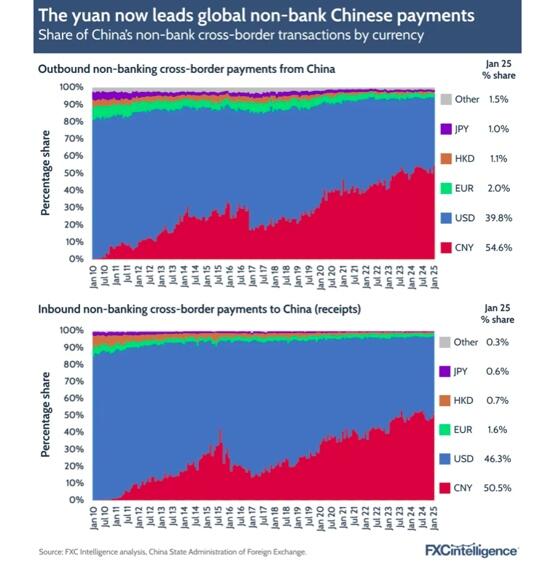

The US doesn’t fear China because of “cheap labor” or “IP theft.” What it truly fears is China’s capacity to undermine the US-led global financial order — the very system that allows America to print dollars and buy the world.

Wall Street’s aging financial architecture is losing its grip. It can’t control crypto flows. It can’t keep up with new financial ecosystems. China — with its digital yuan, vast industrial base, and rising global influence — is the first real threat to this system.

Trump’s “reciprocal tariffs” were never about balancing trade. They were a desperate attempt to slow down China’s rise and protect the dollar system from collapse. Because if China succeeds, the US loses its magic weapon: monetary dominance. See point 2 above.

Today, Trump is laser-focused on America’s financial core with the Treasury bond market (America’s lifeline) and the stock market (America’s wallet). Both are fragile. And any external pressure could trigger a chain reaction.

The US is now panicking over who’s selling off US Treasuries. China? Japan? Others? Trump reportedly wants to punish any surplus country that dumps Treasuries — with tariffs, of course. This is not about trade. It’s about a dying empire trying to stop the bleeding.

In short, America is no longer confident in its own financial fortress. And China is no longer playing by the old rules. This isn’t just a trade war — it’s a war for the future of global finance.

Further to this point, the famous Ben Rickert (for those who’ve watched The Big Short) highlighted this issue:

“For the first time ever, China’s CIPS (Cross-Border Interbank Payment System) surpassed SWIFT in single-day transaction volume. A red banner flashed across Bank of China’s HQ at 1:30AM on April 16, 2025.

CIPS processed a jaw-dropping ¥12.8 trillion RMB in just one day—roughly $1.76 trillion USD. That volume, if verified, overtakes the greenback-dominated SWIFT system in sheer daily cross-border throughput.

No fireworks, no Western headlines. Just one quiet early morning in Beijing where the dollar’s crown slipped. The world’s financial plumbing just got a reroute—through China.”

This of course is known to those who DON’T rely solely on Western propaganda media.

Confucius philosophy says:

“If you want to govern a country, you must first govern your family. If you want to govern your family, you must first govern yourself.”

The issue here isn’t about “fair trade.” It is about survival, though.

Former Greek finance minister Yanis Varoufakis dropped some hard truths about the real reason behind the US- China trade war.

The US doesn’t fear China because of “cheap labor” or “IP theft.” What it truly fears is China’s capacity to undermine the US-led global financial order — the very system that allows America to print dollars and buy the world.

Wall Street’s aging financial architecture is losing its grip. It can’t control crypto flows. It can’t keep up with new financial ecosystems. China — with its digital yuan, vast industrial base, and rising global influence — is the first real threat to this system.

Trump’s “reciprocal tariffs” were never about balancing trade. They were a desperate attempt to slow down China’s rise and protect the dollar system from collapse. Because if China succeeds, the US loses its magic weapon: monetary dominance. See point 2 above.

Today, Trump is laser-focused on America’s financial core with the Treasury bond market (America’s lifeline) and the stock market (America’s wallet). Both are fragile. And any external pressure could trigger a chain reaction.

The US is now panicking over who’s selling off US Treasuries. China? Japan? Others? Trump reportedly wants to punish any surplus country that dumps Treasuries — with tariffs, of course. This is not about trade. It’s about a dying empire trying to stop the bleeding.

In short, America is no longer confident in its own financial fortress. And China is no longer playing by the old rules. This isn’t just a trade war — it’s a war for the future of global finance.

Further to this point, the famous Ben Rickert (for those who’ve watched The Big Short) highlighted this issue:

“For the first time ever, China’s CIPS (Cross-Border Interbank Payment System) surpassed SWIFT in single-day transaction volume. A red banner flashed across Bank of China’s HQ at 1:30AM on April 16, 2025.

CIPS processed a jaw-dropping ¥12.8 trillion RMB in just one day—roughly $1.76 trillion USD. That volume, if verified, overtakes the greenback-dominated SWIFT system in sheer daily cross-border throughput.

No fireworks, no Western headlines. Just one quiet early morning in Beijing where the dollar’s crown slipped. The world’s financial plumbing just got a reroute—through China.”

This of course is known to those who DON’T rely solely on Western propaganda media.

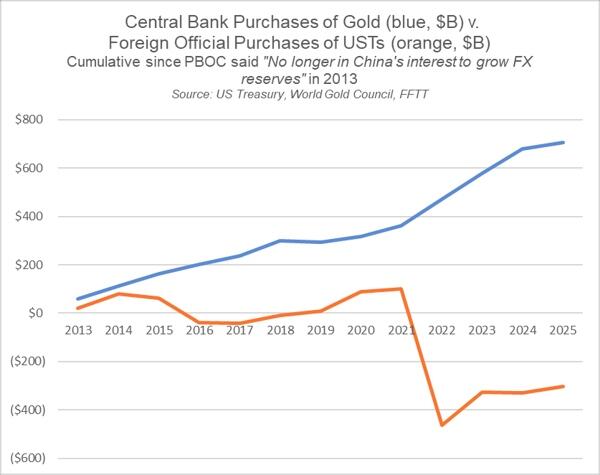

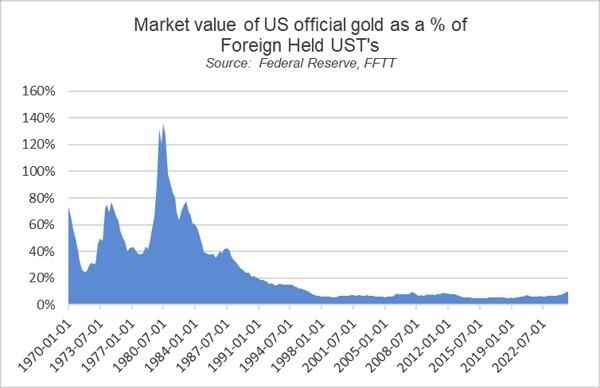

Now, consider the US bond market.

The problem is that the US can’t just do what Milei is doing. The debt is too large, and because US treasuries are embedded in the very fabric of global financial markets, paying down that debt has ramifications that Milei simply doesn’t have to contend with.

To highlight the issue: consider that the most significant effort to cut government spending (DOGE) is set to yield $50 billion in annual savings. Awesome… until you realise that this is on the back of a $7.5 trillion budget. They haven’t even managed to cut 0.75% of spending. Furthermore, the US has to borrow over 10% of GDP annually to keep the lights on.

Now they’re weaponizing the dollar and trade in a desperate attempt to “Make America Great Again.” The rest of the world is preparing.

Now, consider the US bond market.

The problem is that the US can’t just do what Milei is doing. The debt is too large, and because US treasuries are embedded in the very fabric of global financial markets, paying down that debt has ramifications that Milei simply doesn’t have to contend with.

To highlight the issue: consider that the most significant effort to cut government spending (DOGE) is set to yield $50 billion in annual savings. Awesome… until you realise that this is on the back of a $7.5 trillion budget. They haven’t even managed to cut 0.75% of spending. Furthermore, the US has to borrow over 10% of GDP annually to keep the lights on.

Now they’re weaponizing the dollar and trade in a desperate attempt to “Make America Great Again.” The rest of the world is preparing.

Something else…

Something else…

Gold has a long way to go. That being said, it is looking a bit frothy right now, so if you’re the sort that will freak out if you see a decent pullback in a bull market (20-30%), you may want to check yourself on going “all in” here. On the other hand, it’s a bull market, and if — like us — your timeframe runs into the years, then you’re simply ensuring your allocation is adequate and leaving the rest to the market gods.

The old adage is worth considering — never sell a bull market and never buy a bear market. Bonds are in a bear market… and gold is in a bull market.

* * *

We are living through a rare and pivotal moment in financial history — a time when the old order is unraveling, and a new one is being born. The geopolitical chessboard is shifting, trade is being weaponized, and the dollar’s dominance is quietly being challenged in real time. This isn’t business as usual. It’s a systemic clash. If you’re trying to make sense of how to invest amid collapsing narratives, geopolitical chaos, and the breakdown of the global financial order, this is the moment to dig deeper. Download our exclusive special report:

Gold has a long way to go. That being said, it is looking a bit frothy right now, so if you’re the sort that will freak out if you see a decent pullback in a bull market (20-30%), you may want to check yourself on going “all in” here. On the other hand, it’s a bull market, and if — like us — your timeframe runs into the years, then you’re simply ensuring your allocation is adequate and leaving the rest to the market gods.

The old adage is worth considering — never sell a bull market and never buy a bear market. Bonds are in a bear market… and gold is in a bull market.

* * *

We are living through a rare and pivotal moment in financial history — a time when the old order is unraveling, and a new one is being born. The geopolitical chessboard is shifting, trade is being weaponized, and the dollar’s dominance is quietly being challenged in real time. This isn’t business as usual. It’s a systemic clash. If you’re trying to make sense of how to invest amid collapsing narratives, geopolitical chaos, and the breakdown of the global financial order, this is the moment to dig deeper. Download our exclusive special report:

The entire world got a glimpse into the relationship between the French premier and his wife, who literally used to be his teacher when he was a little boy. As the door of the airplane opened, Brigitte Macron palmed him full in the face.

Macron immediately saw the cameras and acted like nothing had happened, before going back behind the door of the plane and presumably begging his wife to stop physically attacking him.

Bizarre moment Emmanuel Macron is slapped by his wife Brigitte

The entire world got a glimpse into the relationship between the French premier and his wife, who literally used to be his teacher when he was a little boy. As the door of the airplane opened, Brigitte Macron palmed him full in the face.

Macron immediately saw the cameras and acted like nothing had happened, before going back behind the door of the plane and presumably begging his wife to stop physically attacking him.

Bizarre moment Emmanuel Macron is slapped by his wife Brigitte

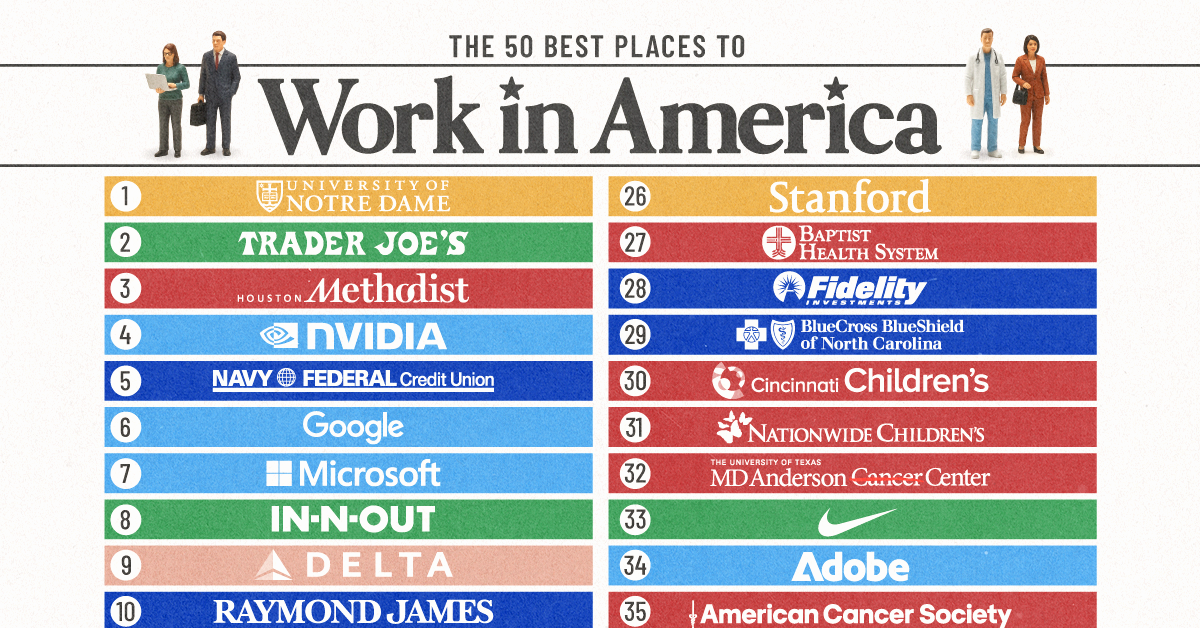

Data & Discussion

The data we used to create this graphic is listed in the table below.

Rank

Name

Industry

1

University of Notre Dame

🎓 Education

2

Trader Joe's

🛒 Consumer

3

Houston Methodist

🏥 Healthcare

4

NVIDIA

💻 Tech

5

Navy Federal Credit Union

💰 Finance & Insurance

6

Google

💻 Tech

7

Microsoft

💻 Tech

8

In-N-Out Burger

🛒 Consumer

9

Delta Air Lines

✈️ Transportation & Industrial

10

Raymond James Financial

💰 Finance & Insurance

11

Memorial Sloan Kettering Cancer Center

🏥 Healthcare

12

Apple

💻 Tech

13

Washington University in Saint Louis

🎓 Education

14

University of Tennessee Medical Center

🏥 Healthcare

15

Salesforce

💻 Tech

16

Garmin

💻 Tech

17

St. Jude Children's Research Hospital

🏥 Healthcare

18

St. Luke's University Health Network

🏥 Healthcare

19

UC Davis Health

🏥 Healthcare

20

NASA

🚀 Government

21

Massachusetts Institute of Technology

🎓 Education

22

Cook Children's Health Care System

🏥 Healthcare

23

Mayo Clinic

🏥 Healthcare

24

Community Health Network

🏥 Healthcare

25

American Express

💰 Finance & Insurance

26

Stanford University

🎓 Education

27

Baptist Health System (TX)

🏥 Healthcare

28

Fidelity Investments

💰 Finance & Insurance

29

Blue Cross Blue Shield of North Carolina

💰 Finance & Insurance

30

Cincinnati Children's

🏥 Healthcare

31

Nationwide Children's Hospital

🏥 Healthcare

32

MD Anderson Cancer Center

🏥 Healthcare

33

Nike

🛒 Consumer

34

Adobe

💻 Tech

35

American Cancer Society

🏥 Healthcare

36

Commercial Metals Company (CMC)

✈️ Transportation & Industrial

37

Cambia Health Solutions

💰 Finance & Insurance

38

Mutual of Omaha

💰 Finance & Insurance

39

University of Virginia

🎓 Education

40

Zillow

💻 Tech

41

Dana-Farber Cancer Institute

🏥 Healthcare

42

Costco Wholesale

🛒 Consumer

43

FirstHealth of the Carolinas

🏥 Healthcare

44

Procter & Gamble

🛒 Consumer

45

U.S. Federal Reserve System

🏛️ Government

46

Children's Hospital Los Angeles

🏥 Healthcare

47

New York-Presbyterian Hospital

🏥 Healthcare

48

Children's Healthcare of Atlanta

🏥 Healthcare

49

Progressive

💰 Finance & Insurance

50

IBM

💻 Tech

At an industry level, the most common was Healthcare, which represented 19 of the 50 best places to work in America for 2025.

Healthcare: 19 employers

Tech: 9 employers

Finance & Insurance: 8 employers

Consumer: 5 employers

Education: 5 employers

Government: 2 employers

Transportation & Industrial: 2 employers

Let’s take a closer look at some of these industries.

🏥 Healthcare

Houston Methodist is the flagship quaternary care hospital of Houston Methodist academic medical center and the highest ranked Healthcare employer for 2025. It recently received a Glassdoor Employees’ Choice Award,

Data & Discussion

The data we used to create this graphic is listed in the table below.

Rank

Name

Industry

1

University of Notre Dame

🎓 Education

2

Trader Joe's

🛒 Consumer

3

Houston Methodist

🏥 Healthcare

4

NVIDIA

💻 Tech

5

Navy Federal Credit Union

💰 Finance & Insurance

6

Google

💻 Tech

7

Microsoft

💻 Tech

8

In-N-Out Burger

🛒 Consumer

9

Delta Air Lines

✈️ Transportation & Industrial

10

Raymond James Financial

💰 Finance & Insurance

11

Memorial Sloan Kettering Cancer Center

🏥 Healthcare

12

Apple

💻 Tech

13

Washington University in Saint Louis

🎓 Education

14

University of Tennessee Medical Center

🏥 Healthcare

15

Salesforce

💻 Tech

16

Garmin

💻 Tech

17

St. Jude Children's Research Hospital

🏥 Healthcare

18

St. Luke's University Health Network

🏥 Healthcare

19

UC Davis Health

🏥 Healthcare

20

NASA

🚀 Government

21

Massachusetts Institute of Technology

🎓 Education

22

Cook Children's Health Care System

🏥 Healthcare

23

Mayo Clinic

🏥 Healthcare

24

Community Health Network

🏥 Healthcare

25

American Express

💰 Finance & Insurance

26

Stanford University

🎓 Education

27

Baptist Health System (TX)

🏥 Healthcare

28

Fidelity Investments

💰 Finance & Insurance

29

Blue Cross Blue Shield of North Carolina

💰 Finance & Insurance

30

Cincinnati Children's

🏥 Healthcare

31

Nationwide Children's Hospital

🏥 Healthcare

32

MD Anderson Cancer Center

🏥 Healthcare

33

Nike

🛒 Consumer

34

Adobe

💻 Tech

35

American Cancer Society

🏥 Healthcare

36

Commercial Metals Company (CMC)

✈️ Transportation & Industrial

37

Cambia Health Solutions

💰 Finance & Insurance

38

Mutual of Omaha

💰 Finance & Insurance

39

University of Virginia

🎓 Education

40

Zillow

💻 Tech

41

Dana-Farber Cancer Institute

🏥 Healthcare

42

Costco Wholesale

🛒 Consumer

43

FirstHealth of the Carolinas

🏥 Healthcare

44

Procter & Gamble

🛒 Consumer

45

U.S. Federal Reserve System

🏛️ Government

46

Children's Hospital Los Angeles

🏥 Healthcare

47

New York-Presbyterian Hospital

🏥 Healthcare

48

Children's Healthcare of Atlanta

🏥 Healthcare

49

Progressive

💰 Finance & Insurance

50

IBM

💻 Tech

At an industry level, the most common was Healthcare, which represented 19 of the 50 best places to work in America for 2025.

Healthcare: 19 employers

Tech: 9 employers

Finance & Insurance: 8 employers

Consumer: 5 employers

Education: 5 employers

Government: 2 employers

Transportation & Industrial: 2 employers

Let’s take a closer look at some of these industries.

🏥 Healthcare

Houston Methodist is the flagship quaternary care hospital of Houston Methodist academic medical center and the highest ranked Healthcare employer for 2025. It recently received a Glassdoor Employees’ Choice Award,

The project, codenamed SAM — short for “Speaking with American Men: A Strategic Plan” - is described in a prospectus obtained by the

The project, codenamed SAM — short for “Speaking with American Men: A Strategic Plan” - is described in a prospectus obtained by the

It raises serious concerns that policymakers—in wealthy countries only—are setting “green” policies that continue to support human-rights atrocities and environmental degradation in poorer, developing countries where the exotic minerals and metals needed for EVs are mined.

Some challenges remain with wind and solar power, which can only generate occasional electricity and are unreliable. This issue has drawn federal legislative attention, with the U.S. Senate voting to discuss a resolution to roll back

It raises serious concerns that policymakers—in wealthy countries only—are setting “green” policies that continue to support human-rights atrocities and environmental degradation in poorer, developing countries where the exotic minerals and metals needed for EVs are mined.

Some challenges remain with wind and solar power, which can only generate occasional electricity and are unreliable. This issue has drawn federal legislative attention, with the U.S. Senate voting to discuss a resolution to roll back

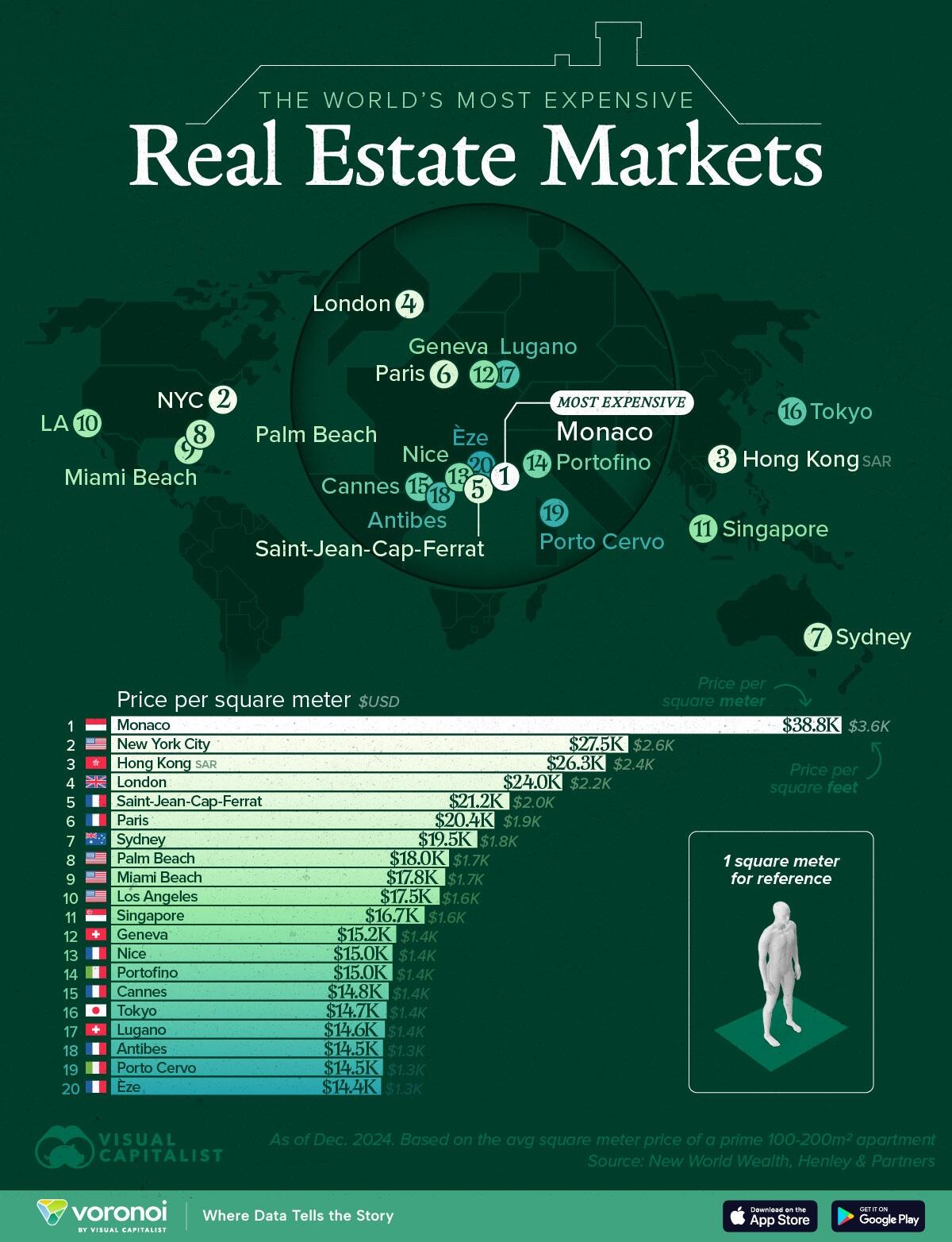

What Is “Prime” Real Estate?

“Prime” real estate refers to properties in the most desirable global locations—whether for lifestyle, investment, or prestige. These homes typically share four key characteristics:

High-Value: Located in top-tier global cities or exclusive resort areas, with premium price tags per square meter.

Luxury-Oriented: High-end properties boasting top-tier amenities, design, and finishes.

Strategically Located: Found in stable, globally connected markets with strong lifestyle appeal.

Investment-Linked: Often eligible for residence or citizenship-by-investment programs, offering benefits beyond ownership.

The Global Leaders in Price per Square Meter

At the top of the list is Monaco, where prime real estate prices dwarf those of other markets.

The small principality on the French Riviera is a haven for the ultra-wealthy, driven by its low taxes, exclusive lifestyle, and financial services sector. With limited land and soaring demand, Monaco continues to command the highest prices globally.

City/RegionCountryUSD/m²USD/sq ft

Monaco🇲🇨 Monaco38,8003,603

New York City🇺🇸 USA27,5002,554

Hong Kong🇭🇰 Hong Kong SAR26,3002,444

London🇬🇧 UK24,0002,230

Saint-Jean-Cap-Ferrat🇫🇷 France21,2001,971

Paris🇫🇷 France20,4001,895

Sydney🇦🇺 Australia19,5001,812

Palm Beach🇺🇸 USA18,0001,672

Miami Beach🇺🇸 USA17,8001,653

Los Angeles🇺🇸 USA17,5001,627

Singapore🇸🇬 Singapore16,7001,551

Geneva🇨🇭 Switzerland15,2001,412

Nice🇫🇷 France15,0001,395

Portofino🇮🇹 Italy15,0001,395

Cannes🇫🇷 France14,8001,376

Tokyo🇯🇵 Japan14,7001,367

Lugano🇨🇭 Switzerland14,6001,358

Antibes🇫🇷 France14,5001,349

Porto Cervo🇮🇹 Italy14,5001,349

Èze🇫🇷 France14,4001,340

In second place is New York City, consistently ranked the world’s leading financial center. Home to billionaires, major investment firms, and iconic luxury developments, NYC remains a global magnet for capital and prestige real estate.

Hong Kong ranks third, reflecting its ongoing role as a global finance hub. With limited land supply, strong investor demand, and its strategic location in Asia, Hong Kong’s prime real estate market remains one of the most expensive on Earth.

If you enjoyed this map, be sure to check out

What Is “Prime” Real Estate?

“Prime” real estate refers to properties in the most desirable global locations—whether for lifestyle, investment, or prestige. These homes typically share four key characteristics:

High-Value: Located in top-tier global cities or exclusive resort areas, with premium price tags per square meter.

Luxury-Oriented: High-end properties boasting top-tier amenities, design, and finishes.

Strategically Located: Found in stable, globally connected markets with strong lifestyle appeal.

Investment-Linked: Often eligible for residence or citizenship-by-investment programs, offering benefits beyond ownership.

The Global Leaders in Price per Square Meter

At the top of the list is Monaco, where prime real estate prices dwarf those of other markets.

The small principality on the French Riviera is a haven for the ultra-wealthy, driven by its low taxes, exclusive lifestyle, and financial services sector. With limited land and soaring demand, Monaco continues to command the highest prices globally.

City/RegionCountryUSD/m²USD/sq ft

Monaco🇲🇨 Monaco38,8003,603

New York City🇺🇸 USA27,5002,554

Hong Kong🇭🇰 Hong Kong SAR26,3002,444

London🇬🇧 UK24,0002,230

Saint-Jean-Cap-Ferrat🇫🇷 France21,2001,971

Paris🇫🇷 France20,4001,895

Sydney🇦🇺 Australia19,5001,812

Palm Beach🇺🇸 USA18,0001,672

Miami Beach🇺🇸 USA17,8001,653

Los Angeles🇺🇸 USA17,5001,627

Singapore🇸🇬 Singapore16,7001,551

Geneva🇨🇭 Switzerland15,2001,412

Nice🇫🇷 France15,0001,395

Portofino🇮🇹 Italy15,0001,395

Cannes🇫🇷 France14,8001,376

Tokyo🇯🇵 Japan14,7001,367

Lugano🇨🇭 Switzerland14,6001,358

Antibes🇫🇷 France14,5001,349

Porto Cervo🇮🇹 Italy14,5001,349

Èze🇫🇷 France14,4001,340

In second place is New York City, consistently ranked the world’s leading financial center. Home to billionaires, major investment firms, and iconic luxury developments, NYC remains a global magnet for capital and prestige real estate.

Hong Kong ranks third, reflecting its ongoing role as a global finance hub. With limited land supply, strong investor demand, and its strategic location in Asia, Hong Kong’s prime real estate market remains one of the most expensive on Earth.

If you enjoyed this map, be sure to check out