On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 26.05.2025

🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner.

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 26.05.2025

🧠Quote(s) of the week:

Fred Krueger: 'Generally, people overanalyze too much. Bitcoin is amazing tech. It works. It has been the top-performing asset in 13 of the last 15 years. Stop with the analysis. Buy it. Don't trade it. Don't look for "entry points". And don't do a 1% allocation either. Grow a pair.'

🧡Bitcoin news🧡

Money. Time. Energy. You only get to pick two… Unless you’re a Bitcoiner. On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️

On the 19th of May.

➡️ El Salvador is $357 million in profit on Bitcoin holdings.

➡️Metaplanet ended Monday as Japan's 9th most traded stock, with ¥61.69B ( $425M) daily volume, surpassing Toyota, SoftBank, and Nintendo.

➡️Circle $USDC in "informal talks" to sell itself to Coinbase or Ripple, Fortune reports. WhalePanda: "Imagine running a $60 billion stablecoin in such an incompetent way you can't even turn a decent profit and desperately have to sell."

➡️Panama introduces a bill to allow citizens to buy, sell, and accept Bitcoin freely anywhere in the country.

On the 20th of May:

➡️ Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

Tick Tock next block, but it seems like we are right on schedule. Bitcoin is doing exactly what it was designed to do.

➡️BTC just hit a new ATH in Argentina Weak currencies first. Then all of them.

➡️ThumzUp Media officially files to raise $500m to buy Bitcoin as a treasury reserve asset.

➡️Indonesian fintech DigiAsia's stock surges over 90% after announcing plans to raise $100M for a Bitcoin treasury.

➡️River: America’s story began with sound money. Hard-working Americans saved their wealth in gold-backed money. Today, Bitcoin carries that torch forward.

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read:

Insane stat! Bitcoin is now the people's money. Imagine the price when nation-states get on board.

The US government is outpacing global rivals like China by embracing Bitcoin. The federal government's Bitcoin holdings now represent twice its global market share of gold reserves.

Worth the read:

River Intelligence

The American Bitcoin Advantage - River Intelligence

The United States is the global Bitcoin superpower. River's new report breaks down how this advantage can fuel the next era of American prospe...

X (formerly Twitter)

MistTrack🕵️ (@MistTrack_io) on X

🚨 The official driver provided by this printer carries a backdoor program. It will hijack the wallet address in the user's clipboard and replace...

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind):

Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users.

In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate.

By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days.

Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible. (foto)

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

On the 22nd of May:

Happy Pizza Day! 15 years ago today Laszlo Hanyecz bought 2 pizzas for 10,000 Bitcoin. That Bitcoin is now worth $1.2 BILLION.

Will Baxter: "But how did he get that much bitcoin? Well, there’s a lot more to Laszlo's story than those pizzas. Here are four facts about him most people don’t know (the last one blew my mind):

Laszlo, a Mac developer, discovered bitcoin in 2010. After realizing that Bitcoin only ran on Windows, he took it upon himself to port it to Mac OS. He built and released the first bitcoin client for Mac making it accessible to more users.

In its earliest days, bitcoin could be mined with just a CPU, something that every computer has. But Laszlo had other plans. In mid-2010, he released a solution that would allow users to mine with their GPUs. Laszlo is single-handedly responsible for ushering in the era of GPU mining which massively increased Bitcoin’s total hashrate.

By being one of the early adopters of GPU mining, Laszlo enjoyed a massive jump in mining efficiency and hashrate, which meant that he was able to mine a lot of blocks. In total, Laszlo’s Bitcoin wallets received more than 80,000 BTC over the first few months of the GPU mining era. It’s estimated that Laszlo mined well over 100,000 BTC in Bitcoin’s early days.

Laszlo has single-handedly mined more Bitcoin than any publicly listed Bitcoin mining company. As an example, MARA, the largest publicly traded Bitcoin miner by market capitalization, has mined an estimated 48,000 BTC since 2018. Laszlo and his GPUs managed to mine more than twice that amount! Incredible. (foto)

➡️Pizza slice inscribed on the Bitcoin blockchain forever! Block #897813

➡️Strategy: 'Bitcoin Pizza Day at Strategy. Paid for with USD.'

Kinda disgusting. The largest Bitcoin Treasury Company is not even able to pay for pizza in Bitcoin on Bitcoin Pizza Day? Why did they even bother to buy pizza today? They show zero understanding of the meaning of Pizza Day and Bitcoin history.

Plebs all around the world are celebrating Pizza Day by "spend and replace" Bitcoin for some lovely pizzas. What is Saylor doing? He decides to use his giant megaphone to stomp all over it. "Pay with Dollars. Eat the Pizza. Keep the Bitcoin." That post rubbed me the wrong way. That’s because they are not bullish on the payment use case of Bitcoin. I have been saying all the time: that he has an agenda against the medium of exchange. This is plausible as Saylor never minced words as far as I know. His model is HODL. Spending would contradict.

Not sure if I am overreacting because of store of value for several more years will eventually lead to a Medium of Exchange Bitcoin world.

As you might already know I am not particularly a fan of the whole Bitcoin treasury - public companies.

Read the following thread why, an excellent thread on the risks of Bitcoin treasury companies by a bitcoiner.

X (formerly Twitter)

lowstrife (@lowstrife) on X

Bitcoin treasury companies are all the rage this week. MSTR, Metaplanet, Twenty One, Nakamoto.

I think they're toxic leverage and the worst thing ...

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen

➡️Michael Saylor's 'Strategy' now has a $23.8 billion unrealized profit on its Bitcoin portfolio. Meanwhile, Strategy is to sell up to $2.1 billion of 10% preferred stock.

➡️'Traditional finance consensus: "What's the use case for BTC?" Allowing Millennials to afford a home despite Boomer policymakers actively pursuing policies to prevent them from doing so Median US home price, price in BTC, 2020-today IMO, this chart is going <1 in coming yrs.' - Luke Gromen Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms.

Just to give you one more perspective on this topic:

➡️Joe Consorti: US real estate has been in a 15-year bull market. But guess what? Priced in bitcoin, the average US home price has dropped from ~3 million BTC to just 4.38 BTC in 15 years. All assets are deflationary in Bitcoin terms. ➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER'

➡️Taiwanese Legislator has proposed a Bitcoin Strategic Reserve at 0.1% of GDP = $780m

➡️Chinese automaker Jiuzi Holdings to buy 1,000 Bitcoin for treasury.

➡️ 'Singapore's Genius Group buys another 24.5 Bitcoin. Now holds 85.5 Bitcoin, 1,000 BTC target confirmed.' - Bitcoin Archive

➡️Standard Chartered expects Bitcoin to hit: - Q2: $120,000 by the end of Q2 - Q4: $200,000 by late 2025 - 2028: $500,000

➡️On-Chain college: 'New ATH for Bitcoin yet realized profit is significantly lower than the last two local tops and prior cycle tops. HIGHER' Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

Not sure about that. Could be a double top.

On the 23rd of May:

➡️The Blockchain Group confirms the acquisition of 227 BTC for ~€21.2 million, the holding of a total of 847 BTC, and a ‘BTC Yield’ of 861.0% YTD Press release.

➡️The 8th largest economy in the world will start to buy Bitcoin. No one is bullish enough! Governor Abbot to sign Bitcoin Reserve bill into law! Texas to become the 3rd US state to enact an SBR!

➡️Publicly traded The Smarter Web Company bought 23.09 Bitcoin for £1.85 million for its treasury.

➡️For the love of god. Delate Coinbase or any other shitcoin casino/exchange (for example here in the Netherlands Bitvavo) and cold-Storage your Bitcoin and don’t touch them.

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿'

Not your keys, not your coins.

➡️'The Russian Bitcoin mining sector now ranks first in growth rates and second in mining volume globally. The country's largest Bitcoin miners, BitRiver and Intelion, controlling over 50% of the market, generated $200M in revenue for FY2024, per RBC.' -Bitcoin News

➡️Alex Gladstein: 'Absolutely crazy Hundreds of millions of people saw their wage and savings technology lose 15%, 30%, 50%, 75%, even 90% (!) of its value last year Fiat is broken, time for a Plan ₿' ➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B.

➡️Bitwise predicts nation-states and institutions will hold 4,269,000 BTC—worth $426.9B. ➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

➡️'Metaplanet is now the #4 most traded stock in Japan, moving nearly $1B in a day—just a year after adopting #Bitcoin. From obscurity to 300x returns, this is what happens when a company runs on hard money.' -Bitcoin for Corporation

➡️TFTC: "Scammers are mailing fake "Ledger Security" letters demanding wallet validation via QR code. They spoof official branding and ask users to visit fraudulent sites."

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999.

On the 24th of May:

➡️Bitcoin has the same number of users as the Internet had in 1999. Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.'

Now talking about that Bitcoin Adoption S-curve...

➡️Thomas Fahrer: 'Holding Bitcoin means getting rich while feeling frustrated 90% of the time. Deflationary money - designed to increase in value - forever. It's difficult for the human mind to comprehend. Most still don't get it.' On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan @Sam

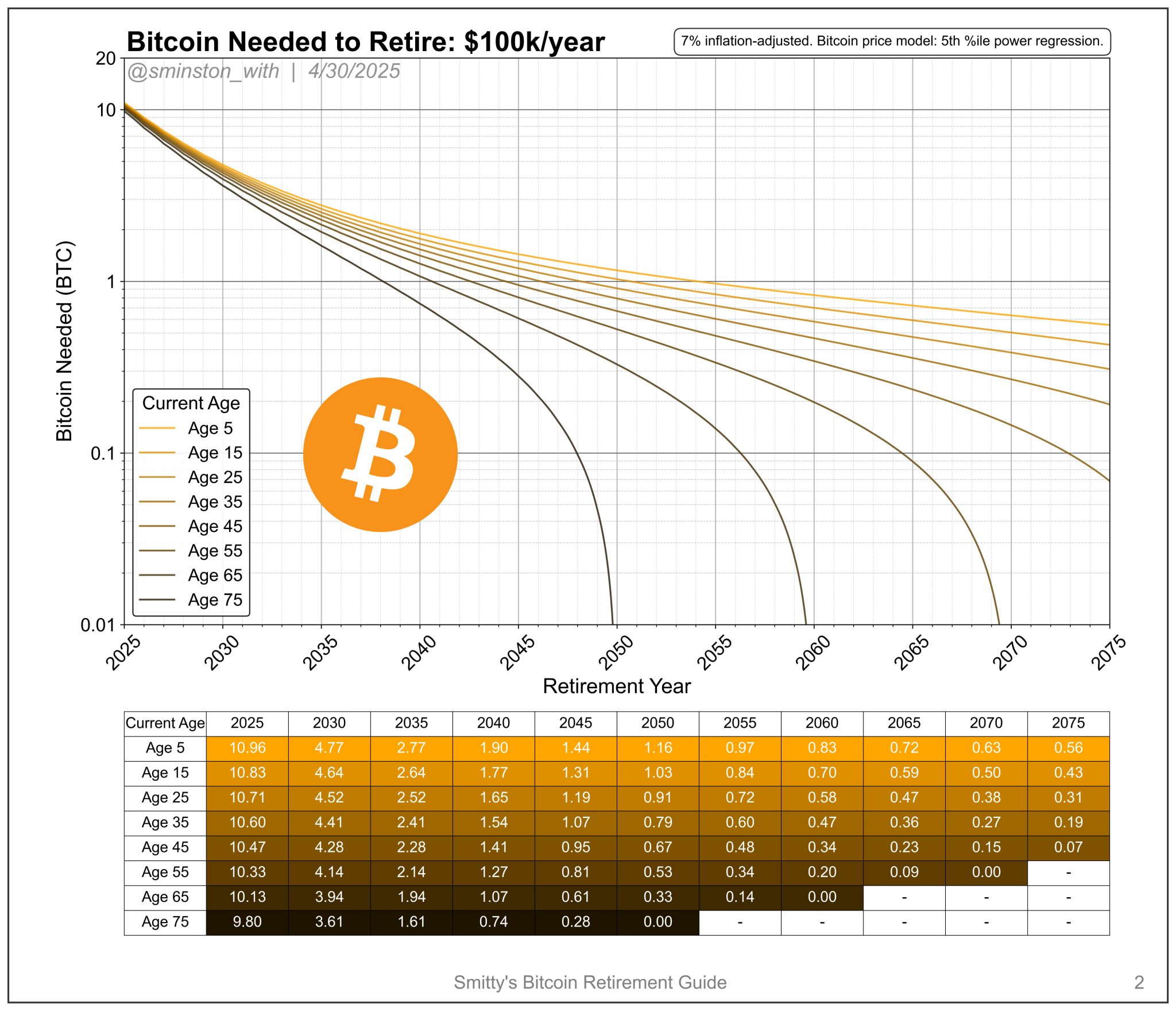

➡️Sminston With: 'There is a myth that 100% of the returns in Bitcoin only happen if you buy at the bottoms and then sell at the tops during one of the cycles. Power law quantile analysis shows otherwise; in fact, there are nearly identical growth rates (CAGR) whether you buy/sell at the bottoms (support) or around the middle (median) 52% vs 53% as of this year! Whichever trendline is followed, even if you only trade at the bottoms, the compounded annual returns of Bitcoin will be >7x of what you'd ever expect from the S&P. Ignore or try to time Bitcoin at your own risk!'

On the 25th of May:

➡️Pakistan allocates 2,000mw of electricity to Bitcoin mining and Ai - Bloomberg Daniel Batten: Pakistan announced 2000 MW for Bitcoin mining & AI. That's potentially ~17,000 BTC per year for an SBR. Plus, India will now have to follow. Game theory playing out. *Assuming that 50% of this is for Bitcoin mining, using latest-gen machines, 95% uptime, network hashrate is on average 1200 EH/s by the time they are complete

➡️Normally, I would write this in the segment below 🌎Macro/Geopolitics... "First signpost: DOGE failed to reduce the deficit.

Second signpost: Pushing for SLR changes to boost demand for Treasuries from domestic banks.

Third signpost: Pushing for legislation to boost demand for Treasuries from stablecoin issuers.

Fourth signpost: New spending bill estimated to increase deficit by 33% by 2027.

Fifth signpost: Bessent: "We'll grow GDP faster than the debt to stabilize debt-to-GDP."

Read below (segment 🌎Macro/Geopolitics) his full statement and my view on it.

TL;DR: Keep spending. Pass new laws and tweak regs to suppress long-end yields. Boost nominal GDP (mostly via inflation). Debase the currency. Bondholders and cash savers lose in real terms. Got Bitcoin?" -Sam Callahan @Sam

➡️Sminston With: 'There is a myth that 100% of the returns in Bitcoin only happen if you buy at the bottoms and then sell at the tops during one of the cycles. Power law quantile analysis shows otherwise; in fact, there are nearly identical growth rates (CAGR) whether you buy/sell at the bottoms (support) or around the middle (median) 52% vs 53% as of this year! Whichever trendline is followed, even if you only trade at the bottoms, the compounded annual returns of Bitcoin will be >7x of what you'd ever expect from the S&P. Ignore or try to time Bitcoin at your own risk!' On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

@Lyn Alden May 2025 Newsletter: A Trade Breakdown

This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the global balance of trade is both popular and extremely difficult to do.

On the 26th of May:

➡️Bitcoin made another weekly record close at $109,004.

➡️When BlackRock holds 1M Bitcoin and the price hits $1M... They’ll be earning $2.5B a year in fees. Every year. Forever.

➡️Florida proposes eliminating Capital Gains Tax on Bitcoin. If passed, it would make Florida the first U.S. state to offer this kind of tax relief.

➡️Strategy acquires 4,020 BTC for $427.1 million at $106,237 per Bitcoin. They now HODL 580,250 BTC acquired for $40.61 billion at $69,979 per Bitcoin.

🎁If you have made it this far, I would like to give you a little gift:

@Lyn Alden May 2025 Newsletter: A Trade Breakdown

This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the global balance of trade is both popular and extremely difficult to do.

Lyn Alden

May 2025 Newsletter: A Trade Breakdown

May 4, 2025 This newsletter issue breaks down the recent trade breakdown (sorry for the pun) and explores some of the nuances of why realigning the...

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 19.05.2025

🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.'

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 19.05.2025

🧠Quote(s) of the week:

'The Cantillon Effect: When new money is printed, those closest to the source (banks, elites) benefit first, buying assets before prices rise. Others lose purchasing power as inflation hits later. If people find out how this works, they will riot.' -Bitcoin for Freedom

Just think about it. Your employer gives you a 5% raise. The Fed (central banks in general) prints 7% more dollars/euros/Fiat. You just got a 2% pay cut. This isn't a conspiracy theory. This is how fiat money steals from the working class every single day. This is why I support Bitcoin.

Anilsaidso: 'Saving in fiat currency is no longer an option. A 2% inflation rate means you lose 1/3 of your purchasing power over 20yrs. At 5% inflation, you lose 60%. And at 10% you've burnt 85%. Reduce your uncertainty. Save in Bitcoin.' 🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

🧡Bitcoin news🧡

“Education increases conviction.

Conviction increases allocation.

Allocation increases freedom.” —Gigi

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

On the 12th of May:

➡️Google searches for "Digital Gold" are at all-time highs. Bitcoin Croesus: "This is the second wave of the Digital Revolution - the digitization of value to complement the Internet's digitization of information. It wasn't possible to own a slice of the Internet itself, but it is possible with Bitcoin, the internet of value." "...It feels like you're late to Bitcoin. But this is a bigger game playing out than most realize, and we are much earlier than casual observers know. If you're reading this, you're here on the frontier early. And you have a chance to stake a claim before 99% of the world shows up. This is a land grab. This is the digital gold rush. Make your descendants proud."

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025.

➡️ 'A new holding company ‘Nakamoto’ just raised $710 million to buy more Bitcoin and will merge with KindlyMD to establish a Bitcoin Treasury company. Saylor playbook!' - Bitcoin Archive

➡️American Bitcoin, backed by Donald Trump Jr. and Eric Trump, will go public via an all-stock merger with Gryphon Digital Mining. Post-merger, Trump affiliates and Hut 8 will retain 98% ownership. GRYP tripled to $2.19, Hut 8 jumped 11% to $15.45. The deal closes in Q3 2025.

➡️Phoenix Wallet: 'Phoenix 0.6.0 is out: offers can now have a custom description simple close (set an exact mutual close tx fee rate) native support for Linux arm64 This is the server version. Phoenix mobile release is around the corner. '

On the 13th of May:

➡️Corporate Bitcoin purchases have now outweighed the supply of new Bitcoin by 3.3x in 2025. ➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack.

➡️ Publicly listed Next Technology disclosed buying 5,000 Bitcoin for $180m, now HODLs 5,833 $BTC worth +$600m.

➡️ After rejecting the Arizona Strategic Bitcoin Reserve Act, Governor Katie Hobbs vetoed Bill SB 1373, which proposed a digital asset reserve fund. "Current volatility in the cryptocurrency markets does not make a prudent fit for general fund dollars."

➡️Meanwhile in Paris, France the kidnapping of a woman with her 2-year-old child morning on the streets of Paris - the target is allegedly the daughter of a crypto CEO. 3 masked men tried forcing them into a fake delivery van, before being fought off by her partner and bystanders. One of whom grabbed a dropped gun and aimed it back.

➡️ 'Bitcoin illiquid supply hit a new all-time high of $1.4B Are you HODLing too, anon?' - Bitcoin News

➡️Why Coinbase entering the S&P 500 matters. Boomers will have Bitcoin / CrApTo exposure, whether they like it or not. Anyway, remember what happened in 2021. The COIN IPO, and they’re still trading about 35% below their IPO-day high. Oh and please read the 'Coinbase" hack below haha.

➡️ Nasdaq listed GD Culture Group to sell up to $300 million shares to buy Bitcoin.

➡️ A Bitcoin wallet untouched since April 2014 just moved 300 BTC worth $31M for the first time in 11 years. This is how you HODL.

➡️ Bitcoin's realized price is steadily increasing, mirroring behaviors seen in past bull markets, according to CryptoQuant.

➡️ Bitcoin whales and sharks (10-10K BTC) accumulated 83,105 BTC in the last 30 days, while small retail holders (<0.1 BTC) sold 387 BTC, according to Santiment.

Bitcoin Whales have been AGGRESSIVELY accumulating BTC recently! With at least 240,000+ Bitcoin transferred to wallets with at least 100 BTC. The largest market participants are trying to buy as much as possible, what do they think comes next...

➡️'The average cost of mining 1 BTC for miners is currently $36.8K. The spread between the current market price and the cost of one coin = 182%. This is essentially the average profitability. This corresponds to the beginning of the bull cycle in November 2022 and the peaks of this cycle >$100K. A price increase above this level will allow miners to fully recover after the last halving and reach excess profits comparable to the beginning of the bull rally in January 2023.' -Axel Adler Jr.

➡️ Remember last week's segment on Coinbase..."Coinbase just disclosed in their Q1 filing: that they have custody of 2.68 million Bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update."

Well, here you go.

Coinbase estimates $180-$400 million in losses, remediation costs, and reimbursement following today’s cyber attack. Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

Coinbase didn't get hacked. Coinbase employees sold customer data on the black market. Coinbase failed to protect customer data. This is why KYC is useless. The criminals have our driver's license scans. They have AI tools that can generate fake images and videos. KYC puts our identities at risk, makes onboarding more difficult, and rewards criminals. To make it even worse. Coinbase knew about the hack as early as January but only disclosed it publicly after being added to the S&P 500.

I will say it one more time! Don't buy your Bitcoin on KYC exchanges. KYC means handing over your identity to be leaked, sold, or extorted.

It was 2 days ago, see the bit on the 13th of May, that we saw a violent attack in Paris. Minimize the data you share with centralized tools. Store as much as you can locally. Always ask yourself what data am I giving and to whom? Remove the need for trust.

And for the love of God, Allah, or whatever god you are praying to...

DON'T LEAVE YOUR COINS ON A FREAKING EXCHANGE!!!!

Clear!

➡️ Sam Callahan: Bitcoin CAGRs over rolling four-year holding periods since 2012:

10th percentile: 33%

25th percentile: 50% 40th percentile: 75%

Said differently, for 90% of the time, Bitcoin’s four-year CAGR was higher than 33%. For comparison, here are the single best four-year CAGRs over the same period for:

Gold: 17%

Silver: 20%

S&P 500: 24%

Apple: 52%

Two lessons here:

1.) Even when Bitcoin underperforms, it still outperforms.

2.) Bitcoin holding goals are best measured in halving cycles.'

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people."

➡️ Deutsche Bank Aktiengesellschaft has bought 96,870 Strategy₿ stocks for 30 Million dollars at an Average Price Of $310 Per Share In Q1 2025, Their Total Holdings Is 518,000 Shares Worth Over 214 Million Dollars.

➡️Senator Lummis urges the U.S. Treasury to eliminate taxes on unrealized gains for Bitcoin.

On the 14th of May:

➡️At $168,000, Bitcoin will surpass Microsoft, the world's largest company.

➡️Fidelity tells institutions to buy Bitcoin if they can’t match Bitcoin’s 65% return on capital.

➡️Michigan has adopted House Resolution 100, declaring May 13 2025 as "Digital Asset Awareness Day." The resolution encourages "activities and programs that foster a deeper understanding of digital assets and their impact on our society and economy."

➡️Publicly traded Vinanz raises funding to buy $2 million in #Bitcoin assets.

➡️Bitcoin News: "Investor Jim Chanos is shorting MicroStrategy while going long on Bitcoin, calling the stock overvalued relative to its BTC holdings. “We’re selling MicroStrategy and buying Bitcoin, basically buying something for $1 and selling it for $2.50," he told CNBC

On the 15th of May:

➡️The Abu Dhabi sovereign wealth fund disclosed owning $511 million in Bitcoin through BlackRock’s ETF.

➡️UK public company Coinsilium Group raises £1.25 million to adopt a Bitcoin treasury strategy.

➡️Chinese Textile company Addentax issues stock to buy 8,000 Bitcoin.

➡️14 US states have reported $632m in $MSTR exposure for Q1, in public retirement and treasury funds. A collective increase of $302m in one quarter. The average increase in holding size was 44%.

➡️Chinese public company DDC Enterprise to adopt a Bitcoin Reserve with 5,000 BTC.

On the 16th of May:

➡️Brazilian listed company Méliuz buys $28.4 million Bitcoin to become the nation's first Bitcoin Treasury Company. Shareholders voted to approve the strategy by an "overwhelming majority".

➡️13F Filings show Texas Retirement System owns MSTR. The day MSTR enters the S&P 500, every pension fund will follow.

➡️'Wealthy Investors Shift Up to 5% into Bitcoin as confidence in fiat falters. UBS, a Swiss banking giant says Bitcoin and digital assets are becoming key hedges against inflation and systemic risk, marking a dramatic shift in modern portfolio strategy.' -CarlBMenger

➡️River: "Above all, Bitcoin is money for the people." On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017)

On the 17th of May:

➡️Illicit activity is now down to 0.14% of transaction volume across all crypto.

Context: World Bank, IMF suggests 1.5–4% of global GDP is laundered yearly through traditional banking Of that 0.14%:

63% of illicit trade was stablecoins.

13% was Bitcoin (declining each year)

Source: The 2025 Crypto Crime Report, Chainalysis 2025

Yet another confirmation that Bitcoin's use in facilitating illicit activities is a rounding error on a rounding error.

On the 18th of May:

➡️JPMorgan CEO Jamie Dimon said they will allow clients to buy Bitcoin. The repeal of SAB 121 is a bigger deal than most realize. “I will fire any employee buying or trading Bitcoin for being stupid” - Jamie Dimon (2017) On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result

90% of climate-focused magazines

87.5% of media coverage on Bitcoin & the environment is now positive

source 7 independent reports

On the 19th of May.

➡️Bookmark the following stuff from Daniel Batten if you want to combat climate change (fanatics)...

'That Bitcoin mining is not only not harmful, but beneficial to the environment is now supported by:

7 independent reports

20 peer-reviewed papers

As a result

90% of climate-focused magazines

87.5% of media coverage on Bitcoin & the environment is now positive

source 7 independent reports

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

➡️Michael Saylor's STRATEGY bought another $764.9m Bitcoin. They now HODL 576,230 Bitcoin, acquired for $40.18 billion at $69,726 per Bitcoin.

➡️The German Government sold 49,858 BTC for $2.89B, at an average price of $57,900. If they had held it, their BTC would now be worth $5.24B.

➡️A record 63% of all the Bitcoin that exist have not transacted or moved from their wallets this year. - Wicked

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🎁If you have made it this far, I would like to give you a little gift, well, in this case, two gifts:

What Bitcoin Did - IS THE FED LOSING CONTROL? With Matthew Mezinskis

'Matthew Mezinskis is a macroeconomic researcher, host of the Crypto Voices podcast, and creator of Porkopolis Economics. In this episode, we discuss fractional reserve banking, why it's controversial among Bitcoiners, the historical precedent for banking practices, and whether fractional reserve banking inherently poses systemic risks. We also get into the dangers and instabilities introduced by central banking, why Bitcoin uniquely offers a pathway to financial sovereignty, the plumbing of the global financial system, breaking down money supply metrics, foreign holdings of US treasuries, and how all these elements indicate growing instability in the dollar system.'

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ On the 5th of May:

➡️US Senator David McCormick discloses +$ 1.0 m Bitcoin purchase on recent dip.

➡️Bitcoin Knots just overtook the latest version of Bitcoin Core on Clark Moody's dashboard

➡️'Merchants in the City of Cannes, France will start accepting Bitcoin and crypto this summer, with the council aiming for 90% adoption.' - Bitcoin Archive

➡️River: Cash is king. Of killing savings. Beat inflation with a small bitcoin allocation.

On the 5th of May:

➡️US Senator David McCormick discloses +$ 1.0 m Bitcoin purchase on recent dip.

➡️Bitcoin Knots just overtook the latest version of Bitcoin Core on Clark Moody's dashboard

➡️'Merchants in the City of Cannes, France will start accepting Bitcoin and crypto this summer, with the council aiming for 90% adoption.' - Bitcoin Archive

➡️River: Cash is king. Of killing savings. Beat inflation with a small bitcoin allocation. ➡️150,000 people tuned into MicroStrategy’s earnings call. Not because of profits, but because they’re watching the blueprint for a Bitcoin-based financial system unfold in real time.

Pledditor: 'The class of 2024/2025 is stacking MSTR more than they are stacking BTC, and that's not a great thing.' Keep in mind, they've never been shown proof that Strategy holds Bitcoin in a cold storage wallet address. I can't find the MicroStrategy wallets holding 555,450 BTC. Can you?

On the 6th of May:

➡️'Serious report by Morgan Stanley. (You can read it here)

-Bitcoin has sufficient market cap to be a reserve, but it is more volatile than other reserve currencies.

-Volatility is decreasing.

-$370b allocation to Bitcoin would reflect market cap proportions.

-A reserve of 12%-17% of the total bitcoin supply would mirror other currency proportions.

Overton window has shifted.' - Troy Cross

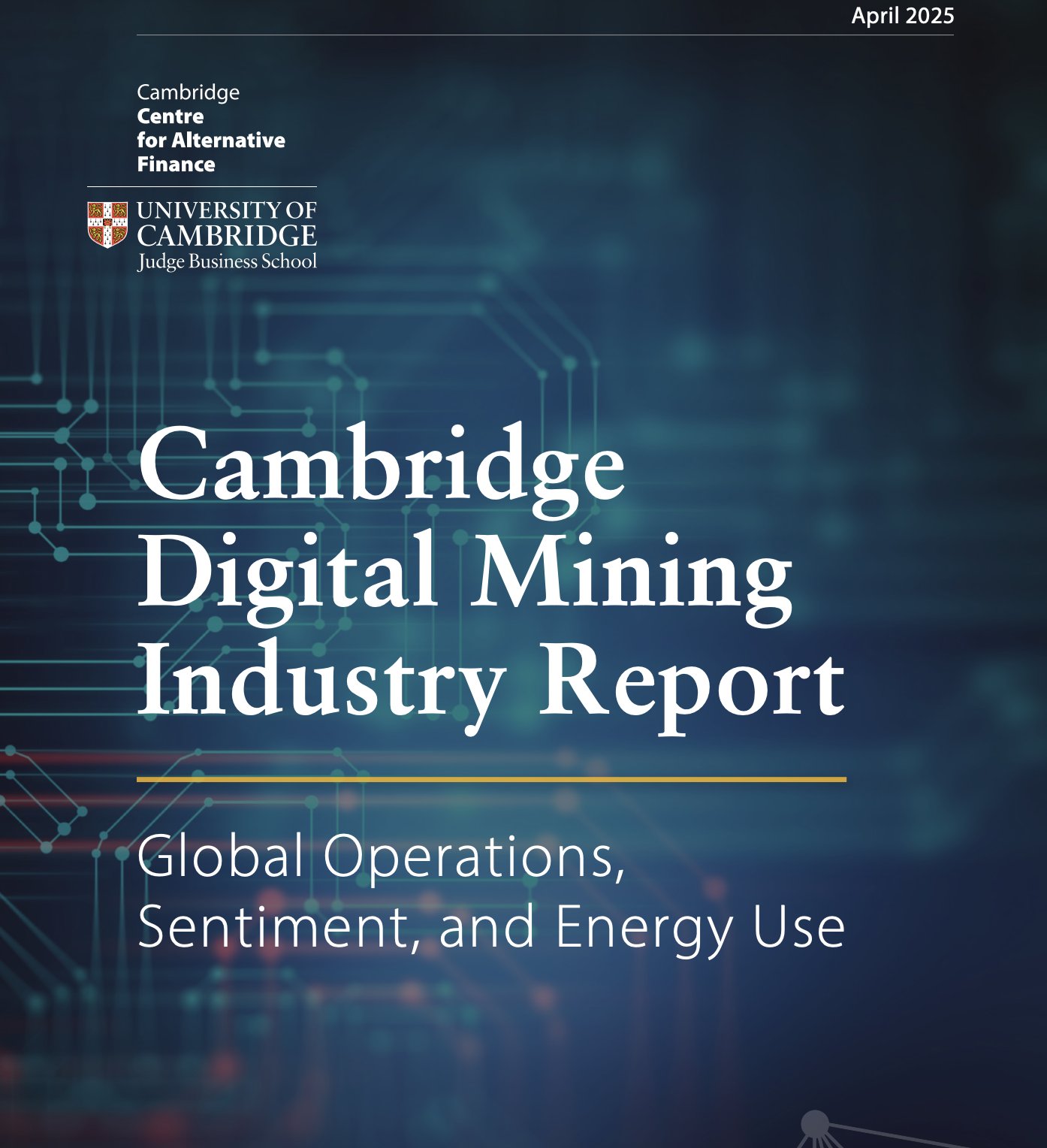

➡️Daniel Batten: 'Bitcoin's environmental benefits have now been validated in 20 peer-reviewed studies, according to a recent Cambridge University report. It's also now being covered by 13 mainstream news outlets. How times change!' Here you can find all the articles.

➡️150,000 people tuned into MicroStrategy’s earnings call. Not because of profits, but because they’re watching the blueprint for a Bitcoin-based financial system unfold in real time.

Pledditor: 'The class of 2024/2025 is stacking MSTR more than they are stacking BTC, and that's not a great thing.' Keep in mind, they've never been shown proof that Strategy holds Bitcoin in a cold storage wallet address. I can't find the MicroStrategy wallets holding 555,450 BTC. Can you?

On the 6th of May:

➡️'Serious report by Morgan Stanley. (You can read it here)

-Bitcoin has sufficient market cap to be a reserve, but it is more volatile than other reserve currencies.

-Volatility is decreasing.

-$370b allocation to Bitcoin would reflect market cap proportions.

-A reserve of 12%-17% of the total bitcoin supply would mirror other currency proportions.

Overton window has shifted.' - Troy Cross

➡️Daniel Batten: 'Bitcoin's environmental benefits have now been validated in 20 peer-reviewed studies, according to a recent Cambridge University report. It's also now being covered by 13 mainstream news outlets. How times change!' Here you can find all the articles.

➡️New Hampshire passes Bitcoin Reserve bill into law! Governor Ayotte signed HB 302 into law this morning, making NH the first U.S. state to enact a Bitcoin Reserve bill.

➡️Regarding the Bitcoin Core debate. I am inclined to take the free market perspective, but I also do not want Bitcoin to be anything like ETH. If you really want to understand the Bitcoin Core debate, I suggest you go and read the actual Pull Request on GitHub. Or else read the great following thread by ColeTU:

➡️New Hampshire passes Bitcoin Reserve bill into law! Governor Ayotte signed HB 302 into law this morning, making NH the first U.S. state to enact a Bitcoin Reserve bill.

➡️Regarding the Bitcoin Core debate. I am inclined to take the free market perspective, but I also do not want Bitcoin to be anything like ETH. If you really want to understand the Bitcoin Core debate, I suggest you go and read the actual Pull Request on GitHub. Or else read the great following thread by ColeTU:

➡️Two long-dormant Silk Road–linked wallets from 2013 moved 3,421 Bitcoin worth $322.5 million in their first transactions in over a decade.

➡️U.S. Spot Bitcoin ETFs are aggressively accumulating Bitcoin again. In the past 7 days, ETFs added over 16,549 coins, while only 3,150 were mined.

➡️Only 993,285 addresses have more than 1 Bitcoin.

On the 7th of May:

➡️Bitcoin is now up 383% since 2 ECB Bloggers wrote Bitcoin's obituary.

➡️Two long-dormant Silk Road–linked wallets from 2013 moved 3,421 Bitcoin worth $322.5 million in their first transactions in over a decade.

➡️U.S. Spot Bitcoin ETFs are aggressively accumulating Bitcoin again. In the past 7 days, ETFs added over 16,549 coins, while only 3,150 were mined.

➡️Only 993,285 addresses have more than 1 Bitcoin.

On the 7th of May:

➡️Bitcoin is now up 383% since 2 ECB Bloggers wrote Bitcoin's obituary. ➡️ARIZONA's other Strategic Bitcoin Reserve bill, SB 1373, moves to Governor Hobbs' desk for signing. Last week, she vetoed the Bitcoin Reserve Bill SB 1025.

➡️Fintech Revolut to integrate the Bitcoin Lightning network. Revolut is now partnering with Lightspark. This will allow Revolut users to send Bitcoin instantly and with lower fees.

➡️Strategy has a larger treasury than Apple.

➡️ARIZONA's other Strategic Bitcoin Reserve bill, SB 1373, moves to Governor Hobbs' desk for signing. Last week, she vetoed the Bitcoin Reserve Bill SB 1025.

➡️Fintech Revolut to integrate the Bitcoin Lightning network. Revolut is now partnering with Lightspark. This will allow Revolut users to send Bitcoin instantly and with lower fees.

➡️Strategy has a larger treasury than Apple. ➡️ 7,200 BTC taken off exchanges yesterday and 103,000 the last month.

➡️ Metaplanet issues $25M in zero-coupon bonds to buy more Bitcoin.

➡️Bitcoin News: "Bitcoin’s volume-weighted market cap dominance is 93%. Unlike simple market cap, this metric factors in actual trading volume, revealing where real liquidity and demand are. Ignore it at your own peril."

➡️ New Hampshire is enacting a Bitcoin Strategic Reserve. Governor Ayotte signed HB302 into law.

➡️Bhutan becomes the 1st nation to implement nationwide Bitcoin payments for tourists.

On the 8th of May:

➡️Bitcoin to be completely exempt from capital gains tax under bill passed by the Missouri House.

➡️ Arizona Governor officially signs law to establish a Strategic Bitcoin Reserve Fund.

➡️ 7,200 BTC taken off exchanges yesterday and 103,000 the last month.

➡️ Metaplanet issues $25M in zero-coupon bonds to buy more Bitcoin.

➡️Bitcoin News: "Bitcoin’s volume-weighted market cap dominance is 93%. Unlike simple market cap, this metric factors in actual trading volume, revealing where real liquidity and demand are. Ignore it at your own peril."

➡️ New Hampshire is enacting a Bitcoin Strategic Reserve. Governor Ayotte signed HB302 into law.

➡️Bhutan becomes the 1st nation to implement nationwide Bitcoin payments for tourists.

On the 8th of May:

➡️Bitcoin to be completely exempt from capital gains tax under bill passed by the Missouri House.

➡️ Arizona Governor officially signs law to establish a Strategic Bitcoin Reserve Fund. ➡️ Oregon passed Senate Bill 167, updating its Uniform Commercial Code (UCC) to include Bitcoin and other digital assets. This new law recognizes digital assets as valid collateral and acknow ledges electronic records and signatures in commercial transactions.

➡️ UAE's state-owned oil giant Emarat accepts Bitcoin and crypto payments at petrol/gas stations.

➡️Standard Chartered Bank analyst apologizes for $120,000 Bitcoin price prediction, says target 'may be too low.'

➡️ 'The Texas House committee has approved SB 21; next steps are a Texas House vote by all members and the governor’s signature. It looks likely that Texas will have a Strategic Bitcoin Reserve, the big open question is how much BTC will be acquired.' -Pierre Rochard

➡️ A month ago first Bitcoin payment was made at a supermarket in Switzerland – Spar in Zug. Interesting data from Swiss supermarket payments (source @OpenCryptoPay): Even though they can be done with practically all "crypto," 90.8% of payments are in sats, 5.3% in stablecoins, 1.2% in WBTC. 20+ transactions per day. Amazing!

On the 9th of May:

➡️'Steak n Shake is accepting Bitcoin payments at all locations starting May 16, making the cryptocurrency available to our more than 100 million customers. The movement is just beginning…' - Steak 'n' Shake Steak 'n Shake has 393 locations, primarily in the Midwest and the South.

➡️ Oregon passed Senate Bill 167, updating its Uniform Commercial Code (UCC) to include Bitcoin and other digital assets. This new law recognizes digital assets as valid collateral and acknow ledges electronic records and signatures in commercial transactions.

➡️ UAE's state-owned oil giant Emarat accepts Bitcoin and crypto payments at petrol/gas stations.

➡️Standard Chartered Bank analyst apologizes for $120,000 Bitcoin price prediction, says target 'may be too low.'

➡️ 'The Texas House committee has approved SB 21; next steps are a Texas House vote by all members and the governor’s signature. It looks likely that Texas will have a Strategic Bitcoin Reserve, the big open question is how much BTC will be acquired.' -Pierre Rochard

➡️ A month ago first Bitcoin payment was made at a supermarket in Switzerland – Spar in Zug. Interesting data from Swiss supermarket payments (source @OpenCryptoPay): Even though they can be done with practically all "crypto," 90.8% of payments are in sats, 5.3% in stablecoins, 1.2% in WBTC. 20+ transactions per day. Amazing!

On the 9th of May:

➡️'Steak n Shake is accepting Bitcoin payments at all locations starting May 16, making the cryptocurrency available to our more than 100 million customers. The movement is just beginning…' - Steak 'n' Shake Steak 'n Shake has 393 locations, primarily in the Midwest and the South. ➡️Bitcoin is now the 3rd largest commodity in the world by market cap!

Gold = $22 trillion

Oil = $3 trillion

Bitcoin = $2 trillion Bitcoin is among the top 5 biggest global assets with a +2 TRILLION market cap. Bigger than Amazon and Google (Alphabet)

➡️Bitcoin is now the 3rd largest commodity in the world by market cap!

Gold = $22 trillion

Oil = $3 trillion

Bitcoin = $2 trillion Bitcoin is among the top 5 biggest global assets with a +2 TRILLION market cap. Bigger than Amazon and Google (Alphabet) ➡️Sam Callahan: A new BIS paper on Bitcoin dropped yesterday. To cut through the jargon: It concluded that Bitcoin use rises when inflation surges, remittances get pricey, and capital controls increase. In other words, when people need it most. Source

➡️ Bitcoin Archive: "Amazon, Tesla, & Google all had BIGGER drawdowns than Bitcoin in the last 6 months, & nobody says they are "too volatile". LAST ~6 MONTHS

AMAZON -33%

TESLA -56%

GOOGLE - 32%

BITCOIN - 31%

Is Bitcoin volatile? Sure, but... ONLY BITCOIN BOUNCED BACK TO PUSH FOR NEW ALL-TIME HIGHS!"

➡️ If you own 1 WHOLE Bitcoin, you're a millionaire in 50 currencies. If you own 0.5 Bitcoin, you're a millionaire in 20-25 currencies. For example, the Turkish Lira has literally gone to ZERO against Bitcoin. The ultimate fate of every fiat currency, some will just get there faster than others Owning 1 BTC will make you a millionaire in ALL currencies in the next decade or so.

➡️ Former PayPal Vice President says Bitcoin Lightning Network will welcome “dozens of digital banks and wallets” and enable 100s of millions of people to receive Bitcoin-powered payments by the end of Q3.

➡️ Coinbase just disclosed in their Q1 filing: they custody 2.68 million bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update.

➡️ FORTUNE: “Meta is in discussions with crypto firms to introduce stablecoins as a means to manage payouts, and has also hired a vice president of product with crypto experience to help shepherd the discussions.” When Bitcoin?

➡️ 344,620 new Bitcoin wallets created as price surges to $103K, according to data from Santiment.

➡️ Great post + article by Parker Lewis: Bitcoin is Money

➡️Sam Callahan: A new BIS paper on Bitcoin dropped yesterday. To cut through the jargon: It concluded that Bitcoin use rises when inflation surges, remittances get pricey, and capital controls increase. In other words, when people need it most. Source

➡️ Bitcoin Archive: "Amazon, Tesla, & Google all had BIGGER drawdowns than Bitcoin in the last 6 months, & nobody says they are "too volatile". LAST ~6 MONTHS

AMAZON -33%

TESLA -56%

GOOGLE - 32%

BITCOIN - 31%

Is Bitcoin volatile? Sure, but... ONLY BITCOIN BOUNCED BACK TO PUSH FOR NEW ALL-TIME HIGHS!"

➡️ If you own 1 WHOLE Bitcoin, you're a millionaire in 50 currencies. If you own 0.5 Bitcoin, you're a millionaire in 20-25 currencies. For example, the Turkish Lira has literally gone to ZERO against Bitcoin. The ultimate fate of every fiat currency, some will just get there faster than others Owning 1 BTC will make you a millionaire in ALL currencies in the next decade or so.

➡️ Former PayPal Vice President says Bitcoin Lightning Network will welcome “dozens of digital banks and wallets” and enable 100s of millions of people to receive Bitcoin-powered payments by the end of Q3.

➡️ Coinbase just disclosed in their Q1 filing: they custody 2.68 million bitcoin. That’s over 13% of all Bitcoin in circulation, on one platform. Is this the greatest honeypot in financial history? Yes, it is...read next week's Weekly Bitcoin update.

➡️ FORTUNE: “Meta is in discussions with crypto firms to introduce stablecoins as a means to manage payouts, and has also hired a vice president of product with crypto experience to help shepherd the discussions.” When Bitcoin?

➡️ 344,620 new Bitcoin wallets created as price surges to $103K, according to data from Santiment.

➡️ Great post + article by Parker Lewis: Bitcoin is Money

➡️Businesses are the largest net buyers of bitcoin so far this year, led by Strategy, which makes up 77% of the growth.

➡️Missouri moves to become the first U.S. state to eliminate capital gains tax on Bitcoin with the passage of HB 594.

➡️99% of Bitcoin will be mined by 2035.

➡️Businesses are the largest net buyers of bitcoin so far this year, led by Strategy, which makes up 77% of the growth.

➡️Missouri moves to become the first U.S. state to eliminate capital gains tax on Bitcoin with the passage of HB 594.

➡️99% of Bitcoin will be mined by 2035. 🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did - The True Cost of the Dollar Empire with Lyn Alden They discuss:

The Trade Deficit

Tariffs

The Price of the USD Hegemony

Bitcoin As a Neutral Reserve Asset

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

🎁If you have made it this far, I would like to give you a little gift:

What Bitcoin Did - The True Cost of the Dollar Empire with Lyn Alden They discuss:

The Trade Deficit

Tariffs

The Price of the USD Hegemony

Bitcoin As a Neutral Reserve Asset

Credit: I have used multiple sources!

My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: PocketBitcoin especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly.

Use the code SE3997

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple. ⠀ ⠀

⠀⠀ ⠀ ⠀⠀⠀

Do you think this post is helpful to you?

If so, please share it and support my work with a zap.

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

⭐ Many thanks⭐

Felipe - Bitcoin Friday!

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃ On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 05.05.2025

🧠Quote(s) of the week:

'Bitcoin is a high-IQ, low-time-preference asset in a world addicted to DoorDash, dopamine, and debt. Holding Bitcoin requires patience, conviction, and the ability to not panic when CNBC tells you it’s dead for the 47th time. That rules out, oh, I don’t know - 95% of the population? This isn’t some egalitarian revolution. This is a cognitive filter disguised as a monetary network. The rich, the strategic, the elite - those who understand volatility as an opportunity - will stack the hardest asset on Earth while the masses beg for interest rate cuts and $600 stimmies to buy groceries they can't afford.

It's not a level playing field. It's a time-preference war, and Bitcoin is the scoreboard. And every cycle, we watch it happen again. The media ridicules it, the politicians fear it, and the smart money buys more. While fiat punishes savers and rewards financial nihilism, Bitcoin inverts the whole structure. It’s a vault for those who can delay gratification, think generationally, and understand that true wealth is preserved rather than printed. The game isn’t rigged. It’s just calibrated for adults.' - Adam Livingston

'Bitcoin is an extremely simple thesis. If you think governments will stop debasing and debanking: number go down. If you think they won’t stop debasing and debanking: number go up'- Alex Gladstein

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)

Enriched with detailed charts, illustrative images, and comprehensive macroeconomic news to provide context and clarity.

Happy reading!

The Latest Bitcoin & Macro news: Weekly Recap 05.05.2025

🧠Quote(s) of the week:

'Bitcoin is a high-IQ, low-time-preference asset in a world addicted to DoorDash, dopamine, and debt. Holding Bitcoin requires patience, conviction, and the ability to not panic when CNBC tells you it’s dead for the 47th time. That rules out, oh, I don’t know - 95% of the population? This isn’t some egalitarian revolution. This is a cognitive filter disguised as a monetary network. The rich, the strategic, the elite - those who understand volatility as an opportunity - will stack the hardest asset on Earth while the masses beg for interest rate cuts and $600 stimmies to buy groceries they can't afford.

It's not a level playing field. It's a time-preference war, and Bitcoin is the scoreboard. And every cycle, we watch it happen again. The media ridicules it, the politicians fear it, and the smart money buys more. While fiat punishes savers and rewards financial nihilism, Bitcoin inverts the whole structure. It’s a vault for those who can delay gratification, think generationally, and understand that true wealth is preserved rather than printed. The game isn’t rigged. It’s just calibrated for adults.' - Adam Livingston

'Bitcoin is an extremely simple thesis. If you think governments will stop debasing and debanking: number go down. If you think they won’t stop debasing and debanking: number go up'- Alex Gladstein

On the 30th of April:

➡️The Bank of Italy identifies Bitcoin as an emerging risk factor with concerns for the financial system.

"The strong growth of Bitcoin and other crypto-assets with high price volatility means risks not only for investors but also potentially for financial stability, given the growing interconnections between the digital asset ecosystem, the traditional financial sector, and the real economy,”

Tell me you are scared of Bitcoin without telling me you are scared of Bitcoin.

➡️4 major wirehouses managing $10 TRILLION to start offering Bitcoin ETFs to clients this year, says BitWise CIO Matt Hougan. Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS are coming to the party.

➡️Roswell, New Mexico, becomes the 1st United States city to launch a strategic Bitcoin reserve.

➡️BlackRock’s Bitcoin ETF IBIT has hit 600,000 BTC!

➡️Semler Scientific bought 165 Bitcoins worth $15.7m. They now hold 3,467 BTC on their balance sheet.

➡️Bitcoin News: 'El Salvador is still buying Bitcoin despite an IMF loan deal that required it to stop. Economy Minister Maria Luisa Hayem confirmed ongoing accumulation, calling Bitcoin “an important project” and a key asset for both the government and private sector.'

➡️New whales are buying Bitcoin faster than ever before!

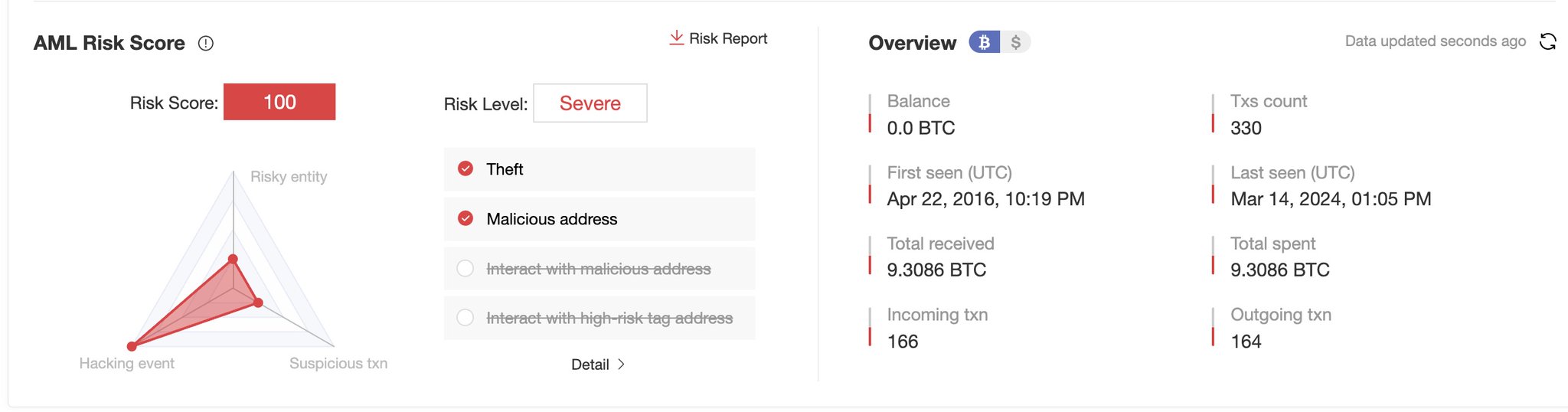

➡️'ZachXBT says the $330M Bitcoin theft involved an elderly U.S. victim targeted by social engineering. The stolen 3,520 BTC were laundered through six exchanges and swapped into Monero, triggering a 50% price spike due to thin liquidity.' -Bitcoin News

On the 1st of May:

➡️North Carolina Bitcoin Reserve Bill has passed the House! This bill enables state retirement funds to invest up to $ 13 B.

➡️Tether’s latest attestation states the company holds $7.6 billion in Bitcoin.

➡️Europe's largest Bitcoin treasury company, The Blockchain Group, aspires to hold 1% of the total Bitcoin supply by 2033.

➡️FiatHawk: 'Central banks create fake money to buy real gold, and we’re supposed to pretend this isn’t theft. The game is rigged. Their paper is trash. Gold knows it. Bitcoin ends it. Stop believing the lie.

On the 30th of April:

➡️The Bank of Italy identifies Bitcoin as an emerging risk factor with concerns for the financial system.

"The strong growth of Bitcoin and other crypto-assets with high price volatility means risks not only for investors but also potentially for financial stability, given the growing interconnections between the digital asset ecosystem, the traditional financial sector, and the real economy,”

Tell me you are scared of Bitcoin without telling me you are scared of Bitcoin.

➡️4 major wirehouses managing $10 TRILLION to start offering Bitcoin ETFs to clients this year, says BitWise CIO Matt Hougan. Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS are coming to the party.

➡️Roswell, New Mexico, becomes the 1st United States city to launch a strategic Bitcoin reserve.

➡️BlackRock’s Bitcoin ETF IBIT has hit 600,000 BTC!

➡️Semler Scientific bought 165 Bitcoins worth $15.7m. They now hold 3,467 BTC on their balance sheet.

➡️Bitcoin News: 'El Salvador is still buying Bitcoin despite an IMF loan deal that required it to stop. Economy Minister Maria Luisa Hayem confirmed ongoing accumulation, calling Bitcoin “an important project” and a key asset for both the government and private sector.'

➡️New whales are buying Bitcoin faster than ever before!

➡️'ZachXBT says the $330M Bitcoin theft involved an elderly U.S. victim targeted by social engineering. The stolen 3,520 BTC were laundered through six exchanges and swapped into Monero, triggering a 50% price spike due to thin liquidity.' -Bitcoin News

On the 1st of May:

➡️North Carolina Bitcoin Reserve Bill has passed the House! This bill enables state retirement funds to invest up to $ 13 B.

➡️Tether’s latest attestation states the company holds $7.6 billion in Bitcoin.

➡️Europe's largest Bitcoin treasury company, The Blockchain Group, aspires to hold 1% of the total Bitcoin supply by 2033.

➡️FiatHawk: 'Central banks create fake money to buy real gold, and we’re supposed to pretend this isn’t theft. The game is rigged. Their paper is trash. Gold knows it. Bitcoin ends it. Stop believing the lie.

When the debt bubble collapses, only sound money with zero counterparty risk matters. Currently, sound money is less than 5% of debt money, and Bitcoin is so tiny it is barely visible on the chart. Stay humble and keep stacking.'

When the debt bubble collapses, only sound money with zero counterparty risk matters. Currently, sound money is less than 5% of debt money, and Bitcoin is so tiny it is barely visible on the chart. Stay humble and keep stacking.' On the 2nd of May:

➡️ Regarding the whole OP_Return debate.

Grok: ++Key Points: ++

The OP_RETURN debate in Bitcoin centers on whether its blockchain should store data beyond financial transactions, with ongoing controversy.

It began in 2010 with concerns about blockchain bloat, intensified in 2014 with the "OP_Return Wars," and continues today.

Research suggests the debate reflects a balance between Bitcoin's monetary purpose and potential for broader applications like Dapps.

Compromises, like setting a 40-byte limit in 2014, aimed to address concerns but didn't fully resolve tensions, influencing platforms like Ethereum.

++Background++ OP_RETURN is a Bitcoin script opcode allowing small data storage in transactions, useful for timestamping or Dapps, but raising concerns about blockchain bloat.

++Historical Context++

The debate started in 2010 with the BitDNS proposal, where Satoshi Nakamoto worried about scalability, leading to Namecoin. It peaked in 2014 with Counterparty's use, leading to a 40-byte limit compromise, later adjusted to 83 bytes by 2016.

++Recent Developments++ By 2018-2019, high OP_RETURN usage (20% of transactions) sparked fee debates, but usage has since declined, though data remains, with recent 2023 controversies over size limits.

If you are interested in Bitcoin, then you should check out the following video.

Great video from @GrassFedBitcoin explaining the current OP_RETURN situation. The choice isn’t between bloating the UTXO set or increasing OP_RETURN, it’s whether we normalize spam or we reject it. Is Bitcoin for data storage or financial transactions? Every Bitcoiner needs to see this! Vires in Numeris.

A great counterargument by Seth for Privacy:

On the 2nd of May:

➡️ Regarding the whole OP_Return debate.

Grok: ++Key Points: ++

The OP_RETURN debate in Bitcoin centers on whether its blockchain should store data beyond financial transactions, with ongoing controversy.

It began in 2010 with concerns about blockchain bloat, intensified in 2014 with the "OP_Return Wars," and continues today.

Research suggests the debate reflects a balance between Bitcoin's monetary purpose and potential for broader applications like Dapps.

Compromises, like setting a 40-byte limit in 2014, aimed to address concerns but didn't fully resolve tensions, influencing platforms like Ethereum.

++Background++ OP_RETURN is a Bitcoin script opcode allowing small data storage in transactions, useful for timestamping or Dapps, but raising concerns about blockchain bloat.

++Historical Context++

The debate started in 2010 with the BitDNS proposal, where Satoshi Nakamoto worried about scalability, leading to Namecoin. It peaked in 2014 with Counterparty's use, leading to a 40-byte limit compromise, later adjusted to 83 bytes by 2016.

++Recent Developments++ By 2018-2019, high OP_RETURN usage (20% of transactions) sparked fee debates, but usage has since declined, though data remains, with recent 2023 controversies over size limits.

If you are interested in Bitcoin, then you should check out the following video.

Great video from @GrassFedBitcoin explaining the current OP_RETURN situation. The choice isn’t between bloating the UTXO set or increasing OP_RETURN, it’s whether we normalize spam or we reject it. Is Bitcoin for data storage or financial transactions? Every Bitcoiner needs to see this! Vires in Numeris.

A great counterargument by Seth for Privacy:

On Nostr, I will exclusively share the most significant Bitcoin news. (this note)

For those (still) beyond Nostr—friends, family, and colleagues—the complete Weekly Recap will be accessible on my Bitcoin Friday page on Habla. (next note)