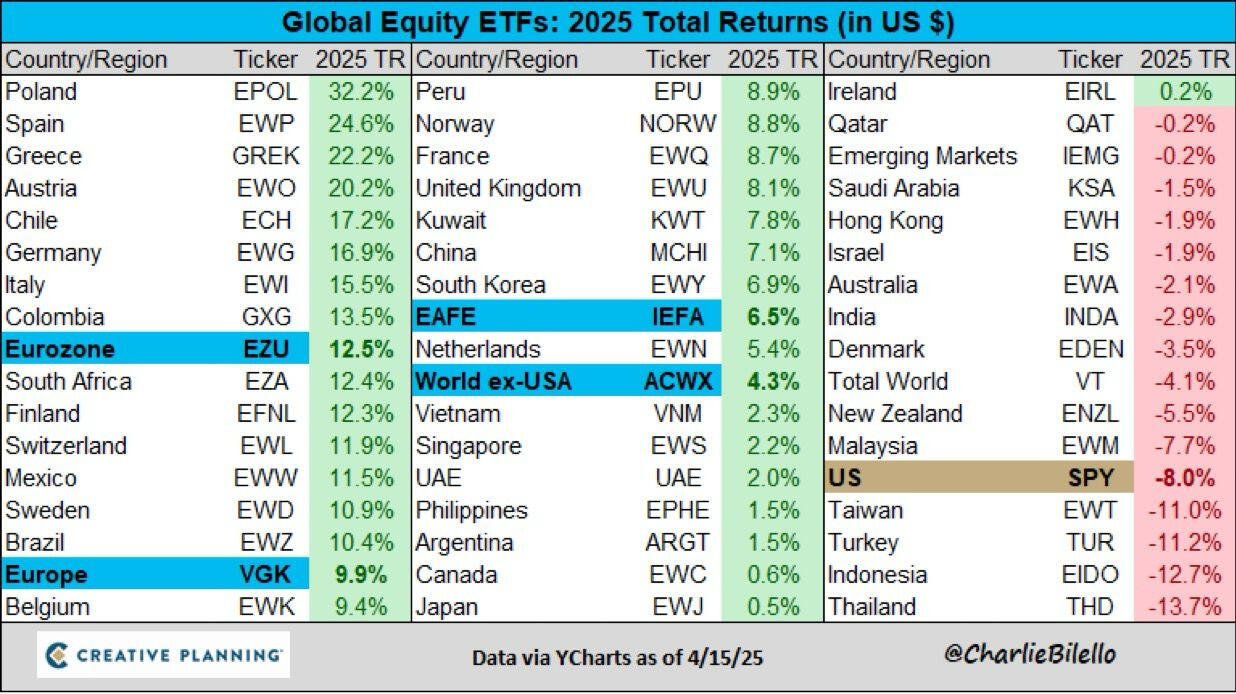

Emerging markets and international stocks have lagged US S&P500 for over 16 years — but 2025 is shaping up as a massive reversion to the mean.

After 16+ years of relentless U.S. outperformance — the longest streak in history — the tides are shifting.

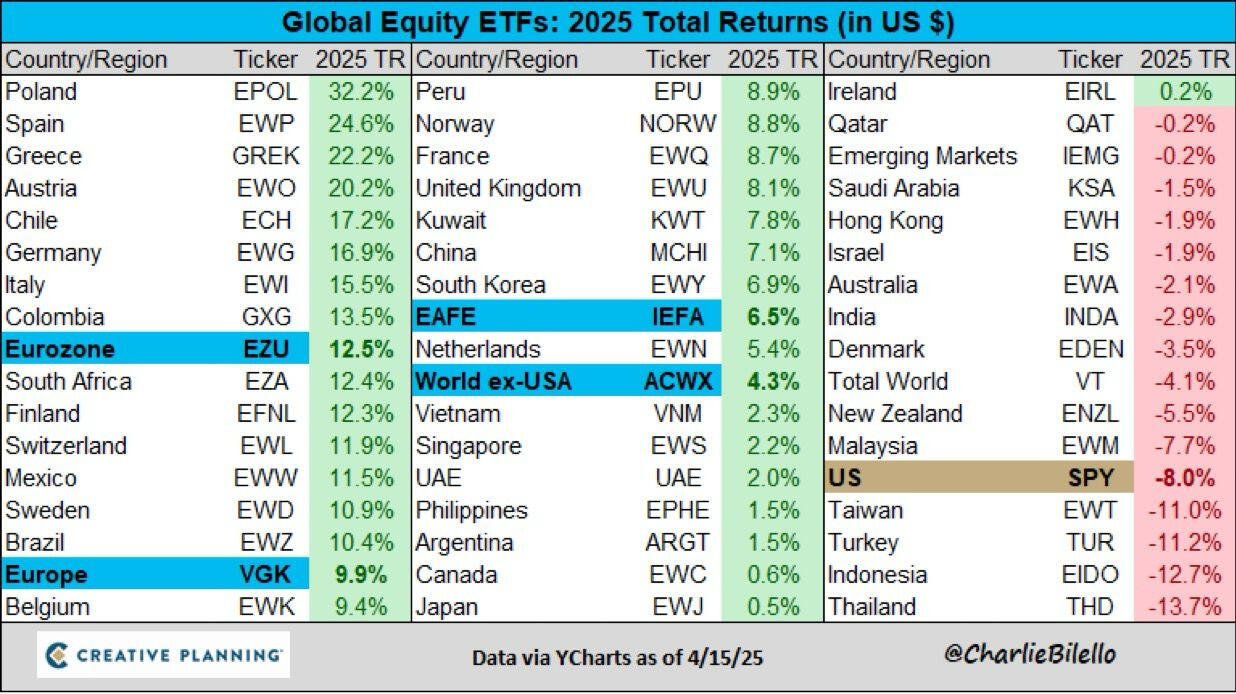

So far this year:

Eurozone stocks +13%

International stocks +4%

S&P 500 –8%

Trade realignments and the aftermath of tariff wars may be setting the stage for a global comeback.

Source: IA

Source: Checkonchain

Source: Checkonchain