Gold Price Hike Sparks Surge In Electronic Metal Detecting

Gold Price Hike Sparks Surge In Electronic Metal Detecting

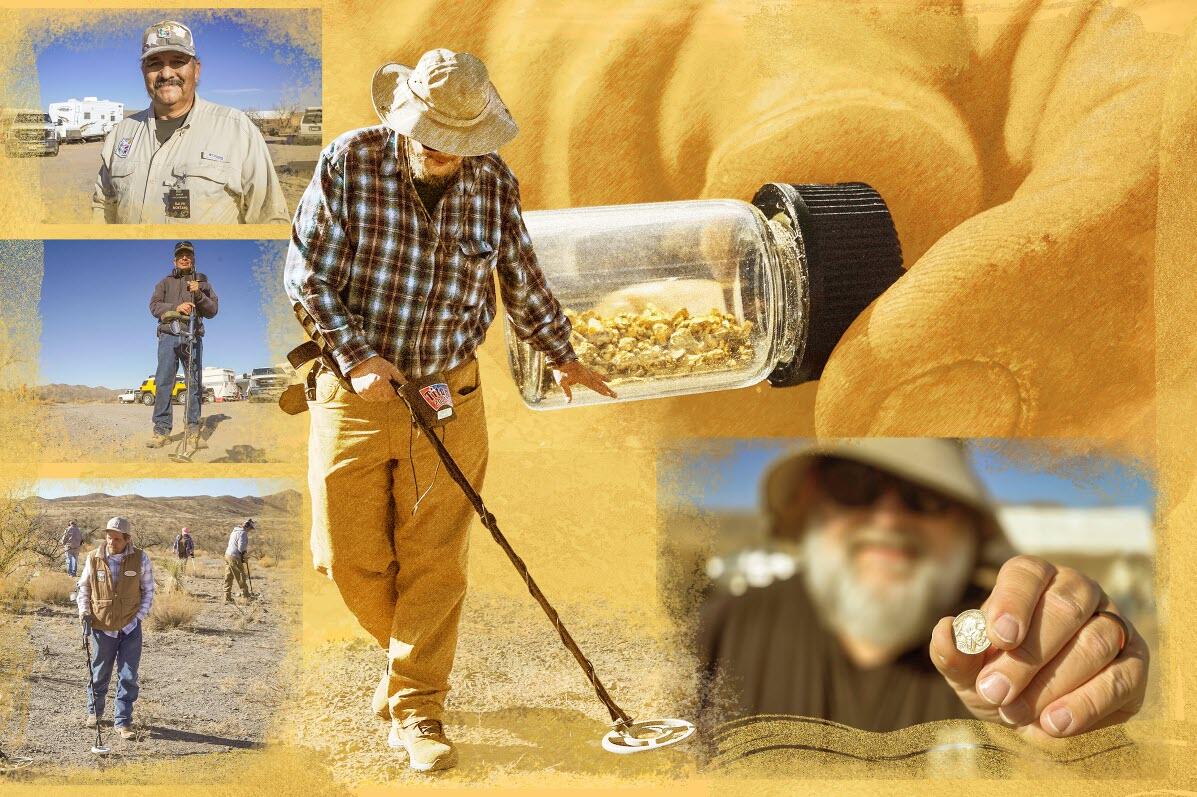

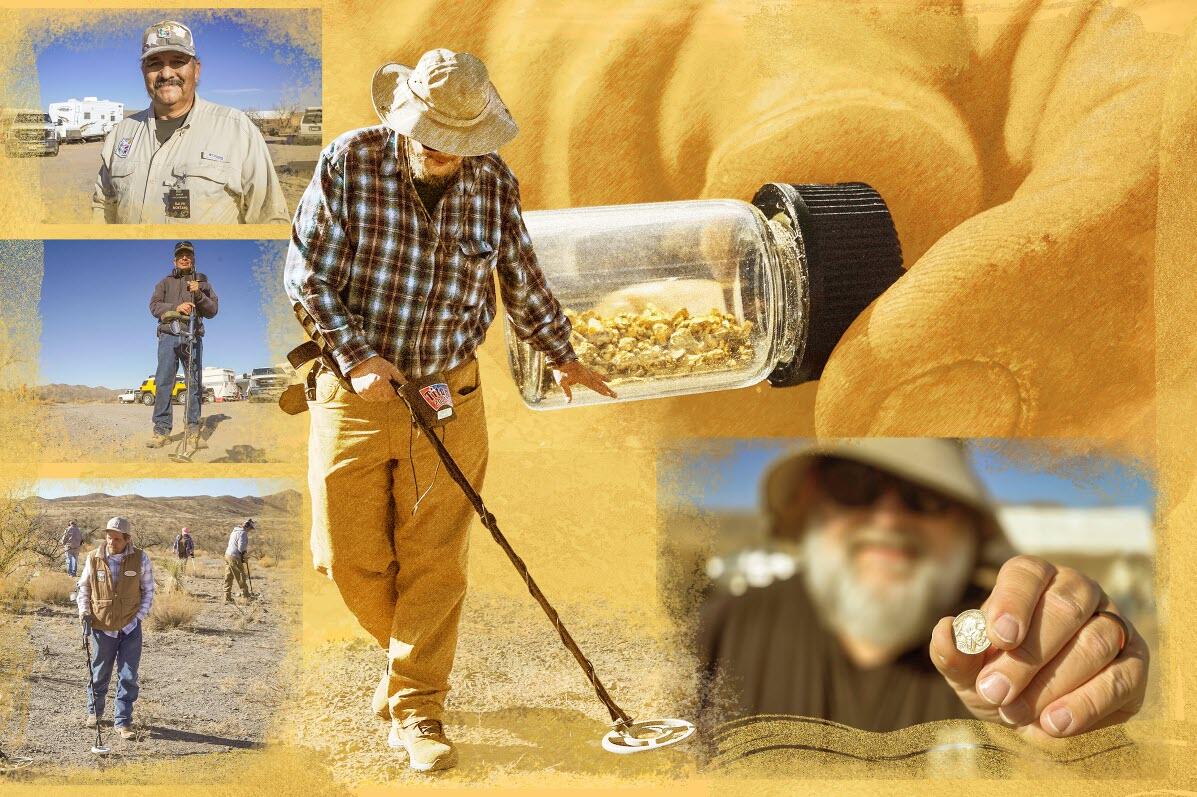

Joe Marihugh caught the gold bug years ago while running buckets of sand through a washer to extract flakes of the precious yellow metal.

He and his wife once ran 50 buckets to retrieve two grams of gold, which was worth nearly $200 at the time.

Since then, he has been using his dependable Minelab Gold Monster 1000 metal detector, with high expectations and his eyes fixed on the ground.

“I love searching for gold. It’s what we do,” Marihugh said as he swept the metal detector’s search coil across the hard, dry soil south of Tucson, Arizona, hoping to discover something valuable beneath the surface.

Joe Marihugh caught the gold bug years ago while running buckets of sand through a washer to extract flakes of the precious yellow metal.

He and his wife once ran 50 buckets to retrieve two grams of gold, which was worth nearly $200 at the time.

Since then, he has been using his dependable Minelab Gold Monster 1000 metal detector, with high expectations and his eyes fixed on the ground.

“I love searching for gold. It’s what we do,” Marihugh said as he swept the metal detector’s search coil across the hard, dry soil south of Tucson, Arizona, hoping to discover something valuable beneath the surface.

On March 22, Marihugh and more than 20 members of the

On March 22, Marihugh and more than 20 members of the  set out to make profitable discoveries during the club’s annual spring outing for metal detecting.

Like forensic investigators searching for evidence, the metal detectorists worked with focused determination in a close formation under the bright morning desert sun.

“There are people out here that do find gold nuggets,” said club president Ralph Montano. “I tell everybody: you’re not going to get rich” metal detecting, but, “you might get lucky.”

It’s not just the thrill of the hunt that draws metal detector enthusiasts, like the Desert Gold Diggers, to remote locations in search of hidden treasure.

It’s the attraction of discovering precious metals following gold’s recent surge to more than $3,000 an ounce—marking the first time in U.S. history.

At the same time, silver continues rising and is more than $34 an ounce.

Montano told The Epoch Times that it’s not merely by chance that the club has been receiving more inquiries from individuals interested in metal detecting.

set out to make profitable discoveries during the club’s annual spring outing for metal detecting.

Like forensic investigators searching for evidence, the metal detectorists worked with focused determination in a close formation under the bright morning desert sun.

“There are people out here that do find gold nuggets,” said club president Ralph Montano. “I tell everybody: you’re not going to get rich” metal detecting, but, “you might get lucky.”

It’s not just the thrill of the hunt that draws metal detector enthusiasts, like the Desert Gold Diggers, to remote locations in search of hidden treasure.

It’s the attraction of discovering precious metals following gold’s recent surge to more than $3,000 an ounce—marking the first time in U.S. history.

At the same time, silver continues rising and is more than $34 an ounce.

Montano told The Epoch Times that it’s not merely by chance that the club has been receiving more inquiries from individuals interested in metal detecting.

Desert Gold Diggers President Ralph Montano coordinates the metal club's annual spring outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There seems to be a direct connection between gold prices and interest in the hobby.

“We’ve gotten a lot of interest lately. In the last couple of months, we’ve gotten a lot of new members,” Montano said.

“They’re coming out and learning from us about what equipment they will need and what to look for—how to look for the spots that might produce.”

Not since gold reached an all-time high of $1,896 and silver hit $49.52 per ounce in 2011 have precious metals—often considered “barbarous relics” in the financial world—commanded such prices.

A Global Run On Gold

According to investment consultant https://www.troweprice.com/en/us/insights/what-is-driving-gold-prices-to-all-time-record-highs

, there are several factors causing the price of gold and silver to breach the $3,000 high-water mark.

Since late 2022, the company observed that the long-standing inverse relationship between gold prices and real interest rates had become disconnected from the U.S. dollar and stock market.

“This reflects the growing influence of global fiscal policies and currency debasement, a sharp rise in central bank buying, as well as an environment of heightened geopolitical risks,” T. Rowe Price noted.

“Geopolitical risks only seem to be growing. Wars rage in the Middle East and Ukraine. Conflicts between China and its neighbors are a looming threat.

“The coalition of countries hostile to the West will continue to look for ways to decrease dependency on the [U.S. Dollar] as a reserve currency and medium for international exchange.”

Gold.org

Desert Gold Diggers President Ralph Montano coordinates the metal club's annual spring outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There seems to be a direct connection between gold prices and interest in the hobby.

“We’ve gotten a lot of interest lately. In the last couple of months, we’ve gotten a lot of new members,” Montano said.

“They’re coming out and learning from us about what equipment they will need and what to look for—how to look for the spots that might produce.”

Not since gold reached an all-time high of $1,896 and silver hit $49.52 per ounce in 2011 have precious metals—often considered “barbarous relics” in the financial world—commanded such prices.

A Global Run On Gold

According to investment consultant https://www.troweprice.com/en/us/insights/what-is-driving-gold-prices-to-all-time-record-highs

, there are several factors causing the price of gold and silver to breach the $3,000 high-water mark.

Since late 2022, the company observed that the long-standing inverse relationship between gold prices and real interest rates had become disconnected from the U.S. dollar and stock market.

“This reflects the growing influence of global fiscal policies and currency debasement, a sharp rise in central bank buying, as well as an environment of heightened geopolitical risks,” T. Rowe Price noted.

“Geopolitical risks only seem to be growing. Wars rage in the Middle East and Ukraine. Conflicts between China and its neighbors are a looming threat.

“The coalition of countries hostile to the West will continue to look for ways to decrease dependency on the [U.S. Dollar] as a reserve currency and medium for international exchange.”

Gold.org  that gold reached more than 40 new highs in 2024, with an additional 14 highs so far this year.

This significant upward movement is considered “no coincidence,” according to the analyst, who indicated that a potential “perfect storm” is forming for the yellow metal.

“The focus isn’t just the number itself but the pace at which gold has reached it. The jump from U.S. $2,500 [per ounce] to $3,000 took just 210 days—a notably faster move that underscores the momentum gold has built over the past two years.”

that gold reached more than 40 new highs in 2024, with an additional 14 highs so far this year.

This significant upward movement is considered “no coincidence,” according to the analyst, who indicated that a potential “perfect storm” is forming for the yellow metal.

“The focus isn’t just the number itself but the pace at which gold has reached it. The jump from U.S. $2,500 [per ounce] to $3,000 took just 210 days—a notably faster move that underscores the momentum gold has built over the past two years.”

Joe Marihugh, from Tucson, Arizona, displays a vial containing roughly 1 gram of gold flakes he extracted from buckets of sand through a washer, on March 22, 2025. Allan Stein/The Epoch Times

While the demand for retail gold and silver remains high, more adventurous individuals are discovering the potential riches of metal detecting.

“All detectorists have dreamt of making that one great find at some point,” noted the Massachusetts-based metal detector seller

Joe Marihugh, from Tucson, Arizona, displays a vial containing roughly 1 gram of gold flakes he extracted from buckets of sand through a washer, on March 22, 2025. Allan Stein/The Epoch Times

While the demand for retail gold and silver remains high, more adventurous individuals are discovering the potential riches of metal detecting.

“All detectorists have dreamt of making that one great find at some point,” noted the Massachusetts-based metal detector seller  .

“The most common items found are usually older coins, gold or silver coins, gold nuggets, Roman coin treasures, medieval coins, ferrous metals, Civil War buttons, and other buried treasure or gold objects.”

Another Gold Rush?

Ron Shore, the owner of https://www.windycitymetaldetectors.com/

in Chicago, has noticed a definite increase in metal detector sales since the price of gold surpassed $3,000 per ounce on March 14.

However, this recent “bump” in purchases is not nearly as substantial as the high volume of metal detectors he sold during the “gold rush” of the 1980s. The company was established in 1985.

In January 1980, gold first reached a price of $850 per ounce, marking a historic milestone.

Shore said that his customers are now seeking an economical way that will “help them find gold” as the price of precious metals trends higher.

“There’s a few people that know the cost of gold is up. They want to get into the hobby because of that,” he said.

“But it’s not even close to what it was in the 80s. I mean, there was literally a gold rush on. I had cars pulling up [outside the store.] I couldn’t get gold detectors in the cars [fast enough]—that’s literally how many were being sold.”

Shore said he hadn’t seen anything like it since he began metal detecting in the 1970s.

However, this could change if the value of gold continues to rise, and indications suggest that it will, he added.

In addition to metal detecting, panning for gold remains a popular activity for those interested in traditional prospecting methods, according to precious metals advisor GMR Gold.

.

“The most common items found are usually older coins, gold or silver coins, gold nuggets, Roman coin treasures, medieval coins, ferrous metals, Civil War buttons, and other buried treasure or gold objects.”

Another Gold Rush?

Ron Shore, the owner of https://www.windycitymetaldetectors.com/

in Chicago, has noticed a definite increase in metal detector sales since the price of gold surpassed $3,000 per ounce on March 14.

However, this recent “bump” in purchases is not nearly as substantial as the high volume of metal detectors he sold during the “gold rush” of the 1980s. The company was established in 1985.

In January 1980, gold first reached a price of $850 per ounce, marking a historic milestone.

Shore said that his customers are now seeking an economical way that will “help them find gold” as the price of precious metals trends higher.

“There’s a few people that know the cost of gold is up. They want to get into the hobby because of that,” he said.

“But it’s not even close to what it was in the 80s. I mean, there was literally a gold rush on. I had cars pulling up [outside the store.] I couldn’t get gold detectors in the cars [fast enough]—that’s literally how many were being sold.”

Shore said he hadn’t seen anything like it since he began metal detecting in the 1970s.

However, this could change if the value of gold continues to rise, and indications suggest that it will, he added.

In addition to metal detecting, panning for gold remains a popular activity for those interested in traditional prospecting methods, according to precious metals advisor GMR Gold.

Members of the Desert Gold Diggers metal detecting club fan out as they search for buried treasure south of Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There are several methods for gold prospecting. The traditional technique of gold panning can be enhanced by using a Rocker Box, also known as a cradle.

This tool is more efficient than simple panning, as it consists of a wooden box with a sieve and a rocking mechanism.

Another method is the sluice box, which features a long trough designed to capture gold particles while directing water and sediment through it.

In areas with scarce water, dry panning is an efficient method that relies on air instead of water to separate gold from the sediment.

“Many enthusiasts enjoy the thrill of panning for gold in rivers and streams, reliving the experiences of the early prospectors,” GMR Gold

Members of the Desert Gold Diggers metal detecting club fan out as they search for buried treasure south of Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There are several methods for gold prospecting. The traditional technique of gold panning can be enhanced by using a Rocker Box, also known as a cradle.

This tool is more efficient than simple panning, as it consists of a wooden box with a sieve and a rocking mechanism.

Another method is the sluice box, which features a long trough designed to capture gold particles while directing water and sediment through it.

In areas with scarce water, dry panning is an efficient method that relies on air instead of water to separate gold from the sediment.

“Many enthusiasts enjoy the thrill of panning for gold in rivers and streams, reliving the experiences of the early prospectors,” GMR Gold  on its blog.

“The history of gold panning is a testament to human ingenuity, perseverance, and the enduring allure of gold.”

Steve Moore, the marketing director of Texas-based electronic metal detector manufacturer

, concurred that the rising price of gold has increased interest in electronic gold prospecting.

Moore said that Garrett, a privately held business, could not speculate on the actual increase in sales volume. Nonetheless, “we expect to see nice increases this year in our prospecting detector sales,” he said.

“Garrett will certainly expect additional sales in 2025 of our best prospecting detectors"—the Goldmaster 24k, specifically made for gold nugget hunting, and the Axiom, Moore told The Epoch Times.

Moore said that there is still subsurface gold to be found in many regions, including Australia, the Yukon, Arizona, California, and Nevada.

“One of the keys to finding gold is having a gold-producing region, which requires some research,” he said. “Then they must gain access to a claim where they can properly search.”

on its blog.

“The history of gold panning is a testament to human ingenuity, perseverance, and the enduring allure of gold.”

Steve Moore, the marketing director of Texas-based electronic metal detector manufacturer

, concurred that the rising price of gold has increased interest in electronic gold prospecting.

Moore said that Garrett, a privately held business, could not speculate on the actual increase in sales volume. Nonetheless, “we expect to see nice increases this year in our prospecting detector sales,” he said.

“Garrett will certainly expect additional sales in 2025 of our best prospecting detectors"—the Goldmaster 24k, specifically made for gold nugget hunting, and the Axiom, Moore told The Epoch Times.

Moore said that there is still subsurface gold to be found in many regions, including Australia, the Yukon, Arizona, California, and Nevada.

“One of the keys to finding gold is having a gold-producing region, which requires some research,” he said. “Then they must gain access to a claim where they can properly search.”

A member of the Desert Gold Diggers metal detecting club searches for buried objects during the club's yearly outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Marihugh credited his uncle with sparking his interest in gold prospecting during his youth. In 2010, the Gold Rush series premiered on the Discovery Channel, and from that moment, Marihugh said he was hooked.

“We’ve just been finding gold ever since. I’ve got ounces that I’ve found over the years.”

To illustrate, he presented a vial containing approximately a gram of gold flakes he recently discovered.

Other detectorists search parks where they may find lost rings and valuable objects, he said.

Gold Side-Hustle

“It’s out there—it’s still out there,” Marihugh said. “People lose rings. The kids lose necklaces.”

As gold prices continue to rise, he said: “It’s going to draw more and more people” to metal detecting as a money-making hobby or pastime.

“Ever since gold hit over $2,200, people have been getting out there more and more. I hope it keeps going up,” he said.

Montano said that Desert Gold Diggers formed about 35 years ago, and currently maintains 19 claims for members to search for buried treasure.

“I’m still learning since I started like six years ago” using an entry-level Garrett 250, he said.

Jose Lizarraga, a club member from Tucson, has been metal detecting for the past two years and used a Monster 1000 at the outing.

He believes it was his “beginner’s luck” to discover a gold nugget during another metal-detecting adventure.

“And so what I did is last year for our anniversary, I made it into a necklace,” Lizarraga told The Epoch Times. “That was my anniversary present for my wife. She loves it.”

A member of the Desert Gold Diggers metal detecting club searches for buried objects during the club's yearly outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Marihugh credited his uncle with sparking his interest in gold prospecting during his youth. In 2010, the Gold Rush series premiered on the Discovery Channel, and from that moment, Marihugh said he was hooked.

“We’ve just been finding gold ever since. I’ve got ounces that I’ve found over the years.”

To illustrate, he presented a vial containing approximately a gram of gold flakes he recently discovered.

Other detectorists search parks where they may find lost rings and valuable objects, he said.

Gold Side-Hustle

“It’s out there—it’s still out there,” Marihugh said. “People lose rings. The kids lose necklaces.”

As gold prices continue to rise, he said: “It’s going to draw more and more people” to metal detecting as a money-making hobby or pastime.

“Ever since gold hit over $2,200, people have been getting out there more and more. I hope it keeps going up,” he said.

Montano said that Desert Gold Diggers formed about 35 years ago, and currently maintains 19 claims for members to search for buried treasure.

“I’m still learning since I started like six years ago” using an entry-level Garrett 250, he said.

Jose Lizarraga, a club member from Tucson, has been metal detecting for the past two years and used a Monster 1000 at the outing.

He believes it was his “beginner’s luck” to discover a gold nugget during another metal-detecting adventure.

“And so what I did is last year for our anniversary, I made it into a necklace,” Lizarraga told The Epoch Times. “That was my anniversary present for my wife. She loves it.”

Jose Lizarraga, a member of the Desert Gold Diggers metal detecting club, stands with his Minelab Gold Monster 1000 near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Bob Burgette, 62, who hails from Wisconsin, began gold prospecting and metal detecting in his youth.

He currently has six Minelab metal detectors to search for various types of metal objects.

“I had a couple sisters that lived out here, so I came out and visited and I got hooked on looking for gold,” Burgette told The Epoch Times.

“They were more into arrowheads, but I used the same amount of time to go out and prospect in washes.”

One of his best discoveries was an 1886 Seated Liberty silver dime, which he found about a foot deep in the ground.

Jose Lizarraga, a member of the Desert Gold Diggers metal detecting club, stands with his Minelab Gold Monster 1000 near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Bob Burgette, 62, who hails from Wisconsin, began gold prospecting and metal detecting in his youth.

He currently has six Minelab metal detectors to search for various types of metal objects.

“I had a couple sisters that lived out here, so I came out and visited and I got hooked on looking for gold,” Burgette told The Epoch Times.

“They were more into arrowheads, but I used the same amount of time to go out and prospect in washes.”

One of his best discoveries was an 1886 Seated Liberty silver dime, which he found about a foot deep in the ground.

Bob Burgette, 62, holds up the 1937 Indian Head nickel he found with his Minelab metal detector during the annual Desert Gold Diggers spring club outing, near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

During the club outing, he uncovered a 1937 Indian Head nickel in good condition.

NGC Coin, an independent coin grading service, estimates that these nickels can sell for between 50 cents and $20, depending on their condition. Nickels with mint defects may fetch much higher prices.

Over time, such finds can offset the cost of a metal detector, said Burgette, who paid $399 for the Minelab machine he used on March 22.

“I’ve been all the way over to California and Oregon looking for gold. I found a nice big hefty 3-gram nugget [panning] over there,” he said.

“And when you see something like that, it just shines in your pan, you know—when the sun hits it. So it just gives you that gold fever.”

Sun, 04/06/2025 - 22:10

Bob Burgette, 62, holds up the 1937 Indian Head nickel he found with his Minelab metal detector during the annual Desert Gold Diggers spring club outing, near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

During the club outing, he uncovered a 1937 Indian Head nickel in good condition.

NGC Coin, an independent coin grading service, estimates that these nickels can sell for between 50 cents and $20, depending on their condition. Nickels with mint defects may fetch much higher prices.

Over time, such finds can offset the cost of a metal detector, said Burgette, who paid $399 for the Minelab machine he used on March 22.

“I’ve been all the way over to California and Oregon looking for gold. I found a nice big hefty 3-gram nugget [panning] over there,” he said.

“And when you see something like that, it just shines in your pan, you know—when the sun hits it. So it just gives you that gold fever.”

Sun, 04/06/2025 - 22:10

The Epoch Times

Gold Price Hike Sparks Surge in Electronic Metal Detecting

‘Gold fever’ spreading as the price of the yellow metal surpasses $3,000 per ounce.

On March 22, Marihugh and more than 20 members of the

On March 22, Marihugh and more than 20 members of the

Desert Gold Diggers

Home - Desert Gold Diggers

Club meetings are held at 6:00 pm on the first Tuesday of the month at Ellie Towne Flowing Wells Community Center, 1660 West Ruthrauff Road,…

Desert Gold Diggers President Ralph Montano coordinates the metal club's annual spring outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There seems to be a direct connection between gold prices and interest in the hobby.

“We’ve gotten a lot of interest lately. In the last couple of months, we’ve gotten a lot of new members,” Montano said.

“They’re coming out and learning from us about what equipment they will need and what to look for—how to look for the spots that might produce.”

Not since gold reached an all-time high of $1,896 and silver hit $49.52 per ounce in 2011 have precious metals—often considered “barbarous relics” in the financial world—commanded such prices.

A Global Run On Gold

According to investment consultant https://www.troweprice.com/en/us/insights/what-is-driving-gold-prices-to-all-time-record-highs

, there are several factors causing the price of gold and silver to breach the $3,000 high-water mark.

Since late 2022, the company observed that the long-standing inverse relationship between gold prices and real interest rates had become disconnected from the U.S. dollar and stock market.

“This reflects the growing influence of global fiscal policies and currency debasement, a sharp rise in central bank buying, as well as an environment of heightened geopolitical risks,” T. Rowe Price noted.

“Geopolitical risks only seem to be growing. Wars rage in the Middle East and Ukraine. Conflicts between China and its neighbors are a looming threat.

“The coalition of countries hostile to the West will continue to look for ways to decrease dependency on the [U.S. Dollar] as a reserve currency and medium for international exchange.”

Gold.org

Desert Gold Diggers President Ralph Montano coordinates the metal club's annual spring outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There seems to be a direct connection between gold prices and interest in the hobby.

“We’ve gotten a lot of interest lately. In the last couple of months, we’ve gotten a lot of new members,” Montano said.

“They’re coming out and learning from us about what equipment they will need and what to look for—how to look for the spots that might produce.”

Not since gold reached an all-time high of $1,896 and silver hit $49.52 per ounce in 2011 have precious metals—often considered “barbarous relics” in the financial world—commanded such prices.

A Global Run On Gold

According to investment consultant https://www.troweprice.com/en/us/insights/what-is-driving-gold-prices-to-all-time-record-highs

, there are several factors causing the price of gold and silver to breach the $3,000 high-water mark.

Since late 2022, the company observed that the long-standing inverse relationship between gold prices and real interest rates had become disconnected from the U.S. dollar and stock market.

“This reflects the growing influence of global fiscal policies and currency debasement, a sharp rise in central bank buying, as well as an environment of heightened geopolitical risks,” T. Rowe Price noted.

“Geopolitical risks only seem to be growing. Wars rage in the Middle East and Ukraine. Conflicts between China and its neighbors are a looming threat.

“The coalition of countries hostile to the West will continue to look for ways to decrease dependency on the [U.S. Dollar] as a reserve currency and medium for international exchange.”

Gold.org

World Gold Council

You asked, we answered: Gold hits $3,000 – What comes next?

Gold recently crossed US$3,000/oz intraday – a headline-worthy event, but the true significance for gold lies in the broader economic trends driv...

Joe Marihugh, from Tucson, Arizona, displays a vial containing roughly 1 gram of gold flakes he extracted from buckets of sand through a washer, on March 22, 2025. Allan Stein/The Epoch Times

While the demand for retail gold and silver remains high, more adventurous individuals are discovering the potential riches of metal detecting.

“All detectorists have dreamt of making that one great find at some point,” noted the Massachusetts-based metal detector seller

Joe Marihugh, from Tucson, Arizona, displays a vial containing roughly 1 gram of gold flakes he extracted from buckets of sand through a washer, on March 22, 2025. Allan Stein/The Epoch Times

While the demand for retail gold and silver remains high, more adventurous individuals are discovering the potential riches of metal detecting.

“All detectorists have dreamt of making that one great find at some point,” noted the Massachusetts-based metal detector seller

MetalDetector.com

Best metal detector finds

We all dream of finding top metal detector finds. Here are some of the world's best metal detector finds. Top customer finds are also explored.

Members of the Desert Gold Diggers metal detecting club fan out as they search for buried treasure south of Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There are several methods for gold prospecting. The traditional technique of gold panning can be enhanced by using a Rocker Box, also known as a cradle.

This tool is more efficient than simple panning, as it consists of a wooden box with a sieve and a rocking mechanism.

Another method is the sluice box, which features a long trough designed to capture gold particles while directing water and sediment through it.

In areas with scarce water, dry panning is an efficient method that relies on air instead of water to separate gold from the sediment.

“Many enthusiasts enjoy the thrill of panning for gold in rivers and streams, reliving the experiences of the early prospectors,” GMR Gold

Members of the Desert Gold Diggers metal detecting club fan out as they search for buried treasure south of Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

There are several methods for gold prospecting. The traditional technique of gold panning can be enhanced by using a Rocker Box, also known as a cradle.

This tool is more efficient than simple panning, as it consists of a wooden box with a sieve and a rocking mechanism.

Another method is the sluice box, which features a long trough designed to capture gold particles while directing water and sediment through it.

In areas with scarce water, dry panning is an efficient method that relies on air instead of water to separate gold from the sediment.

“Many enthusiasts enjoy the thrill of panning for gold in rivers and streams, reliving the experiences of the early prospectors,” GMR Gold

American Standard Gold

The Fascinating History of Panning for Gold

Explore the rich history of gold panning, from ancient techniques to the iconic gold rushes, and its lasting impact on society, culture, and history.

Garrett Direct

Garrett Metal Detector Manufacturer for Sport, Security & More

Garrett designs and manufactures sport, security and countermine metal detectors, including hand-held, ground-search and walk-through detectors. Ma...

A member of the Desert Gold Diggers metal detecting club searches for buried objects during the club's yearly outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Marihugh credited his uncle with sparking his interest in gold prospecting during his youth. In 2010, the Gold Rush series premiered on the Discovery Channel, and from that moment, Marihugh said he was hooked.

“We’ve just been finding gold ever since. I’ve got ounces that I’ve found over the years.”

To illustrate, he presented a vial containing approximately a gram of gold flakes he recently discovered.

Other detectorists search parks where they may find lost rings and valuable objects, he said.

Gold Side-Hustle

“It’s out there—it’s still out there,” Marihugh said. “People lose rings. The kids lose necklaces.”

As gold prices continue to rise, he said: “It’s going to draw more and more people” to metal detecting as a money-making hobby or pastime.

“Ever since gold hit over $2,200, people have been getting out there more and more. I hope it keeps going up,” he said.

Montano said that Desert Gold Diggers formed about 35 years ago, and currently maintains 19 claims for members to search for buried treasure.

“I’m still learning since I started like six years ago” using an entry-level Garrett 250, he said.

Jose Lizarraga, a club member from Tucson, has been metal detecting for the past two years and used a Monster 1000 at the outing.

He believes it was his “beginner’s luck” to discover a gold nugget during another metal-detecting adventure.

“And so what I did is last year for our anniversary, I made it into a necklace,” Lizarraga told The Epoch Times. “That was my anniversary present for my wife. She loves it.”

A member of the Desert Gold Diggers metal detecting club searches for buried objects during the club's yearly outing near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Marihugh credited his uncle with sparking his interest in gold prospecting during his youth. In 2010, the Gold Rush series premiered on the Discovery Channel, and from that moment, Marihugh said he was hooked.

“We’ve just been finding gold ever since. I’ve got ounces that I’ve found over the years.”

To illustrate, he presented a vial containing approximately a gram of gold flakes he recently discovered.

Other detectorists search parks where they may find lost rings and valuable objects, he said.

Gold Side-Hustle

“It’s out there—it’s still out there,” Marihugh said. “People lose rings. The kids lose necklaces.”

As gold prices continue to rise, he said: “It’s going to draw more and more people” to metal detecting as a money-making hobby or pastime.

“Ever since gold hit over $2,200, people have been getting out there more and more. I hope it keeps going up,” he said.

Montano said that Desert Gold Diggers formed about 35 years ago, and currently maintains 19 claims for members to search for buried treasure.

“I’m still learning since I started like six years ago” using an entry-level Garrett 250, he said.

Jose Lizarraga, a club member from Tucson, has been metal detecting for the past two years and used a Monster 1000 at the outing.

He believes it was his “beginner’s luck” to discover a gold nugget during another metal-detecting adventure.

“And so what I did is last year for our anniversary, I made it into a necklace,” Lizarraga told The Epoch Times. “That was my anniversary present for my wife. She loves it.”

Jose Lizarraga, a member of the Desert Gold Diggers metal detecting club, stands with his Minelab Gold Monster 1000 near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Bob Burgette, 62, who hails from Wisconsin, began gold prospecting and metal detecting in his youth.

He currently has six Minelab metal detectors to search for various types of metal objects.

“I had a couple sisters that lived out here, so I came out and visited and I got hooked on looking for gold,” Burgette told The Epoch Times.

“They were more into arrowheads, but I used the same amount of time to go out and prospect in washes.”

One of his best discoveries was an 1886 Seated Liberty silver dime, which he found about a foot deep in the ground.

Jose Lizarraga, a member of the Desert Gold Diggers metal detecting club, stands with his Minelab Gold Monster 1000 near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

Bob Burgette, 62, who hails from Wisconsin, began gold prospecting and metal detecting in his youth.

He currently has six Minelab metal detectors to search for various types of metal objects.

“I had a couple sisters that lived out here, so I came out and visited and I got hooked on looking for gold,” Burgette told The Epoch Times.

“They were more into arrowheads, but I used the same amount of time to go out and prospect in washes.”

One of his best discoveries was an 1886 Seated Liberty silver dime, which he found about a foot deep in the ground.

Bob Burgette, 62, holds up the 1937 Indian Head nickel he found with his Minelab metal detector during the annual Desert Gold Diggers spring club outing, near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

During the club outing, he uncovered a 1937 Indian Head nickel in good condition.

NGC Coin, an independent coin grading service, estimates that these nickels can sell for between 50 cents and $20, depending on their condition. Nickels with mint defects may fetch much higher prices.

Over time, such finds can offset the cost of a metal detector, said Burgette, who paid $399 for the Minelab machine he used on March 22.

“I’ve been all the way over to California and Oregon looking for gold. I found a nice big hefty 3-gram nugget [panning] over there,” he said.

“And when you see something like that, it just shines in your pan, you know—when the sun hits it. So it just gives you that gold fever.”

Bob Burgette, 62, holds up the 1937 Indian Head nickel he found with his Minelab metal detector during the annual Desert Gold Diggers spring club outing, near Tucson, Ariz., on March 22, 2025. Allan Stein/The Epoch Times

During the club outing, he uncovered a 1937 Indian Head nickel in good condition.

NGC Coin, an independent coin grading service, estimates that these nickels can sell for between 50 cents and $20, depending on their condition. Nickels with mint defects may fetch much higher prices.

Over time, such finds can offset the cost of a metal detector, said Burgette, who paid $399 for the Minelab machine he used on March 22.

“I’ve been all the way over to California and Oregon looking for gold. I found a nice big hefty 3-gram nugget [panning] over there,” he said.

“And when you see something like that, it just shines in your pan, you know—when the sun hits it. So it just gives you that gold fever.”

Tyler Durden | Zero Hedge

Zero Hedge

Gold Price Hike Sparks Surge In Electronic Metal Detecting | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

In the

In the

The Washington State Senate Members of Color Caucus (MOCC) condemned the raid, claiming it harms business. “Businesses also face significant challenges, including labor shortages, operational disruptions, and uncertainty in their ability to provide goods and services,” they stated.

Rantz

The Washington State Senate Members of Color Caucus (MOCC) condemned the raid, claiming it harms business. “Businesses also face significant challenges, including labor shortages, operational disruptions, and uncertainty in their ability to provide goods and services,” they stated.

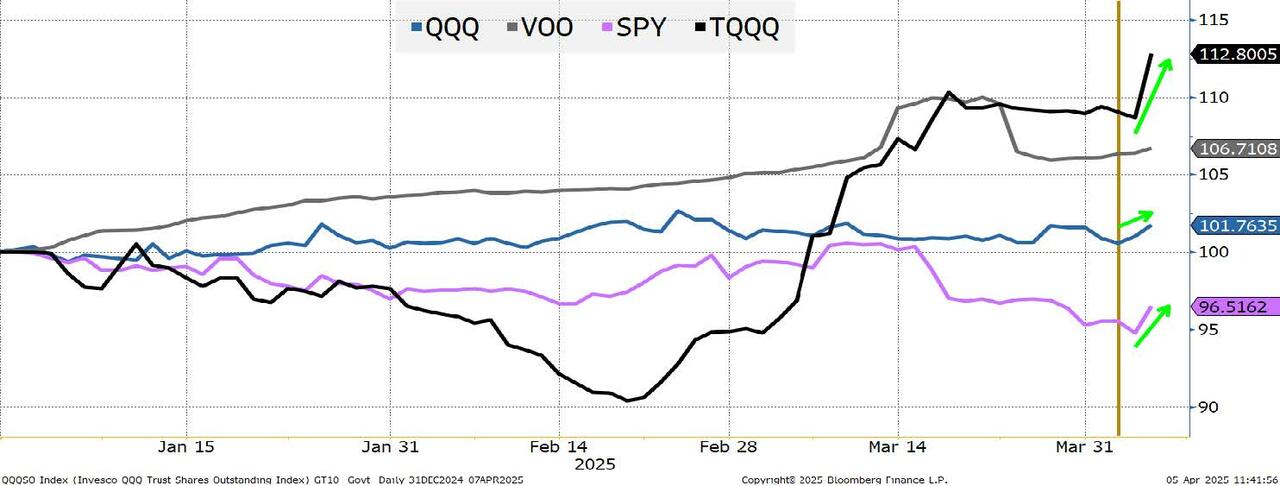

Rantz  The “soft” data all points to extreme fear. CNN Fear and Greed Index. AAII Investor Sentiment. You name it, but I look at these 4 incredibly important ETFs and some had almost record inflows into the selling after April 2nd. It is great to be a contrarian, but is the contrarian trade really that it is oversold? That everyone is bearish?

The “hard” data/fund flows don’t seem to support that. If you get bored and have a Bloomberg terminal, find any ETF you want (the more speculative, the better) and append SO (shares outstanding) at the end of the ticker and hit . Massive inflows into risky funds and big outflows out of inverse funds.

Whatever we might think, there is still a lot of belief that stocks are cheap and that the plans will all work out. Down 20% from the highs, it is difficult to argue with that, and I’m long for a trade, but I think we have another 10% downside and when I look at the massive dip buying still occurring, I’m sadly more comfortable with that outlook in the next week or two.

Credit has “joined” the fray as we thought last weekend. That could turn, but as so many other factors (not discussed today, but that we’ve touched on repeatedly) point us towards recession, maybe even stagflation, I don’t think we’ve seen the wides yet.

At some point I will be bullish again on risk. Either I find the scenarios (as I probability weight them) point to better conditions for stocks, or we finally get so oversold that it is truly the contrarian trade to buy.

In the meantime, I expect more downside.

Rates are tricky, as they should be lower, but inflation pressures could be real if the tariffs go ahead as planned (and are semi-permanent). But my bigger concern, which applies both to stocks and bonds, is that the wave of capital repatriation has only just started.

It will be curious to see if (or when) retirees (or those getting close) decide that maybe it is prudent to reduce stock exposure for safety? I don’t think that has happened yet (though, it probably has occurred with Democrats already as the gap between the parties on so many fronts has never been wider at any time that I can think of).

Good luck, I hope I’m right about the bounce to start the week, and I hope I’m wrong that we won’t see enough of a policy shift, or signs of “winning,” to make me bullish beyond a trade.

The “soft” data all points to extreme fear. CNN Fear and Greed Index. AAII Investor Sentiment. You name it, but I look at these 4 incredibly important ETFs and some had almost record inflows into the selling after April 2nd. It is great to be a contrarian, but is the contrarian trade really that it is oversold? That everyone is bearish?

The “hard” data/fund flows don’t seem to support that. If you get bored and have a Bloomberg terminal, find any ETF you want (the more speculative, the better) and append SO (shares outstanding) at the end of the ticker and hit . Massive inflows into risky funds and big outflows out of inverse funds.

Whatever we might think, there is still a lot of belief that stocks are cheap and that the plans will all work out. Down 20% from the highs, it is difficult to argue with that, and I’m long for a trade, but I think we have another 10% downside and when I look at the massive dip buying still occurring, I’m sadly more comfortable with that outlook in the next week or two.

Credit has “joined” the fray as we thought last weekend. That could turn, but as so many other factors (not discussed today, but that we’ve touched on repeatedly) point us towards recession, maybe even stagflation, I don’t think we’ve seen the wides yet.

At some point I will be bullish again on risk. Either I find the scenarios (as I probability weight them) point to better conditions for stocks, or we finally get so oversold that it is truly the contrarian trade to buy.

In the meantime, I expect more downside.

Rates are tricky, as they should be lower, but inflation pressures could be real if the tariffs go ahead as planned (and are semi-permanent). But my bigger concern, which applies both to stocks and bonds, is that the wave of capital repatriation has only just started.

It will be curious to see if (or when) retirees (or those getting close) decide that maybe it is prudent to reduce stock exposure for safety? I don’t think that has happened yet (though, it probably has occurred with Democrats already as the gap between the parties on so many fronts has never been wider at any time that I can think of).

Good luck, I hope I’m right about the bounce to start the week, and I hope I’m wrong that we won’t see enough of a policy shift, or signs of “winning,” to make me bullish beyond a trade.

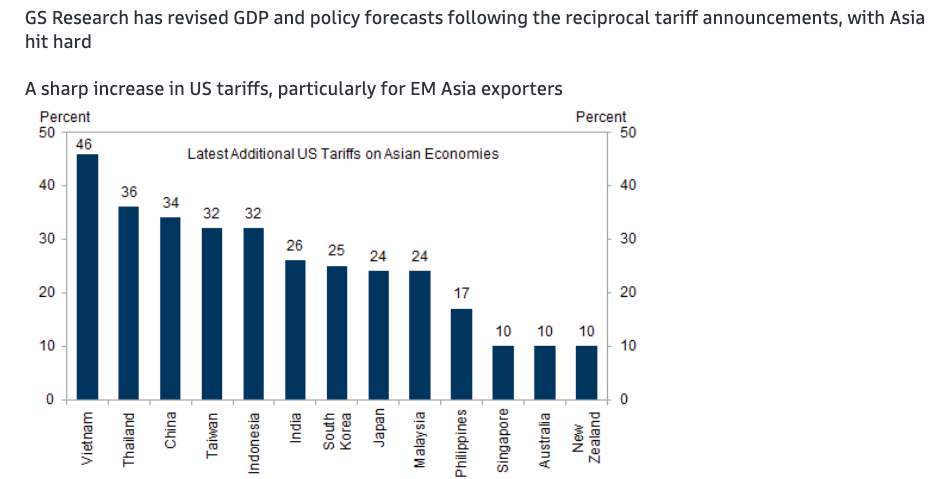

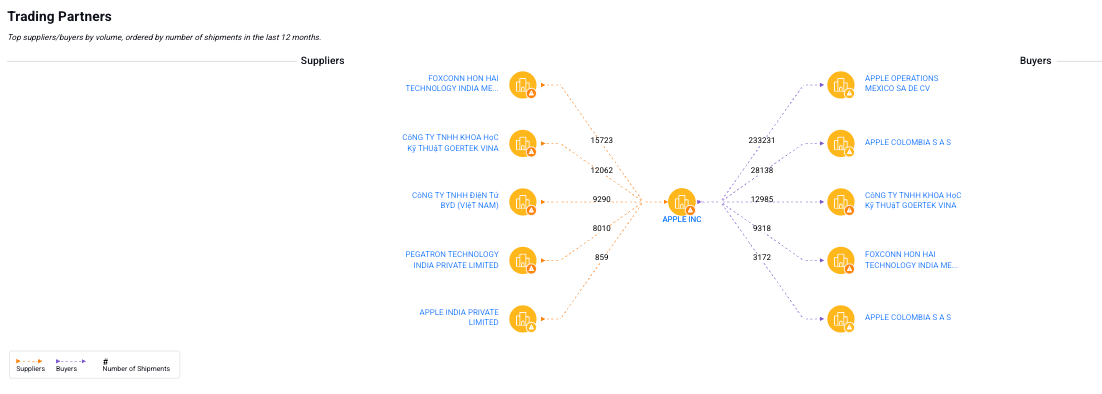

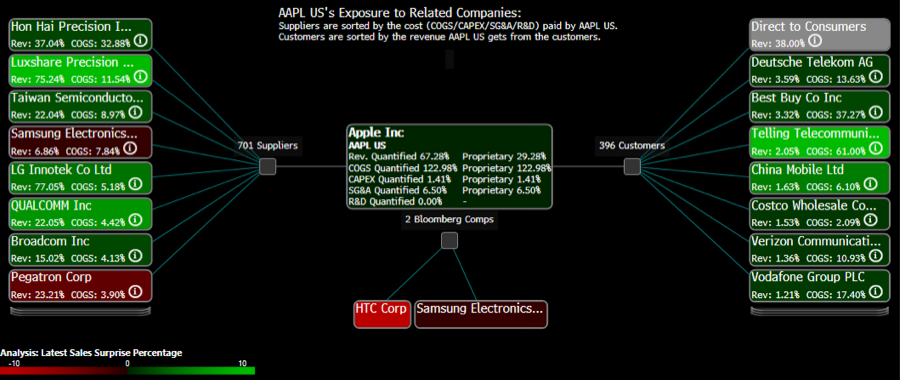

Here's more data from Bloomberg about Apple's complex supply chain throughout Asia.

Here's more data from Bloomberg about Apple's complex supply chain throughout Asia.

The question becomes whether Asian countries capitulate to Trump's tariff bazooka. So far,

The question becomes whether Asian countries capitulate to Trump's tariff bazooka. So far,

In the meantime,

In the meantime,

Last August, the New York Times ran a

Last August, the New York Times ran a

Participants, who must receive special permits, will be escorted by Israeli troops as they travel up to 2.5 kilometers into Syrian land, near the village of Maaraba. Tour highlights include visits to Wadi al-Ruqad (a tributary of the Yarmouk River), the Hejaz Railway Tunnel, and the Shebaa Farms – a contested strip of Lebanese territory occupied by Israel at the base of Mount Hermon.

Though registration has closed, the army said additional tours may be offered depending on the security situation. The excursions mark the first Israeli civilian presence in areas of Syria recently taken over by Israeli forces following the fall of Syrian President Bashar al-Assad in December.

In recent months, Israel has intensified airstrikes on Syrian military bases and moved beyond the Golan Heights' demilitarized buffer zone, occupying strategic areas like Mount Hermon in violation of the 1974 disengagement agreement. Initial Israeli security plans reportedly envisioned a 15-km demilitarized zone and a broader 60-km zone of influence inside Syria.

Prime Minister Benjamin Netanyahu has since called for the complete demilitarization of southern Syria, declaring that Israeli troops would remain in the Golan buffer zone and Mount Hermon indefinitely to block Syrian army access south of Damascus.

Israeli Finance Minister Bezalel Smotrich has openly

Participants, who must receive special permits, will be escorted by Israeli troops as they travel up to 2.5 kilometers into Syrian land, near the village of Maaraba. Tour highlights include visits to Wadi al-Ruqad (a tributary of the Yarmouk River), the Hejaz Railway Tunnel, and the Shebaa Farms – a contested strip of Lebanese territory occupied by Israel at the base of Mount Hermon.

Though registration has closed, the army said additional tours may be offered depending on the security situation. The excursions mark the first Israeli civilian presence in areas of Syria recently taken over by Israeli forces following the fall of Syrian President Bashar al-Assad in December.

In recent months, Israel has intensified airstrikes on Syrian military bases and moved beyond the Golan Heights' demilitarized buffer zone, occupying strategic areas like Mount Hermon in violation of the 1974 disengagement agreement. Initial Israeli security plans reportedly envisioned a 15-km demilitarized zone and a broader 60-km zone of influence inside Syria.

Prime Minister Benjamin Netanyahu has since called for the complete demilitarization of southern Syria, declaring that Israeli troops would remain in the Golan buffer zone and Mount Hermon indefinitely to block Syrian army access south of Damascus.

Israeli Finance Minister Bezalel Smotrich has openly

Seattle police say a large crowd was gathered for a vigil—likely for a recent South Seattle homicide victim—when gunfire erupted. Officers found over 100 shell casings at the scene.

A detective commented: “There was bullet damage to a nearby RV trailer. There was bullet damage to a house, and there was an abandoned vehicle that was also damaged."

The

Seattle police say a large crowd was gathered for a vigil—likely for a recent South Seattle homicide victim—when gunfire erupted. Officers found over 100 shell casings at the scene.

A detective commented: “There was bullet damage to a nearby RV trailer. There was bullet damage to a house, and there was an abandoned vehicle that was also damaged."

The