Up to 99% of Mt. Gox’s $8.2B Bitcoin could be sold: Analyst Nearly all of Mt. Gox’s former creditors might be looking to sell their Bitcoin, which has increased by over 8,500% in value in the 10 years since the exchange’s collapse. Most of the Bitcoin being repaid by defunct exchange Mt. Gox will be market sold, threatening to cause more downside pressure for BTC. According to finance analyst Jacob King, the Mt. Gox repayments could add $8.2 billion worth of additional selling pressure to Bitcoin’s BTCtickers down$55,358 price. The analysts said that on-chain movements already point to the fact that Mt. Gox’s creditors have started selling, King wrote in a July 4 X post: “No Bitcoiner will say this out loud, but the majority of the $8.2 Billion in $BTC that is set to be distributed back to ex-clients are going to be sold off.”

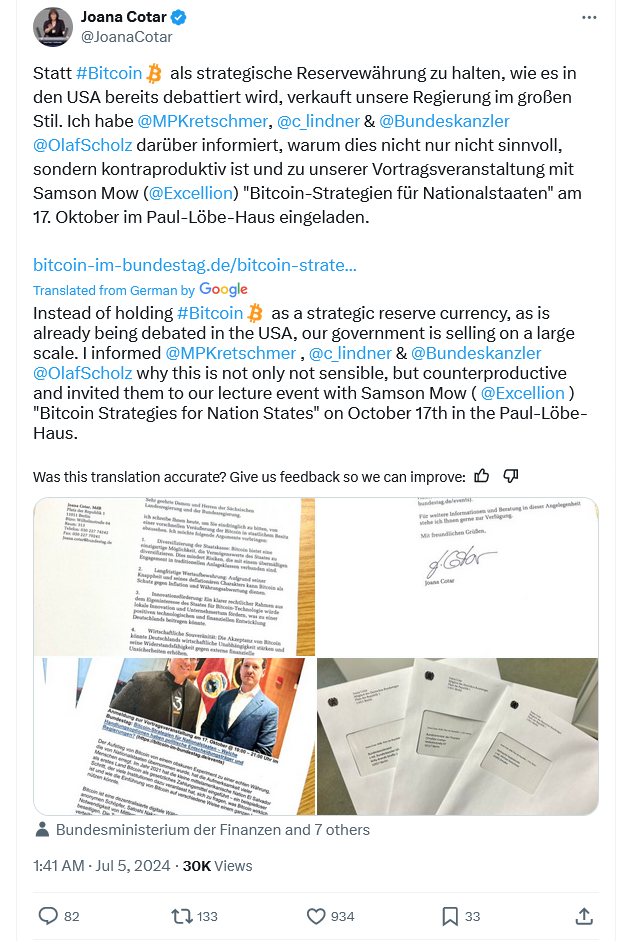

*Source: Joana Cotar X account*

*Source: Joana Cotar X account*