Aimed At Pressuring Big Pharma; Goldman Says Trump's Drug Exec. Order "Symbolic, Not Substantial"

Aimed At Pressuring Big Pharma; Goldman Says Trump's Drug Exec. Order "Symbolic, Not Substantial"

On Monday, President Donald Trump signed the

(MFN) Executive Order on drug pricing, aiming to pressure the pharmaceutical industry to lower prices by linking them to those paid in other developed countries. The order directs the Department of Health and Human Services (HHS) to communicate these international price benchmarks to drug manufacturers. If significant progress isn't achieved within several months, HHS is instructed to initiate a rulemaking process to enforce MFN-based pricing.

Following the MFN EO on drug pricing, Goldman analysts Asad Haider and team noted that stocks most exposed to the EO—such as Regeneron and Merck—rallied sharply, as both the text of the order and the subsequent press briefing alleviated worst-case fears priced into pharma stocks.

According to Goldman's political economist Alec Phillips, the EO appears more designed to increase the Trump administration's negotiation leverage than to implement sweeping reforms immediately. The analyst expects the HHS to impose MFN-based pricing if no "significant progress" is made within several months.

The EO's language is legally cautious. It repeatedly cites the need to act "consistent with law" and lacks clarity on scope—such as whether it applies to Medicare Part B, D, or both.

"Overall, while the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions, our political economist notes that the process appears to be in early stages and does not expect near-term implementation of the measures contemplated in the EO," Haider told clients on Tuesday.

Haider continued, "Our net takeaway is that while the EO removes a potential worst-case scenario, we expect drug pricing to remain a focus and note that clarity across other policy, regulatory, and tariff-related vectors is needed for large-cap biopharma to see a sustained recovery."

Here's Alec Phillips' first-take

President Trump's executive order (EO) on "most favored nation" (MFN) drug pricing could lead to discussions with pharmaceutical companies regarding potential price concessions but does not look likely to lead to substantial near-term policy changes. It orders the Dept. of Health and Human Services (HHS) to communicate price targets to pharmaceutical manufacturers based on prices paid in other developed economies. If "significant progress" has not been achieved on drug pricing after an unspecified period of time—we would expect the White House to give the industry at least several months—the order instructs HHS to propose a "rulemaking plan" to impose MFN pricing. The EO is unclear on whether this would apply only to drugs covered under Medicare and, if so, whether it would apply to all drugs and whether it would apply to Medicare Part B, D or both. In the event "significant progress" is not made, the EO also instructs: (1) HHS to certify safety of drug reimportation, (2) FTC and DOJ to take enforcement action against anti-competitive practices, (3) the Dept. of Commerce to "review and consider" exports of pharmaceuticals, and (4) FDA to "review and potentially modify or revoke" drug approvals. The order also instructs US Trade Representative to guard against "unreasonable or discriminatory" practices in other countries that raise prices in the US, including foreign price controls, and tells HHS to "consider" a program to sell direct to consumer at MFN prices.

Overall, the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions. That said, this process appears to be in early stages and we would not expect near-term implementation of any of the measures contemplated in the EO. Later this year, the main question will be whether the administration has authority to implement these kinds of changes unilaterally. With regard to Medicare, the administration has authority to negotiate discounts on 15 drugs this year under the Inflation Reduction Act (IRA), and could potentially pursue broader price concessions as part of a CMMI demonstration. However, Medicaid pricing (rebates) is set in statute, and the administration has limited ability to constrain prices in the private market. In theory, Congress could affect these areas, but for now neither looks likely to be included in the House's budget reconciliation package.

Overall, analysts view the EO as primarily a negotiation tool rather than a blueprint for immediate reform. The goal is to bring big pharma to the table to negotiate lower drug prices, allowing the Trump administration to advance its price reduction agenda.

Tue, 05/13/2025 - 12:25

According to Goldman's political economist Alec Phillips, the EO appears more designed to increase the Trump administration's negotiation leverage than to implement sweeping reforms immediately. The analyst expects the HHS to impose MFN-based pricing if no "significant progress" is made within several months.

The EO's language is legally cautious. It repeatedly cites the need to act "consistent with law" and lacks clarity on scope—such as whether it applies to Medicare Part B, D, or both.

"Overall, while the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions, our political economist notes that the process appears to be in early stages and does not expect near-term implementation of the measures contemplated in the EO," Haider told clients on Tuesday.

Haider continued, "Our net takeaway is that while the EO removes a potential worst-case scenario, we expect drug pricing to remain a focus and note that clarity across other policy, regulatory, and tariff-related vectors is needed for large-cap biopharma to see a sustained recovery."

Here's Alec Phillips' first-take

President Trump's executive order (EO) on "most favored nation" (MFN) drug pricing could lead to discussions with pharmaceutical companies regarding potential price concessions but does not look likely to lead to substantial near-term policy changes. It orders the Dept. of Health and Human Services (HHS) to communicate price targets to pharmaceutical manufacturers based on prices paid in other developed economies. If "significant progress" has not been achieved on drug pricing after an unspecified period of time—we would expect the White House to give the industry at least several months—the order instructs HHS to propose a "rulemaking plan" to impose MFN pricing. The EO is unclear on whether this would apply only to drugs covered under Medicare and, if so, whether it would apply to all drugs and whether it would apply to Medicare Part B, D or both. In the event "significant progress" is not made, the EO also instructs: (1) HHS to certify safety of drug reimportation, (2) FTC and DOJ to take enforcement action against anti-competitive practices, (3) the Dept. of Commerce to "review and consider" exports of pharmaceuticals, and (4) FDA to "review and potentially modify or revoke" drug approvals. The order also instructs US Trade Representative to guard against "unreasonable or discriminatory" practices in other countries that raise prices in the US, including foreign price controls, and tells HHS to "consider" a program to sell direct to consumer at MFN prices.

Overall, the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions. That said, this process appears to be in early stages and we would not expect near-term implementation of any of the measures contemplated in the EO. Later this year, the main question will be whether the administration has authority to implement these kinds of changes unilaterally. With regard to Medicare, the administration has authority to negotiate discounts on 15 drugs this year under the Inflation Reduction Act (IRA), and could potentially pursue broader price concessions as part of a CMMI demonstration. However, Medicaid pricing (rebates) is set in statute, and the administration has limited ability to constrain prices in the private market. In theory, Congress could affect these areas, but for now neither looks likely to be included in the House's budget reconciliation package.

Overall, analysts view the EO as primarily a negotiation tool rather than a blueprint for immediate reform. The goal is to bring big pharma to the table to negotiate lower drug prices, allowing the Trump administration to advance its price reduction agenda.

Tue, 05/13/2025 - 12:25

Trump Targets Big Pharma: Slashes Drug Prices With 'Most Favored Nation' Rule, Aims To Cut Out Middlemen | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

According to Goldman's political economist Alec Phillips, the EO appears more designed to increase the Trump administration's negotiation leverage than to implement sweeping reforms immediately. The analyst expects the HHS to impose MFN-based pricing if no "significant progress" is made within several months.

The EO's language is legally cautious. It repeatedly cites the need to act "consistent with law" and lacks clarity on scope—such as whether it applies to Medicare Part B, D, or both.

"Overall, while the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions, our political economist notes that the process appears to be in early stages and does not expect near-term implementation of the measures contemplated in the EO," Haider told clients on Tuesday.

Haider continued, "Our net takeaway is that while the EO removes a potential worst-case scenario, we expect drug pricing to remain a focus and note that clarity across other policy, regulatory, and tariff-related vectors is needed for large-cap biopharma to see a sustained recovery."

Here's Alec Phillips' first-take

President Trump's executive order (EO) on "most favored nation" (MFN) drug pricing could lead to discussions with pharmaceutical companies regarding potential price concessions but does not look likely to lead to substantial near-term policy changes. It orders the Dept. of Health and Human Services (HHS) to communicate price targets to pharmaceutical manufacturers based on prices paid in other developed economies. If "significant progress" has not been achieved on drug pricing after an unspecified period of time—we would expect the White House to give the industry at least several months—the order instructs HHS to propose a "rulemaking plan" to impose MFN pricing. The EO is unclear on whether this would apply only to drugs covered under Medicare and, if so, whether it would apply to all drugs and whether it would apply to Medicare Part B, D or both. In the event "significant progress" is not made, the EO also instructs: (1) HHS to certify safety of drug reimportation, (2) FTC and DOJ to take enforcement action against anti-competitive practices, (3) the Dept. of Commerce to "review and consider" exports of pharmaceuticals, and (4) FDA to "review and potentially modify or revoke" drug approvals. The order also instructs US Trade Representative to guard against "unreasonable or discriminatory" practices in other countries that raise prices in the US, including foreign price controls, and tells HHS to "consider" a program to sell direct to consumer at MFN prices.

Overall, the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions. That said, this process appears to be in early stages and we would not expect near-term implementation of any of the measures contemplated in the EO. Later this year, the main question will be whether the administration has authority to implement these kinds of changes unilaterally. With regard to Medicare, the administration has authority to negotiate discounts on 15 drugs this year under the Inflation Reduction Act (IRA), and could potentially pursue broader price concessions as part of a CMMI demonstration. However, Medicaid pricing (rebates) is set in statute, and the administration has limited ability to constrain prices in the private market. In theory, Congress could affect these areas, but for now neither looks likely to be included in the House's budget reconciliation package.

Overall, analysts view the EO as primarily a negotiation tool rather than a blueprint for immediate reform. The goal is to bring big pharma to the table to negotiate lower drug prices, allowing the Trump administration to advance its price reduction agenda.

According to Goldman's political economist Alec Phillips, the EO appears more designed to increase the Trump administration's negotiation leverage than to implement sweeping reforms immediately. The analyst expects the HHS to impose MFN-based pricing if no "significant progress" is made within several months.

The EO's language is legally cautious. It repeatedly cites the need to act "consistent with law" and lacks clarity on scope—such as whether it applies to Medicare Part B, D, or both.

"Overall, while the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions, our political economist notes that the process appears to be in early stages and does not expect near-term implementation of the measures contemplated in the EO," Haider told clients on Tuesday.

Haider continued, "Our net takeaway is that while the EO removes a potential worst-case scenario, we expect drug pricing to remain a focus and note that clarity across other policy, regulatory, and tariff-related vectors is needed for large-cap biopharma to see a sustained recovery."

Here's Alec Phillips' first-take

President Trump's executive order (EO) on "most favored nation" (MFN) drug pricing could lead to discussions with pharmaceutical companies regarding potential price concessions but does not look likely to lead to substantial near-term policy changes. It orders the Dept. of Health and Human Services (HHS) to communicate price targets to pharmaceutical manufacturers based on prices paid in other developed economies. If "significant progress" has not been achieved on drug pricing after an unspecified period of time—we would expect the White House to give the industry at least several months—the order instructs HHS to propose a "rulemaking plan" to impose MFN pricing. The EO is unclear on whether this would apply only to drugs covered under Medicare and, if so, whether it would apply to all drugs and whether it would apply to Medicare Part B, D or both. In the event "significant progress" is not made, the EO also instructs: (1) HHS to certify safety of drug reimportation, (2) FTC and DOJ to take enforcement action against anti-competitive practices, (3) the Dept. of Commerce to "review and consider" exports of pharmaceuticals, and (4) FDA to "review and potentially modify or revoke" drug approvals. The order also instructs US Trade Representative to guard against "unreasonable or discriminatory" practices in other countries that raise prices in the US, including foreign price controls, and tells HHS to "consider" a program to sell direct to consumer at MFN prices.

Overall, the EO appears intended to create leverage for negotiation with the industry and is likely to increase pressure on companies to announce some concessions. That said, this process appears to be in early stages and we would not expect near-term implementation of any of the measures contemplated in the EO. Later this year, the main question will be whether the administration has authority to implement these kinds of changes unilaterally. With regard to Medicare, the administration has authority to negotiate discounts on 15 drugs this year under the Inflation Reduction Act (IRA), and could potentially pursue broader price concessions as part of a CMMI demonstration. However, Medicaid pricing (rebates) is set in statute, and the administration has limited ability to constrain prices in the private market. In theory, Congress could affect these areas, but for now neither looks likely to be included in the House's budget reconciliation package.

Overall, analysts view the EO as primarily a negotiation tool rather than a blueprint for immediate reform. The goal is to bring big pharma to the table to negotiate lower drug prices, allowing the Trump administration to advance its price reduction agenda.

Tyler Durden | Zero Hedge

Zero Hedge

Aimed At Pressuring Big Pharma; Goldman Says Trump's Drug Exec. Order "Symbolic, Not Substantial" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

As for revealing the line-up for the Russian delegation, and who is expected lead, Peskov said "we will announce it as soon as the president [Putin] deems it necessary."

Despite some sensational recent headlines and statements, one thing we can be sure will not happen is President Putin's personal presence. And per the latest from Reuters, President Trump is not going to be there in Turkey either (after on Monday he actually

As for revealing the line-up for the Russian delegation, and who is expected lead, Peskov said "we will announce it as soon as the president [Putin] deems it necessary."

Despite some sensational recent headlines and statements, one thing we can be sure will not happen is President Putin's personal presence. And per the latest from Reuters, President Trump is not going to be there in Turkey either (after on Monday he actually  Moscow worries that such a lengthy pause in fighting would only be used by Ukrainian forces to rearm and regroup along the front lines, at a moment they are exhausted and steadily losing ground.

Peskov told reporters further, "[Western] Europe is, after all, entirely on Ukraine’s side. It cannot claim to have an unbiased approach… Its approach is not balanced, it is rather pro-war, aimed at continuing the fighting, which is in sharp contrast to the approach demonstrated, for example, by Moscow or Washington,"

Moscow worries that such a lengthy pause in fighting would only be used by Ukrainian forces to rearm and regroup along the front lines, at a moment they are exhausted and steadily losing ground.

Peskov told reporters further, "[Western] Europe is, after all, entirely on Ukraine’s side. It cannot claim to have an unbiased approach… Its approach is not balanced, it is rather pro-war, aimed at continuing the fighting, which is in sharp contrast to the approach demonstrated, for example, by Moscow or Washington,"

...thus making any pre/post CPI number comparisons meaningless apples to oranges, the machines will certainly be reacting to what Bloomberg prints in the flashing red headline at 8:30am ET.

...thus making any pre/post CPI number comparisons meaningless apples to oranges, the machines will certainly be reacting to what Bloomberg prints in the flashing red headline at 8:30am ET.

Source: Bloomberg

So, what did we get - did the 'soft' survey data once again completely decouple from the reality of 'hard' actual data?

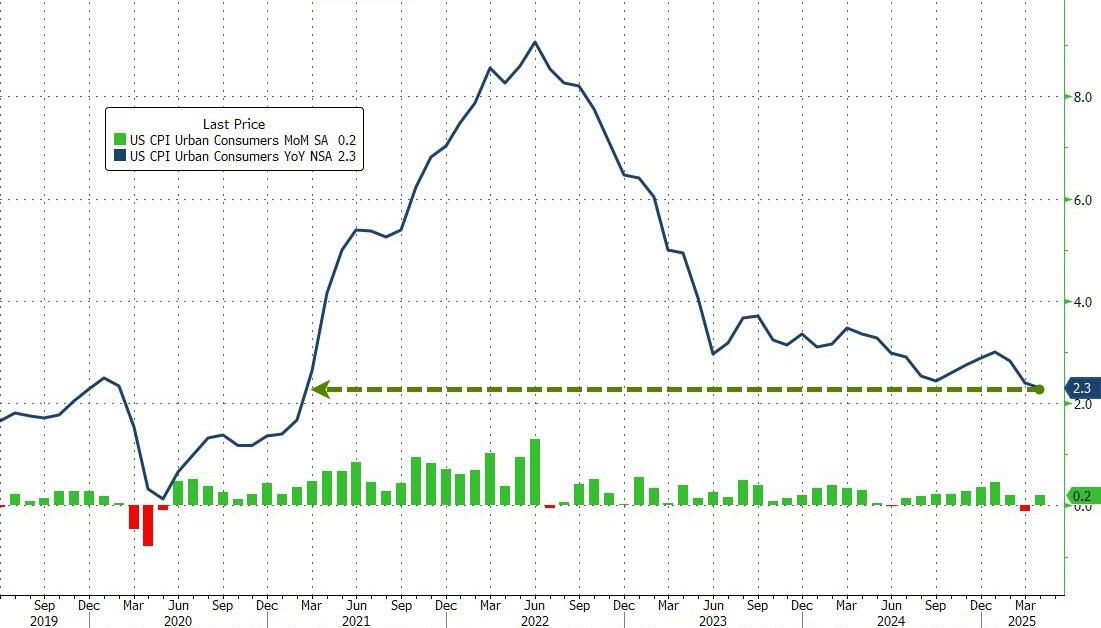

SHOCKER - Despite the panic from the establishment, headline CPI disappointed, rising 0.2% MoM (below the +0.3% exp), pulling the headline down to +2.3% YoY (below the 2.4% exp) - the lowest since February 2021...

Source: Bloomberg

So, what did we get - did the 'soft' survey data once again completely decouple from the reality of 'hard' actual data?

SHOCKER - Despite the panic from the establishment, headline CPI disappointed, rising 0.2% MoM (below the +0.3% exp), pulling the headline down to +2.3% YoY (below the 2.4% exp) - the lowest since February 2021...

Source: Bloomberg

That's quite a difference from the Democrat-sponsored surge in UMich inflation expectations (something it appears Democrats were unable to see or fear in 2021/2022 when President Biden was printing trillions in stimmies to save his base from actually working for a living)...

Source: Bloomberg

That's quite a difference from the Democrat-sponsored surge in UMich inflation expectations (something it appears Democrats were unable to see or fear in 2021/2022 when President Biden was printing trillions in stimmies to save his base from actually working for a living)...

Source: Bloomberg

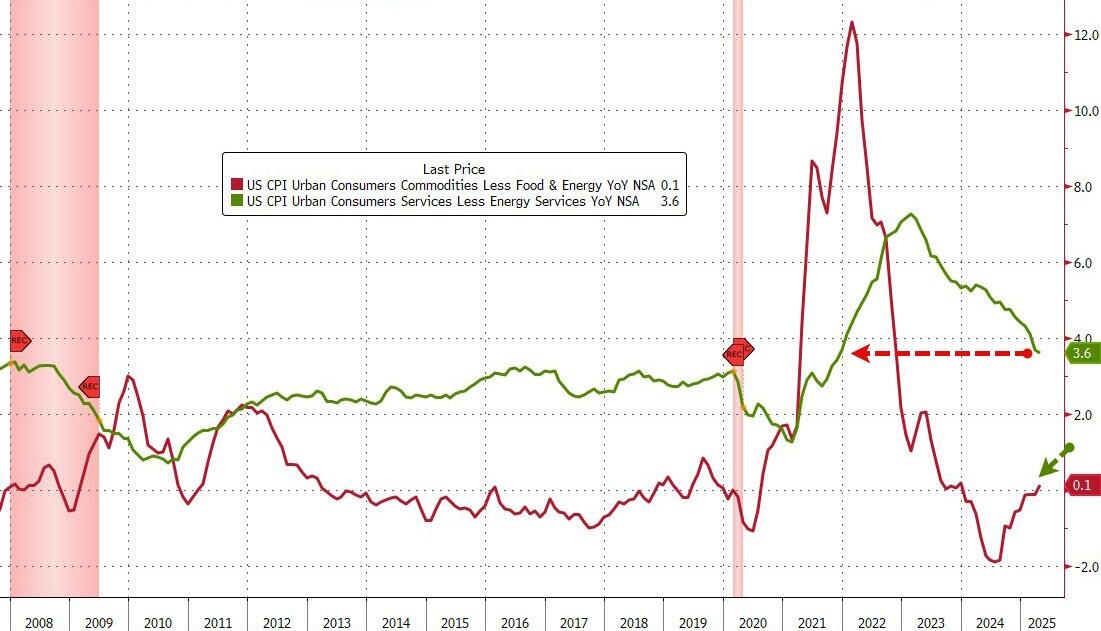

Under the hood, commodity prices just inched back into inflation (+0.1% YoY) while Services inflation continues to slide...

Source: Bloomberg

Under the hood, commodity prices just inched back into inflation (+0.1% YoY) while Services inflation continues to slide...

Source: Bloomberg

Headline CPI 0.2% MoM. Here are the details:

The index for shelter rose 0.3 percent in April, accounting for more than half of the all items monthly increase.

The energy index also increased over the month, rising 0.7 percent as increases in the natural gas index and the electricity index more than offset a decline in the gasoline index.

The index for food, in contrast, fell 0.1 percent in April as the food at home index decreased 0.4 percent and the food away from home index rose 0.4 percent over the month.

But Core Services rose MoM...

Source: Bloomberg

Headline CPI 0.2% MoM. Here are the details:

The index for shelter rose 0.3 percent in April, accounting for more than half of the all items monthly increase.

The energy index also increased over the month, rising 0.7 percent as increases in the natural gas index and the electricity index more than offset a decline in the gasoline index.

The index for food, in contrast, fell 0.1 percent in April as the food at home index decreased 0.4 percent and the food away from home index rose 0.4 percent over the month.

But Core Services rose MoM...

Source: Bloomberg

Egg prices - so much in focus during Trump's first few weeks after Biden's shitshow - plunged 12.7% MoM... the biggest MoM drop since March 1984...

Source: Bloomberg

Egg prices - so much in focus during Trump's first few weeks after Biden's shitshow - plunged 12.7% MoM... the biggest MoM drop since March 1984...

Source: Bloomberg

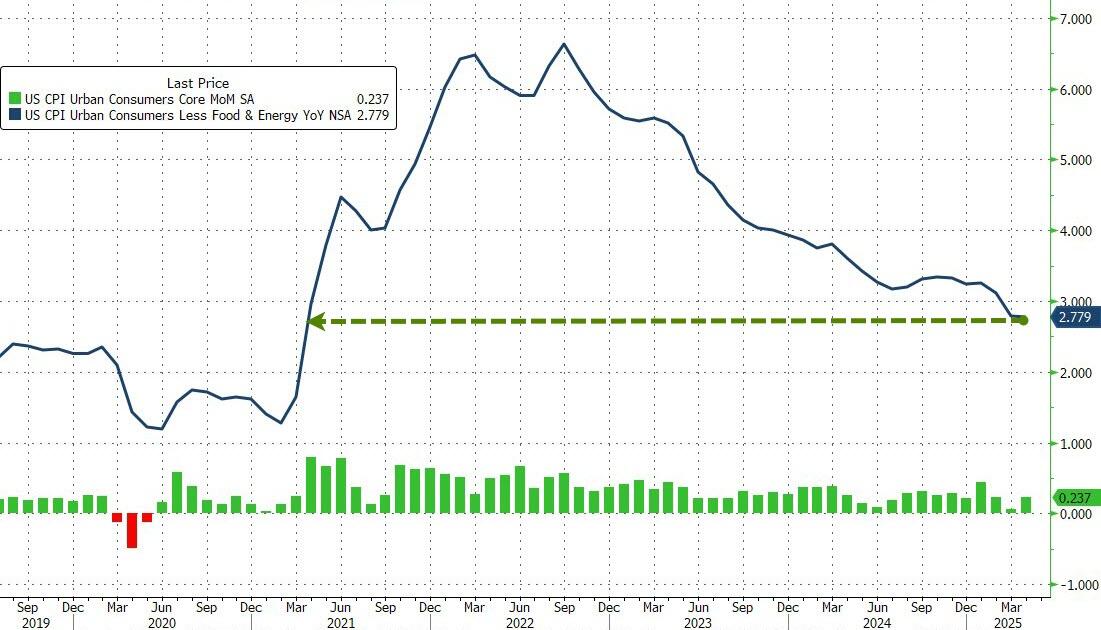

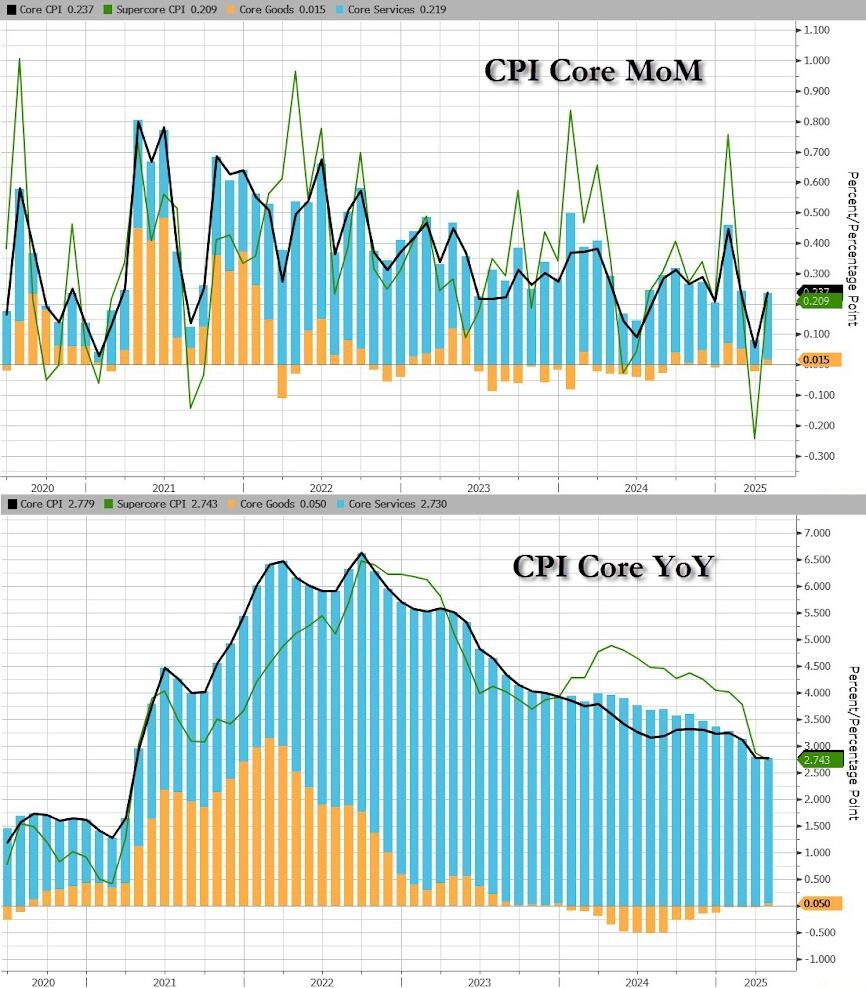

Core CPI also rose 0.2% MoM (below the 0.3% exp) leaving it up 2.8% YoY as expected (lowest since April 2021)...

Source: Bloomberg

Core CPI also rose 0.2% MoM (below the 0.3% exp) leaving it up 2.8% YoY as expected (lowest since April 2021)...

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Core CPI +0.2% MoM. Indexes that increased over the month include household furnishings and operations, medical care, motor vehicle insurance, education, and personal care. The indexes for airline fares, used cars and trucks, communication, and apparel were among the major indexes that decreased in April. Here are the details:

The shelter index increased 0.3 percent over the month.

The index for owners’ equivalent rent rose 0.4 percent in April and the index for rent increased 0.3 percent.

The lodging away from home index fell 0.1 percent in April.

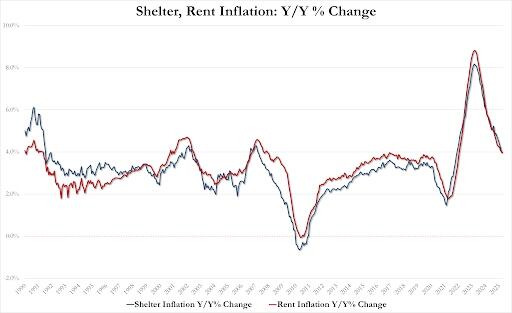

Shelter inflation 0.34% MoM, and 3.99% YoY, unch from a month ago and the lowest since Nov 2021

Rent inflation 0.27% MoM, and 3.98% YoY, down from 3.99% in March and the lowest since Jan 2022

Source: Bloomberg

Core CPI +0.2% MoM. Indexes that increased over the month include household furnishings and operations, medical care, motor vehicle insurance, education, and personal care. The indexes for airline fares, used cars and trucks, communication, and apparel were among the major indexes that decreased in April. Here are the details:

The shelter index increased 0.3 percent over the month.

The index for owners’ equivalent rent rose 0.4 percent in April and the index for rent increased 0.3 percent.

The lodging away from home index fell 0.1 percent in April.

Shelter inflation 0.34% MoM, and 3.99% YoY, unch from a month ago and the lowest since Nov 2021

Rent inflation 0.27% MoM, and 3.98% YoY, down from 3.99% in March and the lowest since Jan 2022

The index for household furnishings and operations increased 1.0 percent in April, after being unchanged in March.

The motor vehicle insurance index rose 0.6 percent in April.

The index for education increased 0.1 percent over the month, as did the index for personal care.

In contrast, the airline fares index fell 2.8 percent in April, after declining 5.3 percent in March.

The index for used cars and trucks fell 0.5 percent over the month, and the indexes for communication and apparel also declined.

The new vehicles index and the recreation index were unchanged in April.

The medical care index increased 0.5 percent over the month.

The index for hospital services increased 0.6 percent in April and the index for physicians’ services rose 0.3 percent over the month.

The prescription drugs index rose 0.4 percent in April.

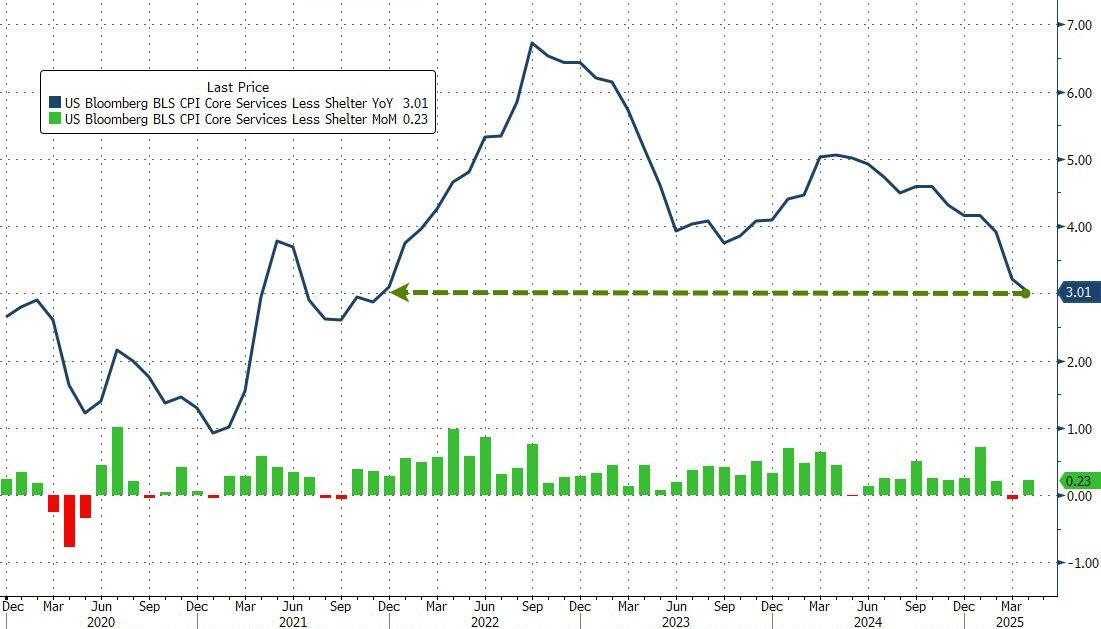

And drilling down even more, the so-called SuperCore CPI (Services Ex Shelter) dropped to +3.01% YoY - the lowest since Dec 2021...

The index for household furnishings and operations increased 1.0 percent in April, after being unchanged in March.

The motor vehicle insurance index rose 0.6 percent in April.

The index for education increased 0.1 percent over the month, as did the index for personal care.

In contrast, the airline fares index fell 2.8 percent in April, after declining 5.3 percent in March.

The index for used cars and trucks fell 0.5 percent over the month, and the indexes for communication and apparel also declined.

The new vehicles index and the recreation index were unchanged in April.

The medical care index increased 0.5 percent over the month.

The index for hospital services increased 0.6 percent in April and the index for physicians’ services rose 0.3 percent over the month.

The prescription drugs index rose 0.4 percent in April.

And drilling down even more, the so-called SuperCore CPI (Services Ex Shelter) dropped to +3.01% YoY - the lowest since Dec 2021...

Source: Bloomberg

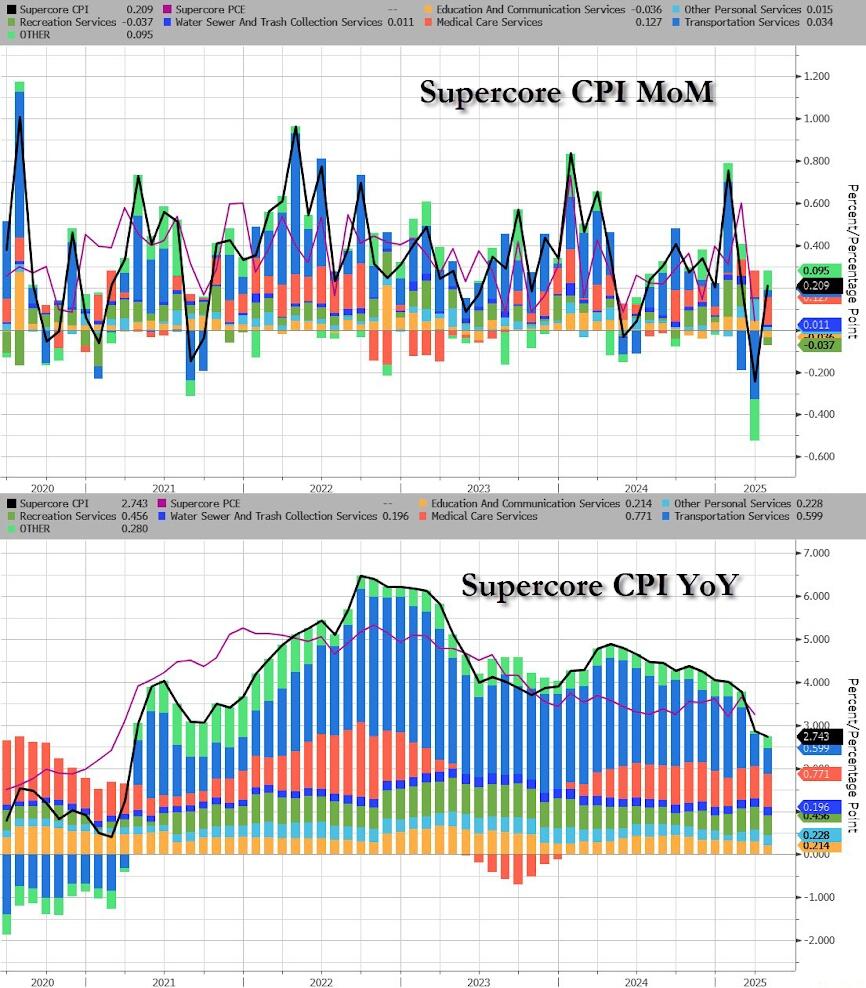

Recreation Services and Education costs are deflating...

Source: Bloomberg

Recreation Services and Education costs are deflating...

Source: Bloomberg

Finally, as Goldman noted ahead of the print, whatever we do learn about tariff-related inflation today lags the rapidly-changing policy reality... so choose the size of the salt crystal to take as you react to the algos initial reaction to this data.

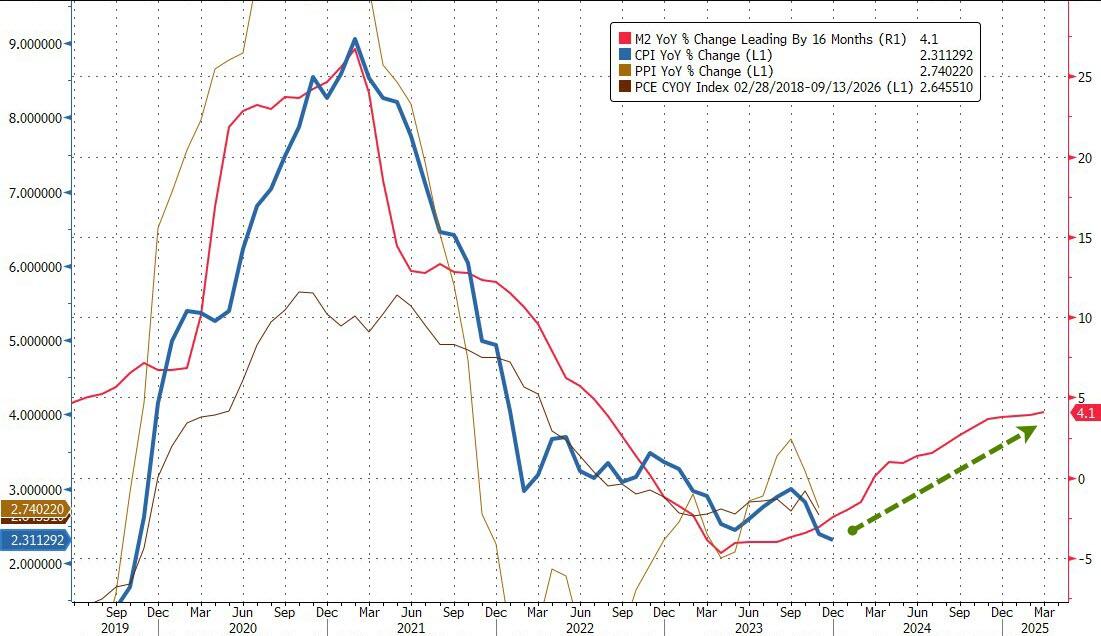

Is the inevitable trajectory of CPI higher given the recent surge in M2...

Source: Bloomberg

Finally, as Goldman noted ahead of the print, whatever we do learn about tariff-related inflation today lags the rapidly-changing policy reality... so choose the size of the salt crystal to take as you react to the algos initial reaction to this data.

Is the inevitable trajectory of CPI higher given the recent surge in M2...

Source: Bloomberg

Real average weekly earnings rose 1.7% YoY - the best growth in wages since March 2021...

Source: Bloomberg

Real average weekly earnings rose 1.7% YoY - the best growth in wages since March 2021...

Source: Bloomberg

Brace for an avalanche of this statement repeated ad nauseum all day from establishment economists - "...we're sure the inflation from tariffs will hit next month..."

Source: Bloomberg

Brace for an avalanche of this statement repeated ad nauseum all day from establishment economists - "...we're sure the inflation from tariffs will hit next month..."

The new narrative: "lack of tariff inflation is transitory"

The new narrative: "lack of tariff inflation is transitory"

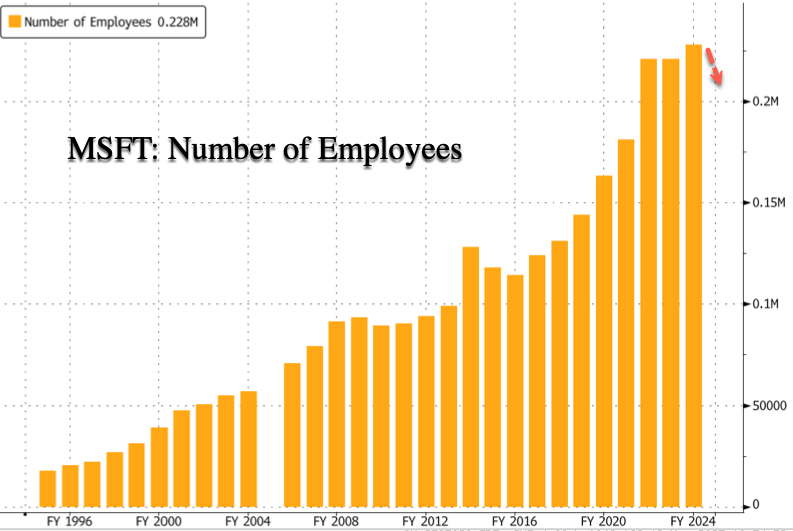

The report is puzzling since Microsoft reported

The report is puzzling since Microsoft reported  However, in the first three months of 2025, Microsoft spent $21.4 billion on Capital expenditures, including assets acquired under finance leases, down more than $1 billion from the previous quarter (and below the $22.56 billion consensus).

However, in the first three months of 2025, Microsoft spent $21.4 billion on Capital expenditures, including assets acquired under finance leases, down more than $1 billion from the previous quarter (and below the $22.56 billion consensus).

The spokesperson told CNBC that the latest round of proposed job cuts is unrelated to performance.

In early 2023, Microsoft laid off 10,000 employees. Total workforce growth has stalled since 2022 after exploding every year since 2016.

Meanwhile, MSFT shares are back at record highs ....

The spokesperson told CNBC that the latest round of proposed job cuts is unrelated to performance.

In early 2023, Microsoft laid off 10,000 employees. Total workforce growth has stalled since 2022 after exploding every year since 2016.

Meanwhile, MSFT shares are back at record highs ....

Several reports have

Several reports have

“President Trump has correctly recognized that the American film and television industry faces an urgent threat from international competition,” leaders of the International Alliance of Theatrical Stage Employees (IATSE), one of the largest and most powerful entertainment unions, said in a

“President Trump has correctly recognized that the American film and television industry faces an urgent threat from international competition,” leaders of the International Alliance of Theatrical Stage Employees (IATSE), one of the largest and most powerful entertainment unions, said in a

The president’s missive appeared to address the fact that an increasing number of American studio films are shot abroad—primarily in Canada, the United Kingdom, Australia, and European countries such as Hungary, which offer competitive subsidies and tax breaks, easy regulatory environments, and lower labor costs for producers trying to deliver a project on budget.

IATSE, which represents members in the United States and Canada, also struck a cautious tone, saying it supports all policy measures “that can be implemented to return and maintain U.S. film and television jobs, while not disadvantaging our Canadian members.”

IATSE urged federal policymakers to level the playing field for U.S. productions, including with a federal film production tax incentive, but said it would await further information about the administration’s proposed tariff plan. “We continue to stand firm in our conviction that any eventual trade policy must do no harm to our Canadian members—nor the industry overall.”

In a recent

The president’s missive appeared to address the fact that an increasing number of American studio films are shot abroad—primarily in Canada, the United Kingdom, Australia, and European countries such as Hungary, which offer competitive subsidies and tax breaks, easy regulatory environments, and lower labor costs for producers trying to deliver a project on budget.

IATSE, which represents members in the United States and Canada, also struck a cautious tone, saying it supports all policy measures “that can be implemented to return and maintain U.S. film and television jobs, while not disadvantaging our Canadian members.”

IATSE urged federal policymakers to level the playing field for U.S. productions, including with a federal film production tax incentive, but said it would await further information about the administration’s proposed tariff plan. “We continue to stand firm in our conviction that any eventual trade policy must do no harm to our Canadian members—nor the industry overall.”

In a recent

‘Built by the Middle Class’

Other union leaders cautioned against a blanket tariff that fails to account for the realities of the industry.

“If this tariff policy is just a headline reaction to productions leaving the U.S., it’s not a solution, it’s sabotage,” David Graves, an executive board member with IATSE Local 728, which represents studio electrical lighting technicians, told The Epoch Times in a text message.

Stressing that the film industry doesn’t run on the same timeline or structure as a brick-and-mortar business, Graves said a one-size-fits-all approach may do more harm than good unless informed by people who work in the industry.

“If the administration truly wants to understand how to apply tariffs to the American film industry, they need to talk to electricians, grips, camera operators, and wardrobe, not just A-list actors who are disconnected from the realities of payroll taxes, foreign incentives, and what economic contraction looks like on the ground,” Graves said.

Big-name producers and celebrity voices, he said, “don’t speak for the working-class crews who are watching their livelihoods disappear with no transition plan, no retraining support, and no safety net.”

A day after Trump’s tariff announcement, Oscar-winning actor Jon Voight, whom Trump previously named a “special ambassador” to Hollywood, said in a video posted to social media platform X that he submitted a detailed plan to the president at his Mar-a-Lago estate in Florida outlining “certain tax provisions” that would help both movie and TV production.

“Our industry recently has suffered greatly. ... Many Americans have lost jobs to productions gone overseas. People have lost their homes, can’t feed their families,” Voight said.

The same day, Deadline, an industry publication based in Los Angeles, published a

‘Built by the Middle Class’

Other union leaders cautioned against a blanket tariff that fails to account for the realities of the industry.

“If this tariff policy is just a headline reaction to productions leaving the U.S., it’s not a solution, it’s sabotage,” David Graves, an executive board member with IATSE Local 728, which represents studio electrical lighting technicians, told The Epoch Times in a text message.

Stressing that the film industry doesn’t run on the same timeline or structure as a brick-and-mortar business, Graves said a one-size-fits-all approach may do more harm than good unless informed by people who work in the industry.

“If the administration truly wants to understand how to apply tariffs to the American film industry, they need to talk to electricians, grips, camera operators, and wardrobe, not just A-list actors who are disconnected from the realities of payroll taxes, foreign incentives, and what economic contraction looks like on the ground,” Graves said.

Big-name producers and celebrity voices, he said, “don’t speak for the working-class crews who are watching their livelihoods disappear with no transition plan, no retraining support, and no safety net.”

A day after Trump’s tariff announcement, Oscar-winning actor Jon Voight, whom Trump previously named a “special ambassador” to Hollywood, said in a video posted to social media platform X that he submitted a detailed plan to the president at his Mar-a-Lago estate in Florida outlining “certain tax provisions” that would help both movie and TV production.

“Our industry recently has suffered greatly. ... Many Americans have lost jobs to productions gone overseas. People have lost their homes, can’t feed their families,” Voight said.

The same day, Deadline, an industry publication based in Los Angeles, published a

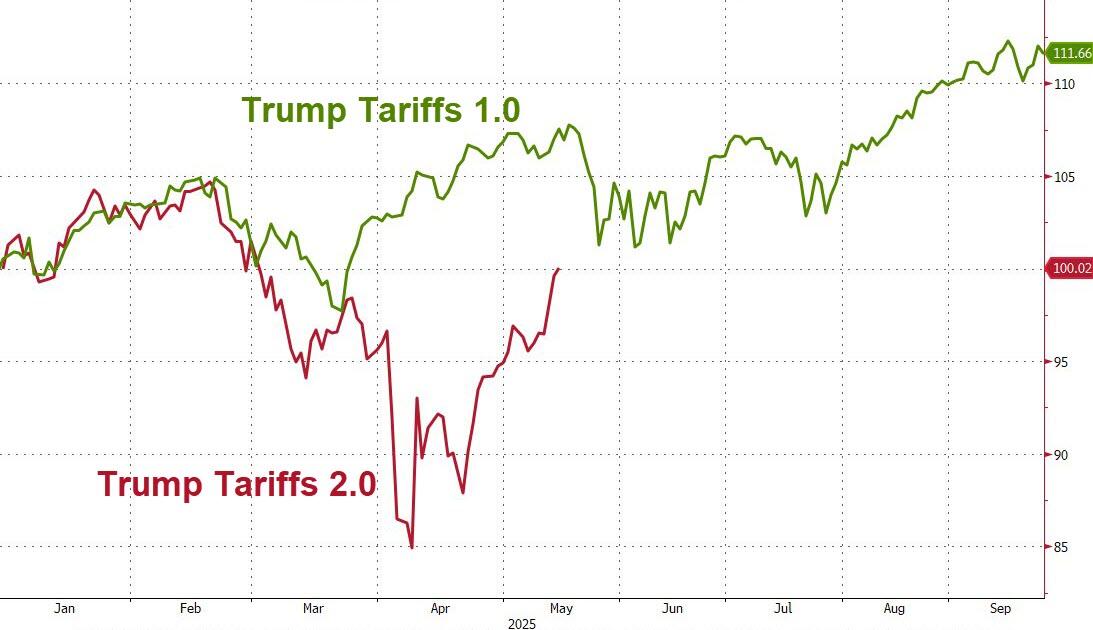

It's different this time - ish...

It's different this time - ish...

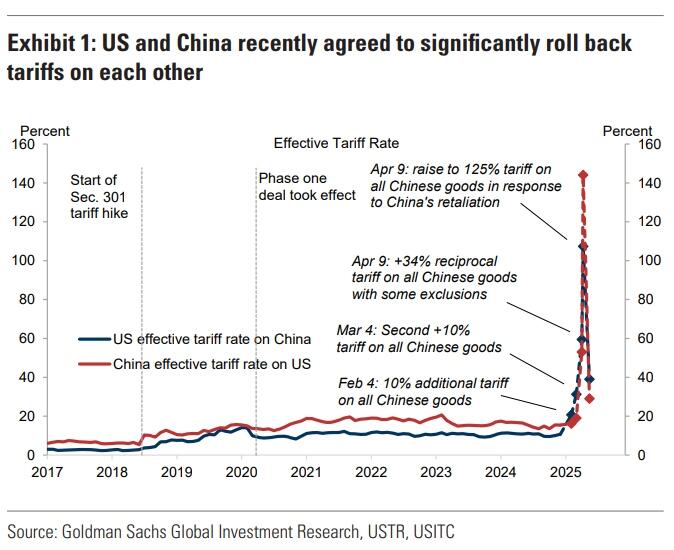

The reflexive nature of global market pain leading to geopolitical negotiations appears to have won out once again as "Uncertainty" around US trade policy has plunged - erasing all of the post-Liberation Day spike...

The reflexive nature of global market pain leading to geopolitical negotiations appears to have won out once again as "Uncertainty" around US trade policy has plunged - erasing all of the post-Liberation Day spike...

Who could have seen that coming?

Chinese Delegation Spotted Entering Treasury Department, Demands Photos Be Deleted: Report

Who could have seen that coming?

Chinese Delegation Spotted Entering Treasury Department, Demands Photos Be Deleted: Report

The greeting was typically lavish, as Trump was received at the Royal Terminal at King Khalid International Airport in Riyadh, after which he and MbS walked a lavender carpet and sat down amid marble columns in navy-and-gold armchairs, as the NYT Times detailed.

"Trump lands in Saudi Arabia to a royal welcome from Crown Prince Mohammed bin Salman," Al-Monitor journalist Elizabeth Hagedorn pointed out. "Biden, by contrast, got the governor of Mecca."

As Air Force One entered the kingdom's airspace earlier Tuesday, Saudi fighter jets escorted it while approaching the Saudi capital.

Scenes from Saudi Arabia as Trump arrives for negotiations with leaders of the region.

Huge week ahead.

The greeting was typically lavish, as Trump was received at the Royal Terminal at King Khalid International Airport in Riyadh, after which he and MbS walked a lavender carpet and sat down amid marble columns in navy-and-gold armchairs, as the NYT Times detailed.

"Trump lands in Saudi Arabia to a royal welcome from Crown Prince Mohammed bin Salman," Al-Monitor journalist Elizabeth Hagedorn pointed out. "Biden, by contrast, got the governor of Mecca."

As Air Force One entered the kingdom's airspace earlier Tuesday, Saudi fighter jets escorted it while approaching the Saudi capital.

Scenes from Saudi Arabia as Trump arrives for negotiations with leaders of the region.

Huge week ahead.

Trump is hoping to secure a $1 trillion investment in US industry from the kingdom, significantly over and above the crown prince’s earlier investment pledge of $600bn, upon this first stop in his Gulf tour which will later include Qatar and UAE.

Importantly, the head of Saudi Arabia’s Public Investment Fund, Yasir Al-Rumayyan, was at the airport with MbS for Trump's grand greeting at the VIP Royal Terminal.

Trump is hoping to secure a $1 trillion investment in US industry from the kingdom, significantly over and above the crown prince’s earlier investment pledge of $600bn, upon this first stop in his Gulf tour which will later include Qatar and UAE.

Importantly, the head of Saudi Arabia’s Public Investment Fund, Yasir Al-Rumayyan, was at the airport with MbS for Trump's grand greeting at the VIP Royal Terminal.

Trump is more of a Diet Coke drinker, (or perhaps there was a remote fear in his mind of being poisoned?)...

U.S. President Donald Trump doesn't drink the local coffee offered to him during his visit to Saudi Arabia.

Ghahwa, a spiced Arabic coffee, is a staple of Saudi hospitality.

Trump is more of a Diet Coke drinker, (or perhaps there was a remote fear in his mind of being poisoned?)...

U.S. President Donald Trump doesn't drink the local coffee offered to him during his visit to Saudi Arabia.

Ghahwa, a spiced Arabic coffee, is a staple of Saudi hospitality.

Democrat Party leaders, however, haven't received the memo. With their now limited resources they are attempting to create artificial drama to draw public attention and lure volunteer protesters to their cause. They can't keep the borders open anymore, but they can try to stop the deportations of the millions of illegals already in the US.

Progressive political leaders are taking to throwing themselves upon the ramparts of ICE detention facilities to disrupt prisoner transfers. The situation has escalated after Newark Mayor Ras Baraka was arrested for trespassing at an ICE center in New Jersey. Baraka arrived at the facility with a cadre of protesters and Democrat representatives. He is seen in bodycam in an argument with officers and apparently refusing to leave the area, at least initially. The details of the arrest are not yet clear, but the establishment media is running with the narrative that this

Democrat Party leaders, however, haven't received the memo. With their now limited resources they are attempting to create artificial drama to draw public attention and lure volunteer protesters to their cause. They can't keep the borders open anymore, but they can try to stop the deportations of the millions of illegals already in the US.

Progressive political leaders are taking to throwing themselves upon the ramparts of ICE detention facilities to disrupt prisoner transfers. The situation has escalated after Newark Mayor Ras Baraka was arrested for trespassing at an ICE center in New Jersey. Baraka arrived at the facility with a cadre of protesters and Democrat representatives. He is seen in bodycam in an argument with officers and apparently refusing to leave the area, at least initially. The details of the arrest are not yet clear, but the establishment media is running with the narrative that this