🗓️ THIS WEEK, WHAT TO WATCH:

Monday: U.S. ISM Manufacturing PMI

Tuesday: U.S. JOLTS Job Openings

Wednesday: U.S. ADP Employment Report

Thursday' U.S. Jobless Claims & U.S. Productivity and Labor Costs

Friday: U.S. Non-Farm Payrolls, (NFP), U.S. Unemployment Rate & U.S. Average Hourly Earnings

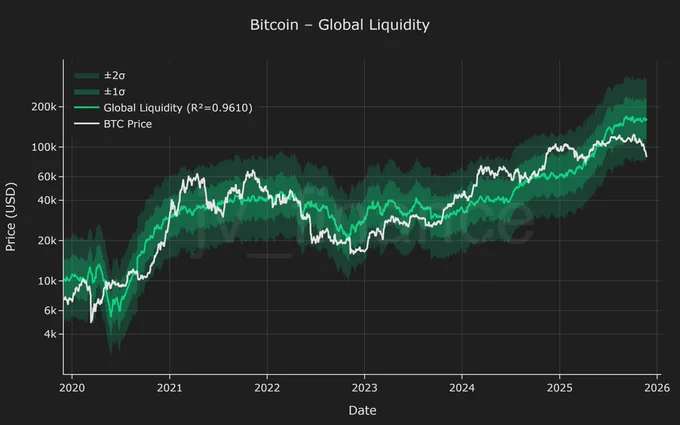

And stay tune to the liquidity game as @espn ✔️ well posted (smart), DCA is great but buying deeps is better.

#Bitcoin

#BTC

🚀 Ending QT tomorrow December 1st halts approx $40 billion per month in total runoff, providing a subtle boost keeping that cash in the system (via reinvestments).

This will ease short term funding stresses (like lower SOFR spreads) instantly, as markets anticipate less reserve pressure.

What does it means for #Bitcoin?

Lower yields on short term Treasuries, potential Bitxoin rally (as seen post-2019 QT end).

#askNostr

#askNostr