You Ain't Seen Nothing Yet

You Ain't Seen Nothing Yet

By Peter Tchir of

You Ain’t Seen Nothing Yet

I’m not sure what it means that this song, by a Canadian band, is stuck in my head, but I think it sums up where we are. If we listen to President Trump or Treasury Secretary Bessent – “we ain’t seen nothing yet.” Both are openly discussing possible hardships that need to be endured to get to the endgame they are looking for. Increasingly the endgame is that President Trump wants to create a legacy of returning manufacturing to the U.S. and re-invigorating a middle-class lifestyle in the U.S.

That is a laudable goal and it would be awesome if it could be achieved.

Many of our investment themes such as National Security Equals National Production and Refine Baby Refine are based on the U.S. taking the steps to achieve those goals.

We are not averse to the application of tariffs and think that at least some of the inflation concerns are overdone. We provided

The New Trump Tariffs | Academy Securities

, analyzing our overall views on tariffs, at the beginning of February. We do stand by the argument that corporations spend time to optimize their supply chains, and disruptions take time to digest, which will be problematic for the economy and earnings.

We have long argued that both Russia and Ukraine will need to be brought to the negotiating table with a mixture of “carrot and stick” diplomacy.

All of this fits well into our theme for 2025 –

Messy, But Manageable | Academy Securities

. This is less about the “what” (though concerns about the “what” are also rising), and much more about the “how.” The “what” vs “how” issue came up a lot during Trump 1.0. It seems to be coming up more and more lately, with a twist – is the “how” now affecting the “what?” We were all expecting an avalanche of executive orders and initiatives and that is what we are getting and dealing with.

It was all the way back in November that we published

3D Chess or 52-Card Pickup? | Academy Securities

. The only thing I know for certain is that those who see the administration as playing 3D Chess, still see it that way, and those that see the opposite continue to see the opposite. For the rest of us, we are still trying to figure it out.

What Risk Assets Need to Rebound

We could go into a laundry list of details, but to me, there are two clear paths to a rebound in risk assets:

A lot of meaningful wins occur quickly. We’ve seen things like TSMC’s U.S. investment plans. We’ve seen or heard of various DOGE victories (though many of the initial claims seem to be getting watered down). We have seen, certainly with Mexico, some steps on the “war on drugs” front. But there have been stumbles. China, so far, doesn’t appear to be coming to the table with their hat in their hand. The list of risks is possibly longer than the list of wins so far. If that changes rapidly, and it could, then risk assets should be off to the races!

Consensus shifts to a high degree of certainty that the economic policies will deliver over time. Markets are always pricing in the future. If the market suddenly agreed that all of the current policies would shift us to the economy that the administration envisions, risk assets would rally.

I find option 1 far more likely than option 2 to trigger a rally in risk any time in the next few weeks.

Shifting the Narrative from Tax Cuts to Avoiding Tax Hikes

I’d love for a slew of new tax cuts to be put on the table. Bringing back the SALT deduction would be nice. But the reality is that extending the tax cuts that are expiring would not act like a tax cut. Literally no one, not one single person, is changing their spending behavior today with the expectation that taxes will be higher next year, because the cuts will expire (and deductions like SALT won’t be reinstated).

If the tax cuts don’t get extended that is like a tax hike! Merely extending the tax cuts already in place will not act like a tax cut for the economy, because it won’t affect spending. Yes, for all the official deficit projections, the extension will look like a tax cut, but it won’t impact the economy, because that is already priced into existing behavior.

This is a bit of a detour in today’s report, but I couldn’t help myself as this could be very important in the coming months as we start to see governing through legislation rather than through executive order.

The Market Risk of Deglobalization

Last weekend we questioned

Where Is the Economy Headed? | Academy Securities

? Nothing that has occurred in the past week changes my view that the risks remain to the downside (though option 1 above could occur at any time, causing a rapid rethink of this view).

But today, we are going to go down a slightly different path. We will even discuss a couple of things that we rarely mention in the T-Reports – P/E ratios and Warren Buffet.

There is a large body of academic and practical research on the relationship between trade flows and capital flows. Since I only play an economist on TV, I typically don’t place a lot of emphasis on things that are very difficult to measure or infer causality in real time, like capital vs trade flows (we discussed this on Bloomberg TV – flows that is, not playing the role of an economist ).

This administration is quite clearly adamant that trade balances need to be corrected. Will correcting trade balances have any negative consequences? The corollary is, did rising trade deficits accrue any benefits to the U.S.? Certainly, some portion of the academic literature would argue that it did, potentially through capital flows. But that is all “too highfalutin” for a T-Report, so let’s bring it down to our level.

Somewhere between 25% and over 40% of revenue for the S&P 500 companies comes from outside the U.S. AI came up with 28% and someone I know well (and trust more than AI), Torsten Slok, produced a slide published on February 5th, showing “41% of revenue in the S&P 500 companies comes from abroad” (

Apollo Academy

The Daily Spark - Apollo Academy

Want it delivered daily to your inbox? Subscribe Now Torsten Slok Apollo Chief Economist See important disclaimers at the bottom...

).

In any case a significant amount of revenue (and presumably earnings and/or sales, depending on how revenue is used) comes from outside of the U.S. for the companies in the S&P 500. We have argued over and over, especially from a geopolitical standpoint, that this is crucial. “China Inc.” is the concept that Chinese companies and the Chinese government are effectively one and the same. That is just not the case for the U.S. government and U.S. companies (companies in the S&P 500 in this case).

The U.S. government is here to serve its constituents – which are the citizens of the Unites States. Administrations may find that the best way to do that varies, but that is ultimately their goal. It is clear that this administration is currently taking a focused view on what their constituency needs – lower taxes and more manufacturing.

The companies in the S&P 500 presumably have constituents across the globe that they need to pay attention to. Not just as customers, but also as suppliers. I haven’t spent much time on this because:

With some hiccups, we had been drifting towards more and more globalization where national boundaries seemed to make less of a difference. Since 2018 when Academy started focusing on China as a Strategic Competitor we could hone our analysis in on China (our view that China is shifting from

The Threat of “Made by China 2025” | Academy Securities

, went from being an outlying viewpoint, to pretty much consensus in the past year or so).

We have presumed companies have optimized their supply chains and distribution networks, and while from time to time, government policies (here and abroad) would create risks and opportunities, they have only impacted companies at the margins.

Right now, this isn’t at the margins and everyday there are indications of accelerating deglobalization (or at least dramatic changes in interconnectivity – like the potential for a reinvigorated trading relationship between Russia and the U.S.).

First chart ever looking at P/E ratios.

There have been a few periods when the average P/E ratio between the S&P 500 and the STOXX 600 has diverged. The times when the U.S. was significantly higher than Europe have been highlighted in orange. The recent divergence has lasted longer and is significantly higher than the other two periods of divergence since the early 2000s.

P/E ratios, especially for the U.S., but also for Europe (at least until 2022) have been drifting higher.

There are several reasons for this that have nothing to do with deglobalization:

More wealth chasing fewer public investment options.

A higher percentage of tech companies in the U.S. indices.

But what if globalization also allowed P/E ratios to rise? That the benefits and efficiencies of globalization helped investors get comfortable with paying more for stocks? That companies being able to optimize their businesses globally supported higher P/E ratios?

I’m not arguing that globalization was the biggest force behind higher P/E ratios, especially during the recent wave of AI valuations soaring, but it seems plausible that it was a part of it. Especially with somewhere around 1/3 of S&P 500 revenues coming from outside of the U.S.

Which brings us to Warren Buffet. The only time that I can recall mentioning him was in reference to his insurance companies selling massive amounts of first loss protection on the HY CDX Index first loss tranche. It was an incredibly efficient way to raise money at Libor flat to pay for Katrina damages (with low tail risk, unlike other things they underwrote). Pretty impressive for a person who is famous for claiming “derivatives are weapons of mass financial destruction.” But I digress.

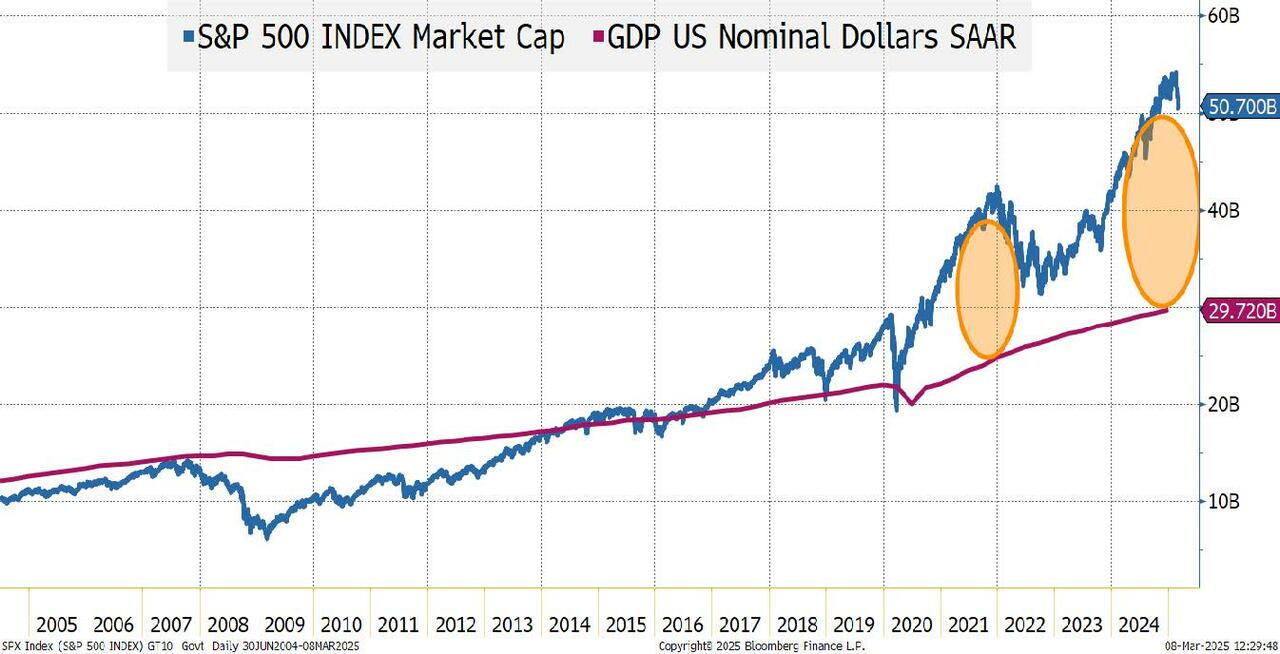

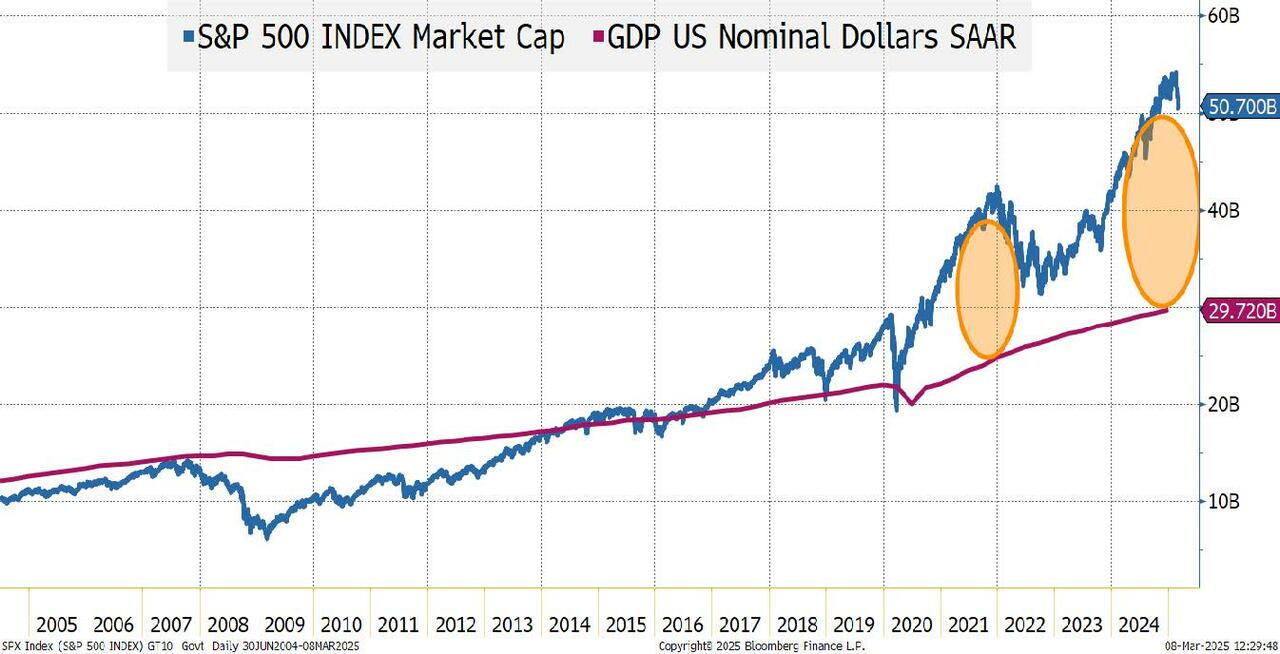

I could be wrong (I really don’t pay attention to Buffet), but I think he is often linked to comparing the market capitalization of the S&P 500 with U.S. GDP. There are a number of bears out there who point out this disparity. Many seem to link it to

Buffet holding record amounts of cash.

I’ve largely dismissed any comparison between U.S. GDP and the S&P 500 Market Cap because – you guessed it – about 1/3 of revenue comes from overseas!

Comparing global equity market cap to global GDP makes more sense, but it is nothing I spent much time thinking about, until recently.

I think it is more difficult to argue that globalization hasn’t played a role in this divergence! Again, lots of other factors are at work, but how much of that orange oval is linked to the benefits of globalization that may be getting disrupted?

Bottom Line

We are at the very early stages of a dramatic realignment of the global economy. The U.S. is the one setting it in motion, and the administration seems comfortable with creating bumps along the way. If the legacy is achieved, will it be great for domestic stocks? Unclear, but that is not today’s issue. Others are responding to the steps set in motion by this administration (we could also go back in time and figure out who did what to who, and when they did what to who, but tracing an “eye for an eye” back to the first eye, hardly ever accomplishes anything).

On risk assets, look for continued reversion to the mean. Own what is under-owned and shorted (globally). Be underweight what has been overbought and remains crowded longs. (Despite the recent domestic sell-off, despite the Nasdaq 100 closing below the 200-day moving average, I’m struggling to see signs of capitulation).

This is likely to bleed into credit spreads. The weakness that started a week or so ago, and accelerated last week, is likely to continue as this isn’t just reacting to shifts in data, it is the beginning of a reaction to a potential dramatic shift in global economics.

Rates are confusing to me. On the one hand, our outlook for the economy would indicate lower yields. I’m firmly in the 3 to 4 cuts camp, starting in May (I’d argue that we got into that camp before others starting joining us). But is that what will drive 10s and beyond? The 10-year yield rose 10 bps during a week in which the Nasdaq and S&P dropped over 3% (and no, the drop wasn’t tied to rate fears). Longer dated bonds have to contend with higher yields elsewhere. These are some of the same capital flow issues that foreigners may see, potentially making the U.S. seem like a less interesting place to allocate assets. DOGE (and the deficit) seemed to take off like a rocket ship, but lately, under more scrutiny, the work seems less impressive than initially publicized. No doubt it is finding fat and excess, but maybe not to the degree or ease that it felt like in the first days of rapid-fire announcements. I was worried that an aggressive effort to buy crypto would have hurt the bond market, but we seem to have avoided that, for now. So, with two hands balancing so much, I’d err to slight caution on rates, but think 4.2% to 4.4% is fair on 10s. We only get below that range on weak data (which may be coming, but it is a bit early). We could get higher on good data (which wouldn’t be bad) or we could break the range to the upside on yields because of a buyer strike, which would not be good for anyone!

I do think that crypto remains a leader on some days, and think that we could see further weakness next week as no new money was committed and this is a market that needs new money to flourish.

While it is difficult to be as bearish at levels around 10% below the highs, that is the direction I’m leaning as this isn’t your run-of-the-mill response to earnings and economic headlines. We are trying to price in a potentially massive change to the global economic and geopolitical landscape!

Despite the volatility that we’ve already experienced, I suspect that We Ain’t Seen Nothing Yet. On that happy note, the weather looks to be turning for the better for much of the country!

Tyler Durden | Zero Hedge

Zero Hedge

Sun, 03/09/2025 - 14:00

You Ain't Seen Nothing Yet | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

(emphasis ours),

A federal judge on March 7 declined to block a new federal immigration enforcement policy that lets agents enter schools to arrest illegal immigrants.

(emphasis ours),

A federal judge on March 7 declined to block a new federal immigration enforcement policy that lets agents enter schools to arrest illegal immigrants.

U.S. District Judge Daniel D. Domenico, during a hearing in Colorado,

U.S. District Judge Daniel D. Domenico, during a hearing in Colorado,  a request from Denver Public Schools to enter a temporary restraining order or a preliminary injunction against the policy. He said that Denver Public Schools failed to prove that a drop in attendance was due to a new policy from President Donald Trump’s administration.

The federal government in January

a request from Denver Public Schools to enter a temporary restraining order or a preliminary injunction against the policy. He said that Denver Public Schools failed to prove that a drop in attendance was due to a new policy from President Donald Trump’s administration.

The federal government in January  guidelines that largely barred federal officers from arresting illegal immigrants at certain places, including schools and food banks.

Denver Public Schools

guidelines that largely barred federal officers from arresting illegal immigrants at certain places, including schools and food banks.

Denver Public Schools  in its lawsuit that the U.S. Department of Homeland Security (DHS) had not demonstrated there were good reasons to implement the change.

“Defendants have provided no evidence that it examined relevant data, or any data. For example, Defendants have not cited any evidence to support its statement that criminals were hiding in schools,” the suit stated.

That means the move was arbitrary and capricious, in contravention of federal law, Denver officials said.

A DHS spokesperson said at the time that the administration was “protecting our schools, places of worship, and Americans who attend by preventing criminal aliens and gang members from exploiting these locations and taking safe haven there because these criminals knew law enforcement couldn’t go inside under the previous Administration. DHS’s directive gives our law enforcement the ability to do their jobs.”

A DHS official .pdf

in a Jan. 31 memorandum that a supervisor needed to approve immigration enforcement operations at or near churches and other “protected areas.”

Since the policy change, Denver school officials said that there has been a decrease in school attendance and a slew of reported ICE raids around schools. Denver’s superintendent told the court that students and parents had been arrested in the raids, stoking fear in the school community.

Under a previous version of the policy, agents with Immigration and Customs Enforcement, a DHS component, made just two arrests at schools, under exigent circumstances, from Oct. 1, 2018, through Oct. 31, 2020, according to a court filing. Another 18 arrests were made near schools.

Federal officials said in court filings that Denver officials have not shown the drop in attendance or any other injury was caused by the new DHS policy. “Rather, the evidence shows that any drop is the result of fears among students and parents, not any actual enforcement actions by DHS at schools, and may relate to false reports of immigration enforcement at schools or enforcement actions that did not take place on school grounds or at bus stops,” officials .pdf

in one filing.

They also said that the new policy did not differ significantly from the previous policy. While that 2021 policy said in part that “we should not take an enforcement action in or near a location” listed as protected, agents were still able to conduct arrests at or around such places, the officials noted. Schools remain on a list of protected areas, and agents still need authorization before entering the locations, they added.

Domenico, the judge, said on Friday that it wasn’t clear how much of the fear surrounding possible enforcement actions in schools was really due to the new rules as opposed to broader concerns of increased immigration actions.

He noted the requirement that authorities receive supervisory approval before entering sensitive places and said that the fear over the new rules, as well as the belief that the old rules provided protection to schools, both seemed to be overstated.

The Associated Press contributed to this report.

Sun, 03/09/2025 - 15:10

in its lawsuit that the U.S. Department of Homeland Security (DHS) had not demonstrated there were good reasons to implement the change.

“Defendants have provided no evidence that it examined relevant data, or any data. For example, Defendants have not cited any evidence to support its statement that criminals were hiding in schools,” the suit stated.

That means the move was arbitrary and capricious, in contravention of federal law, Denver officials said.

A DHS spokesperson said at the time that the administration was “protecting our schools, places of worship, and Americans who attend by preventing criminal aliens and gang members from exploiting these locations and taking safe haven there because these criminals knew law enforcement couldn’t go inside under the previous Administration. DHS’s directive gives our law enforcement the ability to do their jobs.”

A DHS official .pdf

in a Jan. 31 memorandum that a supervisor needed to approve immigration enforcement operations at or near churches and other “protected areas.”

Since the policy change, Denver school officials said that there has been a decrease in school attendance and a slew of reported ICE raids around schools. Denver’s superintendent told the court that students and parents had been arrested in the raids, stoking fear in the school community.

Under a previous version of the policy, agents with Immigration and Customs Enforcement, a DHS component, made just two arrests at schools, under exigent circumstances, from Oct. 1, 2018, through Oct. 31, 2020, according to a court filing. Another 18 arrests were made near schools.

Federal officials said in court filings that Denver officials have not shown the drop in attendance or any other injury was caused by the new DHS policy. “Rather, the evidence shows that any drop is the result of fears among students and parents, not any actual enforcement actions by DHS at schools, and may relate to false reports of immigration enforcement at schools or enforcement actions that did not take place on school grounds or at bus stops,” officials .pdf

in one filing.

They also said that the new policy did not differ significantly from the previous policy. While that 2021 policy said in part that “we should not take an enforcement action in or near a location” listed as protected, agents were still able to conduct arrests at or around such places, the officials noted. Schools remain on a list of protected areas, and agents still need authorization before entering the locations, they added.

Domenico, the judge, said on Friday that it wasn’t clear how much of the fear surrounding possible enforcement actions in schools was really due to the new rules as opposed to broader concerns of increased immigration actions.

He noted the requirement that authorities receive supervisory approval before entering sensitive places and said that the fear over the new rules, as well as the belief that the old rules provided protection to schools, both seemed to be overstated.

The Associated Press contributed to this report.

Sun, 03/09/2025 - 15:10

U.S. District Judge Daniel D. Domenico, during a hearing in Colorado,

U.S. District Judge Daniel D. Domenico, during a hearing in Colorado,

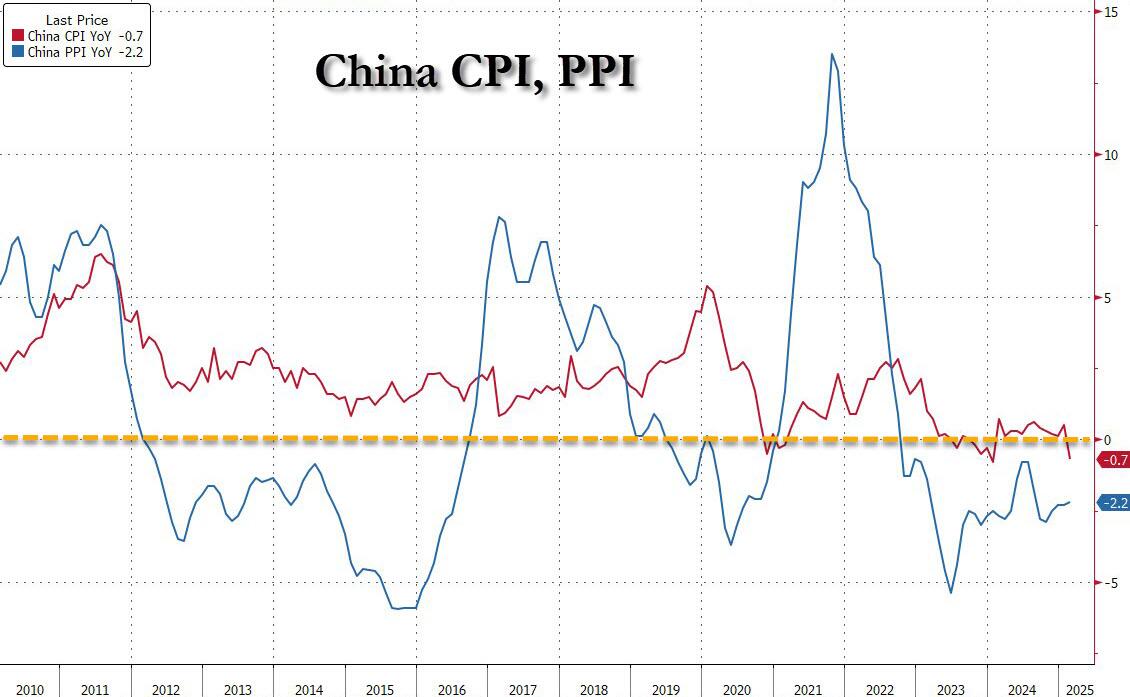

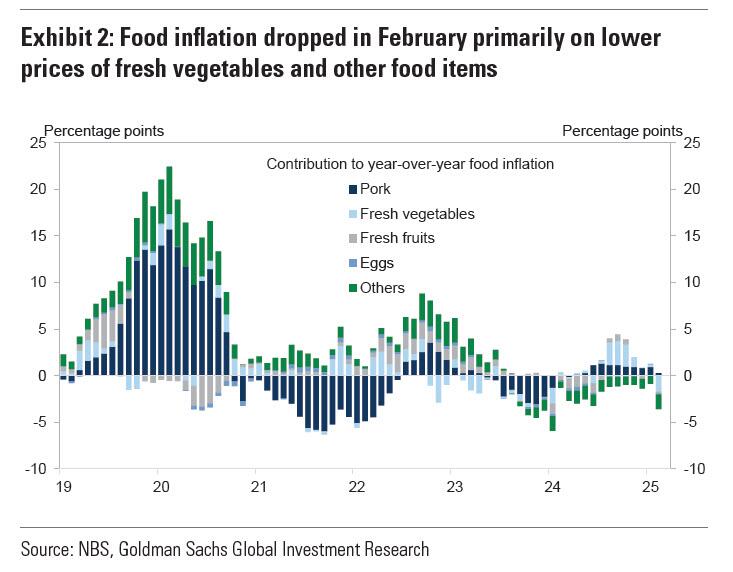

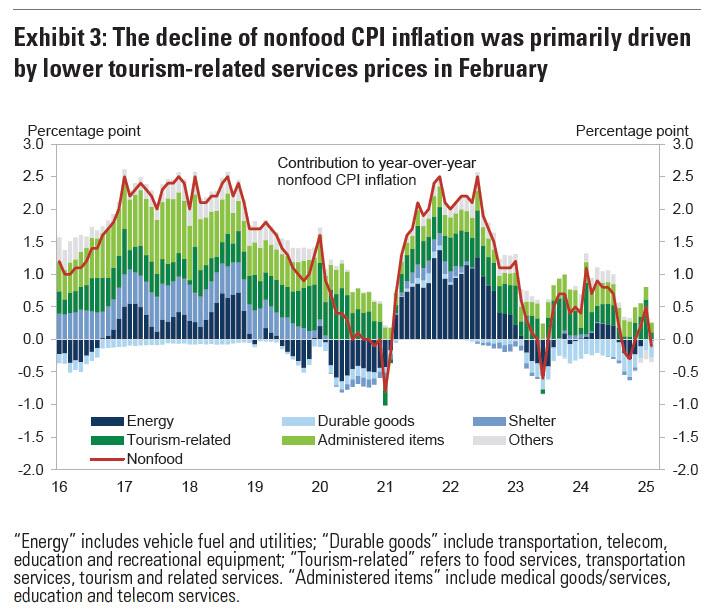

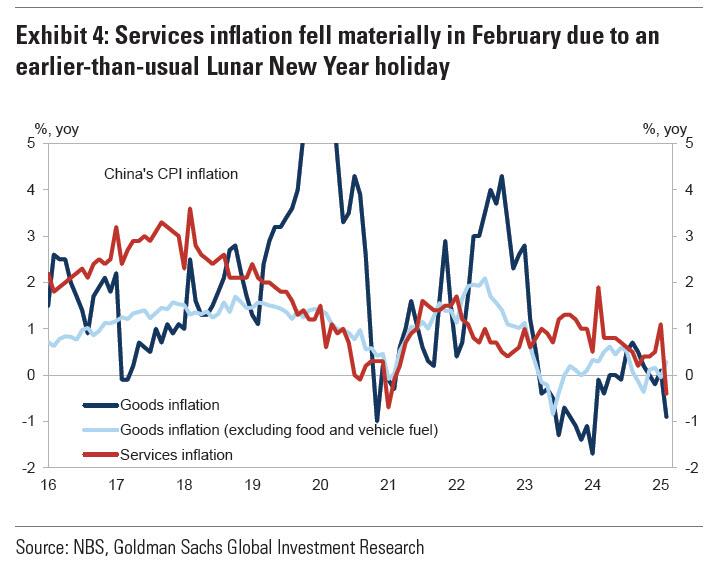

In February, China's headline CPI inflation fell to -0.7% yoy from +0.5% yoy in January, driven by lower food prices and tourism-related services prices partly driven by an earlier-than-usual Lunar New Year holiday. Goldman estimates suggest the earlier holiday (January 29 vs. February 10 in 2024) reduced year-over-year headline CPI inflation by 0.7% in February. In month-on-month terms, headline CPI inflation fell to -3.5% (annualized, seasonally adjusted) in February (vs. -1.7% mom s.a. annualized in January).

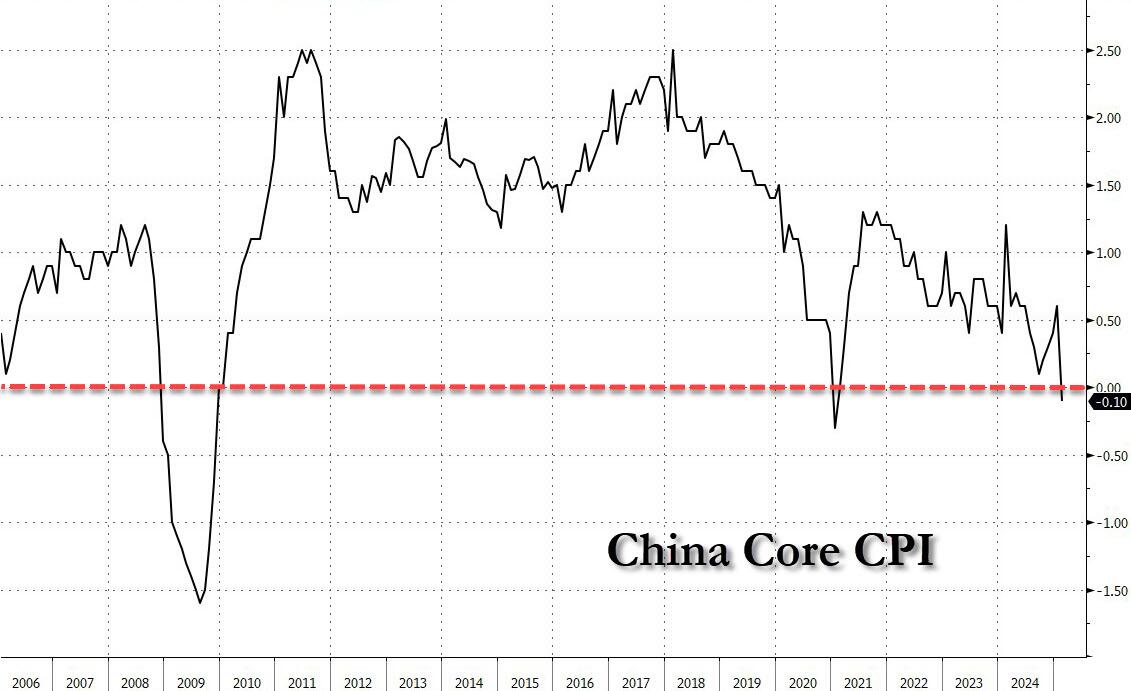

Even when adjusted for the effect of an earlier-than-usual Lunar New Year holiday, consumer inflation slowed to among the weakest levels in months, according to a Goldman report (available to pro subscribers in the usual place). A decline in services prices, combined with a rare negative reading for core inflation, were among symptoms of sluggish consumption.

More shocking was that China’s core CPI, which excludes volatile items such as food and energy, decreased for the first time since 2021 with a drop of 0.1%, and only the second time the gauge has contracted over more than 15 years. Factory deflation extended into a 29th month.

In February, China's headline CPI inflation fell to -0.7% yoy from +0.5% yoy in January, driven by lower food prices and tourism-related services prices partly driven by an earlier-than-usual Lunar New Year holiday. Goldman estimates suggest the earlier holiday (January 29 vs. February 10 in 2024) reduced year-over-year headline CPI inflation by 0.7% in February. In month-on-month terms, headline CPI inflation fell to -3.5% (annualized, seasonally adjusted) in February (vs. -1.7% mom s.a. annualized in January).

Even when adjusted for the effect of an earlier-than-usual Lunar New Year holiday, consumer inflation slowed to among the weakest levels in months, according to a Goldman report (available to pro subscribers in the usual place). A decline in services prices, combined with a rare negative reading for core inflation, were among symptoms of sluggish consumption.

More shocking was that China’s core CPI, which excludes volatile items such as food and energy, decreased for the first time since 2021 with a drop of 0.1%, and only the second time the gauge has contracted over more than 15 years. Factory deflation extended into a 29th month.

“China’s economy still faces deflationary pressure,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “Domestic demand remains weak.”

The statistics bureau said a key factor for the decline in inflation was the effect of a high base from a year earlier, created by elevated prices caused by spending during the Lunar New Year. The festival is a moving holiday that fell entirely in February 2024 but ran from Jan. 28 to Feb. 4 this year.

When accounting for seasonality, the statistics bureau estimates consumer inflation actually rose 0.1% from a year earlier in February, according to a statement published on Sunday. Goldman economists estimate the earlier holiday brought year-over-year CPI inflation down by 0.7% in February, so roughly a wash.

Some more details courtesy of Goldman:

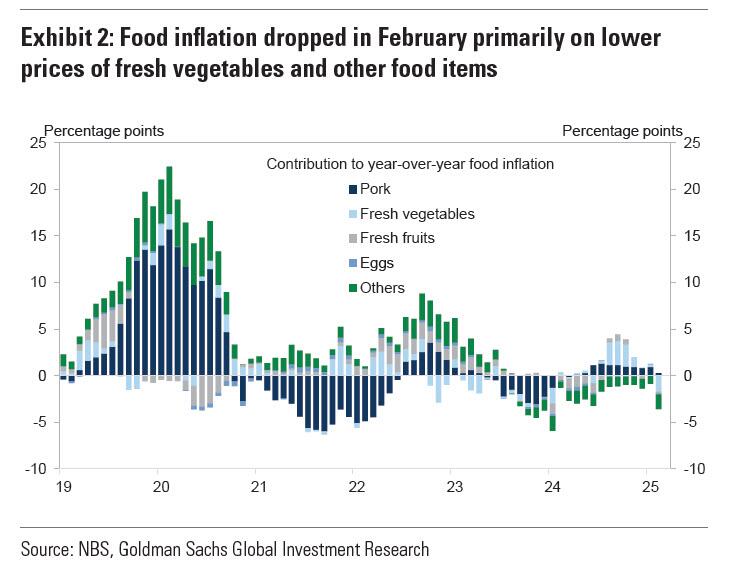

In year-over-year terms, food inflation dropped to -3.3% yoy in February from +0.4% yoy in January. The sharp decline of food inflation was mainly due to 1) lower food prices on decreased seasonal demand after the Lunar New Year holiday and 2) increased supply of fresh vegetables from warmer weather compared to a year ago.

“China’s economy still faces deflationary pressure,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “Domestic demand remains weak.”

The statistics bureau said a key factor for the decline in inflation was the effect of a high base from a year earlier, created by elevated prices caused by spending during the Lunar New Year. The festival is a moving holiday that fell entirely in February 2024 but ran from Jan. 28 to Feb. 4 this year.

When accounting for seasonality, the statistics bureau estimates consumer inflation actually rose 0.1% from a year earlier in February, according to a statement published on Sunday. Goldman economists estimate the earlier holiday brought year-over-year CPI inflation down by 0.7% in February, so roughly a wash.

Some more details courtesy of Goldman:

In year-over-year terms, food inflation dropped to -3.3% yoy in February from +0.4% yoy in January. The sharp decline of food inflation was mainly due to 1) lower food prices on decreased seasonal demand after the Lunar New Year holiday and 2) increased supply of fresh vegetables from warmer weather compared to a year ago.

Among major food items, pork prices rose by +4.1% yoy in February (vs. +13.8% yoy in January). Fresh vegetable prices fell by 12.6% yoy in February (vs. +2.4% yoy in January), and fresh fruit prices declined by 1.8% yoy in February (vs. +0.6% yoy in January).

Among major food items, pork prices rose by +4.1% yoy in February (vs. +13.8% yoy in January). Fresh vegetable prices fell by 12.6% yoy in February (vs. +2.4% yoy in January), and fresh fruit prices declined by 1.8% yoy in February (vs. +0.6% yoy in January).

Non-food CPI inflation moderated to -0.1% yoy in February from +0.5% yoy in January. The fall of nonfood CPI inflation was mainly driven by lower tourism-related services prices in February, due to the distortions from timing of Lunar New year holiday.

Non-food CPI inflation moderated to -0.1% yoy in February from +0.5% yoy in January. The fall of nonfood CPI inflation was mainly driven by lower tourism-related services prices in February, due to the distortions from timing of Lunar New year holiday.

For example, transportation services prices fell 3.9% yoy in February (vs. +2.9% yoy in January). Fuel costs fell by 1.2% yoy in February (vs. -0.6% yoy in January), on the falling crude oil prices. After excluding food and energy prices, core CPI inflation fell to -0.1% yoy in February (vs. +0.6% in January). Services inflation declined materially to -0.4% yoy in February from +1.1% in January.

For example, transportation services prices fell 3.9% yoy in February (vs. +2.9% yoy in January). Fuel costs fell by 1.2% yoy in February (vs. -0.6% yoy in January), on the falling crude oil prices. After excluding food and energy prices, core CPI inflation fell to -0.1% yoy in February (vs. +0.6% in January). Services inflation declined materially to -0.4% yoy in February from +1.1% in January.

Year-over-year PPI inflation edged up to -2.2% yoy in February (vs. -2.2% yoy in January). In month-over-month terms, PPI inflation declined to -1.3% (annualized, seasonally adjusted) in February (vs. -0.8% in January). PPI inflation in producer goods edged up to -2.5% yoy in February (vs. -2.6% yoy in January), and PPI inflation in consumer goods was flat at -1.2% yoy in February.

A clearer read on China’s inflation trajectory will emerge in March, as investors look for signs that the government’s stimulus is translating into stronger domestic demand. The country is on track for the longest streak of economy-wide price declines since the 1960s as a result of weak spending, while the property crash has yet to bottom out.

China has set its inflation target at the lowest level in over 20 years and now aims to bring consumer-price growth to around 2% in 2025 — down from the previous 3% target. It’s a signal top leaders are finally recognizing the deflationary pressures weighing on the world’s second-largest economy, with consumer inflation stuck at just 0.2% for the past two years.

Even so, it is unclear what miraculous stimulus China will unleash - monetary or fiscal - to send core inflation soaring to 2% in the coming 10 months.

Urgency has grown for the government to reflate the economy. At the annual parliament session Wednesday, China announced an ambitious economic growth goal of about 5% for 2025, despite the threat of an intensifying trade war with the US. Beijing also laid out plans to boost fiscal stimulus and domestic consumption.

More in the

Year-over-year PPI inflation edged up to -2.2% yoy in February (vs. -2.2% yoy in January). In month-over-month terms, PPI inflation declined to -1.3% (annualized, seasonally adjusted) in February (vs. -0.8% in January). PPI inflation in producer goods edged up to -2.5% yoy in February (vs. -2.6% yoy in January), and PPI inflation in consumer goods was flat at -1.2% yoy in February.

A clearer read on China’s inflation trajectory will emerge in March, as investors look for signs that the government’s stimulus is translating into stronger domestic demand. The country is on track for the longest streak of economy-wide price declines since the 1960s as a result of weak spending, while the property crash has yet to bottom out.

China has set its inflation target at the lowest level in over 20 years and now aims to bring consumer-price growth to around 2% in 2025 — down from the previous 3% target. It’s a signal top leaders are finally recognizing the deflationary pressures weighing on the world’s second-largest economy, with consumer inflation stuck at just 0.2% for the past two years.

Even so, it is unclear what miraculous stimulus China will unleash - monetary or fiscal - to send core inflation soaring to 2% in the coming 10 months.

Urgency has grown for the government to reflate the economy. At the annual parliament session Wednesday, China announced an ambitious economic growth goal of about 5% for 2025, despite the threat of an intensifying trade war with the US. Beijing also laid out plans to boost fiscal stimulus and domestic consumption.

More in the  There have been a few periods when the average P/E ratio between the S&P 500 and the STOXX 600 has diverged. The times when the U.S. was significantly higher than Europe have been highlighted in orange. The recent divergence has lasted longer and is significantly higher than the other two periods of divergence since the early 2000s.

P/E ratios, especially for the U.S., but also for Europe (at least until 2022) have been drifting higher.

There are several reasons for this that have nothing to do with deglobalization:

More wealth chasing fewer public investment options.

A higher percentage of tech companies in the U.S. indices.

But what if globalization also allowed P/E ratios to rise? That the benefits and efficiencies of globalization helped investors get comfortable with paying more for stocks? That companies being able to optimize their businesses globally supported higher P/E ratios?

I’m not arguing that globalization was the biggest force behind higher P/E ratios, especially during the recent wave of AI valuations soaring, but it seems plausible that it was a part of it. Especially with somewhere around 1/3 of S&P 500 revenues coming from outside of the U.S.

Which brings us to Warren Buffet. The only time that I can recall mentioning him was in reference to his insurance companies selling massive amounts of first loss protection on the HY CDX Index first loss tranche. It was an incredibly efficient way to raise money at Libor flat to pay for Katrina damages (with low tail risk, unlike other things they underwrote). Pretty impressive for a person who is famous for claiming “derivatives are weapons of mass financial destruction.” But I digress.

There have been a few periods when the average P/E ratio between the S&P 500 and the STOXX 600 has diverged. The times when the U.S. was significantly higher than Europe have been highlighted in orange. The recent divergence has lasted longer and is significantly higher than the other two periods of divergence since the early 2000s.

P/E ratios, especially for the U.S., but also for Europe (at least until 2022) have been drifting higher.

There are several reasons for this that have nothing to do with deglobalization:

More wealth chasing fewer public investment options.

A higher percentage of tech companies in the U.S. indices.

But what if globalization also allowed P/E ratios to rise? That the benefits and efficiencies of globalization helped investors get comfortable with paying more for stocks? That companies being able to optimize their businesses globally supported higher P/E ratios?

I’m not arguing that globalization was the biggest force behind higher P/E ratios, especially during the recent wave of AI valuations soaring, but it seems plausible that it was a part of it. Especially with somewhere around 1/3 of S&P 500 revenues coming from outside of the U.S.

Which brings us to Warren Buffet. The only time that I can recall mentioning him was in reference to his insurance companies selling massive amounts of first loss protection on the HY CDX Index first loss tranche. It was an incredibly efficient way to raise money at Libor flat to pay for Katrina damages (with low tail risk, unlike other things they underwrote). Pretty impressive for a person who is famous for claiming “derivatives are weapons of mass financial destruction.” But I digress.

I could be wrong (I really don’t pay attention to Buffet), but I think he is often linked to comparing the market capitalization of the S&P 500 with U.S. GDP. There are a number of bears out there who point out this disparity. Many seem to link it to

Buffet holding record amounts of cash.

I’ve largely dismissed any comparison between U.S. GDP and the S&P 500 Market Cap because – you guessed it – about 1/3 of revenue comes from overseas!

Comparing global equity market cap to global GDP makes more sense, but it is nothing I spent much time thinking about, until recently.

I think it is more difficult to argue that globalization hasn’t played a role in this divergence! Again, lots of other factors are at work, but how much of that orange oval is linked to the benefits of globalization that may be getting disrupted?

Bottom Line

We are at the very early stages of a dramatic realignment of the global economy. The U.S. is the one setting it in motion, and the administration seems comfortable with creating bumps along the way. If the legacy is achieved, will it be great for domestic stocks? Unclear, but that is not today’s issue. Others are responding to the steps set in motion by this administration (we could also go back in time and figure out who did what to who, and when they did what to who, but tracing an “eye for an eye” back to the first eye, hardly ever accomplishes anything).

On risk assets, look for continued reversion to the mean. Own what is under-owned and shorted (globally). Be underweight what has been overbought and remains crowded longs. (Despite the recent domestic sell-off, despite the Nasdaq 100 closing below the 200-day moving average, I’m struggling to see signs of capitulation).

This is likely to bleed into credit spreads. The weakness that started a week or so ago, and accelerated last week, is likely to continue as this isn’t just reacting to shifts in data, it is the beginning of a reaction to a potential dramatic shift in global economics.

Rates are confusing to me. On the one hand, our outlook for the economy would indicate lower yields. I’m firmly in the 3 to 4 cuts camp, starting in May (I’d argue that we got into that camp before others starting joining us). But is that what will drive 10s and beyond? The 10-year yield rose 10 bps during a week in which the Nasdaq and S&P dropped over 3% (and no, the drop wasn’t tied to rate fears). Longer dated bonds have to contend with higher yields elsewhere. These are some of the same capital flow issues that foreigners may see, potentially making the U.S. seem like a less interesting place to allocate assets. DOGE (and the deficit) seemed to take off like a rocket ship, but lately, under more scrutiny, the work seems less impressive than initially publicized. No doubt it is finding fat and excess, but maybe not to the degree or ease that it felt like in the first days of rapid-fire announcements. I was worried that an aggressive effort to buy crypto would have hurt the bond market, but we seem to have avoided that, for now. So, with two hands balancing so much, I’d err to slight caution on rates, but think 4.2% to 4.4% is fair on 10s. We only get below that range on weak data (which may be coming, but it is a bit early). We could get higher on good data (which wouldn’t be bad) or we could break the range to the upside on yields because of a buyer strike, which would not be good for anyone!

I do think that crypto remains a leader on some days, and think that we could see further weakness next week as no new money was committed and this is a market that needs new money to flourish.

While it is difficult to be as bearish at levels around 10% below the highs, that is the direction I’m leaning as this isn’t your run-of-the-mill response to earnings and economic headlines. We are trying to price in a potentially massive change to the global economic and geopolitical landscape!

Despite the volatility that we’ve already experienced, I suspect that We Ain’t Seen Nothing Yet. On that happy note, the weather looks to be turning for the better for much of the country!

I could be wrong (I really don’t pay attention to Buffet), but I think he is often linked to comparing the market capitalization of the S&P 500 with U.S. GDP. There are a number of bears out there who point out this disparity. Many seem to link it to

Buffet holding record amounts of cash.

I’ve largely dismissed any comparison between U.S. GDP and the S&P 500 Market Cap because – you guessed it – about 1/3 of revenue comes from overseas!

Comparing global equity market cap to global GDP makes more sense, but it is nothing I spent much time thinking about, until recently.

I think it is more difficult to argue that globalization hasn’t played a role in this divergence! Again, lots of other factors are at work, but how much of that orange oval is linked to the benefits of globalization that may be getting disrupted?

Bottom Line

We are at the very early stages of a dramatic realignment of the global economy. The U.S. is the one setting it in motion, and the administration seems comfortable with creating bumps along the way. If the legacy is achieved, will it be great for domestic stocks? Unclear, but that is not today’s issue. Others are responding to the steps set in motion by this administration (we could also go back in time and figure out who did what to who, and when they did what to who, but tracing an “eye for an eye” back to the first eye, hardly ever accomplishes anything).

On risk assets, look for continued reversion to the mean. Own what is under-owned and shorted (globally). Be underweight what has been overbought and remains crowded longs. (Despite the recent domestic sell-off, despite the Nasdaq 100 closing below the 200-day moving average, I’m struggling to see signs of capitulation).

This is likely to bleed into credit spreads. The weakness that started a week or so ago, and accelerated last week, is likely to continue as this isn’t just reacting to shifts in data, it is the beginning of a reaction to a potential dramatic shift in global economics.

Rates are confusing to me. On the one hand, our outlook for the economy would indicate lower yields. I’m firmly in the 3 to 4 cuts camp, starting in May (I’d argue that we got into that camp before others starting joining us). But is that what will drive 10s and beyond? The 10-year yield rose 10 bps during a week in which the Nasdaq and S&P dropped over 3% (and no, the drop wasn’t tied to rate fears). Longer dated bonds have to contend with higher yields elsewhere. These are some of the same capital flow issues that foreigners may see, potentially making the U.S. seem like a less interesting place to allocate assets. DOGE (and the deficit) seemed to take off like a rocket ship, but lately, under more scrutiny, the work seems less impressive than initially publicized. No doubt it is finding fat and excess, but maybe not to the degree or ease that it felt like in the first days of rapid-fire announcements. I was worried that an aggressive effort to buy crypto would have hurt the bond market, but we seem to have avoided that, for now. So, with two hands balancing so much, I’d err to slight caution on rates, but think 4.2% to 4.4% is fair on 10s. We only get below that range on weak data (which may be coming, but it is a bit early). We could get higher on good data (which wouldn’t be bad) or we could break the range to the upside on yields because of a buyer strike, which would not be good for anyone!

I do think that crypto remains a leader on some days, and think that we could see further weakness next week as no new money was committed and this is a market that needs new money to flourish.

While it is difficult to be as bearish at levels around 10% below the highs, that is the direction I’m leaning as this isn’t your run-of-the-mill response to earnings and economic headlines. We are trying to price in a potentially massive change to the global economic and geopolitical landscape!

Despite the volatility that we’ve already experienced, I suspect that We Ain’t Seen Nothing Yet. On that happy note, the weather looks to be turning for the better for much of the country!

Maybe that was something that Europe wants to do that. Great. Go. Europe should go protect Ukraine.

We have no NATO agreement with Ukraine. And this thing where Zelensky then goes and quotes all these other European leaders. They're with me, not with the United States. Great. Go, go, go work together.

We have 100,000 Americans being killed by the Chinese and Mexican fentanyl and methamphetamine mafias every year. Our kids are not learning to read. We have thousands of veterans with PTSD and are hurting. We have been at war in the Middle East for a quarter century. It's been 80 years since we bailed out Europe. You have your own militaries. You have your own nuclear weapons. I've been trying to be really indirect about this for years.

I've been trying to be soft peddling that you guys don't get it. Europeans do not get it. You guys think that this relationship is going to last forever. You think that because something's written down on a piece of paper, it's going to last forever. Americans have voted against this multiple times. This is not about what you think of Trump or like Trump. People on the left, on the right, they do not want to be in a nuclear war with Russia.

How can we explain this to you?

We do not want to continue to be in the Ukraine war. We want peace.

Our natural inclination is to actually not get involved in conflicts in Europe and Asia We didn't want to have to continue to intervene after World War II. I get it, but times have changed. We're ready to move on.

We bear a lot of responsibility for this. The United States bears a lot of responsibility for this.

Our people, our administrations, our think tanks told Zelensky and told the Europeans that we were loyal to that alliance, that we were going to stick with them. No, the American people are not on board with that. Again, the left has traditionally been against those kinds of military entanglements. Now the right is, but a lot of the left is too. A lot of Democrats, a lot of liberals. I would love an orderly transition here, but the behavior that we're seeing coming out of European leaders and out of Zelensky just now in the Oval Office suggests that the relationship is over. We'll reset the relationship afterwards.

We're going to have a trade. We're going to visit each other. It's great. But this thing of this entitlement, I don't think Europeans understand how angry it makes us. I don't think Europeans really understand how much Americans want to deal with our problems. We go to Europe. You have universal healthcare. You work 35 hours a week. You retire at a young age. You don't work nearly as hard as we do in the United States. You have many more benefits in Large part because we pay for all of your security or a large part of it. And in return, we just get disrespect, entitlement, like your children.

This is a dysfunctional relationship. It needs to end. It needs to change. Maybe there's a transition period something, but this has gone too far. I think that the anger that you saw in the White House with Trump in advance with Zelensky holding his arms, rolling his eyes, acting like he was telling us what the deal was. No, that's not a Republican, Democrat, whatever thing. That is not how we're going to be treated by people that we're helping.

So it's time to grow up. It's time for the relationship to change.

Healthy relationships depend on mutual respect. Ukraine and Europe don't respect us; they look down on us. America never had any obligation to protect Ukraine. And now we're asking why we should continue to spend our money, and put our lives on the line, to protect Europe.

Maybe that was something that Europe wants to do that. Great. Go. Europe should go protect Ukraine.

We have no NATO agreement with Ukraine. And this thing where Zelensky then goes and quotes all these other European leaders. They're with me, not with the United States. Great. Go, go, go work together.

We have 100,000 Americans being killed by the Chinese and Mexican fentanyl and methamphetamine mafias every year. Our kids are not learning to read. We have thousands of veterans with PTSD and are hurting. We have been at war in the Middle East for a quarter century. It's been 80 years since we bailed out Europe. You have your own militaries. You have your own nuclear weapons. I've been trying to be really indirect about this for years.

I've been trying to be soft peddling that you guys don't get it. Europeans do not get it. You guys think that this relationship is going to last forever. You think that because something's written down on a piece of paper, it's going to last forever. Americans have voted against this multiple times. This is not about what you think of Trump or like Trump. People on the left, on the right, they do not want to be in a nuclear war with Russia.

How can we explain this to you?

We do not want to continue to be in the Ukraine war. We want peace.

Our natural inclination is to actually not get involved in conflicts in Europe and Asia We didn't want to have to continue to intervene after World War II. I get it, but times have changed. We're ready to move on.

We bear a lot of responsibility for this. The United States bears a lot of responsibility for this.

Our people, our administrations, our think tanks told Zelensky and told the Europeans that we were loyal to that alliance, that we were going to stick with them. No, the American people are not on board with that. Again, the left has traditionally been against those kinds of military entanglements. Now the right is, but a lot of the left is too. A lot of Democrats, a lot of liberals. I would love an orderly transition here, but the behavior that we're seeing coming out of European leaders and out of Zelensky just now in the Oval Office suggests that the relationship is over. We'll reset the relationship afterwards.

We're going to have a trade. We're going to visit each other. It's great. But this thing of this entitlement, I don't think Europeans understand how angry it makes us. I don't think Europeans really understand how much Americans want to deal with our problems. We go to Europe. You have universal healthcare. You work 35 hours a week. You retire at a young age. You don't work nearly as hard as we do in the United States. You have many more benefits in Large part because we pay for all of your security or a large part of it. And in return, we just get disrespect, entitlement, like your children.

This is a dysfunctional relationship. It needs to end. It needs to change. Maybe there's a transition period something, but this has gone too far. I think that the anger that you saw in the White House with Trump in advance with Zelensky holding his arms, rolling his eyes, acting like he was telling us what the deal was. No, that's not a Republican, Democrat, whatever thing. That is not how we're going to be treated by people that we're helping.

So it's time to grow up. It's time for the relationship to change.

Healthy relationships depend on mutual respect. Ukraine and Europe don't respect us; they look down on us. America never had any obligation to protect Ukraine. And now we're asking why we should continue to spend our money, and put our lives on the line, to protect Europe.

Data comes from the

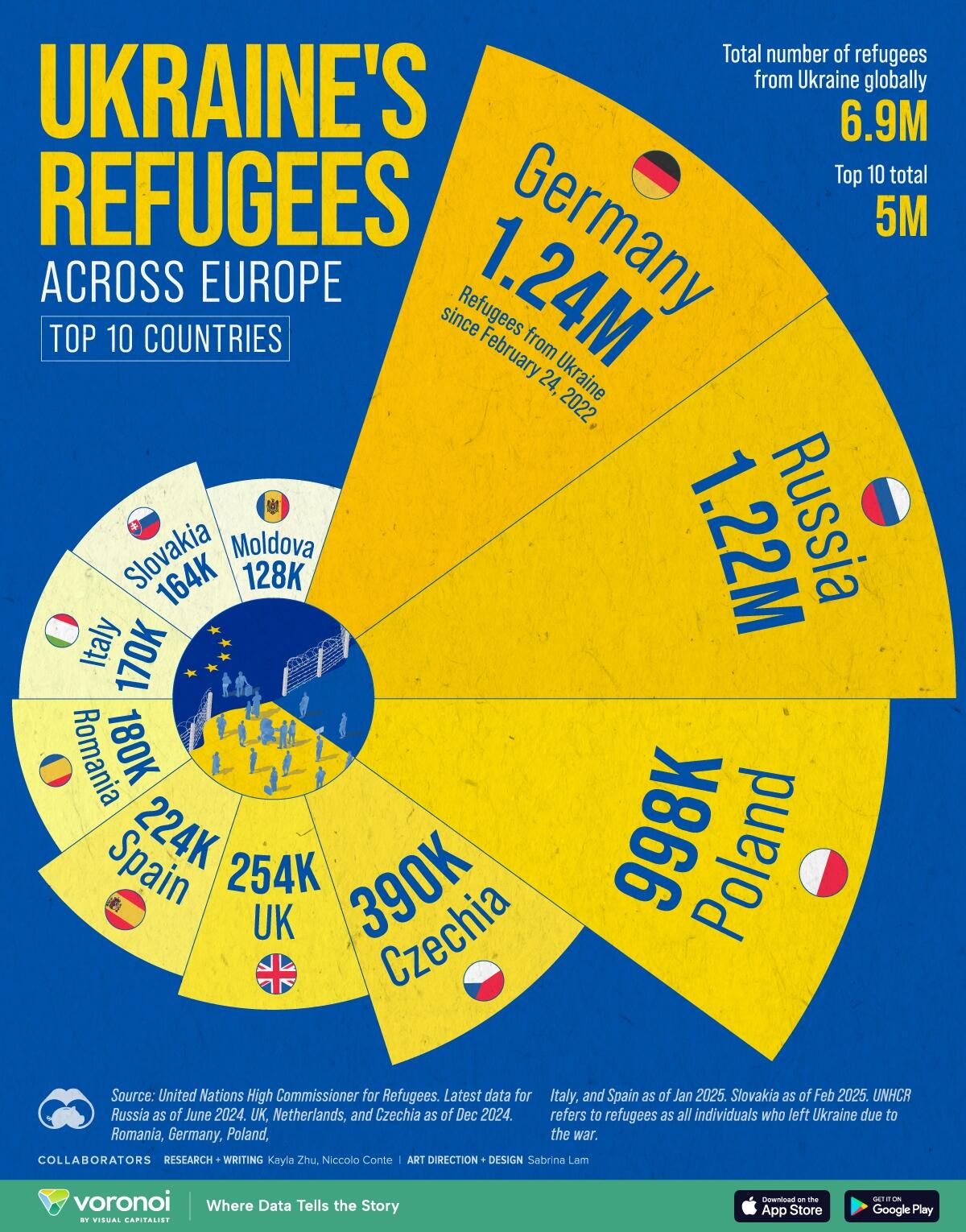

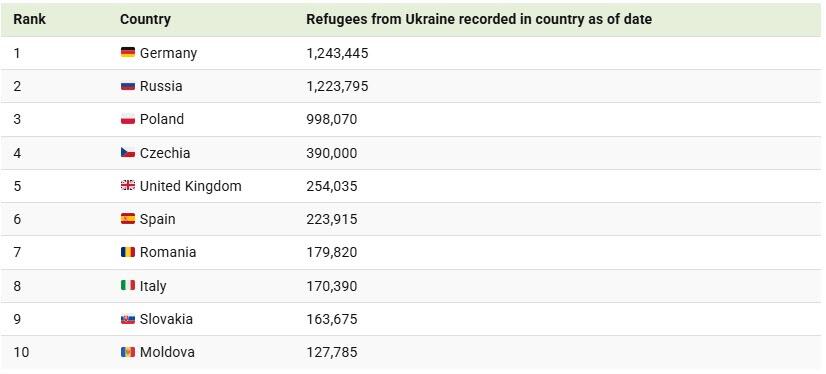

Data comes from the  Since the start of the war, around 6.9 million Ukrainians have been displaced globally, with about 5 million finding refuge in the top 10 host countries in Europe.

Germany (1.24 million), Russia (1.22 million), and Poland (998,000) have received the largest numbers of Ukrainian refugees.

Smaller countries like Czechia (390,000), Slovakia (164,000), and Moldova (128,000) have also provided significant support, demonstrating the broad impact of Ukraine’s refugee crisis across Europe.

Many of these countries have implemented

Since the start of the war, around 6.9 million Ukrainians have been displaced globally, with about 5 million finding refuge in the top 10 host countries in Europe.

Germany (1.24 million), Russia (1.22 million), and Poland (998,000) have received the largest numbers of Ukrainian refugees.

Smaller countries like Czechia (390,000), Slovakia (164,000), and Moldova (128,000) have also provided significant support, demonstrating the broad impact of Ukraine’s refugee crisis across Europe.

Many of these countries have implemented

Trump, Nixon and the China analogy

The US view of Russia as a foe working against its interests has defined the Middle East since the end of WWII, when Franklin Delano Roosevelt courted Saudi Arabia for Gulf oil. In the following decades, the US worked to counter the Soviet Union across the region.

The US’s support for Israel in the 1973 War led to an eventual peace treaty between Israel and Egypt. In the process, Egyptian President Anwar Sadat evicted Soviet military advisors who had been welcomed by Gamal Abdel Nasser. Until December 2024, the United States viewed the toppled Syrian Assad dynasty as a vehicle for nefarious Russian power projection.

Trump’s allies looking to explain his outreach to Putin have said he is trying to break up a bloc of states, mainly Russia, Iran and China, from coordinating against the US. They add that Trump’s overtures echo the strategic diplomacy of Richard Nixon and Henry Kissinger opening up to China in the 1970s.

Chas Freeman, a former US diplomat, whose career spanned almost three decades, told Middle East Eye it was a “false comparison”.

“A better analogy to Trump’s opening to Putin is Sadat going to Jerusalem.” Freeman is reliable on the subject considering he was the interpreter for Nixon’s trip.

In the Middle East, Trump’s bid to work with Putin may reflect his priorities and a geopolitical world view. Some of Trump’s confidants have raised the alarm about Turkey’s expanding influence.

Steve Bannon & Mike Flynn's worldview

Steve Bannon, a former Trump advisor whose podcast War Room has become required listening to those seeking to discern Trump’s world view, said recently that Turkish President Recep Tayyip Erdogan was “one of the most dangerous leaders” in the world and wants to "re-establish the Ottoman Empire”.

Trump himself said that the collapse of the Assad government in Syria was merely an “unfriendly takeover” by Turkey. Trump wants to withdraw US troops from northeastern Syria. According to Reuters, Israel has told the Trump administration one way to reduce Turkey’s influence in the country would be via Russia.

“Donald Trump wants to be out of Syria. I can imagine that Russia and Israel cooperate to limit Turkish influence there and Trump just says, ‘I don’t care. You guys deal with Turkey',” Robert Ford, the US’s former ambassador to Syria, told MEE.

Trump has selected traditional Republicans who have been hostile to Russia, like Secretary of State Marco Rubio and national security advisor Mike Waltz. But career US diplomats and defence officials say their influence is limited. For example, Rubio sat silent as Vice President JD Vance challenged Ukrainian President Volodymyr Zelensky at the White House last month. Steve Witkoff, Trump’s unconfirmed Middle East envoy, was the one tapped to meet Putin - speaking for roughly three hours -in Russia.

The gatekeepers to Trump’s selection of appointees are not diehard Russia hawks but those who believe the US should engage Moscow.

Officials looking to get into the White House have courted Mike Flynn, Trump’s former national security advisor who was ousted from his first administration over his discussions with the Russians. Trump

Trump, Nixon and the China analogy

The US view of Russia as a foe working against its interests has defined the Middle East since the end of WWII, when Franklin Delano Roosevelt courted Saudi Arabia for Gulf oil. In the following decades, the US worked to counter the Soviet Union across the region.

The US’s support for Israel in the 1973 War led to an eventual peace treaty between Israel and Egypt. In the process, Egyptian President Anwar Sadat evicted Soviet military advisors who had been welcomed by Gamal Abdel Nasser. Until December 2024, the United States viewed the toppled Syrian Assad dynasty as a vehicle for nefarious Russian power projection.

Trump’s allies looking to explain his outreach to Putin have said he is trying to break up a bloc of states, mainly Russia, Iran and China, from coordinating against the US. They add that Trump’s overtures echo the strategic diplomacy of Richard Nixon and Henry Kissinger opening up to China in the 1970s.

Chas Freeman, a former US diplomat, whose career spanned almost three decades, told Middle East Eye it was a “false comparison”.

“A better analogy to Trump’s opening to Putin is Sadat going to Jerusalem.” Freeman is reliable on the subject considering he was the interpreter for Nixon’s trip.

In the Middle East, Trump’s bid to work with Putin may reflect his priorities and a geopolitical world view. Some of Trump’s confidants have raised the alarm about Turkey’s expanding influence.

Steve Bannon & Mike Flynn's worldview

Steve Bannon, a former Trump advisor whose podcast War Room has become required listening to those seeking to discern Trump’s world view, said recently that Turkish President Recep Tayyip Erdogan was “one of the most dangerous leaders” in the world and wants to "re-establish the Ottoman Empire”.

Trump himself said that the collapse of the Assad government in Syria was merely an “unfriendly takeover” by Turkey. Trump wants to withdraw US troops from northeastern Syria. According to Reuters, Israel has told the Trump administration one way to reduce Turkey’s influence in the country would be via Russia.

“Donald Trump wants to be out of Syria. I can imagine that Russia and Israel cooperate to limit Turkish influence there and Trump just says, ‘I don’t care. You guys deal with Turkey',” Robert Ford, the US’s former ambassador to Syria, told MEE.

Trump has selected traditional Republicans who have been hostile to Russia, like Secretary of State Marco Rubio and national security advisor Mike Waltz. But career US diplomats and defence officials say their influence is limited. For example, Rubio sat silent as Vice President JD Vance challenged Ukrainian President Volodymyr Zelensky at the White House last month. Steve Witkoff, Trump’s unconfirmed Middle East envoy, was the one tapped to meet Putin - speaking for roughly three hours -in Russia.

The gatekeepers to Trump’s selection of appointees are not diehard Russia hawks but those who believe the US should engage Moscow.

Officials looking to get into the White House have courted Mike Flynn, Trump’s former national security advisor who was ousted from his first administration over his discussions with the Russians. Trump

Here's more color about the operation via the source:

Virtually the entire southeastern territory of the country has already been "scanned" by the United States in its fight against drug trafficking, logically including the state of Campeche.

Here's more color about the operation via the source:

Virtually the entire southeastern territory of the country has already been "scanned" by the United States in its fight against drug trafficking, logically including the state of Campeche.

The Lockheed P-3B Orion aircraft, registration N149CS, of the US Customs and Border Protection (CBP) service, has been carrying out reconnaissance work over Chiapas, Tabasco, Campeche and Yucatán since the beginning of this week.

The Lockheed P-3B Orion aircraft, registration N149CS, of the US Customs and Border Protection (CBP) service, has been carrying out reconnaissance work over Chiapas, Tabasco, Campeche and Yucatán since the beginning of this week.

The aircraft, with high spying capabilities, was spotted on Tuesday 4th at the "Manuel Crescencio Rejón" International Airport or Mérida International Airport (MMMD). "A tremendous visitor yesterday (04/03/25) the powerful Lookheed P-3B Orion (N149CS)," wrote Alex Piña in the Facebook group "Aeropuerto MMMD."

However, the N149CS was seen this Wednesday, 5th, near the Tuxtla Gutiérrez Airport, Chiapas, according to the specialized application FlightAware. According to another flight tracking app: FlightRadar24, the American plane, belonging to Customs and Border Protection (CBP), has flown over the territory of Chiapas, Tabasco, Campeche and Yucatán.

🔍🕵🏻𝐂𝐚𝐦𝐩𝐞𝐜𝐡𝐞 𝐲𝐚 𝐟𝐮𝐞 𝐞𝐬𝐜𝐚𝐧𝐞𝐚𝐝𝐨 𝐩𝐨𝐫 𝐚𝐯𝐢𝐨𝐧𝐞𝐬 𝐝𝐞 𝐄𝐬𝐭𝐚𝐝𝐨𝐬 𝐔𝐧𝐢𝐝𝐨𝐬.

🛫🇺🇸 El avión Lockheed P-3B Orion ya sobrevuela el sur del país, practicamente todo el territorio Sursureste del país ha sido "escaneado" por Estados Unidos en su lucha…

The aircraft, with high spying capabilities, was spotted on Tuesday 4th at the "Manuel Crescencio Rejón" International Airport or Mérida International Airport (MMMD). "A tremendous visitor yesterday (04/03/25) the powerful Lookheed P-3B Orion (N149CS)," wrote Alex Piña in the Facebook group "Aeropuerto MMMD."

However, the N149CS was seen this Wednesday, 5th, near the Tuxtla Gutiérrez Airport, Chiapas, according to the specialized application FlightAware. According to another flight tracking app: FlightRadar24, the American plane, belonging to Customs and Border Protection (CBP), has flown over the territory of Chiapas, Tabasco, Campeche and Yucatán.

🔍🕵🏻𝐂𝐚𝐦𝐩𝐞𝐜𝐡𝐞 𝐲𝐚 𝐟𝐮𝐞 𝐞𝐬𝐜𝐚𝐧𝐞𝐚𝐝𝐨 𝐩𝐨𝐫 𝐚𝐯𝐢𝐨𝐧𝐞𝐬 𝐝𝐞 𝐄𝐬𝐭𝐚𝐝𝐨𝐬 𝐔𝐧𝐢𝐝𝐨𝐬.

🛫🇺🇸 El avión Lockheed P-3B Orion ya sobrevuela el sur del país, practicamente todo el territorio Sursureste del país ha sido "escaneado" por Estados Unidos en su lucha…

The bill largely maintains current spending levels, while an additional $8 billion would be included for defense programs, and $6 billion for veterans' healthcare.

Non-defense spending would drop by approximately $13 billion.

Johnson is setting up the bill for a vote on Tuesday, despite a lack of buy-in from Democrats - essentially daring them to vote against it and risk a shutdown. He's also betting that Republicans will be able to quash inner divisions over spending and force it through.

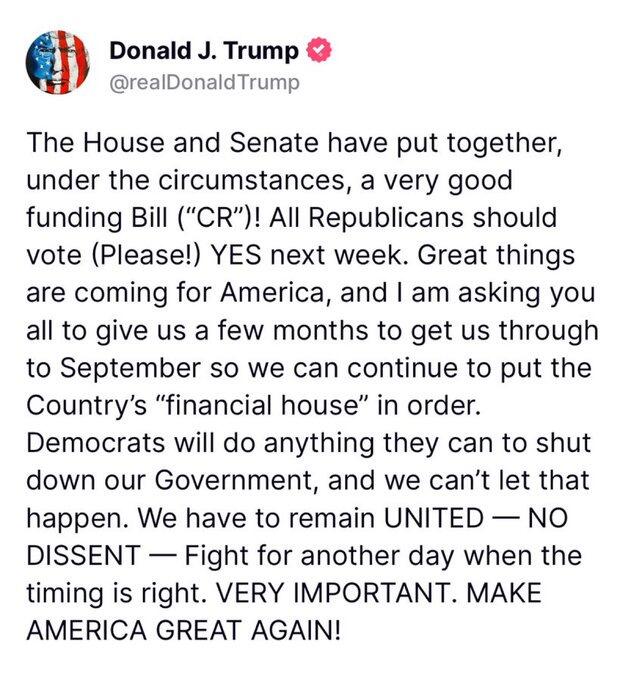

Trump Asks GOP To Come Together

"The House and Senate have put together, under the circumstances, a very good funding Bill ("CR")!" Trump wrote on Truth Social, aking all Republicans to (Please!) vote yes on it next week.

"I am asking you to give us a few months to get us through to September so we can continue to put the Country's "financial house" in order," the post continues.

"Democrats will do anything they can to shut down our Government, and we can't let that happen. We have to remain UNITED -- NO DISSENT -- Fight for another day when the timing is right. VERY IMPORTANT. MAKE AMERICA GREAT AGAIN."

The bill largely maintains current spending levels, while an additional $8 billion would be included for defense programs, and $6 billion for veterans' healthcare.

Non-defense spending would drop by approximately $13 billion.

Johnson is setting up the bill for a vote on Tuesday, despite a lack of buy-in from Democrats - essentially daring them to vote against it and risk a shutdown. He's also betting that Republicans will be able to quash inner divisions over spending and force it through.

Trump Asks GOP To Come Together

"The House and Senate have put together, under the circumstances, a very good funding Bill ("CR")!" Trump wrote on Truth Social, aking all Republicans to (Please!) vote yes on it next week.

"I am asking you to give us a few months to get us through to September so we can continue to put the Country's "financial house" in order," the post continues.

"Democrats will do anything they can to shut down our Government, and we can't let that happen. We have to remain UNITED -- NO DISSENT -- Fight for another day when the timing is right. VERY IMPORTANT. MAKE AMERICA GREAT AGAIN."

As Bloomberg notes, unlike previous shutdowns, this one would impact all discretionary spending since none of the 12 appropriations bills have been signed into law.

While key entitlement programs like Social Security, Medicare, and Medicaid would continue making payments, administrative delays could affect new enrollments. With a razor-thin Republican majority in the House and the need for bipartisan cooperation in the Senate, negotiations remain fraught, as both parties clash over budgetary provisions that could make or break a last-minute deal.

The economic consequences of a prolonged shutdown, according to Bloomberg Intelligence, would be immediate yet largely reversible. A month-long halt in government operations could shave 0.4 percentage points off GDP growth in the first quarter, though a rebound is expected once normal spending resumes. While federal workers may face furloughs, unemployment figures would not be affected in March but could rise by 0.5 percentage points in April if the impasse drags on. Inflation would see a temporary uptick because furloughed federal workers’ output wouldn’t be counted, even though they will eventually be paid.

More:

Economic Data Collection: The shutdown will delay crucial economic reports like the consumer price index (CPI), unemployment rate, and retail sales data.

Federal Agencies: Around 850,000 workers could be furloughed.

Impact on the Fed: The Federal Reserve, which operates independently, will continue normal operations, including the scheduled March 18-19 FOMC meeting.

As Bloomberg concludes:

In normal times, avoiding a shutdown would be a big priority – but now, amid the flurry of dramatic steps early in Trump’s term, it’s just one of many competing priorities. It’s not clear if the two sides can find common ground. Only twice before has the government been shuttered when one party controlled the White House, House of Representatives and Senate – and both were during the first Trump administration. Whether a third such episode can be avoided will depend on how the two sides assess the tactical risks of bringing the normal operations of government to a halt.

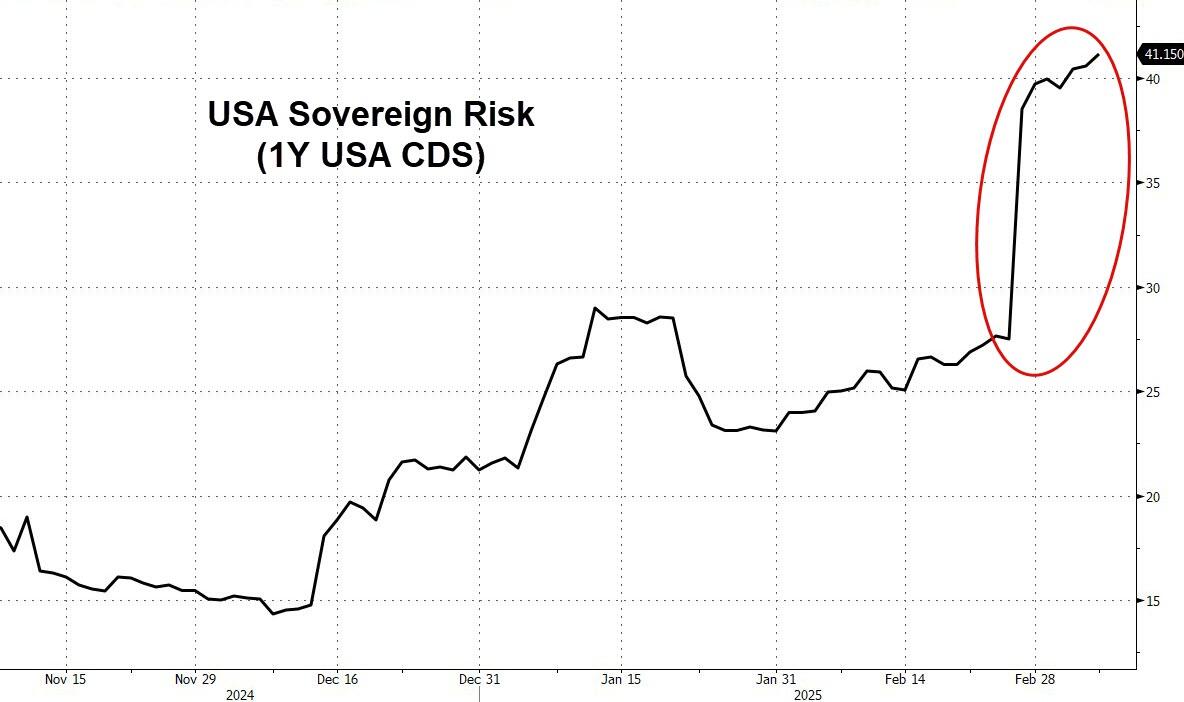

Meanwhile, US Sovereign Risk suggests people are getting nervous...

As Bloomberg notes, unlike previous shutdowns, this one would impact all discretionary spending since none of the 12 appropriations bills have been signed into law.

While key entitlement programs like Social Security, Medicare, and Medicaid would continue making payments, administrative delays could affect new enrollments. With a razor-thin Republican majority in the House and the need for bipartisan cooperation in the Senate, negotiations remain fraught, as both parties clash over budgetary provisions that could make or break a last-minute deal.

The economic consequences of a prolonged shutdown, according to Bloomberg Intelligence, would be immediate yet largely reversible. A month-long halt in government operations could shave 0.4 percentage points off GDP growth in the first quarter, though a rebound is expected once normal spending resumes. While federal workers may face furloughs, unemployment figures would not be affected in March but could rise by 0.5 percentage points in April if the impasse drags on. Inflation would see a temporary uptick because furloughed federal workers’ output wouldn’t be counted, even though they will eventually be paid.

More:

Economic Data Collection: The shutdown will delay crucial economic reports like the consumer price index (CPI), unemployment rate, and retail sales data.

Federal Agencies: Around 850,000 workers could be furloughed.

Impact on the Fed: The Federal Reserve, which operates independently, will continue normal operations, including the scheduled March 18-19 FOMC meeting.

As Bloomberg concludes:

In normal times, avoiding a shutdown would be a big priority – but now, amid the flurry of dramatic steps early in Trump’s term, it’s just one of many competing priorities. It’s not clear if the two sides can find common ground. Only twice before has the government been shuttered when one party controlled the White House, House of Representatives and Senate – and both were during the first Trump administration. Whether a third such episode can be avoided will depend on how the two sides assess the tactical risks of bringing the normal operations of government to a halt.

Meanwhile, US Sovereign Risk suggests people are getting nervous...

* * *

Pick up a top-selling

* * *

Pick up a top-selling

Trump recently told US media outlets, "Hopefully we can have a peace deal, I’m not speaking out of strength or weakness. I’m just saying I’d rather see a peace deal, than the other. But, the other, will solve the problem."

However, Iran's Permanent Representative to the UN Amir Saeid Iravani rejected the overture. "Trump says he has sent a letter to Iran. We have not received any such letter," the representative

Trump recently told US media outlets, "Hopefully we can have a peace deal, I’m not speaking out of strength or weakness. I’m just saying I’d rather see a peace deal, than the other. But, the other, will solve the problem."

However, Iran's Permanent Representative to the UN Amir Saeid Iravani rejected the overture. "Trump says he has sent a letter to Iran. We have not received any such letter," the representative

The GEGD program provides access to commercial satellite imagery collected by the United States for partner nations and allies. Ukraine has apparently been blocked from further participation for the time being.

"The US government has decided to temporarily suspend Ukrainian accounts in GEGD," the Maxar statement said, referring reporters to the US National Geospatial-Intelligence Agency for any further questions.

"We take our contractual commitments very seriously, and there is no change to other Maxar customer programs," Maxar explained.

The CIA had on Wednesday confirmed blockage of all intelligence-sharing with Ukraine. President Trump on Friday linked any further sharing on Ukraine's willingness to enter peace negotiations with Moscow.

"Ukraine has to get on the ball and get a job done," Trump said, adding that the US is "trying to help" get peace negotiations moving.

But he admitted to reporters at the White House that it's currently more difficult for Washington to deal with Ukraine than with Russia, which has "all the cards" in the war. Watch:

President Trump on Putin and the war in Ukraine:

"I think we're doing very well with Russia. But right now they're bombing the hell out of Ukraine. I'm finding it more difficult, frankly, to deal with Ukraine."

The GEGD program provides access to commercial satellite imagery collected by the United States for partner nations and allies. Ukraine has apparently been blocked from further participation for the time being.

"The US government has decided to temporarily suspend Ukrainian accounts in GEGD," the Maxar statement said, referring reporters to the US National Geospatial-Intelligence Agency for any further questions.

"We take our contractual commitments very seriously, and there is no change to other Maxar customer programs," Maxar explained.

The CIA had on Wednesday confirmed blockage of all intelligence-sharing with Ukraine. President Trump on Friday linked any further sharing on Ukraine's willingness to enter peace negotiations with Moscow.

"Ukraine has to get on the ball and get a job done," Trump said, adding that the US is "trying to help" get peace negotiations moving.

But he admitted to reporters at the White House that it's currently more difficult for Washington to deal with Ukraine than with Russia, which has "all the cards" in the war. Watch:

President Trump on Putin and the war in Ukraine:

"I think we're doing very well with Russia. But right now they're bombing the hell out of Ukraine. I'm finding it more difficult, frankly, to deal with Ukraine."