Beijing Vows To Stabilize China's Sinking Economy

Beijing Vows To Stabilize China's Sinking Economy

As we have shown on several recent occasions, the US-China trade war is notable in that while the Xi and Trump admins are clearly going at it, their core "support" organizations such as the Fed and PBOC have taken on decidedly different paths: while the Chinese central bank (which is controlled by the communist party) is doing everything to prop up markets and the yuan, and give Beijing the upper hand when it comes to market leverage in the war with Trump, the Fed is doing just the opposite, allowing the dollar to tumble and letting stocks slide, refusing to intervene in the market.

In fact one of the biggest tension points in recent weeks has been Trump's anger at Powell, and his desire to "remove" the Fed chair due to the Fed's reluctance to cut rates now, versus cutting them in September 2024, when the market was at all time highs and the Biden economy was reportedly so much stronger.

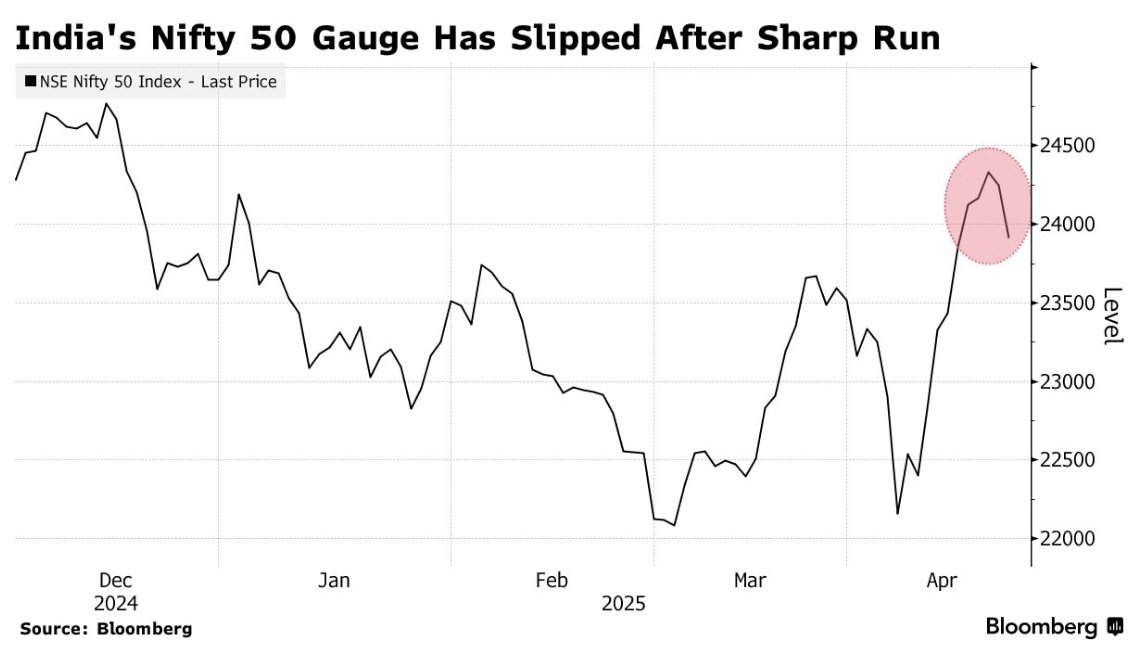

China PPT: propping up Chinese stocks literally every day

Fed's Powell: fuck your calls  — zerohedge (@zerohedge)

— zerohedge (@zerohedge)  Perhaps not surprisingly, with every passing day this dynamic only gets more acute, because while the Fed is desperately seeking reasons to avoid cutting rates such as predicting inflation may jump in a year or so - despite increasingly dovish comments from the likes of Fed officials Waller and Hammack who realize that the US would be in recession long before inflation kicks in - China’s leadership overnight vowed to stabilize the economy and society, "as the country is now at a critical stage in handling the unprecedented trade war with the United States."

In an economic-analysis meeting on Friday, the 24-man Politburo, China's main decision-making body headed by President Xi Jinping, said authorities would roll out specific plans to support companies and individuals affected by the trade war.

They pledged to “coordinate domestic economic work with international economic and trade engagements, resolutely focus on doing our own affairs, steadfastly expand high-level opening up, and focus on stabilizing employment, businesses, markets, and expectations”, according to a meeting readout released by Xinhua.

“By enhancing the certainty of high-quality development, we can effectively respond to the uncertainties brought by drastic changes in the external environment,” it said.

In other words, the PBOC will continue doing more of the same, creating a false sense of stability, even as stateside, the Fed encourages the all too real sense of instability.

The Politburo meeting typically sets the tone for the country’s economic work in the second quarter. This year, it has come amid uncertainty over how the world’s second-largest economy will fare in an escalated tariff war with the US while trying to meet leadership’s annual growth target of “around 5 per cent”, after a solid start in the first quarter saw gross domestic product rise by 5.4%, but the growth rate is expected to tumble in coming months.

To boost the role of domestic consumption in driving economic growth, Beijing will strive to increase the income of the lower- and middle-income groups while vigorously developing service consumption, the authorities said. Which is desperately needed since unlike the US, China does not have a social safety net, and therefore how long its economy can remain stressed depends entirely on how long the middle class refuses to revolt.

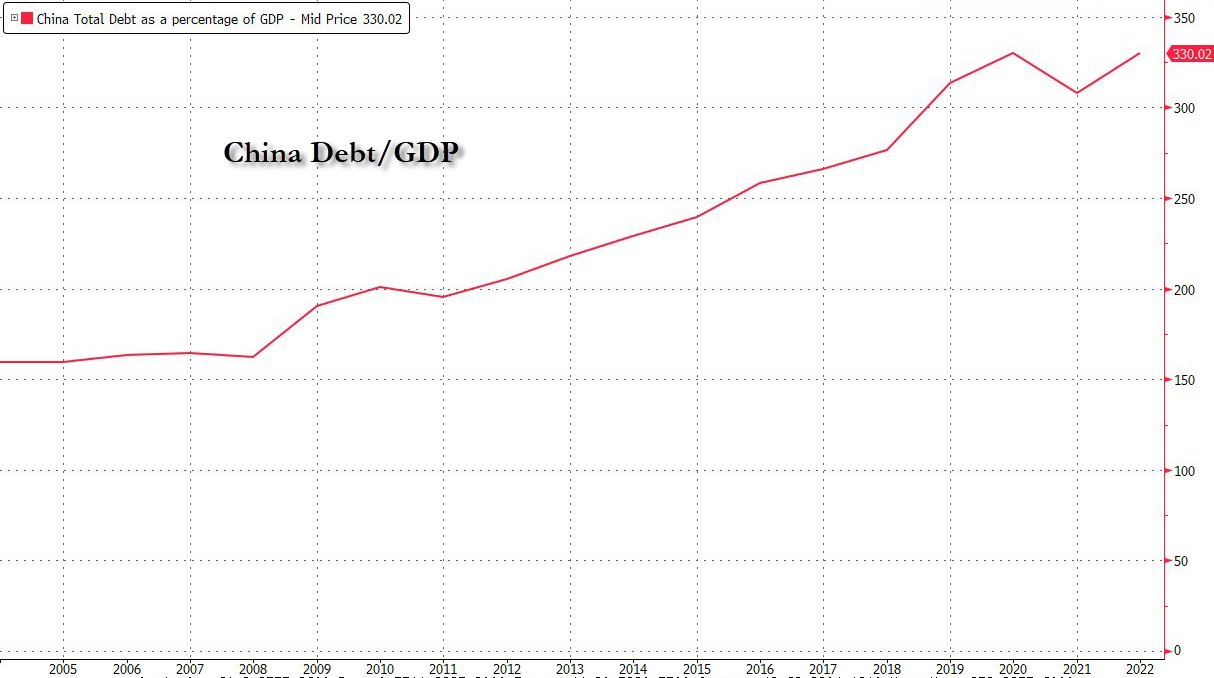

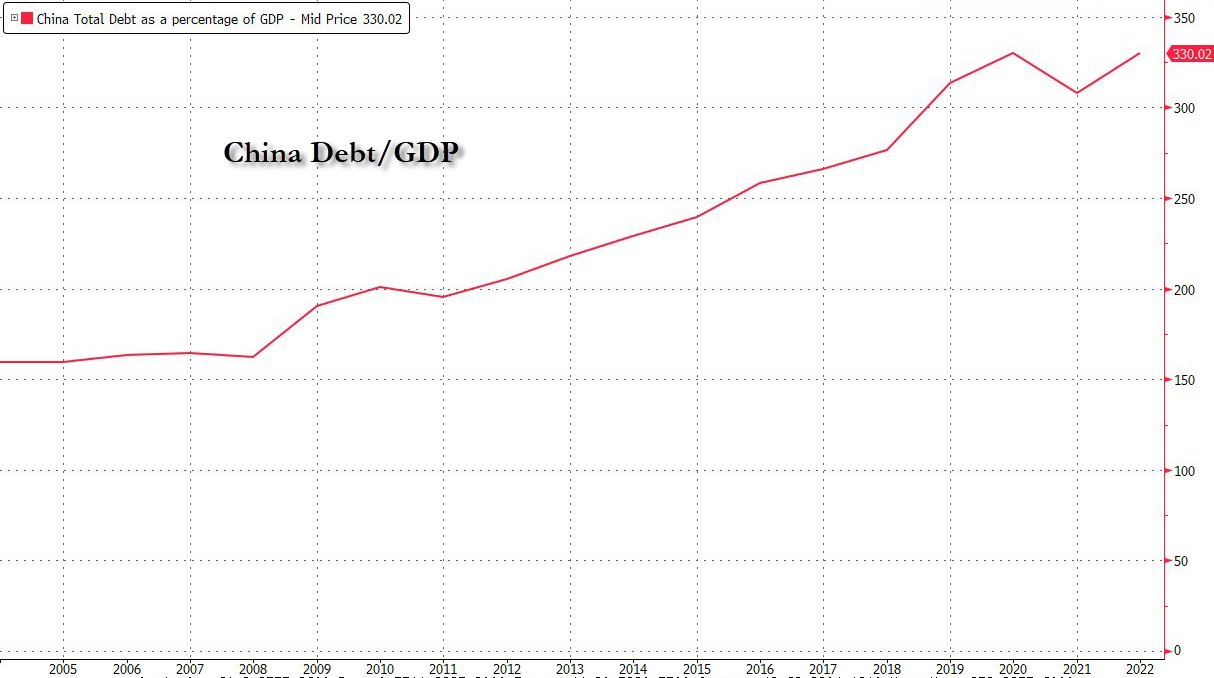

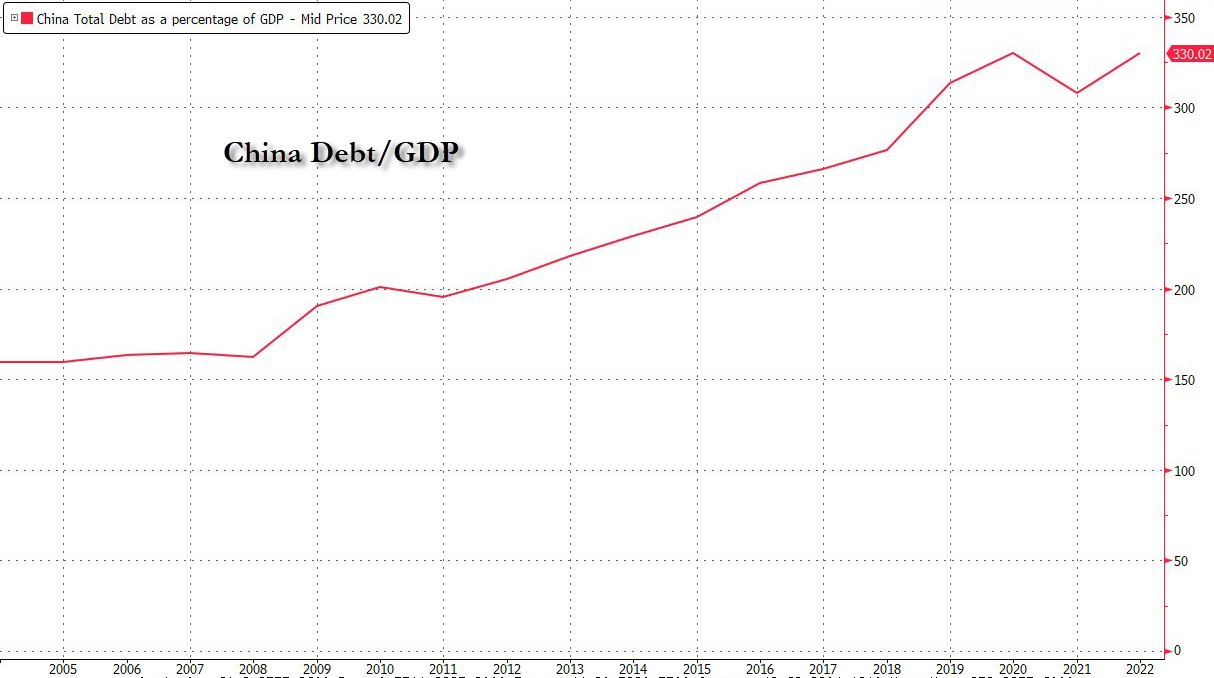

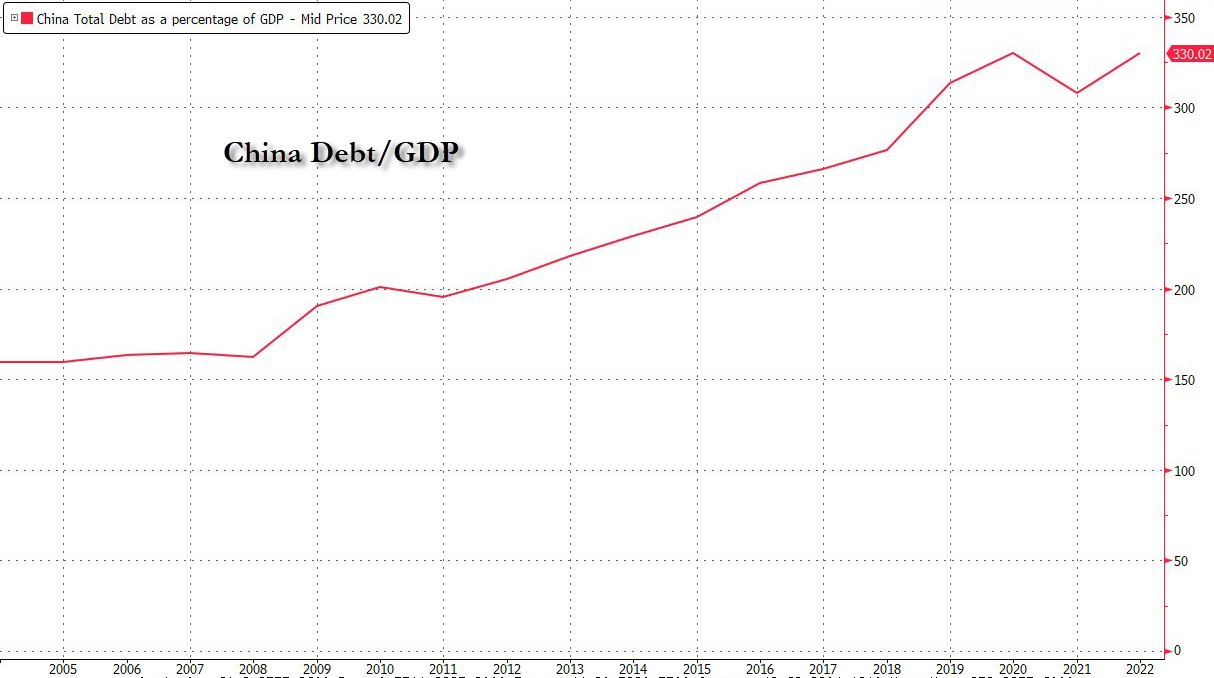

Beijing will also step up measures to stabilize the housing market, including renovating dilapidated housing in urban areas and refining policies for the acquisition of commercial housing inventory, according to the readout. On the other hand, why Beijing has failed to do this for the past 5 years ever since China suffered a spectacular collapse in its housing sector which crushed the middle class, is anyone's guess. Actually, it's not a guess: the reason why China can not do anything to forcefully stabilize its housing market is because China has way too much debt, and any attempt for massive fiscal stimulus will lead to a quick sugar high... and epic crash shortly after. And Beijing is well aware of this, which is why China has perfected the art of jawboning constantly and doing absolutely nothing.

In response to Trump tariff hikes, China vows to unleash much more stimulus, as it has every week for the past 3 years.

Luckily, at 330% debt/GDP China has lots of fiscal space for stimulus

Oh wait...

Perhaps not surprisingly, with every passing day this dynamic only gets more acute, because while the Fed is desperately seeking reasons to avoid cutting rates such as predicting inflation may jump in a year or so - despite increasingly dovish comments from the likes of Fed officials Waller and Hammack who realize that the US would be in recession long before inflation kicks in - China’s leadership overnight vowed to stabilize the economy and society, "as the country is now at a critical stage in handling the unprecedented trade war with the United States."

In an economic-analysis meeting on Friday, the 24-man Politburo, China's main decision-making body headed by President Xi Jinping, said authorities would roll out specific plans to support companies and individuals affected by the trade war.

They pledged to “coordinate domestic economic work with international economic and trade engagements, resolutely focus on doing our own affairs, steadfastly expand high-level opening up, and focus on stabilizing employment, businesses, markets, and expectations”, according to a meeting readout released by Xinhua.

“By enhancing the certainty of high-quality development, we can effectively respond to the uncertainties brought by drastic changes in the external environment,” it said.

In other words, the PBOC will continue doing more of the same, creating a false sense of stability, even as stateside, the Fed encourages the all too real sense of instability.

The Politburo meeting typically sets the tone for the country’s economic work in the second quarter. This year, it has come amid uncertainty over how the world’s second-largest economy will fare in an escalated tariff war with the US while trying to meet leadership’s annual growth target of “around 5 per cent”, after a solid start in the first quarter saw gross domestic product rise by 5.4%, but the growth rate is expected to tumble in coming months.

To boost the role of domestic consumption in driving economic growth, Beijing will strive to increase the income of the lower- and middle-income groups while vigorously developing service consumption, the authorities said. Which is desperately needed since unlike the US, China does not have a social safety net, and therefore how long its economy can remain stressed depends entirely on how long the middle class refuses to revolt.

Beijing will also step up measures to stabilize the housing market, including renovating dilapidated housing in urban areas and refining policies for the acquisition of commercial housing inventory, according to the readout. On the other hand, why Beijing has failed to do this for the past 5 years ever since China suffered a spectacular collapse in its housing sector which crushed the middle class, is anyone's guess. Actually, it's not a guess: the reason why China can not do anything to forcefully stabilize its housing market is because China has way too much debt, and any attempt for massive fiscal stimulus will lead to a quick sugar high... and epic crash shortly after. And Beijing is well aware of this, which is why China has perfected the art of jawboning constantly and doing absolutely nothing.

In response to Trump tariff hikes, China vows to unleash much more stimulus, as it has every week for the past 3 years.

Luckily, at 330% debt/GDP China has lots of fiscal space for stimulus

Oh wait...  — zerohedge (@zerohedge)

— zerohedge (@zerohedge)  There's more: authorities said they will also maintain stability and boost vitality in the capital markets, in other words the PBOC and "National Team" plunge protection teams will be even more active... while Powell goes fishing.

The Politburo reiterated that Beijing would implement a more proactive fiscal policy and moderately loose monetary policy, by accelerating the issuance of government bonds and cutting the reserve requirement ratio and key policy interest rates at an appropriate time.

It will also launch new lending facilities to boost technological innovation, consumption and trade.

To support companies significantly impacted by tariffs, the proportion of job-retention refunds from unemployment insurance funds will be increased, the readout added. “We must focus on ensuring people’s livelihoods,” it said correctly, although it will be short by a few trillion yuan when it's all said and done.

Earlier this week, the International Monetary Fund cut its forecast for China’s economic growth this year to 4%, down from 4.6%, while slashing the US growth outlook to 1.8%, a 0.9% drop from its January projection, as the trade war between the two countries raises the risk of a prolonged decoupling.

And speaking to just how debt-constrained China truly is, the Politburo meeting did not announce any new stimulus measures beyond the budget approved in the National People’s Congress in March, but it "reflects the government’s readiness to launch new policies" when the economy is affected by external shocks, according to Zhang Zhiwei, president and chief economist at Pinpoint Asset Management.

“It seems Beijing is not in a rush to launch a large stimulus at this stage,” Zhang said. “It takes time to monitor and evaluate the timing and the size of the trade shock.” Actually, the only reason China is not in a rush to launch a large stimulus, is because it can't: if it does, all it does is buy a few quarters of time before a far more dire crash as deflationary debt-crisis spreads across the country.

Fri, 04/25/2025 - 12:40

There's more: authorities said they will also maintain stability and boost vitality in the capital markets, in other words the PBOC and "National Team" plunge protection teams will be even more active... while Powell goes fishing.

The Politburo reiterated that Beijing would implement a more proactive fiscal policy and moderately loose monetary policy, by accelerating the issuance of government bonds and cutting the reserve requirement ratio and key policy interest rates at an appropriate time.

It will also launch new lending facilities to boost technological innovation, consumption and trade.

To support companies significantly impacted by tariffs, the proportion of job-retention refunds from unemployment insurance funds will be increased, the readout added. “We must focus on ensuring people’s livelihoods,” it said correctly, although it will be short by a few trillion yuan when it's all said and done.

Earlier this week, the International Monetary Fund cut its forecast for China’s economic growth this year to 4%, down from 4.6%, while slashing the US growth outlook to 1.8%, a 0.9% drop from its January projection, as the trade war between the two countries raises the risk of a prolonged decoupling.

And speaking to just how debt-constrained China truly is, the Politburo meeting did not announce any new stimulus measures beyond the budget approved in the National People’s Congress in March, but it "reflects the government’s readiness to launch new policies" when the economy is affected by external shocks, according to Zhang Zhiwei, president and chief economist at Pinpoint Asset Management.

“It seems Beijing is not in a rush to launch a large stimulus at this stage,” Zhang said. “It takes time to monitor and evaluate the timing and the size of the trade shock.” Actually, the only reason China is not in a rush to launch a large stimulus, is because it can't: if it does, all it does is buy a few quarters of time before a far more dire crash as deflationary debt-crisis spreads across the country.

Fri, 04/25/2025 - 12:40

X (formerly Twitter)

zerohedge (@zerohedge) on X

China PPT: propping up Chinese stocks literally every day

Fed's Powell: fuck your calls

X (formerly Twitter)

zerohedge (@zerohedge) on X

China PPT: propping up Chinese stocks literally every day

Fed's Powell: fuck your calls

X (formerly Twitter)

zerohedge (@zerohedge) on X

In response to Trump tariff hikes, China vows to unleash much more stimulus, as it has every week for the past 3 years.

Luckily, at 330% debt/GDP...

X (formerly Twitter)

zerohedge (@zerohedge) on X

In response to Trump tariff hikes, China vows to unleash much more stimulus, as it has every week for the past 3 years.

Luckily, at 330% debt/GDP...

Tyler Durden | Zero Hedge

Zero Hedge

Beijing Vows To Stabilize China's Sinking Economy | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Tourist visas will be denied to those who travel to the country for the primary purpose of giving birth on U.S. soil, the State Department said.

“It is unacceptable for foreign parents to use a U.S. tourist visa for the primary purpose of giving birth in the United States to obtain citizenship for the child, which also could result in American taxpayers paying the medical care costs,” the State Department

Tourist visas will be denied to those who travel to the country for the primary purpose of giving birth on U.S. soil, the State Department said.

“It is unacceptable for foreign parents to use a U.S. tourist visa for the primary purpose of giving birth in the United States to obtain citizenship for the child, which also could result in American taxpayers paying the medical care costs,” the State Department

Small arms were used by both sides in the gunfight, and no casualties have as of yet been reported, a briefing by an Indian official

Small arms were used by both sides in the gunfight, and no casualties have as of yet been reported, a briefing by an Indian official

It alleged that Mangione “took steps to evade law enforcement, flee New York City immediately after the murder, and cross state lines while armed with a privately manufactured firearm and silencer.”

Prosecutors filed the notice just one day before Mangione, 26, is scheduled to appear in Manhattan federal court for an arraignment.

Mangione is facing both federal and state charges over the Dec. 4 death of Thompson, a 50-year-old father of two who was killed as he walked outside a hotel in Midtown Manhattan, where UnitedHealthcare was gathering for an investor conference. UnitedHealthcare is the insurance division of UnitedHealth Group.

Mangione, a prep school and Ivy League graduate, has pleaded

It alleged that Mangione “took steps to evade law enforcement, flee New York City immediately after the murder, and cross state lines while armed with a privately manufactured firearm and silencer.”

Prosecutors filed the notice just one day before Mangione, 26, is scheduled to appear in Manhattan federal court for an arraignment.

Mangione is facing both federal and state charges over the Dec. 4 death of Thompson, a 50-year-old father of two who was killed as he walked outside a hotel in Midtown Manhattan, where UnitedHealthcare was gathering for an investor conference. UnitedHealthcare is the insurance division of UnitedHealth Group.

Mangione, a prep school and Ivy League graduate, has pleaded

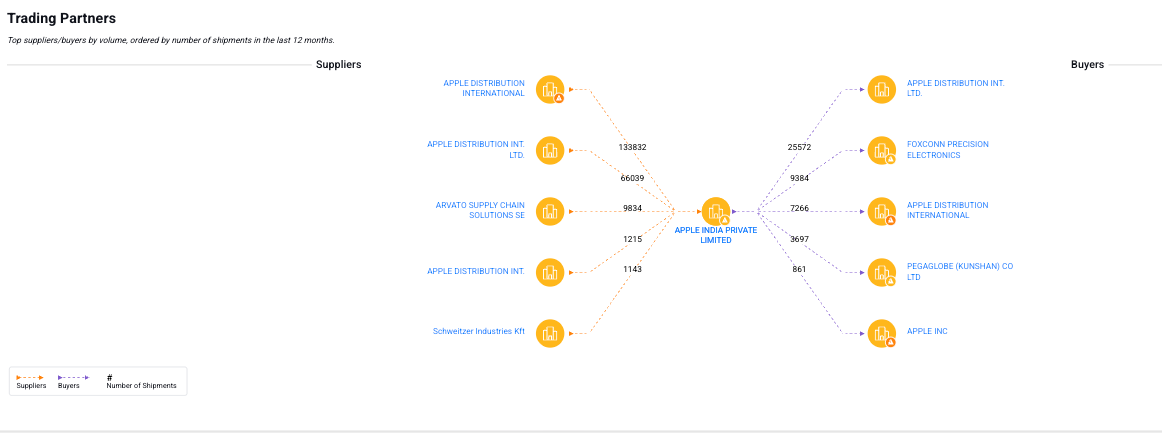

It only took Trump's trade war to get CEO Tim Cook very serious about diversifying supply chains out of China into friendlier countries. While friend-shoring is a must, what about re-shoring?

It only took Trump's trade war to get CEO Tim Cook very serious about diversifying supply chains out of China into friendlier countries. While friend-shoring is a must, what about re-shoring?

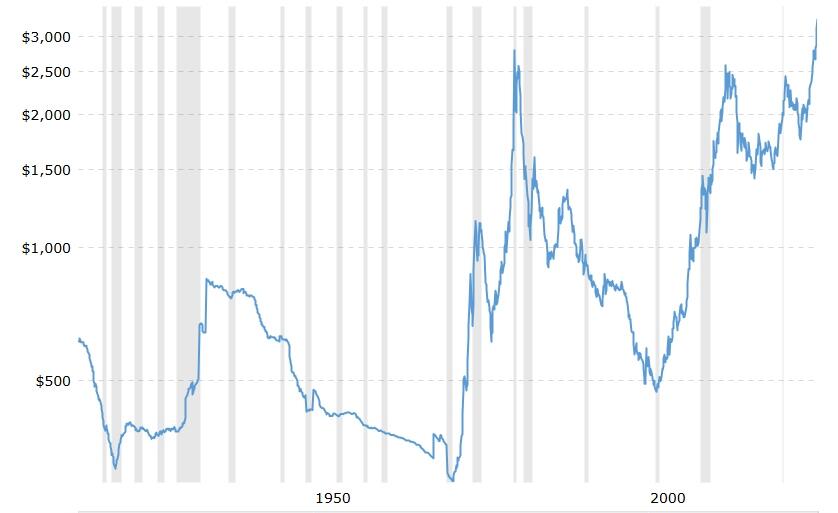

Gold has been on a tear lately. It was $1,830 as of October 5, 2023. At today’s prices, that marks a 75% surge in just 18 months. Gold has outperformed stocks by a wide margin this year, but it has also outperformed stocks for the past twenty-five years. Gold was around $250 per ounce in 1999. The gain since then is 1,180% or almost 12 times the starting price.

This is not the first bull market for gold. In the gold bull market of 1971 to 1980, gold rose 2,185%. In the gold bull market of 1999 to 2011, gold rose 670%. There were notable gold bear markets from 1981 to 1999 and again from 2012 to 2015. There were no bull or bear markets before 1971 because the world was on a gold standard and the price was fixed at $35.00 per ounce from 1944 to 1971. Still, the upward trend in gold prices is relentless and undeniable. Taking the entire period from 1971 until today including bull and bear markets gold has risen over 9,000%. Not bad.

Gold has been on a tear lately. It was $1,830 as of October 5, 2023. At today’s prices, that marks a 75% surge in just 18 months. Gold has outperformed stocks by a wide margin this year, but it has also outperformed stocks for the past twenty-five years. Gold was around $250 per ounce in 1999. The gain since then is 1,180% or almost 12 times the starting price.

This is not the first bull market for gold. In the gold bull market of 1971 to 1980, gold rose 2,185%. In the gold bull market of 1999 to 2011, gold rose 670%. There were notable gold bear markets from 1981 to 1999 and again from 2012 to 2015. There were no bull or bear markets before 1971 because the world was on a gold standard and the price was fixed at $35.00 per ounce from 1944 to 1971. Still, the upward trend in gold prices is relentless and undeniable. Taking the entire period from 1971 until today including bull and bear markets gold has risen over 9,000%. Not bad.

Of course, that’s all in the past. What investors want to know is where do we go from here? The short answer is up significantly.

Here’s Why

The most fundamental reason for the rise in gold prices is simple supply and demand. Central banks predominantly from developing markets moved from being net sellers to net buyers of gold in 2010. Total gold reserves of central banks have risen significantly since then from just over 30,000 metric tonnes (mt) to over 35,000mt today.

The top buyers were the central banks of Russia, China, Turkey, Poland and India. Russia increased its reserves by 1,684mt to a total of 2,333mt. China increased its reserves by 1,181mt to a total of 2,235mt. Iran is also a major buyer of gold, but it is non-transparent, and its purchases and reserves are not publicly known.

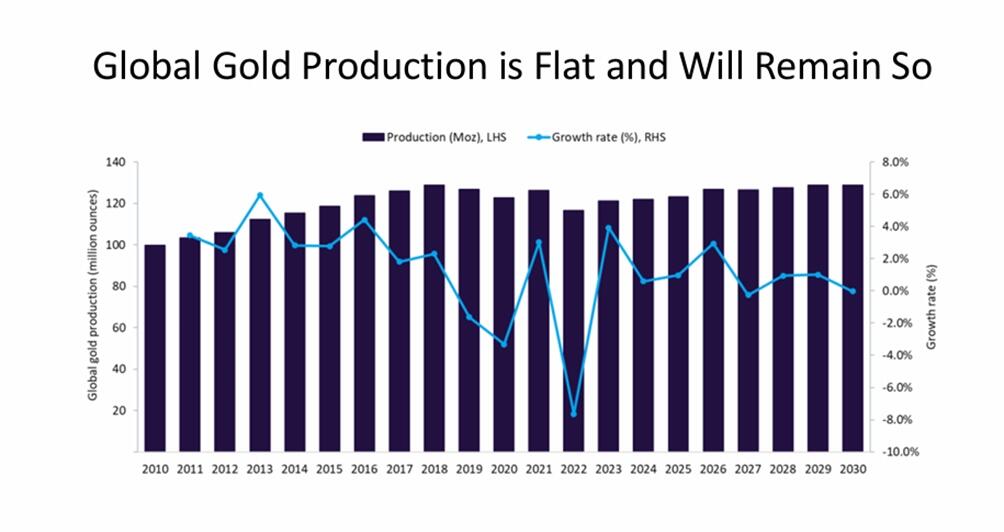

At the same time gold demand has been growing, gold output is flat. Global mining output of gold was about 130 million ounces in 2018 and was about 120 million ounces in 2024. Output declined slowly from 2018 to 2022 and then recovered slowly over the course of 2023 and 2024 but the change in both directions was slight.

Of course, that’s all in the past. What investors want to know is where do we go from here? The short answer is up significantly.

Here’s Why

The most fundamental reason for the rise in gold prices is simple supply and demand. Central banks predominantly from developing markets moved from being net sellers to net buyers of gold in 2010. Total gold reserves of central banks have risen significantly since then from just over 30,000 metric tonnes (mt) to over 35,000mt today.

The top buyers were the central banks of Russia, China, Turkey, Poland and India. Russia increased its reserves by 1,684mt to a total of 2,333mt. China increased its reserves by 1,181mt to a total of 2,235mt. Iran is also a major buyer of gold, but it is non-transparent, and its purchases and reserves are not publicly known.

At the same time gold demand has been growing, gold output is flat. Global mining output of gold was about 130 million ounces in 2018 and was about 120 million ounces in 2024. Output declined slowly from 2018 to 2022 and then recovered slowly over the course of 2023 and 2024 but the change in both directions was slight.

Gold production is projected to grow slightly from today until 2030 but is still not projected to exceed the 2018 high. In short, gold production by miners is flat. This does not mean that we are at “peak gold” or that new discoveries are not being made. They are. What it means is that gold is becoming harder to find and costs of production (especially water and energy) are going up, so the total output trend is flat.

Continually increasing demand with flat output is a recipe for higher gold prices.

The second driver of higher prices is the role of BRICS+. From an original membership of Brazil, Russia, India and China in 2009 (South Africa joined in 2010), the group has expanded to include Egypt, Ethiopia, Indonesia, Iran and the UAE. It’s waiting list of additional members who will be added in the years ahead includes Malaysia, Nigeria, Turkey and Vietnam among others.

There was much discussion in 2023 and 2024 about a new BRICS currency that would displace the U.S. dollar in trade among members and might ultimately prove to be an acceptable reserve currency to rival the dollar. In fact, no such alternative currency is in the works. It might happen in the future but it would take ten years or longer properly to design and implement.

Instead, the BRICS are building a new payments system using proprietary cables, secure servers and highly encrypted message traffic protocols along with a blockchain-type ledger. Payments are in local currencies in the new payment channels that cannot be disrupted by western powers.

This begs the question of how trade imbalances accumulating in local currencies can be settled and converted into more liquid assets. The traditional answer was dollars. In short, the BRICS+ already have a new global currency, which is actually quite old – it’s gold. This is one reason why BRICS+ members are among the largest buyers of gold bullion.

The Everything Hedge

Importantly, gold is not just an inflation hedge, in fact it is an imperfect inflation hedge in terms of strict correlation. Gold prices have skyrocketed in recent years even as inflation has remained relatively tame (despite an inflation surge in 2022). A better model is to think of gold as the “everything hedge.”

The vectors of uncertainty are everywhere. These include tariffs, tax policy, the Department of Government Efficiency (DOGE), the War in Ukraine, the rise of China, a likely recession, left-wing violence, and even the status of Greenland and the Panama Canal among others.

It’s difficult to forecast how any one of these situations will turn out, let alone all of them and their complex interactions. Stocks and bonds can be volatile as a result. Gold is the one safe haven asset that powers through them all and offers investors some peace of mind. It is truly the everything hedge.

These drivers are sending gold prices higher and putting a floor under current price levels so that investors can enjoy potential upside with reduced concern about the downside. That’s what we call an asymmetric trade, which greatly favors investors.

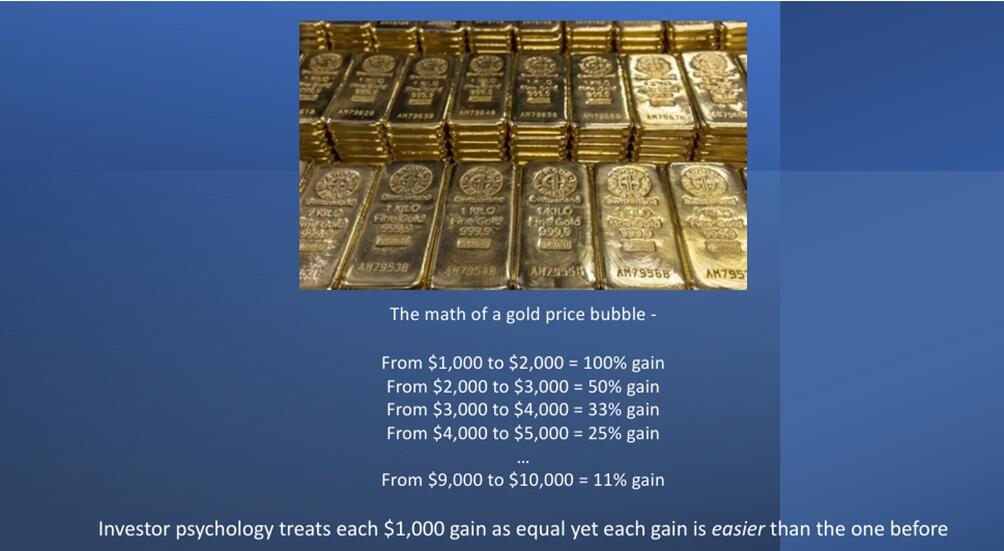

Finally, there’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

Investors naturally focus on dollar gains in the price of gold. When gold goes from $1,000 per ounce to $2,000 per ounce, investors cheer on the $1,000 gain. The same is true when gold goes from $2,000 per ounce to $3,000 per ounce. Again, investors pat themselves on the back for another $1,000 per ounce gain.

What investors don’t realize at least initially is that each $1,000 per ounce gain is easier than the one before. This phenomena involves the interaction of simple math and more complicated behavioral psychology.

The psychology is a matter of what’s called anchoring. The investor anchors on the number of $1,000 as a fixed gain and treats each such gain as the same. In pure dollars, they are the same. You make $1,000 per ounce as each benchmark is passed.

But here’s the conversion of those dollar benchmarks with each gain translated from dollars per ounce to percentages of the prior baseline:

Gold production is projected to grow slightly from today until 2030 but is still not projected to exceed the 2018 high. In short, gold production by miners is flat. This does not mean that we are at “peak gold” or that new discoveries are not being made. They are. What it means is that gold is becoming harder to find and costs of production (especially water and energy) are going up, so the total output trend is flat.

Continually increasing demand with flat output is a recipe for higher gold prices.

The second driver of higher prices is the role of BRICS+. From an original membership of Brazil, Russia, India and China in 2009 (South Africa joined in 2010), the group has expanded to include Egypt, Ethiopia, Indonesia, Iran and the UAE. It’s waiting list of additional members who will be added in the years ahead includes Malaysia, Nigeria, Turkey and Vietnam among others.

There was much discussion in 2023 and 2024 about a new BRICS currency that would displace the U.S. dollar in trade among members and might ultimately prove to be an acceptable reserve currency to rival the dollar. In fact, no such alternative currency is in the works. It might happen in the future but it would take ten years or longer properly to design and implement.

Instead, the BRICS are building a new payments system using proprietary cables, secure servers and highly encrypted message traffic protocols along with a blockchain-type ledger. Payments are in local currencies in the new payment channels that cannot be disrupted by western powers.

This begs the question of how trade imbalances accumulating in local currencies can be settled and converted into more liquid assets. The traditional answer was dollars. In short, the BRICS+ already have a new global currency, which is actually quite old – it’s gold. This is one reason why BRICS+ members are among the largest buyers of gold bullion.

The Everything Hedge

Importantly, gold is not just an inflation hedge, in fact it is an imperfect inflation hedge in terms of strict correlation. Gold prices have skyrocketed in recent years even as inflation has remained relatively tame (despite an inflation surge in 2022). A better model is to think of gold as the “everything hedge.”

The vectors of uncertainty are everywhere. These include tariffs, tax policy, the Department of Government Efficiency (DOGE), the War in Ukraine, the rise of China, a likely recession, left-wing violence, and even the status of Greenland and the Panama Canal among others.

It’s difficult to forecast how any one of these situations will turn out, let alone all of them and their complex interactions. Stocks and bonds can be volatile as a result. Gold is the one safe haven asset that powers through them all and offers investors some peace of mind. It is truly the everything hedge.

These drivers are sending gold prices higher and putting a floor under current price levels so that investors can enjoy potential upside with reduced concern about the downside. That’s what we call an asymmetric trade, which greatly favors investors.

Finally, there’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

Investors naturally focus on dollar gains in the price of gold. When gold goes from $1,000 per ounce to $2,000 per ounce, investors cheer on the $1,000 gain. The same is true when gold goes from $2,000 per ounce to $3,000 per ounce. Again, investors pat themselves on the back for another $1,000 per ounce gain.

What investors don’t realize at least initially is that each $1,000 per ounce gain is easier than the one before. This phenomena involves the interaction of simple math and more complicated behavioral psychology.

The psychology is a matter of what’s called anchoring. The investor anchors on the number of $1,000 as a fixed gain and treats each such gain as the same. In pure dollars, they are the same. You make $1,000 per ounce as each benchmark is passed.

But here’s the conversion of those dollar benchmarks with each gain translated from dollars per ounce to percentages of the prior baseline:

Because each $1,000 per ounce gain begins from a higher level, the percentage gain associated with each dollar gain is less. The increase from $1,000 to $2,000 per ounce is a heavy lift. The increase from $9,000 to $10,000 per ounce is not much more than a good month. (Gold has been going up 1% to 2% daily with recent volatility).

This math is what gives rise to a gold buying frenzy. We’re not there yet. Gold buying has been limited mostly to central banks and large institutions such as sovereign wealth funds (SWFs). Retail interest in the U.S. has been slight although retail buyers have been more active in India and China. Once the frenzy kicks in those $1,000 benchmarks will be passed quickly. That’s why it’s not too late to become a gold investor. Don’t kick yourself about the gains you’ve missed. Instead, look forward to the gains that are coming.

How To Invest

The two main ways to invest in gold are what I call paper gold and physical gold bullion. Paper gold refers to securities and futures linked to the price of gold such as exchange-traded funds (GLD is the most liquid ticker), COMEX gold futures or unallocated gold purchase agreements available from large banks. Paper gold will give you price exposure and the potential for gains, but you do not own gold bullion. Many things can go wrong with a paper gold strategy including early termination of contracts, closure of futures exchanges or the failure of a dealer bank. You may find that you’re out of the gold market just when you most want to be in it.

Physical bullion is my preferred way to invest in gold. American Gold Eagle coins from the U.S. Mint in one-ounce or one-quarter ounce denominations are practical. For larger amounts you can look at 1-kilo gold bars from a reputable refiner. Do not buy “rare” or “pre-1933” gold coins unless you are a collector or numismatic expert. The premium for such coins is high and they are not worth the extra expense. Gold is gold.

Do not store your bullion in a safe deposit box. Banks are the first place the government will lock down in a crisis. Your gold could be seized. Use a private storage company like Brinks or install a home safe. If you’re using a home safe there are several techniques you can use to protect it. The best protection is not to tell anyone you have gold. That way no one will come looking.

Because each $1,000 per ounce gain begins from a higher level, the percentage gain associated with each dollar gain is less. The increase from $1,000 to $2,000 per ounce is a heavy lift. The increase from $9,000 to $10,000 per ounce is not much more than a good month. (Gold has been going up 1% to 2% daily with recent volatility).

This math is what gives rise to a gold buying frenzy. We’re not there yet. Gold buying has been limited mostly to central banks and large institutions such as sovereign wealth funds (SWFs). Retail interest in the U.S. has been slight although retail buyers have been more active in India and China. Once the frenzy kicks in those $1,000 benchmarks will be passed quickly. That’s why it’s not too late to become a gold investor. Don’t kick yourself about the gains you’ve missed. Instead, look forward to the gains that are coming.

How To Invest

The two main ways to invest in gold are what I call paper gold and physical gold bullion. Paper gold refers to securities and futures linked to the price of gold such as exchange-traded funds (GLD is the most liquid ticker), COMEX gold futures or unallocated gold purchase agreements available from large banks. Paper gold will give you price exposure and the potential for gains, but you do not own gold bullion. Many things can go wrong with a paper gold strategy including early termination of contracts, closure of futures exchanges or the failure of a dealer bank. You may find that you’re out of the gold market just when you most want to be in it.

Physical bullion is my preferred way to invest in gold. American Gold Eagle coins from the U.S. Mint in one-ounce or one-quarter ounce denominations are practical. For larger amounts you can look at 1-kilo gold bars from a reputable refiner. Do not buy “rare” or “pre-1933” gold coins unless you are a collector or numismatic expert. The premium for such coins is high and they are not worth the extra expense. Gold is gold.

Do not store your bullion in a safe deposit box. Banks are the first place the government will lock down in a crisis. Your gold could be seized. Use a private storage company like Brinks or install a home safe. If you’re using a home safe there are several techniques you can use to protect it. The best protection is not to tell anyone you have gold. That way no one will come looking.

“We believe Judge Dugan intentionally misdirected federal agents away from the subject to be arrested in her courthouse, Eduardo Flores Ruiz, allowing the subject — an illegal alien — to evade arrest,” Patel said in a brief statement shared on X. “Thankfully our agents chased down the perp on foot and he’s been in custody since, but the Judge’s obstruction created increased danger to the public.”

“We believe Judge Dugan intentionally misdirected federal agents away from the subject to be arrested in her courthouse, Eduardo Flores Ruiz, allowing the subject — an illegal alien — to evade arrest,” Patel said in a brief statement shared on X. “Thankfully our agents chased down the perp on foot and he’s been in custody since, but the Judge’s obstruction created increased danger to the public.”

In a recent

among central banks.

He pointed to a long-term trend where countries have been reducing their reliance on dollar-based reserves in favor of assets like gold and, increasingly, Bitcoin.

“This whole diversification away from traditional assets and into things like gold and also crypto [...] probably began three, four years ago,” Jacobs explained.

He said that recent geopolitical fragmentation has intensified the push toward alternative stores of value.

Jacobs referenced growing concerns about the freezing of $300 billion in Russian central bank assets following its invasion of Ukraine, suggesting that such events have prompted countries like China to rethink their reserve strategies.

BlackRock executive Jay Jacobs on CNBC. Source: YouTube

Geopolitical fragmentation to shape global markets

During the interview, Jacobs said BlackRock, the world’s largest asset manager, has identified geopolitical fragmentation as a defining force for global markets over the coming decades:

“We really identified geopolitical fragmentation as a mega force that is driving the world forward over the next several decades.”

He noted that this environment is fueling demand for uncorrelated assets, with Bitcoin increasingly viewed alongside gold as a safe-haven asset.

“We’ve seen significant inflows into gold ETFs. We’ve seen significant inflows into Bitcoin. And this is all because people are looking for those assets that will behave differently,” Jacobs said.

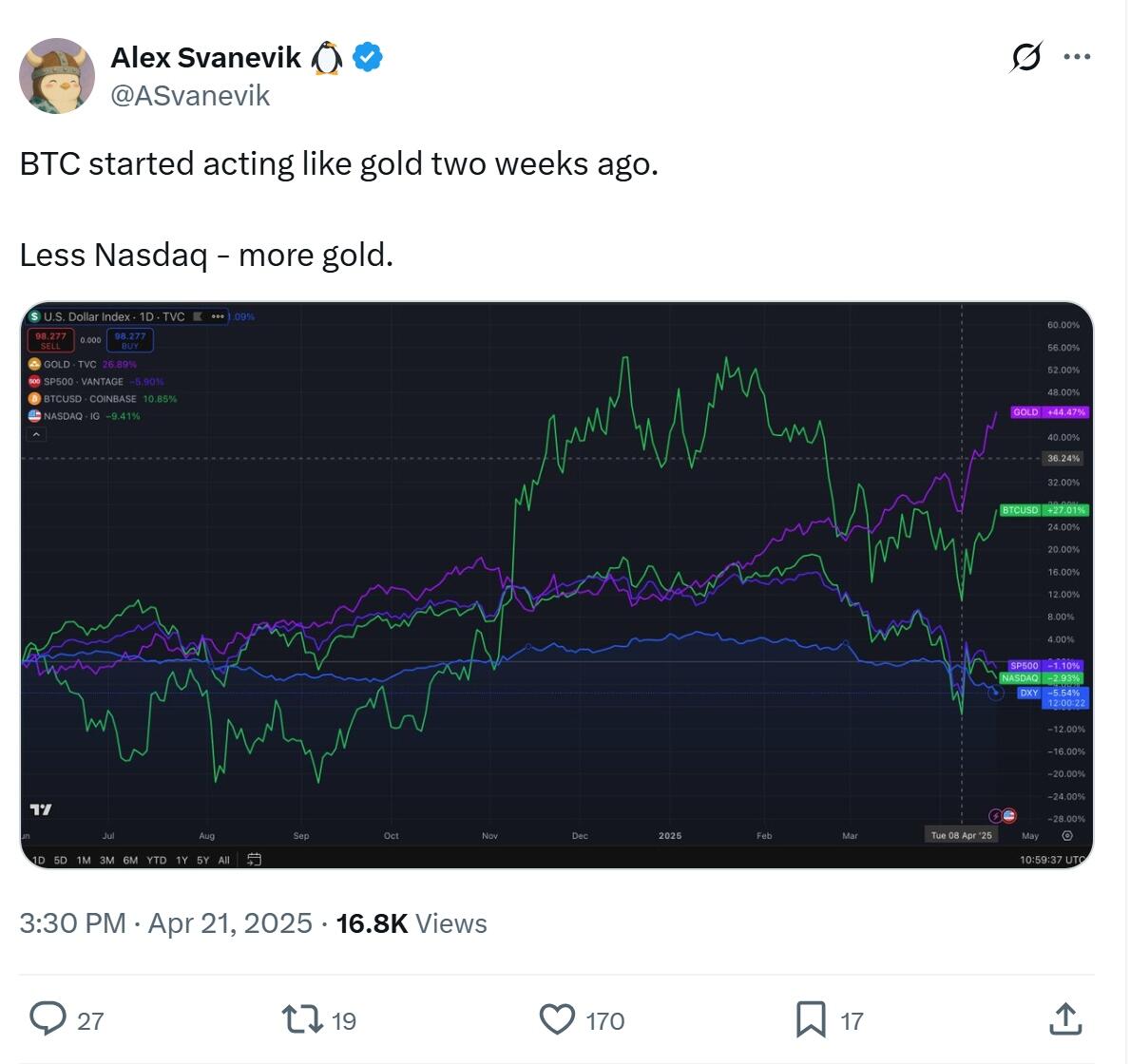

Investors highlight Bitcoin decoupling

Notably, Jacobs is not alone in stressing Bitcoin’s declining correlation with US equities. Several analysts have also observed that Bitcoin is beginning to decouple from the US stock market.

On April 22, Alex Svanevik, co-founder and CEO of the Nansen crypto intelligence platform, said

In a recent

among central banks.

He pointed to a long-term trend where countries have been reducing their reliance on dollar-based reserves in favor of assets like gold and, increasingly, Bitcoin.

“This whole diversification away from traditional assets and into things like gold and also crypto [...] probably began three, four years ago,” Jacobs explained.

He said that recent geopolitical fragmentation has intensified the push toward alternative stores of value.

Jacobs referenced growing concerns about the freezing of $300 billion in Russian central bank assets following its invasion of Ukraine, suggesting that such events have prompted countries like China to rethink their reserve strategies.

BlackRock executive Jay Jacobs on CNBC. Source: YouTube

Geopolitical fragmentation to shape global markets

During the interview, Jacobs said BlackRock, the world’s largest asset manager, has identified geopolitical fragmentation as a defining force for global markets over the coming decades:

“We really identified geopolitical fragmentation as a mega force that is driving the world forward over the next several decades.”

He noted that this environment is fueling demand for uncorrelated assets, with Bitcoin increasingly viewed alongside gold as a safe-haven asset.

“We’ve seen significant inflows into gold ETFs. We’ve seen significant inflows into Bitcoin. And this is all because people are looking for those assets that will behave differently,” Jacobs said.

Investors highlight Bitcoin decoupling

Notably, Jacobs is not alone in stressing Bitcoin’s declining correlation with US equities. Several analysts have also observed that Bitcoin is beginning to decouple from the US stock market.

On April 22, Alex Svanevik, co-founder and CEO of the Nansen crypto intelligence platform, said

Source:

Source:

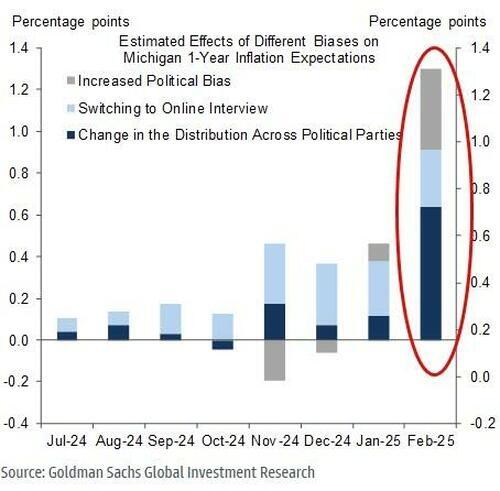

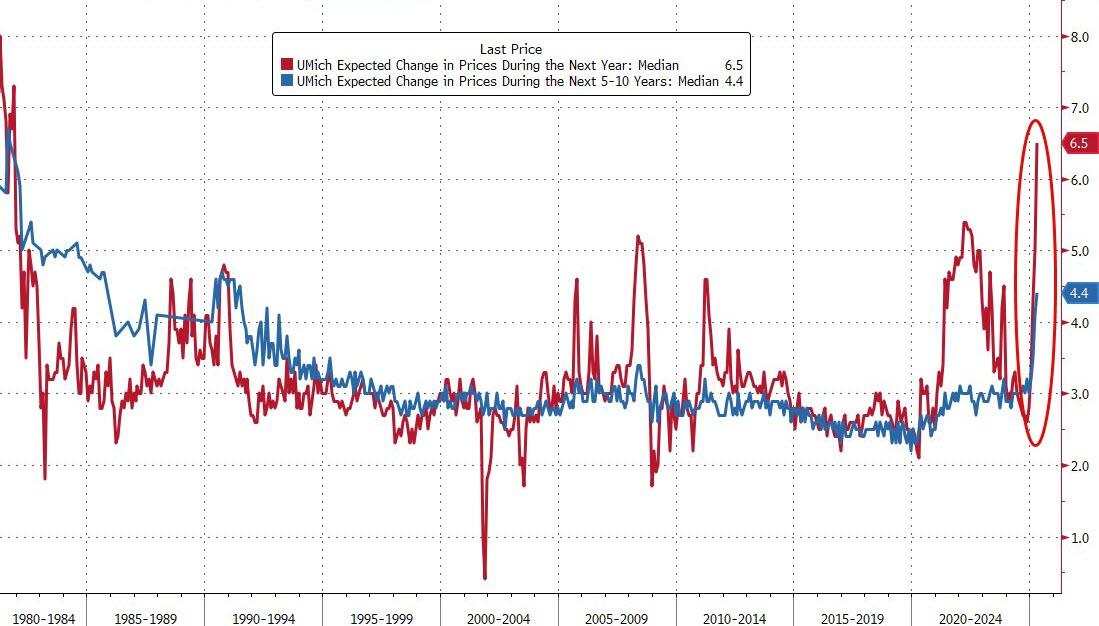

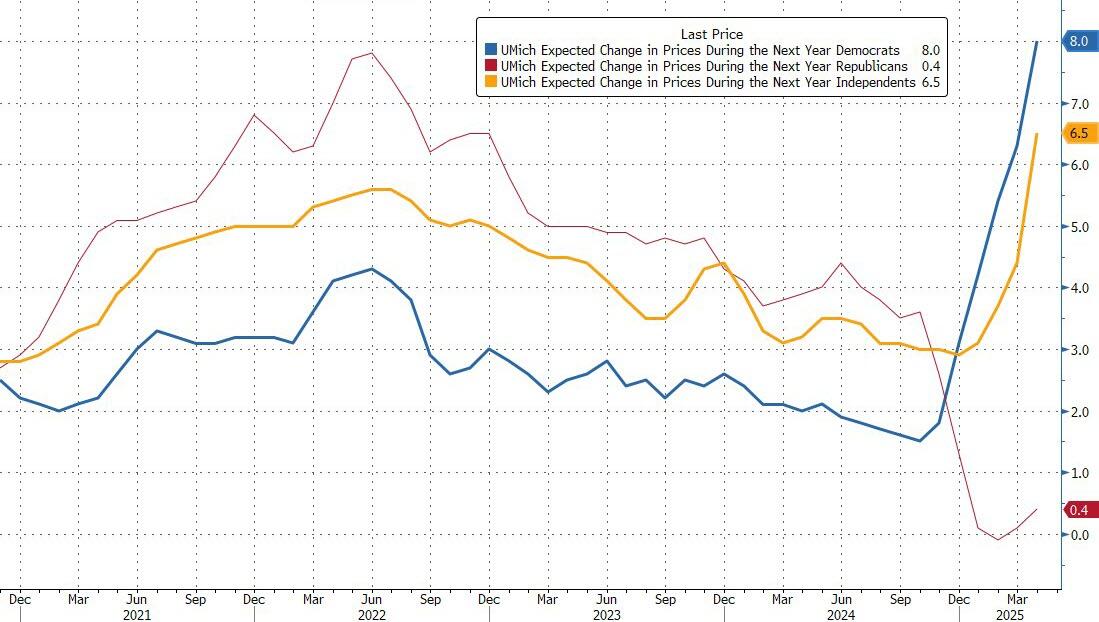

So, with all that in mind, let's see what the final data looks like - did it get even crazier?

The short answer is - YES!

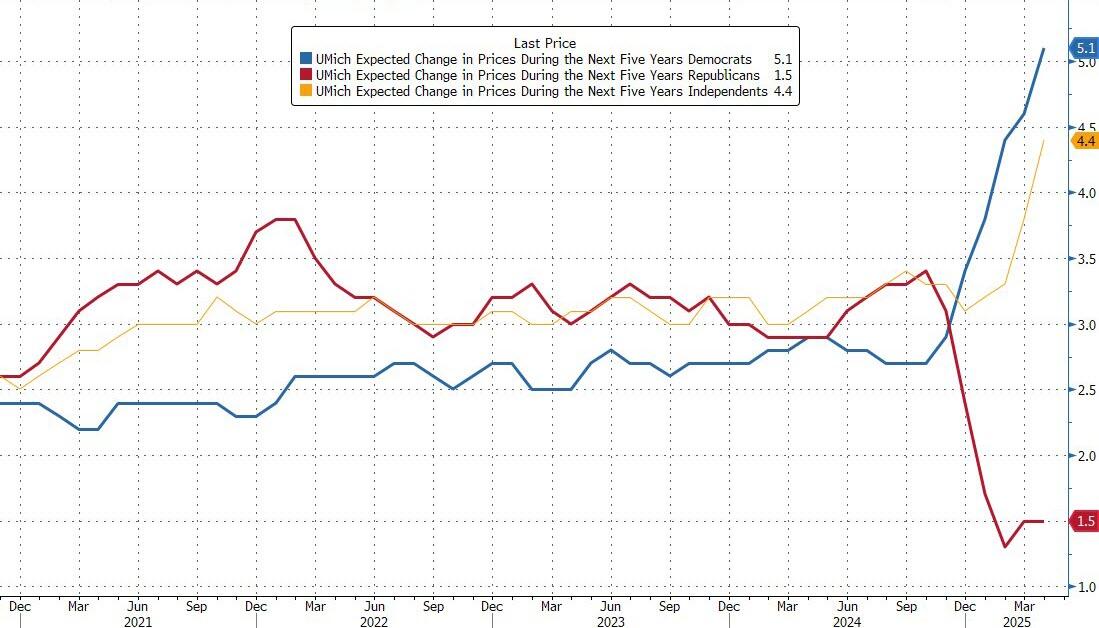

UMich 1Yr inflation expectations rose to 6.5% (slightly lower than the 6.8% expected but still the highest since Nov 1981) while the 5-10Y expectations jumped to 4.4% - the highest since June 1991...

So, with all that in mind, let's see what the final data looks like - did it get even crazier?

The short answer is - YES!

UMich 1Yr inflation expectations rose to 6.5% (slightly lower than the 6.8% expected but still the highest since Nov 1981) while the 5-10Y expectations jumped to 4.4% - the highest since June 1991...

Source: Bloomberg

The gaping chasm of propaganda-driven fear is evident below the surface with Republicans expected 0.4% inflation while Democrats expect - wait for it - 8.0% price rises in the next year (Independents also saw inflation expectations rising)...

Source: Bloomberg

The gaping chasm of propaganda-driven fear is evident below the surface with Republicans expected 0.4% inflation while Democrats expect - wait for it - 8.0% price rises in the next year (Independents also saw inflation expectations rising)...

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Bear in mind that Democrat's 1Yr inflation expectations are now more than 2 times higher than they were in June 2021 when inflation would actually rise to 9%. Back then the Democrats were only off by a factor of 3x.

The final April sentiment index declined to 52.2 from 57 a month earlier, but this was considerably better than the 50.8 preliminary number and the median estimate of 50.5 in a Bloomberg survey of economists.

"While this month’s deterioration was particularly strong for middle-income families, expectations worsened for vast swaths of the population across age, education, income, and political affiliation," Joanne Hsu, director of the survey, said in a statement.

“ Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead."

The survey showed the expectations index plunged 11.4 points, the sharpest drop since 2021, to 52.6 this month. The current conditions gauge decreased to a six-month low of 63.8.

Source: Bloomberg

Bear in mind that Democrat's 1Yr inflation expectations are now more than 2 times higher than they were in June 2021 when inflation would actually rise to 9%. Back then the Democrats were only off by a factor of 3x.

The final April sentiment index declined to 52.2 from 57 a month earlier, but this was considerably better than the 50.8 preliminary number and the median estimate of 50.5 in a Bloomberg survey of economists.

"While this month’s deterioration was particularly strong for middle-income families, expectations worsened for vast swaths of the population across age, education, income, and political affiliation," Joanne Hsu, director of the survey, said in a statement.

“ Consumers perceived risks to multiple aspects of the economy, in large part due to ongoing uncertainty around trade policy and the potential for a resurgence of inflation looming ahead."

The survey showed the expectations index plunged 11.4 points, the sharpest drop since 2021, to 52.6 this month. The current conditions gauge decreased to a six-month low of 63.8.

Source: Bloomberg

After five straight months of disappointments, April saw the biggest beat for headline UMich sentiment since June 2024...

Source: Bloomberg

After five straight months of disappointments, April saw the biggest beat for headline UMich sentiment since June 2024...

Source: Bloomberg

“ Labor market expectations remained bleak,’’ Joanne Hsu, director of the survey, said in a statement.

“ Even more concerning for the path of the economy, consumers anticipated weaker income growth for themselves in the year ahead. Without reliably strong incomes, spending is unlikely to remain strong amid the numerous warnings signs perceived by consumers.”

Compare UMich's survey for the longer-term inflation expectations, according to Democrats, to what the market is pricing in...

Source: Bloomberg

“ Labor market expectations remained bleak,’’ Joanne Hsu, director of the survey, said in a statement.

“ Even more concerning for the path of the economy, consumers anticipated weaker income growth for themselves in the year ahead. Without reliably strong incomes, spending is unlikely to remain strong amid the numerous warnings signs perceived by consumers.”

Compare UMich's survey for the longer-term inflation expectations, according to Democrats, to what the market is pricing in...

Source: Bloomberg

Is it really any surprise that even Fed Chair Jay Powell dismisses this survey's farcical numbers as a partisan outlier.

Source: Bloomberg

Is it really any surprise that even Fed Chair Jay Powell dismisses this survey's farcical numbers as a partisan outlier.

Amid a sudden resurgence in net inflows into BTC ETFs...

Amid a sudden resurgence in net inflows into BTC ETFs...

The Board is rescinding its 2022

The Board is rescinding its 2022

Combined with bullish chart structures and concentrated short liquidity overhead, BTC remains positioned for a potential move toward $100,000 by May.

Combined with bullish chart structures and concentrated short liquidity overhead, BTC remains positioned for a potential move toward $100,000 by May.