Happy ₿itcoin whitepaper day 👍 📄📄📄

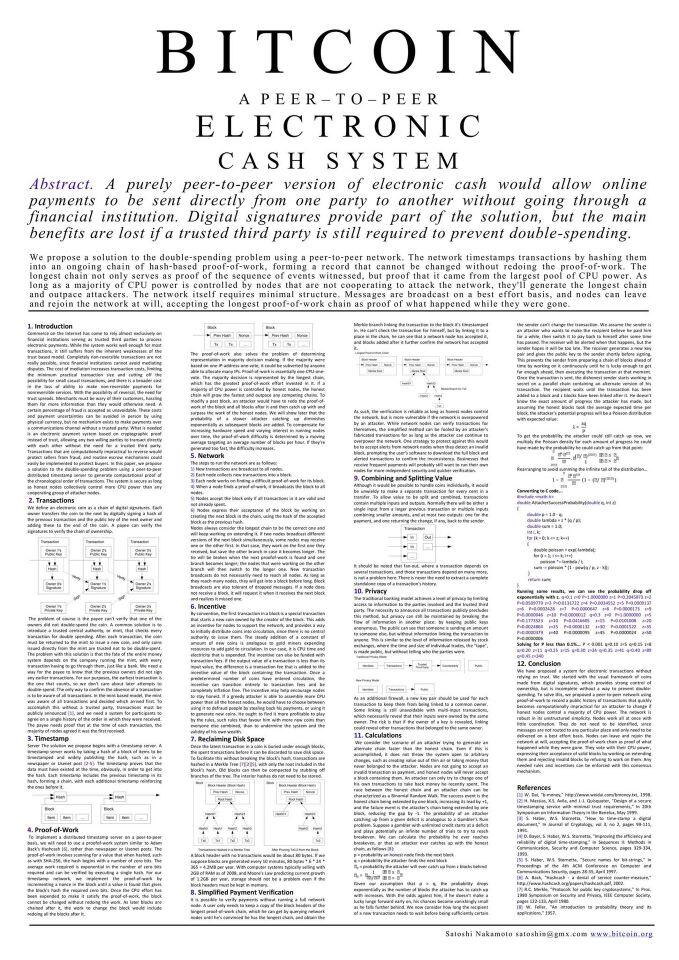

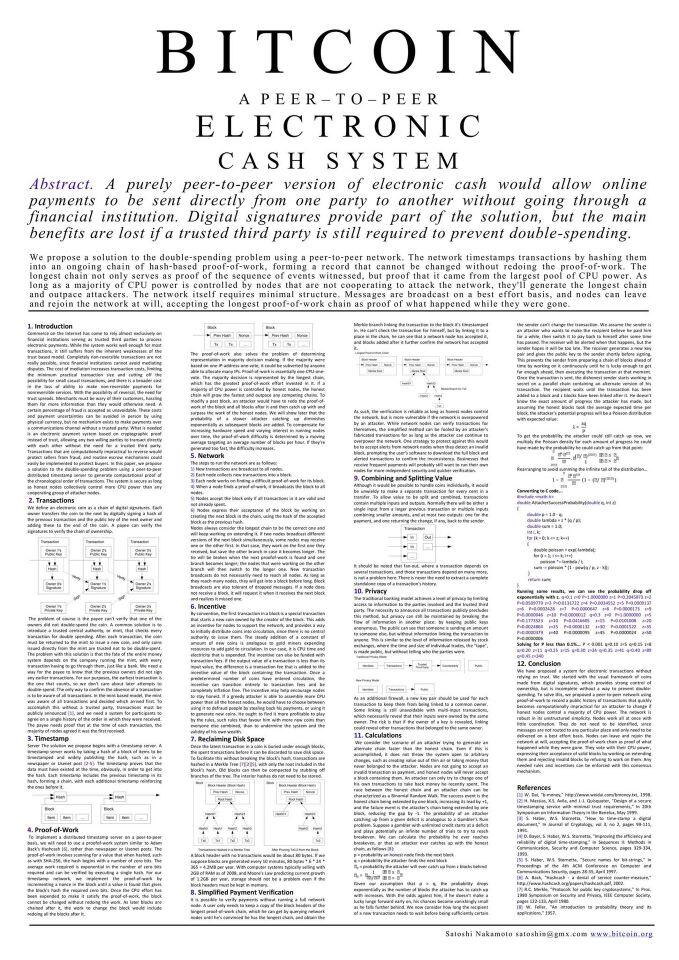

15 years ago today, on October 31, 2008, Satoshi Nakamoto published his white paper entitled “Bitcoin: A Peer-to-Peer Electronic Cash System”.

At that time, the pseudonymous Bitcoin inventor shared his thoughts with others for the first time on a mailing list of the so-called cypherpunks.

Our thanks for this epochal gift to humanity go to Satoshi!

For the white paper's fifteenth birthday today,

here are some not (well) known facts for you about this piece of internet and money history.

- The exact date and time of the first publication of the white paper is Friday, October 31, 2008, at 7:10:00 p.m. German time.

- There is an assumption that Satoshi specifically chose the day to post Luther's theses because it symbolized the reformation of the church and Bitcoin for the reformation of the monetary system.

- The initial publication took place on the metzdowd.com mailing list.

- Satoshi only referenced eight other sources in the white paper.

- Ten different people were named in the white paper. Including Adam Back, the current CEO of Blockstream.

- Satoshi wrote the code first and then the white paper. He wanted to make sure that everything really worked and that he could solve all the problems in practice.

- Neither the word “blockchain” nor “wallet” nor “mining” appear in the white paper.

- The limit of almost 21 million BTC is also not mentioned in the white paper.

Here you can get the whitepaper

.pdf

![[bit] max⚡️'s avatar](https://pfp.nostr.build/28f7f3abd075d7364e93083592753396eca6265face7753c41b80da83c92f565.jpg)