Peak Permian? Geology And Water Say We're Close

Peak Permian? Geology And Water Say We're Close

Some areas in the Permian have hit geological limits while others, yet to be drilled, are not expected to be as prolific as the prime Tier 1 acreage.

Despite record U.S. crude oil production, limits to growth have started to emerge.

In the Permian, the gas-to-oil ratio (GOR) has steadily risen from 34% of total production in 2014 to 40% in 2024.

After more than a decade of relentless drilling in the top U.S. oil-producing basin, the Permian, some areas have hit geological limits while others, yet to be drilled, are not expected to be as prolific as the prime Tier 1 acreage that producers have started to exhaust.

Some areas in the Permian have hit geological limits while others, yet to be drilled, are not expected to be as prolific as the prime Tier 1 acreage.

Despite record U.S. crude oil production, limits to growth have started to emerge.

In the Permian, the gas-to-oil ratio (GOR) has steadily risen from 34% of total production in 2014 to 40% in 2024.

After more than a decade of relentless drilling in the top U.S. oil-producing basin, the Permian, some areas have hit geological limits while others, yet to be drilled, are not expected to be as prolific as the prime Tier 1 acreage that producers have started to exhaust.

Top executives at major shale firms have already expressed opinions that Permian oil production could hit its peak as early as the end of this decade.

To be sure, crude oil output in the top basin continues to rise, but growth has slowed since 2022—not only because producers restrain capex and don’t drill themselves into oblivion.

Higher gas-to-oil ratio and water-to-oil ratio in the Permian suggest that some formations in the basin are reaching geological constraints, and more drilling isn’t necessarily proportionate to the oil volumes produced.

The Permian still leads U.S. oil production growth and will do so in the coming years, forecasters including the Energy Information Administration (EIA) say.

Total U.S. crude oil production is expected to average 13.61 million bpd this year, rising to 13.76 million bpd next year, according to the EIA’s latest .pdf

.

Despite record U.S. crude oil production, limits to the growth have started to emerge, executives acknowledge.

Vicki Hollub, the chief executive of Occidental Petroleum, said at the CERAWeek conference early this month, “We think that between 2027 and 2030 it's likely that the U.S. will see peak production, and after that some decline.”

Ryan Lance, CEO at ConocoPhillips, expects U.S. oil production to plateau this decade and remain flat for an undefined period of time after 2030.

“It’s going to be a slow decline beyond that because there’s a lot of resource” left to drill, Lance

Top executives at major shale firms have already expressed opinions that Permian oil production could hit its peak as early as the end of this decade.

To be sure, crude oil output in the top basin continues to rise, but growth has slowed since 2022—not only because producers restrain capex and don’t drill themselves into oblivion.

Higher gas-to-oil ratio and water-to-oil ratio in the Permian suggest that some formations in the basin are reaching geological constraints, and more drilling isn’t necessarily proportionate to the oil volumes produced.

The Permian still leads U.S. oil production growth and will do so in the coming years, forecasters including the Energy Information Administration (EIA) say.

Total U.S. crude oil production is expected to average 13.61 million bpd this year, rising to 13.76 million bpd next year, according to the EIA’s latest .pdf

.

Despite record U.S. crude oil production, limits to the growth have started to emerge, executives acknowledge.

Vicki Hollub, the chief executive of Occidental Petroleum, said at the CERAWeek conference early this month, “We think that between 2027 and 2030 it's likely that the U.S. will see peak production, and after that some decline.”

Ryan Lance, CEO at ConocoPhillips, expects U.S. oil production to plateau this decade and remain flat for an undefined period of time after 2030.

“It’s going to be a slow decline beyond that because there’s a lot of resource” left to drill, Lance  the CERAWeek conference.

However, what’s left to drill may not be as oil-yielding as the best Permian locations, which were the first to be tapped by drillers.

Production of associated natural gas from the Permian, the Eagle Ford, and the Bakken oil wells has surged over the past decade, the EIA

the CERAWeek conference.

However, what’s left to drill may not be as oil-yielding as the best Permian locations, which were the first to be tapped by drillers.

Production of associated natural gas from the Permian, the Eagle Ford, and the Bakken oil wells has surged over the past decade, the EIA  .

In the Permian, the gas-to-oil ratio (GOR) has steadily risen from 34% of total production in 2014 to 40% in 2024.

Pressure within the reservoir declines as more oil is brought to the surface, which allows more natural gas to be released from the geologic formation. The pressure will also decrease as more wells are concentrated within an area, the EIA says.

Another ratio is even more suggestive of the Permian oil wells and the operating costs for drilling wells—produced water.

The water-to-oil ratio in the Permian is much higher than in other basins. On average, four barrels of water are produced for each barrel of oil, according to data from oilfield water analytics firm B3 Insight cited by https://www.reuters.com/markets/commodities/us-oil-producers-face-new-challenges-top-oilfield-flags-2025-03-27/

.

While the Permian crude production is set to exceed 6.5 million bpd in 2025, up from more than 6 million bpd in 2024, the basin “is simultaneously generating an unprecedented volume of produced water—a costly and complex byproduct of hydrocarbon extraction,” B3 Insight

.

In the Permian, the gas-to-oil ratio (GOR) has steadily risen from 34% of total production in 2014 to 40% in 2024.

Pressure within the reservoir declines as more oil is brought to the surface, which allows more natural gas to be released from the geologic formation. The pressure will also decrease as more wells are concentrated within an area, the EIA says.

Another ratio is even more suggestive of the Permian oil wells and the operating costs for drilling wells—produced water.

The water-to-oil ratio in the Permian is much higher than in other basins. On average, four barrels of water are produced for each barrel of oil, according to data from oilfield water analytics firm B3 Insight cited by https://www.reuters.com/markets/commodities/us-oil-producers-face-new-challenges-top-oilfield-flags-2025-03-27/

.

While the Permian crude production is set to exceed 6.5 million bpd in 2025, up from more than 6 million bpd in 2024, the basin “is simultaneously generating an unprecedented volume of produced water—a costly and complex byproduct of hydrocarbon extraction,” B3 Insight  this week.

Crude-focused wells in the Permian account for the vast majority of the produced water generated in the leading U.S. shale plays, analysts at RBN Energy https://rbnenergy.com/coming-around-again-permian-produced-water-posing-challenges-and-offering-opportunities

last year.

The higher produced water ratio will ultimately drive costs for oil producers higher, according to Shannon Flowers, director of crude and water marketing at Coterra Energy.

“There are only so many places to drill, inject and frac, and as that goes down, you still have to find a home for the rest of your produced water,” Flowers told Reuters.

Higher costs to dispose of, reuse, or recycle produced water isn’t good news for U.S. oil producers who are already concerned with the U.S. Administration’s preference of a $50 a barrel oil price.

“There cannot be "U.S. energy dominance" and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters),” an executive at an exploration and production firm wrote in

this week.

Crude-focused wells in the Permian account for the vast majority of the produced water generated in the leading U.S. shale plays, analysts at RBN Energy https://rbnenergy.com/coming-around-again-permian-produced-water-posing-challenges-and-offering-opportunities

last year.

The higher produced water ratio will ultimately drive costs for oil producers higher, according to Shannon Flowers, director of crude and water marketing at Coterra Energy.

“There are only so many places to drill, inject and frac, and as that goes down, you still have to find a home for the rest of your produced water,” Flowers told Reuters.

Higher costs to dispose of, reuse, or recycle produced water isn’t good news for U.S. oil producers who are already concerned with the U.S. Administration’s preference of a $50 a barrel oil price.

“There cannot be "U.S. energy dominance" and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters),” an executive at an exploration and production firm wrote in  to the Dallas Fed Energy Survey for the first quarter of 2025.

“The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel,” the executive noted.

Mon, 03/31/2025 - 13:40

to the Dallas Fed Energy Survey for the first quarter of 2025.

“The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel,” the executive noted.

Mon, 03/31/2025 - 13:40

OilPrice.com

Peak Permian? Geology and Water Say We’re Close | OilPrice.com

Some areas in the Permian have hit geological limits while others, yet to be drilled, are not expected to be as prolific as the prime Tier 1 acreage.

Top executives at major shale firms have already expressed opinions that Permian oil production could hit its peak as early as the end of this decade.

To be sure, crude oil output in the top basin continues to rise, but growth has slowed since 2022—not only because producers restrain capex and don’t drill themselves into oblivion.

Higher gas-to-oil ratio and water-to-oil ratio in the Permian suggest that some formations in the basin are reaching geological constraints, and more drilling isn’t necessarily proportionate to the oil volumes produced.

The Permian still leads U.S. oil production growth and will do so in the coming years, forecasters including the Energy Information Administration (EIA) say.

Total U.S. crude oil production is expected to average 13.61 million bpd this year, rising to 13.76 million bpd next year, according to the EIA’s latest .pdf

.

Despite record U.S. crude oil production, limits to the growth have started to emerge, executives acknowledge.

Vicki Hollub, the chief executive of Occidental Petroleum, said at the CERAWeek conference early this month, “We think that between 2027 and 2030 it's likely that the U.S. will see peak production, and after that some decline.”

Ryan Lance, CEO at ConocoPhillips, expects U.S. oil production to plateau this decade and remain flat for an undefined period of time after 2030.

“It’s going to be a slow decline beyond that because there’s a lot of resource” left to drill, Lance

Top executives at major shale firms have already expressed opinions that Permian oil production could hit its peak as early as the end of this decade.

To be sure, crude oil output in the top basin continues to rise, but growth has slowed since 2022—not only because producers restrain capex and don’t drill themselves into oblivion.

Higher gas-to-oil ratio and water-to-oil ratio in the Permian suggest that some formations in the basin are reaching geological constraints, and more drilling isn’t necessarily proportionate to the oil volumes produced.

The Permian still leads U.S. oil production growth and will do so in the coming years, forecasters including the Energy Information Administration (EIA) say.

Total U.S. crude oil production is expected to average 13.61 million bpd this year, rising to 13.76 million bpd next year, according to the EIA’s latest .pdf

.

Despite record U.S. crude oil production, limits to the growth have started to emerge, executives acknowledge.

Vicki Hollub, the chief executive of Occidental Petroleum, said at the CERAWeek conference early this month, “We think that between 2027 and 2030 it's likely that the U.S. will see peak production, and after that some decline.”

Ryan Lance, CEO at ConocoPhillips, expects U.S. oil production to plateau this decade and remain flat for an undefined period of time after 2030.

“It’s going to be a slow decline beyond that because there’s a lot of resource” left to drill, Lance

Bloomberg.com

Specter of Peak Oil Production Looms Once Again

The topic has featured prominently at this week’s CERAWeek conference in Houston.

Share of natural gas production in U.S. tight oil plays increased over the last decade - U.S. Energy Information Administration (EIA)

Energy Information Administration - EIA - Official Energy Statistics from the U.S. Government

B3 Insight

Balancing Growth and Risk: Why Water Management is the Permian Basin’s Biggest Challenge

Faced with rising costs and regulatory pressure, Permian Basin operators are being forced to rethink their approach to water management.

Oil and gas activity edges higher; uncertainty rising, costs increase

Activity in the oil and gas sector increased slightly in first quarter of 2025, according to oil and gas executives responding to the Dallas Fed En...

Tyler Durden | Zero Hedge

Zero Hedge

Peak Permian? Geology And Water Say We're Close | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The impact that new U.S. LNG exports have on the environment and the economy was reviewed by U.S. Energy Department scientists and completed by September 2023. It appears that neither President Biden nor Secretary Jennifer Granholm liked the science or the conclusions. Rather than “follow the science,” they buried the report while allegedly making claims directly refuted by their own experts.

The report was finished while Biden was still running for reelection and would have likely enraged environmentalists. The draft study, “Energy, Economic, and Environmental Assessment of U.S. LNG Exports,” found that, under all modeled scenarios, an increase in U.S. LNG exports and natural gas production would not change global or U.S. greenhouse gas emissions. It further found that it would not increase energy prices for consumers.

Biden and Granholm reportedly buried the report and then announced a pause on all new U.S. LNG export terminals in January 2024, citing the danger to environmental and economic impacts.

Comer’s office told Fox News Digital that DOE repeatedly declined to provide this study to the House Oversight Committee or comply with other requests for information.

What is most concerning is that our LNG exports help reduce the dependence on Russia and would have decreased the revenues to that country to support its war in Ukraine. However, critics charge that Biden ignored the national security and economic benefits. Supporters note that we still exported a massive amount of LNG.

When the U.S. ramped up exports to Europe, progressive Democrats like Sen. Jeff Merkley, D-Ore., went ballistic. This appears to have worked in shelving the study while slowing demands for further increases.

The Biden Administration later released data in December 2024 suggesting that a rise in exports could cause consumer prices to rise by as much as 30%.

There are obviously two sides to this debate. The problem is that it seems that only one side was allowed to be publicly presented by the delay in the release of the study.

The impact that new U.S. LNG exports have on the environment and the economy was reviewed by U.S. Energy Department scientists and completed by September 2023. It appears that neither President Biden nor Secretary Jennifer Granholm liked the science or the conclusions. Rather than “follow the science,” they buried the report while allegedly making claims directly refuted by their own experts.

The report was finished while Biden was still running for reelection and would have likely enraged environmentalists. The draft study, “Energy, Economic, and Environmental Assessment of U.S. LNG Exports,” found that, under all modeled scenarios, an increase in U.S. LNG exports and natural gas production would not change global or U.S. greenhouse gas emissions. It further found that it would not increase energy prices for consumers.

Biden and Granholm reportedly buried the report and then announced a pause on all new U.S. LNG export terminals in January 2024, citing the danger to environmental and economic impacts.

Comer’s office told Fox News Digital that DOE repeatedly declined to provide this study to the House Oversight Committee or comply with other requests for information.

What is most concerning is that our LNG exports help reduce the dependence on Russia and would have decreased the revenues to that country to support its war in Ukraine. However, critics charge that Biden ignored the national security and economic benefits. Supporters note that we still exported a massive amount of LNG.

When the U.S. ramped up exports to Europe, progressive Democrats like Sen. Jeff Merkley, D-Ore., went ballistic. This appears to have worked in shelving the study while slowing demands for further increases.

The Biden Administration later released data in December 2024 suggesting that a rise in exports could cause consumer prices to rise by as much as 30%.

There are obviously two sides to this debate. The problem is that it seems that only one side was allowed to be publicly presented by the delay in the release of the study.

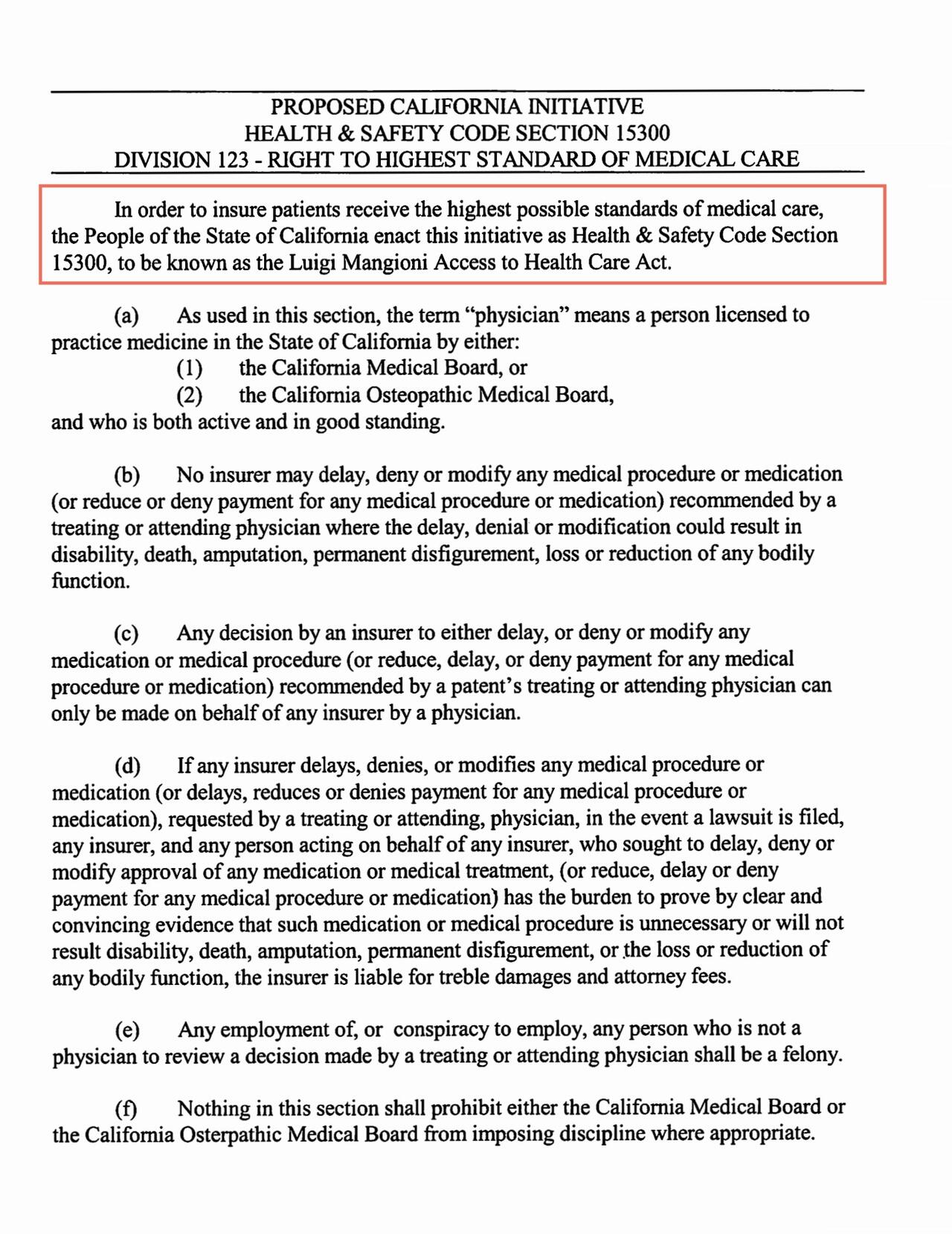

Insurers would bear a high burden of proof if they delay care, needing clear and convincing evidence the treatment was unnecessary or wouldn’t prevent serious harm. Patients could sue for treble damages and attorney fees.

KTLA

Insurers would bear a high burden of proof if they delay care, needing clear and convincing evidence the treatment was unnecessary or wouldn’t prevent serious harm. Patients could sue for treble damages and attorney fees.

KTLA

“A lot of people want me to do it,” Trump

“A lot of people want me to do it,” Trump

The

The  The auction will also feature an “exceedingly rare” five-piece Toman set, minted in Tehran and Isfahan during the late 1700s and early 1800s by Agha Mohammad Khan Qajar. Only five complete sets are known to exist, including one housed at Oxford's Ashmolean Museum.

Arturo Russo, director of Numismatica Ars Classica, called the sale “a landmark in the history of numismatics,” citing the range, rarity, and quality of the coins, along with the collection’s unique backstory.

David Guest, a consultant to the collection, added: “Not only was the quality exceptional but many of the coins before me were of types not known to have been offered for sale in over 80 years and, in some cases, completely unrecorded.”

The auction will also feature an “exceedingly rare” five-piece Toman set, minted in Tehran and Isfahan during the late 1700s and early 1800s by Agha Mohammad Khan Qajar. Only five complete sets are known to exist, including one housed at Oxford's Ashmolean Museum.

Arturo Russo, director of Numismatica Ars Classica, called the sale “a landmark in the history of numismatics,” citing the range, rarity, and quality of the coins, along with the collection’s unique backstory.

David Guest, a consultant to the collection, added: “Not only was the quality exceptional but many of the coins before me were of types not known to have been offered for sale in over 80 years and, in some cases, completely unrecorded.”

The B-21 is a “bomber on a budget.” One of the most overlooked insights from the recent Air Force budgets is that the B-21 program is proving a new business case by keeping costs under control. During the 2025 budget cycle, smooth progress on the production line enabled the Air Force to negotiate lower rates for the B-21 bombers now in production. The Air Force trimmed about $1 billion off the B-21 program’s cost for Fiscal Year 2025 alone and bagged additional savings for future years.

Coming in under budget is a first for a stealth aircraft – and quite a victory for the bomber leg of the nuclear deterrence Triad. Contrast that with the snarls affecting nuclear shipbuilding and the Columbia-class submarine program. It is also a great vote of confidence for future sixth-generation programs for both the Air Force and the Navy.

The B-21 was planned from the outset to “bend the cost curve” for advanced aircraft procurement. A cost cap of $550 million per bomber (averaged over 100 aircraft, and in 2010 dollars) was set as a performance parameter for the competition. Northrop Grumman was widely believed to have won the B-21 program due to the combination of its experience in stealth bombers and its low bid price. However, executing the B-21 plan has been a testament, first and foremost, to the Air Force’s Rapid Capabilities Office (RCO), the team that ran the B-21 from source selection onward but likes to stay out of the limelight.

The Air Force is also capitalizing on progress with digital design, open software approaches, sophisticated aerospace composites, and a host of other advances in the American aerospace industry. The net effect is smoother progress through design and early production. For example, in 2021, a “major redesign” of the B-21 engine inlets was completed while the first two B-21s were being assembled, without incurring cost or schedule overruns. “There’s nothing going on in that program that is leading to either a cost or schedule breach,” Air Force Lieutenant General Duke Richardson

The B-21 is a “bomber on a budget.” One of the most overlooked insights from the recent Air Force budgets is that the B-21 program is proving a new business case by keeping costs under control. During the 2025 budget cycle, smooth progress on the production line enabled the Air Force to negotiate lower rates for the B-21 bombers now in production. The Air Force trimmed about $1 billion off the B-21 program’s cost for Fiscal Year 2025 alone and bagged additional savings for future years.

Coming in under budget is a first for a stealth aircraft – and quite a victory for the bomber leg of the nuclear deterrence Triad. Contrast that with the snarls affecting nuclear shipbuilding and the Columbia-class submarine program. It is also a great vote of confidence for future sixth-generation programs for both the Air Force and the Navy.

The B-21 was planned from the outset to “bend the cost curve” for advanced aircraft procurement. A cost cap of $550 million per bomber (averaged over 100 aircraft, and in 2010 dollars) was set as a performance parameter for the competition. Northrop Grumman was widely believed to have won the B-21 program due to the combination of its experience in stealth bombers and its low bid price. However, executing the B-21 plan has been a testament, first and foremost, to the Air Force’s Rapid Capabilities Office (RCO), the team that ran the B-21 from source selection onward but likes to stay out of the limelight.

The Air Force is also capitalizing on progress with digital design, open software approaches, sophisticated aerospace composites, and a host of other advances in the American aerospace industry. The net effect is smoother progress through design and early production. For example, in 2021, a “major redesign” of the B-21 engine inlets was completed while the first two B-21s were being assembled, without incurring cost or schedule overruns. “There’s nothing going on in that program that is leading to either a cost or schedule breach,” Air Force Lieutenant General Duke Richardson

The

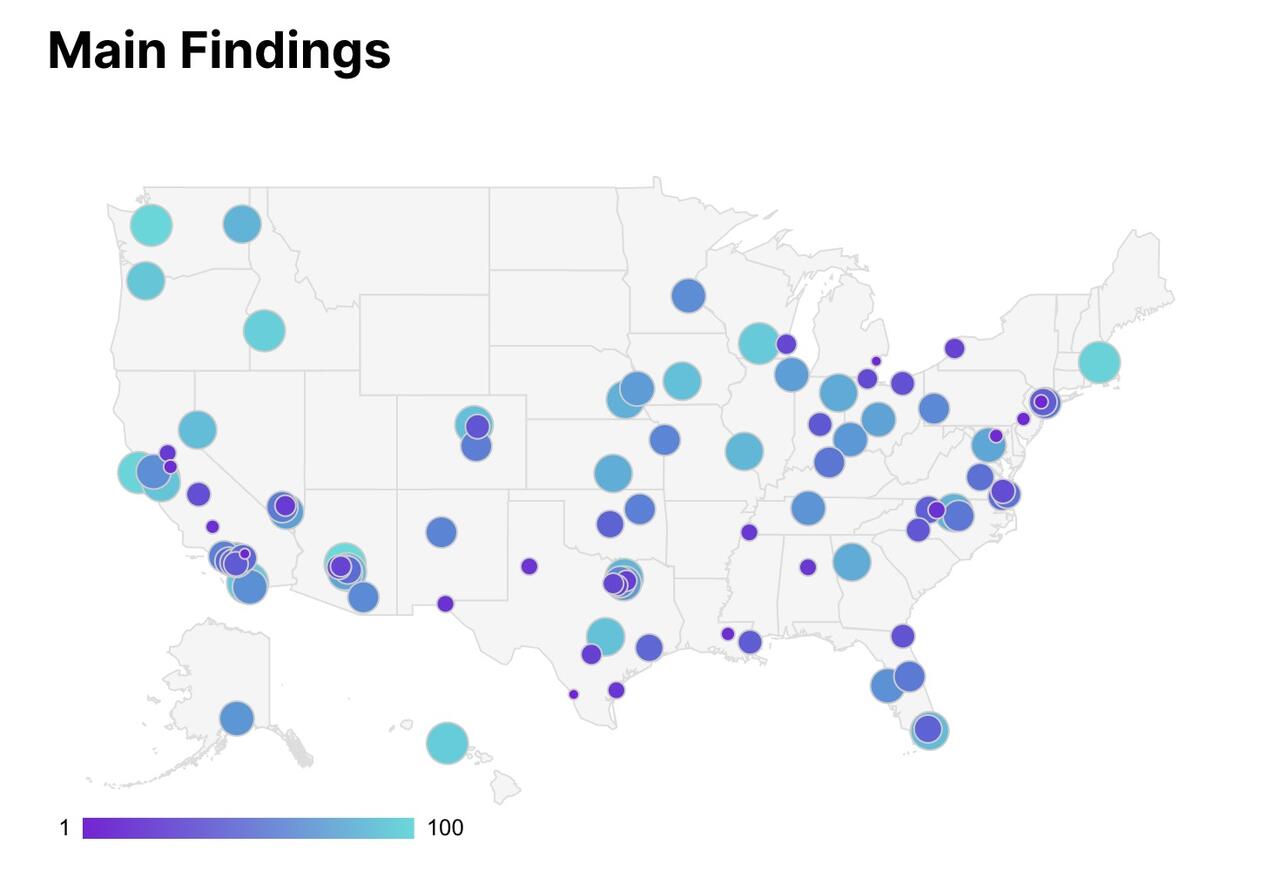

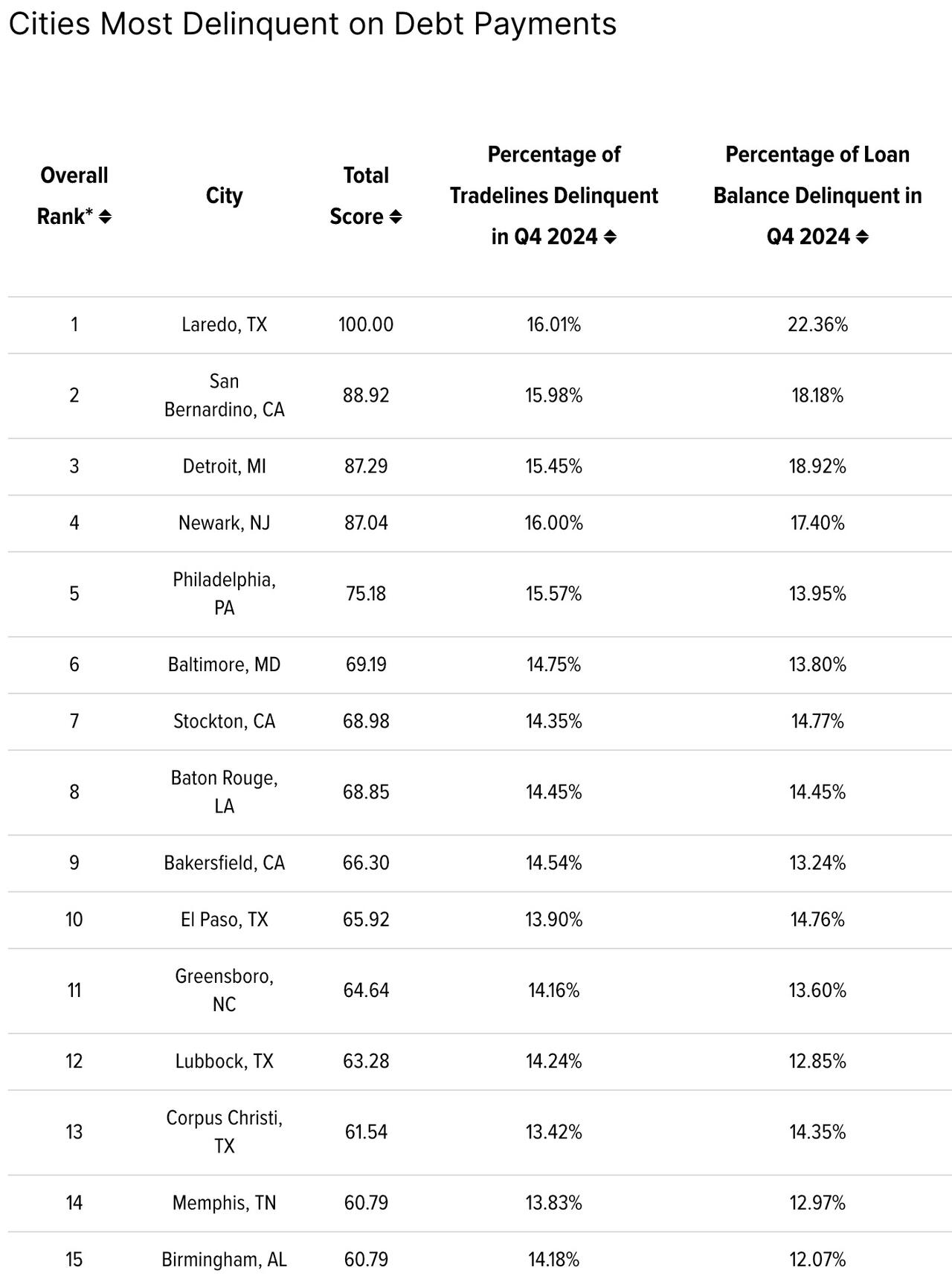

The  Overall, the most delinquent cities are often older, economically challenged urban centers—many of them in the Rust Belt or South—where residents face a mix of high costs and limited income growth. This study provides a snapshot of where debt stress is most acute, offering insight for policymakers and financial institutions focused on economic stability.

Analyst Chip Lupo commented: “Being delinquent on debt can significantly damage a person’s credit score and make it more difficult to get a credit card, rent apartments, or buy cars and homes in the future. People who miss a loan payment should try to get current as quickly as possible. The good news is that for many types of debt, borrowers have at least 30 days before delinquency gets reported to the credit bureaus."

"That allows people a little leeway to get the funds together and avoid credit score damage, though the issuer will still likely charge a late fee.”

Thanks for the tip...Chip.

Overall, the most delinquent cities are often older, economically challenged urban centers—many of them in the Rust Belt or South—where residents face a mix of high costs and limited income growth. This study provides a snapshot of where debt stress is most acute, offering insight for policymakers and financial institutions focused on economic stability.

Analyst Chip Lupo commented: “Being delinquent on debt can significantly damage a person’s credit score and make it more difficult to get a credit card, rent apartments, or buy cars and homes in the future. People who miss a loan payment should try to get current as quickly as possible. The good news is that for many types of debt, borrowers have at least 30 days before delinquency gets reported to the credit bureaus."

"That allows people a little leeway to get the funds together and avoid credit score damage, though the issuer will still likely charge a late fee.”

Thanks for the tip...Chip.

"Once again, they wanted to adopt a common position in which we want to give Ukraine even more money and even more weapons, and we are committed to the war," the Hungarian leader explained after the veto.

"Over the past three years, Hungarian families have lost around 2.5 million forints (approximately €6,268) per household as a result of the war. I must stop this, and we must not allow Hungarian families to continue to pay the economic consequences," Orbán stated.

He urged European capitals to get in Trump's corner, who is seeking a diplomatic solution. But here's how The Associated Press and other outlets characterized Hungary's stubborn refusal to go along with

"Once again, they wanted to adopt a common position in which we want to give Ukraine even more money and even more weapons, and we are committed to the war," the Hungarian leader explained after the veto.

"Over the past three years, Hungarian families have lost around 2.5 million forints (approximately €6,268) per household as a result of the war. I must stop this, and we must not allow Hungarian families to continue to pay the economic consequences," Orbán stated.

He urged European capitals to get in Trump's corner, who is seeking a diplomatic solution. But here's how The Associated Press and other outlets characterized Hungary's stubborn refusal to go along with

The decision to eliminate Georgescu from the May 4 presidential race will likely deepen Romania’s anti-establishment mood and benefit the far-right.

Polls showed that had Georgescu run, he would’ve garnered between 40% and 45% of the vote in the first round, giving him a real chance of becoming Romania’s president.

Georgescu submitted his candidacy for May’s election - as an independent - reminding voters of the utter farce he has been through over the last coupel of months:

“Everyone is watching Romania and how the corrupt system acted,” said Georgescu on Friday, adding that he thought it’s impossible for his name not to be on the ballot’s list of candidates.

“They can’t afford to repeat the mistake."

Well, they did!

As a reminder, after

The decision to eliminate Georgescu from the May 4 presidential race will likely deepen Romania’s anti-establishment mood and benefit the far-right.

Polls showed that had Georgescu run, he would’ve garnered between 40% and 45% of the vote in the first round, giving him a real chance of becoming Romania’s president.

Georgescu submitted his candidacy for May’s election - as an independent - reminding voters of the utter farce he has been through over the last coupel of months:

“Everyone is watching Romania and how the corrupt system acted,” said Georgescu on Friday, adding that he thought it’s impossible for his name not to be on the ballot’s list of candidates.

“They can’t afford to repeat the mistake."

Well, they did!

As a reminder, after

We suspect those criticisms will turn all the way up to 11 after today's court decision to ban him from actually being on the ballot.

None of this should be a surprise - as shocking as it is for an elite establishment who constantly crow about "democracy".

Simply put, from the perspective of western liberal world order, Georgescu cannot be allowed to win because he takes the common sense approach that confrontation with Moscow does much more harm to Romanians than to Russia.

And Romania is simply too important to NATO and the effort to weaken Russia. Washington and Brussels are already dealing with wayward governments in Hungary and Slovakia, but Romania is a different animal.

We suspect those criticisms will turn all the way up to 11 after today's court decision to ban him from actually being on the ballot.

None of this should be a surprise - as shocking as it is for an elite establishment who constantly crow about "democracy".

Simply put, from the perspective of western liberal world order, Georgescu cannot be allowed to win because he takes the common sense approach that confrontation with Moscow does much more harm to Romanians than to Russia.

And Romania is simply too important to NATO and the effort to weaken Russia. Washington and Brussels are already dealing with wayward governments in Hungary and Slovakia, but Romania is a different animal.

Romania is also the site of the $2.7 billion expansion of Mihail Kogălniceanu airbase to make it the largest one in Europe.

It’s entirely possible that Romania is just the start of annulled elections as the neoliberal war champions who call themselves the “center” would no doubt love the power to cancel elections wherever they see fit.

Romania is also the site of the $2.7 billion expansion of Mihail Kogălniceanu airbase to make it the largest one in Europe.

It’s entirely possible that Romania is just the start of annulled elections as the neoliberal war champions who call themselves the “center” would no doubt love the power to cancel elections wherever they see fit.