On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 26.05.2025

🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner.

On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️

Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read:

River Intelligence

The American Bitcoin Advantage - River Intelligence

The United States is the global Bitcoin superpower. River's new report breaks down how this advantage can fuel the next era of American prospe...

'In this report, you'll learn about:

Why Bitcoin is an underestimated pillar of American dominance.

America’s lead in Bitcoin businesses, institutions, development, and policy.

Bitcoin's emergence as America’s reserve asset.'

Ergo: America is the dominant Bitcoin player in just about every dimension: investment, government reserves, development, institutional embrace, supportive policy, and mining.

➡️Texas Bitcoin Reserve bill SB 21 will be considered on the second reading in the House this morning. Note: the Texas Constitution requires that second and third readings be conducted on separate days. If it passes today, then the final vote could be tomorrow

➡️Bitcoin accumulation trends signal bullishness with smallholders (<1 BTC) accelerating accumulation (score ~0.55), and whales (100-10K BTC) aggressively buying. Source: Glassnode

➡️French company The Blockchain Group raises €8.6 million to buy more Bitcoin. Press release

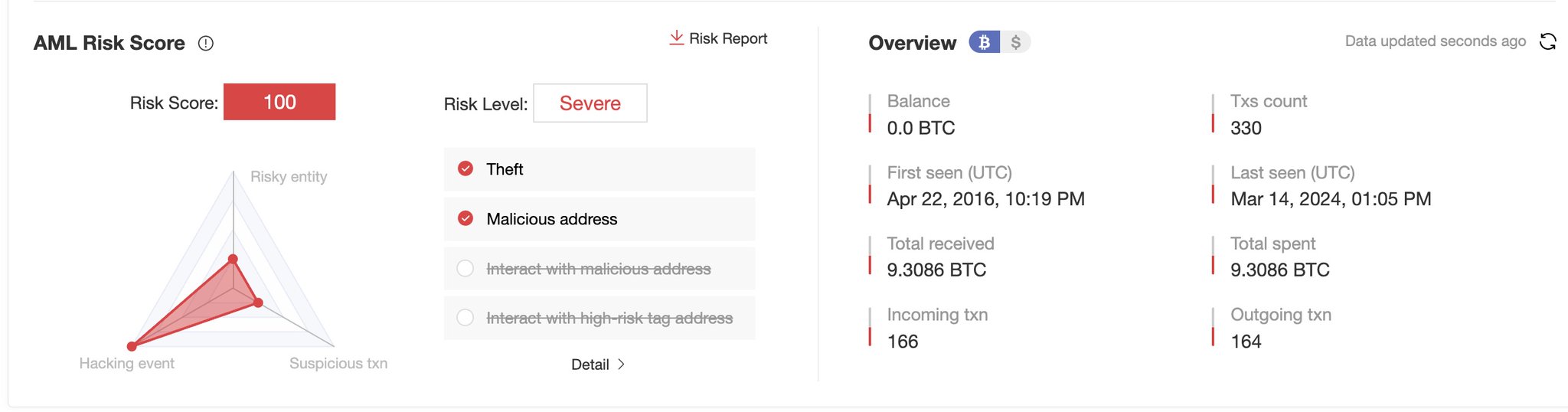

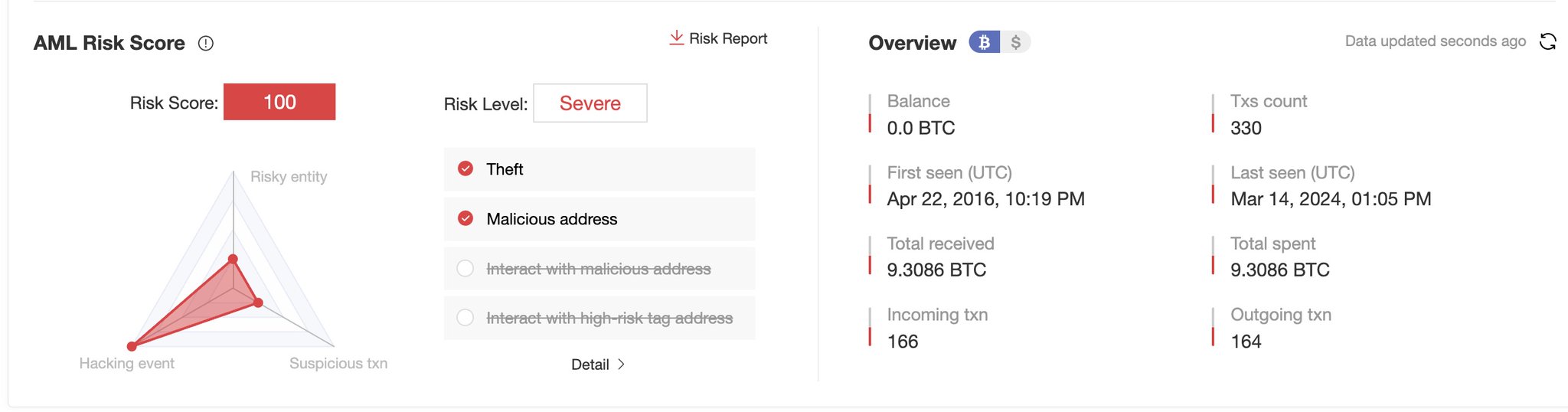

➡️Chinese printer manufacturer Procolored unknowingly distributed Bitcoin-stealing malware through its official device drivers, resulting in 9.3 BTC ($950K) stolen from users.

X (formerly Twitter)

MistTrack🕵️ (@MistTrack_io) on X

🚨 The official driver provided by this printer carries a backdoor program. It will hijack the wallet address in the user's clipboard and replace...

➡️Bitmine launches its Bitcoin Treasury Advisory Practice with a $4M deal, including $3.2M for leasing 3K Bitcoin miners and an $800K consulting agreement

➡️Bitcoin's correlation to gold is at its lowest since February 2025, per Glassnode data.

➡️UK-listed Smarter Web Company adds 16.42 BTC to its treasury at an average price of $104,202. Total Holdings: 35.62 BTC The Smarter Web Company is stacking with conviction—building a treasury designed for the long term.

On the 21st of May:

➡️Vivek's Strive Asset Management looking to buy up to 75,000 Bitcoin from Mt. Gox claims at a discount to build a Bitcoin treasury.

➡️Bitcoin is $1k from an all-time high and the Google Trends chart looks like this.

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind):

Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users.

In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate.

By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days.

Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible. (foto)

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

X (formerly Twitter)

lowstrife (@lowstrife) on X

Bitcoin treasury companies are all the rage this week. MSTR, Metaplanet, Twenty One, Nakamoto.

I think they're toxic leverage and the worst thing ...

➡️For the first time in history, Bitcoin is now trading above $111,000 and just surpassed $2.2 TRILLION in market cap for the first time in history. $3 Billion worth of Bitcoin shorts to be liquidated at $120,000 Small, tiny reminder. In 2021 dollars, Bitcoin hasn’t broken $100K yet. We need to hit $118K to meet that milestone. Celebrating $1 million (eventually) might not be as much fun as you think.

➡️H100 Group buys 4.39 BTC and becomes Sweden's first publicly listed #Bitcoin treasury company. After announcing its first Bitcoin purchase shares surged 37%. A small stack, big signal.

➡️Bitcoin has now surpassed both Amazon and Google to become the 5th largest asset in the world, and Bitcoin just surpassed the Taiwan Dollar and is now the 8 largest currency in the world. Nothing stops this train.

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen

Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms.

➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER'

Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿'

➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B.

➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999.

Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.'

On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan

@Sam

➡️Sminston With: 'There is a myth that 100% of the returns in Bitcoin only happen if you buy at the bottoms and then sell at the tops during one of the cycles. Power law quantile analysis shows otherwise; in fact, there are nearly identical growth rates (CAGR) whether you buy/sell at the bottoms (support) or around the middle (median) 52% vs 53% as of this year! Whichever trendline is followed, even if you only trade at the bottoms, the compounded annual returns of Bitcoin will be >7x of what you'd ever expect from the S&P. Ignore or try to time Bitcoin at your own risk!'

On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

@Lyn Alden May 2025 Newsletter: A Trade Breakdown

This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the global balance of trade is both popular and extremely difficult to do.

Lyn Alden

May 2025 Newsletter: A Trade Breakdown

May 4, 2025 This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the...

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

Do you think this post is helpful? If so, please share it with your friends, family co-workers, and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐️ Many thanks⭐️

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🧡Bitcoin news🧡

"The premise required for the universe to function is the conservation of energy. A person without energy is a ghost. An object without energy is an image. Money without energy is credit." —Michael Saylor

🧡Bitcoin news🧡

"The premise required for the universe to function is the conservation of energy. A person without energy is a ghost. An object without energy is an image. Money without energy is credit." —Michael Saylor On the 26th of May:

➡️'Bitcoin capital flows could exceed $120B by the end of 2025 and reach $300B in 2026, per Bitwise. U.S. spot Bitcoin ETFs attracted over $36.2B in net inflows during 2024, outperforming expectations and exceeding early SPDR Gold Shares (GLD) performance by 20x.' -Bitcoin News

On the 26th of May:

➡️'Bitcoin capital flows could exceed $120B by the end of 2025 and reach $300B in 2026, per Bitwise. U.S. spot Bitcoin ETFs attracted over $36.2B in net inflows during 2024, outperforming expectations and exceeding early SPDR Gold Shares (GLD) performance by 20x.' -Bitcoin News

➡️Michael Saylor's STRATEGY becomes the first company to hold over 500,000 Bitcoin on its balance sheet. Over the last 64 days, Saylor has purchased approximately 80,000 Bitcoin.

➡️River: '2-3% inflation per year sounds harmless... until you zoom out. Every line on this chart is a reason Bitcoin exists.'

➡️Michael Saylor's STRATEGY becomes the first company to hold over 500,000 Bitcoin on its balance sheet. Over the last 64 days, Saylor has purchased approximately 80,000 Bitcoin.

➡️River: '2-3% inflation per year sounds harmless... until you zoom out. Every line on this chart is a reason Bitcoin exists.'

➡️State Street Corporation has bought 1.13 million Strategy₿ $MSTR stocks for 344.78 million dollars at an average price of $304.41 per share in Q1 2025. Their total holdings are 4.98 million shares worth over 1.84 billion dollars.

On the 27th of May:

➡️Cantor Fitzgerald officially launches $2 BILLION Bitcoin-backed lending with first loans, partnering with Anchorage Digital and Copper. - Bloomberg

➡️Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal. Trump Media is following the MSTR playbook. With that amount, you can now buy over 22,500 BTC. TMTG would then enter the list of largest corporate Bitcoin holders in fourth place.

Pledditor: "Trump just sabotaged Cynthia Lummis's BITCOIN ACT by doing this I see no future where Trump buys billions of dollars of bitcoin and then Congress codifies SBR into law. The corruption is just too brazen." Spot on! Considering the brazen corruption so far this actually makes it more likely.

➡️'Jack Dorsey’s Block to launch Bitcoin Lightning Payments on all Square terminals!' -Bitcoin Archive

Jack Dorsey’s Block is launching Bitcoin payments on Square at the Bitcoin Conference. Merchants can choose to hold the BTC or automatically convert it to fiat. The feature will expand to more sellers later this year.

➡️Sminston With: "But yes, I'm sure this cycle has peaked."

'Bitcoin cycles @ power law fit, a la 365-day SMA At ~$110,000/coin today, the 365-dSMA is only touching the trendline; History shows each cycle moving 2-3x higher than this. Have a nice day!'

➡️State Street Corporation has bought 1.13 million Strategy₿ $MSTR stocks for 344.78 million dollars at an average price of $304.41 per share in Q1 2025. Their total holdings are 4.98 million shares worth over 1.84 billion dollars.

On the 27th of May:

➡️Cantor Fitzgerald officially launches $2 BILLION Bitcoin-backed lending with first loans, partnering with Anchorage Digital and Copper. - Bloomberg

➡️Trump Media Announces Approximately $2.5 Billion Bitcoin Treasury Deal. Trump Media is following the MSTR playbook. With that amount, you can now buy over 22,500 BTC. TMTG would then enter the list of largest corporate Bitcoin holders in fourth place.

Pledditor: "Trump just sabotaged Cynthia Lummis's BITCOIN ACT by doing this I see no future where Trump buys billions of dollars of bitcoin and then Congress codifies SBR into law. The corruption is just too brazen." Spot on! Considering the brazen corruption so far this actually makes it more likely.

➡️'Jack Dorsey’s Block to launch Bitcoin Lightning Payments on all Square terminals!' -Bitcoin Archive

Jack Dorsey’s Block is launching Bitcoin payments on Square at the Bitcoin Conference. Merchants can choose to hold the BTC or automatically convert it to fiat. The feature will expand to more sellers later this year.

➡️Sminston With: "But yes, I'm sure this cycle has peaked."

'Bitcoin cycles @ power law fit, a la 365-day SMA At ~$110,000/coin today, the 365-dSMA is only touching the trendline; History shows each cycle moving 2-3x higher than this. Have a nice day!'

➡️Whales have shifted to net distribution with a score around 0.3, reversing their earlier accumulation pattern during this year's price rallies, according to data from Glassnode.

➡️Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments '#Bitcoin is faster than credit cards'

➡️BlackRock increases Bitcoin exposure for their own funds. The Strategic Income Opportunities Portfolio now holds 2,123,592 shares of IBIT as of March 31 (worth $99.4M) up from 1,691,143 shares on December 31.

➡️Interesting, so Michael Saylor is refusing to publish on-chain proof of Bitcoin reserves...

If Metaplanet and El Salvador can do proof of reserves, why not Strategy? At the end of the day, it's investors' money that is being used to buy Bitcoin. What am I missing?

Arkham: 'SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES ... SO WE DID We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to identify these holdings publicly. This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody).'

➡️Whales have shifted to net distribution with a score around 0.3, reversing their earlier accumulation pattern during this year's price rallies, according to data from Glassnode.

➡️Fast food giant Steak 'n Shake announced they're saving 50% in processing fees accepting Bitcoin payments '#Bitcoin is faster than credit cards'

➡️BlackRock increases Bitcoin exposure for their own funds. The Strategic Income Opportunities Portfolio now holds 2,123,592 shares of IBIT as of March 31 (worth $99.4M) up from 1,691,143 shares on December 31.

➡️Interesting, so Michael Saylor is refusing to publish on-chain proof of Bitcoin reserves...

If Metaplanet and El Salvador can do proof of reserves, why not Strategy? At the end of the day, it's investors' money that is being used to buy Bitcoin. What am I missing?

Arkham: 'SAYLOR SAID HE WOULD NEVER REVEAL HIS ADDRESSES ... SO WE DID We have identified an additional 70,816 BTC belonging to Strategy, bringing our total identified MSTR BTC holdings to $54.5 Billion. We are the first to identify these holdings publicly. This represents 87.5% of total MSTR holdings (including assets in Fidelity Digital’s omnibus custody).'

➡️Ryan Gentry: 'The biggest news at @TheBitcoinConf just dropped. @milessuter shared that the c= routing node is earning 9.7% APR on its bitcoin liquidity (which I’d estimate at ~$10M, 50% of its 184 BTC of public capacity). True non-custodial yield based on the utility of bitcoin payments.'

Great response on the matter by Sam Callahan: "Imagine a treasury company with 1,000 BTC earning ~10% annual yield. Sovereign, Bitcoin-native yield without counterparty risk that’s tied to the economic activity of Lightning instead of interest rate policy. At $1M per BTC, that’s $100M in annual recurring revenue."

9.7% REAL yield on a payment network while holding the keys to their BTC the entire time!! Madness! The constant claims that no one uses lightning are ridiculous.

On the 29th of May:

➡️ Investors are selling gold for Bitcoin - Bloomberg Gold ETF outflows: -$2.8 billion Bitcoin ETF inflows: +$9 billion.

➡️'Spanish banking giant Banco Santander looking to make Bitcoin and stablecoins available to retail clients. Santander has 175 million customers worldwide and is the BIGGEST lender in the Eurozone.' - Bitcoin Archive

➡️The U.S. Department of Labor rescinded 2022 guidance discouraging 401(k) plans from including Bitcoin and cryptocurrency, allowing retirement plans to potentially include Bitcoin and other digital assets. If just 1% of the $8 trillion in 401k funds flows into Bitcoin, that’s $80 billion of new demand, and 2x more than what’s flowed into Bitcoin ETFs.

➡️ Blockstream launches the Blockstream App, enabling users to buy Bitcoin directly and store it in a self-custodial wallet, eliminating the need for third-party custodians.

➡️$550 billion DBS bank says Bitcoin mining could help stabilize the grid and reduce emissions.

➡️Tether reveals that it owns over 100,000 Bitcoin & +50 tons of gold.

➡️Paris Saint Germain adopts Bitcoin as a Treasury Reserve asset.

➡️'The supply of BTC held by long-term holders has now increased by OVER 1.4 MILLION in under 3 months! The market's most experienced participants are refusing to sell Bitcoin at these prices, and soon there won't be enough $BTC left for those late to the party...' - Bitcoin Magazine Pro

On the 30th of May:

➡️Joe Consorti:

It was foretold. Should Bitcoin follow global M2 all the way down on this correction, we may see $97,500. May not happen, may see lower, nobody knows. The only certainty is that the global aggregate of fiat denominated in USD will rise, and so too will BTC follow it in time.

➡️Ryan Gentry: 'The biggest news at @TheBitcoinConf just dropped. @milessuter shared that the c= routing node is earning 9.7% APR on its bitcoin liquidity (which I’d estimate at ~$10M, 50% of its 184 BTC of public capacity). True non-custodial yield based on the utility of bitcoin payments.'

Great response on the matter by Sam Callahan: "Imagine a treasury company with 1,000 BTC earning ~10% annual yield. Sovereign, Bitcoin-native yield without counterparty risk that’s tied to the economic activity of Lightning instead of interest rate policy. At $1M per BTC, that’s $100M in annual recurring revenue."

9.7% REAL yield on a payment network while holding the keys to their BTC the entire time!! Madness! The constant claims that no one uses lightning are ridiculous.

On the 29th of May:

➡️ Investors are selling gold for Bitcoin - Bloomberg Gold ETF outflows: -$2.8 billion Bitcoin ETF inflows: +$9 billion.

➡️'Spanish banking giant Banco Santander looking to make Bitcoin and stablecoins available to retail clients. Santander has 175 million customers worldwide and is the BIGGEST lender in the Eurozone.' - Bitcoin Archive

➡️The U.S. Department of Labor rescinded 2022 guidance discouraging 401(k) plans from including Bitcoin and cryptocurrency, allowing retirement plans to potentially include Bitcoin and other digital assets. If just 1% of the $8 trillion in 401k funds flows into Bitcoin, that’s $80 billion of new demand, and 2x more than what’s flowed into Bitcoin ETFs.

➡️ Blockstream launches the Blockstream App, enabling users to buy Bitcoin directly and store it in a self-custodial wallet, eliminating the need for third-party custodians.

➡️$550 billion DBS bank says Bitcoin mining could help stabilize the grid and reduce emissions.

➡️Tether reveals that it owns over 100,000 Bitcoin & +50 tons of gold.

➡️Paris Saint Germain adopts Bitcoin as a Treasury Reserve asset.

➡️'The supply of BTC held by long-term holders has now increased by OVER 1.4 MILLION in under 3 months! The market's most experienced participants are refusing to sell Bitcoin at these prices, and soon there won't be enough $BTC left for those late to the party...' - Bitcoin Magazine Pro

On the 30th of May:

➡️Joe Consorti:

It was foretold. Should Bitcoin follow global M2 all the way down on this correction, we may see $97,500. May not happen, may see lower, nobody knows. The only certainty is that the global aggregate of fiat denominated in USD will rise, and so too will BTC follow it in time.

➡️Buy Real Bitcoin, and NOT:

⇒ BTC Companies,

⇒ Wrapped BTC

⇒ BTC IOU's

⇒ ...

Bitcoin in self-custody is the only way you get all the benefits of BTC.

➡️Buy Real Bitcoin, and NOT:

⇒ BTC Companies,

⇒ Wrapped BTC

⇒ BTC IOU's

⇒ ...

Bitcoin in self-custody is the only way you get all the benefits of BTC.

And please, as Wicked described it perfectly: 'Don’t run a node for Bitcoin, run and use it for yourself. Your humble little node isn’t saving the network, but it can protect your privacy and verify that the coins you receive are legit…if you’re actually using it.'

On the 31st of May:

➡️The Texas legislature has passed the Strategic Bitcoin Reserve bill. It now goes to Governor Abbott who is expected to sign it into law. This is a historic moment for Bitcoin and Texas, one of the largest (8th largest) economies in the world.

➡️Bitcoin News: 'Norwegian digital asset firm K33 has raised 60 million SEK (about $5.6 million) to expand its Bitcoin treasury. The funds were secured from insiders and strategic investors, including Klein Group and Modiola AS. CEO Torbjørn Bull Jenssen said the move reflects K33’s belief in Bitcoin’s long-term role in global finance and strengthens the company’s balance sheet as it grows its presence as a leading crypto broker in Europe.'

➡️ IMF raises concern over Pakistan‘s Bitcoin mining power plans. They want everyone under their control. They can't do it with Bitcoin. They might be losing another 'customer'. The IMF sees all the debt slaves becoming financially sovereign and independent by embracing Bitcoin.

And please, as Wicked described it perfectly: 'Don’t run a node for Bitcoin, run and use it for yourself. Your humble little node isn’t saving the network, but it can protect your privacy and verify that the coins you receive are legit…if you’re actually using it.'

On the 31st of May:

➡️The Texas legislature has passed the Strategic Bitcoin Reserve bill. It now goes to Governor Abbott who is expected to sign it into law. This is a historic moment for Bitcoin and Texas, one of the largest (8th largest) economies in the world.

➡️Bitcoin News: 'Norwegian digital asset firm K33 has raised 60 million SEK (about $5.6 million) to expand its Bitcoin treasury. The funds were secured from insiders and strategic investors, including Klein Group and Modiola AS. CEO Torbjørn Bull Jenssen said the move reflects K33’s belief in Bitcoin’s long-term role in global finance and strengthens the company’s balance sheet as it grows its presence as a leading crypto broker in Europe.'

➡️ IMF raises concern over Pakistan‘s Bitcoin mining power plans. They want everyone under their control. They can't do it with Bitcoin. They might be losing another 'customer'. The IMF sees all the debt slaves becoming financially sovereign and independent by embracing Bitcoin.

I have rewritten Daniel Batten's quote/post on this matter:

**

'Why Pakistan’s Bitcoin Plans May Not Survive the IMF"

**

While I’m an optimist by nature—and I truly hope I’m wrong—I believe Pakistan will struggle to follow through on its Bitcoin and Bitcoin mining ambitions.

Short Answer: The IMF

Mid-Length Explanation:

Bitcoin poses a significant threat to the IMF’s influence—on at least five fronts.

Pakistan is heavily indebted to the IMF, and history shows a clear pattern: the IMF has already derailed or scaled back Bitcoin initiatives in all of the three countries that attempted adoption—El Salvador, Argentina, and the Central African Republic.

Pakistan will likely face similar pushback.

And given Pakistan’s economic vulnerabilities, it’s equally likely that the IMF will succeed.

What the IMF’s Next Steps Might Look Like

Manufacturing Doubt and Delay The IMF will likely begin by generating fear, uncertainty, and doubt (FUD) around the viability of Pakistan’s Bitcoin program. Expect references to:

“Energy shortages”

“High electricity costs”

“Unclear regulatory frameworks”

“Anti-money laundering (AML) concerns”

These will be framed as responsible concerns by a seasoned financial guardian. The IMF may also imply that Pakistan acted prematurely, noting the country did not consult the IMF before announcing its Bitcoin initiative—suggesting a lack of due diligence. However, these objections are highly debatable. Multiple peer-reviewed studies show that Bitcoin mining can improve grid stability and lower electricity costs. Moreover, examples like Bhutan and El Salvador demonstrate how Bitcoin can enhance economic sovereignty. But that’s precisely the issue: economic sovereignty reduces the IMF’s lending relevance, and that’s not in the IMF’s institutional interest.

Weaponizing Debt and Conditionality

Under its $7 billion Extended Fund Facility program, the IMF is likely to:

Demand FATF-compliant crypto regulation

Prohibit state-level Bitcoin accumulation

Tie loan disbursements to rollbacks on Bitcoin and mining-related policies

This approach exploits Pakistan’s financial dependence on IMF loans to meet external debt obligations and maintain its foreign exchange reserves.

Enforcing Compliance Through Vulnerability

Pakistan’s financial position leaves little room for defiance:

It faces $12.7 billion in debt repayments in FY 2025.

Without IMF support, reserves could fall below $4 billion, covering less than one month of imports—far below the threshold needed for macroeconomic stability.

A repeat of early 2023, when reserves fell to $2.92 billion, would likely trigger another balance-of-payments crisis.

This would pressure the Pakistani rupee, already having depreciated from PKR 100 to over 330 per USD since 2017, and could push the country closer to default. Given its past FATF grey-listing, Pakistan cannot afford another multilateral funding freeze.

So What Does This All Mean?

It means the gloves are off.

The IMF is no longer merely advising—it’s actively resisting. Bitcoin threatens its long-standing monopoly over financially vulnerable nations, and Pakistan is shaping up to be the fourth test case of this resistance. If the IMF pressures Pakistan into reversing course, it will mark a 4-for-4 track record in blocking Bitcoin adoption efforts by countries under its financial umbrella.

The Bigger Picture

This is how entrenched institutions behave when facing disruption. They won’t stand aside—they’ll use every tool available to defend the system they control.

If a nation wants to adopt Bitcoin, it must either:

Be financially independent, like Bhutan or even the United States, or

Secure alternative funding, so IMF leverage becomes ineffective.

Bitcoin isn’t just a financial network. It’s a threat to the debt-based global order—and that means those invested in the status quo will fight back.'

➡️'Recent analysis by market research firm Alphractal suggests that, based on its current Sharpe Ratio, a key measure of risk-adjusted returns, Bitcoin still has room to run. The metric, which compares excess returns to volatility, is trending upward but remains well below the historical levels that have marked past market tops in 2013, 2017, and 2021.' - Bitcoin News

I have rewritten Daniel Batten's quote/post on this matter:

**

'Why Pakistan’s Bitcoin Plans May Not Survive the IMF"

**

While I’m an optimist by nature—and I truly hope I’m wrong—I believe Pakistan will struggle to follow through on its Bitcoin and Bitcoin mining ambitions.

Short Answer: The IMF

Mid-Length Explanation:

Bitcoin poses a significant threat to the IMF’s influence—on at least five fronts.

Pakistan is heavily indebted to the IMF, and history shows a clear pattern: the IMF has already derailed or scaled back Bitcoin initiatives in all of the three countries that attempted adoption—El Salvador, Argentina, and the Central African Republic.

Pakistan will likely face similar pushback.

And given Pakistan’s economic vulnerabilities, it’s equally likely that the IMF will succeed.

What the IMF’s Next Steps Might Look Like

Manufacturing Doubt and Delay The IMF will likely begin by generating fear, uncertainty, and doubt (FUD) around the viability of Pakistan’s Bitcoin program. Expect references to:

“Energy shortages”

“High electricity costs”

“Unclear regulatory frameworks”

“Anti-money laundering (AML) concerns”

These will be framed as responsible concerns by a seasoned financial guardian. The IMF may also imply that Pakistan acted prematurely, noting the country did not consult the IMF before announcing its Bitcoin initiative—suggesting a lack of due diligence. However, these objections are highly debatable. Multiple peer-reviewed studies show that Bitcoin mining can improve grid stability and lower electricity costs. Moreover, examples like Bhutan and El Salvador demonstrate how Bitcoin can enhance economic sovereignty. But that’s precisely the issue: economic sovereignty reduces the IMF’s lending relevance, and that’s not in the IMF’s institutional interest.

Weaponizing Debt and Conditionality

Under its $7 billion Extended Fund Facility program, the IMF is likely to:

Demand FATF-compliant crypto regulation

Prohibit state-level Bitcoin accumulation

Tie loan disbursements to rollbacks on Bitcoin and mining-related policies

This approach exploits Pakistan’s financial dependence on IMF loans to meet external debt obligations and maintain its foreign exchange reserves.

Enforcing Compliance Through Vulnerability

Pakistan’s financial position leaves little room for defiance:

It faces $12.7 billion in debt repayments in FY 2025.

Without IMF support, reserves could fall below $4 billion, covering less than one month of imports—far below the threshold needed for macroeconomic stability.

A repeat of early 2023, when reserves fell to $2.92 billion, would likely trigger another balance-of-payments crisis.

This would pressure the Pakistani rupee, already having depreciated from PKR 100 to over 330 per USD since 2017, and could push the country closer to default. Given its past FATF grey-listing, Pakistan cannot afford another multilateral funding freeze.

So What Does This All Mean?

It means the gloves are off.

The IMF is no longer merely advising—it’s actively resisting. Bitcoin threatens its long-standing monopoly over financially vulnerable nations, and Pakistan is shaping up to be the fourth test case of this resistance. If the IMF pressures Pakistan into reversing course, it will mark a 4-for-4 track record in blocking Bitcoin adoption efforts by countries under its financial umbrella.

The Bigger Picture

This is how entrenched institutions behave when facing disruption. They won’t stand aside—they’ll use every tool available to defend the system they control.

If a nation wants to adopt Bitcoin, it must either:

Be financially independent, like Bhutan or even the United States, or

Secure alternative funding, so IMF leverage becomes ineffective.

Bitcoin isn’t just a financial network. It’s a threat to the debt-based global order—and that means those invested in the status quo will fight back.'

➡️'Recent analysis by market research firm Alphractal suggests that, based on its current Sharpe Ratio, a key measure of risk-adjusted returns, Bitcoin still has room to run. The metric, which compares excess returns to volatility, is trending upward but remains well below the historical levels that have marked past market tops in 2013, 2017, and 2021.' - Bitcoin News

➡️Publicly-listed Brazilian fintech Méliuz to raise $78m to buy more Bitcoin, after buying $26.5m Bitcoin yesterday.

On the 1st of June:

➡️Bitcoin made its Highest Monthly Close ever last night!

➡️ Someone just donated 300 Bitcoin worth +$30m to Ross Ulbricht, founder of SilkRoad.

➡️Publicly-listed Brazilian fintech Méliuz to raise $78m to buy more Bitcoin, after buying $26.5m Bitcoin yesterday.

On the 1st of June:

➡️Bitcoin made its Highest Monthly Close ever last night!

➡️ Someone just donated 300 Bitcoin worth +$30m to Ross Ulbricht, founder of SilkRoad.

Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s.

➡️Top Bitcoin holders:

Satoshi Nakamoto: 1.1M BTC ($114B)

Coinbase: 983K BTC ($103B)

Binance: 619K BTC ($65B)

BlackRock: 600K BTC ($63B)

Strategy: 580K BTC ($47B)

Fidelity: 346K BTC ($36B)

Grayscale: 218K BTC ($23B)

U.S. Government: 196K BTC ($20B)

On the 2nd of June:

➡️IG Group becomes the first UK-listed firm to offer Bitcoin trading to retail investors - Financial Times “Customer demand [for bitcoin] is reaching a tipping point,” says MD Michael Healy

➡️Tether moved 14,000 Bitcoin worth +$1.4 BILLION to Twenty-One Capital (XXI) as part of its investment.

➡️Hong Kong-based Reitar Logtech announces they will buy $1.5 billion Bitcoin for their reserves — SEC filing The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Russia's largest bank Sberbank launches structured bonds tied to Bitcoin. Source

"No power on earth can stop an idea whose time has come"

Bitcoin's global hashrate has reached a new all-time high, with data from Hashrate Index showing a 7-day simple moving average peak of 943 EH/s.

➡️Top Bitcoin holders:

Satoshi Nakamoto: 1.1M BTC ($114B)

Coinbase: 983K BTC ($103B)

Binance: 619K BTC ($65B)

BlackRock: 600K BTC ($63B)

Strategy: 580K BTC ($47B)

Fidelity: 346K BTC ($36B)

Grayscale: 218K BTC ($23B)

U.S. Government: 196K BTC ($20B)

On the 2nd of June:

➡️IG Group becomes the first UK-listed firm to offer Bitcoin trading to retail investors - Financial Times “Customer demand [for bitcoin] is reaching a tipping point,” says MD Michael Healy

➡️Tether moved 14,000 Bitcoin worth +$1.4 BILLION to Twenty-One Capital (XXI) as part of its investment.

➡️Hong Kong-based Reitar Logtech announces they will buy $1.5 billion Bitcoin for their reserves — SEC filing The logistics and real estate company says the move strengthens its financial foundation as it scales its global tech platform.

➡️Russia's largest bank Sberbank launches structured bonds tied to Bitcoin. Source

"No power on earth can stop an idea whose time has come"

➡️Australian Bitcoin ETFs took in 60x more funds thant Gold ETFs in May - AFR Bitcoin = $87.3m Gold = $1.5m

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

The debt is compounding. The interest expense is rising. The trust funds are running dry. And the political will to do anything about it doesn’t exist.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

Highly recommend watching this one all the way through."

➡️Australian Bitcoin ETFs took in 60x more funds thant Gold ETFs in May - AFR Bitcoin = $87.3m Gold = $1.5m

🎁If you have made it this far, I would like to give you a little gift:

Lysander: "Lyn Alden gave one of the clearest breakdowns of why the U.S. is on an unstoppable fiscal path—and why Bitcoin matters more than ever because of it.

Lyn Alden walks through the numbers behind the federal deficit, interest expenses, Social Security, and the structural changes that happened post-2008. The short version? We’re in a new era. One where the government can’t slow down even if it wants to.

The debt is compounding. The interest expense is rising. The trust funds are running dry. And the political will to do anything about it doesn’t exist.

Her phrase: “Nothing stops this train.” Not because of ideology, but because of math—and human nature.

This isn’t hyperinflation doom-talk. It’s a sober look at what happens when a system built on ever-growing debt reaches its limits—and why Bitcoin, with its fixed supply and transparent rules, is the opposite of that system.

Highly recommend watching this one all the way through."

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 26.05.2025

🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner.

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 26.05.2025

🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner. On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️

On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️ Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read:

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read:

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind):

Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users.

In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate.

By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days.

Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible. (foto)

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind):

Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users.

In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate.

By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days.

Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible. (foto)

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms.

Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms. ➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER'

➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER' Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿'

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿' ➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B.

➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B. ➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999.

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999. Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.'

Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.' On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan

On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan  On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift: