Fake News Narrative Of "Empty Ports, Empty Shelves" Suffers Spectacular Implosion

Fake News Narrative Of "Empty Ports, Empty Shelves" Suffers Spectacular Implosion

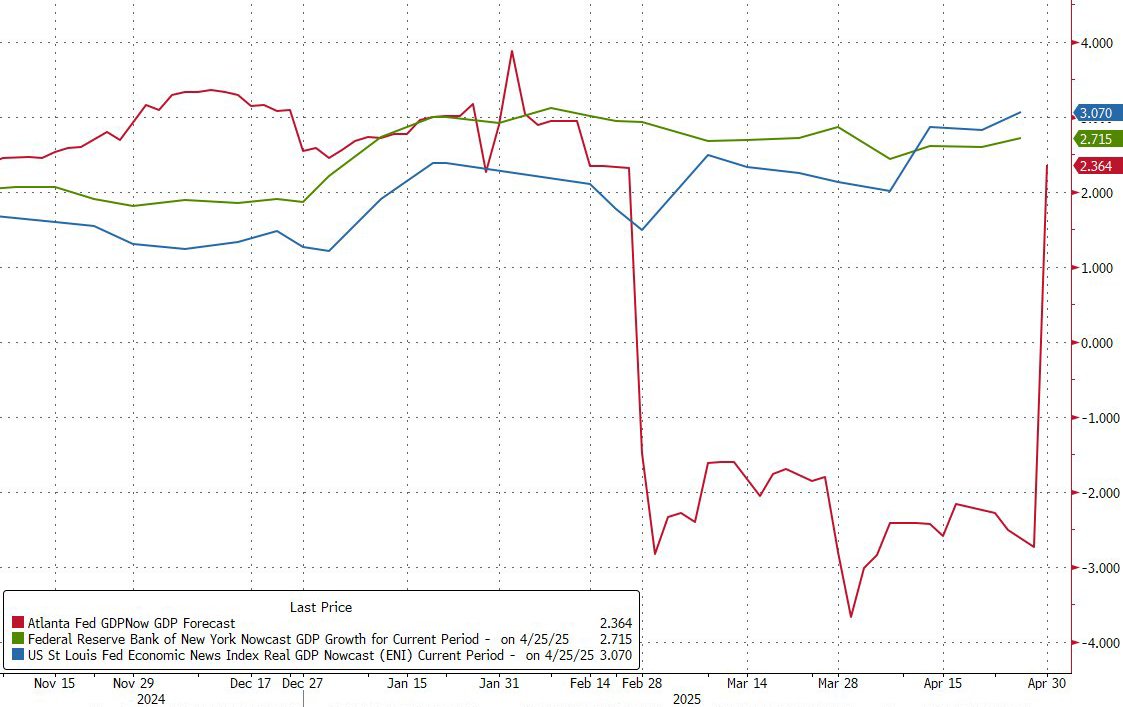

It was about one month ago, when as stocks tumbled, economists rushed to catch down to the sliding market by doing what they do best: chasing prices (in this case lower) by slashing their economic forecasts (most notably Goldman Sachs) a move which we mocked at the time, and correctly predicted it would be about a month before these same economists made an "unrecession" their base case once stocks rebounded.

Will be so slightly awkward when all the banks who made a recession their base case this week, make an unrecession their base case in 1 month.

— zerohedge (@zerohedge)

X (formerly Twitter)

zerohedge (@zerohedge) on X

Will be so slightly awkward when all the banks who made a recession their base case this week, make an unrecession their base case in 1 month.

It took less than a month for this forecast to come true, and now that stocks have erased all of their post Liberation Day losses, one of the most closely followed people on Wall Street, Goldman's chief economist Jan Hatzius, said on CNBC on May 2 - just weeks after declaring that a recession was his base case for 90 minutes - that "The most recent information is certainly consistent with the economy not going through a recession right now".

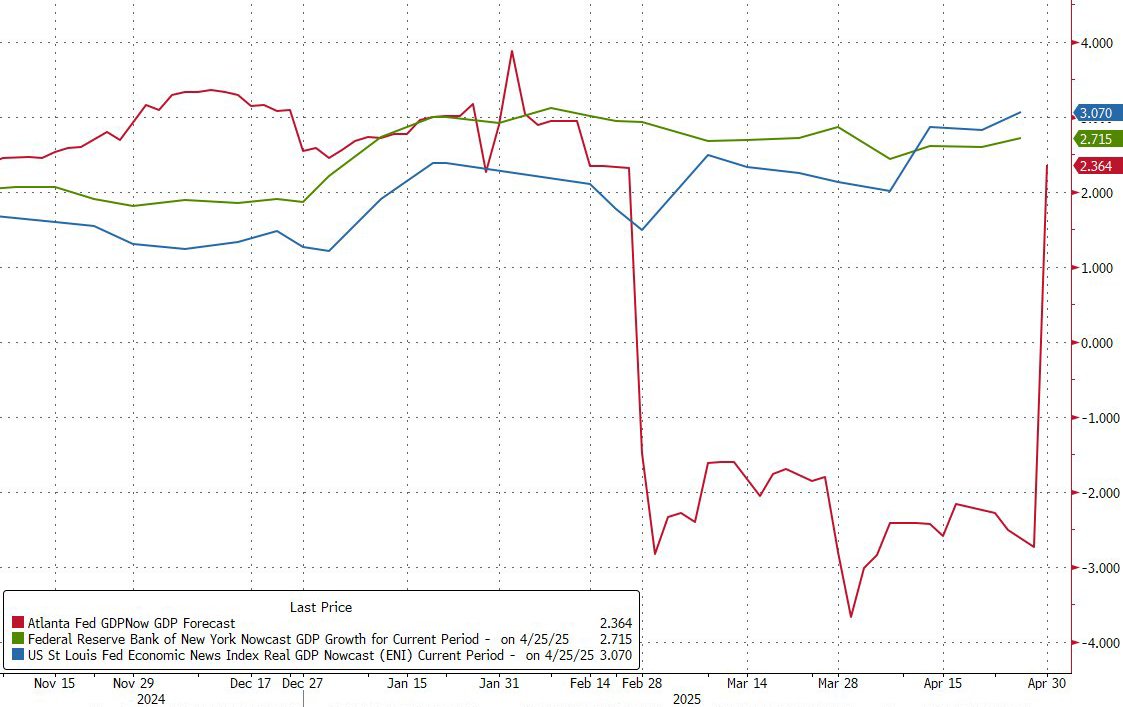

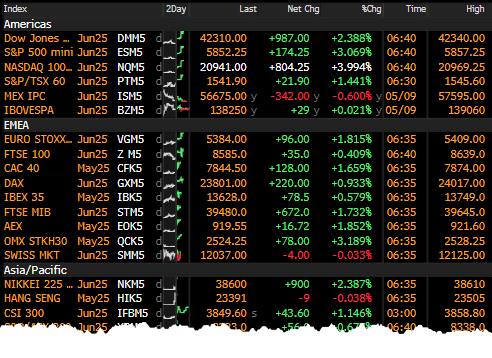

Of course, the concurrent surge in the Atlanta Fed real-time GDP tracker from -3% (which was dead wrong to where Q1 GDP actually printed) to +2.4% in Q2, only cemented a non-recession base case...

Regional Fed GDP tracking update

X (formerly Twitter)

zerohedge (@zerohedge) on X

Regional Fed GDP tracking update

— zerohedge (@zerohedge)

X (formerly Twitter)

zerohedge (@zerohedge) on X

Regional Fed GDP tracking update

... because the technical definition of a recession - two consecutive negative quarters - meant that with Q2 GDP set to print well in the green, the earliest the US could be declared to be in an official recession was some time in early 2026 when the Q4 2025 GDP number would come out.

This was devastating to the liberal wing of the economic profession, not to mention the mainstream media, all of whom had decided that a Trump recession was imminent, and so they had to pivot to something else that would trigger a daily doom and gloom narrative.

That something was the hypothesis that with trade war between the US and China raging, it was only a matter of time before west coast ports were empty, as no Chinese containerships would come to the US, and the result would be a covid-like panic scramble for products (remember the legendary toilet paper runs) amid a historic inventory destocking.

It was as if the media turned on a dime, and with the "looming recession" narrative suddenly left in the dust, it was instead replaced with story after story about the looming port crisis that would, gasp, result in covid-like empty shelves everywhere across America!

"

Sky News

Trump

A lorry driver in California tells Sky News: "We're already seeing work slowing down. How are we going to survive?"

."

You get the picture.

But that was just the beginning, because the liberal media was only just starting its fearmongering campaign to get Americans to panic and to rush out and start stockpiling toilet paper once again. In other words, the "independent press" was hoping to cause the very catastrophic outcome it was "warning" about.

Nowhere was this more evident than on MSNBC where anchor and former Deutsche Bank bond salesman, Stephanie Ruhle, no longer an expert intimately familiar with Under Armor (

https://www.wsj.com/business/media/under-armour-kevin-plank-stephanie-ruhle-66cb65b5

), but now a full-blown trade guru, declared that "Donald Trump has been told look at the cargo ships coming in to Seattle, the port of Los Angeles, pick the port. Those ports are getting fewer and fewer ships with less and less cargo. And unless he turns this around, three weeks from now, you walk into a store and we're going to have a covid-like supply chain crisis, and Trump is looking for an exit."

"Unless he turns this around, three weeks from now, you walk into a store and we're going to have a covid-like supply chain crisis, and Trump is looking for an exit" -- here's the

X (formerly Twitter)

Stephanie Ruhle (@SRuhle) on X

Host of @11thhour on @MSNOWNews M-F 11PM EST, MS NOW Snr Business Analyst, former: @Bloombergtv, Deutsche Bank, CSFB. L❤️ver of odd #s & even p...

— Aaron Rupar (@atrupar)

X (formerly Twitter)

Aaron Rupar (@atrupar) on X

"Unless he turns this around, three weeks from now, you walk into a store and we're going to have a covid-like supply chain crisis, and Trump is lo...

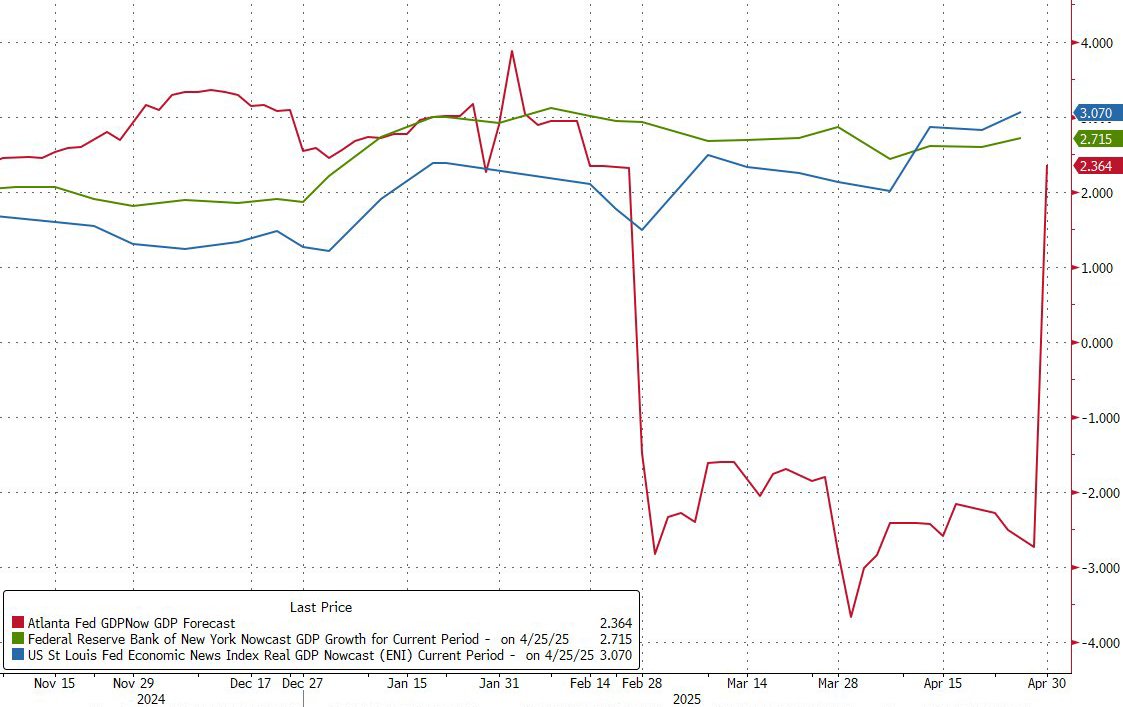

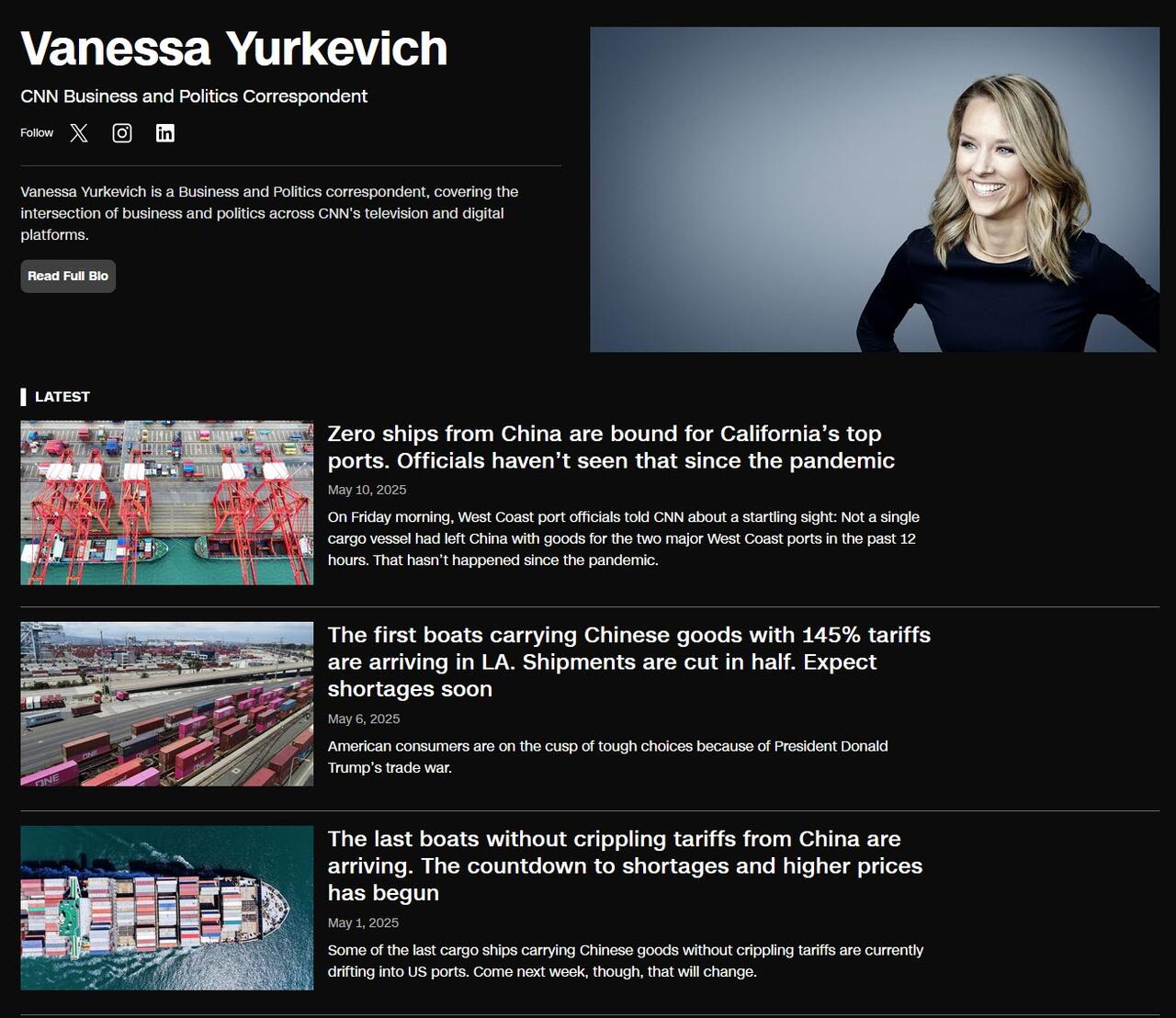

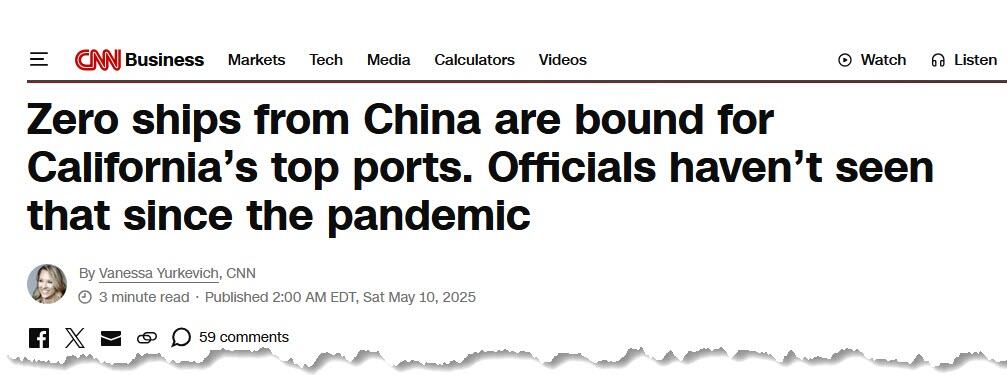

But, as always happens, it was CNN that finally took this "broken telephone" narrative to its absurd conclusion, when the media outlet that has become the butt of all propaganda jokes declared that "

https://www.cnn.com/2025/05/10/business/zero-ships-china-trade-ports-pandemic

."

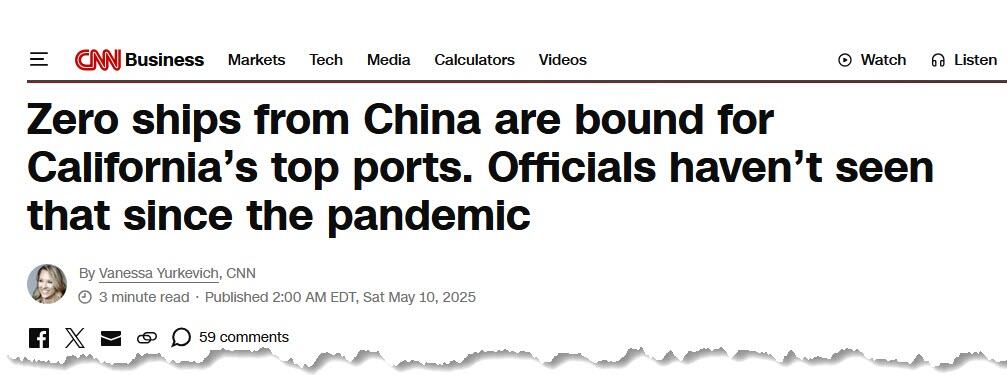

... an article written by CNN's Business and Politics correspondent,

X (formerly Twitter)

Vanessa Yurkevich (@VanessaCNN) on X

Business & Politics Correspondent @CNN

Send tips to: vanessa.yurkevich@cnn.com

RT ≠ endorsement

, who like MSNBC's Ruhle above, is now a full-blown expert on naval commerce and logistics as a quick scan of her latest articles reveals.

So up until this point we had stayed away from this idiotic discussion, which merely demonstrated how little understanding so-called experts actually have of a nuanced and complicated topic as trade and global commerce.

However, CNN's idiocy was the last straw.

But before we go there, a quick look at what has been really taking place.

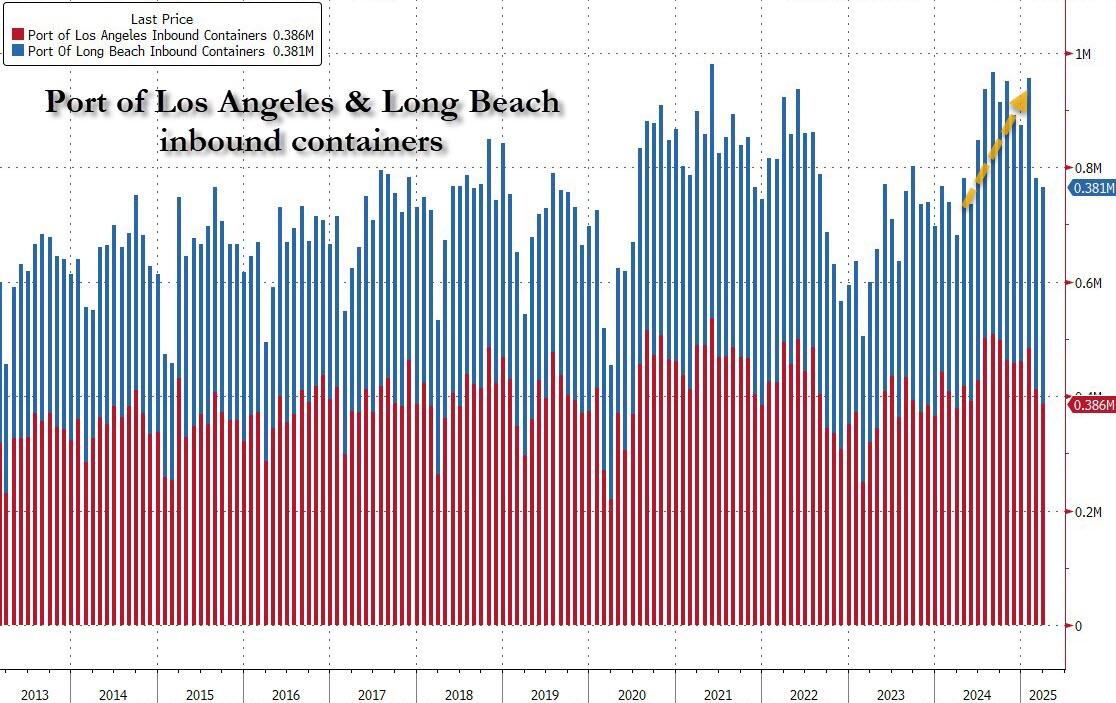

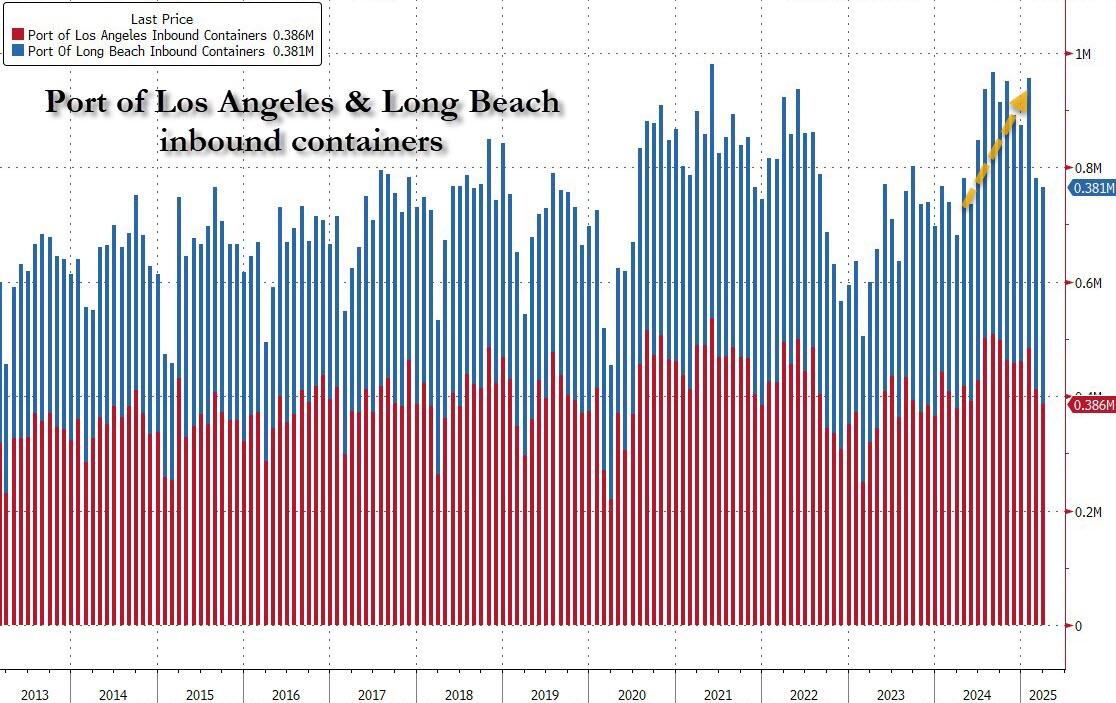

First, regarding the claim that west coast ports have seen a sharp drop in inbound traffic, there certainly has been a modest decline in February and March inbound traffic, but a decline from a near-record print in January, which in turn was the result of inventory restocking ahead of what most retailers knew would be a trade war. After all, Trump had made it clear about a year ago that he had every intention of restarting trade war with the world, and especially China, and only someone watching CNN would be surprised by the recent sharp spike in tariffs, a move which incidentally was never meant to be permanent but was a strategy meant to inflict max pain and get trading partners to the negotiating table. In any case, the total inbound traffic to California ports shown below is hardly the apocalypse the liberal media has been making it out to be (and even Reuters discusses this in "

https://www.reuters.com/business/near-record-us-container-import-streak-expected-snap-may-due-tariffs-2025-05-08/

").

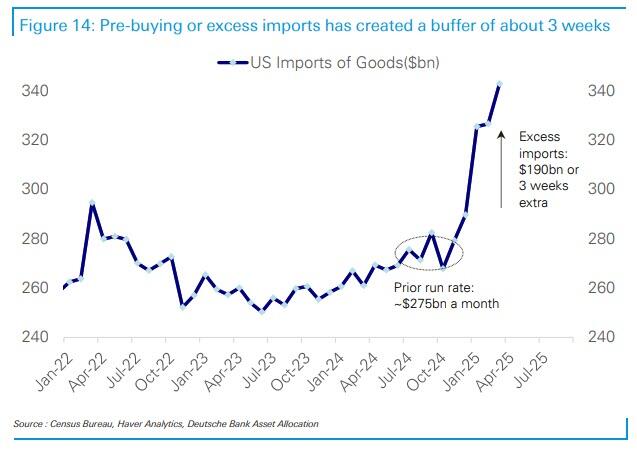

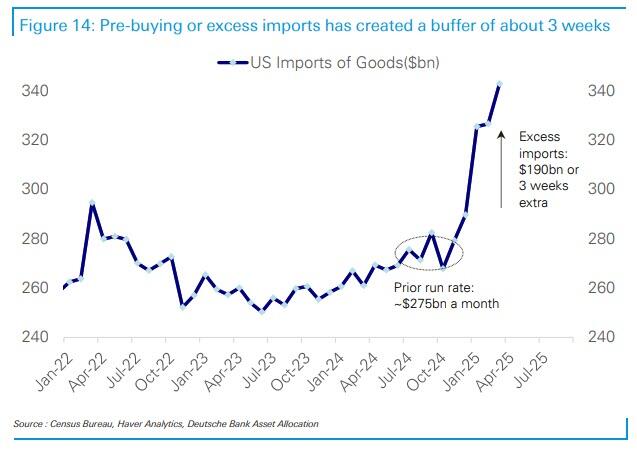

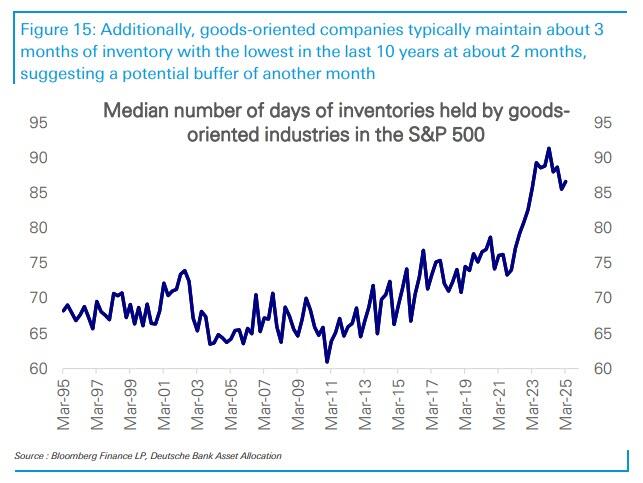

Then, addressing the topic of imminent product shortages, this was another fake news narrative meant to spark panic and chaos, and resulting in just the outcome the media was "warning" about. Because if it hurts Trump, it's great for MSNBC and CNN... and of course China, which begs the question: just how much "ad dollars" and/or sponsorship have these media outlets received from Beijing and Chinese companies in recent months. As the following charts from Deutsche Bank demonstrate clearly, what has been taking place in recent months - and why we are now seeing the reverse - is record prebuying and excess imports...

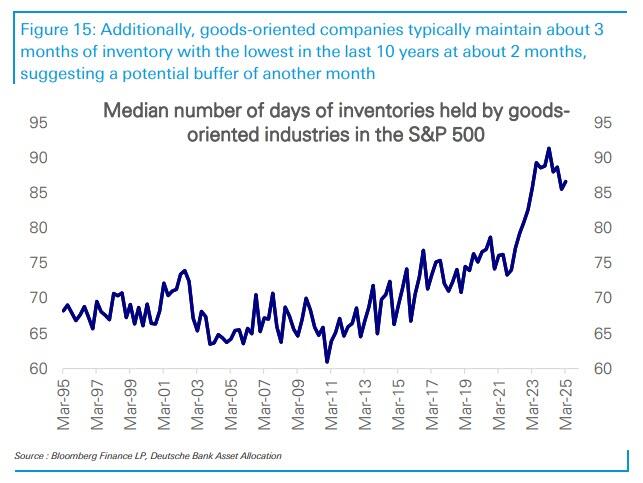

... which according to Deutsche Bank has led to precisely the opposite outcome than the one MSNBC and CNN have been blasting: there is excess inventory in the supply channel, enough in fact to last weeks if not months, assuming a full-blown collapse in global trade, which of course would never happen absent a covid-like shock.

Additionally, if and when retailers end up liquidating these billions in excess inventories they have accumulated just for this contingency, the outcome would be wildly deflationary, and hardly the inflationary shock so many "experts" predict (that's the topic of another post, and we'll get to it eventually).

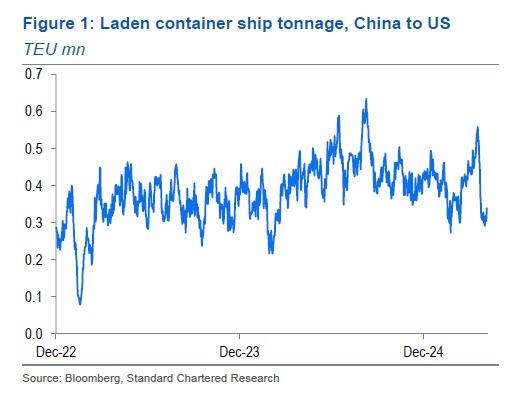

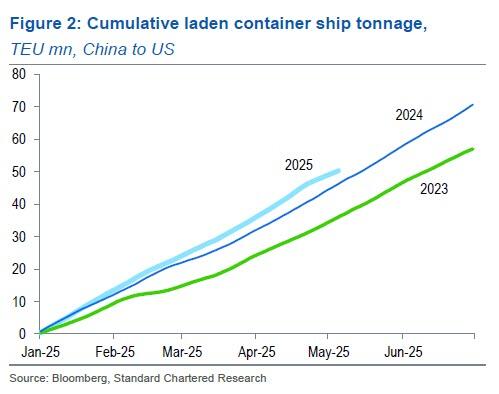

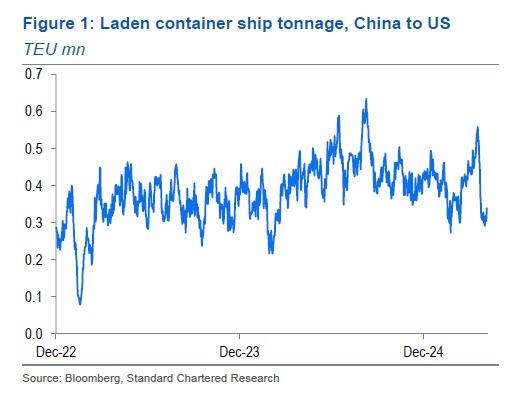

Going back to the media's favorite topic of dropping cargoes from China, it wasn't just us that countered the popular narrative: so did Standard Chartered's Steve Englander who wrote last week that "the lurid headlines on the drop in cargoes from China may be misleading."

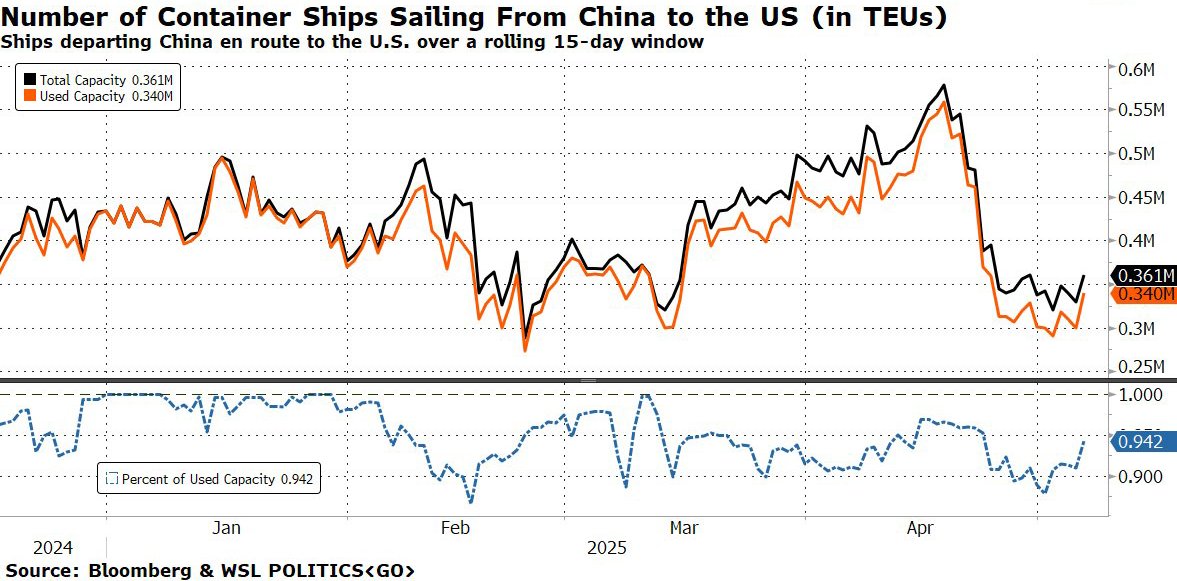

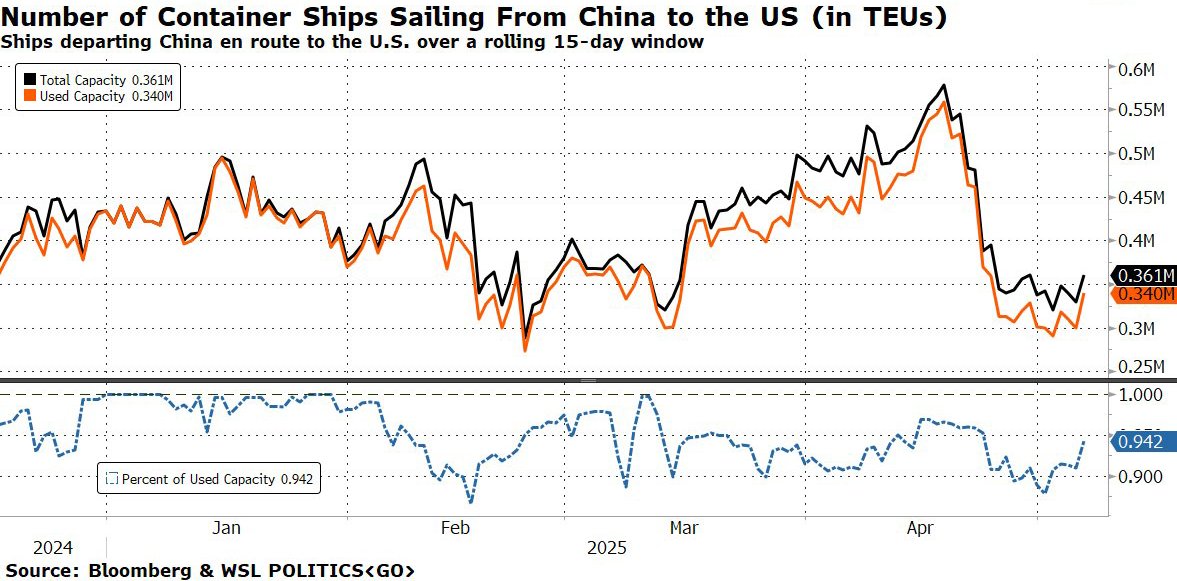

That's because as we noted above, the volume of laden cargo now being shipped from China to the US is down almost 50% versus mid-April 2025, but the mid-April level was very high, and while you will never hear this on CNN, the current level is about on a par with much of 2023. In fact, Englander said that "the current pace as the low end of normal over the last couple of years." Only again, hardly the apocalypse Kevin Plank's favorite media body

https://www.wsj.com/business/media/under-armour-kevin-plank-stephanie-ruhle-66cb65b5

portrays it to be.

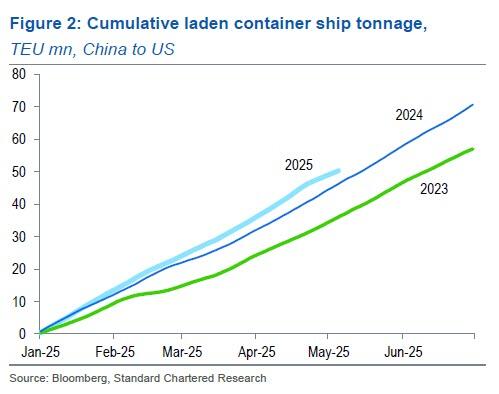

There's more: another thing you would never hear on MSNBC or CNN is that if the early-May pace of shipping to the US is maintained though end-June, the cumulative amount shipped in H1-2025 would be 18% higher than in H1-2023 and only 5% lower than in H1-2024. So far this year, the tonnage shipped to the US is 40% higher than in 2023 and 9% higher than in 2024. Indeed, as noted above, and as Englander observes, "US importers may have an inventory buffer until tariffs are negotiated downwards."

Taking a step back, if only for the benefit of our CNN and MSNBC readers, the big picture is one that even if the US were to lose all Chinese imports - an outcome which nobody anticipates as it would destroy China's economy as Reuters admitted last week - the outcome to the US would hardly be devastating. Yes, prices would rise, but overall the US would be able to handle it. Here, again, is Englander explaining why:

US imports from China are about 1.6% of US GDP in value terms. If inbound cargo stays at early-May levels, then H2-2025 imports will be 85% of 2023 levels (in volume terms) and 67% of 2024 levels. So the import volume shock would be 0.25% of GDP relative to 2023 and 0.5% relative to 2024. And keep in mind that there may be substitution from elsewhere. There may be temporary delays as US importers figure out the practicalities of dealing with the new tariffs, and shipping may be down temporarily because importers stocked up ahead of tariff implementation.

There is little precedent for this kind of tariff shock, but our judgement is that the US economy can handle it. We agree that disruption is likely from tariffs and that any benefits are uncertain, but we don’t think that the US economy will fall off a precipice because of a shock of this magnitude.

Remarkably, none of the so-called experts predicting doom and gloom in recent days spent even a minute to consider this eventuality. Which is also why the left's attempt to spark widespread panic by focusing on Chinese imports had largely been a dud... and why it forced the media to escalate its claims to ever more ludicrous proportions, until we got the CNN story that there were "zero ships from China are bound for California's top ports."

And this is where we drew the line because it takes about a 10 second google search on any of the marine tracking websites such as

MarineTraffic: Global Ship Tracking Intelligence | AIS Marine Traffic

MarineTraffic Live Ships Map. Discover information and vessel positions for vessels around the world. Search the MarineTraffic ships database of mo...

to find out this is total bullshit. And the fact that CNN didn't even consider that not all of its readers are absolute idiots who would accept its lies with zero pushback, is what was most remarkable.

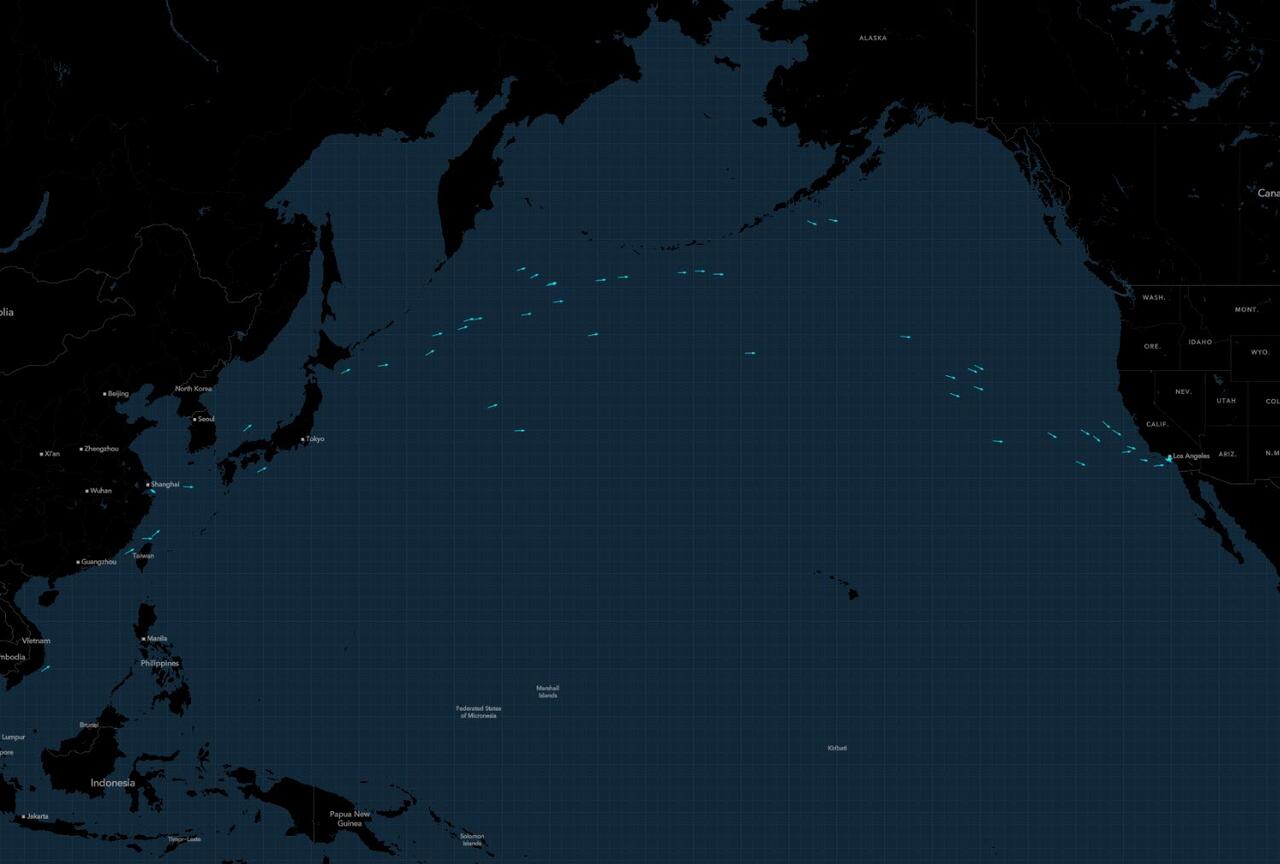

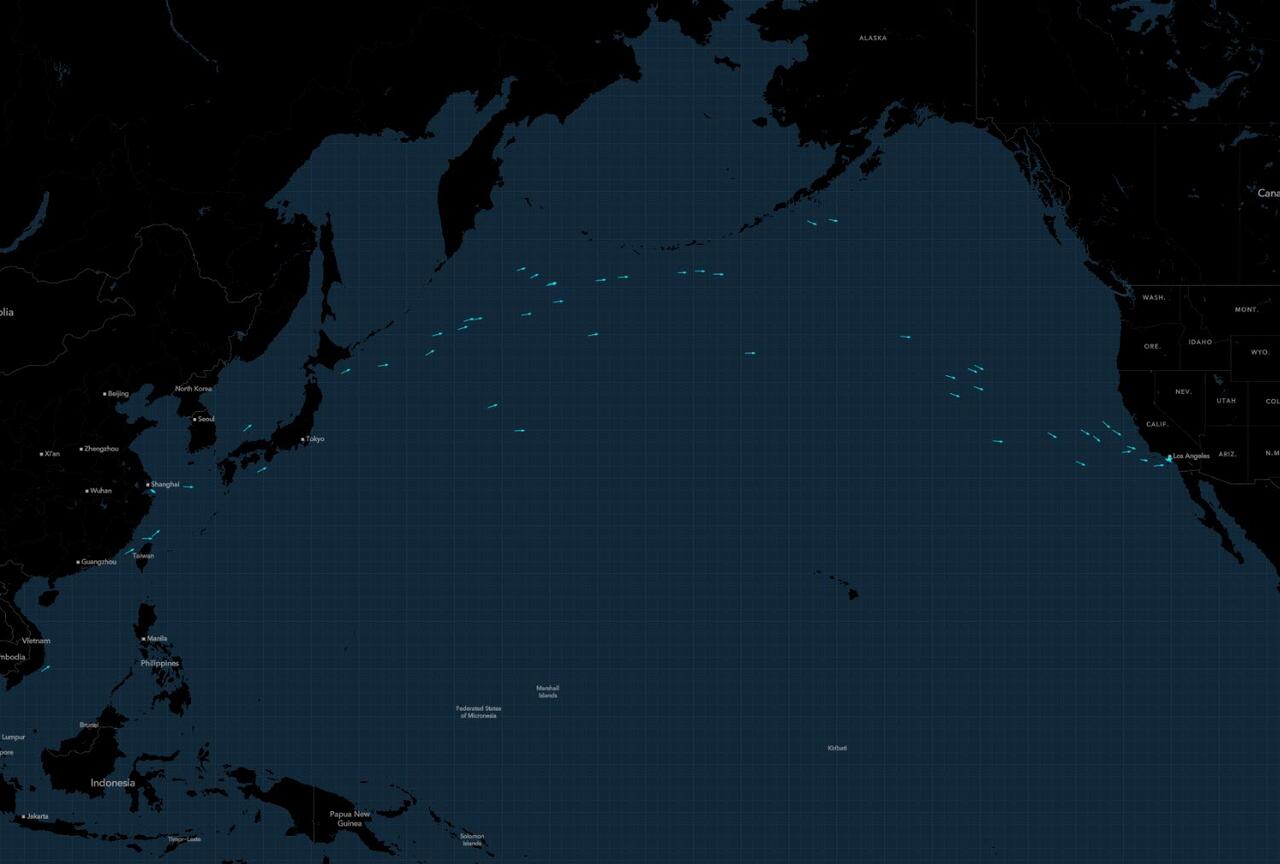

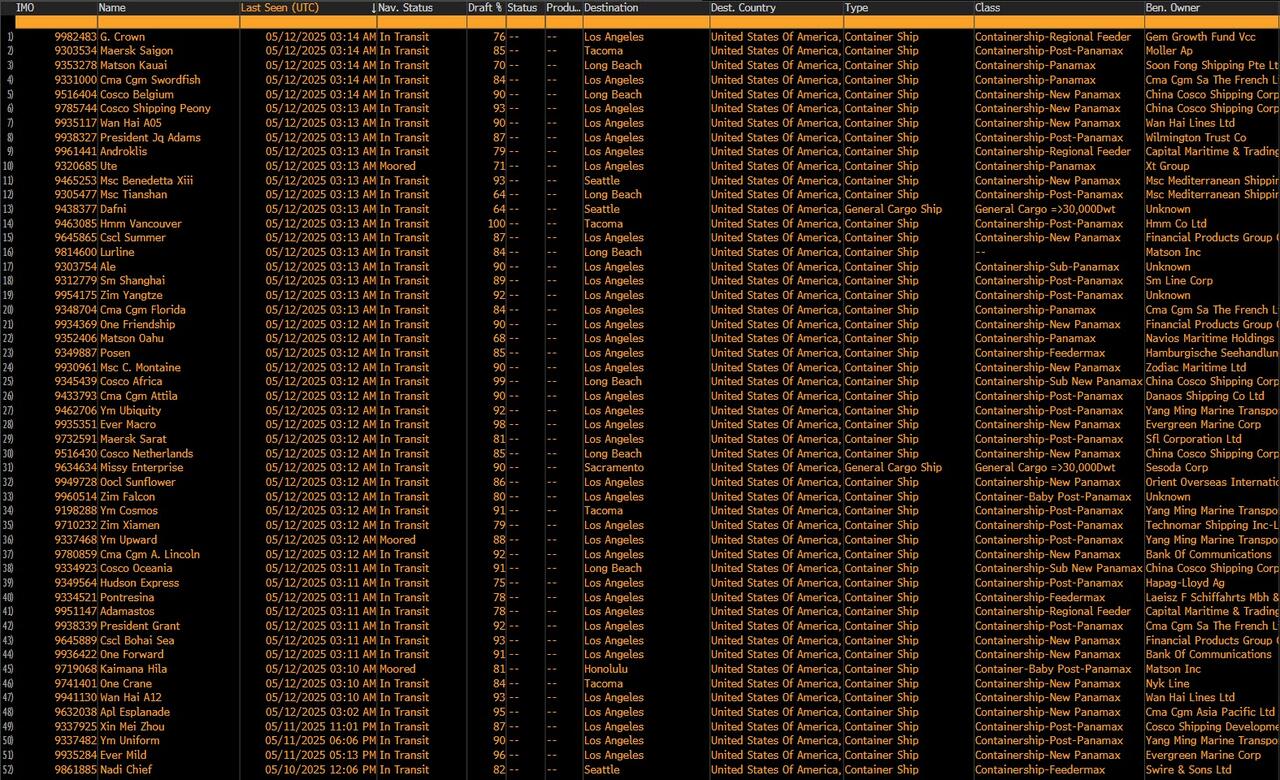

Below is a chart from Bloomberg showing all the Dry Cargo/Container ships that have recently left China, and are currently in the water, headed for Wast Coast ports.

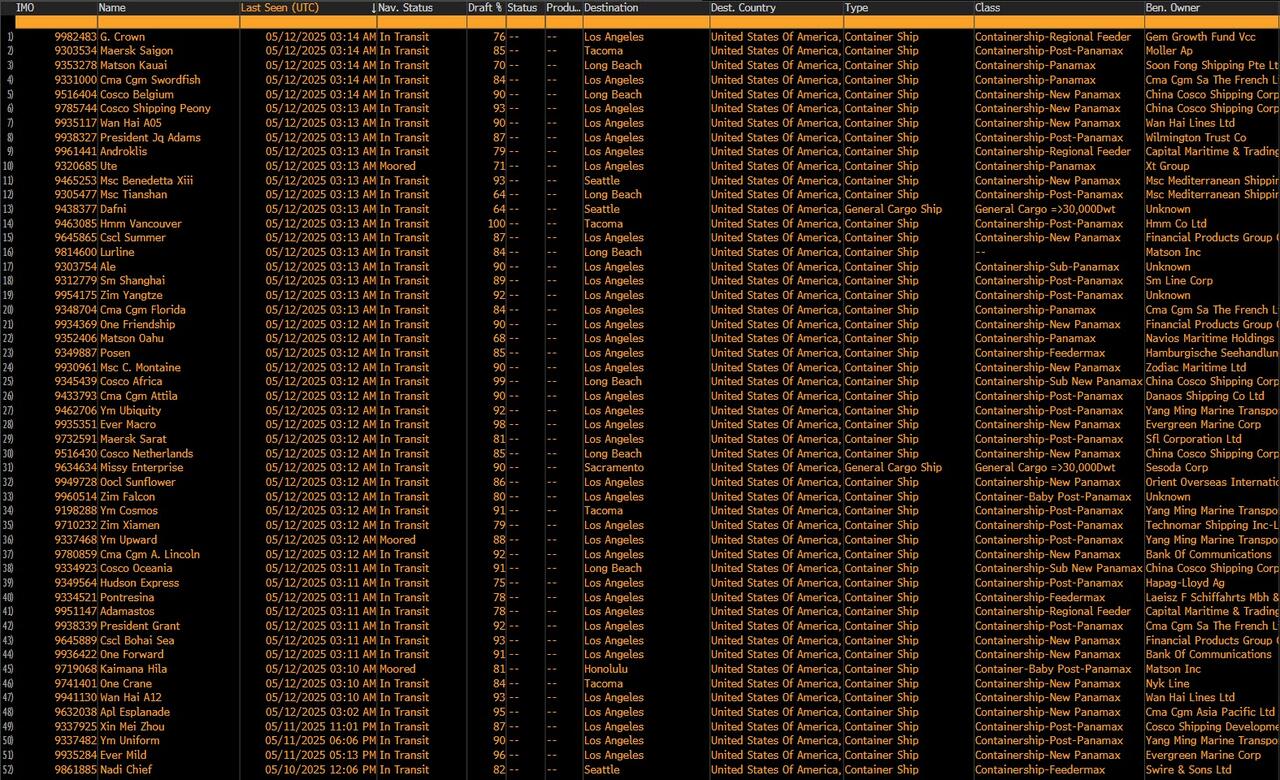

According to Bloomberg, there are no less than 52 cargo ships currently sailing from China to California and the West Coast, with the full list shown below.

It goes without saying that 52 is quite different from the zero ships headed to the US, as

https://www.cnn.com/2025/05/10/business/zero-ships-china-trade-ports-pandemic

, and to put that number in context, here is what the average number of ships heading across from China to the US has been in 2025:

January 59 ships

February 56

March 55

April 55

And now May is 52. So that drop - from 55 to 52 - is supposed to be the "covid-like emergency" that the mainstream propaganda media is urging Americans to run to their local Walmart and stock up on 1 year of toilet paper?

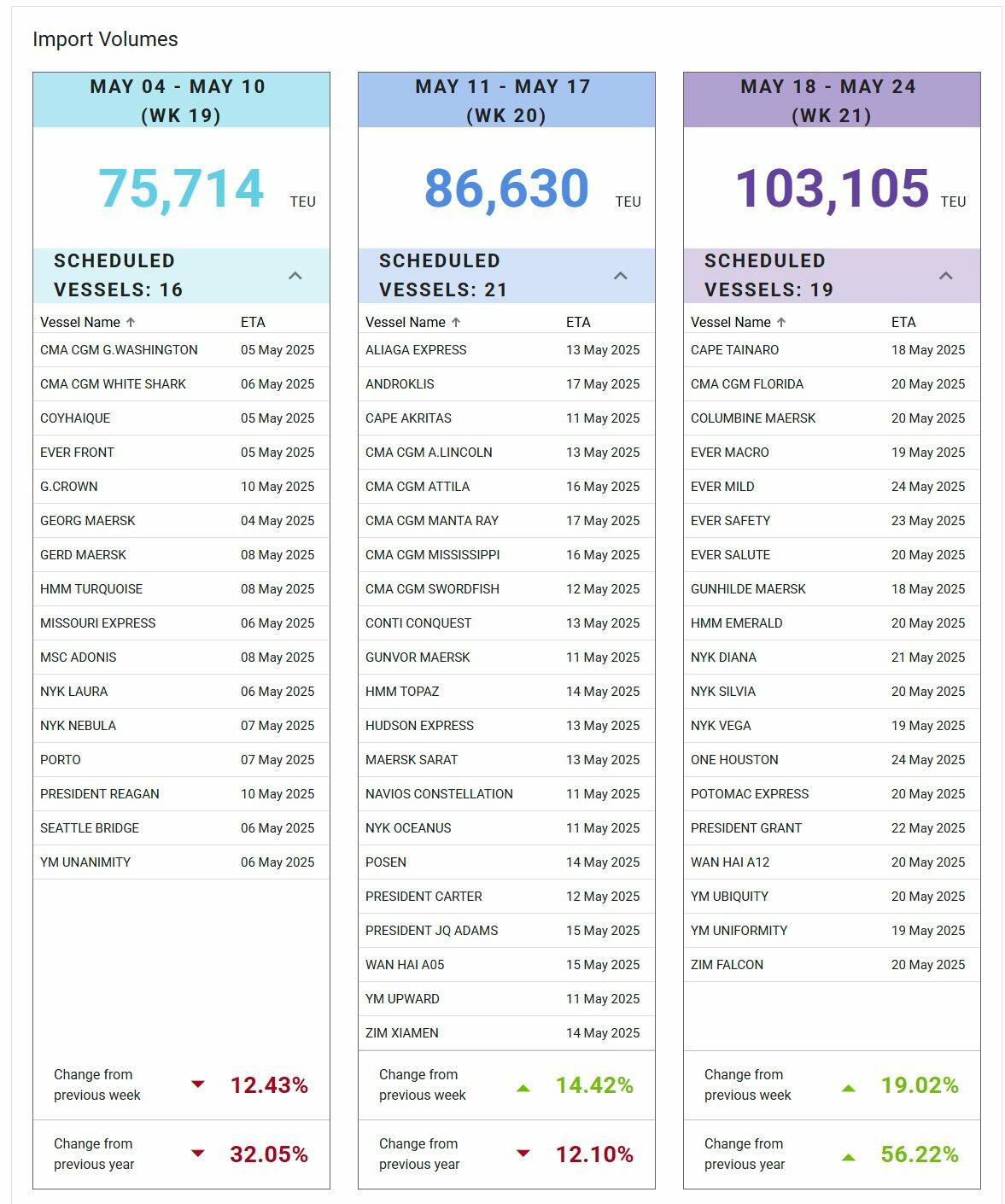

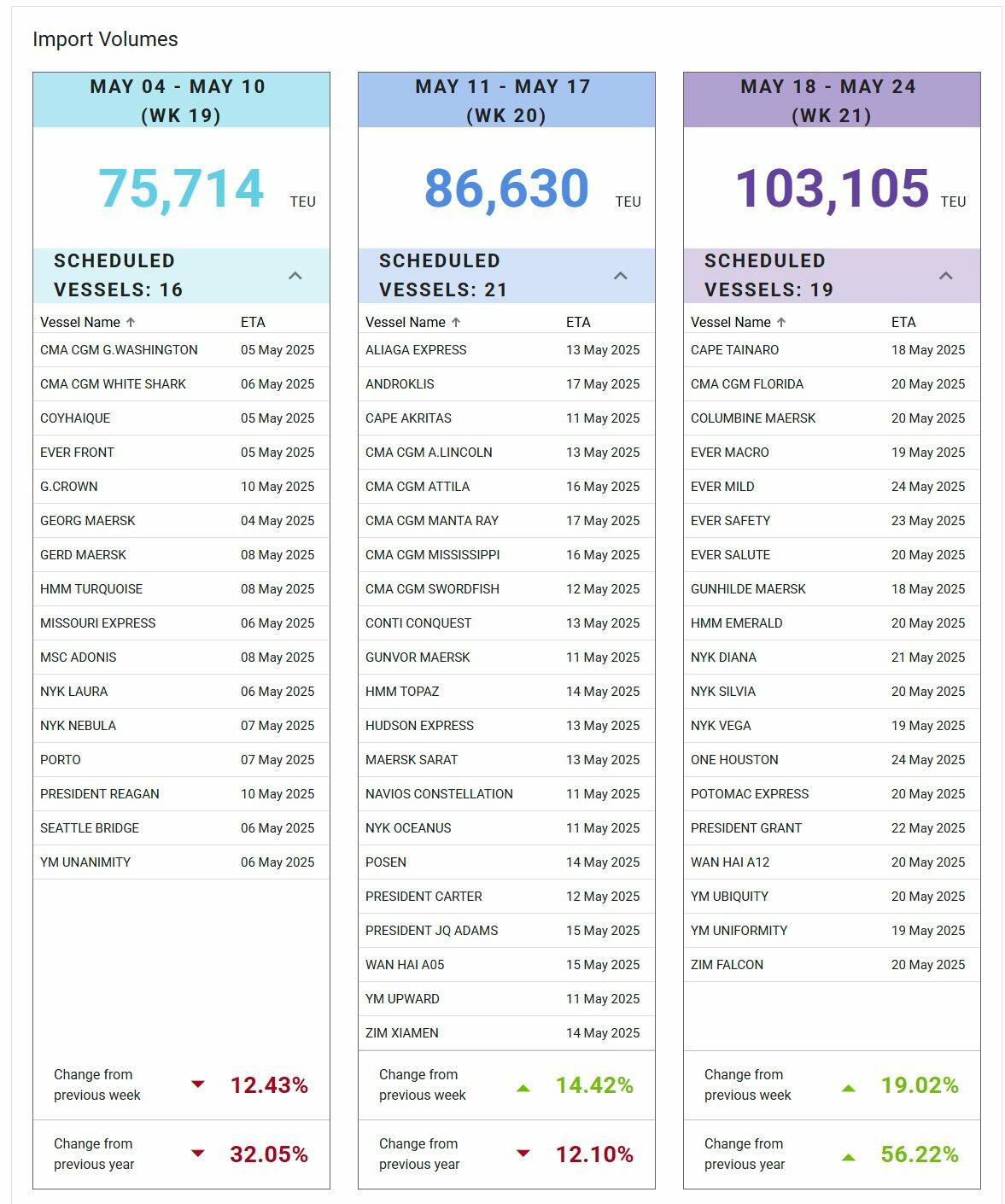

But it gets worse for CNN, because while we can understand if they don't have access to Bloomberg, or even google as a result of recent cuts in USAID funding, they could have just gone to the Port of Los Angeles website to look at the public Port Optimizer data which shows that contrary to fake narratives of collapsing global trade, the import volumes for the week of May 18-24 are up 19% from the previous week and up a whopping 56% from a year ago.

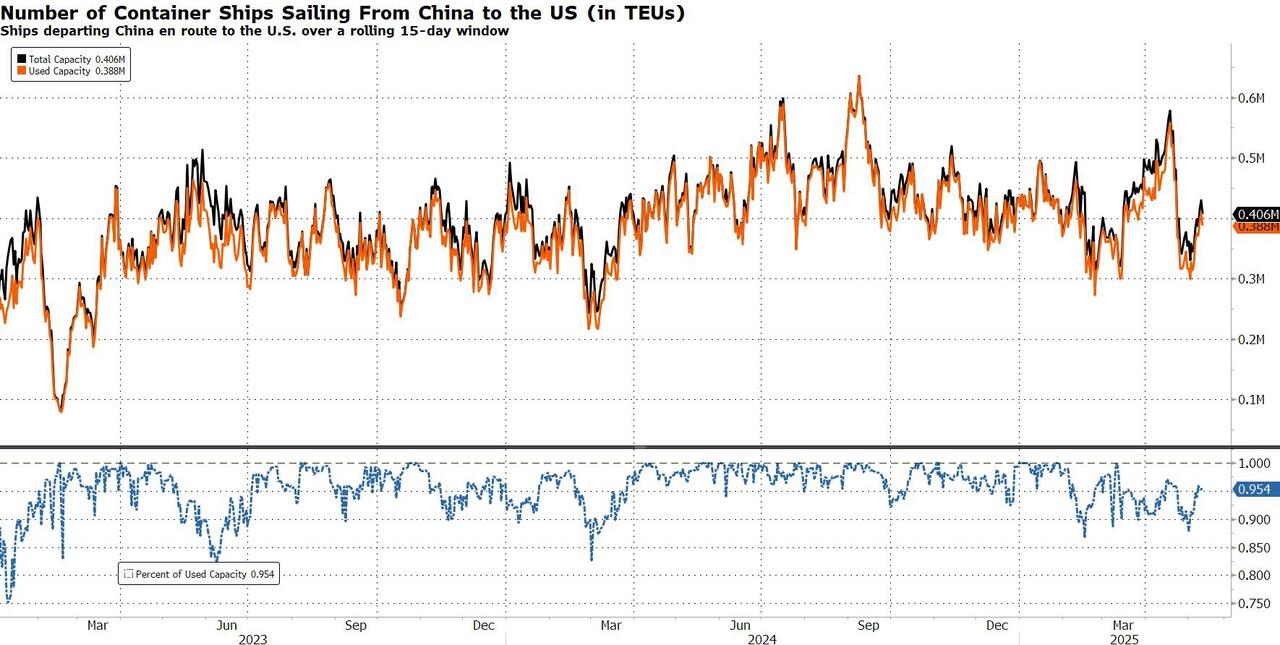

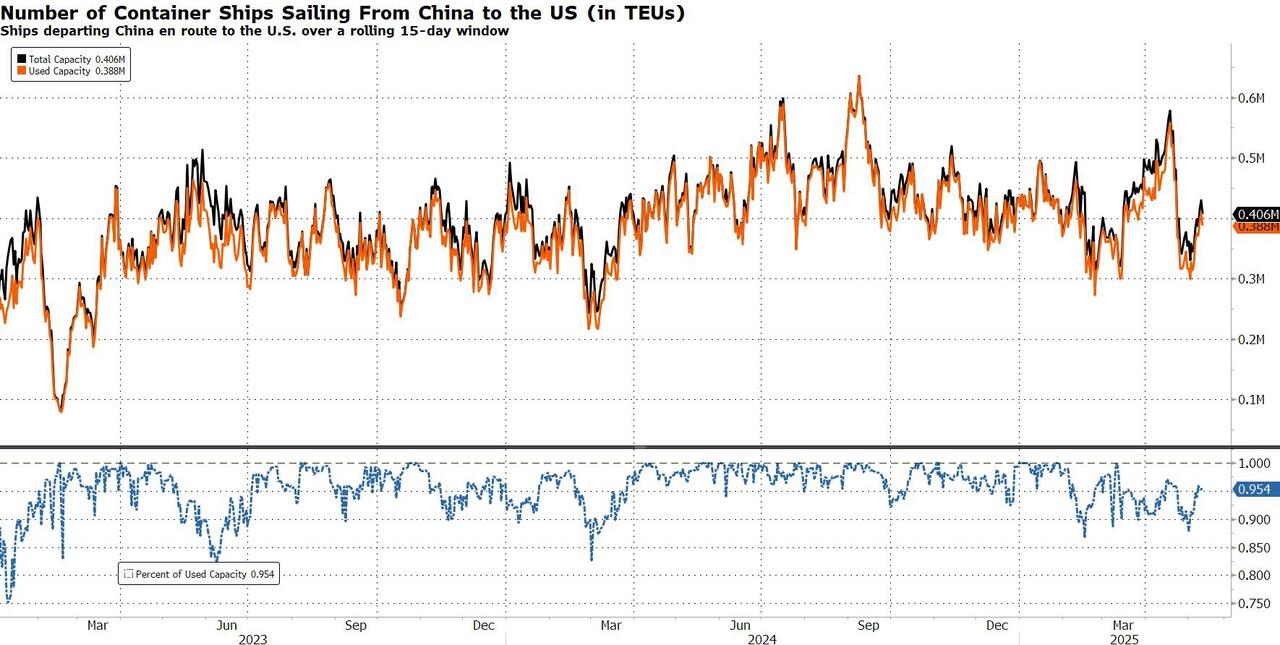

And another way of showing it: here is the total number of container ships sailing from China to the US (in TEUs). The number on May 11 is higher than where it was in 2024 and the same as May 2023. But you won't hear any of that on CNN.

Instead, this is what you will hear on CNN:

"On Friday morning, West Coast port officials told CNN about a startling sight: Not a single cargo vessel had left China with goods for the two major West Coast ports in the past 12 hours. That hasn’t happened since the pandemic."

Only this attempt to spark panic (while evoking the covid pandemic for obvious reasons) is also dead wrong: first, consider that there are currently 52 ships transiting the Pacific from China to SoCal, in line with historic numbers: the trip takes 20 days which means 2.6 ships sailing each day or one ship every 9 to 10 hours. So a 12 hour period is not unusual. And, as Sal Mercogliano points out, while no ships may have set sail for California on Friday, a quick look at Marine Traffic shows that three ships - Cosco Africa, Ever Safety and Ever Mild - are all leaving China for SoCal this weekend. So much for that "startling sight."

6/The story said 41 ships were scheduled to sail, but on Friday it was zero. This does not mean the 41 are not sailing. A quick look

X (formerly Twitter)

MarineTraffic (@MarineTraffic) on X

The #1 ship tracking service in the world. Available on the web https://t.co/YmiB0QyZJp and mobile app https://t.co/YVWnhe7LDs

— Sal Mercogliano (WGOW Shipping) 🚢⚓🐪🚒🏴☠️ (@mercoglianos)

https://twitter.com/mercoglianos/status/1921308576997351543?ref_src=twsrc%5Etfw

We could continue but you - unlike CNN - get the picture: transpacific trade may have slowed down, but it is nowhere near the full ground stop observed for a few weeks during covid, not even remotely close.

Meanwhile, the entire discussion about empty ports and empty shelves is completely moot because

https://www.reuters.com/business/autos-transportation/trade-talks-begin-chinese-exporters-prepare-get-goods-moving-us-again-2025-05-09/

even before the news of this weekend's US-China trade talks breakthrough hit, "China-based shipping agents have resumed buying container space for goods headed for the United States after a series of U.S. tariff-induced cancellations, as Beijing and Washington head for trade talks in Switzerland."

And here is

https://www.reuters.com/business/autos-transportation/trade-talks-begin-chinese-exporters-prepare-get-goods-moving-us-again-2025-05-09/

what we said several days ago: "Since late April, however, traders have stepped up buying of shipping capacity, locking in space from mid-May, according to two China-based executives with freight forwarding firms."

Or precisely what we said a week ago.

Ships sailing from China to US hits 2 week high. But Long Beach was supposed to be a ghost port

X (formerly Twitter)

zerohedge (@zerohedge) on X

Ships sailing from China to US hits 2 week high. But Long Beach was supposed to be a ghost port

— zerohedge (@zerohedge)

X (formerly Twitter)

zerohedge (@zerohedge) on X

Ships sailing from China to US hits 2 week high. But Long Beach was supposed to be a ghost port

And remarkably, and contrary to anything you may hear on CNN or MSNBC, shipping from China to the US is actually set for another surge! According to Dominic Desmarais, chief solutions officer at Liya Solutions which connects small and medium-sized companies with suppliers in China making everything from furniture to titanium products, prices could go up by $500 per container after May 15 as shipping activity recovers.

So much for CNN's fake news.

We'll leave readers with another far more critical discussion topic, namely whether tariffs lead to inflation, something about which we will have more to say in the coming days since this has become a focal point of much economic debate in recent months, not just in the political arena but also inside the Fed.

And while Fed Chair Powell appears to be very "confused" once again, claiming that tariffs are inflationary with the same erroneous conviction he previously argued "inflation was transitory" - we will instead point you to the recent work of Javier Bianchi, senior research economist at the Federal Reserve Bank of Minneapolis, who thinks tariffs are not just a negative supply shock, but also a negative demand shock, and argues that the optimal monetary policy response to tariffs - which lead not to inflation but threaten recession - is to cut rates. For much more on this critical issue read "

Under a stiff tariff, boosting the economy takes priority over inflation for a central bank | Federal Reserve Bank of Minneapolis

A look at “The Optimal Monetary Policy Response to Tariffs”

", something we are 100% certain neither CNN or MSNBC will never do.

Tyler Durden | Zero Hedge

Zero Hedge

Mon, 05/12/2025 - 00:16

Fake News Narrative Of "Empty Ports, Empty Shelves" Suffers Spectacular Implosion | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

But the talks - which involved a relatively low level delegation on the Russian side - did result in commitments to a sizeable prisoner swap, the likelihood of further rounds of talks, and both agreeing to compose their vision of a future ceasefire.

The prisoner exchange pledge is significant, given it would mark the largest since the Russian invasion: there will be an exchange 1,000 prisoners of war.

However, there's no ceasefire - not even the 30 days that Kiev and Washington have been pushing for.

Earlier in the day Kiev's top European allies blasted Russia's stance as presented in Istanbul "unacceptable":

British Prime Minister Keir Starmer, joined by French President Emmanuel Macron, German Chancellor Friedrich Merz and Polish leader Donald Tusk, said in a statement on Friday that “the Russian position is clearly unacceptable, and not for the first time,” according to Reuters.

The Wall Street Journal has https://www.wsj.com/world/europe/russia-ukraine-peace-talks-begin-amid-low-expectations-f010d73b?st=sEfTsr&reflink=mobilewebshare_permalink

that "The talks, in the Dolmabahçe Palace in Istanbul, came about as the result of President Trump’s pressure, so far mostly applied on Ukrainian President Volodymyr Zelensky, to find an end to the war."

President Zelensky has meanwhile been making clear that Ukraine will not surrender its territory as "this is Ukraine's land" - and he isn't so much as ready to even offer Crimea. Zelensky and European leaders are reportedly holding a phone call with US President Trump in the wake of the Istanbul meeting.

Prior statement of Macron two months ago...

NEW

Macron: Europe's sanctions on the Russian Federation will be lifted only in the event that the regime withdraws behind the borders of 1991.

🇪🇺🇺🇦🇫🇷

But the talks - which involved a relatively low level delegation on the Russian side - did result in commitments to a sizeable prisoner swap, the likelihood of further rounds of talks, and both agreeing to compose their vision of a future ceasefire.

The prisoner exchange pledge is significant, given it would mark the largest since the Russian invasion: there will be an exchange 1,000 prisoners of war.

However, there's no ceasefire - not even the 30 days that Kiev and Washington have been pushing for.

Earlier in the day Kiev's top European allies blasted Russia's stance as presented in Istanbul "unacceptable":

British Prime Minister Keir Starmer, joined by French President Emmanuel Macron, German Chancellor Friedrich Merz and Polish leader Donald Tusk, said in a statement on Friday that “the Russian position is clearly unacceptable, and not for the first time,” according to Reuters.

The Wall Street Journal has https://www.wsj.com/world/europe/russia-ukraine-peace-talks-begin-amid-low-expectations-f010d73b?st=sEfTsr&reflink=mobilewebshare_permalink

that "The talks, in the Dolmabahçe Palace in Istanbul, came about as the result of President Trump’s pressure, so far mostly applied on Ukrainian President Volodymyr Zelensky, to find an end to the war."

President Zelensky has meanwhile been making clear that Ukraine will not surrender its territory as "this is Ukraine's land" - and he isn't so much as ready to even offer Crimea. Zelensky and European leaders are reportedly holding a phone call with US President Trump in the wake of the Istanbul meeting.

Prior statement of Macron two months ago...

NEW

Macron: Europe's sanctions on the Russian Federation will be lifted only in the event that the regime withdraws behind the borders of 1991.

🇪🇺🇺🇦🇫🇷  — Astraia Intel (@astraiaintel)

— Astraia Intel (@astraiaintel)  They will likely try to convince the US leader that attempts to negotiate an end to the war with Putin are futile. This seems to have been Zelensky's aim all along: getting Washington and Trump back on his side, and securing the unending flow of weapons, cash, and intelligence.

Will the White House at the very least demand that Zelensky will acknowledge Russian sovereignty over Crimea?

Sat, 05/17/2025 - 07:35

They will likely try to convince the US leader that attempts to negotiate an end to the war with Putin are futile. This seems to have been Zelensky's aim all along: getting Washington and Trump back on his side, and securing the unending flow of weapons, cash, and intelligence.

Will the White House at the very least demand that Zelensky will acknowledge Russian sovereignty over Crimea?

Sat, 05/17/2025 - 07:35

But the talks - which involved a relatively low level delegation on the Russian side - did result in commitments to a sizeable prisoner swap, the likelihood of further rounds of talks, and both agreeing to compose their vision of a future ceasefire.

The prisoner exchange pledge is significant, given it would mark the largest since the Russian invasion: there will be an exchange 1,000 prisoners of war.

However, there's no ceasefire - not even the 30 days that Kiev and Washington have been pushing for.

Earlier in the day Kiev's top European allies blasted Russia's stance as presented in Istanbul "unacceptable":

British Prime Minister Keir Starmer, joined by French President Emmanuel Macron, German Chancellor Friedrich Merz and Polish leader Donald Tusk, said in a statement on Friday that “the Russian position is clearly unacceptable, and not for the first time,” according to Reuters.

The Wall Street Journal has https://www.wsj.com/world/europe/russia-ukraine-peace-talks-begin-amid-low-expectations-f010d73b?st=sEfTsr&reflink=mobilewebshare_permalink

that "The talks, in the Dolmabahçe Palace in Istanbul, came about as the result of President Trump’s pressure, so far mostly applied on Ukrainian President Volodymyr Zelensky, to find an end to the war."

President Zelensky has meanwhile been making clear that Ukraine will not surrender its territory as "this is Ukraine's land" - and he isn't so much as ready to even offer Crimea. Zelensky and European leaders are reportedly holding a phone call with US President Trump in the wake of the Istanbul meeting.

Prior statement of Macron two months ago...

NEW

Macron: Europe's sanctions on the Russian Federation will be lifted only in the event that the regime withdraws behind the borders of 1991.

🇪🇺🇺🇦🇫🇷

But the talks - which involved a relatively low level delegation on the Russian side - did result in commitments to a sizeable prisoner swap, the likelihood of further rounds of talks, and both agreeing to compose their vision of a future ceasefire.

The prisoner exchange pledge is significant, given it would mark the largest since the Russian invasion: there will be an exchange 1,000 prisoners of war.

However, there's no ceasefire - not even the 30 days that Kiev and Washington have been pushing for.

Earlier in the day Kiev's top European allies blasted Russia's stance as presented in Istanbul "unacceptable":

British Prime Minister Keir Starmer, joined by French President Emmanuel Macron, German Chancellor Friedrich Merz and Polish leader Donald Tusk, said in a statement on Friday that “the Russian position is clearly unacceptable, and not for the first time,” according to Reuters.

The Wall Street Journal has https://www.wsj.com/world/europe/russia-ukraine-peace-talks-begin-amid-low-expectations-f010d73b?st=sEfTsr&reflink=mobilewebshare_permalink

that "The talks, in the Dolmabahçe Palace in Istanbul, came about as the result of President Trump’s pressure, so far mostly applied on Ukrainian President Volodymyr Zelensky, to find an end to the war."

President Zelensky has meanwhile been making clear that Ukraine will not surrender its territory as "this is Ukraine's land" - and he isn't so much as ready to even offer Crimea. Zelensky and European leaders are reportedly holding a phone call with US President Trump in the wake of the Istanbul meeting.

Prior statement of Macron two months ago...

NEW

Macron: Europe's sanctions on the Russian Federation will be lifted only in the event that the regime withdraws behind the borders of 1991.

🇪🇺🇺🇦🇫🇷

The two nations are said to be finalizing a joint declaration that denounces the Court’s recent rulings as overreach, particularly in cases where national efforts to restrict illegal immigration have been struck down.

The move is timed to coincide with the 75th anniversary of the European Convention on Human Rights, signed on Nov. 4, 1950. But rather than celebrating the institution that enforces it, the initiative reportedly seeks to “launch a debate” over whether the ECHR’s current interpretation of the Convention is still fit for purpose amid mounting challenges posed by mass illegal immigration.

“What was right yesterday may not be right today,” the draft letter reportedly states. Its aim is to gather support from like-minded countries within the 46-member Council of Europe. Besides Denmark and Italy, Czechia, Finland, Poland, and the Netherlands are expected to support the declaration.

Once finalized, the document is expected to form the foundation of an informal alliance pressuring for reform of how the Convention is applied, particularly regarding national sovereignty over immigration control.

The pushback follows a series of rulings by the ECHR that have infuriated national governments. In 2024, Italy was found to have violated the rights of three Tunisian migrants detained in an overcrowded facility on the island of Lampedusa. The Court described their treatment as “inhuman and degrading,” noting that the detainees had only two toilets for 40 people and that some were forced to sleep outside on mattresses.

Italy was further frustrated by recent domestic court rulings in Rome, citing the ECHR, which prevented the transfer of illegal migrants to reception centers in Tirana, following a bilateral agreement with the Albanian government.

Italian premier Giorgia Meloni has long been critical of the political overreach by the judiciary afforded to them by the European Convention on Human Rights. Speaking to the Italian press in 2023 following a ruling on migrant detention in Lampedusa, she said, “We are seeing a distortion in the application of the European Convention that no longer respects the rights of nations to defend their borders.”

Denmark, for its part, was the subject of a precedent-setting ruling in November 2024. In the case Sharafane v. Denmark, the ECHR questioned the legality of the applicant’s expulsion based in part on whether he could realistically expect to return to Denmark in the future. The European Centre for Law and Justice described the ruling as a de facto creation of a “right of return” for expelled foreigners, a move seen as directly undermining Denmark’s efforts to maintain a strict migration policy.

Following the ruling, Social Democrat government minister Rasmus Stoklund said, “The European Court of Human Rights has gradually shifted from defending basic rights to dictating policy decisions that should be left to democratically elected governments.”

Several other European conservatives have voiced their criticism of what they suggest is now outdated legislation no longer fit for purpose.

In October 2023, former Polish Prime Minister Mateusz Morawiecki told the Sejm, “Poland cannot accept a situation where unelected judges in Strasbourg decide who can or cannot be expelled from our territory.”

Similarly, in February this year, the U.K.’s leader of the opposition, Kemi Badenoch, warned that Britain will “at some point probably have to leave” the convention if it “continues to stop us doing what is right for the people of this country.”

The two nations are said to be finalizing a joint declaration that denounces the Court’s recent rulings as overreach, particularly in cases where national efforts to restrict illegal immigration have been struck down.

The move is timed to coincide with the 75th anniversary of the European Convention on Human Rights, signed on Nov. 4, 1950. But rather than celebrating the institution that enforces it, the initiative reportedly seeks to “launch a debate” over whether the ECHR’s current interpretation of the Convention is still fit for purpose amid mounting challenges posed by mass illegal immigration.

“What was right yesterday may not be right today,” the draft letter reportedly states. Its aim is to gather support from like-minded countries within the 46-member Council of Europe. Besides Denmark and Italy, Czechia, Finland, Poland, and the Netherlands are expected to support the declaration.

Once finalized, the document is expected to form the foundation of an informal alliance pressuring for reform of how the Convention is applied, particularly regarding national sovereignty over immigration control.

The pushback follows a series of rulings by the ECHR that have infuriated national governments. In 2024, Italy was found to have violated the rights of three Tunisian migrants detained in an overcrowded facility on the island of Lampedusa. The Court described their treatment as “inhuman and degrading,” noting that the detainees had only two toilets for 40 people and that some were forced to sleep outside on mattresses.

Italy was further frustrated by recent domestic court rulings in Rome, citing the ECHR, which prevented the transfer of illegal migrants to reception centers in Tirana, following a bilateral agreement with the Albanian government.

Italian premier Giorgia Meloni has long been critical of the political overreach by the judiciary afforded to them by the European Convention on Human Rights. Speaking to the Italian press in 2023 following a ruling on migrant detention in Lampedusa, she said, “We are seeing a distortion in the application of the European Convention that no longer respects the rights of nations to defend their borders.”

Denmark, for its part, was the subject of a precedent-setting ruling in November 2024. In the case Sharafane v. Denmark, the ECHR questioned the legality of the applicant’s expulsion based in part on whether he could realistically expect to return to Denmark in the future. The European Centre for Law and Justice described the ruling as a de facto creation of a “right of return” for expelled foreigners, a move seen as directly undermining Denmark’s efforts to maintain a strict migration policy.

Following the ruling, Social Democrat government minister Rasmus Stoklund said, “The European Court of Human Rights has gradually shifted from defending basic rights to dictating policy decisions that should be left to democratically elected governments.”

Several other European conservatives have voiced their criticism of what they suggest is now outdated legislation no longer fit for purpose.

In October 2023, former Polish Prime Minister Mateusz Morawiecki told the Sejm, “Poland cannot accept a situation where unelected judges in Strasbourg decide who can or cannot be expelled from our territory.”

Similarly, in February this year, the U.K.’s leader of the opposition, Kemi Badenoch, warned that Britain will “at some point probably have to leave” the convention if it “continues to stop us doing what is right for the people of this country.”

To the law enforcement officers of Upstate New York, the North Country, and everywhere else across our nation: Thank you. Your service does not go unnoticed, and your commitment to keeping our communities safe is deeply appreciated. I stand with you, and I will continue fighting for policies that prioritize the safety of our communities, ensuring that you have the resources and support needed to do your vital work.

In these challenging times, it’s crucial that we stand up for those who serve us. While the far left continues to push anti-police rhetoric and policies that put our officers in dangerous positions, it’s more important than ever to back the blue. The far-left “Defund the Police” movement and the dangerous rise of anti-police sentiment threaten the very fabric of our communities. Our law enforcement officers are the backbone of our safety and security, and they deserve the respect, resources, and protection to do their jobs effectively. Their hard work ensures that law-abiding citizens can live in peace, free from fear.

Unfortunately, many on the left in Albany, Washington, and across the nation are taking law enforcement for granted. Policies like reckless bail reforms and calls to defund the police only endanger our communities. It’s time we recognize the critical role our officers play in public safety and stop allowing radical left movements to jeopardize their ability to serve and protect.

During my tenure in Congress, I have worked tirelessly to provide officers with the resources, training, and recognition they deserve. I introduced bills aimed at bolstering funding for police departments, improving officer safety, and enhancing mental health services for law enforcement personnel. I also have been a vocal proponent of holding criminals accountable while ensuring that police officers have the necessary protections to do their jobs without fear of unjust retribution.

In Upstate New York, we are fortunate to have some of the most dedicated law enforcement officers in the country. Their work has resulted in our district having one of the lowest crime rates in the nation.

I’m proud to stand with them and will always fight for policies that support law enforcement and keep our communities safe.

National Police Week may only last seven days, but the gratitude and respect we owe to our men and women in blue should echo every single day. Thank you to our heroes in uniform, and may we continue to support and protect them in their mission to safeguard us all.

Republican Elise Stefanik represents New York’s 21st District in Congress.

To the law enforcement officers of Upstate New York, the North Country, and everywhere else across our nation: Thank you. Your service does not go unnoticed, and your commitment to keeping our communities safe is deeply appreciated. I stand with you, and I will continue fighting for policies that prioritize the safety of our communities, ensuring that you have the resources and support needed to do your vital work.

In these challenging times, it’s crucial that we stand up for those who serve us. While the far left continues to push anti-police rhetoric and policies that put our officers in dangerous positions, it’s more important than ever to back the blue. The far-left “Defund the Police” movement and the dangerous rise of anti-police sentiment threaten the very fabric of our communities. Our law enforcement officers are the backbone of our safety and security, and they deserve the respect, resources, and protection to do their jobs effectively. Their hard work ensures that law-abiding citizens can live in peace, free from fear.

Unfortunately, many on the left in Albany, Washington, and across the nation are taking law enforcement for granted. Policies like reckless bail reforms and calls to defund the police only endanger our communities. It’s time we recognize the critical role our officers play in public safety and stop allowing radical left movements to jeopardize their ability to serve and protect.

During my tenure in Congress, I have worked tirelessly to provide officers with the resources, training, and recognition they deserve. I introduced bills aimed at bolstering funding for police departments, improving officer safety, and enhancing mental health services for law enforcement personnel. I also have been a vocal proponent of holding criminals accountable while ensuring that police officers have the necessary protections to do their jobs without fear of unjust retribution.

In Upstate New York, we are fortunate to have some of the most dedicated law enforcement officers in the country. Their work has resulted in our district having one of the lowest crime rates in the nation.

I’m proud to stand with them and will always fight for policies that support law enforcement and keep our communities safe.

National Police Week may only last seven days, but the gratitude and respect we owe to our men and women in blue should echo every single day. Thank you to our heroes in uniform, and may we continue to support and protect them in their mission to safeguard us all.

Republican Elise Stefanik represents New York’s 21st District in Congress.

ℹ️ The U.S. is included as a reference point; removing it would make China the largest economy.

Figures are sourced from the Bureau of Economic Analysis(

ℹ️ The U.S. is included as a reference point; removing it would make China the largest economy.

Figures are sourced from the Bureau of Economic Analysis(

The German Federal Office for the Protection of the Constitution (BfV), the country’s powerful domestic spy agency, had labeled the AfD a “confirmed far-right organization” before suspending this designation last week. The main reason presented was that the AfD is appealing the designation in court and the agency would wait until this appeal is concluded to decide whether to keep the designation.

However, Germany’s ally, the United States, immediately criticized the designation in some of the harshest language possible, with Secretary of State Marco Rubio calling it “tyranny in disguise.” That was not all, though. U.S. Senator Tom Cotton, chairman of the powerful U.S. Senate Intelligence Committee, then asked Director of National Intelligence Tulsi Gabbard (DNI) to suspend intelligence cooperation between the United States and Germany.

According to Cotton, the German authorities’ politically motivated surveillance activities resemble methods used by dictatorships that are unbecoming of a democratic ally.

“Rather than trying to undermine the AfD using the tools of authoritarian states, Germany’s incoming government might be better advised to consider why the AfD continues to gain electoral ground,” he wrote.

I asked

The German Federal Office for the Protection of the Constitution (BfV), the country’s powerful domestic spy agency, had labeled the AfD a “confirmed far-right organization” before suspending this designation last week. The main reason presented was that the AfD is appealing the designation in court and the agency would wait until this appeal is concluded to decide whether to keep the designation.

However, Germany’s ally, the United States, immediately criticized the designation in some of the harshest language possible, with Secretary of State Marco Rubio calling it “tyranny in disguise.” That was not all, though. U.S. Senator Tom Cotton, chairman of the powerful U.S. Senate Intelligence Committee, then asked Director of National Intelligence Tulsi Gabbard (DNI) to suspend intelligence cooperation between the United States and Germany.

According to Cotton, the German authorities’ politically motivated surveillance activities resemble methods used by dictatorships that are unbecoming of a democratic ally.

“Rather than trying to undermine the AfD using the tools of authoritarian states, Germany’s incoming government might be better advised to consider why the AfD continues to gain electoral ground,” he wrote.

I asked

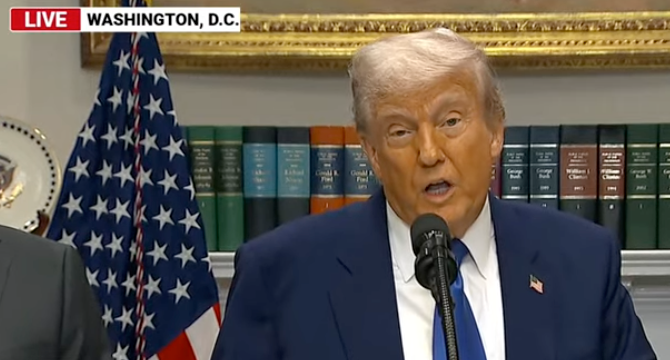

More headlines from Trump's press conference (courtesy of Bloomberg):

TRUMP: Total Reset With China

TRUMP: No Decoupling With China

TRUMP: Doesn’t Include Cars, Steel, Aluminum

TRUMP: Will Speak to Xi Maybe at End of Week

TRUMP: China Deal 'Not the Easiest Thing to Paper'

.

More headlines from Trump's press conference (courtesy of Bloomberg):

TRUMP: Total Reset With China

TRUMP: No Decoupling With China

TRUMP: Doesn’t Include Cars, Steel, Aluminum

TRUMP: Will Speak to Xi Maybe at End of Week

TRUMP: China Deal 'Not the Easiest Thing to Paper'

.

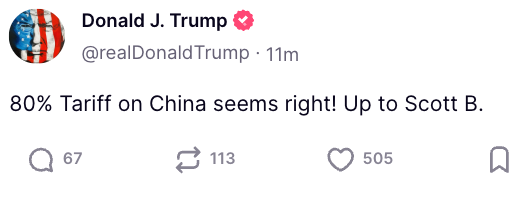

"In our view, equity markets are returning to where they would have moved to if Liberation Day had not happened and Trump had just applied the 10% universal tariff," said Roberto Scholtes, head of strategy at Singular Bank.

Scholtes noted, "Corporate fundamentals are healthy, first quarter results have substantially surprised on the upside, and there's plenty of cash to be invested."

"This deescalation is much more positive than anticipated (GSe: 54% U.S. on China tariffs and 34% China on U.S. tariffs) and the market is reacting as such. We are seeing a clear reversal in short USD positions as U.S. recession risks reduce (GSe was 45%!) and risk-on sentiment rises. DXY rallied over 1%, S&P futures surged 3%, 10y UST rose to 4.43%, gold tumbled ~3%," Goldman analyst Yichin Tsai told clients.

S&P 500 futures are up 3%, and Nasdaq futures are up 4%. European stocks are in the green.

"In our view, equity markets are returning to where they would have moved to if Liberation Day had not happened and Trump had just applied the 10% universal tariff," said Roberto Scholtes, head of strategy at Singular Bank.

Scholtes noted, "Corporate fundamentals are healthy, first quarter results have substantially surprised on the upside, and there's plenty of cash to be invested."

"This deescalation is much more positive than anticipated (GSe: 54% U.S. on China tariffs and 34% China on U.S. tariffs) and the market is reacting as such. We are seeing a clear reversal in short USD positions as U.S. recession risks reduce (GSe was 45%!) and risk-on sentiment rises. DXY rallied over 1%, S&P futures surged 3%, 10y UST rose to 4.43%, gold tumbled ~3%," Goldman analyst Yichin Tsai told clients.

S&P 500 futures are up 3%, and Nasdaq futures are up 4%. European stocks are in the green.

The move toward lower tariffs and easing trade tensions between the world's two largest economies follows Sunday's negotiations, during which both sides reported making "

The move toward lower tariffs and easing trade tensions between the world's two largest economies follows Sunday's negotiations, during which both sides reported making "

... an article written by CNN's Business and Politics correspondent,

... an article written by CNN's Business and Politics correspondent,

So up until this point we had stayed away from this idiotic discussion, which merely demonstrated how little understanding so-called experts actually have of a nuanced and complicated topic as trade and global commerce.

However, CNN's idiocy was the last straw.

But before we go there, a quick look at what has been really taking place.

First, regarding the claim that west coast ports have seen a sharp drop in inbound traffic, there certainly has been a modest decline in February and March inbound traffic, but a decline from a near-record print in January, which in turn was the result of inventory restocking ahead of what most retailers knew would be a trade war. After all, Trump had made it clear about a year ago that he had every intention of restarting trade war with the world, and especially China, and only someone watching CNN would be surprised by the recent sharp spike in tariffs, a move which incidentally was never meant to be permanent but was a strategy meant to inflict max pain and get trading partners to the negotiating table. In any case, the total inbound traffic to California ports shown below is hardly the apocalypse the liberal media has been making it out to be (and even Reuters discusses this in "

So up until this point we had stayed away from this idiotic discussion, which merely demonstrated how little understanding so-called experts actually have of a nuanced and complicated topic as trade and global commerce.

However, CNN's idiocy was the last straw.

But before we go there, a quick look at what has been really taking place.

First, regarding the claim that west coast ports have seen a sharp drop in inbound traffic, there certainly has been a modest decline in February and March inbound traffic, but a decline from a near-record print in January, which in turn was the result of inventory restocking ahead of what most retailers knew would be a trade war. After all, Trump had made it clear about a year ago that he had every intention of restarting trade war with the world, and especially China, and only someone watching CNN would be surprised by the recent sharp spike in tariffs, a move which incidentally was never meant to be permanent but was a strategy meant to inflict max pain and get trading partners to the negotiating table. In any case, the total inbound traffic to California ports shown below is hardly the apocalypse the liberal media has been making it out to be (and even Reuters discusses this in " Then, addressing the topic of imminent product shortages, this was another fake news narrative meant to spark panic and chaos, and resulting in just the outcome the media was "warning" about. Because if it hurts Trump, it's great for MSNBC and CNN... and of course China, which begs the question: just how much "ad dollars" and/or sponsorship have these media outlets received from Beijing and Chinese companies in recent months. As the following charts from Deutsche Bank demonstrate clearly, what has been taking place in recent months - and why we are now seeing the reverse - is record prebuying and excess imports...

Then, addressing the topic of imminent product shortages, this was another fake news narrative meant to spark panic and chaos, and resulting in just the outcome the media was "warning" about. Because if it hurts Trump, it's great for MSNBC and CNN... and of course China, which begs the question: just how much "ad dollars" and/or sponsorship have these media outlets received from Beijing and Chinese companies in recent months. As the following charts from Deutsche Bank demonstrate clearly, what has been taking place in recent months - and why we are now seeing the reverse - is record prebuying and excess imports...

... which according to Deutsche Bank has led to precisely the opposite outcome than the one MSNBC and CNN have been blasting: there is excess inventory in the supply channel, enough in fact to last weeks if not months, assuming a full-blown collapse in global trade, which of course would never happen absent a covid-like shock.

... which according to Deutsche Bank has led to precisely the opposite outcome than the one MSNBC and CNN have been blasting: there is excess inventory in the supply channel, enough in fact to last weeks if not months, assuming a full-blown collapse in global trade, which of course would never happen absent a covid-like shock.

Additionally, if and when retailers end up liquidating these billions in excess inventories they have accumulated just for this contingency, the outcome would be wildly deflationary, and hardly the inflationary shock so many "experts" predict (that's the topic of another post, and we'll get to it eventually).

Going back to the media's favorite topic of dropping cargoes from China, it wasn't just us that countered the popular narrative: so did Standard Chartered's Steve Englander who wrote last week that "the lurid headlines on the drop in cargoes from China may be misleading."

That's because as we noted above, the volume of laden cargo now being shipped from China to the US is down almost 50% versus mid-April 2025, but the mid-April level was very high, and while you will never hear this on CNN, the current level is about on a par with much of 2023. In fact, Englander said that "the current pace as the low end of normal over the last couple of years." Only again, hardly the apocalypse Kevin Plank's favorite media body

Additionally, if and when retailers end up liquidating these billions in excess inventories they have accumulated just for this contingency, the outcome would be wildly deflationary, and hardly the inflationary shock so many "experts" predict (that's the topic of another post, and we'll get to it eventually).

Going back to the media's favorite topic of dropping cargoes from China, it wasn't just us that countered the popular narrative: so did Standard Chartered's Steve Englander who wrote last week that "the lurid headlines on the drop in cargoes from China may be misleading."

That's because as we noted above, the volume of laden cargo now being shipped from China to the US is down almost 50% versus mid-April 2025, but the mid-April level was very high, and while you will never hear this on CNN, the current level is about on a par with much of 2023. In fact, Englander said that "the current pace as the low end of normal over the last couple of years." Only again, hardly the apocalypse Kevin Plank's favorite media body  There's more: another thing you would never hear on MSNBC or CNN is that if the early-May pace of shipping to the US is maintained though end-June, the cumulative amount shipped in H1-2025 would be 18% higher than in H1-2023 and only 5% lower than in H1-2024. So far this year, the tonnage shipped to the US is 40% higher than in 2023 and 9% higher than in 2024. Indeed, as noted above, and as Englander observes, "US importers may have an inventory buffer until tariffs are negotiated downwards."

There's more: another thing you would never hear on MSNBC or CNN is that if the early-May pace of shipping to the US is maintained though end-June, the cumulative amount shipped in H1-2025 would be 18% higher than in H1-2023 and only 5% lower than in H1-2024. So far this year, the tonnage shipped to the US is 40% higher than in 2023 and 9% higher than in 2024. Indeed, as noted above, and as Englander observes, "US importers may have an inventory buffer until tariffs are negotiated downwards."

Taking a step back, if only for the benefit of our CNN and MSNBC readers, the big picture is one that even if the US were to lose all Chinese imports - an outcome which nobody anticipates as it would destroy China's economy as Reuters admitted last week - the outcome to the US would hardly be devastating. Yes, prices would rise, but overall the US would be able to handle it. Here, again, is Englander explaining why:

US imports from China are about 1.6% of US GDP in value terms. If inbound cargo stays at early-May levels, then H2-2025 imports will be 85% of 2023 levels (in volume terms) and 67% of 2024 levels. So the import volume shock would be 0.25% of GDP relative to 2023 and 0.5% relative to 2024. And keep in mind that there may be substitution from elsewhere. There may be temporary delays as US importers figure out the practicalities of dealing with the new tariffs, and shipping may be down temporarily because importers stocked up ahead of tariff implementation.

There is little precedent for this kind of tariff shock, but our judgement is that the US economy can handle it. We agree that disruption is likely from tariffs and that any benefits are uncertain, but we don’t think that the US economy will fall off a precipice because of a shock of this magnitude.

Remarkably, none of the so-called experts predicting doom and gloom in recent days spent even a minute to consider this eventuality. Which is also why the left's attempt to spark widespread panic by focusing on Chinese imports had largely been a dud... and why it forced the media to escalate its claims to ever more ludicrous proportions, until we got the CNN story that there were "zero ships from China are bound for California's top ports."

And this is where we drew the line because it takes about a 10 second google search on any of the marine tracking websites such as

Taking a step back, if only for the benefit of our CNN and MSNBC readers, the big picture is one that even if the US were to lose all Chinese imports - an outcome which nobody anticipates as it would destroy China's economy as Reuters admitted last week - the outcome to the US would hardly be devastating. Yes, prices would rise, but overall the US would be able to handle it. Here, again, is Englander explaining why:

US imports from China are about 1.6% of US GDP in value terms. If inbound cargo stays at early-May levels, then H2-2025 imports will be 85% of 2023 levels (in volume terms) and 67% of 2024 levels. So the import volume shock would be 0.25% of GDP relative to 2023 and 0.5% relative to 2024. And keep in mind that there may be substitution from elsewhere. There may be temporary delays as US importers figure out the practicalities of dealing with the new tariffs, and shipping may be down temporarily because importers stocked up ahead of tariff implementation.

There is little precedent for this kind of tariff shock, but our judgement is that the US economy can handle it. We agree that disruption is likely from tariffs and that any benefits are uncertain, but we don’t think that the US economy will fall off a precipice because of a shock of this magnitude.

Remarkably, none of the so-called experts predicting doom and gloom in recent days spent even a minute to consider this eventuality. Which is also why the left's attempt to spark widespread panic by focusing on Chinese imports had largely been a dud... and why it forced the media to escalate its claims to ever more ludicrous proportions, until we got the CNN story that there were "zero ships from China are bound for California's top ports."

And this is where we drew the line because it takes about a 10 second google search on any of the marine tracking websites such as  According to Bloomberg, there are no less than 52 cargo ships currently sailing from China to California and the West Coast, with the full list shown below.

According to Bloomberg, there are no less than 52 cargo ships currently sailing from China to California and the West Coast, with the full list shown below.

It goes without saying that 52 is quite different from the zero ships headed to the US, as

It goes without saying that 52 is quite different from the zero ships headed to the US, as  And another way of showing it: here is the total number of container ships sailing from China to the US (in TEUs). The number on May 11 is higher than where it was in 2024 and the same as May 2023. But you won't hear any of that on CNN.

And another way of showing it: here is the total number of container ships sailing from China to the US (in TEUs). The number on May 11 is higher than where it was in 2024 and the same as May 2023. But you won't hear any of that on CNN.

Instead, this is what you will hear on CNN:

"On Friday morning, West Coast port officials told CNN about a startling sight: Not a single cargo vessel had left China with goods for the two major West Coast ports in the past 12 hours. That hasn’t happened since the pandemic."

Only this attempt to spark panic (while evoking the covid pandemic for obvious reasons) is also dead wrong: first, consider that there are currently 52 ships transiting the Pacific from China to SoCal, in line with historic numbers: the trip takes 20 days which means 2.6 ships sailing each day or one ship every 9 to 10 hours. So a 12 hour period is not unusual. And, as Sal Mercogliano points out, while no ships may have set sail for California on Friday, a quick look at Marine Traffic shows that three ships - Cosco Africa, Ever Safety and Ever Mild - are all leaving China for SoCal this weekend. So much for that "startling sight."

6/The story said 41 ships were scheduled to sail, but on Friday it was zero. This does not mean the 41 are not sailing. A quick look

Instead, this is what you will hear on CNN:

"On Friday morning, West Coast port officials told CNN about a startling sight: Not a single cargo vessel had left China with goods for the two major West Coast ports in the past 12 hours. That hasn’t happened since the pandemic."

Only this attempt to spark panic (while evoking the covid pandemic for obvious reasons) is also dead wrong: first, consider that there are currently 52 ships transiting the Pacific from China to SoCal, in line with historic numbers: the trip takes 20 days which means 2.6 ships sailing each day or one ship every 9 to 10 hours. So a 12 hour period is not unusual. And, as Sal Mercogliano points out, while no ships may have set sail for California on Friday, a quick look at Marine Traffic shows that three ships - Cosco Africa, Ever Safety and Ever Mild - are all leaving China for SoCal this weekend. So much for that "startling sight."

6/The story said 41 ships were scheduled to sail, but on Friday it was zero. This does not mean the 41 are not sailing. A quick look

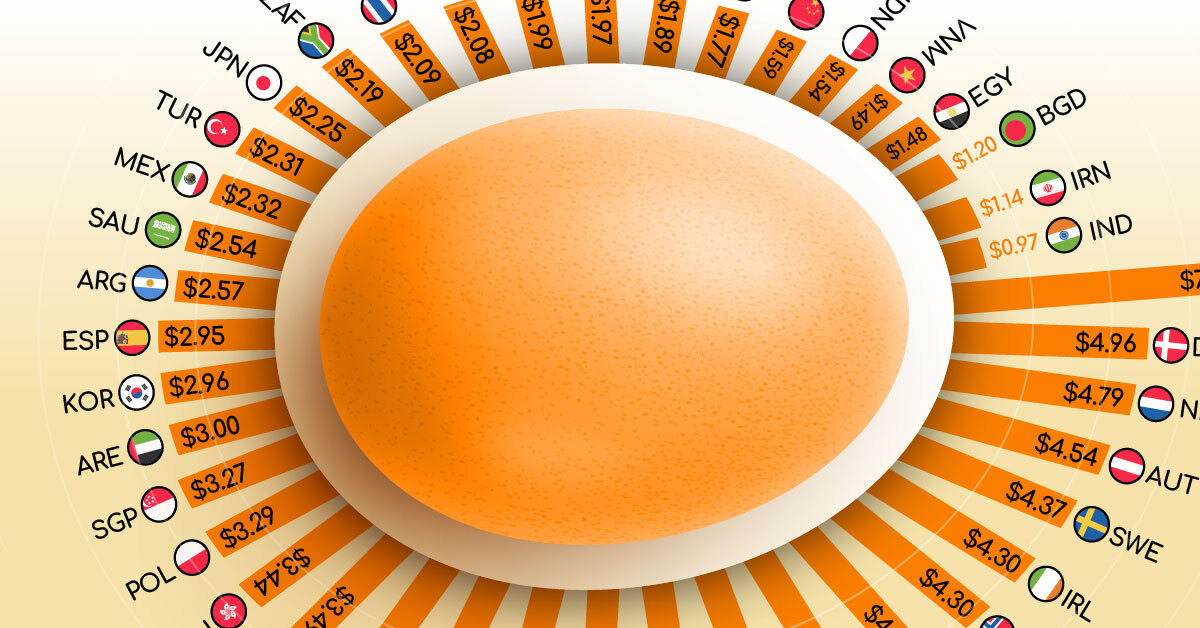

Switzerland Tops the List

Switzerland tops the global chart, with consumers paying an average of $7.31 per dozen eggs—the highest price globally and nearly double what shoppers pay in neighboring Italy.

On the other hand, India offers the lowest egg prices, with a dozen costing just $0.97, reflecting broader affordability in emerging markets.

Rank

Country

Price (USD)

🥇 1

🇨🇭 Switzerland

$7.27

🥈 2

🇳🇿 New Zealand

$6.40

🥉 3

🇮🇸 Iceland

$6.23

4

🇧🇧 Barbados

$5.39

5

🇩🇰 Denmark

$4.93

6

🇱🇺 Luxembourg

$4.91

7

🇳🇱 Netherlands

$4.76

8

🇦🇹 Austria

$4.54

9

🇬🇷 Greece

$4.39

10

🇸🇪 Sweden

$4.34

11

🇳🇴 Norway

$4.32

12

🇦🇺 Australia

$4.27

13

🇺🇸 United States

$4.25

14

🇫🇷 France

$4.22

15

🇹🇹 Trinidad & Tobago

$4.20

16

🇮🇪 Ireland

$4.20

17

🇺🇾 Uruguay

$4.17

18

🇨🇾 Cyprus

$4.17

19

🇮🇱 Israel

$4.03

20

🇬🇧 United Kingdom

$3.94

21

🇧🇪 Belgium

$3.93

22

🇮🇹 Italy

$3.93

23

🇩🇪 Germany

$3.77

24

🇸🇮 Slovenia

$3.69

25

🇸🇰 Slovakia

$3.68

26

🇭🇷 Croatia

$3.63

27

🇲🇹 Malta

$3.63

28

🇨🇱 Chile

$3.59

29

🇦🇱 Albania

$3.58

30

🇨🇦 Canada

$3.50

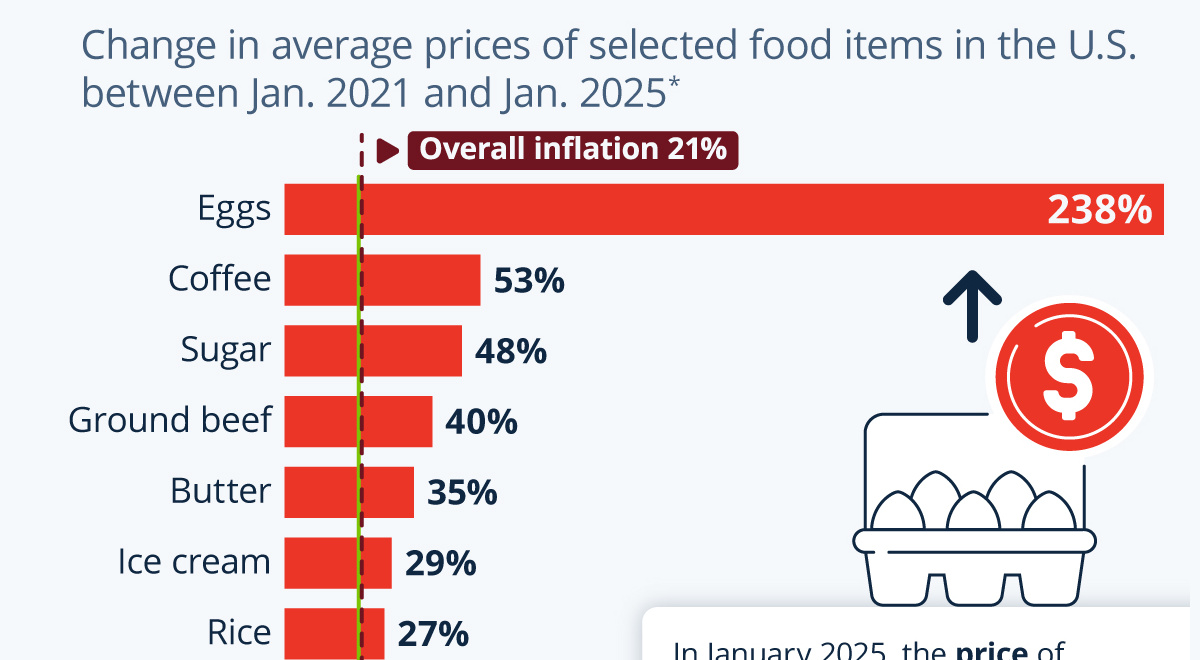

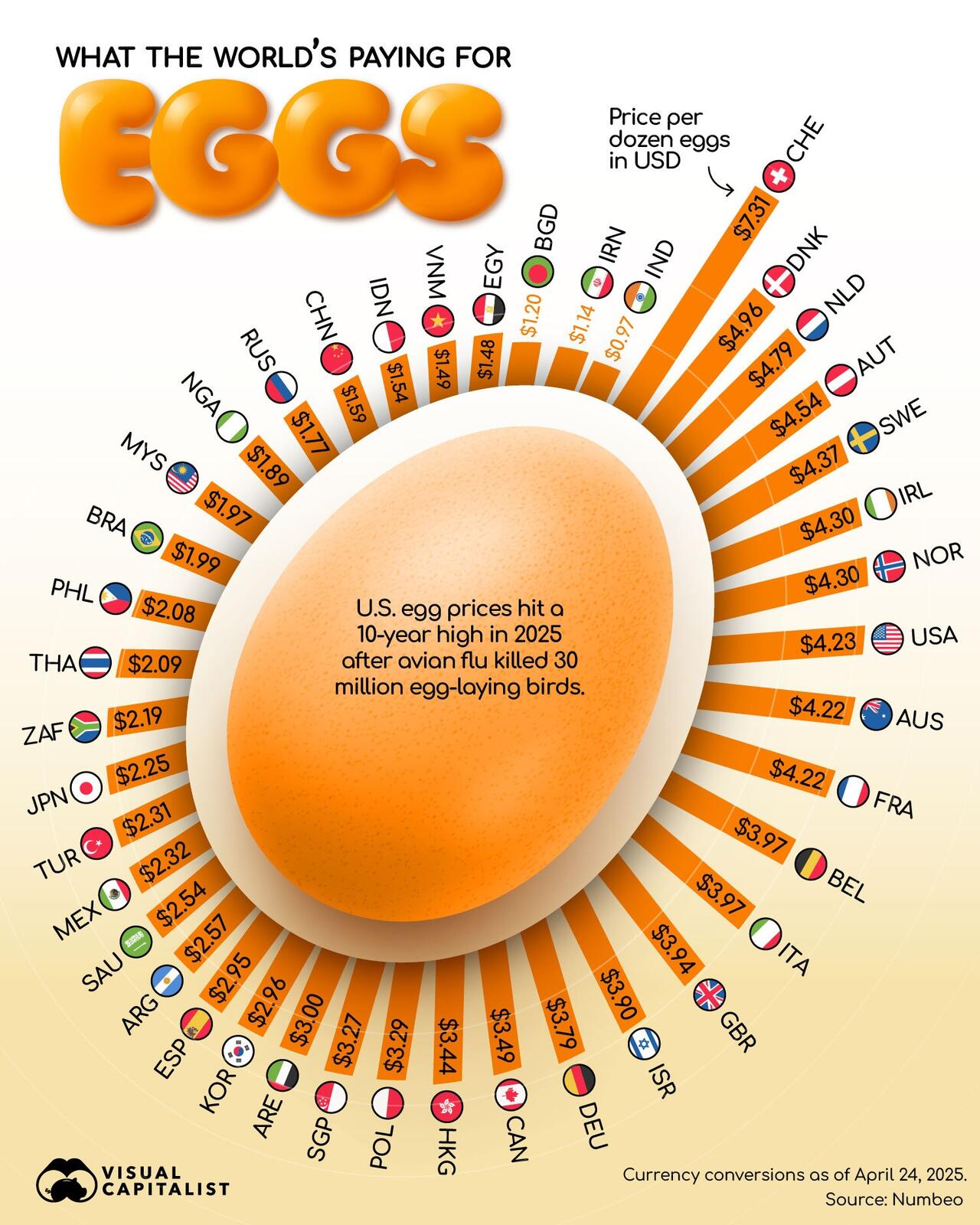

U.S. Prices Rise Amid Shortages and Policy Shifts

Egg prices in the United States climbed sharply through the end of the Biden administration (topping $8 per dozen), thanks to a combination of avian flu outbreaks, and supply chain disruptions drove costs higher, surpassing prices in many European nations and Canada.

The last few weeks, since President Trump took over, egg prices have tumbled back below $4 per dozen...

Switzerland Tops the List

Switzerland tops the global chart, with consumers paying an average of $7.31 per dozen eggs—the highest price globally and nearly double what shoppers pay in neighboring Italy.

On the other hand, India offers the lowest egg prices, with a dozen costing just $0.97, reflecting broader affordability in emerging markets.

Rank

Country

Price (USD)

🥇 1

🇨🇭 Switzerland

$7.27

🥈 2

🇳🇿 New Zealand

$6.40

🥉 3

🇮🇸 Iceland

$6.23

4

🇧🇧 Barbados

$5.39

5

🇩🇰 Denmark

$4.93

6

🇱🇺 Luxembourg

$4.91

7

🇳🇱 Netherlands

$4.76

8

🇦🇹 Austria

$4.54

9

🇬🇷 Greece

$4.39

10

🇸🇪 Sweden

$4.34

11

🇳🇴 Norway

$4.32

12

🇦🇺 Australia

$4.27

13

🇺🇸 United States

$4.25

14

🇫🇷 France

$4.22

15

🇹🇹 Trinidad & Tobago

$4.20

16

🇮🇪 Ireland

$4.20

17

🇺🇾 Uruguay

$4.17

18

🇨🇾 Cyprus

$4.17

19

🇮🇱 Israel

$4.03

20

🇬🇧 United Kingdom

$3.94

21

🇧🇪 Belgium

$3.93

22

🇮🇹 Italy

$3.93

23

🇩🇪 Germany

$3.77

24

🇸🇮 Slovenia

$3.69

25

🇸🇰 Slovakia

$3.68

26

🇭🇷 Croatia

$3.63

27

🇲🇹 Malta

$3.63

28

🇨🇱 Chile

$3.59

29

🇦🇱 Albania

$3.58

30

🇨🇦 Canada

$3.50

U.S. Prices Rise Amid Shortages and Policy Shifts

Egg prices in the United States climbed sharply through the end of the Biden administration (topping $8 per dozen), thanks to a combination of avian flu outbreaks, and supply chain disruptions drove costs higher, surpassing prices in many European nations and Canada.

The last few weeks, since President Trump took over, egg prices have tumbled back below $4 per dozen...

Emerging Markets Offer Relative Bargains

Despite global inflation, several emerging markets remain egg-price havens. In Brazil, Russia, and China, consumers pay under $2 per dozen, making eggs a highly accessible protein source for large populations.

To learn more about food prices, check out this

Emerging Markets Offer Relative Bargains

Despite global inflation, several emerging markets remain egg-price havens. In Brazil, Russia, and China, consumers pay under $2 per dozen, making eggs a highly accessible protein source for large populations.

To learn more about food prices, check out this

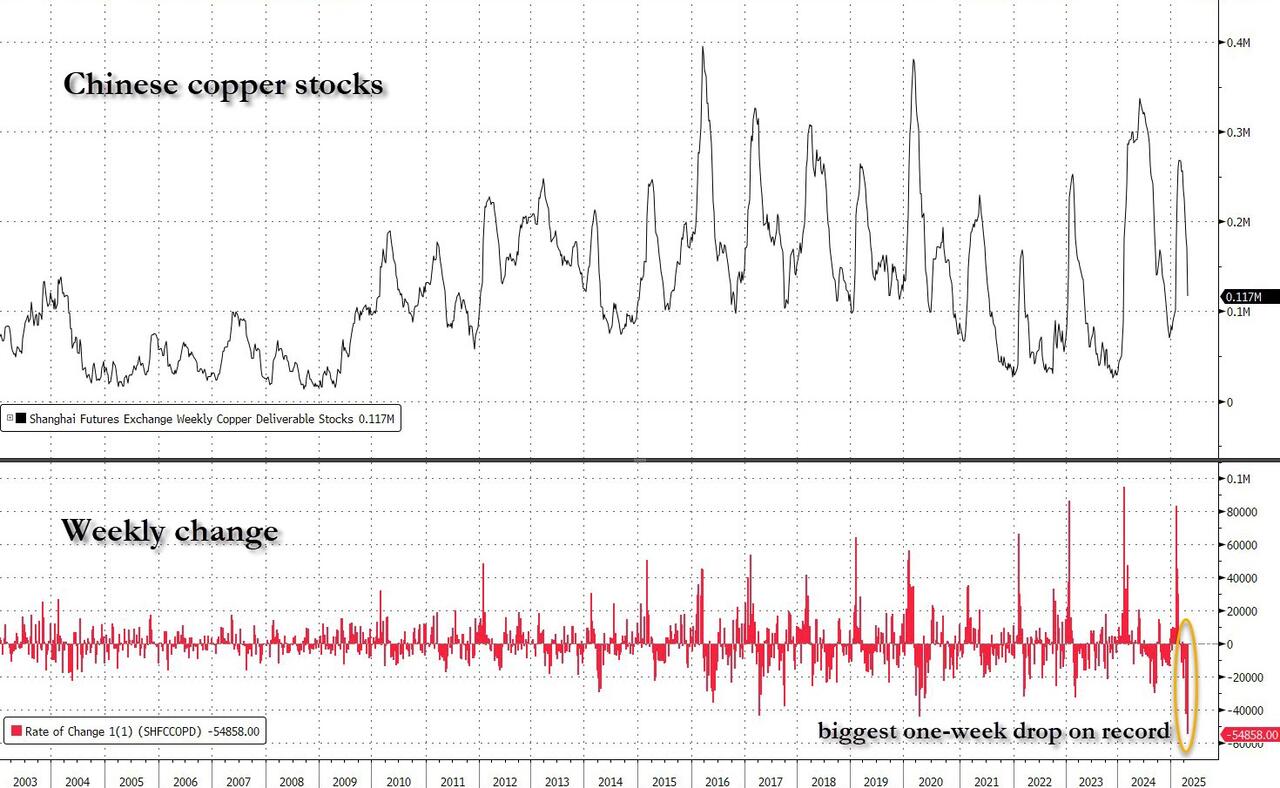

This “is potentially going to be one of the greatest tightening shocks this market’s ever seen”, Snowdon said. Beijing had a “razor thin inventory buffer” to meet domestic demand, he added.

Ironically, copper prices tumbled after Liberation Day to the lowest level in over a year, only to surge again as copper demand in China proved remarkably resilient despite headwinds from the US-led trade war and the nation’s property crisis, with buyers taking advantage of price slumps to snap up supplies.

“The copper market remains in a tight balance, despite macro-economic difficulties,” Xiao Qianjun, vice general manager of trade business at Jiangxi Copper, a top smelter, told an industry conference this week. After prices fell recently, “spot orders from fabricators exploded,” Xiao said.

At the same time, there is growing speculation Beijing may ramp up stimulus to support the world’s second-largest economy - and especially the copper-intensive housing market - to counter more challenging overseas conditions as Trump imposes punishing tariffs, while also holding out the promise of talks and a deal.

“Demand in the spot market, from surveys of downstream users or apparent consumption, are all very good,” Angela Bi, head of Asian metals and mineral research at Mercuria said at a conference, held by Shanghai Metals Market in Nanchang, Jiangxi. Indicators “are too good to be true,” Bi added.

Meanwhile, the Yangshan premium - a gauge of import demand - recently hit the highest since 2023. And local yuan-priced futures are steeply backwardated, a bullish pattern that points to near-term tightness.

The problem is that besides soaring domestic Chinese demand, there is also massive demand for physical copper from the US. Mercuria's head of metals and mining, Kostas Bintas, said the US was for the “first time” competing with China for supplies of copper, which was likely to supercharge prices. The impact of US protectionism on the copper market adds to pressure from Chinese domestic demand and retaliatory levies that could hit vital flows of copper scrap.

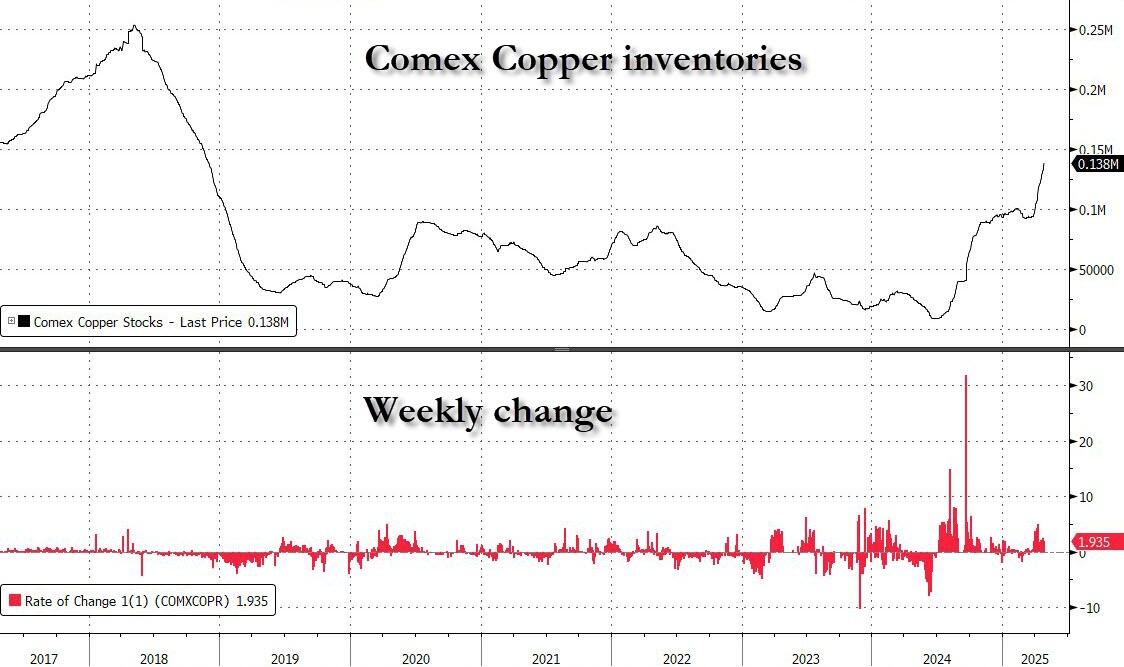

Similar to the frenzied record deliveries of physical gold to Comex, metal traders have been importing massive amounts of copper into the US ahead of possible tariffs, which could result from an investigation initiated by US President Donald Trump into alleged “dumping and state sponsored overproduction” of the metal. He has already imposed a 25% levy on aluminium and steel imports.

And just like gold, copper stocks in Comex warehouses in the US have soared this month to their highest level on Friday since 2018.

This “is potentially going to be one of the greatest tightening shocks this market’s ever seen”, Snowdon said. Beijing had a “razor thin inventory buffer” to meet domestic demand, he added.

Ironically, copper prices tumbled after Liberation Day to the lowest level in over a year, only to surge again as copper demand in China proved remarkably resilient despite headwinds from the US-led trade war and the nation’s property crisis, with buyers taking advantage of price slumps to snap up supplies.

“The copper market remains in a tight balance, despite macro-economic difficulties,” Xiao Qianjun, vice general manager of trade business at Jiangxi Copper, a top smelter, told an industry conference this week. After prices fell recently, “spot orders from fabricators exploded,” Xiao said.

At the same time, there is growing speculation Beijing may ramp up stimulus to support the world’s second-largest economy - and especially the copper-intensive housing market - to counter more challenging overseas conditions as Trump imposes punishing tariffs, while also holding out the promise of talks and a deal.

“Demand in the spot market, from surveys of downstream users or apparent consumption, are all very good,” Angela Bi, head of Asian metals and mineral research at Mercuria said at a conference, held by Shanghai Metals Market in Nanchang, Jiangxi. Indicators “are too good to be true,” Bi added.

Meanwhile, the Yangshan premium - a gauge of import demand - recently hit the highest since 2023. And local yuan-priced futures are steeply backwardated, a bullish pattern that points to near-term tightness.

The problem is that besides soaring domestic Chinese demand, there is also massive demand for physical copper from the US. Mercuria's head of metals and mining, Kostas Bintas, said the US was for the “first time” competing with China for supplies of copper, which was likely to supercharge prices. The impact of US protectionism on the copper market adds to pressure from Chinese domestic demand and retaliatory levies that could hit vital flows of copper scrap.

Similar to the frenzied record deliveries of physical gold to Comex, metal traders have been importing massive amounts of copper into the US ahead of possible tariffs, which could result from an investigation initiated by US President Donald Trump into alleged “dumping and state sponsored overproduction” of the metal. He has already imposed a 25% levy on aluminium and steel imports.

And just like gold, copper stocks in Comex warehouses in the US have soared this month to their highest level on Friday since 2018.

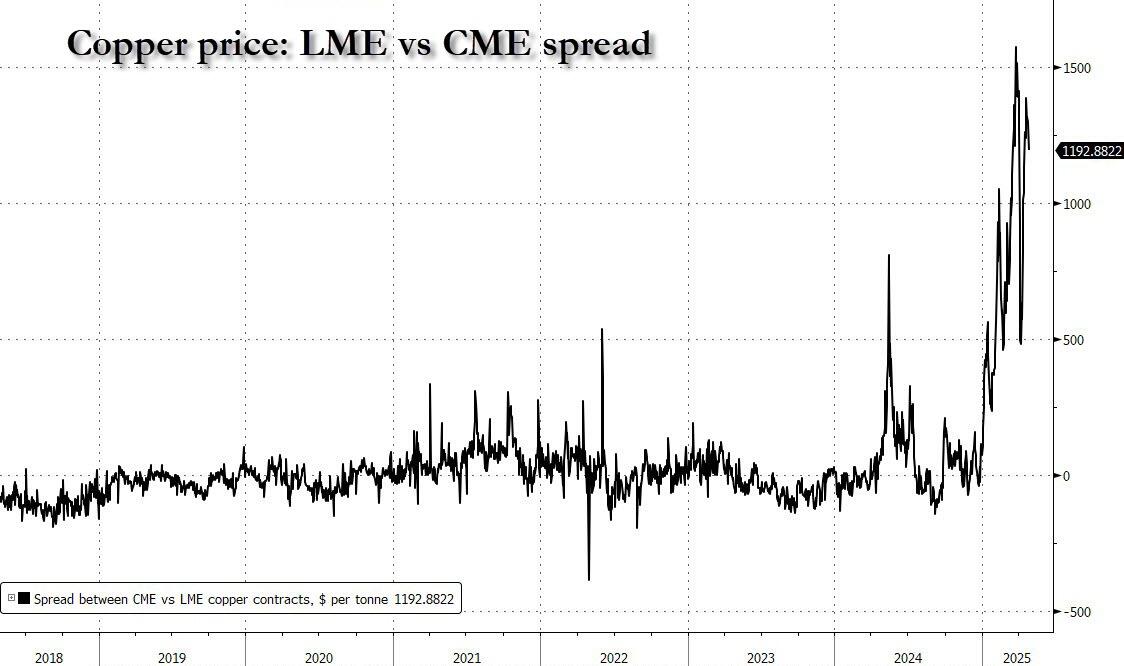

Helping drive supplies to the US is the same arbitrage observed in late 2024 in the gold market, one created by investors' fear of tariffs, among others. This has pushed up sharply the price of the metal on New York’s Comex exchange in comparison with prices on London’s London Metal Exchange.

This spread has created an unprecedented arb for traders who buy copper futures contracts in London and sell contracts in New York. The spread stood at nearly $1,200 per tonne on Monday, having risen above $1,600 in March, well above its long-term average of roughly $0.

Helping drive supplies to the US is the same arbitrage observed in late 2024 in the gold market, one created by investors' fear of tariffs, among others. This has pushed up sharply the price of the metal on New York’s Comex exchange in comparison with prices on London’s London Metal Exchange.

This spread has created an unprecedented arb for traders who buy copper futures contracts in London and sell contracts in New York. The spread stood at nearly $1,200 per tonne on Monday, having risen above $1,600 in March, well above its long-term average of roughly $0.

The arb has been so popular, a potential short squeeze is emerging: as the FT reports, "some traders who had large commitments to sell copper on Comex have been urgently trying to get their hands on additional tonnes into the US to cover those short positions before any new tariffs were introduced, said Bintas." Which explains the panic scramble of physical out of China and into the US... because if they don't "get their hands on additional tonnes", the price of copper could go vertical.

There could be even more chaos: retaliatory tariffs imposed by China on US imports could also hit the crucial copper scrap market, analysts said, adding to the tightness in the Chinese market.

That could worsen if the US imposes a ban on the export of copper scrap, of which it is a big exporter. It shipped 960,000 tonnes in 2024, with almost half going to China, according to commodity pricing agency Fastmarkets.

In January and February, the latest data available, the US exported 142,000 tonnes in total, compared with 149,000 during the same period last year. That number could quickly hit zero if Washington decided to impose an embargo on the commodity to hammer Beijing, which urgently needs copper to develop everything from electrical infrastructure, to AI data centers, to ghost cities.

Sure enough, Andrew Cole, a metals analyst at Fastmarkets, said he expected “a significant plunge in scrap shipments from the US to China in March to May at the very least.

“That’s what will lead to the escalation of supply squeeze in China we have been expecting to develop as the year progresses,” he said.

“Imported copper scrap stockpiles in China have dropped significantly,” said Mercuria's Bi

However, while Chinese stocks were being depleted, in reality markets would react before stocks reached zero, with higher prices attracting more imports of copper and scrap, said Snowdon.

“That comes at the point of record pull of copper units into the US. As those two forces meet that creates an unprecedented competition for copper,” he said.

The arb has been so popular, a potential short squeeze is emerging: as the FT reports, "some traders who had large commitments to sell copper on Comex have been urgently trying to get their hands on additional tonnes into the US to cover those short positions before any new tariffs were introduced, said Bintas." Which explains the panic scramble of physical out of China and into the US... because if they don't "get their hands on additional tonnes", the price of copper could go vertical.

There could be even more chaos: retaliatory tariffs imposed by China on US imports could also hit the crucial copper scrap market, analysts said, adding to the tightness in the Chinese market.

That could worsen if the US imposes a ban on the export of copper scrap, of which it is a big exporter. It shipped 960,000 tonnes in 2024, with almost half going to China, according to commodity pricing agency Fastmarkets.

In January and February, the latest data available, the US exported 142,000 tonnes in total, compared with 149,000 during the same period last year. That number could quickly hit zero if Washington decided to impose an embargo on the commodity to hammer Beijing, which urgently needs copper to develop everything from electrical infrastructure, to AI data centers, to ghost cities.

Sure enough, Andrew Cole, a metals analyst at Fastmarkets, said he expected “a significant plunge in scrap shipments from the US to China in March to May at the very least.

“That’s what will lead to the escalation of supply squeeze in China we have been expecting to develop as the year progresses,” he said.

“Imported copper scrap stockpiles in China have dropped significantly,” said Mercuria's Bi

However, while Chinese stocks were being depleted, in reality markets would react before stocks reached zero, with higher prices attracting more imports of copper and scrap, said Snowdon.

“That comes at the point of record pull of copper units into the US. As those two forces meet that creates an unprecedented competition for copper,” he said.

The Orange County Register reported last month that Orange County will lose out on

The Orange County Register reported last month that Orange County will lose out on